Automotive Simulation Market | Acumen Research and Consulting

Automotive Simulation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format : ![]()

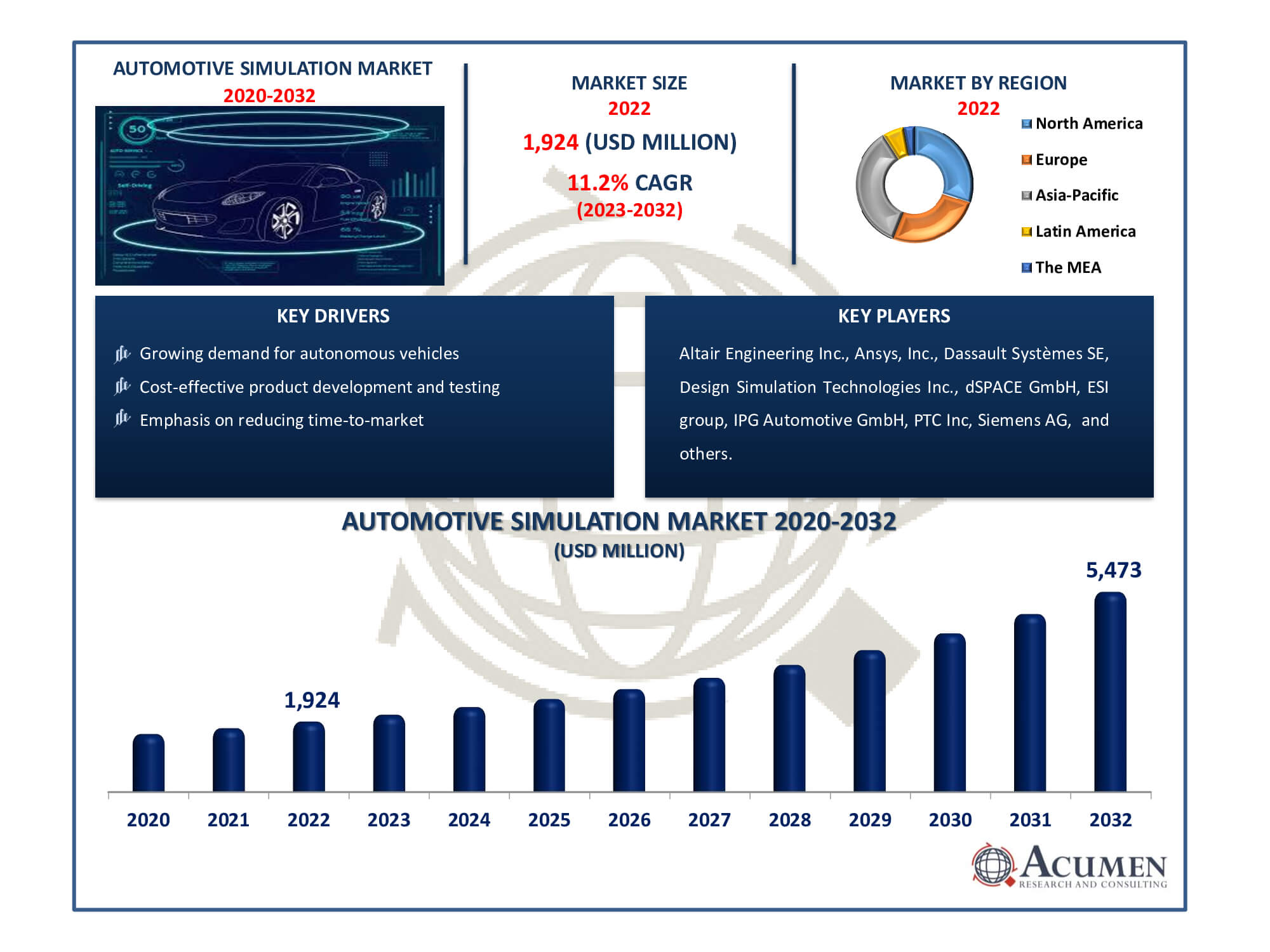

The Automotive Simulation Market Size accounted for USD 1,924 Million in 2022 and is estimated to achieve a market size of USD 5,473 Million by 2032 growing at a CAGR of 11.2% from 2023 to 2032.

Automotive Simulation Market Highlights

- The global automotive simulation market is set to achieve revenue of USD 5,473 million by 2032

- The automotive simulation market is experiencing a CAGR of 11.2% from 2023 to 2032

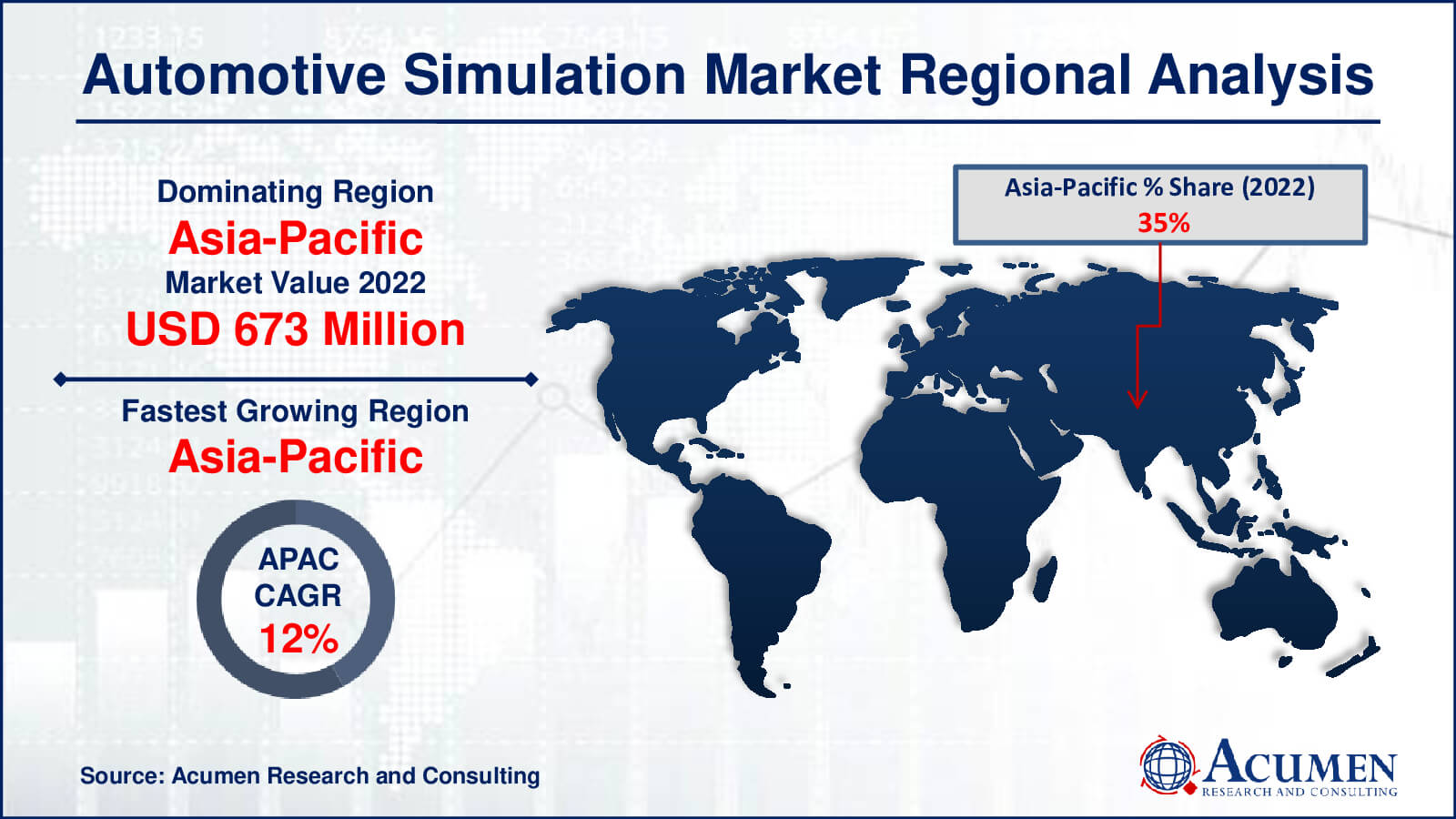

- In 2022, Asia-Pacific dominated the automotive simulation market with USD 673 million revenue

- The Asia-Pacific market is likely to witness CAGR of over 12% from 2023 to 2032

- Among component, the software sub-segment generated revenue exceeding USD 1,366 million in 2022

- In terms of sales channel, the OEMs sub-segment accounted for approximately 49% of the market share in 2022

- Simulation for smart city integration is a notable automotive simulation market trend

Automotive simulation is advanced software that simulates passenger vehicles and their components for the testing and development of driver assistance systems, vehicle dynamic controls, onboard power electronics, and engine controls. Automotive simulation replicates the characteristics of real vehicles in a virtual environment by recreating the external factors and conditions that a vehicle interacts with. It also enables individuals to learn how to drive without the risk of an accident with an actual vehicle. Additionally, it helps OEMs (Original Equipment Manufacturers) detect risks or faults in components before incorporating them into the vehicle, thus enhancing product efficiency.

Global Automotive Simulation Market Dynamics

Market Drivers

- Growing demand for autonomous vehicles

- Cost-effective product development and testing

- Emphasis on reducing time-to-market

- Safety testing without physical risks

Market Restraints

- High initial setup costs

- Limited real-world validation

- Data privacy and security concerns

Market Opportunities

- Rapid advancements in AI and machine learning

- Expansion in electric vehicle simulation

- Enhanced driver training and education

Automotive Simulation Market Report Coverage

| Market | Automotive Simulation Market |

| Automotive Simulation Market Size 2022 | USD 1,924 Million |

| Automotive Simulation Market Forecast 2032 | USD 5,473 Million |

| Automotive Simulation Market CAGR During 2023 - 2032 | 11.2% |

| Automotive Simulation Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Deployment, By Component, By Application, By Sales Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Altair Engineering Inc., Ansys, Inc., Dassault Systèmes SE, Design Simulation Technologies Inc., dSPACE GmbH, ESI group, IPG Automotive GmbH, PTC Inc, Siemens AG, SIMUL8 Corporation, Synopsys, Inc., and The MathWorks, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Simulation Market Insights

Rapid technological changes, driven by increased focus on R&D activities, are fueling market growth. Ongoing technological advancements, facilitated by the emergence of virtual platforms, are bolstering market value. The rising adoption of cloud computing, coupled with the use of automotive simulation software in governmental regulatory test centers, is also propelling market expansion. One of the key benefits of simulation software is its significant reduction of efforts for OEMs in both lab and on-road testing for new products and technologies, which further contributes to market growth. Additionally, the ongoing developments in the field of autonomous and semi-autonomous vehicles are expected to create potential opportunities throughout the forecast period from 2020 to 2027.

However, on the downside, constraints and complications related to real-time control in simulation activities, as well as the lack of established standards and regulations, are factors expected to impede market growth.

Automotive Simulation Market Segmentation

The worldwide market for automotive simulation is segmented into deployment, component, application, sales channel, and geography.

Automotive Simulation Deployments

- On-Premise

- Cloud

According to the automotive simulation industry analysis, both on-premise and cloud deployments have a presence in the automotive simulation market, although cloud-based deployments were gaining traction. Cloud-based solutions were becoming more popular owing to their scalability, adaptability, and cost-effectiveness. They supported remote access and collaboration, making them ideal for complicated simulation jobs and scattered teams. However, the decision between on-premise and cloud implementation was frequently influenced by the automobile firms' individual demands and preferences. Because market trends might shift, I recommend consulting the most recent industry studies for the most up-to-date information on the dominating deployment technique in the automotive simulation market in 2022.

Automotive Simulation Components

- Software

- Services

As per the automotive simulation market forecast, software has continually prevailed as the key engine of development and innovation. The heart of the business is automotive simulation software, which powers virtual environments that simulate real-world driving circumstances and car behavior. These software solutions are critical for creating, testing, and fine-tuning many components of automotive technology, including driver assistance systems and engine controls.

Automakers and suppliers may develop and customize virtual testing scenarios with software, making it a cost-effective and time-efficient alternative to physical testing. The fast rate of technological innovation and the rising complexity of vehicles necessitate sophisticated software tools to simulate and analyse performance.

Automotive Simulation Applications

- Prototyping

- Testing

In terms of application, testing was the market leader in the automotive simulation industry. Driver assistance systems, vehicle dynamics, engine components, and safety features were all developed and validated using testing simulations. The use of simulation for testing enabled automobile firms to conduct a wide range of tests in virtual settings, eliminating the need for costly and time-consuming physical testing.

Testing simulations offered manufacturers with a low-cost and efficient way of evaluating the performance, safety, and operation of their cars and components under a variety of scenarios.

Automotive Simulation Sales Channels

- OEMs

- Component Manufacturers

- Regulatory Bodies

According to the automotive simulation market analysis, OEMs accounted for a major share of the revenue (%) in the global automotive simulation market. The rapid expansion of primary OEMs and increasing investments by major original equipment manufacturers are driving market growth. Rapid industrialization and infrastructural development are also creating opportunities for OEMs in the market. OEMs are offering advanced applications such as HMI, keyless entry, and auto-park assists, which are likely to generate demand for testing and prototyping of new automotive systems in the global automotive simulation market. These factors are expected to provide a competitive advantage to OEMs and, in turn, contribute to the overall growth of the global market.

Automotive Simulation Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Simulation Market Regional Analysis

"In 2022, Asia Pacific accounted for a significant share (%) in terms of value, and the region is expected to maintain its dominance over the forecast period from 2023 to 2032. Several factors contribute to the regional market's strong performance, including the increasing production of vehicles, growing demand for in-vehicle services connected to external cloud platforms, expansion of primary OEMs and automotive component suppliers, and changes in in-vehicle electronic architecture. Moreover, the rising sales of connected vehicles and stringent regulations promoting the use of eco-friendly vehicles in the regional market are further bolstering its value. Additionally, the region is projected to exhibit the fastest growth, with a substantial CAGR (%) throughout the forecast period from 2023 to 2032.

Automotive Simulation Market Players

Some of the top automotive simulation companies offered in our report include Altair Engineering Inc., Ansys, Inc., Dassault Systèmes SE, Design Simulation Technologies Inc., dSPACE GmbH, ESI group, IPG Automotive GmbH, PTC Inc, Siemens AG, SIMUL8 Corporation, Synopsys, Inc., and The MathWorks, Inc.

Frequently Asked Questions

How big is the automotive simulation market?

The automotive simulation market collected USD 1,924 Million in 2022.

What is the CAGR of the automotive simulation market from 2023 to 2032?

The CAGR of automotive simulation is 11.2% during the analysis period of 2023 to 2032.

Which are the key players in the automotive simulation market?

The key players operating in the global market are Altair Engineering Inc., Ansys, Inc., Dassault Systèmes SE, Design Simulation Technologies Inc., dSPACE GmbH, ESI group, IPG Automotive GmbH, PTC Inc, Siemens AG, SIMUL8 Corporation, Synopsys, Inc., and The MathWorks, Inc.

Which region dominated the global automotive simulation market share?

Asia-Pacific held the dominating position in automotive simulation industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of automotive simulation during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automotive simulation Industry?

The current trends and dynamics in the automotive simulation industry include growing demand for autonomous vehicles, cost-effective product development and testing, and emphasis on reducing time-to-market.

Which component held the maximum share in 2022?

The software component held the maximum share of the automotive simulation Industry.