Automotive Selective Catalytic Reduction Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Automotive Selective Catalytic Reduction Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

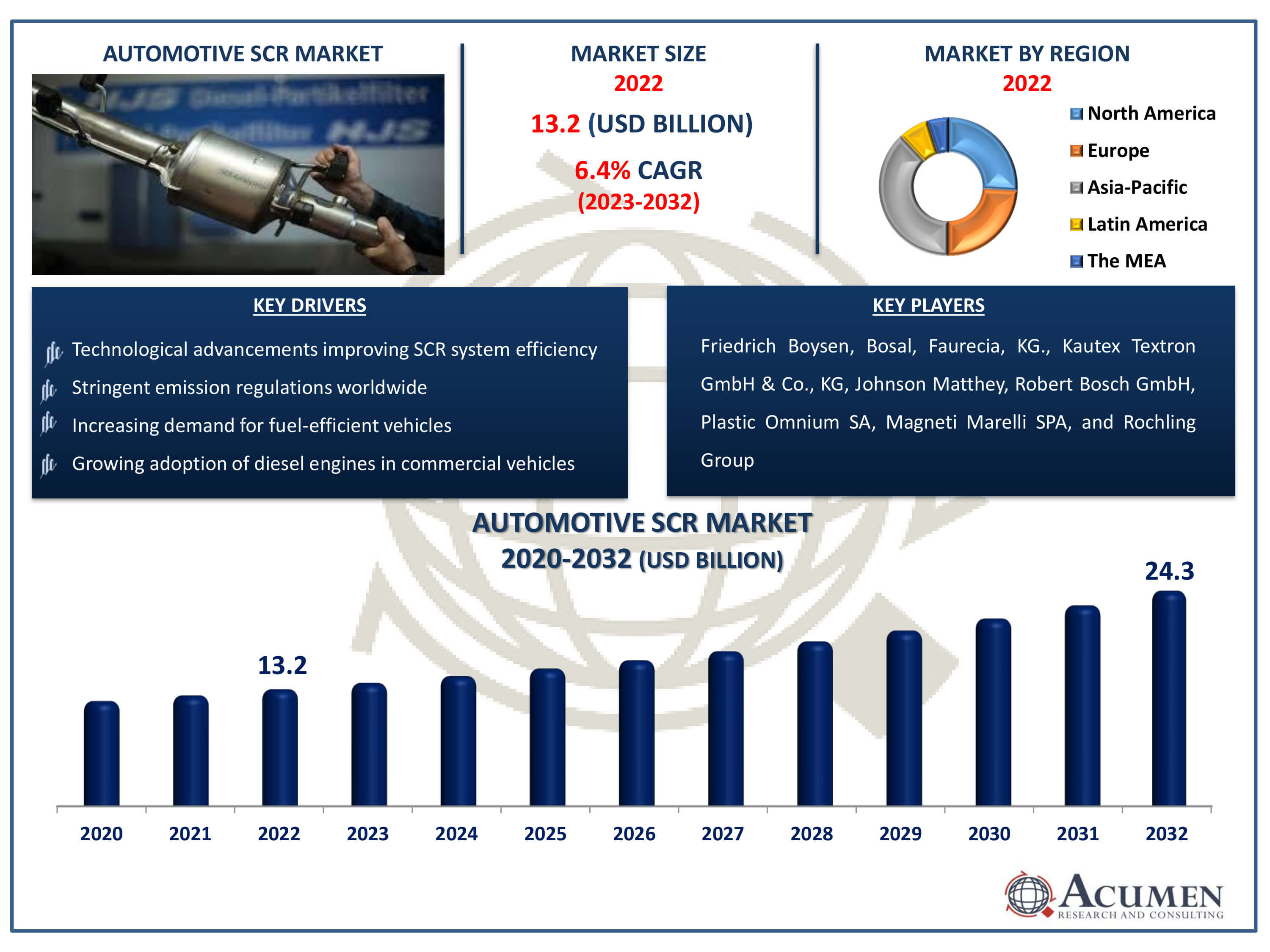

The Automotive Selective Catalytic Reduction (SCR) Market Size accounted for USD 13.2 Billion in 2022 and is estimated to achieve a market size of USD 24.3 Billion by 2032 growing at a CAGR of 6.4% from 2023 to 2032.

Automotive Selective Catalytic Reduction (SCR) Market Highlights

- Global automotive selective catalytic reduction (SCR) market revenue is poised to garner USD 24.3 billion by 2032 with a CAGR of 6.4% from 2023 to 2032

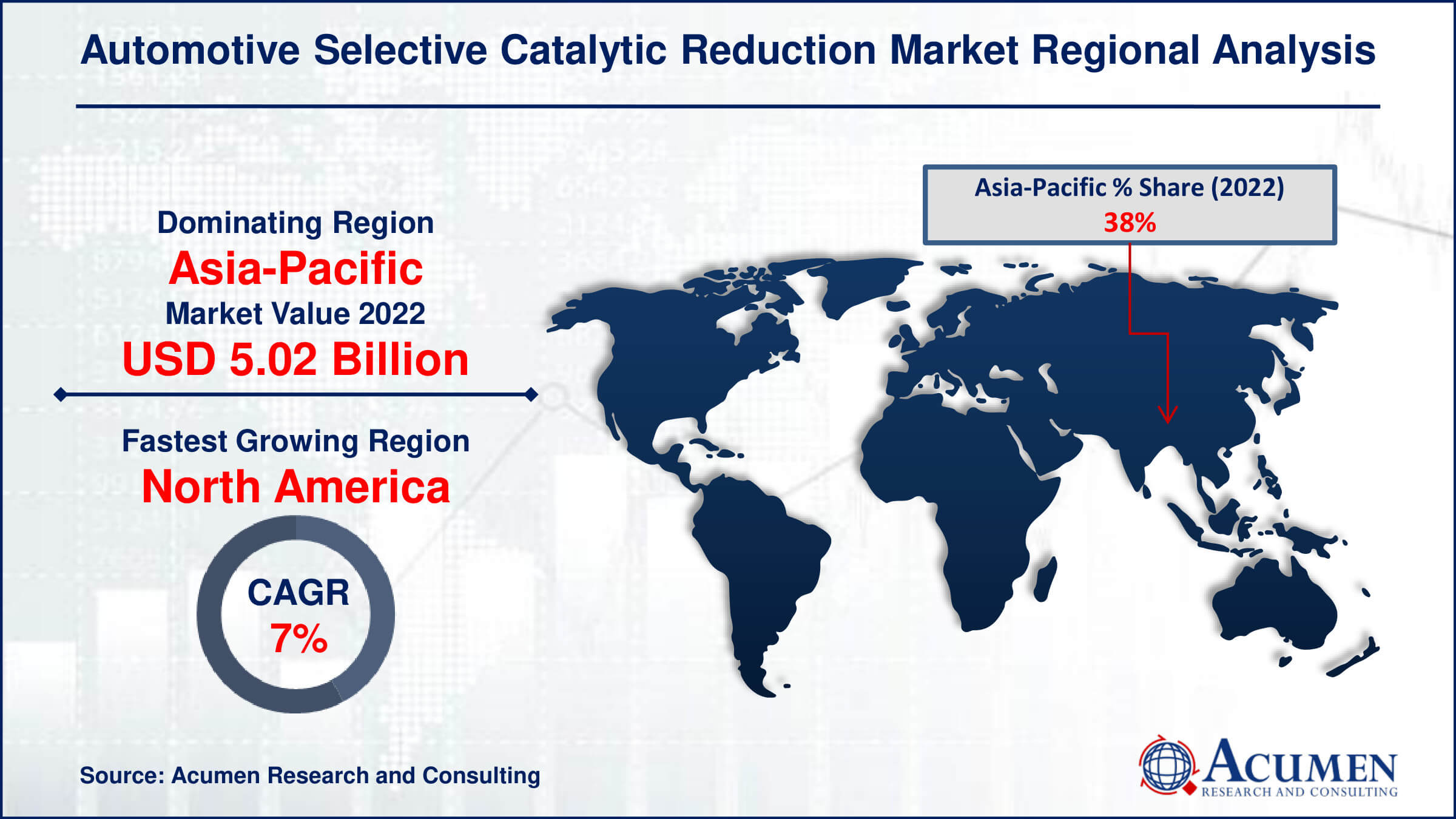

- Asia-Pacific automotive selective catalytic reduction (SCR) market value occupied around USD 5 billion in 2022

- North America automotive selective catalytic reduction (SCR) market growth will record a CAGR of more than 7% from 2023 to 2032

- Among type, the urea tank sub-segment generated more than USD 5.9 billion revenue in 2022

- Based on end use, the passenger cars sub-segment generated around 55% market share in 2022

- Integration of SCR systems in off-road vehicles and heavy-duty equipment is a popular automotive selective catalytic reduction (SCR) market trend that fuels the industry demand

Automotive selective catalytic reduction (SCR) is an emissions control technique used in diesel-powered automobiles to lower nitrogen oxide (NOx) levels. SCR systems use a catalyst and a reducing agent, usually urea-based diesel exhaust fluid (DEF), to transform NOx emissions into harmless nitrogen and water vapor via a chemical process. In the SCR process, DEF is injected into the vehicle's exhaust stream, where it combines with NOx gases on the catalyst surface, converting them into nitrogen and water. This reaction takes place at very low temperatures, making SCR systems extremely successful in reducing NOx emissions even in cold start circumstances. SCR technology enables automobiles to comply with rigorous pollution requirements while boosting fuel efficiency and engine performance.

Global Automotive Selective Catalytic Reduction (SCR) Market Dynamics

Market Drivers

- Stringent emission regulations worldwide

- Increasing demand for fuel-efficient vehicles

- Growing adoption of diesel engines in commercial vehicles

- Technological advancements improving SCR system efficiency

Market Restraints

- High initial investment costs for SCR systems

- Complexity of integrating SCR technology into existing vehicle designs

- Potential supply chain disruptions for urea-based diesel exhaust fluid

Market Opportunities

- Expansion of automotive SCR market in emerging economies

- Rising demand for electric vehicles leading to increased focus on emissions reduction in internal combustion engines

- Development of innovative SCR catalyst materials enhancing performance and durability

Automotive Selective Catalytic Reduction (SCR) Market Report Coverage

| Market | Automotive Selective Catalytic Reduction Market |

| Automotive Selective Catalytic Reduction Market Size 2022 | USD 13.2 Billion |

| Automotive Selective Catalytic Reduction Market Forecast 2032 |

USD 24.3 Billion |

| Automotive Selective Catalytic Reduction Market CAGR During 2023 - 2032 | 6.4% |

| Automotive Selective Catalytic Reduction Market Analysis Period | 2020 - 2032 |

| Automotive Selective Catalytic Reduction Market Base Year |

2022 |

| Automotive Selective Catalytic Reduction Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Fuel Type, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Friedrich Boysen, Bosal, Faurecia, KG., Kautex Textron GmbH & Co., KG, Johnson Matthey, Robert Bosch GmbH, Plastic Omnium SA, Magneti Marelli SPA, and Rochling Group. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Selective Catalytic Reduction (SCR) Market Insights

The primary drivers of the global expansion in demand for automotive SCR systems include heightened safety concerns stemming from automotive pollution and supportive policies and regional initiatives aimed at minimizing vehicle emissions. Additionally, increased adoption of Trig system technology in diesel vehicles is expected to drive demand growth in the target market. Furthermore, stringent legislation aimed at reducing carbon emissions and improving fuel quality also contributes to market growth.

Manufacturers are increasingly advocating for the use of SCR, EGR, and Diesel Particulate Filters to mitigate particulate matter pollution from diesel vehicles, thereby adopting treatment technologies.

A noteworthy development in the target market is the introduction of progressive emission standards in developing markets. Emission requirements such as Euro 6, China 6, and Bharat Stage 6 regulations aim to regulate and manage or minimize hazardous emissions such as carbon monoxide, ozone, and hydrocarbons, necessitating economic and environmental regulation.

The high cost of adopting selective catalytic reduction (SCR) systems is a key limitation on the Automotive SCR Market. While SCR technology substantially decreases nitrogen oxide (NOx) emissions in diesel-powered cars, the installation and maintenance costs can be significant for manufacturers and vehicle owners. The initial investment in SCR systems, which includes the cost of the SCR catalyst, urea-based diesel exhaust fluid (DEF), and other components, can be significant. Furthermore, recurring payments for DEF refills and frequent maintenance add to the overall cost of ownership.

Automotive Selective Catalytic Reduction (SCR) Market Segmentation

The worldwide market for automotive selective catalytic reduction (SCR) is split based on type, fuel type, end use, and geography.

Automotive SCR Market By Type

- Urea Pump

- Urea Tank

- Injector

- ECU

According to automotive selective catalytic reduction (SCR) industry analysis, the urea tank category is the biggest. Urea tanks are critical components of SCR systems because they store diesel exhaust fluid (DEF), a urea-based solution required for NOx reduction. As governments throughout the world apply more rigorous emissions laws, demand for SCR technology has grown, notably in diesel-powered automobiles. Urea tanks, as key components of SCR systems, are in high demand because of their critical function in storing and providing DEF to the exhaust stream for NOx conversion. Furthermore, the growing usage of SCR technology in numerous automotive applications, such as commercial trucks, buses, and passenger cars, drives up demand for urea tanks, emphasising their importance in the automotive SCR industry.

Automotive SCR Market By Fuel Type

- Diesel

- Gasoline

The diesel sector dominates the market and it is expected to grow over the automotive selective catalytic reduction (SCR) market forecast period. Diesel engines are renowned for emitting more nitrogen oxide (NOx) than petrol engines owing to their combustion characteristics. As a result, the demand for SCR systems in diesel-powered cars has increased dramatically to fulfil tough emission requirements set by governments across the world. SCR technology significantly decreases NOx emissions by pumping urea-based diesel exhaust fluid (DEF) into the exhaust stream, where it interacts with NOx gases to produce harmless nitrogen and water vapour. Diesel engines are widely used in commercial trucks, buses, and heavy-duty vehicles, hence the diesel sector leads the automotive SCR market because to its bigger market share and increased demand for emissions control solutions in diesel-powered cars.

Automotive SCR Market By End-Use

- Commercial Vehicle

- Passenger Cars

The market for automotive selective catalytic reduction (SCR) is dominated by passenger cars. This dominance is due to the widespread deployment of SCR technology in passenger vehicles to fulfill stringent emissions standards imposed by governments across the world. Passenger cars equipped with SCR systems effectively reduce harmful nitrogen oxide (NOx) emissions, contributing to improved air quality and environmental conservation. Furthermore, rising consumer awareness of the environmental impact of automobile emissions has boosted demand for cleaner, more fuel-efficient automobiles. As a result, automobile manufacturers are gradually introducing SCR technology into their passenger car models in order to meet pollution standards while also offering maximum performance and driving enjoyment, which is boosting the growth of the Passenger Cars sector in the SCR market.

Automotive Selective Catalytic Reduction Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Selective Catalytic Reduction (SCR) Market Regional Analysis

The Asia-Pacific region is projected to offer lucrative opportunities in the automotive selective catalytic reduction (SCR) industry worldwide. The development of the automotive SCR market in this area is expected to be driven by stringent government regulations, coupled with improved transportation facilities and infrastructure. The automotive SCR market is poised to thrive in the region, particularly if governments in countries like India and China incentivize original equipment manufacturers (OEMs) to introduce these vehicle systems, primarily to enhance fuel efficiency and reduce emissions.

North America is the fastest growing region during the automotive selective catalytic reduction (SCR) market forecast period. Rapid progress is also underway in other regions such as America and Europe. The presence of advanced technologies and leading producers in these regions provides companies with a solid foundation for SCR implementation. Established car manufacturers continue to drive demand growth in these regions, largely due to the advanced technology required to establish key business layers.

Automotive Selective Catalytic Reduction (SCR) Market Players

Some of the top automotive selective catalytic reduction (SCR) companies offered in our report includes Friedrich Boysen, Bosal, Faurecia, KG., Kautex Textron GmbH & Co., KG, Johnson Matthey, Robert Bosch GmbH, Plastic Omnium SA, Magneti Marelli SPA, and Rochling Group.

Frequently Asked Questions

How big is the automotive selective catalytic reduction (SCR) market?

The automotive selective catalytic reduction (SCR) market size was valued at USD 13.2 billion in 2022.

What is the CAGR of the global automotive selective catalytic reduction (SCR) market from 2023 to 2032?

The CAGR of automotive selective catalytic reduction (SCR) is 6.4% during the analysis period of 2023 to 2032.

Which are the key players in the automotive selective catalytic reduction (SCR) market?

The key players operating in the global market are including Friedrich Boysen, Bosal, Faurecia, KG., Kautex Textron GmbH & Co., KG, Johnson Matthey, Robert Bosch GmbH, Plastic Omnium SA, Magneti Marelli SPA, and Rochling Group.

Which region dominated the global automotive selective catalytic reduction (SCR) market share?

Asia-Pacific held the dominating position in automotive selective catalytic reduction (SCR) industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of automotive selective catalytic reduction (SCR) during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automotive selective catalytic reduction (SCR) industry?

The current trends and dynamics in the automotive selective catalytic reduction (SCR) industry include stringent emission regulations worldwide, increasing demand for fuel-efficient vehicles, growing adoption of diesel engines in commercial vehicles, and technological advancements improving SCR system efficiency.

Which fuel type held the maximum share in 2022?

The diesel fuel type held the maximum share of the automotive selective catalytic reduction (SCR) industry.