Automotive Polycarbonate Glazing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Automotive Polycarbonate Glazing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

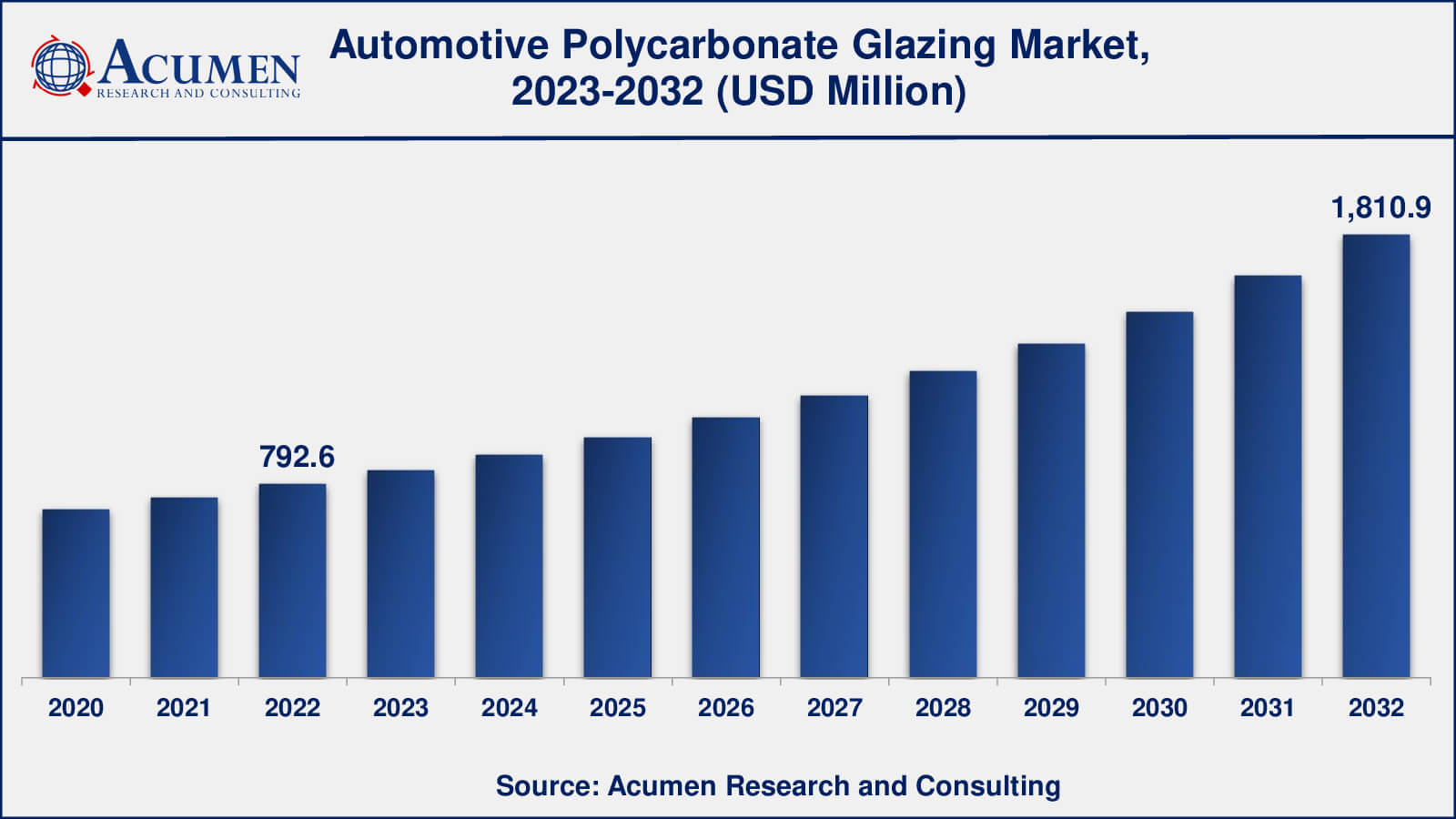

The Global Automotive Polycarbonate Glazing Market Size accounted for USD 792.6 Million in 2022 and is estimated to achieve a market size of USD 1,810.9 Million by 2032 growing at a CAGR of 8.8% from 2023 to 2032.

Automotive Polycarbonate Glazing Market Highlights

- Global automotive polycarbonate glazing market revenue is poised to garner USD 1,810.9 million by 2032 with a CAGR of 8.8% from 2023 to 2032

- Asia-Pacific automotive polycarbonate glazing market value occupied around USD 380 million in 2022

- Europe automotive polycarbonate glazing market growth will record a CAGR of more than 9% from 2023 to 2032

- Among application, the front window sub-segment generated over US$ 214 million revenue in 2022

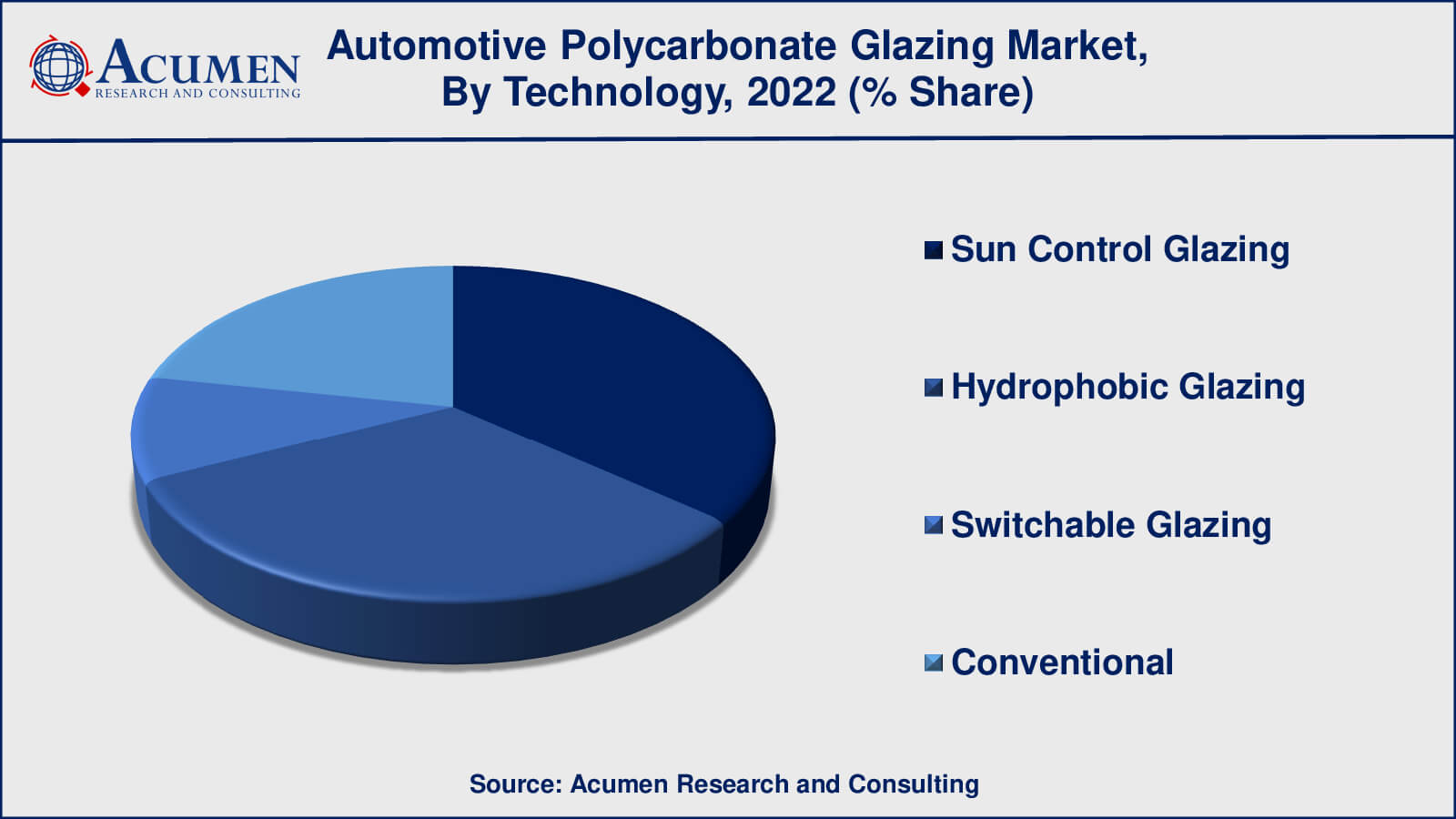

- Based on technology, the sun control glazing sub-segment generated around 36% share in 2022

- Interactive displays in polycarbonate windows is a popular automotive polycarbonate glazing market trend that fuels the industry demand

Automotive polycarbonate glazing is manufactured using foam materials such as polyurethane, polypropylene, nylon, rubber, or combinations thereof. The primary function of automotive polycarbonate glazing is to shield the vehicle's exterior surface from corrosion, dirt, and wear. This technology offers a clean exterior appearance for vehicles, simplifies maintenance, and enhances overall durability.

In terms of applications, polycarbonate glazing finds use in various parts of a vehicle, including the windscreen, sidelite, backlit areas, sunroof, and others. These glazing components play a vital role in ensuring visibility, aesthetics, and protection for both passengers and the vehicle itself. Additionally, their utilization contributes to reducing the overall weight of the vehicle, resulting in decreased engine load and improved fuel efficiency.

Polycarbonate materials also serve the purpose of enhancing fuel efficiency, which aligns with the automotive industry's increasing focus on environmental sustainability. These materials are applied not only in the windows at the rear and sides of vehicles but also in the construction of panoramic sunroofs, allowing for a stylish and functional addition to modern vehicles.

Global Automotive Polycarbonate Glazing Market Dynamics

Market Drivers

- Fuel efficiency and emissions benefits from lightweight polycarbonate glazing

- Complex shapes enabled by moldable polycarbonate for creative vehicle designs

- High impact resistance for improved occupant protection

- Acoustic insulation properties enhance cabin comfort

Market Restraints

- Polycarbonate is prone to scratches, requiring protective coatings

- Weathering can affect optical clarity and longevity

- Higher production expenses compared to traditional glass

- Meeting safety and visibility standards could be difficult

Market Opportunities

- Lightweight glazing extends EV battery life

- Design flexibility for advanced autonomous interiors

- Scratch-resistant coatings and durability upgrades

Automotive Polycarbonate Glazing Market Report Coverage

| Market | Automotive Polycarbonate Glazing Market |

| Automotive Polycarbonate Glazing Market Size 2022 | USD 792.6 Million |

| Automotive Polycarbonate Glazing Market Forecast 2032 | USD 1,810.9 Million |

| Automotive Polycarbonate Glazing Market CAGR During 2023 - 2032 | 8.8% |

| Automotive Polycarbonate Glazing Market Analysis Period | 2020 - 2032 |

| Automotive Polycarbonate Glazing Market Base Year | 2022 |

| Automotive Polycarbonate Glazing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Vehicle Type, By Sales Channel, By Application, By Technology, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Chi Mei Corporation, Covestro, Engle Machinery Inc., Evonik, Freeglass, Guardian Industries, KRD Sicherheitstechnik GmbH, Mitsubishi Engineering Plastics, SABIC, Saint-Gobain, Sumitomo Corporation, Trinseo, and Webasto. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Polycarbonate Glazing Market Insights

The growth of the automotive polycarbonate glazing market is primarily propelled by several key factors. These include the rising number of vehicle sales, the growing adoption of sunroofs in passenger cars, consumer preferences geared towards enhancing the aesthetic appeal of vehicles, and the continuous stream of technological advancements in automotive polycarbonate glazing.

Furthermore, stringent government regulations within the automotive industry are driving the demand for lightweight parts and materials, pushing both original equipment manufacturers (OEMs) and aftermarket players to provide automotive polycarbonate glazing that is both safe and cost-effective. Consumers' focus on glazing as a means to enhance the overall appearance and radiance of their vehicles, along with the availability of advanced design options in automotive glazing, is anticipated to contribute significantly to market growth.

Moreover, the shifting lifestyles of consumers, particularly in developed countries, coupled with the expansion of the automotive aftermarket industry, the rising demand for electric vehicles, technological advancements, and the increasing application possibilities are all expected to create a plethora of opportunities for manufacturers in the global market throughout the forecast period.

However, certain challenges remain. The volatile prices of raw materials pose a potential obstacle, and the limited familiarity of engineers with advanced plastic glazing technologies could hinder the growth of the global automotive polycarbonate glazing market in the coming years. Despite these challenges, the market's trajectory remains positive, driven by the industry's determination to overcome obstacles and harness the numerous growth prospects on the horizon.

Automotive Polycarbonate Glazing Market Segmentation

The worldwide market for automotive polycarbonate glazing is split based on vehicle type, technology, sales channel, application, and geography.

Automotive Polycarbonate Glazing Vehicle Types

- Passenger Cars

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

The passenger cars segment has held the largest share in the global automotive polycarbonate glazing market in recent years. The growing demand for luxury passenger cars, rapid industrialization, an increase in the production and sales of passenger cars in developing countries such as India, China, and Indonesia, along with an increase in the purchasing power of consumers, are expected to further drive this segment over the forecast period.

The rising consumer focus on improving aesthetic appeal, a growing emphasis on safety and the longevity of exterior components, and supportive government initiatives for automotive polycarbonate glazing in research and development centers are expected to contribute to the increasing demand for passenger car applications during the forecast period.

Automotive Polycarbonate Glazing Sales Channels

- OEM

- Aftermarket

The aftermarket segment was expected to hold a significant share in the global automotive polycarbonate glazing market in previous years. Factors such as the growth of the aftermarket industry, increasing demands for replacements, and a rise in the number of private-level shops are anticipated to contribute to the increased demand for aftermarket products. Additionally, the limited availability of high-quality products in the aftermarket is expected to further boost this segment over the forecast period.

Automotive Polycarbonate Glazing Applications

- Side Window

- Front Window

- Sunroof

- Large Wind-Shield

- Hyrdophobic Glazing

- Rear Wind-Shield

- Head-Up Display

- Switchable Glazing

Historically, the front window and bigger windscreen (front windscreen) sectors have been among the key income earners because to their critical roles in vehicle safety, visibility, and aesthetics. These bigger sections of glazing necessitate the use of high-quality materials that are impact resistant, clear, and long-lasting.

Sunroofs and head-up display (HUD) applications are also popular, since they improve driving experiences and interior aesthetics. However, due to changes in market dynamics and consumer preferences, the income earned by any application might fluctuate over time.

Automotive Polycarbonate Glazing Technologies

- Sun Control Glazing

- Hydrophobic Glazing

- Switchable Glazing

- Conventional

According to the automotive polycarbonate glazing market forecast, the sun control glazing segments have dominated the market share and are expected to maintain their dominance throughout the anticipated timeframe of 2023 to 2032. Sun control glazing technology has grown in popularity as a means of regulating solar heat gain in automobiles. This technique has piqued the interest of those concerned about energy economy and passenger comfort. Sun control glazing, by lowering the amount of heat entering the car, can reduce the demand on air conditioning systems, improving both energy economy and interior comfort. Its ability to reduce solar heat gain while retaining visibility adds to its allure.

Automotive Polycarbonate Glazing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Polycarbonate Glazing Market Regional Analysis

Asia-Pacific accounted for the largest market share in the automotive polycarbonate glazing market, and the region is projected to maintain its dominance over the forecast period. The region is experiencing significant growth due to the widespread adoption of automotive polycarbonate glazing across various applications, the presence of key automotive polycarbonate glazing companies, and the rapid expansion of the automotive aftermarket industry. Furthermore, the increasing demand for glazing materials for passenger vehicles in countries such as China, India, and Thailand, coupled with the growth of manufacturing facilities driven by low production costs and supportive government incentives, is fueling the expansion of the automotive polycarbonate glazing market in the Asia-Pacific region. Europe follows the Asia-Pacific region as a significant player in the automotive polycarbonate glazing market.

North America is expected to achieve the significant compound annual growth rate (CAGR) in the global market during the forecast period. The growth in automobile production in the US and Canada, coupled with increasing innovation and development in automotive polycarbonate glazing, as well as the thriving automotive industry in Mexico, are set to drive market growth in the global automotive polycarbonate glazing market throughout the forecast period.

Automotive Polycarbonate Glazing Market Players

Some of the top automotive polycarbonate glazing companies offered in our report includes Chi Mei Corporation, Covestro, Engle Machinery Inc., Evonik, Freeglass, Guardian Industries, KRD Sicherheitstechnik GmbH, Mitsubishi Engineering Plastics, SABIC, Saint-Gobain, Sumitomo Corporation, Trinseo, and Webasto.

Frequently Asked Questions

What was the market size of the global automotive polycarbonate glazing in 2022?

The market size of automotive polycarbonate glazing was USD 792.6 million in 2022.

What is the CAGR of the global automotive polycarbonate glazing market from 2023 to 2032?

The CAGR of automotive polycarbonate glazing is 8.8% during the analysis period of 2023 to 2032.

Which are the key players in the automotive polycarbonate glazing market?

The key players operating in the global market are including Chi Mei Corporation, Covestro, Engle Machinery Inc., Evonik, Freeglass, Guardian Industries, KRD Sicherheitstechnik GmbH, Mitsubishi Engineering Plastics, SABIC, Saint-Gobain, Sumitomo Corporation, Trinseo, and Webasto.

Which region dominated the global automotive polycarbonate glazing market share?

Asia-Pacific held the dominating position in automotive polycarbonate glazing industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of automotive polycarbonate glazing during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automotive polycarbonate glazing industry?

The current trends and dynamics in the automotive polycarbonate glazing industry includes fuel efficiency and emissions benefits from lightweight polycarbonate glazing Complex shapes enabled by moldable polycarbonate for creative vehicle designs, high impact resistance for improved occupant protection, and acoustic insulation properties enhance cabin comfort.

Which vehicle type held the maximum share in 2022?

The passenger vehicle type held the maximum share of the automotive polycarbonate glazing industry.