Automotive Plastics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 � 2030

Published :

Report ID:

Pages :

Format :

Automotive Plastics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 � 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

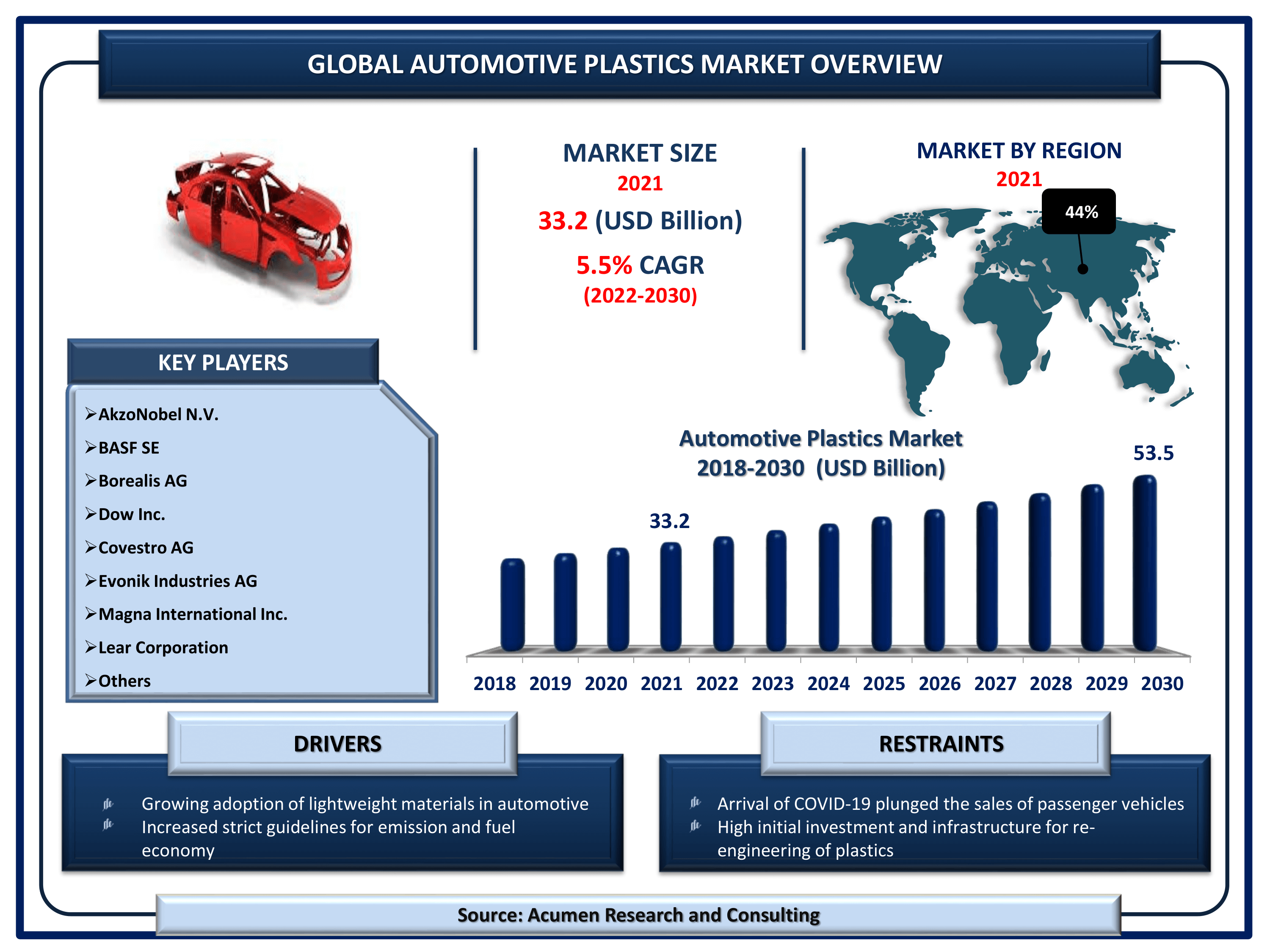

The Global Automotive Plastics Market Size accounted for USD 33.2 Billion in 2021 and is projected to achieve a market size of USD 53.5 Billion by 2030 rising at a CAGR of 5.5% from 2022 to 2030. The rising need to reduce the weight of automobiles is a primary factor that is fueling the automotive plastics market share. In addition to that, increasing trend of vehicle electrification is a popular automotive plastics market trend that is supporting the industry growth.

Automotive Plastics Market Report Statistics

- Global automotive plastics market revenue is estimated to reach USD 53.5 Billion by 2030 with a CAGR of 5.5% from 2022 to 2030

- Asia-Pacific automotive plastics market share accounted for over 44.6% shares in 2021

- According to the U.S. Department of Energy, U.S. fleet could save more than 5 billion gallons of fuel annually by 2030 using advanced materials in one quarter

- Asia-Pacific automotive plastics market growth will record considerable CAGR from 2022 to 2030

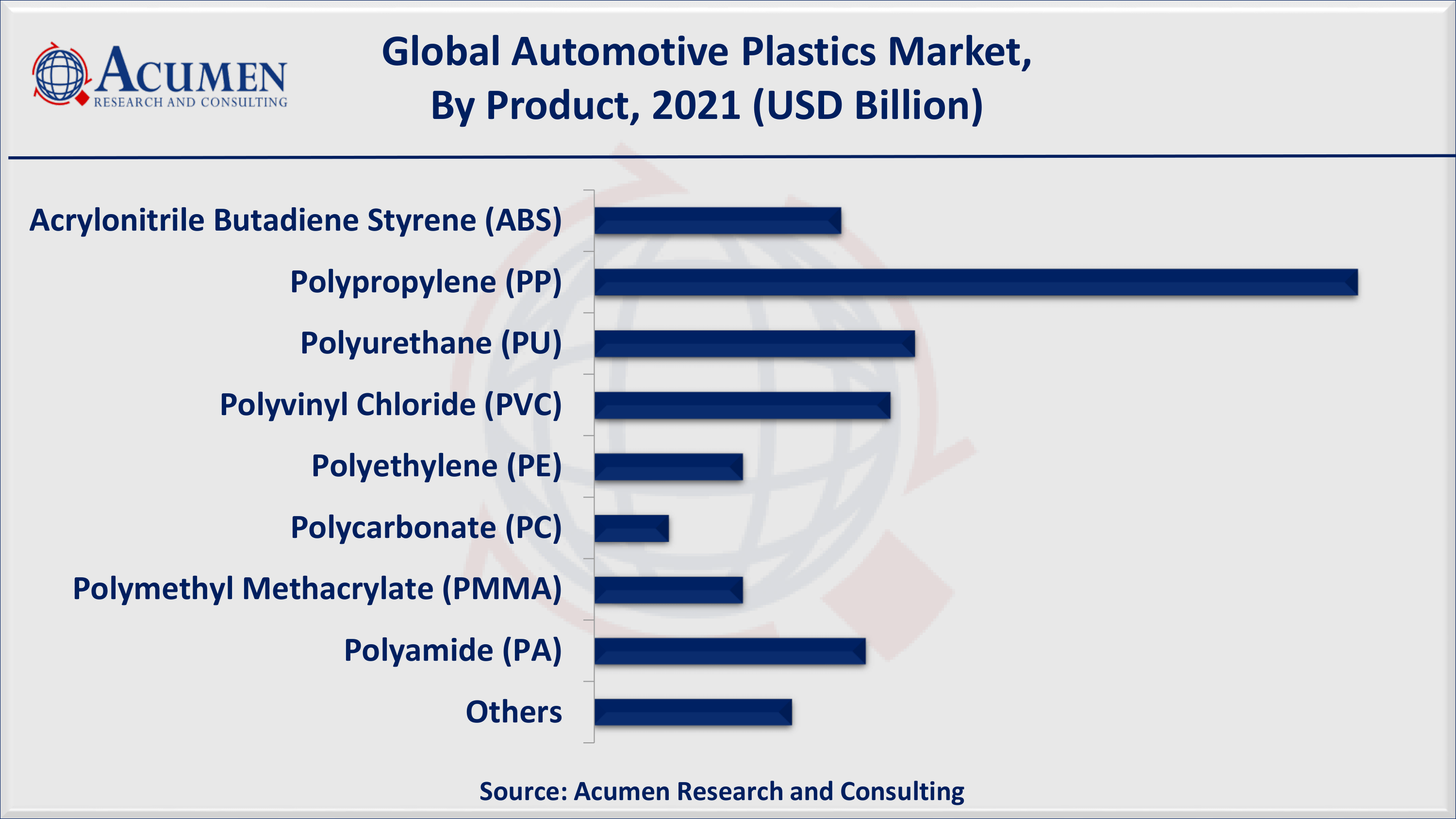

- Based on product, polypropylene (PP) accounted for over 31% of the overall market share in 2021

- Growing use of bioplastics in vehicle production fuels the global automotive plastics market value

Plastics account for approximately 15% of the weight of the average passenger car today, according to the ODI research report. They are increasingly being used to replace steel in automobile bodies and chassis, as well as hundreds of other components such as lights, bumpers, engine components, dashboards, and interior furnishings. Furthermore, every 10% reduction in vehicle weight reduces fuel consumption by 6 to 8%. According to a research study released by PLASTIVISION INDIA, automobile manufacturers are now incorporating more advanced plastic materials to reduce weight and make vehicles more fuel efficient due to current environmental and economic concerns.

Global Automotive Plastics Market Dynamics

Market Drivers

- Growing adoption of lightweight materials in automotive

- Increased strict guidelines for emission and fuel economy

- Advent of new safety features and luxury components

- Players focus towards thermally stable plastics

Market Restraints

- Arrival of COVID-19 plunged the sales of passenger vehicles

- High initial investment and infrastructure for re-engineering of plastics

Market Opportunities

- Rapid application of anti-microbial plastics/additives in vehicle car production

- Use of composites and PMMA in vehicle car production

Automotive Plastics Market Report Coverage

| Market | Automotive Plastics Market |

| Automotive Plastics Market Size 2021 | USD 33.2 Billion |

| Automotive Plastics Market Forecast 2030 | USD 53.5 Billion |

| Automotive Plastics Market CAGR During 2022 - 2030 | 5.5% |

| Automotive Plastics Market Analysis Period | 2018 - 2030 |

| Automotive Plastics Market Base Year | 2021 |

| Automotive Plastics Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By Process, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AkzoNobel N.V., BASF SE, Borealis AG, Dow Inc., Covestro AG, Evonik Industries AG, Magna International Inc., Lear Corporation, Plastic Omnium, Royal DSM N.V., and SABIC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Automotive Plastics Market Dynamics

Automotive Plastics Promise To Keep Automobile Industry Alive

While companies work on self-driving cars, the global car stock is gradually electrifying. According to the International Energy Agency, 750,000 plug-in hybrid and fully electric vehicles were sold globally last year, accounting for about 1% of the total car market (IEA). Last year, consumers in the United States purchased 160,000 hybrid and electric vehicles. The scale and nature of change that lies ahead for the industry are unprecedented. These changes are also having an impact on the business of supplying engineering plastics to the automotive industry. Plastics used to make connectors and housings for the numerous electrical and electronic components required for both electric and autonomous vehicles will see an increase in demand. Polymers, for example, have aided in vehicle advancement for generations. Notably, they save energy by reducing vehicle weight by replacing heavier materials such as metal and glass. Polymer incorporation in automobiles helps to reduce weight by 10% and improves fuel economy by about 5%. Plastics also save money for automakers. A nylon bracket, for example, that holds components together under the hood may have mounts and other features molded right into it. A similar part made of metal would be made of many pieces and would necessitate costly assembly steps. As a result of these factors, the amount of plastics used in automobiles has grown over time.

COVID-19 Impact on Global Automotive Plastics Market

The COVID-19 pandemic has had an immediate and severe impact on the global automotive industry. The automotive industry has been hit harder than any other sector of the plastics industry. Auto assembly lines, where employees work side by side, have been closed in China, Europe, and the United States. According to Autodata, 9 million vehicles were sold in the United States in April, a 46% decrease from the previous year. Celanese, which derives about 15% of its revenue from engineering polymers for automakers, took a significant hit. During April, the firm saw demand from the auto market fall by 50% globally and by 80% in the United States. Demand for polyvinyl chloride (PVC), which is used in pipes, siding, windows, and doors, has also been affected by the downturn in construction. The US Census Bureau reported a 19% drop in housing starts in April compared to the previous year, resulting in a nearly 25% drop during the same period.

Recycled Plastics in Automobile Parts and Components Spur the Growth of the Global Automotive Plastics Market

Auto recyclers and automakers are focusing on plastics and polymers: automakers are recycling plastic scraps, defective parts, and other materials as part of their manufacturing processes, as well as recycled post-consumer plastics; and recyclers and scrap yards are starting to recycle. There are currently about 39 different types of basic plastics and polymers used to make an automobile today; however, these three polymers account for 66 percent of the plastic used in automobiles: polypropylene (32%), polyurethane (17%), and polyvinyl-chloride (PVC) (16%). Plastics made from ELV. The use of recycled plastics in the manufacture of new auto parts and components is a goal shared by participants throughout the automotive life cycle. Recycled plastic from automobiles, bottles, caps, containers, and other packaging is increasingly being used to manufacture new car parts.

Automotive Plastics Market Segmentation

The worldwide automotive plastics market is split based on product, process, application, and geography.

Automotive Plastics Market By Product

- Acrylonitrile Butadiene Styrene (ABS)

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Polycarbonate (PC)

- Polymethyl Methacrylate (PMMA)

- Polyamide (PA)

- Polypropylene (PP)

- Others

According to our automotive plastics industry analysis, the polypropylene segment leads the global automotive plastics market with the highest share. Recent advances in composite material technology have enabled the development of general-purpose plastics with properties comparable to those of engineering plastics in the field of general-purpose plastics such as polypropylene. By combining polypropylene compounds with excellent thermal properties, high impact strength, and a low coefficient of linear expansion. They can also be painted online in lamp finisher and front bumper applications. The regeneration of automotive plastics, particularly polypropylene, has enormous potential as a new supply source for the automobile industry while also meeting regulatory requirements for End-of-Life Vehicles (ELV) recovery. Furthermore, the closed-loop developed for polypropylene (PP) plastics entails converting car bumpers (fenders) and wheel arch liners into directly reusable material that can be injected into new car parts.

Automotive Plastics Market By Process

- Injection Molding

- Blow Molding

- Thermoforming

- Others

As per the automotive plastics market forecast, Injection molding will gain a significant market share in the global automotive plastics market. The high share is attributed to the automotive industry's use of a diverse range of injection-molded plastics to manufacture door handles, engine hoses and tubes, console and dashboard covers and brackets, radio covers and other electrical internal components, buttons and bezel panels, knobs for shifter levers, controls and covers for the sunroof, and convertible roof assemblies.

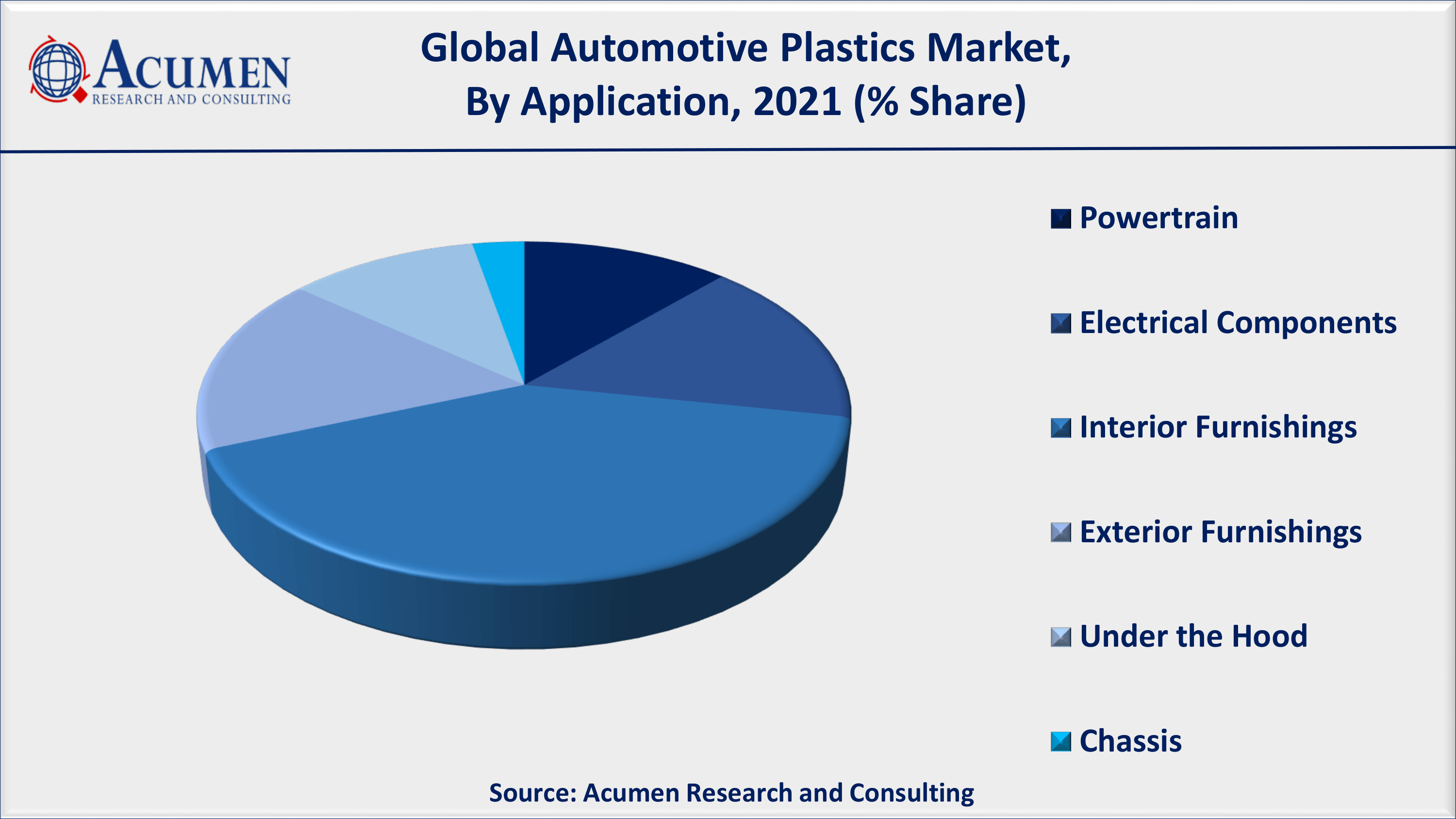

Automotive Plastics Market By Application

- Powertrain

- Electrical Components

- Interior Furnishings

- Exterior Furnishings

- Under the Hood

- Chassis

The interior furnishings segment, by application, will foster a reasonable share of the automotive plastics market. The increasing demand for automotive plastics in areas such as body and light panels, seat covers, steering wheels, seat bases, load floors, headliners, and rear package shelves and fascia systems is expected to drive segment growth.

Automotive Plastics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Automotive Plastics Market Regional Analysis

Asia Pacific dominates the automotive plastics market

The Asia-Pacific region dominates the automotive plastics market. Higher concentrations of passenger vehicle manufacturing industries, as well as rising demand for passenger cars, three-wheelers, and two-wheelers in China and other Asia Pacific countries such as India and Japan, are driving industry growth. In 2021, Europe accounted for second-largest market for automotive plastics. High-performance plastics are used by European automakers because they are energy-efficient and aid in vehicle weight reduction.

Automotive Plastics Market Players

Some of the key automotive plastics companies in the market are AkzoNobel N.V., BASF SE, Borealis AG, Dow Inc., Covestro AG, Evonik Industries AG, Magna International Inc., Lear Corporation, Plastic Omnium, Royal DSM N.V., and SABIC.

Frequently Asked Questions

What is the size of global automotive plastics market in 2021?

The market size of automotive plastics market in 2021 was accounted to be USD 33.2 Billion.

What is the CAGR of global automotive plastics market during forecast period of 2022 to 2030?

The projected CAGR of automotive plastics market during the analysis period of 2022 to 2030 is 5.5%.

Which are the key players operating in the market?

The prominent players of the global automotive plastics market are AkzoNobel N.V., BASF SE, Borealis AG, Dow Inc., Covestro AG, Evonik Industries AG, Magna International Inc., Lear Corporation, Plastic Omnium, Royal DSM N.V., and SABIC.

Which region held the dominating position in the global automotive plastics market?

North America held the dominating automotive plastics during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for automotive plastics during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global automotive plastics market?

Growing adoption of lightweight materials in automotive, increased strict guidelines for emission and fuel economy, and advent of new safety features and luxury components drives the growth of global automotive plastics market.

Which product held the maximum share in 2021?

Based on product, polypropylene (PP) segment is expected to hold the maximum share automotive plastics market.