Automotive Paint Additives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Automotive Paint Additives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

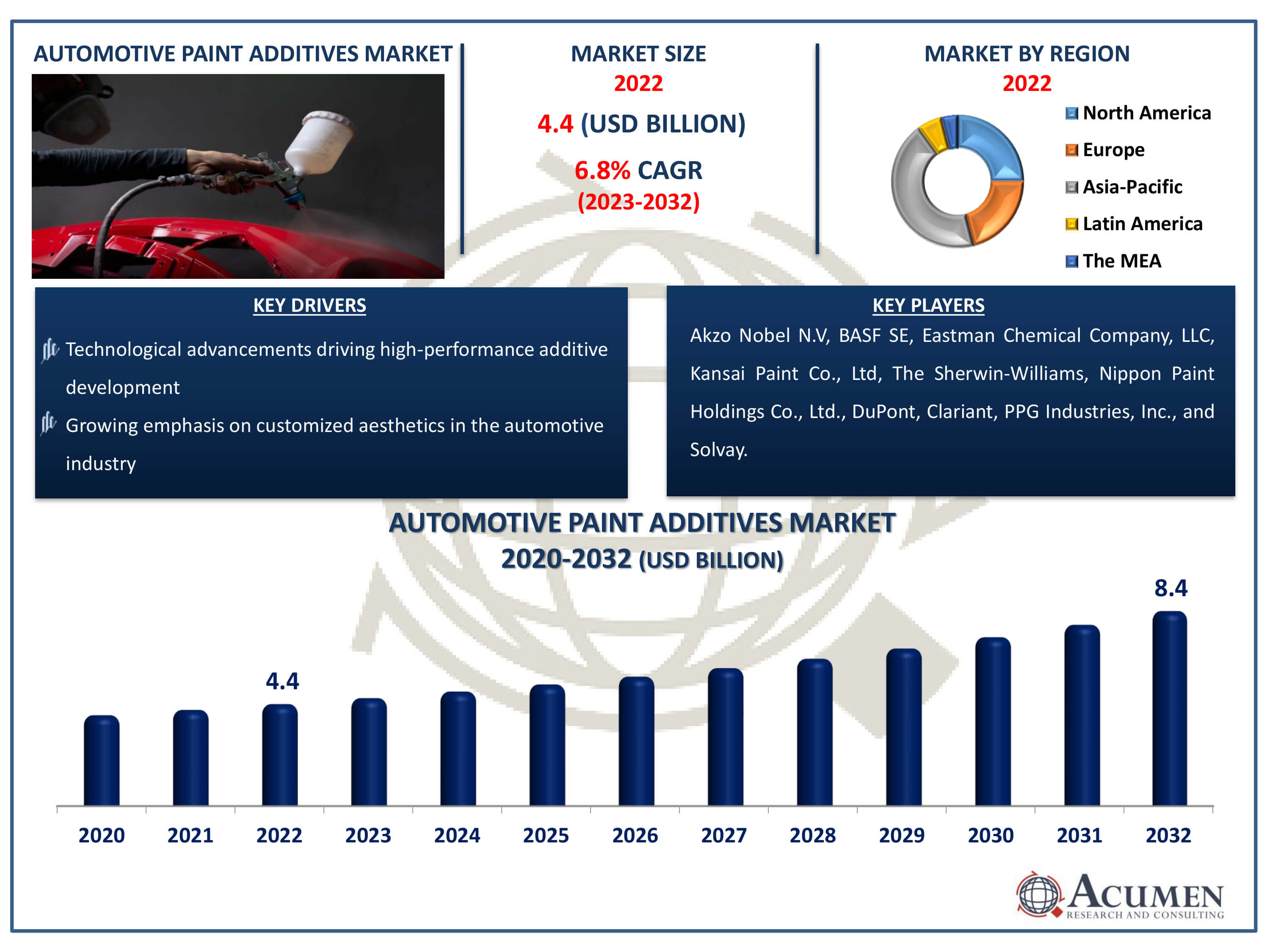

The Automotive Paint Additives Market Size accounted for USD 4.4 Billion in 2022 and is estimated to achieve a market size of USD 8.4 Billion by 2032 growing at a CAGR of 6.8% from 2023 to 2032.

Automotive Paint Additives Market Highlights

- Global automotive paint additives market revenue is poised to garner USD 8.4 billion by 2032 with a CAGR of 6.8% from 2023 to 2032

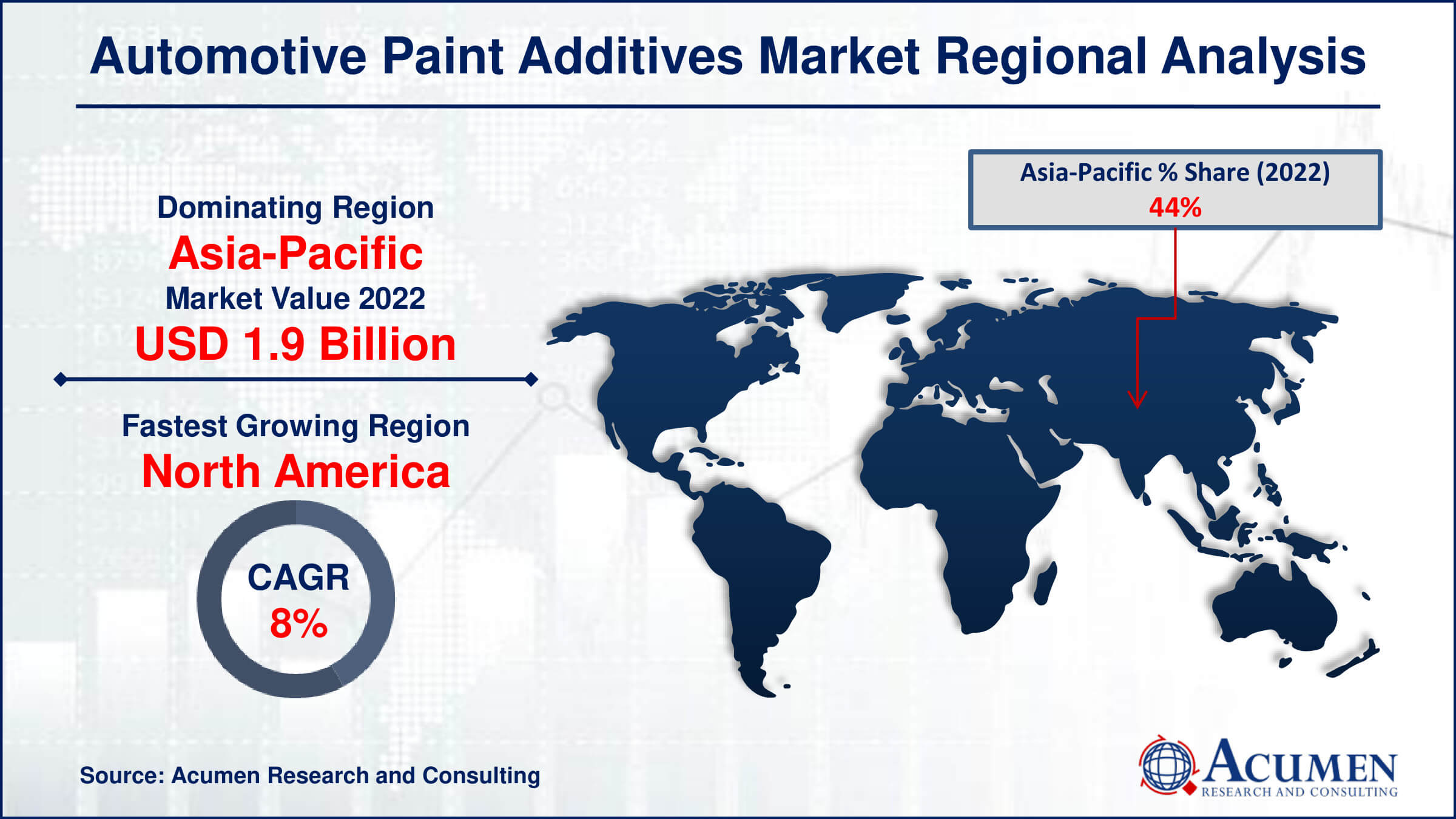

- Asia-Pacific automotive paint additives market value occupied around USD 1.9 billion in 2022

- North America automotive paint additives market growth will record a CAGR of more than 8% from 2023 to 2032

- Among power station type, the fisheye eliminator sub-segment generated more than USD 1.7 billion in 2022

- Based on application, the automotive antirust paint sub-segment generated around 34% share in 2022

- Growing awareness of corrosion protection is a popular automotive paint additives market trend that fuels the industry demand

Paint additives for cars are essential for improving the performance of vehicle paints and guaranteeing maximum effectiveness in a range of applications. These compositions protect the cosmetic integrity of auto components in addition to providing attributes like rust resistance and odorless. Furthermore, one of the main functions of automotive paint additives is to maintain surfactant agents, which are essential for controlling surface tension between particles and structures. Continuous innovation propels the creation of sophisticated formulations in the dynamic automotive paint additives market, satisfying the changing demands of the automotive sector. Efficiency, robustness, and aesthetic improvement are becoming increasingly important in this market, which reflects the industry's dedication to quality and technological advancement.

Global Automotive Paint Additives Market Dynamics

Market Drivers

- Increasing demand for environmentally friendly automotive paint solutions

- Technological advancements driving high-performance additive development

- Growing emphasis on customized aesthetics in the automotive industry

- Stringent regulations promoting safety and compliance

Market Restraints

- Escalating raw material costs impacting affordability

- Challenges in maintaining consistent quality across diverse environments

- Regulatory complexities hindering market growth

Market Opportunities

- Rising focus on electric vehicles driving demand for innovative paint formulations

- Global automotive production growth, particularly in emerging markets

- Nanotechnology advancements opening new possibilities for sustainable additives

Automotive Paint Additives Market Report Coverage

| Market | Automotive Paint Additives Market |

| Automotive Paint Additives Market Size 2022 | USD 4.4 Billion |

| Automotive Paint Additives Market Forecast 2032 | USD 8.4 Billion |

| Automotive Paint Additives Market CAGR During 2023 - 2032 | 6.8% |

| Automotive Paint Additives Market Analysis Period | 2020 - 2032 |

| Automotive Paint Additives Market Base Year |

2022 |

| Automotive Paint Additives Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Power Station Type, By Vehicle Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Akzo Nobel N.V, BASF SE, Eastman Chemical Company, LLC, Kansai Paint Co., Ltd, The Sherwin-Williams, Nippon Paint Holdings Co., Ltd., DuPont, Clariant, PPG Industries, Inc., and Solvay. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Paint Additives Market Insights

Paint additives play a crucial role in enhancing UV protection, preventing anti-catering, minimizing foaming and chipping of coatings, and ensuring stable dispersions in the automotive industry. Automotive formulations, fortified with these paint additives, exhibit robust resistance to humidity, abrasion, contaminants, and high temperatures. Given the significant investment in cars, buyers readily spend to preserve their pristine appearance, driving the global automotive painting additives industry. Furthermore, restrictions on aquatic paints emitting volatile organic chemicals contribute to the increased demand for automotive paint additives. Recently developed additives, featuring self-healing properties, have further piqued interest in this market. However, the high cost of these color additives remains a key obstacle, urging market players to explore cost-effective and desirable additives to gain a competitive edge.

The market for automotive paint additives is expected to grow as a result of the changing automotive landscape. First off, there is a big chance for the creation and use of environmentally friendly paint additives due to the growing emphasis on sustainability and environmental responsibility. The market for additives that help minimize emissions, waste, and the overall environmental impact of automobile coatings is expanding as a result of regulatory requirements and consumer preferences that favour less environmental impact. In this environmentally concerned market, manufacturers who spend in R&D to create such sustainable additives will have an advantage over their competitors.

The growing popularity of electric vehicles (EVs) offers a special chance for paint formulation innovation in the automotive industry. There is a need for specialized coatings that suit the particular requirements of EVs, such as heat management, lightweight materials, and superior aesthetics, as the automotive industry transitions to electric mobility. Manufacturers of automotive paint additives can take advantage of this by creating coatings that meet the unique performance needs of electric vehicles in addition to improving their aesthetic appeal. In the automotive paint additives sector, producers are positioned at the forefront of technological breakthroughs and market relevance through their pursuit of cutting-edge formulations targeted to the expanding electric car market.

Automotive Paint Additives Market Segmentation

The worldwide market for automotive paint additives is split based on power station type, vehicle type, application, and geography.

Automotive Paint Additives Power Station Types

- Flow Enhancers

- Blending Solvents

- Fisheye Eliminator

- Other

According to the automotive paint additives industry analysis, the market is dominated by the fisheye eliminator sector which holds the largest market share owing to its crucial function in guaranteeing perfect paint finishes. Fisheye flaws, which are circular blemishes that cause paint coats to become less smooth, are specifically targeted by fisheye eliminators. These additives improve the overall quality of vehicle paint applications by efficiently dissolving surface tension imperfections and reducing fisheye development. Because attaining a perfect and spotless finish is so important to the automotive industry, fisheye eliminators are in high demand, which makes this market segment a major driver of the automotive paint additives market.

Automotive Paint Additives Vehicle Types

- Passenger Cars

- Commercial Vehicles

The passenger car category is the leading segment in the market and it will be expected to grow during the automotive paint additives industry forecast period. This is explained by the fact that passenger car production and demand are far higher than those of commercial vehicles. Individual ownership and a wide range of aesthetic tastes among consumers lead to a larger frequency of paint applications on passenger automobiles, including sedans, hatchbacks, and SUVs. Advanced paint additives are heavily relied upon by the automobile industry to obtain excellent finishes, as passenger car aesthetics are highly valued. Therefore, the automotive paint additives market is significantly influenced by the passenger car segment, which reflects the industry's emphasis on improving the visual quality of automobiles for a wide range of consumer markets.

Automotive Paint Additives Applications

- Automotive Antirust Paint

- Automotive Decorative Paint

- Automotive Fire Retardant Paint

- Other

The vehicle antirust paint category maintains the largest share in the automotive paint additives market due to its critical function in reducing corrosion and extending the life of vehicle surfaces. In the automotive sector, preventing rust is crucial, especially for components that are subjected to a variety of external factors. With the use of specific compounds, automotive antirust paint creates a barrier that prevents corrosion and prolongs the life of parts and cars. Because lifespan and rust prevention are essential for preserving the structural integrity and overall appearance of cars, additive demand in the Automotive Antirust Paint market is constantly strong, making it the industry leader.

Automotive Paint Additives Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Paint Additives Market Regional Analysis

In terms of automotive paint additives market analysis, the Asia-Pacific region claims the title of the largest in the industry, attributed to its escalating automobile production and the establishment of robust trade agreements between major suppliers and local companies. The region's optimistic outlook is further bolstered by the enforcement of stricter regulations governing environmentally friendly car coatings, promising a brighter future for the automotive additives sector. Meanwhile, North America emerges as the fastest-growing market for automotive paint additives, fueled by a significant shift toward the production of waterborne resins. This transition not only accelerates the demand for automotive paint coatings but is particularly noteworthy for the coating of interior plastic components in automobiles. Within the dynamic automotive paint additives market, Asia Pacific and North America hold pivotal positions, driven by their increased adoption of environmentally friendly solutions and innovative production processes.

Automotive Paint Additives Market Players

Some of the top automotive paint additives companies offered in our report includes Akzo Nobel N.V, BASF SE, Eastman Chemical Company, LLC, Kansai Paint Co., Ltd, The Sherwin-Williams, Nippon Paint Holdings Co., Ltd., DuPont, Clariant, PPG Industries, Inc., and Solvay.

Frequently Asked Questions

How big is the automotive paint additives market?

The automotive paint additives market size was valued at USD 4.4 billion in 2022.

What is the CAGR of the global automotive paint additives market from 2023 to 2032?

The CAGR of automotive paint additives is 6.8% during the analysis period of 2023 to 2032.

Which are the key players in the automotive paint additives market?

The key players operating in the global market are including Akzo Nobel N.V, BASF SE, Eastman Chemical Company, LLC, Kansai Paint Co., Ltd, The Sherwin-Williams, Nippon Paint Holdings Co., Ltd., DuPont, Clariant, PPG Industries, Inc., and Solvay.

Which region dominated the global automotive paint additives market share?

Asia-Pacific held the dominating position in automotive paint additives industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of automotive paint additives during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automotive paint additives industry?

The current trends and dynamics in the automotive paint additives industry include increasing demand for environmentally friendly automotive paint solutions, technological advancements driving high-performance additive development, growing emphasis on customized aesthetics in the automotive industry, and stringent regulations promoting safety and compliance.

Which application held the maximum share in 2022?

The automotive antirust paint application held the maximum share of the automotive paint additives industry.