Automotive Lubricants Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Automotive Lubricants Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

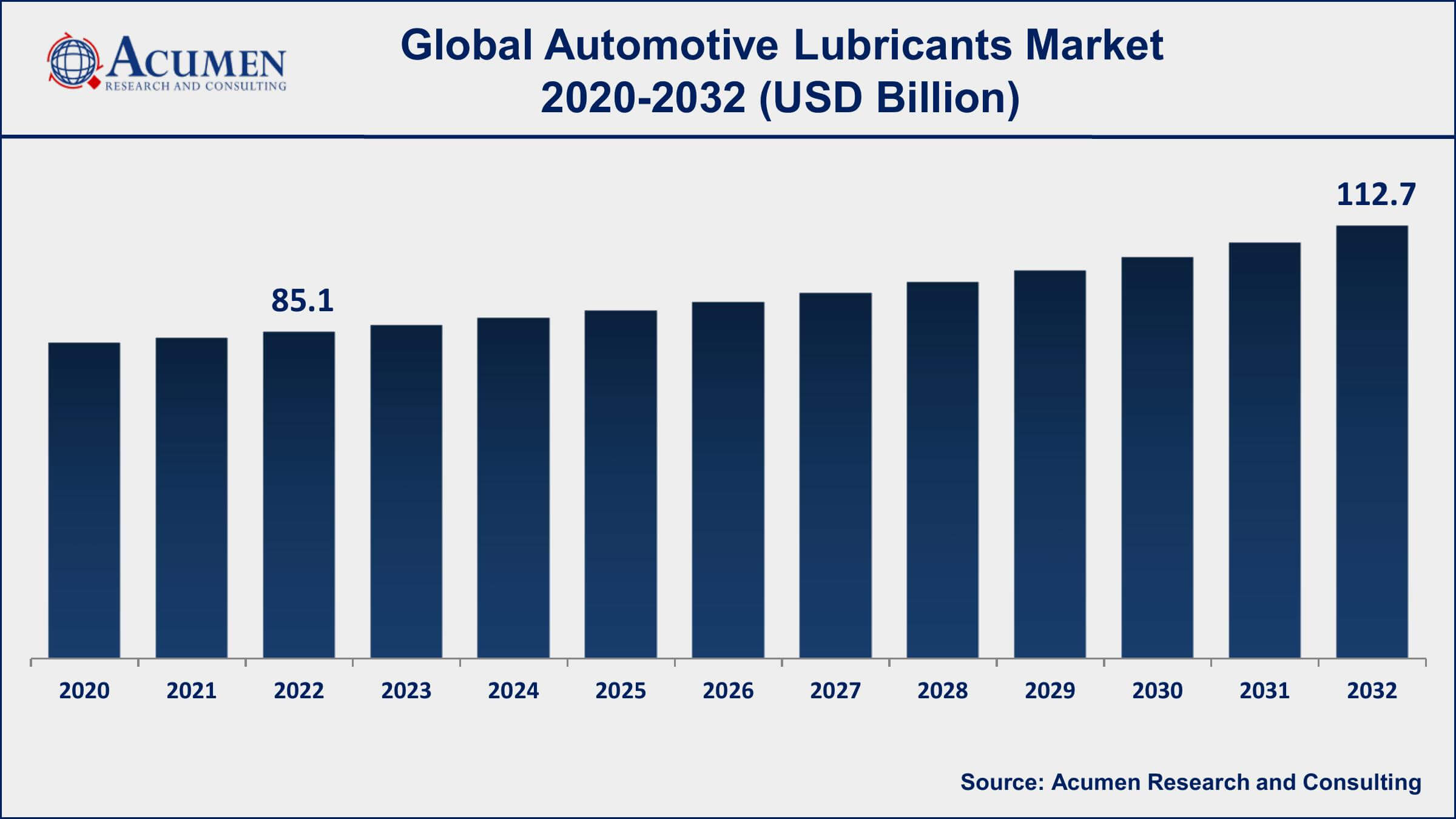

The Automotive Lubricants Market Size accounted for USD 85.1 Billion in 2022 and is projected to achieve a market size of USD 112.7 Billion by 2032 growing at a CAGR of 2.6% from 2023 to 2032.

Automotive Lubricants Market Report Key Highlights

- Global automotive lubricants market revenue is expected to increase by USD 112.7 Billion by 2032, with a 2.6% CAGR from 2023 to 2032

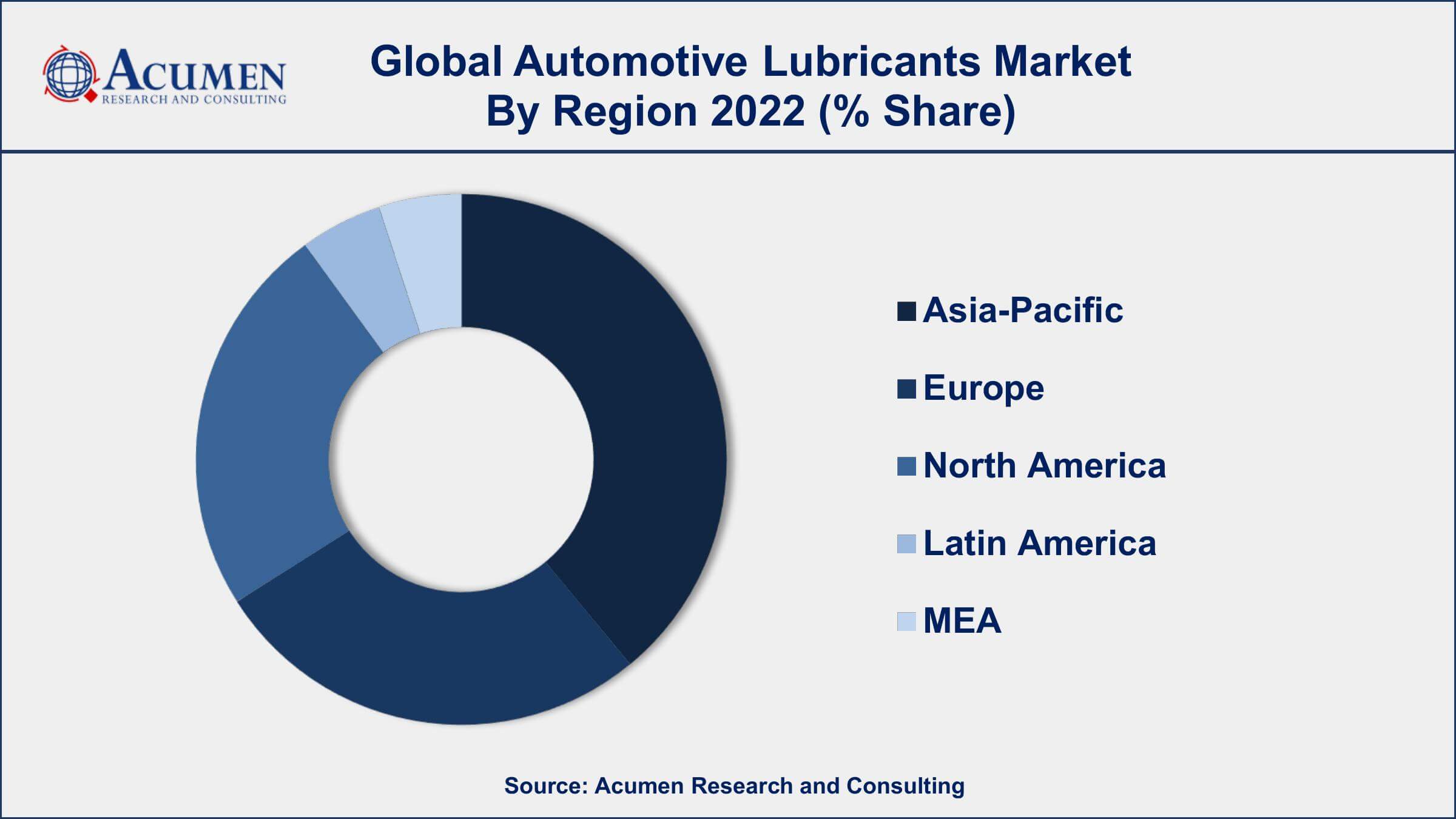

- Asia-Pacific region led with more than 39% of automotive lubricants market share in 2022

- According to an International Energy Agency (IEA) report, adopting low-viscosity engine oils and lubricants can reduce CO2 emissions by up to 2%

- The mineral oil lubricants segment accounts for more than 52% of the total market share in the automobile industry

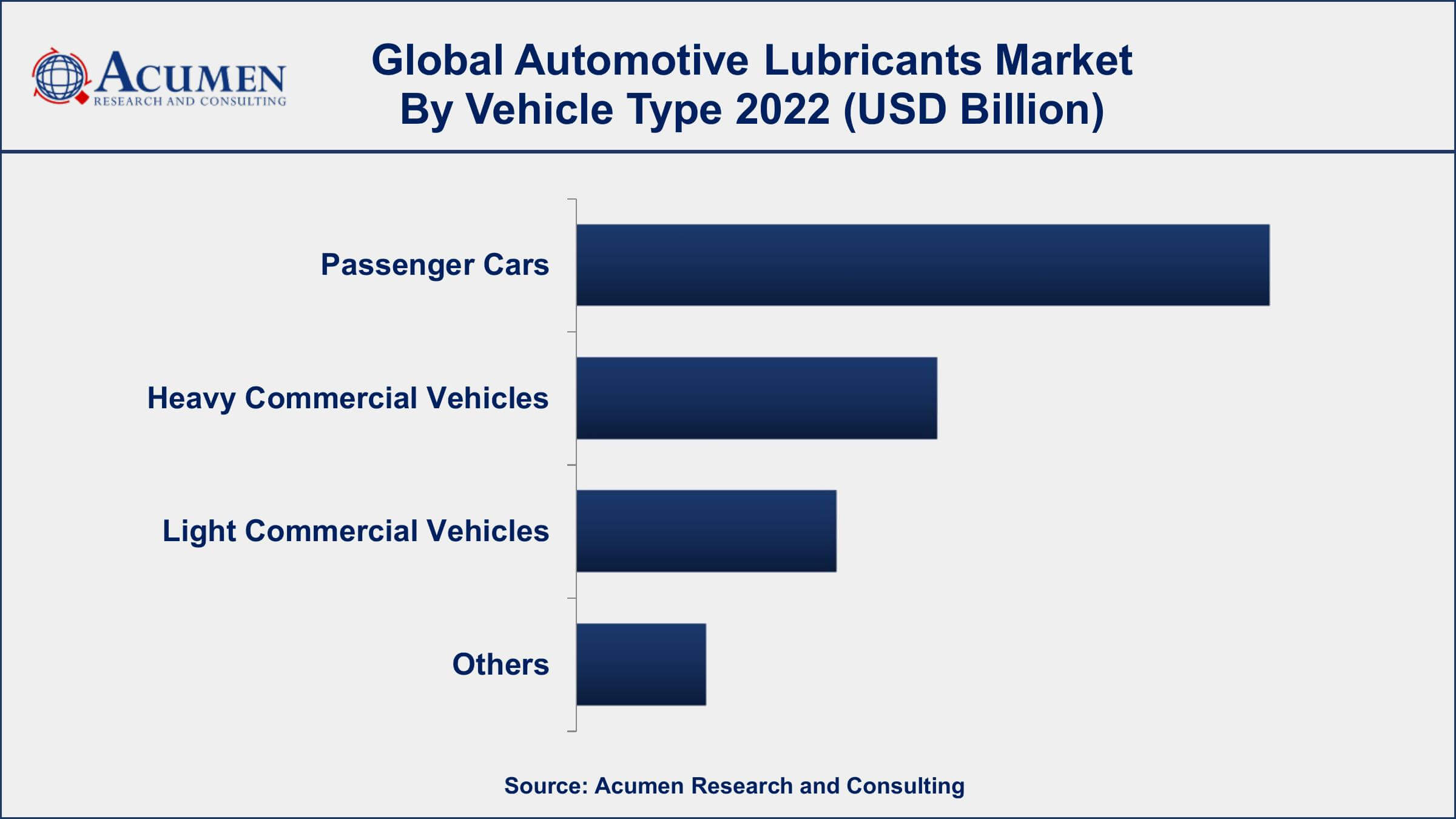

- The passenger car segment is the largest vehicle type segment of the market, accounting for more than 48% of the total market share

- Growing demand for fuel-efficient and low-emission vehicles, drives the automotive lubricants market size

Automotive lubricants are specialized fluids used to reduce friction and wear between the moving parts of a vehicle's engine and transmission system. These lubricants are designed to maintain optimal engine performance by reducing friction, dissipating heat, and preventing wear and tear of engine components. They play a vital role in ensuring the longevity and reliability of a vehicle's engine and transmission system.

The global automotive lubricants market has been experiencing steady growth over the years, owing to the increasing demand for vehicles and the rising awareness among consumers regarding the importance of regular maintenance of their vehicles. One of the major factors driving the growth of the automotive lubricants market is the increasing demand for high-performance lubricants that offer superior protection and extended oil change intervals. In addition, the growing trend toward the use of synthetic lubricants in high-performance engines is further boosting the growth of the market. Moreover, the stringent emission regulations imposed by various governments across the globe are also driving the demand for more advanced lubricants that can help reduce emissions and improve fuel efficiency.

Global Automotive Lubricants Market Trends

Market Drivers

- Increasing demand for automobiles worldwide

- Rising awareness about vehicle maintenance and increasing demand for high-performance lubricants

- Growing demand for fuel-efficient and low-emission vehicles

- Technological advancements in lubricant formulations and packaging

Market Restraints

- Stringent environmental regulations on emissions and disposal of used lubricants

- Fluctuating raw material prices

Market Opportunities

- Development of eco-friendly lubricants with low environmental impact

- Growing demand for high-performance lubricants in the aviation, marine, and industrial sectors

Automotive Lubricants Market Report Coverage

| Market | Automotive Lubricants Market |

| Automotive Lubricants Market Size 2022 | USD 85.1 Billion |

| Automotive Lubricants Market Forecast 2032 | USD 112.7 Billion |

| Automotive Lubricants Market CAGR During 2023 - 2032 | 2.6% |

| Automotive Lubricants Market Analysis Period | 2020 - 2032 |

| Automotive Lubricants Market Base Year | 2022 |

| Automotive Lubricants Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Base Oil, By Application, By Vehicle Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Royal Dutch Shell, ExxonMobil, BP plc, Chevron Corporation, Total S.A., PetroChina Company Limited, Sinopec Limited, Idemitsu Kosan Co., Ltd., FUCHS Petrolub SE, Phillips 66 Company, Valvoline Inc., and Indian Oil Corporation Limited. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

A lubricant is a chemical compound used to reduce friction between two surfaces when in mutual contact, which in turn ultimately helps in reducing the overall heat generated during the movement of concerned surfaces. Lubricants may also carry the functions of transporting foreign particles, heating or cooling the surfaces, or transmitting forces. Automotive lubricants are primarily used to achieve the smooth functioning of the vehicle and reduce friction. Some automotive lubricant products include gear oil, engine oil, greases, transmission fluid, bearing oil, coolants, and brake fluid, among others. Engine oil is expected to grow at a significant rate over the forecast period owing to a rise in the number of vehicles, globally. Moreover, stringent government regulations on emissions from vehicles are a key factor projected to affect the use of bio-based or synthetic lubricants as an alternative to mineral oil-based lubricants.

Engine oil, gear oil, and transmission fluid are the key types of automotive lubricants generally used across the globe. Engine oil or motor oil is the mostly used product in automotive lubricants and is analyzed to maintain its dominance over the forecast period. The increasing number of vehicles is one of the key factors driving the growth of the global automotive lubricants market exceptionally. On the other hand, demand for transmission fluid and gear oil is anticipated to witness a slight decline in the foreseeable years owing to the increasing use of the same type of fluid for both transmission box and gearbox. In addition, increasing demand for heavy-duty commercial vehicles and lightweight passenger cars has accelerated global automotive production over the forecast period. This is, in turn, expected to increase the demand for lubricants over the forecasted period. Also, rapid industrialization in India, China, Mexico, Brazil, etc. has developed applications of lubricants in the maintenance of industrial machinery. Increasing spending on construction, especially in Latin America and Asia-Pacific, has been a key driving factor in the global automotive lubricants market. The aforementioned products are exclusively deployed in infrastructure sectors such as bearings, hydraulic oil, wire rope, and engine oil applications. Furthermore, the rising demand for oilfield chemicals due to expanding exploration and drilling activities is anticipated to influence the global automotive lubricants market positively.

Automotive Lubricants Market Segmentation

The global automotive lubricants market segmentation is based on base oil, application, vehicle type, and geography.

Automotive Lubricants Market By Base Oil

- Mineral Oil Lubricants

- Semi-synthetic Lubricants

- Synthetic Lubricants

- Bio-Based Lubricants

According to our automotive lubricants industry analysis, the mineral oil lubricants segment accounted for the largest market share in 2022. Mineral oil lubricants are one of the most commonly used lubricants in the automotive industry. These lubricants are derived from petroleum and are composed of various hydrocarbon compounds. Mineral oil lubricants are known for their low cost and high availability, which makes them a popular choice among vehicle owners and manufacturers. The market for mineral oil lubricants in the automotive industry is expected to remain significant in the coming years. This is due to the large existing installed base of vehicles that require mineral oil lubricants, particularly in emerging economies where the demand for automobiles is increasing rapidly. The cost-effectiveness of mineral oil lubricants also makes them an attractive option for vehicle owners and manufacturers in developing markets.

Automotive Lubricants Market By Application

- Engine Oil

- Greases

- Transmission Fluids

- Gear & Brake Oil

- Others

In terms of application, the engine oil segment is one of the largest and most important segments of the automotive lubricants market. This segment is expected to witness steady growth in the coming years, driven by the increasing demand for high-performance engine oils that can withstand extreme conditions and provide better fuel efficiency. The growing trend towards downsized engines with higher power densities and longer oil change intervals is also driving the demand for more advanced and specialized engine oils. In addition to the traditional mineral and synthetic engine oils, there is a growing demand for bio-based engine oils made from renewable sources such as vegetable oil or animal fats. These eco-friendly engine oils are gaining popularity due to their lower environmental impact and improved biodegradability.

Automotive Lubricants Market By Vehicle Type

- Passenger Cars

- Heavy Commercial Vehicles

- Light Commercial Vehicles

- Others

According to the automotive lubricants market forecast, the passenger cars segment is expected to grow significantly in the coming years. Passenger cars are a popular mode of transportation for individuals and families worldwide, and they require regular maintenance, including oil changes and lubrication of various components. The demand for lubricants in the passenger car segment is driven by several factors, including the increasing number of passenger cars on the road, the growing trend towards higher fuel efficiency and reduced emissions, and the demand for better engine performance and longevity. As a result, passenger car lubricants need to meet stringent performance specifications and regulatory requirements to ensure optimal engine protection, fuel economy, and emission control.

Automotive Lubricants Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Lubricants Market Regional Analysis

Geographically, Asia-Pacific is the largest and fastest-growing region in the automotive lubricants market, accounting for a significant share of the global market. The region is dominated by countries such as China, India, Japan, South Korea, and Indonesia, which are major automotive manufacturing hubs. The high demand for passenger cars and commercial vehicles in these countries is a significant driver of the automotive lubricants market in the region.

The growth of the Asia-Pacific automotive lubricants market is also driven by several other factors, including increasing urbanization, rising disposable income, and changing consumer preferences. The increasing number of vehicles on the road, particularly in emerging economies, has resulted in a higher demand for automotive lubricants. Additionally, the growing awareness about the benefits of regular vehicle maintenance and the increasing focus on fuel efficiency and emission control are driving the demand for high-performance lubricants in the region.

Automotive Lubricants Market Player

Some of the top automotive lubricants market companies offered in the professional report include Royal Dutch Shell, ExxonMobil, BP plc, Chevron Corporation, Total S.A., PetroChina Company Limited, Sinopec Limited, Idemitsu Kosan Co., Ltd., FUCHS Petrolub SE, Phillips 66 Company, Valvoline Inc., and Indian Oil Corporation Limited.

Frequently Asked Questions

How big is the automotive lubricants market?

The automotive lubricants market size was USD 85.1 Billion in 2022.

What is the CAGR of the global automotive lubricants market during forecast period of 2023 to 2032?

The CAGR of automotive lubricants market is 2.6% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global automotive lubricants market are Royal Dutch Shell, ExxonMobil, BP plc, Chevron Corporation, Total S.A., PetroChina Company Limited, Sinopec Limited, Idemitsu Kosan Co., Ltd., FUCHS Petrolub SE, Phillips 66 Company, Valvoline Inc., and Indian Oil Corporation Limited.

Which region held the dominating position in the global automotive lubricants market?

Asia-Pacific held the dominating position in automotive lubricants market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for automotive lubricants market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automotive lubricants market?

The current trends and dynamics in the automotive lubricants industry include the rising awareness about vehicle maintenance and increasing demand for high-performance lubricants.

Which base oil held the maximum share in 2022?

The mineral oil lubricants base oil held the maximum share of the automotive lubricants market.