Automotive Interior Leather Market | Acumen Research and Consulting

Automotive Interior Leather Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

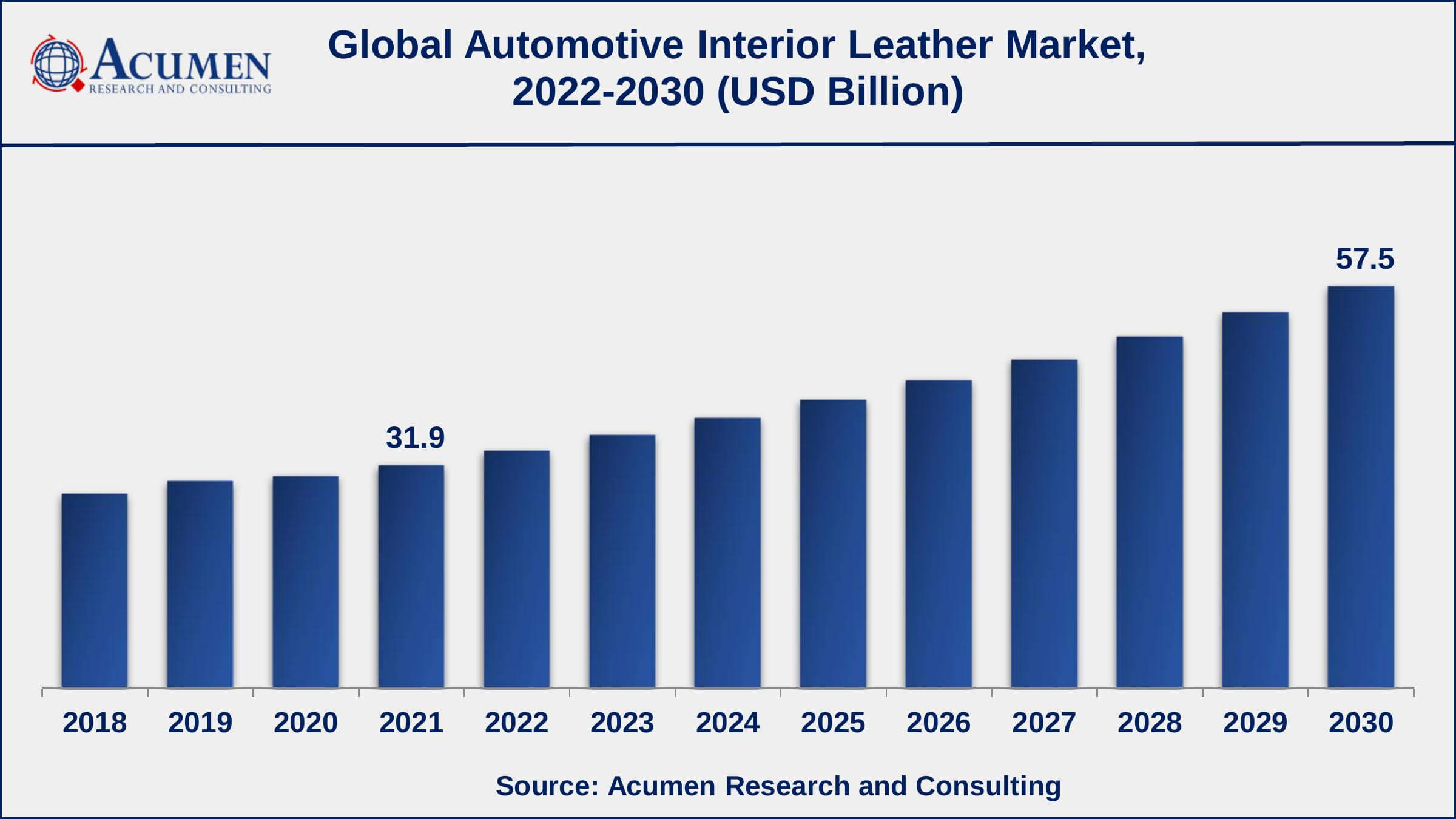

The Global Automotive Interior Leather Market Size accounted for USD 31.9 Billion in 2021 and is projected to occupy a market size of USD 57.5 Billion by 2030 growing at a CAGR of 6.8% from 2022 to 2030. The speedily expanding automotive sector across the globe is anticipated to boost the automotive interior leather market during the forthcoming years. Also, blast in car manufacturing industry, especially in rising economies of Asia-Pacific, combined with ascend sought after for counterfeit calfskin is ready to drive the market over the coming years.

Automotive Interior Leather Market Report Statistics

- Global automotive interior leather market revenue is estimated to reach USD 57.5 Billion by 2030 with a CAGR of 6.8% from 2022 to 2030

- Asia-Pacific automotive interior leather market share generated over 45% shares in 2021

- North America automotive interior leather market growth will record noteworthy CAGR of over 7% from 2022 to 2030

- Based on vehicle, passenger cars recorded around 52% of the overall market share in 2021

- According to our analysis, global car sales grew to over 66 million in 2021 from 63 million units in 2020

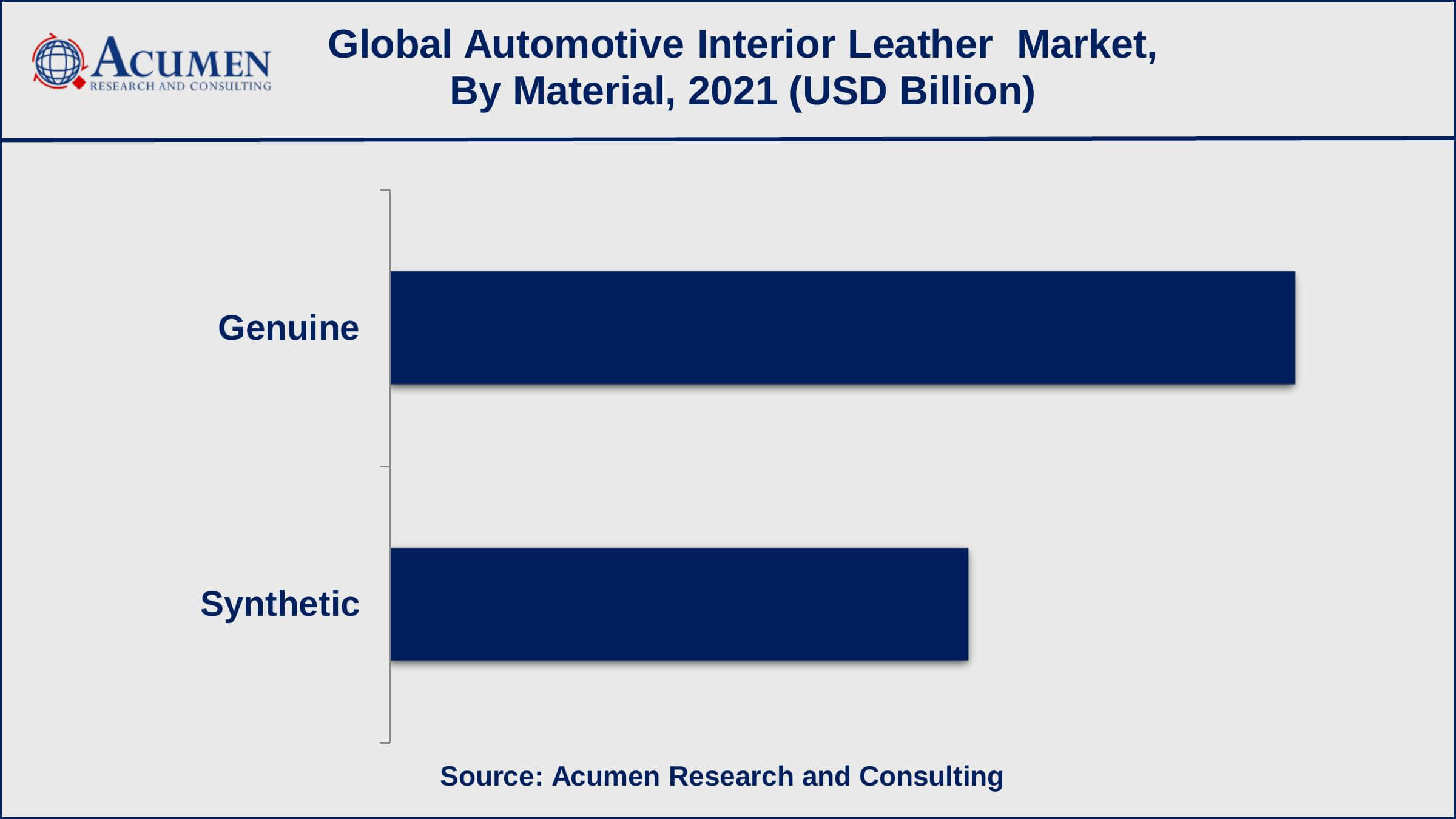

- Among material, genuine leather generated shares of over 60% in 2021

- Robust demand for interior leather in passenger vehicles is a popular automotive interior leather market trend that is fueling the industry demand

Global Automotive Interior Leather Market Dynamics

Market Drivers

- Growing trend of lightweight leather material

- Surging demand for hybrid and electric vehicles

- Rapid growth in the adoption of synthetic leathers

Market Restraints

- Environmental concerns associated with leather

- Slowdown in global automotive production

Market Opportunities

- Rise in sustainable leather production

- Growing product innovation

Automotive Interior Leather Market Report Coverage

| Market | Automotive Interior Leather Market |

| Automotive Interior Leather Market Size 2021 | USD 31.9 Billion |

| Automotive Interior Leather Market Forecast 2030 | USD 57.5 Billion |

| Automotive Interior Leather Market CAGR During 2022 - 2030 | 6.8% |

| Automotive Interior Leather Market Analysis Period | 2018 - 2030 |

| Automotive Interior Leather Market Base Year | 2021 |

| Automotive Interior Leather Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Vehicle, By Material, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Alphaline Auto, Bayerische Motoren Werke AG, Fiat S.p.A, Eagle Ottawa LLC, Ford Motor Company, Kuraray Plastics, Lear Corporation, MazdaMotor Corporation, Nissan Motor Co., Ltd., Scottish Leather Group, Tata International Ltd., Wollsdorf Leder Schmidt & Co Ges.m.b.H. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Automotive Interior Leather Market Growth Factors

Rising car manufacturing activities, particularly in rising economies of Asia-Pacific, for example, China, and India, is one of the key patterns heightening business sector development. Additionally, flooding demand for fake/manufactured calfskin in less expensive engine vehicle variations is ready to give an up thrust to the market amid the estimate time frame.

Asia-Pacific is watching a blast in assembling in the car business. China and India are the sights of high development rates in the area. Solid GDP development rate, rising disposable income of the people, and government bolster are revving up the creation of engine vehicles in these nations. In addition, their demand in lower level urban areas is probably going to increase with declining costs.

Automotive Interior Leather Market Insights

SAIC Motor, Dongfeng, FAW, and Chang'an Automobile Group are significant local car producers of China. Different makers incorporate Beijing Automotive Group, Brilliance Automotive, BYD, Chery, Greely, Jianghuai (JAC), Great Wall, and Guangzhou Automobile Group.

Broadening base of white collar class populace and less expensive accessibility of work and different assets are enhancing the development of the engine vehicle fabricating industry in Asia-Pacific. The district is likewise seeing speculations from key players, for example, Bayerische Motoren Werke AG, Fiat S.p.A, Ford Motor Company, MazdaMotor Corporation, Nissan Motor Co., Ltd., and Jaguar.

There has been a significant move towards engineered/counterfeit variations, which are viewed as less expensive option of certifiable cowhide. Their expense of creation is not as much as that of common cowhide and furthermore has a simpler assembling process. Developing unmistakable quality of fake cowhide is prompting increment in demands in the division, which will in this manner help improve overall product penetration.

Automotive Interior Leather Market Segmentation

The global automotive interior leather market is segmented based on vehicle, material, application, and geography.

Automotive Interior Leather Market By Vehicle

- Passenger Cars

- Light Commercial Vehicles

- Trucks & Buses

According to an analysis of the automotive interior leather industry, passenger cars will account for more than 35% of the total market in 2021. Passenger vehicles such as SUVs and sedans are still in high demand. As a result, the passenger car segment has emerged as the market's largest end-user. The interior leather market is becoming more appealing as the automobile industry expands and passenger vehicle sales increase.

Automotive Interior Leather Market By Material

- Genuine

- Synthetic

According to our automotive interior leather market forecast, the genuine sub-segment is anticipated to hold a prominent market share from 2022 to 2030. The majority of premium car owners prefer synthetic leather as an alternative to real/genuine leather. Fake/synthetic leather trim, on the other hand, was introduced as a low-cost substitute for real leather. It is now highly sought after by a wide range of customers, particularly those who prefer environmentally friendly vehicles.

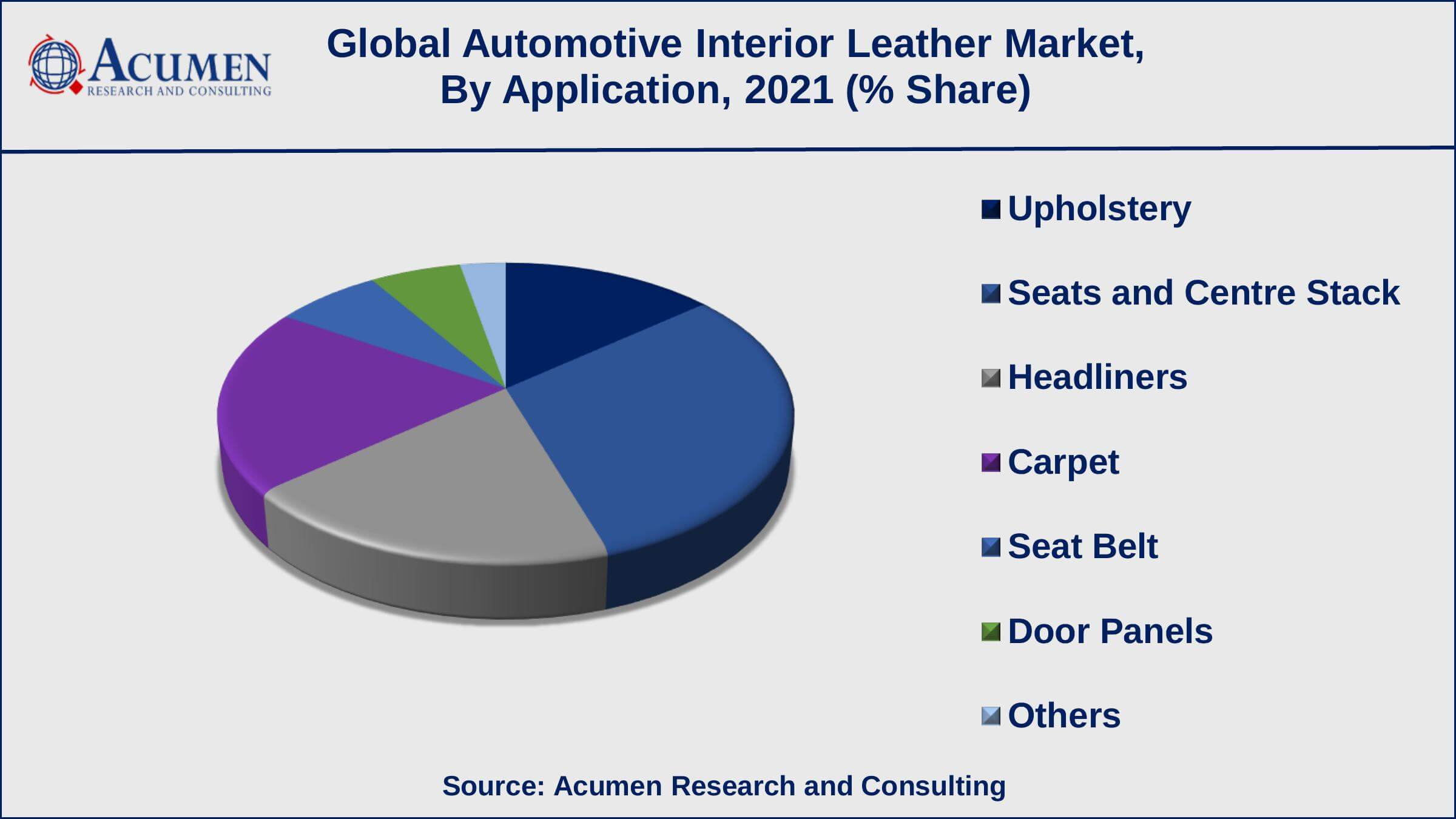

Automotive Interior Leather Market By Application

- Upholstery

- Seats and Centre Stack

- Headliners

- Carpet

- Seat Belt

- Door Panels

- Others

Among application, seats & centre stack collected an impressive chuck of market shares in 2021 and is likely to do so in the coming years. Leather in vehicle interior components such as the seat and centre stack is becoming more popular due to benefits such as durability, softer feel, lower interior noise levels, fewer vibrations, and aesthetic characteristics. The carpet and headliners are also holding significant market share combining more than 25% in the entire category.

Automotive Interior Leather Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Interior Leather Market Regional Analysis

North America captures the market in 2021 owing to increase need for better interior leather and constant launch of new product portfolio associated to automotive interior leather by main key players. Also, inventive marketing strategies being accepted by main key companies to encourage and automotive interior leather market and associated products are expected to inspire end users to accept these products, which in turn will stimulate the development of the regional market.

Asia-Pacific is anticipated to observer the highest CAGR of over 7.5% during the forecast time frame. Growing disposable income is expected to increase the development of the regional automotive interior leather industry.

Automotive Interior Leather Market Players

Market companies are concentrating on implementing new strategies for instance regional expansion, partnerships, mergers and acquisitions, new product launches, and distribution agreements to surge their revenue share. The major players associated with the automotive interior leather market are Alphaline Auto, Bayerische Motoren Werke AG, Fiat S.p.A, Eagle Ottawa LLC, Ford Motor Company, Kuraray Plastics, Lear Corporation, MazdaMotor Corporation, Nissan Motor Co., Ltd., Scottish Leather Group, Tata International Ltd., Wollsdorf Leder Schmidt & Co Ges.m.b.H.

Frequently Asked Questions

What is the size of global automotive interior leather market in 2021?

The market size of automotive interior leather market in 2021 was accounted to be USD 31.9 Billion.

What is the CAGR of global automotive interior leather market during forecast period of 2022 to 2030?

The projected CAGR of automotive interior leather market during the analysis period of 2022 to 2030 is 6.8%.

Which are the key players operating in the market?

The prominent players of the global automotive interior leather market Alphaline Auto, Bayerische Motoren Werke AG, Fiat S.p.A, Eagle Ottawa LLC, Ford Motor Company, Kuraray Plastics, Lear Corporation, MazdaMotor Corporation, Nissan Motor Co., Ltd., Scottish Leather Group, Tata International Ltd., Wollsdorf Leder Schmidt & Co Ges.m.b.H.

Which region held the dominating position in the global automotive interior leather market?

Asia-Pacific held the dominating automotive interior leather during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for automotive interior leather during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global automotive interior leather market?

Growing trend of lightweight leather, surging demand for hybrid and electric vehicles, and rapid growth in the application of synthetic leathers drives the growth of global automotive interior leather market.

Which vehicle held the maximum share in 2021?

Based on vehicle, passenger vehicles segment is expected to hold the maximum share of the automotive interior leather market.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date