Automotive Infotainment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Automotive Infotainment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

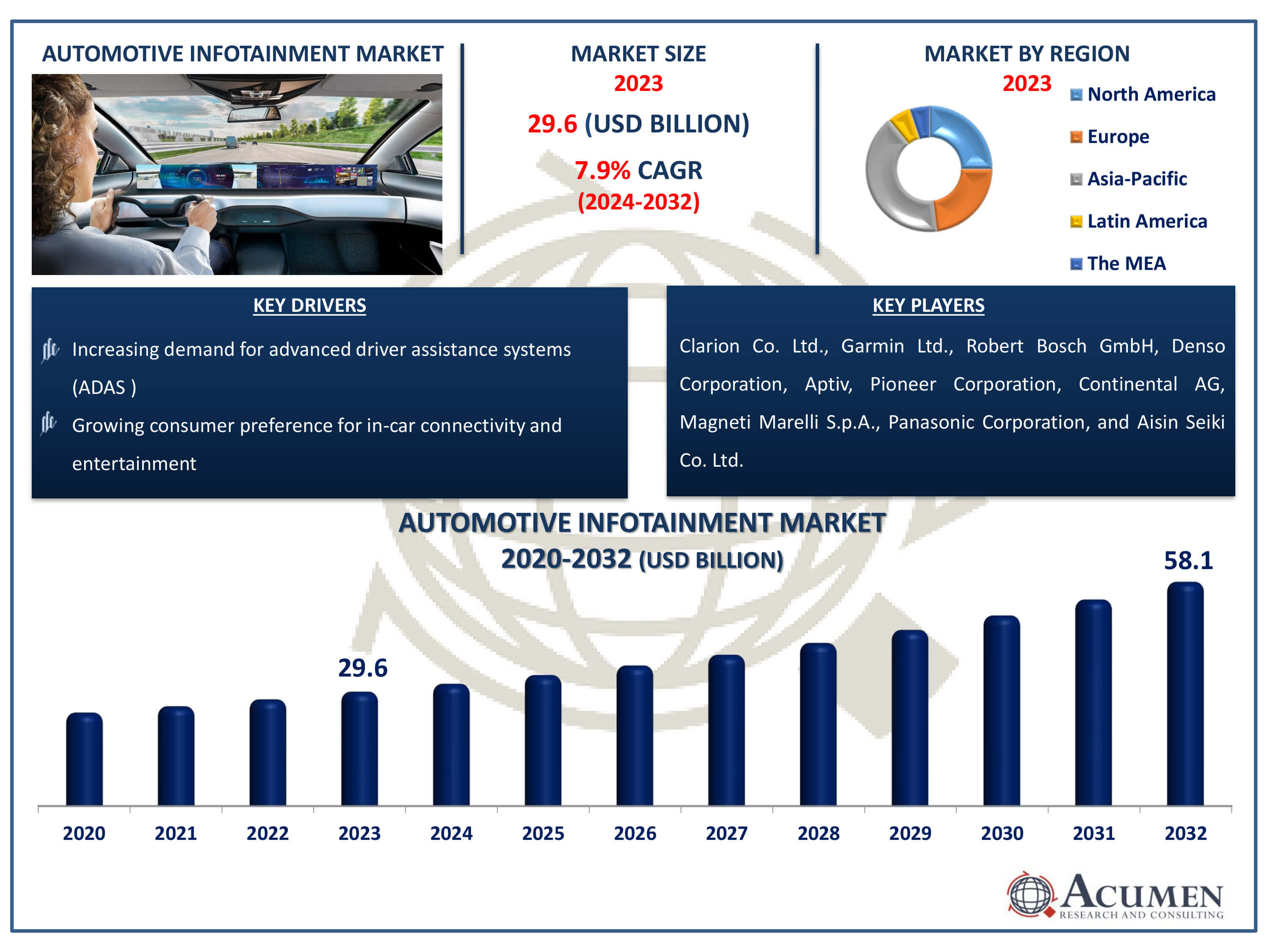

The Automotive Infotainment Market Size accounted for USD 29.6 Billion in 2023 and is estimated to achieve a market size of USD 58.1 Billion by 2032 growing at a CAGR of 7.9% from 2024 to 2032.

Automotive Infotainment Market Highlights

- Global automotive infotainment market revenue is poised to garner USD 58.1 billion by 2032 with a CAGR of 7.9% from 2024 to 2032

- Asia-Pacific automotive infotainment market value occupied around USD 12.1 billion in 2023

- North America automotive infotainment market growth will record a CAGR of more than 9% from 2024 to 2032

- Among product type, the navigation unit sub-segment generated more than USD 10.9 billion revenue in 2023

- Based on fit type, the OEM sub-segment generated around 73% market share in 2023

- Growth in emerging markets with increasing vehicle ownership and technological adoption is a popular automotive infotainment market trend that fuels the industry demand

Automotive infotainment refers to the advanced hardware and software systems that bring audio and video entertainment to your vehicle. These systems stream content via wireless networks like LTE, Wi-Fi, and Bluetooth, or through wired connections like HDMI and Ethernet, and can also play media from CDs or USB devices. They handle all your car's communication and entertainment needs, from phone calls and navigation to music and podcasts. Current trends in the automotive infotainment market include internet-based applications and social network integration, while the future promises even more exciting developments. Expect to see extendable, hybrid, adaptive, and personalized human-machine interfaces (HMI) that enhance the driving experience like never before.

Global Automotive Infotainment Market Dynamics

Market Drivers

- Increasing demand for advanced driver assistance systems (ADAS)

- Growing consumer preference for in-car connectivity and entertainment

- Rising adoption of smartphones and internet services in vehicles

- Technological advancements in infotainment systems

Market Restraints

- High costs associated with advanced infotainment systems

- Concerns over driver distraction and safety issues

- Compatibility and integration challenges with various car models

Market Opportunities

- Development of 5G technology for faster and more reliable in-car connectivity

- Integration of artificial intelligence and machine learning for personalized user experiences

- Expansion of electric and autonomous vehicles requiring sophisticated infotainment solutions

Automotive Infotainment Market Report Coverage

| Market | Automotive Infotainment Market |

| Automotive Infotainment Market Size 2023 | USD 29.6 Billion |

| Automotive Infotainment Market Forecast 2032 |

USD 58.1 Billion |

| Automotive Infotainment Market CAGR During 2024 - 2032 | 7.9% |

| Automotive Infotainment Market Analysis Period | 2020 - 2032 |

| Automotive Infotainment Market Base Year |

2023 |

| Automotive Infotainment Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Product Type, By System Type, By Fit Type, By Vehicle Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Clarion Co. Ltd., Garmin Ltd., Robert Bosch GmbH, Denso Corporation, Pioneer Corporation, Continental AG, Aptiv, Magneti Marelli S.p.A., Panasonic Corporation, and Aisin Seiki Co. Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Infotainment Market Insights

The global market has seen significant growth due to the rising utility of smartphones. Automotive infotainment systems have developed noticeably in recent years, with increasing consumer popularity driven by the adoption of smartphone-enabled systems like Android Auto and Apple CarPlay, as highlighted by a Consumer Reports, Inc. survey. According to the report, 64% of users are very satisfied with Apple CarPlay, 59% with Android Auto, and 58% with built-in vehicle systems. Service providers continually enhance their software through updates and bug fixes to improve user experience. For example, in September 2021, Apple updated CarPlay with iOS 15, introducing features such as message announcing via Siri, driving focus for managing notifications, and new wallpapers for a personalized look. These advancements are positively influencing the overall growth of the global automotive infotainment market.

Market has surged forward, driven by technological advancements. Each car brand offers its own unique infotainment system, reflecting the diversity in the market. Historically, the evolution of automotive human-machine interfaces (HMIs) has been closely tied to technological innovations. The push for safer, more efficient, and comfortable vehicle systems has spurred the development of new interactive in-car functionalities. Over the years, not only have these technologies advanced, but the processes behind their development have also evolved to meet the challenges posed by emerging technologies in the automotive industry.

The automotive infotainment market is getting more challenging and complex. This is because more and more people want features like mobile internet, traffic information, navigation, digital broadcasting, and streaming services all in one system. There are many different broadcast, wireless, and cellular standards, along with various audio and video file formats and codecs, that infotainment systems need to handle. Manufacturers must make sure their systems work properly even with interference. According to Consumer Reports, only 56% of car owners are happy with their car's infotainment system. There is a big difference in quality between the best and worst systems, which is holding back the growth of the global automotive infotainment market.

Automotive Infotainment Market Segmentation

The worldwide market for automotive infotainment is split based on product type, system type, fit type, vehicle type, and geography.

Automotive Infotainment Product Types

- Audio Unit

- Display Unit

- Heads-Up Display

- Navigation Unit

- Communication Unit

According to automotive infotainment industry analysis, the navigation unit sector now holds the highest proportion market. This dominance stems from the growing need for enhanced navigation capabilities such as real-time traffic updates, route optimization, and location-based services. As drivers seek greater comfort and efficiency, navigation systems have become critical to improving the whole driving experience. Combination of GPS technology and current traffic data aids in avoiding congested routes and saving time, hence increasing their appeal. Furthermore, the growing trend of connected vehicles, which rely on precise navigation systems for a variety of applications, has considerably contributed to the market's growth. This development highlights the importance of navigation devices in modern automobile infotainment systems.

Automotive Infotainment System Types

- Entertainment System

- Connectivity System

- Driver Assistance System

The entertainment system sector is predicted to be the most significant in the car infotainment industry. This expansion is fueled by rising consumer demand for high-quality in-car entertainment experiences. Multimedia devices, video streaming, gaming, and superior audio systems are becoming standard features, improving passengers driving experiences. The increase in long-distance travel, as well as the requirement to keep passengers, particularly youngsters, entertained during travels, all contribute to the popularity of entertainment systems. Furthermore, advances in display technology and the integration of smartphones with automotive infotainment systems provide smooth access to a variety of entertainment alternatives. As a result, automakers are working on providing strong entertainment options to match consumer expectations and remain competitive in the market.

Automotive Infotainment Fit Types

- OEM

- Aftermarket

The OEM (Original Equipment Manufacturer) segment leads in the fit type category and it is expected to grow over the automotive infotainment industry forecast period. This dominance arises from the growing desire for factory-installed infotainment systems that blend seamlessly with the vehicle's design and functioning. OEM entertainment systems are often of greater quality and reliability since they are specifically built to fulfill the demanding standards set by automobile manufacturers. They also give a better user experience with enhanced features and are frequently covered by the vehicle's warranty, making them more appealing to buyers. Furthermore, the rise of connected and driverless vehicles has forced OEMs to add cutting-edge infotainment systems as standard equipment, fueling the segment's growth.

Automotive Infotainment Vehicle Types

- Passenger Cars

- Commercial Vehicles

Passenger cars takes maximum share in the automotive infotainment market in terms of vehicle types. This is mainly because there are simply more passenger cars on the roads compared to commercial vehicles. Everyday drivers, who mostly own passenger cars, want advanced infotainment features such as music streaming and navigation. Automakers understand this demand and prioritize developing high-quality infotainment systems specifically for passenger cars. Consequently, you often find state-of-the-art infotainment setups in new passenger car models. This focus on meeting consumer preferences contributes significantly to the dominance of passenger cars in propelling the growth of the infotainment market within the automotive industry.

Automotive Infotainment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Infotainment Market Regional Analysis

The industry in the Asia-Pacific (APAC) region, particularly driven by India, China, South Korea, and Japan, is experiencing significant growth APAC is expected to grow continue during the automotive infotainment market forecast period. This growth is propelled by high government involvement, supportive regulations, the presence of key players, and favorable foreign direct investment (FDI) policies. According to a report from Cambridge University, Chinese auto manufacturing companies are undergoing paradigm shifts, creating new opportunities for domestic firms while opening up to multinational corporations. The Chinese government ensures a competitive environment for both state-owned enterprises and entrepreneurial startups, fostering new collaborations and business models such as the Alibaba and Xpeng partnership, which focuses on intelligent and connected electric vehicles.

In Europe, countries like France, Germany, the UK, and Italy represent mature markets for automotive infotainment. The region benefits from the integration of robotic technology into the automotive sector, contributing to its growth.

In terms of automotive infotainment market analysis, North America is also poised for considerable growth in the industry, with Canada playing a significant role. The Canadian government recognizes the challenges and opportunities in the automotive sector, leading to the development and launch of innovative products driven by technology. Canada's automotive industry is a vital component of its economy, representing a significant portion of manufacturing GDP and total merchandise exports. With over 670 suppliers of traditional automotive components and additional suppliers from industries like information and communication technology (ICT), Canada serves as a hub for innovation and development in the automotive sector within North America.

Automotive Infotainment Market Players

Some of the top automotive infotainment companies offered in our report include Clarion Co. Ltd., Garmin Ltd., Robert Bosch GmbH, Denso Corporation, Pioneer Corporation, Continental AG, Aptiv, Magneti Marelli S.p.A., Panasonic Corporation, and Aisin Seiki Co. Ltd.

Frequently Asked Questions

How big is the automotive infotainment market?

The automotive infotainment market size was valued at USD 29.6 billion in 2023.

What is the CAGR of the global automotive infotainment market from 2024 to 2032?

The CAGR of automotive infotainment is 7.9% during the analysis period of 2024 to 2032.

Which are the key players in the automotive infotainment market?

The key players operating in the global market are including Clarion Co. Ltd., Garmin Ltd., Robert Bosch GmbH, Denso Corporation, Pioneer Corporation, Continental AG, Aptiv, Magneti Marelli S.p.A., Panasonic Corporation, and Aisin Seiki Co. Ltd.

Which region dominated the global automotive infotainment market share?

Asia-Pacific held the dominating position in automotive infotainment industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of automotive infotainment during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global automotive infotainment industry?

The current trends and dynamics in the automotive infotainment industry include increasing demand for advanced driver assistance systems (ADAS), growing consumer preference for in-car connectivity and entertainment, rising adoption of smartphones and internet services in vehicles, and technological advancements in infotainment systems.

Which fit type held the maximum share in 2023?

The OEM fit type held the maximum share of the automotive infotainment industry.