Automotive HVAC Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Automotive HVAC Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

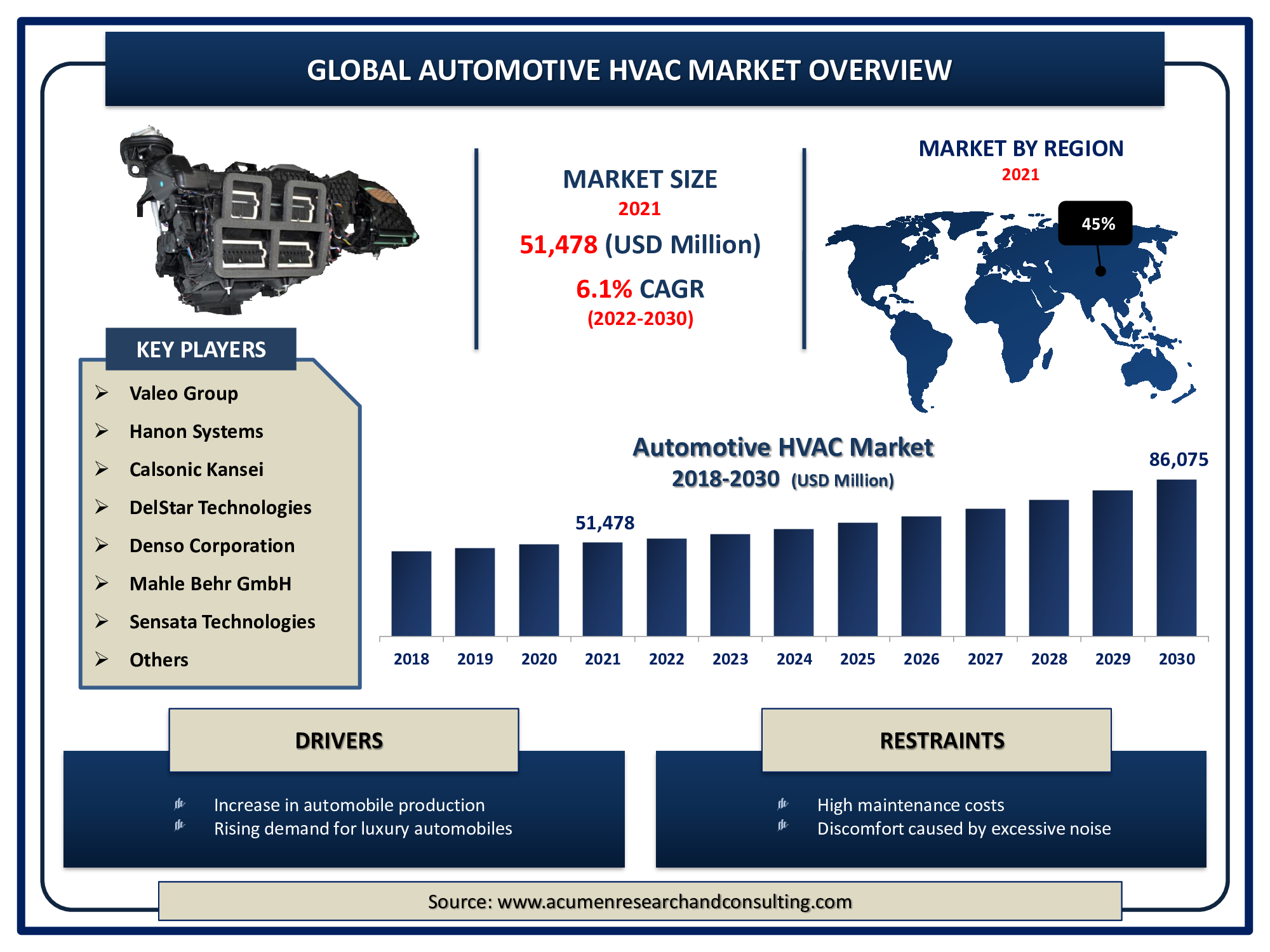

Request Sample Report

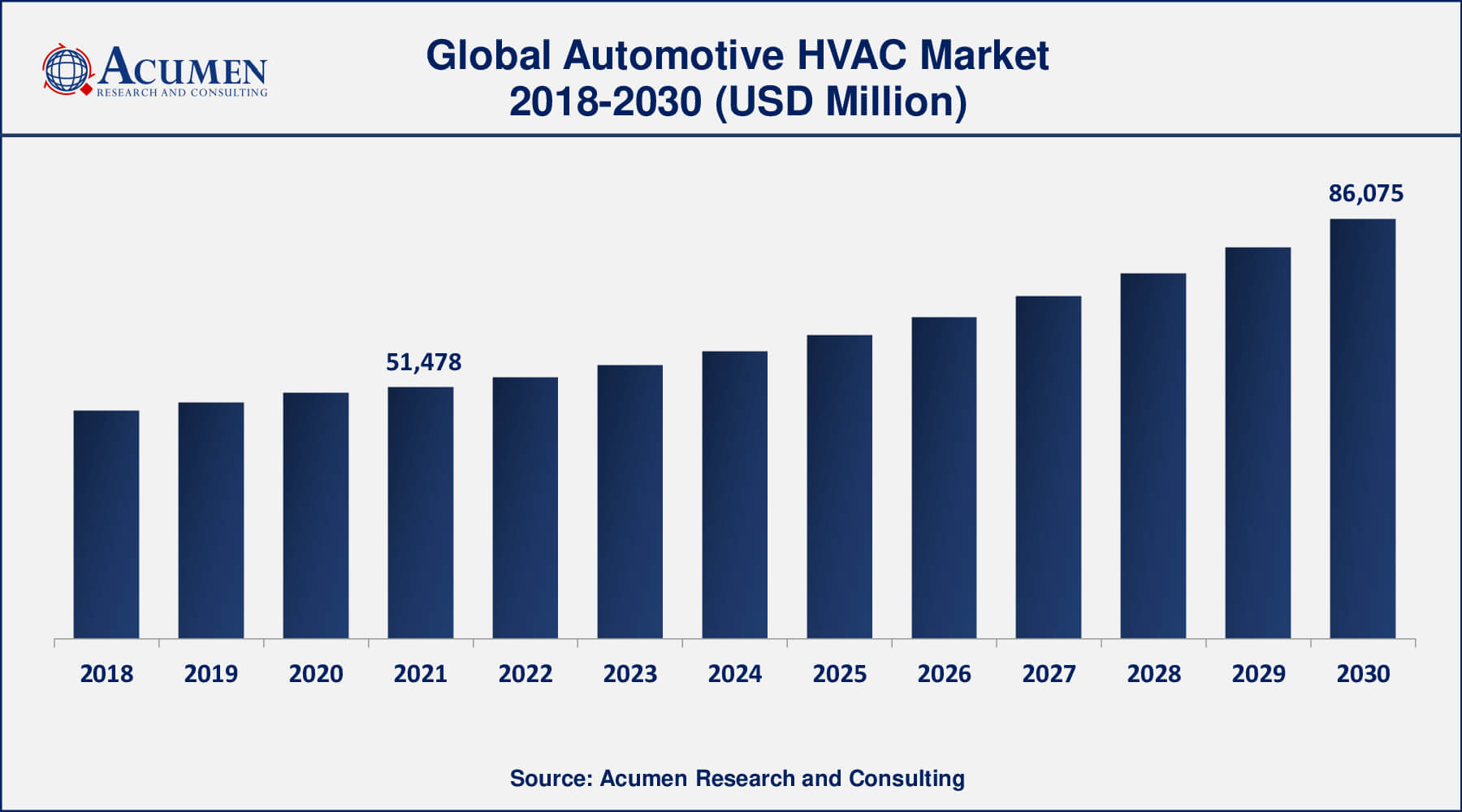

The Global Automotive HVAC Market Size accounted for USD 51,478 Million in 2021 and is estimated to achieve a market size of USD 86,075 Million by 2030 growing at a CAGR of 6.1% from 2022 to 2030. The development of creative, eco-friendly, and eco-accommodating HVAC arrangements, combined with rising global demand for passenger vehicles, is driving the automotive HVAC market growth. Rising disposable income and a growing proclivity for increasingly extravagant and pleasurable travel are expected to fuel the growth of the automotive HVAC market value.

Automotive HVAC Market Report Key Highlights

- Global automotive HVAC market revenue is estimated to expand by USD 86,075 million by 2030, with a 6.1% CAGR from 2022 to 2030.

- Asia-Pacific automotive HVAC market share accounted for over 44.8% shares in 2021

- North America automotive HVAC market growth will monitor fastest CAGR from 2022 to 2030

- Based on vehicle type, passenger vehicles segment accounted for over 60% of the overall market share in 2021

- Among technology, automatic category engaged more than 64.2% of the total market share

- Growth in electric vehicle market sales, drives the automotive HVAC market size

The heating, ventilation, and air conditioning (HVAC) technology in a car are used to regulate the interior temperature. It consists of three subsystems: heating, cooling, as well as air conditioning, which work together to provide filtered air to the car cabin, ensuring a thermal environment for drivers and passengers. It maintains the temperature of the air, checks the moisture content of the air, and removes excess humidity from the air flowing. The expanding demand for autonomous control features, combined with increased knowledge about the usage of eco-friendly refrigeration systems in HVAC systems, has increased demand for automotive HVAC systems.

Global Automotive HVAC Market Dynamics

Market Drivers

- Rising need for comfort and safety as a result of HVAC system adoption

- Increase in automobile production

- Increased demand for automotive heating systems and automatic temperature control features

- Rising demand for luxury automobiles

Market Restraints

- High maintenance costs

- Discomfort caused by excessive noise

Market Opportunities

- Expansion in electric vehicle market sales

- Adoption of environmentally friendly HVAC systems in vehicles

Automotive HVAC Market Report Coverage

| Market | Automotive HVAC Market |

| Automotive HVAC Market Size 2021 | USD 51,478 Million |

| Automotive HVAC Market Forecast 2030 | USD 86,075 Million |

| Automotive HVAC Market CAGR During 2022 - 2030 | 6.1% |

| Automotive HVAC Market Analysis Period | 2018 - 2030 |

| Automotive HVAC Market Base Year | 2021 |

| Automotive HVAC Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Vehicle Type, By Technology, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Valeo Group, Hanon Systems, Brose Fahrzeugteile GmbH & Co. Kg, Air International Thermal Systems, Sanden Holdings Corporation, Calsonic Kansei, DelStar Technologies, Engineered Plastic Components, Denso Corporation, Mahle Behr GmbH, Sensata Technologies, Japan Climate Systems Corporation, and Johnson Electric. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

In the current situation, an automotive HVAC unit has turned into a fundamental piece of passenger vehicles, offering solace includes that impacts buyer purchasing conduct. Rising concerns with respect to a dangerous atmospheric deviation are prompting increment in temperature levels, which thusly is bringing about an expanded need for improved inside condition and solace. Technical developments and significant needs in research and development activities are prompting the advancement of eco-friendly and eco-accommodating HVAC units combined with creative plans to bring down the load and size of frameworks for better flexibility.

The spiraling need for private vehicles inferable from prospering vehicle rental industry and the rising normal time spent on vehicles is relied upon to support the development of the market. Furthermore, reasonable automotive fund plots and expanding inclination to utilize private vehicles instead of open transport can likewise support the development of the automotive HVAC showcase. The Asia-Pacific is foreseen to rule the worldwide market all through the conjecture skyline attributable to the nearness of key automotive producers combined with a more extensive purchaser base boosting vehicle requests. Rising worries about the natural impacts of refrigerants and high upkeep expenses can obstruct the development of the automotive HVAC market trend.

Automotive HVAC Market Segmentation

The worldwide automotive HVAC market segmentation is based on the vehicle type, technology, and geography.

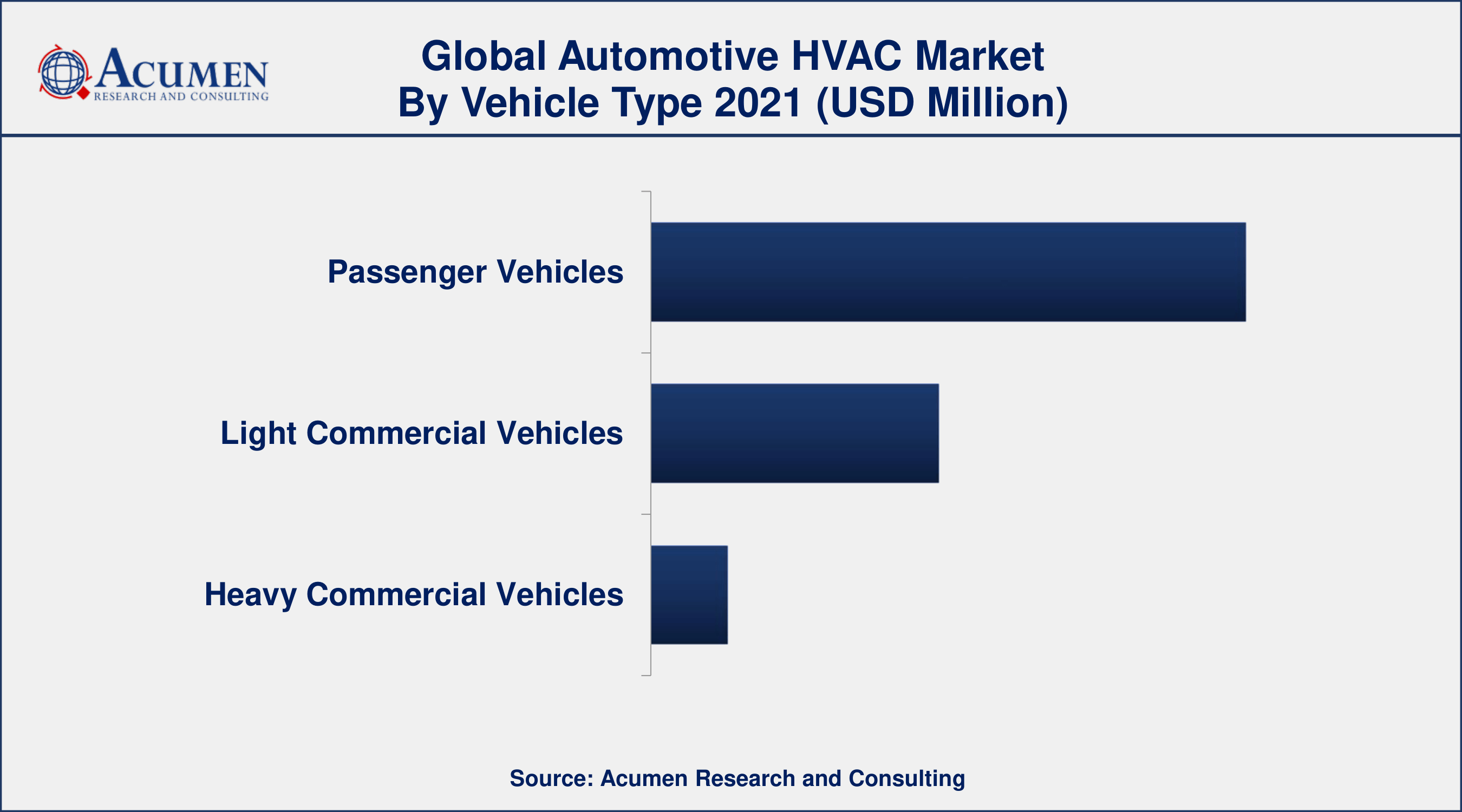

Automotive HVAC Market By Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

According to the automotive HVAC industry analysis, the passenger vehicle segment will hold a significant market share in 2021. This expansion is due to factors such as rising demand for automobiles in developing countries, rapid growth in electric vehicles, and tough climate-control rules enacted by governments in the United States and Europe. Rising discretionary income and the accessibility of various funding options are expected to drive market expansion over the projected timeframe.

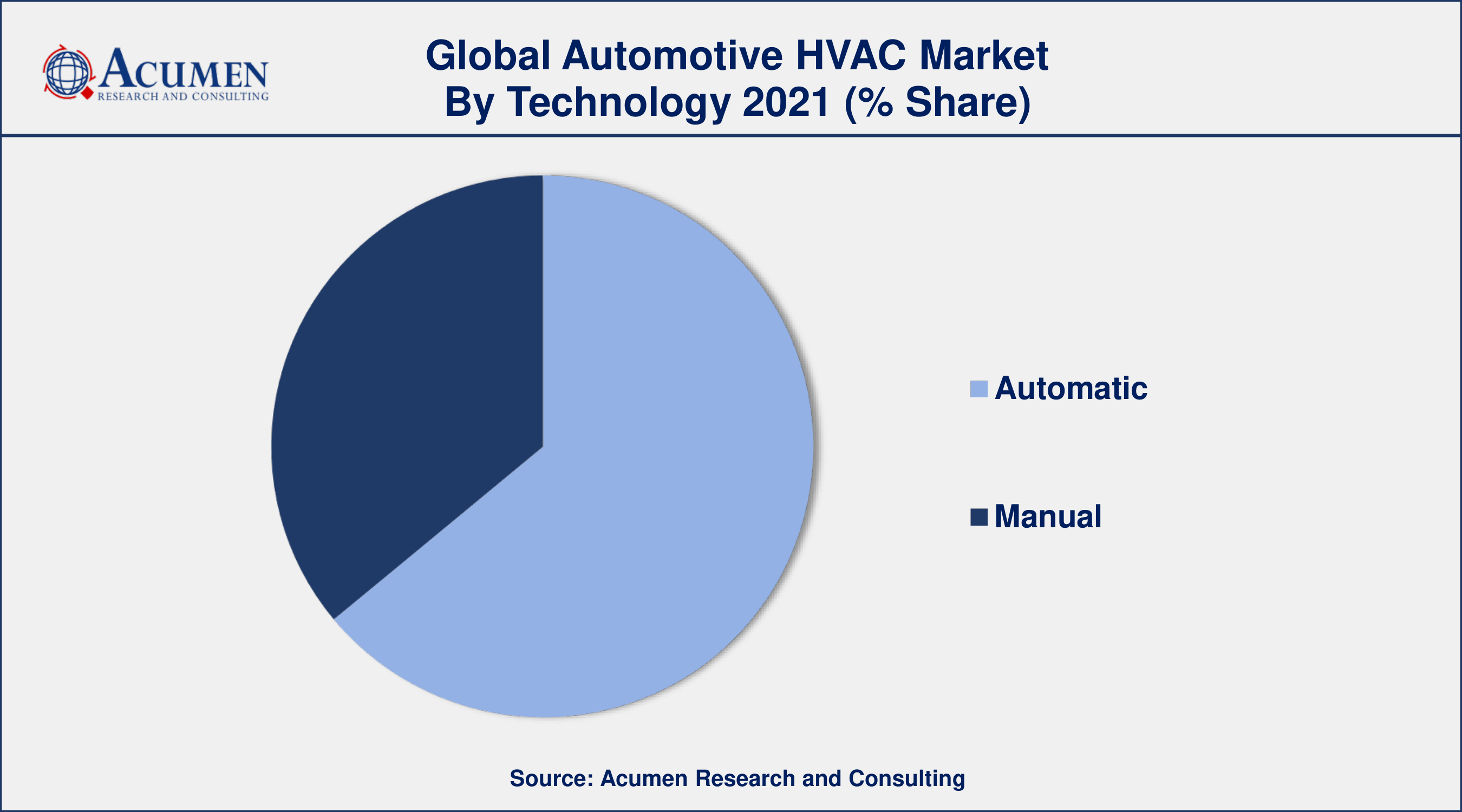

Automotive HVAC Market By Technology

- Automatic

- Manual

According to the automotive HVAC market forecast, the automated segment is predicted to increase significantly in the market over the next few years. One of the primary elements driving the sector is the increased need for high-cabin luxury and ease of use. demand. Temperature and moisture sensors must be installed inside the car cabin to regulate the temperature based on the needs of the passengers.

Automotive HVAC Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Asia-Pacific Region Is Expected To Dominate The Global Automotive HVAC Market

The Asia-Pacific market is probably going to observe huge development attributable to the nearness of key automotive makers, vast scale generation of vehicles, and spiraling vehicle requests in creating countries, for example, India, South Korea, and China. Government activities to restore the automotive business are required to drive the market during the forthcoming year. For example, the Government of India permitted 100.0% Foreign Direct Investment (FDI) through the programmed course in the automotive area.

North America is expected to grow strongly in the next years as a result of improving macroeconomic conditions and increased automobile production in the region. The district is expected to grow at a rapid pace over the forecast time span. Also, rising disposable income in the U.S. what's more, the increasing need for extravagant vehicles is anticipated to animate the development of the territorial market over a similar period.

Automotive HVAC Market Players

Some of the top automotive HVAC market companies offered in the professional report include Valeo Group, Hanon Systems, Brose Fahrzeugteile GmbH & Co. Kg, Air International Thermal Systems, Sanden Holdings Corporation, Calsonic Kansei, DelStar Technologies, Engineered Plastic Components, Denso Corporation, Mahle Behr GmbH, Sensata Technologies, Japan Climate Systems Corporation, and Johnson Electric.

Frequently Asked Questions

What is the size of global automotive HVAC market in 2021?

The estimated value of global automotive HVAC market in 2021 was accounted to be USD 51,478 Million.

What is the CAGR of global automotive HVAC market during forecast period of 2022 to 2030?

The projected CAGR automotive HVAC market during the analysis period of 2022 to 2030 is 6.1%.

Which are the key players operating in the market?

The prominent players of the global automotive HVAC market are Valeo Group, Hanon Systems, Brose Fahrzeugteile GmbH & Co. Kg, Air International Thermal Systems, Sanden Holdings Corporation, Calsonic Kansei, DelStar Technologies, Engineered Plastic Components, Denso Corporation, Mahle Behr GmbH, Sensata Technologies, Japan Climate Systems Corporation, and Johnson Electric.

Which region held the dominating position in the global automotive HVAC market?

Asia-Pacific held the dominating automotive HVAC during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for automotive HVAC during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global automotive HVAC market?

Rising need for comfort and safety as a result of HVAC system adoption, and increase in automobile production drives the growth of global automotive HVAC market.

By technology segment, which sub-segment held the maximum share?

Based on technology, automatic segment is expected to hold the maximum share of the automotive HVAC market.