Automotive Engine Oil Market | Acumen Research and Consulting

Automotive Engine Oil Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

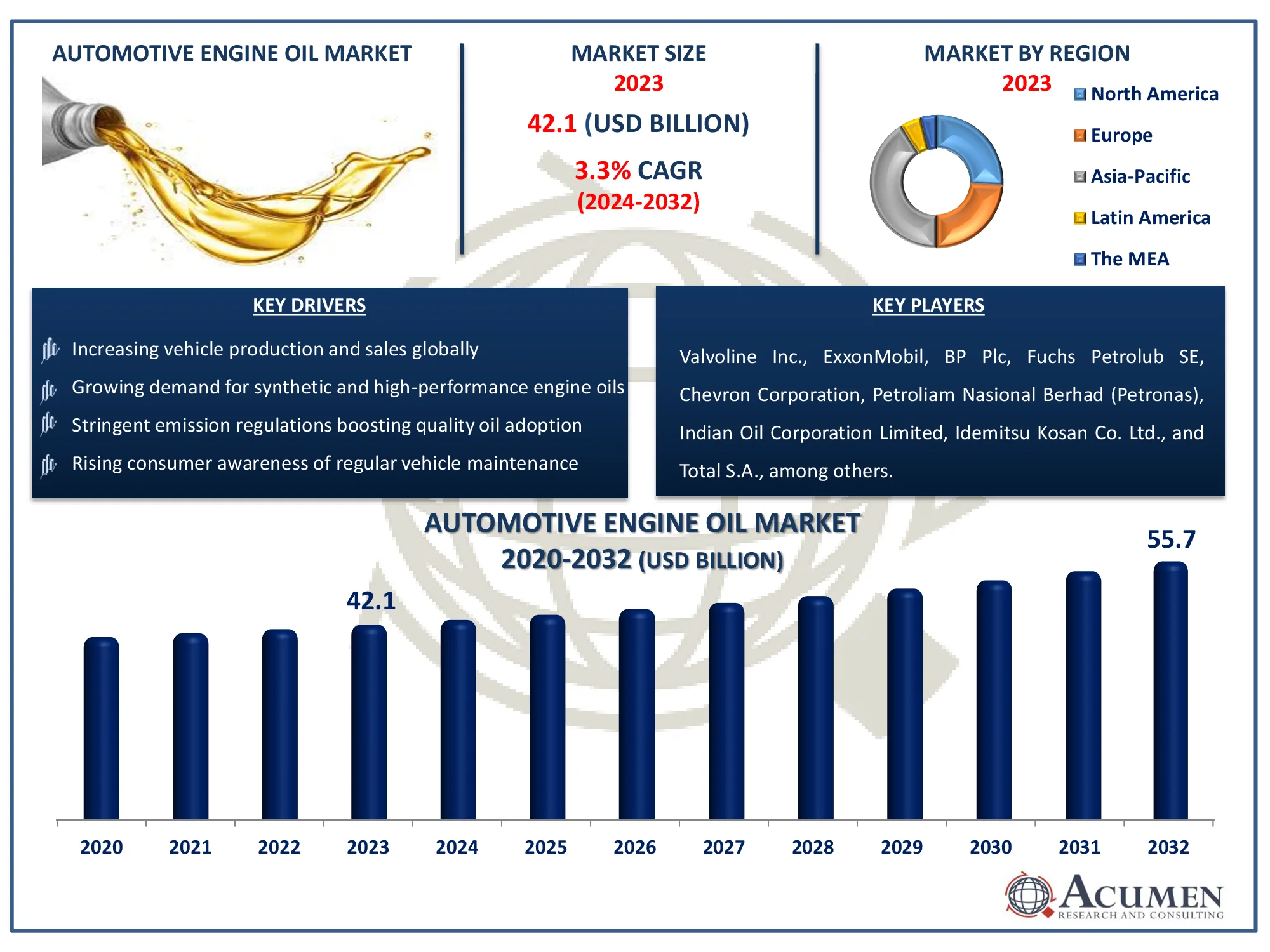

Format :

The Global Automotive Engine Oil Market Size accounted for USD 42.1 Billion in 2023 and is estimated to achieve a market size of USD 55.7 Billion by 2032 growing at a CAGR of 3.3% from 2024 to 2032.

Automotive Engine Oil Market Highlights

- Global automotive engine oil market revenue is poised to garner USD 55.7 billion by 2032 with a CAGR of 3.3% from 2024 to 2032

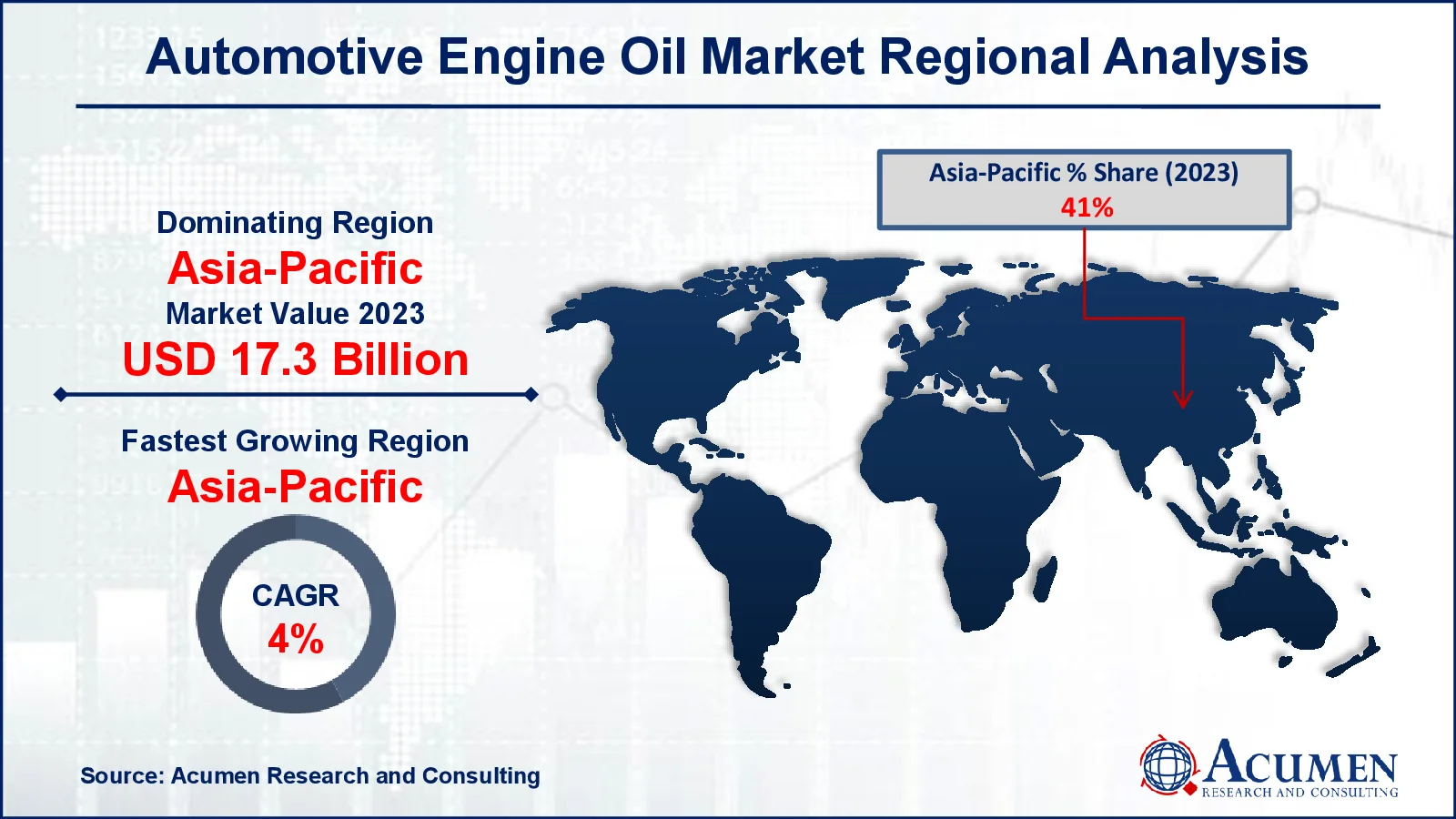

- Asia-Pacific automotive engine oil market value occupied around USD 17.3 billion in 2023

- Asia-Pacific automotive engine oil market growth will record a CAGR of more than 4% from 2024 to 2032

- Among engine type, the diesel sub-segment generated more than USD 21.5 billion revenue in 2023

- Based on vehicle type, the passenger cars sub-segment generated around 37% automotive engine oil market share in 2023

- Growth in the aftermarket service and maintenance sector is a popular automotive engine oil market trend that fuels the industry demand

Automotive engine oil is required to keep a vehicle's engine running correctly. It acts as a lubricant by reducing friction between the engine's moving parts, so preventing wear and tear. Additionally, engine oil helps to cool the engine by collecting and distributing heat from vital components. It also cleans the engine by removing dirt, debris, and other pollutants before they may cause damage or clog engine components.

Engine oils are classified into three types: conventional, synthetic, and synthetic blends, with each providing varying levels of protection and performance. Choosing the correct oil and changing it on a regular basis are critical for maintaining engine health, boosting fuel efficiency, and extending the vehicle's life. Without adequate engine oil maintenance, the engine may overheat, seize, or sustain long-term damage.

Global Automotive Engine Oil Market Dynamics

Market Drivers

- Increasing vehicle production and sales globally

- Growing demand for synthetic and high-performance engine oils

- Stringent emission regulations boosting quality oil adoption

- Rising consumer awareness of regular vehicle maintenance

Market Restraints

- Volatile crude oil prices affecting production costs

- Growing electric vehicle market reducing demand for engine oil

- Environmental concerns over oil disposal and pollution

Market Opportunities

- Expansion in emerging markets with rising automotive sales

- Development of eco-friendly and biodegradable engine oils

- Increasing adoption of engine oil for hybrid vehicles

Automotive Engine Oil Market Report Coverage

| Market | Automotive Engine Oil Market |

| Automotive Engine Oil Market Size 2022 |

USD 42.1 Billion |

| Automotive Engine Oil Market Forecast 2032 | USD 55.7 Billion |

| Automotive Engine Oil Market CAGR During 2023 - 2032 | 3.3% |

| Automotive Engine Oil Market Analysis Period | 2020 - 2032 |

| Automotive Engine Oil Market Base Year |

2022 |

| Automotive Engine Oil Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Grade, By Engine Type, By Vehicle Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Valvoline Inc., ExxonMobil, BP Plc, Fuchs Petrolub SE, Chevron Corporation, Petroliam Nasional Berhad (Petronas), Indian Oil Corporation Limited, Idemitsu Kosan Co. Ltd., Total S.A., China Petrochemical Corporation (Sinopec), Phillips 66, and Royal Dutch Shell. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Engine Oil Market Insights

Expanding generation of automobiles and need for the customary and synthetic products are the key variables driving automotive engine oil market. Automotive vehicle deals have appeared steady ascent in the course of recent years, primarily in the Asia Pacific and Europe districts, because of developing populace and consumer spending capacity.

Despite economic constraints, the Chinese engine lubricant market is predicted to increase steadily. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), China's automotive vehicle production has increased significantly, indicating the country's strong automotive sector. In Latin America, Brazil stands out as a prominent automobile manufacturer, fueling regional demand. Meanwhile, in Eastern Europe and Central Asia, Russia dominates the automobile market, with its vast population driving much of the demand for vehicles.

Dominant part of the gas engine vehicles contain light trucks and traveler vehicles. Such engines can't work easily with higher-consistency oils as the engine sort isn't prepared to work inconvenience free with high warmth age. The business is very described by the nearness of real industry members persistently doing R&D on added substances for engine oil to enhance the execution and decrease mileage of engine parts. Organizations, for example, Motul and Amsoil, deliberately wandered into joint business activities with oil and gas mammoths to giants long haul raw material acquirement ease.

In the further advancement of vehicle engines, manufactured engine oil is anticipated to assume a pivotal job. Customer mindfulness for eco-friendliness and superior variations are required to make worthwhile open doors for the producers in the business. Engineered oil performs easily at a high working temperature, which is a noteworthy explanation behind OEMs to manufacture turbocharged vehicle engines.

Automotive Engine Oil Market Segmentation

The worldwide market for automotive engine oil is split based on grade, engine type vehicle type, and geography.

Automotive Engine Oil Market By Grades

- Mineral

- Semi-synthetic

- Fully-synthetic

According to automotive engine oil industry analysis, the fully synthetic sector provides the most revenue in the market due to its improved performance and innovative formulation. Fully synthetic oils outperform mineral and semi-synthetic oils in terms of engine wear protection, fuel efficiency, and extreme temperature performance. They are meant to offer proper lubrication, minimize friction, and increase engine life. As a result, entirely synthetic lubricants are becoming increasingly popular among consumers and manufacturers, especially for high-performance and luxury automobiles. The segment's dominating revenue generation is driven by expanding knowledge of the long-term benefits of utilizing entirely synthetic oil, as well as a growing trend among consumers choosing premium products for their automobiles.

Automotive Engine Oil Market By Engine Types

- Gasoline

- Diesel

- Alternative Fuel

The diesel sector has the biggest automotive engine oil market share due to the widespread use of diesel engines in commercial vehicles and heavy-duty applications. Diesel engines are widely used in vehicles, buses, and industrial machinery due to their efficiency and durability. These engines require specific engine oils to withstand the increased heat and pressures associated with diesel combustion. Furthermore, diesel engines frequently require longer oil change intervals, increasing the demand for high-performance engine oils. The expansion of the transportation and logistics industries, particularly in emerging nations, drives up demand for diesel engine oils, cementing the company's market dominance.

Automotive Engine Oil Market By Vehicle Types

- Passenger Cars

- Light Commercial Vehicles

- Heavy Duty Vehicles

- Motorcycles

The automotive engine oil market is dominated by passenger automobiles due to the large amount of these vehicles in use worldwide. Passenger cars are the major source of transportation for many people and families, resulting in a consistent and large need for engine oil. Regular oil changes are critical for preserving the performance and longevity of these vehicles, resulting in continual demand. The increasing sales of passenger cars, particularly in developing countries, bolster this segment's market position. Furthermore, growing consumer awareness of the need of vehicle maintenance, as well as a preference for premium engine oils, help to explain why the passenger car sector has the biggest automotive engine oil market share.

Automotive Engine Oil Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Engine Oil Market Regional Analysis

Asia-Pacific is the industry's largest region, and it is predicted to develop the fastest during the automotive engine oil market forecast period due to increased product demand from emerging economies such as Thailand, India, and Vietnam. Enhanced product quality and execution as a result of tight controls by the Society of Automotive Engineers (SAE) and the American Petroleum Institute (API) have also contributed to the region's growth. However, E-Mobility, or the use of battery-powered EVs, has gained popularity in a few European countries.

The market in Middle East has the hardest hit because of fall in oil costs. Be that as it may, expanding speculations from universal organizations may help the provincial market. As of late, Saudi Arabia evacuated the restriction on ladies to drive business vehicles, which is foreseen to supplement the district's development. The automotive engine oil market in Africa is driven by second vehicles imported from created nations. The general commitment of African locale in the worldwide vehicle producing division is little.

Automotive Engine Oil Market Players

Some of the top automotive engine oil companies offered in our report includes Valvoline Inc., ExxonMobil, BP Plc, Fuchs Petrolub SE, Chevron Corporation, Petroliam Nasional Berhad (Petronas), Indian Oil Corporation Limited, Idemitsu Kosan Co. Ltd., Total S.A., China Petrochemical Corporation (Sinopec), Phillips 66, and Royal Dutch Shell.

Frequently Asked Questions

How big is the automotive engine oil market?

The automotive engine oil market size was valued at USD 42.1 billion in 2023.

What is the CAGR of the global automotive engine oil market from 2024 to 2032?

The CAGR of automotive engine oil is 3.3% during the analysis period of 2024 to 2032.

Which are the key players in the automotive engine oil market?

The key players operating in the global market are including Valvoline Inc., ExxonMobil, BP Plc, Fuchs Petrolub SE, Chevron Corporation, Petroliam Nasional Berhad (Petronas), Indian Oil Corporation Limited, Idemitsu Kosan Co. Ltd., Total S.A., China Petrochemical Corporation (Sinopec), Phillips 66, and Royal Dutch Shell.

Which region dominated the global automotive engine oil market share?

Asia-Pacific held the dominating position in automotive engine oil industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of automotive engine oil during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global automotive engine oil industry?

The current trends and dynamics in the automotive engine oil industry include increasing vehicle production and sales globally, growing demand for synthetic and high-performance engine oils, stringent emission regulations boosting quality oil adoption, and rising consumer awareness of regular vehicle maintenance.

Which engine type held the maximum share in 2023?

The diesel engine type held the maximum share of the automotive engine oil industry.