Automotive Electronics Market | Acumen Research and Consulting

Automotive Electronics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

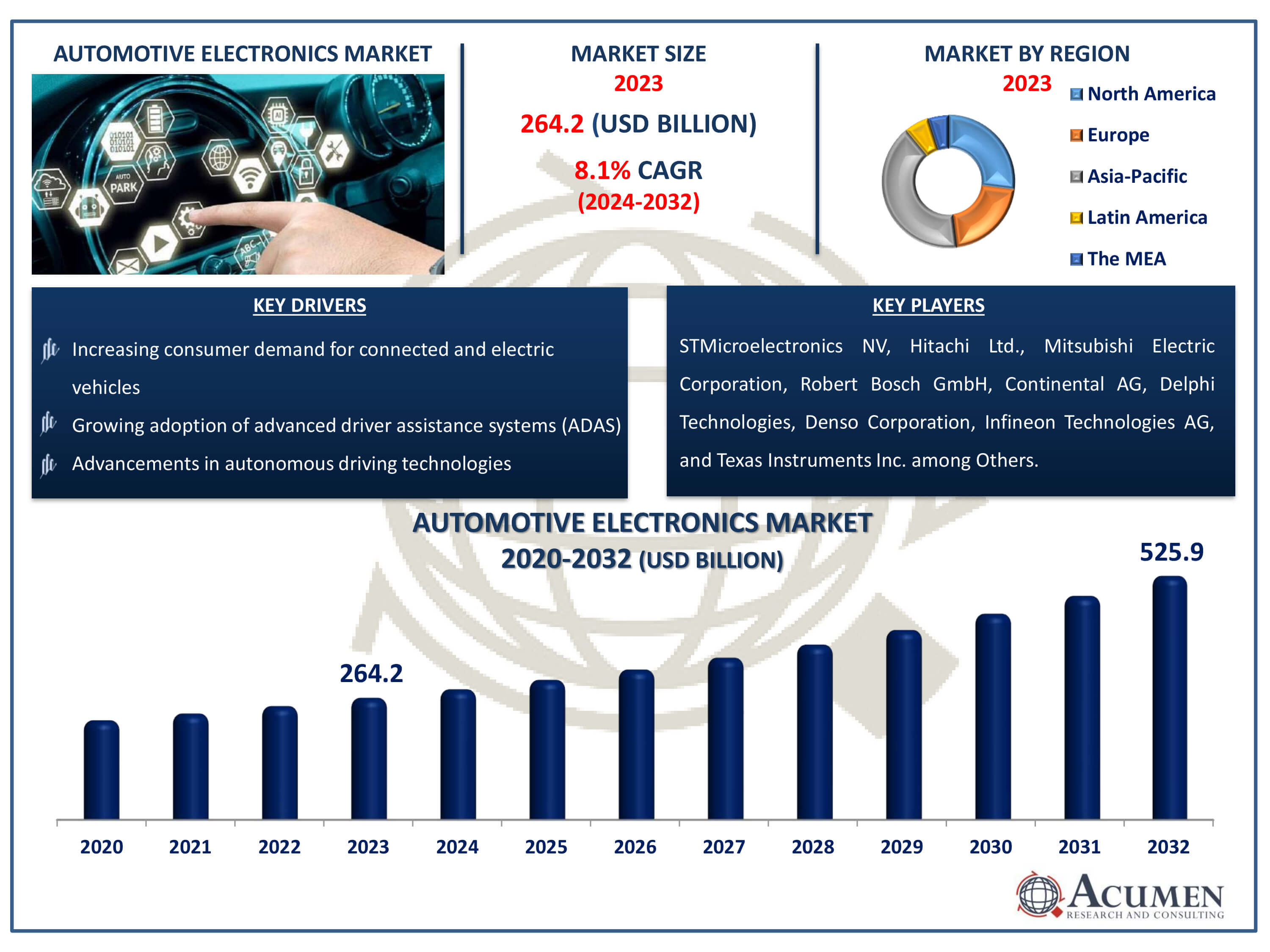

The Automotive Electronics Market Size accounted for USD 264.2 Billion in 2023 and is estimated to achieve a market size of USD 525.9 Billion by 2032 growing at a CAGR of 8.1% from 2024 to 2032.

Automotive Electronics Market Highlights

- Global automotive electronics market revenue is poised to garner USD 525.9 billion by 2032 with a CAGR of 8.1% from 2024 to 2032

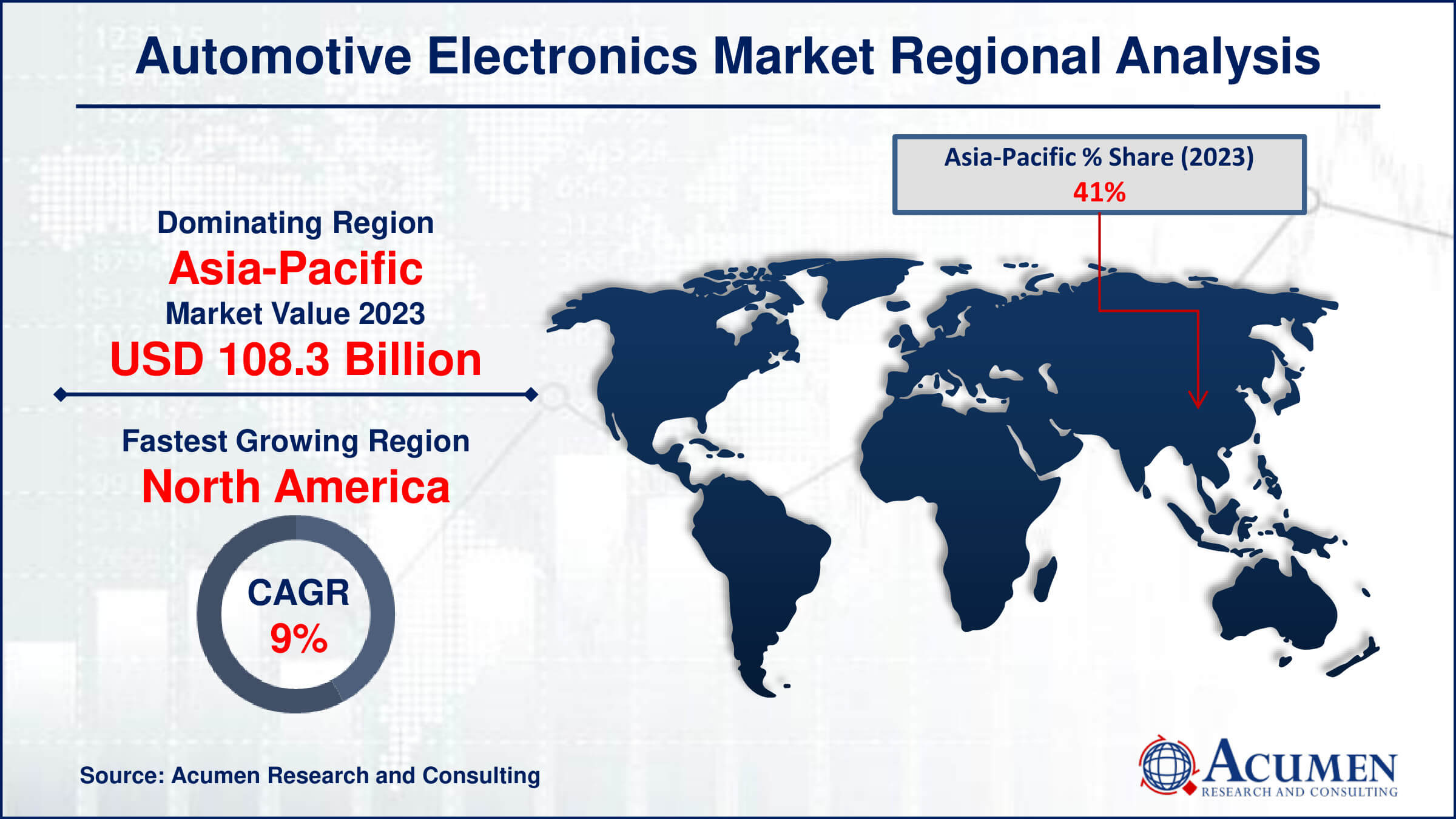

- Asia-Pacific automotive electronics market value occupied around USD 108.3 billion in 2023

- North America automotive electronics market growth will record a CAGR of more than 9% from 2024 to 2032

- Among distribution channel, the OEM sub-segment generated more than USD 171.7 billion revenue in 2023

- Based on component, the current carrying devices sub-segment generated around 40% market share in 2023

- Increasing focus on enhancing in-car entertainment and connectivity features is a popular automotive electronics market trend that fuels the industry demand

Automotive electronics refer to the electronic systems and components integrated into vehicles to enhance functionality, safety, and efficiency. These systems encompass a wide range of technologies, including sensors, control units, actuators, and communication modules, all interconnected to manage vehicle operations. Key applications include engine control, transmission systems, braking systems, steering assistance, infotainment, navigation, and advanced driver-assistance systems (ADAS). Automotive electronics play a critical role in modern vehicles by improving performance, optimizing fuel efficiency, enhancing driver and passenger comfort, and enabling autonomous driving capabilities. As automotive technology advances, so too does the complexity and integration of electronics, paving the way for innovations in electric and autonomous vehicles that rely heavily on sophisticated electronic systems for operation and connectivity.

Global Automotive Electronics Market Dynamics

Market Drivers

- Increasing consumer demand for connected and electric vehicles

- Advancements in autonomous driving technologies

- Stringent government regulations for vehicle safety and emissions

- Growing adoption of advanced driver assistance systems (ADAS)

Market Restraints

- High initial costs associated with automotive electronic components

- Concerns regarding cybersecurity and data privacy

- Complexities in integrating electronic systems across vehicle platforms

Market Opportunities

- Rising investments in electric and hybrid vehicle technologies

- Expansion of smart infrastructure and smart city initiatives

- Development of next-generation vehicle-to-everything (V2X) communication systems

Automotive Electronics Market Report Coverage

| Market | Automotive Electronics Market |

| Automotive Electronics Market Size 2022 | USD 264.2 Billion |

| Automotive Electronics Market Forecast 2032 | USD 525.9 Billion |

| Automotive Electronics Market CAGR During 2023 - 2032 | 8.1% |

| Automotive Electronics Market Analysis Period | 2020 - 2032 |

| Automotive Electronics Market Base Year |

2022 |

| Automotive Electronics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Vehicle Type, By Application, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | STMicroelectronics NV, Hitachi Ltd., Mitsubishi Electric Corporation, Robert Bosch GmbH, Continental AG, Delphi Technologies, Denso Corporation, Infineon Technologies AG, Texas Instruments Inc., Panasonic Corporation, Valeo SA, Aptiv PLC, NXP Semiconductors NV. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Electronics Market Insights

The rising penetration of hybrid electric vehicles (HEV) and electric vehicles (EV), along with the increasing adoption of advanced safety systems such as advanced airbags and anti-lock braking systems, is crucial in reducing road fatalities and driving market growth. Manufacturers are heavily investing in research and development to produce high-performance automotive electronics at competitive costs, while also transitioning towards energy storage technologies like lithium-ion batteries. This shift not only enhances vehicle efficiency but also supports sustainability goals in the automotive sector. Original equipment manufacturers (OEMs) are increasingly relying on advanced technology-based electronics, enabling them to integrate sophisticated safety features into vehicles, thereby improving overall vehicle safety ratings. This trend is reinforced by stringent government regulations in developed and developing countries mandating the installation of automated safety systems in automobiles, further boosting revenue growth in the global automotive electronics market forecast period.

The industry's dependence on the availability, supply chain efficiency, procurement costs, and timely delivery of raw materials such as resin, aluminum, copper, and others significantly impacts OEM operating costs and profitability. Managing these factors efficiently is critical for maintaining competitive pricing and profitability in the market. Electronics accounted for approximately one-third of total vehicle costs. With ongoing technological advancements and the increasing complexity of automotive electronics, including infotainment systems, connectivity solutions, and autonomous driving technologies, this share is projected to rise to around half of the total vehicle cost in the automotive electronics market forecast period. This evolution underscores the pivotal role of automotive electronics in shaping the future of vehicle design, safety, and consumer experience.

Automotive Electronics Market Segmentation

The worldwide market for automotive electronics is split based on component, vehicle type, application, distribution channel, and geography.

Automotive Electronics Market By Component

- Electronic Control Unit (ECU)

- Sensors

- Current Carrying Devices

- Others

According to automotive electronics industry analysis, the current carrying devices represent a critical segment, encompassing components like wiring harnesses and connectors that conduct electricity throughout vehicles. These devices serve as essential conduits, enabling the flow of power and signals to various electronic systems within cars, such as engine control units (ECUs) and sensors. Their significance lies in ensuring reliable operation and seamless communication between different automotive electronic components, thereby supporting functions like engine management, safety features, and entertainment systems. The current carrying devices segment's prominence is driven by the increasing complexity and connectivity requirements of modern vehicles, where efficient electrical distribution is essential for performance, safety, and overall vehicle functionality. This segment's growth underscores its pivotal role in advancing automotive electronics to meet evolving consumer demands and technological innovations.

Automotive Electronics Market By Vehicle Type

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

In the automotive electronics market, the passenger car segment stands out as the largest category, driven by its widespread consumer appeal and technological advancements. Passenger cars, ranging from compact hatchbacks to luxury sedans, integrate a diverse array of electronic systems to enhance comfort, safety, and performance. These vehicles utilize sophisticated electronic control units (ECUs) to manage engine functions, safety features like adaptive cruise control and parking sensors, and advanced infotainment systems. The segment's dominance reflects the growing consumer demand for smart features and connectivity options in everyday vehicles, contributing to increased adoption of automotive electronics. Furthermore, stringent safety regulations and the push towards fuel efficiency are pushing manufacturers to innovate in electronic systems, making passenger cars a focal point for technological advancement in the automotive industry.

Automotive Electronics Market By Application

- ADAS

- Infotainment

- Body electronics

- Safety systems

- Powertrain

The leading category in the automotive electronics market is safety systems, which is critical to improving vehicle safety and driver protection. This sector includes a variety of electronic technology used to prevent and lessen accidents. Electronic stability control (ESC), anti-lock braking systems (ABS), and advanced driver assistance systems (ADAS) such as collision avoidance and lane departure warnings are all examples of safety features. These technologies use sensors, cameras, and ECUs to monitor road conditions and driver behavior, intervening as needed to prevent or mitigate collisions.

The importance of Safety Systems is being driven by rising regulatory standards that require the installation of this technology in automobiles worldwide. Furthermore, increased consumer awareness and demand for safer driving experiences fuel the market expansion. Manufacturers continue to develop, including artificial intelligence and machine learning to increase the effectiveness and dependability of safety systems, ensuring vehicles are prepared to manage a wide range of driving circumstances and improve overall road safety.

Automotive Electronics Market By Distribution Channels

- OEM

- Aftermarket

The automotive electronics market distribution channels are mostly made up of original equipment manufacturers (OEMs) and the aftermarket. The OEM segment is the major distribution channel. This sector includes electronics fitted during the construction of cars. OEMs have a significant advantage because of their strong integration with car manufacturers, which ensures that their products meet strict quality and compatibility requirements. This connectivity also makes it easier to design advanced and unique electronic systems for individual vehicle models. The OEM segment's dominance is fueled by rising demand for sophisticated in-vehicle electronics, greater safety features, and the increased integration of modern technologies into new vehicles.

Automotive Electronics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Electronics Market Regional Analysis

In terms of automotive electronics market analysis, the Asia-Pacific region is the largest, driven by the presence of major automobile manufacturers and the high demand for vehicles in countries like China, Japan, and India. The region's dominance is attributed to several factors, including the rapid industrialization, urbanization, and the increasing disposable incomes of consumers. These factors have led to a significant rise in vehicle production and sales, subsequently boosting the demand for advanced automotive electronics. Additionally, the adoption of electric vehicles (EVs) and hybrid vehicles is growing, further propelling the market for automotive electronics in this region. The strong presence of key players and the continuous technological advancements also contribute to the market's growth in Asia-Pacific.

North America is expected to be the fastest-growing region in the automotive electronics industry forecast period. This growth is fueled by the increasing demand for advanced driver-assistance systems (ADAS), infotainment systems, and other smart electronics in vehicles. The region's strong focus on technological innovation and the early adoption of advanced technologies play a significant role in this growth. Moreover, the presence of leading automotive manufacturers and a well-established automotive industry infrastructure support the expansion of the market. The shift towards electric and autonomous vehicles in North America is another critical factor driving the demand for sophisticated automotive electronics. Government regulations promoting vehicle safety and emissions control also contribute to the rapid growth of this market in the region.

Automotive Electronics Market Players

Some of the top automotive electronics companies offered in our report includes STMicroelectronics NV, Hitachi Ltd., Mitsubishi Electric Corporation, Robert Bosch GmbH, Continental AG, Delphi Technologies, Denso Corporation, Infineon Technologies AG, Texas Instruments Inc., Panasonic Corporation, Valeo SA, Aptiv PLC, NXP Semiconductors NV.

Frequently Asked Questions

How big is the automotive electronics market?

The automotive electronics market size was valued at USD 264.2 billion in 2023.

What is the CAGR of the global automotive electronics market from 2024 to 2032?

The CAGR of automotive electronics is 8.1% during the analysis period of 2024 to 2032.

Which are the key players in the automotive electronics market?

The key players operating in the global market are including STMicroelectronics NV, Hitachi Ltd., Mitsubishi Electric Corporation, Robert Bosch GmbH, Continental AG, Delphi Technologies, Denso Corporation, Infineon Technologies AG, Texas Instruments Inc., Panasonic Corporation, Valeo SA, Aptiv PLC, and NXP Semiconductors NV.

Which region dominated the global automotive electronics market share?

Asia-Pacific held the dominating position in automotive electronics industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of automotive electronics during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global automotive electronics industry?

The current trends and dynamics in the automotive electronics industry include increasing consumer demand for connected and electric vehicles, advancements in autonomous driving technologies, stringent government regulations for vehicle safety and emissions, and growing adoption of advanced driver assistance systems (ADAS).

Which vehicle type held the maximum share in 2023?

The passenger car vehicle types the maximum share of the automotive electronics industry.