Automotive E-Compressor Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Automotive E-Compressor Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The global Automotive E-Compressor Market size was valued at USD 2.1 Billion in 2022 and is projected to reach USD 26.4 Billion by 2032 mounting at a CAGR of 29.1% from 2023 to 2032.

Automotive E-Compressor Market Highlights

- Global automotive e-compressor market revenue is poised to garner USD 26.4 billion by 2032 with a CAGR of 29.1% from 2023 to 2032

- Asia-Pacific automotive e-compressor market value occupied around USD 848 million in 2022

- Asia-Pacific automotive e-compressor market growth will record a CAGR of more than 30% from 2023 to 2032

- Among types, the passenger vehicle sub-segment generated over US$ 1.2 billion revenue in 2022

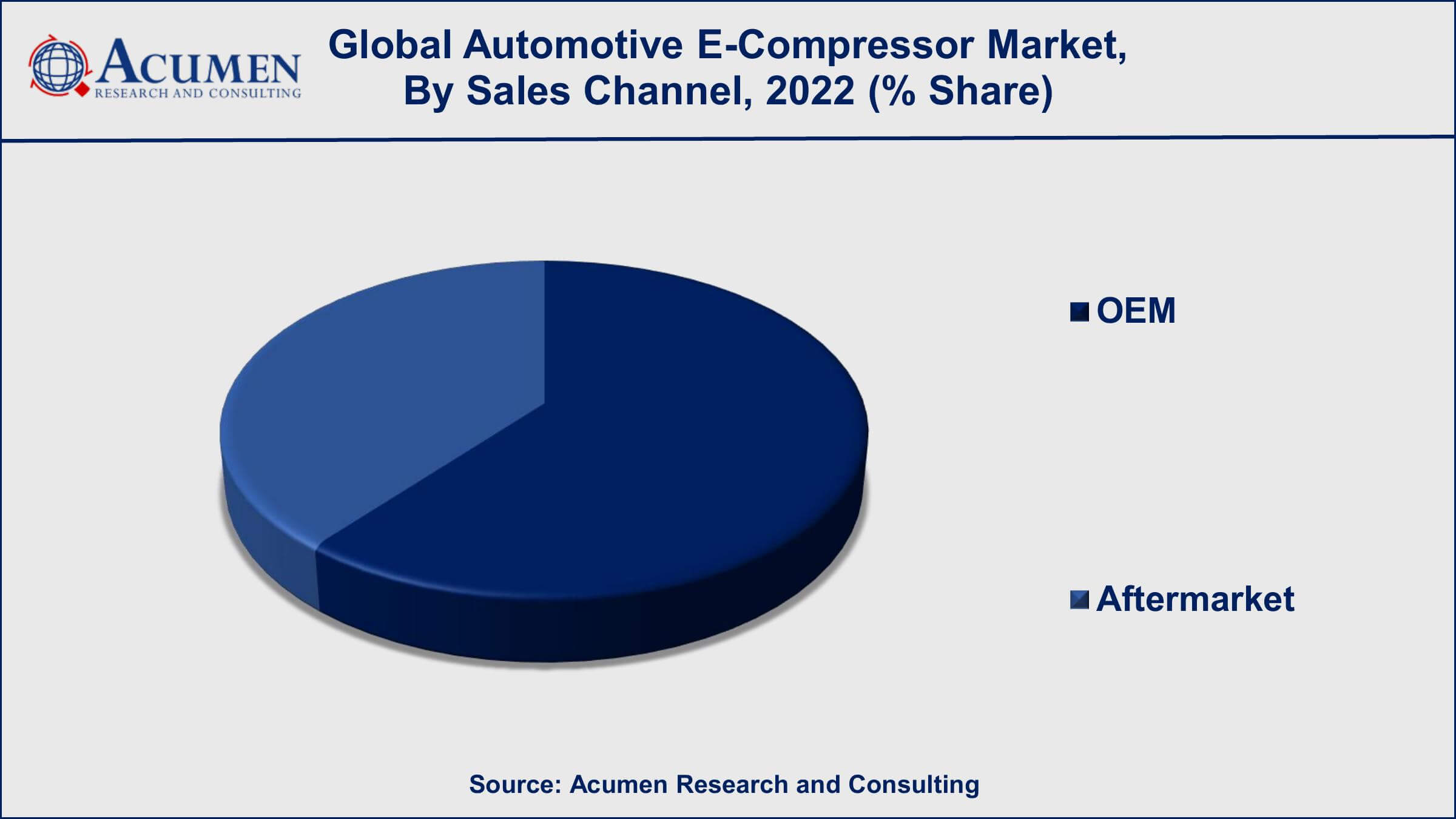

- Based on sales channel, the OEM sub-segment generated around 61% share in 2022

- Integration of e-compressors with advanced connectivity and smart features is a popular automotive e-compressor market trend that fuels the industry demand

Automotive e-compressors are tightly sealed types of compressors and function with their motor inside so that the compressor terminals are used for power transfer. The compressor terminal prevents leakage of the refrigerant and directs to transfer of a large amount of energy from the battery to the air conditioning compressor in hybrid and electric vehicles.

Currently, various development activities are conducted in automotive e-compressors by the market players. These involve electronic data capture services (EDCs) with high cooling capacity for cabin air conditioning and heat pump systems coupled with battery thermal management systems. Such compressors improve vehicle interior comfort and battery cooling during quick charging with a reduction in CO2 emissions as it requires low power consumption. However, the challenges in the e-compressor business are still acute due to the competitive market and the need for reduction in the size, weight, and improvement in efficiency.

Global Automotive E-Compressor Market Dynamics

Market Drivers

- Increasing demand for electric and hybrid vehicles (EVs and HEVs)

- Stringent emission regulations and environmental concerns

- Advancements in electric vehicle technology

- Government incentives and subsidies for EV adoption

- Growing consumer preference for eco-friendly vehicles

- Rising awareness about climate control and comfort features in vehicles

Market Restraints

- High initial costs of electric vehicles

- Limited charging infrastructure in certain regions

- Range anxiety and limited driving range of electric vehicles

- Potential supply chain disruptions for critical components

- Concerns regarding battery performance and durability

Market Opportunities

- Technological advancements in e-compressor efficiency and performance

- Expansion of charging infrastructure networks

- Collaboration between automakers and technology companies

- Increasing focus on research and development to improve battery efficiency

- Emerging markets with untapped potential for electric vehicle adoption

Automotive E-Compressor Market Report Coverage

| Market | Automotive E-Compressor Market |

| Automotive E-Compressor Market Size 2022 | USD 2.1 Billion |

| Automotive E-Compressor Market Forecast 2032 | USD 26.4 Billion |

| Automotive E-Compressor Market CAGR During 2023 - 2032 | 29.1% |

| Automotive E-Compressor Market Analysis Period | 2020 - 2032 |

| Automotive E-Compressor Market Base Year | 2022 |

| Automotive E-Compressor Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, Vehicle Type, Drivetrain, Cooling Capacity, Component, Sales Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Denso Corporation, Sanden Holdings Corporation, Valeo SA, Hanon Systems, MAHLE GmbH, Mitsubishi Heavy Industries Thermal Systems, Ltd., LG Electronics Inc., Panasonic Corporation, Calsonic Kansei Corporation, Delphi Technologies (now part of BorgWarner Inc.), Robert Bosch GmbH, GREE Electric Appliances Inc. (Gree Electric), Continental AG Behr Hella Service GmbH, and Hitachi Automotive Systems, Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive E-Compressor Market Insights

The continued use of hybrid and electric cars is a significant driver of the automotive e-compressor industry. The fuel-saving benefits of automobile e-compressors increase consumer desire for hybrid and electric cars. Rising government backing for the car sector boosts future growth of electric vehicles (EVs), which eventually boosts demand for the automotive ecompressor market.

According to the Ministry of Heavy Industries and Public Enterprises (MHIPE), 2019 was considered a positive year for India’s evolving electric vehicles industry. The government support with approval of Rs. 10,000 crore programs under the FAME-2 scheme for the promotion of electric and hybrid vehicles. Till November 2019 close to 285,000 buyers of electric and hybrid vehicles benefitted from subsidies under the FAME-2 scheme that marked revenue of INR 3.6 Bn. However, low information distributed among buyers towards electric and hybrid vehicles ultimately limits the growth of automotive e-compressors. Moreover, less knowledge among buyers regarding the servicing and charging operations of EVs and hybrid vehicles restrains the market from growing worldwide.

In addition, electric connections for the compressor and feed-through are still critical coupled with high-voltage connections. This factor acts challenge for the automotive e-compressor market to expand worldwide. But with the automobile industry commitment in respective regions towards developing green sustainable mobility acts as an emerging business opportunity worldwide.

COVID-19 Impact on Automotive E-Compressor Market

Automobile industries existing in the global markets were induced by COVID-19's negative impact on electronic vehicles (EVs). One of the first causalities witnessed was the economic crisis with falling crude oil prices worldwide. Low oil prices at the pump reduce the economic viability of EV adoption with combustion vehicles, especially in countries with limited fiscal incentives for EVs. Another risk factor associated with EV adoption comes with disruptions in supply chains. Also, lockdowns and social distancing norms had a serious impact on the cash flows for mobility service providers. Financial stress, bankruptcies, and consolidation in the mobility service market delayed Ev's manufacturing.

Automotive E-Compressor Market Segmentation

The worldwide market for automotive e-compressor is split based on type, vehicle type, drivetrain, cooling capacity, component, sales channel, and geography.

Automotive E-Compressor Types

- Swash

- Wobble

- Screw

- Scroll

- Others

According to automotive e-compressor industry analysis, the scroll kind of compressor has been the most popular choice in the automobile e-compressor market. Because of their efficiency and dependability, scroll compressors are commonly employed in vehicle air conditioning systems. These compressors compress the refrigerant using two interleaved scrolls, providing smooth and continuous operation with minimum noise and vibration.

While the other varieties you listed, such as Swash, Wobble, Screw, and Others, have uses in certain sectors or systems, they are not as common or prominent in the automotive e-compressor market as the Scroll type. Scroll compressors are popular in the automobile industry because of their small size, energy economy, and enhanced performance in air conditioning and temperature control systems.

Automotive E-Compressor Vehicle Types

- Passenger Vehicle

- Light Duty Vehicle

- Medium & Heavy Duty Trucks

- Buses & Coache

The passenger car category has dominated the automotive ecompressor industry. Sedans, hatchbacks, SUVs, and other vehicles meant for personal usage are examples of passenger vehicles. These cars frequently incorporate air conditioning systems and temperature control features that necessitate the use of e-compressors to deliver cooling and heating.

Passenger vehicles have a sizable market share due to their large number of sales and extensive use of air conditioning systems. As customer demand for comfort and convenience features grows, so does the need for automotive e-compressors in passenger vehicles.

While e-compressors are employed in various vehicle sectors such as light-duty vehicles, medium and heavy-duty trucks, and buses/coaches, passenger vehicles have the biggest market share in terms of e-compressor usage. However, it is worth mentioning that the use of electric and hybrid cars is spreading across multiple vehicle categories, which may affect future market dynamics for automotive e-compressors.

Automotive E-Compressor Drivetrains

- ICE Vehicle

- Electric Vehicle

According to the automotive e-compressor market forecast, electric vehicles (EVs) are expected to acquire utmost market shares from 2023 to 2032. The automotive industry has shifted significantly towards electric vehicles (EVs). As a result, electric cars are gaining popularity and will likely dominate the automotive e-compressor industry in the future years.

While internal combustion engine (ICE) cars have historically been the principal consumers of automotive e-compressors for their air conditioning systems, the growing popularity of electric vehicles is altering the picture. E-compressors are used in electric cars, including battery electric vehicles (BEVs) and hybrid electric vehicles (HEVs), for air conditioning and climate control.

With the worldwide desire to reduce emissions and address environmental issues, electric transportation is becoming more popular. Governments throughout the world are enacting stronger pollution standards and providing incentives to encourage the use of electric vehicles. This trend is predicted to boost the need for automotive e-compressors in electric cars, eventually overtaking ICE vehicle demand.

Automotive E-Compressor Cooling Capacities

- Less than 20 CC

- 20 to 40 CC

- More than 60 CC

The cooling capacity of automobile ecompressors is commonly measured in cubic centimetres (CC). However, depending on the vehicle type, use, and regional preferences, the specific cooling capacity dominating the automotive e-compressor market might vary. Having stated that, the 20 to 40 CC cooling capacity range has been widely employed and dominating in the automobile e-compressor sector. This range is appropriate for a broad variety of passenger cars, such as sedans, SUVs, and hatchbacks. To provide efficient air conditioning and temperature control performance, these cars require e-compressors with modest cooling capacity.

While e-compressors with cooling capacities less than 20 CC or greater than 60 CC may find applications in specific vehicle types or market segments, the 20 to 40 CC range is generally the most common in the automotive industry due to its compatibility with standard passenger vehicle air conditioning systems.

Automotive E-Compressor Components

- Compressor Section

- Motor

- Inverter

- Oil Separator

- Others

The compressor portion is often the component that dominates the automobile e-compressor market. The compressor section is the main component in charge of compressing the refrigerant and circulating it through the vehicle's air conditioning system.

The compressor component of the automobile e-compressor is critical to its overall performance and efficiency. It is in charge of delivering the necessary cooling capacity and keeping the car interior at the proper temperature.

While the other components you mentioned, such as the motor, inverter, and oil separator, are all necessary components of an automobile e-compressor system, the compressor portion is frequently regarded as the most important in terms of market domination. The compressor section's efficiency, dependability, and performance are critical variables in determining the overall quality and efficacy of the e-compressor.

Automotive E-Compressor Sales Channels

- OEM

- Aftermarket

As per the automotive e compressor market analysis, the original equipment manufacturer (OEM) sales channel normally dominates. OEM sales are manufacturers' direct sales of e-compressors to car manufacturers for installation during the vehicle production process. Because of the enormous amount of e-compressors installed into automobiles during manufacture, the OEM sales channel is dominating. As a key component of the vehicle's HVAC (Heating, Ventilation, and Air Conditioning) system, automotive e-compressors are frequently integrated into the air conditioning systems.

While the OEM sales channel is dominant, there is also a significant presence of e-compressor sales in the aftermarket. The aftermarket sales channel involves the sale of e-compressors as replacement parts for existing vehicles. These e-compressors are typically sold through various channels, including automotive parts suppliers, dealerships, and online platforms.

Automotive E-Compressor Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive E-Compressor Market Regional Analysis

Based on regions, Asia-Pacific is leading the overall e-compressor market globally followed by Europe. China is recognized as the world’s largest automobile manufacturer since the past. It is anticipated that in the next five years, China will grab a market share of 30% worldwide in the car segment. The Chinese government has a high focus on the development of new energy vehicles which is a high priority supported by policies and incentives.

The automotive industry in the United States accounts for 4-5% of the US gross domestic product which resulted in the employment of 716,900 workforce in 2011 whereas Japan almost comprised 7, 90,000 people to work directly in the automotive industry.

On the other hand, Europe is gaining a strong pace in the regional market for automotive e-compressors. This can be attributed to the prominent automotive market player’s presence in this region which is likely to boost the automotive e-compressor market in Europe. In the European Union (EU), around 16 million units are manufactured which is about 26% of the world’s annual production. Hence, the annual turnover of the cars segment is US$ 852.75 billion. Further, the high focus of the European automobile industries on R&D activities bolsters the regional growth of the automotive e-compressor market.

Europe comprises 210 production plants of which the automotive industry exports US$ 852.75 billion in net trade annually, Also, recognized as the largest sector in private R&D investments with more than 5,800 patents filed in 2011. In Europe, Germany consists of 750,000 + employees working directly in the automotive sector in more than 45 plants.

Automotive E-Compressor Market Players

Some of the top automotive e-compressor companies offered in our report include Denso Corporation, Sanden Holdings Corporation, Valeo SA, Hanon Systems, MAHLE GmbH, Mitsubishi Heavy Industries Thermal Systems, Ltd., LG Electronics Inc., Panasonic Corporation, Calsonic Kansei Corporation, Delphi Technologies (now part of BorgWarner Inc.), Robert Bosch GmbH, GREE Electric Appliances Inc. (Gree Electric), Continental AG Behr Hella Service GmbH, and Hitachi Automotive Systems, Ltd.

Automotive E-Compressor Industry Recent Developments

- Denso Corporation, a prominent producer of automotive technology and components, has achieved considerable progress in the field of vehicle e-compressors. Denso has announced the debut of the Sora e-compressor, a new e-compressor for electric cars (EVs). The Sora e-compressor is intended to improve the economy and performance of electric vehicle air conditioning systems. It is appropriate for a broad range of EV models because to its small and lightweight design, better cooling capacity, and lower power consumption. Denso's Sora e-compressor seeks to aid in the creation of more efficient and environmentally friendly electric automobiles.

- Sanden Holdings Corporation, a global pioneer in automotive air conditioning systems, has been actively involved in the development of electric vehicle e-compressors. Sanden has announced their latest electric e-compressor, the SD7H15EA. The SD7H15EA e-compressor is intended for use in electric and hybrid electric cars. It is excellent for EV applications because to its high efficiency, low noise levels, and compact design. The SD7H15EA e-compressor from Sanden is designed to deliver optimal temperature control performance while also contributing to the overall efficiency and sustainability of electric cars.

Frequently Asked Questions

What was the market size of the global automotive e-compressor in 2022?

The market size of automotive e-compressor was USD 2.1 billion in 2022.

What is the CAGR of the global automotive e-compressor market from 2023 to 2032?

The CAGR of automotive e-compressor is 29.1% during the analysis period of 2023 to 2032.

Which are the key players in the automotive e-compressor market?

The key players operating in the global market are including Denso Corporation, Sanden Holdings Corporation, Valeo SA, Hanon Systems, MAHLE GmbH, Mitsubishi Heavy Industries Thermal Systems, Ltd., LG Electronics Inc., Panasonic Corporation, Calsonic Kansei Corporation, Delphi Technologies (now part of BorgWarner Inc.), Robert Bosch GmbH, GREE Electric Appliances Inc. (Gree Electric), Continental AG Behr Hella Service GmbH, and Hitachi Automotive Systems, Ltd.

Which region dominated the global automotive e-compressor market share?

Asia-Pacific held the dominating position in automotive e-compressor industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of automotive e-compressor during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automotive e-compressor industry?

The current trends and dynamics in the automotive e-compressor industry include increasing demand for electric and hybrid vehicles (EVs and HEVs), stringent emission regulations and environmental concerns, and advancements in electric vehicle technology.

Which vehicle type held the maximum share in 2022?

The passenger vehicle type held maximum share of the automotive e-compressor industry.