Automotive Digital Cockpit Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Automotive Digital Cockpit Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

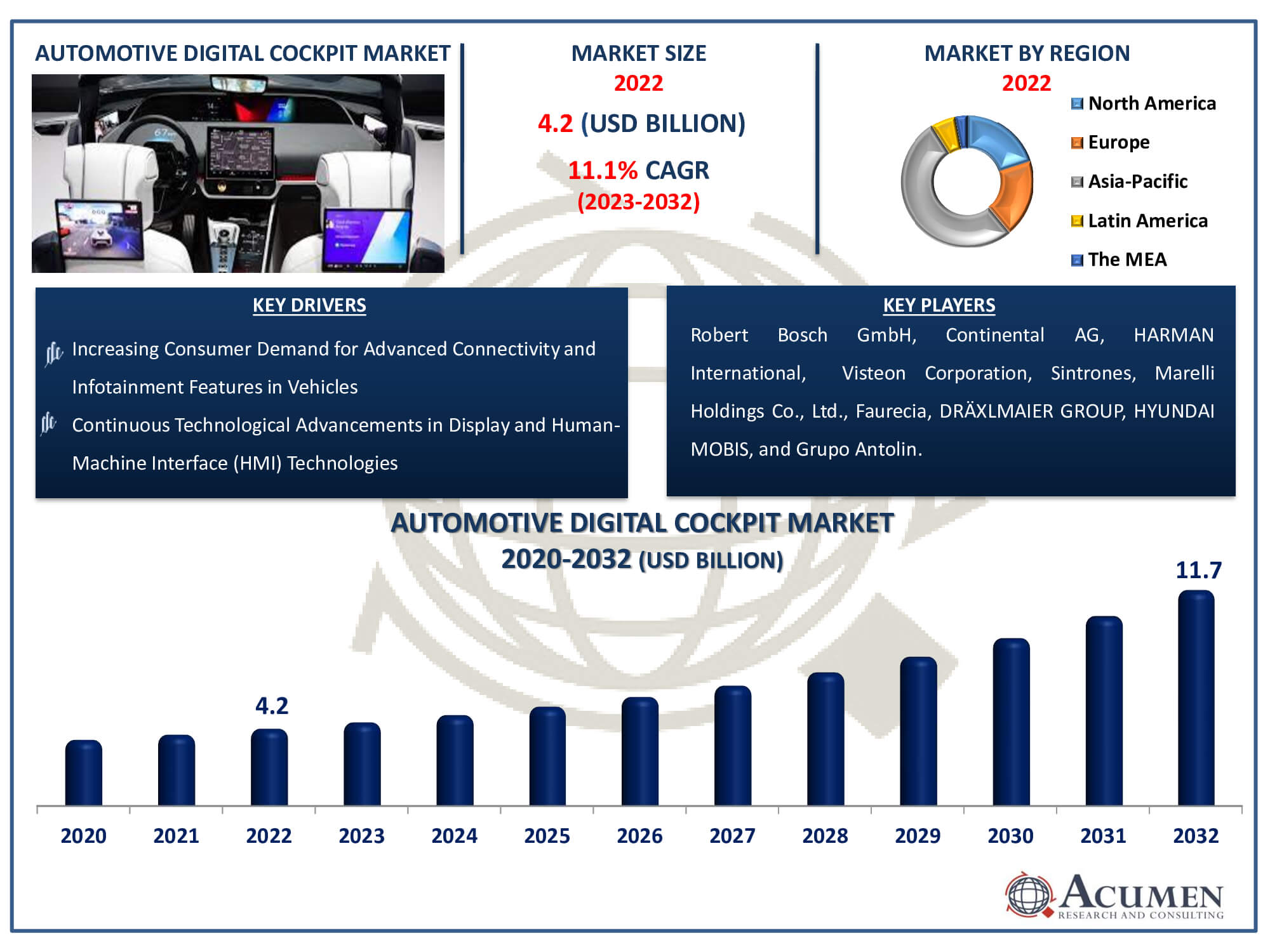

The Automotive Digital Cockpit Market Size accounted for USD 4.2 Billion in 2022 and is estimated to achieve a market size of USD 11.7 Billion by 2032 growing at a CAGR of 11.1% from 2023 to 2032.

Automotive Digital Cockpit Market Highlights

- Global automotive digital cockpit market revenue is poised to garner USD 11.7 billion by 2032 with a CAGR of 11.1% from 2023 to 2032

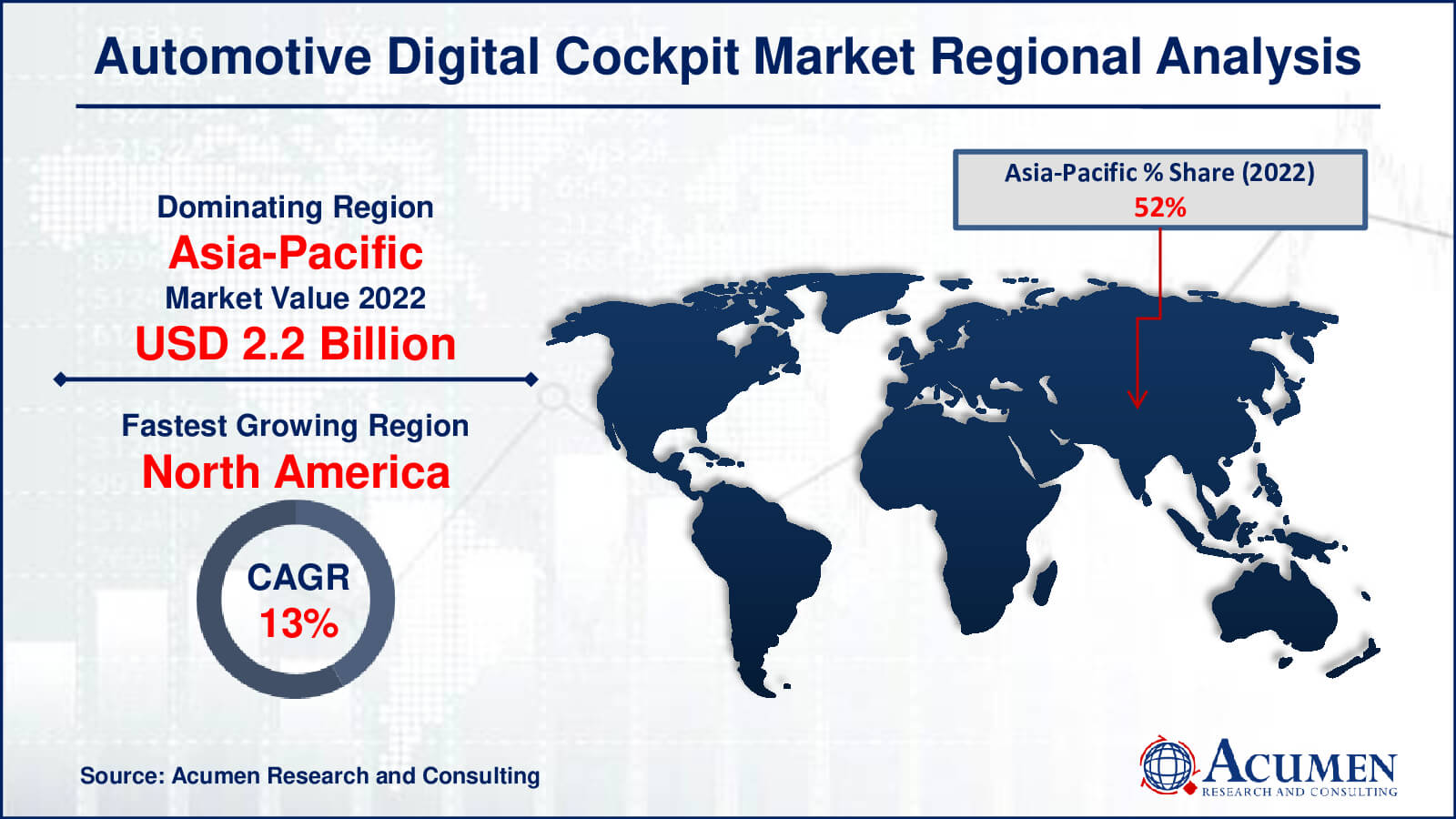

- Asia-Pacific automotive digital cockpit market value occupied around USD 2.2 billion in 2022

- North America automotive digital cockpit market growth will record a CAGR of more than 13% from 2023 to 2032

- Among equipment, the camera based driver monitoring sub-segment generated over US$ 1.9 billion revenue in 2022

- Based on display technology, the TFT-LCD sub-segment generated around 56% share in 2022

- Increasing focus on customization and personalization of digital cockpit experiences is a popular automotive digital cockpit market trend that fuels the industry demand

In today's increasingly digital and complex world, there is a strong demand for simpler, more user-friendly information management systems inside automobiles. With such new capabilities focusing on automated driving and safety, connectivity, and user experience, it gives rise to the development of automotive digital cockpits. The automotive digital cockpit enables automakers to differentiate and create new revenue opportunities by providing new, personalized services and applications to drivers and passengers.

Global Automotive Digital Cockpit Market Dynamics

Market Drivers

- Increasing consumer demand for advanced connectivity and infotainment features in vehicles

- Growing emphasis on enhanced safety and driver assistance technologies

- Rise in the adoption of electric and autonomous vehicles

- Continuous technological advancements in display and human-machine interface (HMI) technologies

Market Restraints

- High initial implementation costs and integration challenges

- Concerns regarding data security and privacy in connected vehicles

- Limited consumer awareness and acceptance of advanced digital cockpit features

Market Opportunities

- Expanding market potential in emerging economies

- Integration of augmented reality (AR) and artificial intelligence (AI) in cockpit design

- Collaboration and partnerships between automakers and technology providers

Automotive Digital Cockpit Market Report Coverage

| Market | Automotive Digital Cockpit Market |

| Automotive Digital Cockpit Market Size 2022 | USD 4.2 Billion |

| Automotive Digital Cockpit Market Forecast 2032 | USD 11.7 Billion |

| Automotive Digital Cockpit Market CAGR During 2023 - 2032 | 11.1% |

| Automotive Digital Cockpit Market Analysis Period | 2020 - 2032 |

| Automotive Digital Cockpit Market Base Year |

2022 |

| Automotive Digital Cockpit Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Equipment, By Display Technology, By Vehicle Type, By Electric Vehicle Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Robert Bosch GmbH, Continental AG, HARMAN International (A Samsung Company), Visteon Corporation, Faurecia, Sintrones, Marelli Holdings Co., Ltd., DRÄXLMAIER GROUP, HYUNDAI MOBIS, and Grupo Antolin. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Digital Cockpit Market Insights

Rising demand for excellent digital user experiences is driving the shift away from traditional analogue car dashboards and toward a multi-screen and multimodal digital experience for drivers and passengers. Automobile manufacturers are moving toward ECU consolidation in order to share resources, eliminate components, and reduce costs. ECU consolidation is a significant step forward for the automotive industry's software-defined vehicles. Because modern cars have multiple digital displays of various sizes and shapes, reducing driver distraction is a critical factor addressed by feature consolidation and smart HMI screens. Furthermore, design, cost, and performance bring the right product that is intuitive and futuristic, offering the best user experience in the shortest amount of time and at the lowest cost by installing an automotive digital cockpit. It is considered a stable process because the automotive digital cockpit includes instrument clusters and functionally safe software that complies with ISO26262 standards. Such factors significantly contribute to the growth of the global automotive digital cockpit market.

The Quintessential Factors of Automotive Digital Cockpit Market

Safety, connectivity, maintainability, user experience, and technology are all important aspects of an ideal automotive digital cockpit design. By evaluating various innovative solutions, the majority of automakers have included digital cockpit as part of their growth strategy. Currently, the cost of automotive high-grade displays is decreasing, and the automotive digital cockpit has a positive impact on mid-level vehicles. Safety, connectivity, maintainability, user experience, and technology are all important aspects of an ideal digital cockpit design. As a result, an automotive digital cockpit combines infotainment, rear seat entertainment, a cluster, and a heads-up display. Such newer developments are propelling the global automotive digital cockpit market forward.

Big Calls for In-Vehicle Infotainment (IVI) System into an Automotive Digital Cockpit Market

Currently, automakers incorporate a variety of features such as ADAS, connected car, and autonomous driving to make driving safer. As a result, the car's IVI system is more than just a platform for entertainment; it also provides a better user experience. Personalization is a prominent factor in which passengers are demanding, and as a result, automakers must incorporate such technology. The desire for personalization, as well as the trend toward consolidation of infotainment and safety-critical features, is critical. Integrating all of these advanced technologies will necessitate an efficient supply chain system, as well as feature-rich processors and system on chips (SOCs), operating systems, application frameworks, virtualization techniques, and software suppliers.

Modernization Fuel the Growth Of Global Automotive Digital Cockpit Industry

The evolution of a digital instrument cluster and a dedicated centre stack display is one of the most common applications of in-cabin displays. This strategy is cost-effective for an automaker in providing a more digital experience to the customer while maintaining a more traditional, and less distracting, distribution of information to the driver. This is one of the most straightforward ways for automakers to replace traditional analogue gauge clusters with digital displays across time levels of the same models. As the digital cockpit in automobiles began with high-priced models and trim levels, this display trend is now trickling down to mid-priced vehicles. Volkswagen (VW) 12.3" Digital Cockpit (instrument cluster display), for example, is available globally for US and European automotive vehicles such as the Jetta, Tiguan, Passat, and others. Furthermore, the installation rate of digital instrument clusters is expected to increase from 11.5 million units to 31.9 million units, with an increase from 16.5% to 34.1% of passenger light vehicles.

Automotive Digital Cockpit Market Segmentation

The worldwide market for automotive digital cockpit is split based on equipment, display technology, vehicle type, electric vehicle type, and geography.

Automotive Digital Cockpit Equipments

- Digital Instrument Cluster

- Advanced Head Unit

- Camera Based Driver Monitoring

- Head-up Display (HUD)

According to automotive digital cockpit industry analysis, within the equipment category, the camera-based driver monitoring segment is the largest. By using cameras to track a driver's actions and level of focus, this technology improves safety and makes advanced driver assistance capabilities possible. It greatly enhances driving safety by analysing elements like head posture and eye movement. The market sector known as camera-based driver monitoring has gained significant traction due to the growing need for sophisticated driver monitoring systems, which is being driven by safety concerns and regulatory obligations.

Automotive Digital Cockpit Display Technologies

- LCD

- TFT-LCD

- OLED

The automotive digital cockpit market analysis, the TFT-LCD (thin-film transistor liquid crystal display) sector is the market leader in the display technology category. TFT-LCDs are a popular option for vehicle displays because of their bright colour reproduction, quick reaction times, and high resolution. The user experience is improved overall in digital cockpits thanks to this technology, which guarantees crisp and clear graphics. Because of its adaptability, dependability, and broad use in a range of automotive applications, TFT-LCDs dominate the market and have cemented their status as a top display technology.

Automotive Digital Cockpit Vehicle Types

- Passenger Cars

- Commercial Vehicles

In terms of vehicle type, the market is dominated by the passenger cars segment and it is expected to dominate throughout the automotive digital cockpit industry forecast period. Due to consumer demands for more connected and enjoyable driving experiences, there is a greater need than ever for sophisticated digital cockpit elements in passenger cars, which is why this lead is present. Modern digital cockpit technology is a top priority for automakers as they strive to satisfy changing customer demands with their passenger vehicles. The market's emphasis on providing creative and advanced digital solutions catered to the tastes and expectations of a wide range of consumers is shown by the prominence of the passenger car segment.

Automotive Digital Cockpit Electric Vehicle Types

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

Plug-In hybrid electric vehicles (PHEVs) hold the largest market share in the automotive digital cockpit market's electric vehicle type category. PHEVs are well-liked by consumers looking for efficiency and a longer driving range since they combine the advantages of internal combustion engines and electric power. The rising market share is a result of PHEV adoption, which is in line with worldwide trends towards environmentally friendly transportation. The dominance of this area highlights how important plug-in hybrid technology will be in determining the direction of the vehicle digital cockpit market.

Automotive Digital Cockpit Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Digital Cockpit Market Regional Analysis

The Asia-Pacific region dominates the automotive digital cockpit market. As China rapidly approaches becoming the world's largest automotive market, identifying new solutions allied with auto megatrends such as connectivity, shared mobility, and electrification, it is regarded as one of the key countries driving the growth of the automotive digital cockpit market. China's major OEMs and suppliers are pooling their resources to create new automotive intelligent cockpit products. Furthermore, the wave of intelligence in the automotive industry is being supported at the national level. For example, the Strategy for the Innovation Development of Intelligent Vehicles establishes the goal of mass-producing conditional Intelligent Vehicles by 2025 and completing China's standard intelligent vehicle system by 2035. Such factors contribute to the expansion of the automotive digital cockpit market.

North America is the fastest growing region in the market; Moreover Europe has a sizable market share in the automotive digital cockpit market. Among European automakers, German automakers remain at the forefront of the development of automotive digital cockpits that intend to connect with their suppliers. The primary goal is to standardize a digital platform that will serve as a digital data hub. Furthermore, by combining cooperative data and AI, German automakers pinpoint their leading position on the global market. Moreover, among suppliers, there is a strong emphasis on autonomous driving and digitalization of value creation. Through the incorporation of standardized information and data availability, participating companies increase the competitiveness of the automobile industry, improve the efficiency of industry-specific cooperation, and accelerate company processes.

Automotive Digital Cockpit Market Players

Some of the top automotive digital cockpit companies offered in our report includes Robert Bosch GmbH, Continental AG, HARMAN International (A Samsung Company), Visteon Corporation, Faurecia, Sintrones, Marelli Holdings Co., Ltd., DRÄXLMAIER GROUP, HYUNDAI MOBIS, and Grupo Antolin.

Frequently Asked Questions

How big is the automotive digital cockpit market?

The automotive digital cockpit market size was valued at USD 4.2 Billion in 2022.

What is the CAGR of the global automotive digital cockpit market from 2023 to 2032?

The CAGR of automotive digital cockpit is 11.1% during the analysis period of 2023 to 2032.

Which are the key players in the automotive digital cockpit market?

The key players operating in the global market are including Robert Bosch GmbH, Continental AG, HARMAN International (A Samsung Company), Visteon Corporation, Faurecia, Sintrones, Marelli Holdings Co., Ltd., DR�XLMAIER GROUP, HYUNDAI MOBIS, and Grupo Antolin

Which region dominated the global automotive digital cockpit market share?

Asia-Pacific held the dominating position in automotive digital cockpit industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of automotive digital cockpit during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automotive digital cockpit industry?

The current trends and dynamics in the automotive digital cockpit industry include increasing consumer demand for advanced connectivity and infotainment features in vehicles, growing emphasis on enhanced safety and driver assistance technologies, rise in the adoption of electric and autonomous vehicles, and continuous technological advancements in display and human-machine interface (HMI) technologies.

Which equipment held the maximum share in 2022?

The camera based driver monitoring equipment held the maximum share of the automotive digital cockpit industry.?