Automotive Cybersecurity Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Automotive Cybersecurity Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

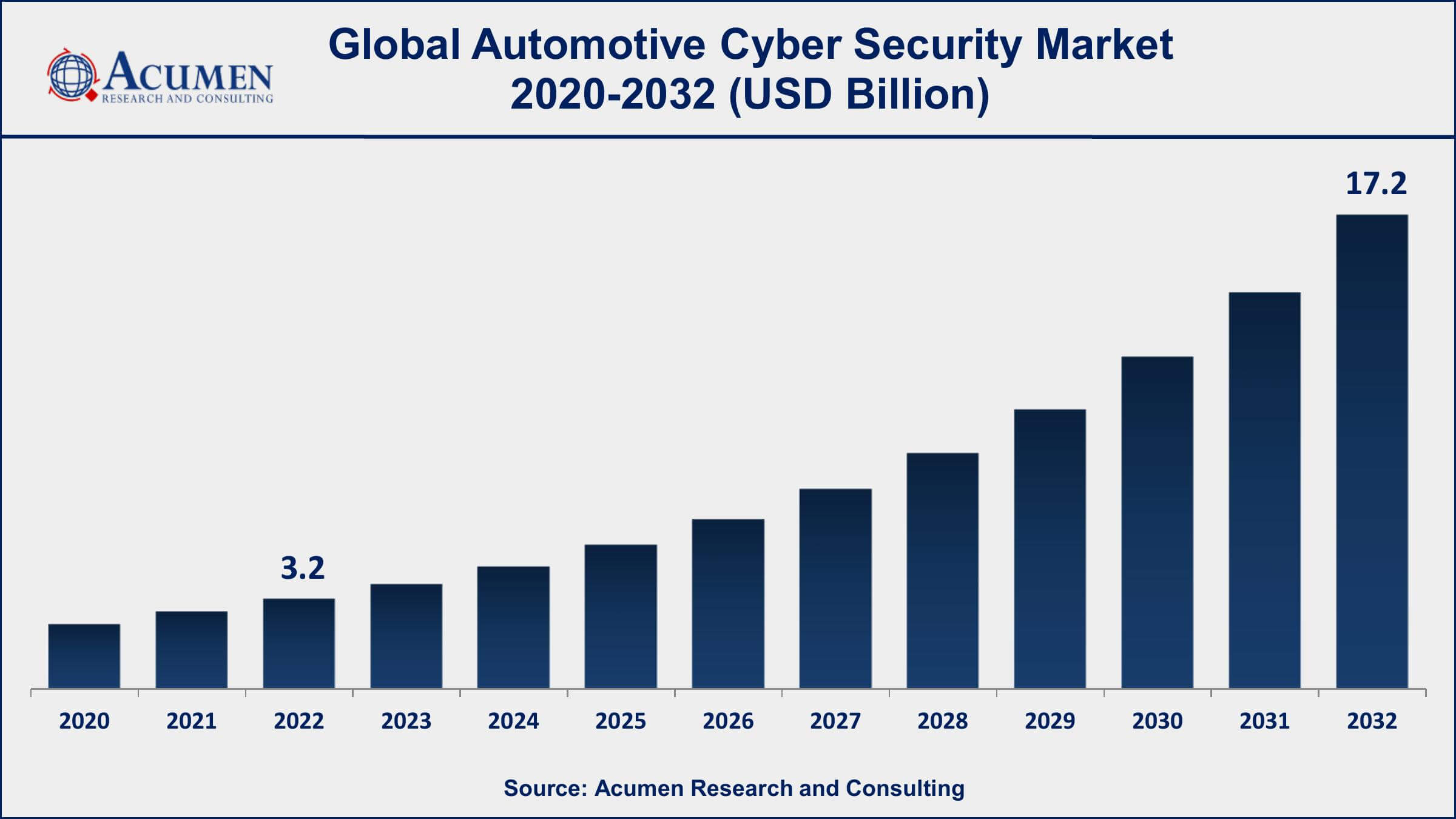

The Global Automotive Cybersecurity Market Size accounted for USD 3.2 Billion in 2022 and is projected to achieve a market size of USD 17.2 Billion by 2032 growing at a CAGR of 18.3% from 2023 to 2032.

Automotive Cybersecurity Market Highlights

- Global Automotive Cybersecurity Market revenue is expected to increase by USD 17.2 Billion by 2032, with a 18.3% CAGR from 2023 to 2032

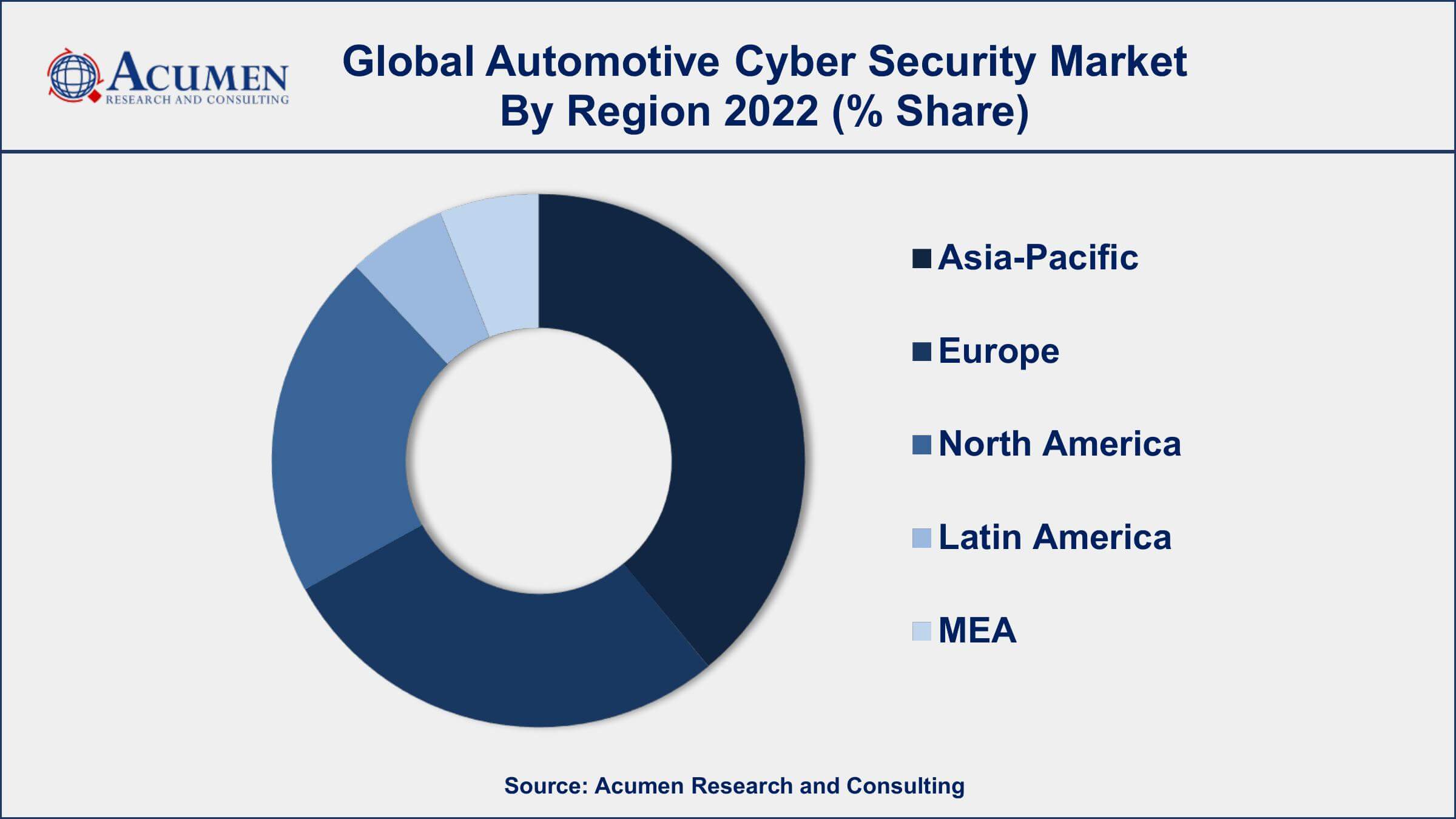

- Asia-Pacific region led with more than 37% of Automotive Cybersecurity Market share in 2022

- Europe Automotive Cybersecurity Market growth will record a CAGR of around 19% from 2023 to 2032

- According to an Upstream Security analysis, the number of automotive API attacks has increased by 380% in 2022, accounting for 12% of total incidents, despite OEMs employing advanced IT cybersecurity protections

- According to the study's findings, 60% of automotive threats would target vehicle-to-cloud connectivity by 2025

- Increasing connectivity and digitalization of vehicles, drives the Automotive Cybersecurity Market value

Automotive cyber security refers to the measures and technologies implemented to protect vehicles from cyber threats and ensure the safety and security of the vehicle's electronic systems, software, and data. As modern vehicles become increasingly connected and autonomous, they become more vulnerable to cyber attacks that can compromise their functionality, safety, and even the privacy of drivers and passengers. Automotive cyber security involves safeguarding various components such as the in-vehicle network, infotainment systems, telematics, and connectivity features to prevent unauthorized access, tampering, or malicious activities.

The market for automotive cyber security has witnessed significant growth in recent years and is expected to continue expanding at a rapid pace. The increasing adoption of connected and autonomous vehicles, along with the growing concern for vehicle safety and data privacy, has fueled the demand for robust cyber security solutions. Additionally, regulatory requirements and industry standards are driving the implementation of cyber security measures in automotive systems. The market growth is driven by factors such as the rising number of cyber attacks targeting vehicles, the integration of advanced technologies in vehicles, and the growing awareness among automakers about the importance of cyber security. Furthermore, partnerships and collaborations between automotive manufacturers and cyber security companies are contributing to the development of innovative solutions and driving market growth.

Global Automotive Cybersecurity Market Trends

Market Drivers

- Increasing connectivity and digitalization of vehicles

- Rise in the number of cyber threats and attacks on vehicles

- Growing awareness about the importance of automotive cybersecurity

- Adoption of advanced driver-assistance systems (ADAS) and autonomous vehicles

Market Restraints

- Complexity of automotive systems and networks, making them susceptible to vulnerabilities

- Lack of standardized cybersecurity frameworks and protocols

Market Opportunities

- Increasing collaborations and partnerships between automakers and cybersecurity companies

- Growing demand for cloud-based security solutions in the automotive industry

Automotive Cybersecurity Market Report Coverage

| Market | Automotive Cybersecurity Market |

| Automotive Cybersecurity Market Size 2022 | USD 3.2 Billion |

| Automotive Cybersecurity Market Forecast 2032 | USD 17.2 Billion |

| Automotive Cybersecurity Market CAGR During 2023 - 2032 | 18.3% |

| Automotive Cybersecurity Market Analysis Period | 2020 - 2032 |

| Automotive Cybersecurity Market Base Year | 2022 |

| Automotive Cybersecurity Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Security Type, By Vehicle Type, By Application, By Form, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Argus Cyber Security (Subsidiary of Continental AG), Harman International Industries (Subsidiary of Samsung Electronics), Karamba Security, GuardKnox Cyber Technologies, Upstream Security, Arilou Technologies (Subsidiary of NNG), ESCRYPT (Subsidiary of Bosch), Symantec Corporation (Subsidiary of Broadcom), Lear Corporation, SBD Automotive & NCC Group, Vector Informatik, and Trillium Secure Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive cybersecurity is the protection of vehicles and their electronic systems from cyber threats and attacks. As vehicles become increasingly connected and rely on digital systems, they become vulnerable to hacking, unauthorized access, data breaches, and malicious manipulation. Automotive cybersecurity aims to safeguard the integrity, confidentiality, and availability of vehicle systems, preventing potential risks that could compromise driver safety, privacy, and vehicle functionality.

The application of automotive cybersecurity involves implementing various measures and technologies to secure vehicles and their components. One key application is securing the in-vehicle networks and communication systems. This involves implementing firewalls, intrusion detection and prevention systems, and encryption mechanisms to protect against unauthorized access and data manipulation. Another application is securing the vehicle's software and firmware, including the operating system, infotainment systems, and electronic control units (ECUs). This includes utilizing code analysis, secure coding practices, and software updates to mitigate vulnerabilities and ensure the integrity of the software stack.

The automotive cybersecurity market has been experiencing significant growth and is expected to continue expanding in the coming years. Several factors contribute to this growth trajectory. Firstly, the increasing prevalence of connected cars and the integration of advanced technologies in vehicles have expanded the attack surface for cyber threats. This has raised concerns among automakers and consumers, driving the demand for robust cybersecurity solutions to protect vehicle systems and data. Moreover, the rising number of high-profile cyberattacks targeting vehicles has spurred the need for effective cybersecurity measures. These attacks have highlighted the potential risks associated with vehicle vulnerabilities, leading to increased investments in automotive cybersecurity.

Automotive Cybersecurity Market Segmentation

The global Automotive Cybersecurity Market segmentation is based on security type, vehicle type, application, form, and geography.

Automotive Cybersecurity Market By Security Type

- Endpoint Security

- Wireless Network Security

- Application Security

According to the automotive cyber security industry analysis, the wireless network segment accounted for the largest market share in 2022. This growth is due to the increasing connectivity and reliance on wireless technologies in vehicles. This segment focuses on securing wireless communication channels and protocols used in modern vehicles. With the advent of connected cars and the Internet of Things (IoT) in the automotive industry, wireless networks play a crucial role in enabling various functionalities such as remote vehicle access, over-the-air updates, and vehicle-to-vehicle (V2V) communication. One key driver for the growth of the wireless network segment is the rising demand for secure and seamless connectivity in vehicles. Consumers now expect advanced features like in-car Wi-Fi, smartphone integration, and cloud-based services. This necessitates robust security measures to protect wireless communication from unauthorized access, data breaches, and malicious attacks.

Automotive Cybersecurity Market By Vehicle Type

- Passenger Car

- Commercial Vehicle

- Electrical Vehicle

In terms of vehicle types, the electrical vehicle segment is expected to witness significant growth in the coming years. This growth is driven by the expanding adoption of electric vehicles worldwide. As EVs become more prevalent, there is an increasing need to address cybersecurity challenges unique to this segment. The growth of the EV segment in the automotive cybersecurity market can be attributed to several key factors. One key driver for the growth of the EV segment in the automotive cybersecurity market is the integration of complex software systems and connectivity features in electric vehicles. EVs rely heavily on software-controlled components, battery management systems, and sophisticated charging infrastructure. This interconnectedness creates new vulnerabilities that hackers can exploit, emphasizing the need for robust cybersecurity solutions to safeguard critical EV functions and data.

Automotive Cybersecurity Market By Application

- ADAS & Safety System

- Powertrain

- Body Electronics

- Infotainment

- Telematics

According to the Automotive Cybersecurity Market forecast, the ADAS & safety system segment is expected to witness significant growth in the coming years. ADAS systems, such as adaptive cruise control, lane-keeping assist, and automatic emergency braking, rely on interconnected sensors, cameras, and communication networks. This integration introduces potential vulnerabilities that can be exploited by cyber threats, necessitating robust cybersecurity measures. One of the key drivers for the growth of the ADAS and safety system segment is the rising demand for vehicle safety features and regulatory requirements. Governments and regulatory bodies worldwide are mandating the implementation of safety systems in vehicles to reduce accidents and enhance road safety. This has led to increased adoption of ADAS technologies, which in turn drives the need for effective cybersecurity solutions to protect these systems from potential cyber-attacks.

Automotive Cybersecurity Market By Form

- External Cloud Services

- In-Vehicle Services

Based on the form, the in-vehicle services segment is expected to continue its growth trajectory in the coming years. In-vehicle services encompass a wide range of functionalities such as telematics, remote vehicle access, infotainment, navigation, and cloud-based services. As vehicles become more connected, the need to protect these services from cyber threats becomes increasingly critical, driving the growth of cybersecurity solutions tailored for in-vehicle services. One of the key drivers for the growth of the in-vehicle services segment is the rising consumer demand for connected features and personalized experiences in vehicles. Consumers now expect seamless connectivity, access to online services, and integration with their digital lifestyles while on the road.

Automotive Cybersecurity Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Cybersecurity Market Regional Analysis

Asia-Pacific dominates the automotive cybersecurity market for several reasons, positioning the region as a key player in this industry. Asia-Pacific is the largest automotive market globally, with countries like China, Japan, and South Korea being major contributors. The region has witnessed significant growth in automotive production and sales, resulting in a large customer base for automotive cybersecurity solutions. The increasing adoption of connected cars and advanced technologies in vehicles across Asia-Pacific creates a strong demand for cybersecurity measures to protect against cyber threats and ensure the safety and security of vehicles and their occupants. Moreover, Asia-Pacific is home to several leading automotive manufacturers and technology providers. Companies in this region are investing heavily in research and development of automotive cybersecurity solutions to stay ahead in the market. Furthermore, Asian countries have a strong focus on emerging technologies such as autonomous driving, electric vehicles, and connectivity, which require robust cybersecurity measures. As a result, the region has a thriving ecosystem of automotive cybersecurity companies, research institutions, and innovative startups.

Automotive Cybersecurity Market Player

Some of the top Automotive Cybersecurity Market companies offered in the professional report include Argus Cyber Security (Subsidiary of Continental AG), Harman International Industries (Subsidiary of Samsung Electronics), Karamba Security, GuardKnox Cyber Technologies, Upstream Security, Arilou Technologies (Subsidiary of NNG), ESCRYPT (Subsidiary of Bosch), Symantec Corporation (Subsidiary of Broadcom), Lear Corporation, SBD Automotive & NCC Group, Vector Informatik, and Trillium Secure Inc.

Frequently Asked Questions

What was the market size of the global automotive cyber security in 2022?

The market size of automotive cyber security was USD 3.2 Billion in 2022.

What is the CAGR of the global Automotive Cybersecurity Market from 2023 to 2032?

The CAGR of automotive cyber security is 18.3% during the analysis period of 2023 to 2032.

Which are the key players in the Automotive Cybersecurity Market?

The key players operating in the global market are including Argus Cyber Security (Subsidiary of Continental AG), Harman International Industries (Subsidiary of Samsung Electronics), Karamba Security, GuardKnox Cyber Technologies, Upstream Security, Arilou Technologies (Subsidiary of NNG), ESCRYPT (Subsidiary of Bosch), Symantec Corporation (Subsidiary of Broadcom), Lear Corporation, SBD Automotive & NCC Group, Vector Informatik, and Trillium Secure Inc.

Which region dominated the global Automotive Cybersecurity Market share?

Asia-Pacific held the dominating position in automotive cyber security industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of automotive cyber security during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automotive cyber security industry?

The current trends and dynamics in the automotive cyber security industry include increasing connectivity and digitalization of vehicles, and rise in the number of cyber threats and attacks on vehicles.

Which security type held the maximum share in 2022?

The wireless network security type held the maximum share of the automotive cyber security industry.