Automotive Coatings Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Automotive Coatings Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

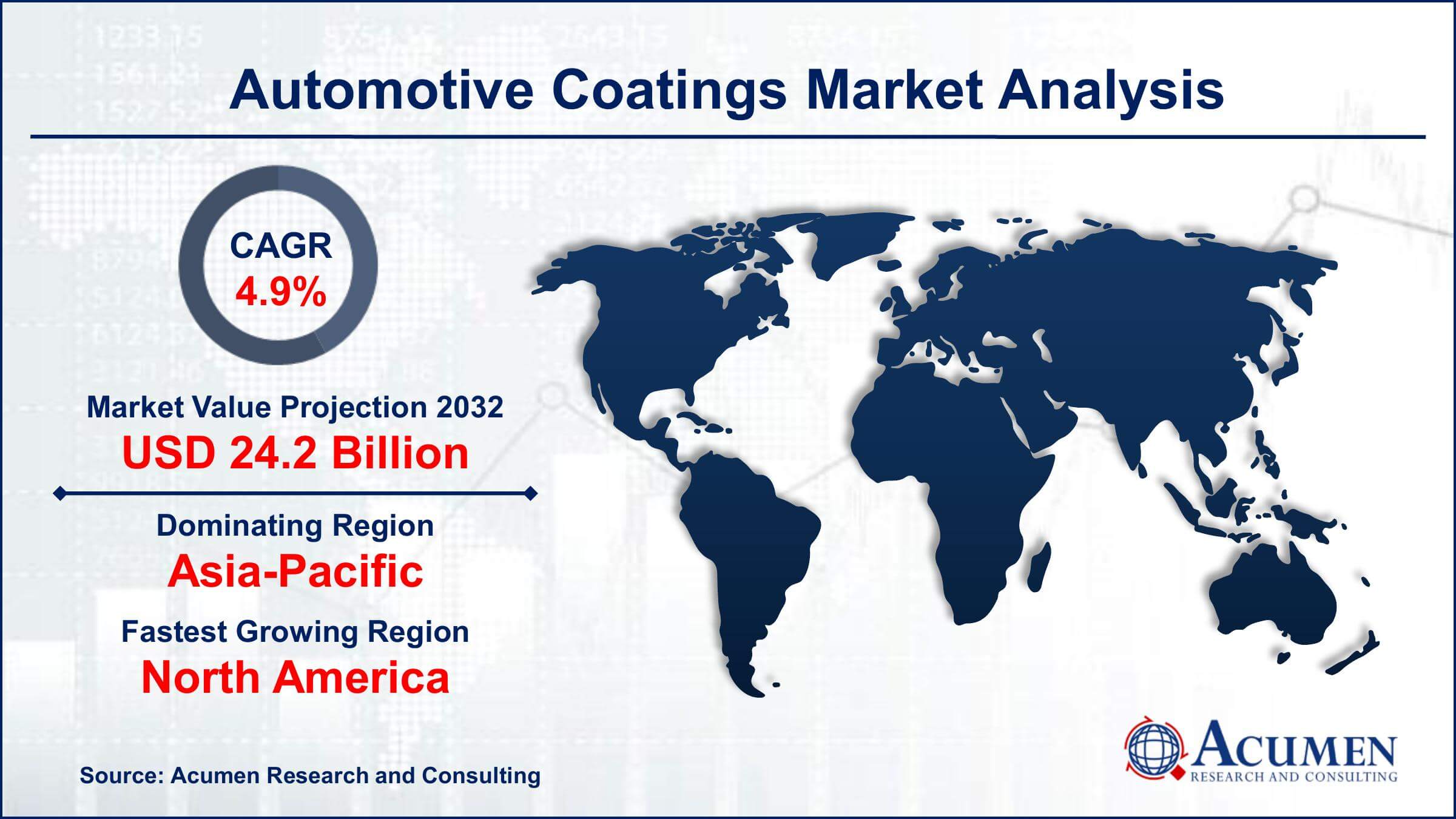

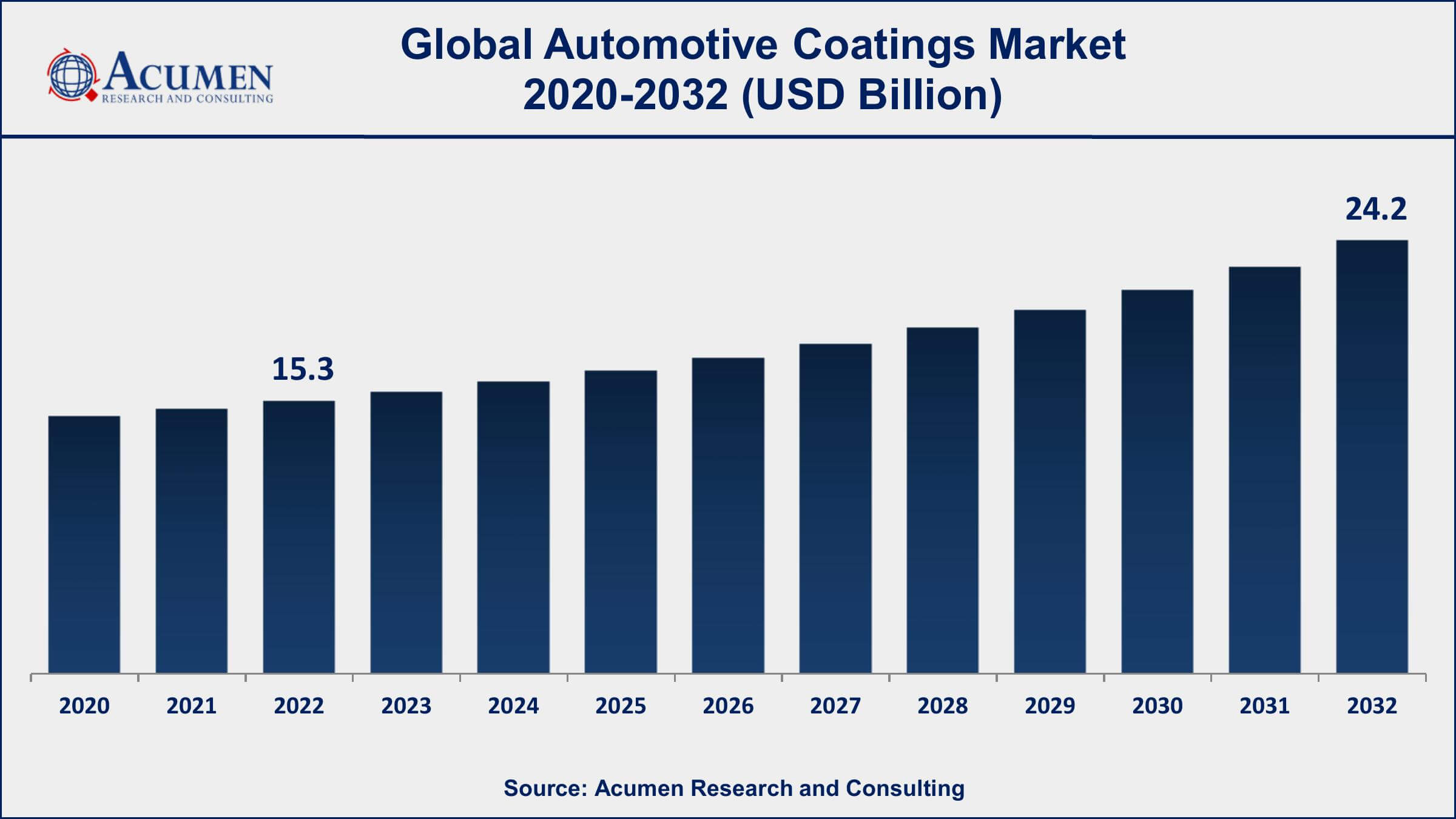

The Global Automotive Coatings Market Size accounted for USD 15.3 Billion in 2022 and is projected to achieve a market size of USD 24.2 Billion by 2032 growing at a CAGR of 4.9% from 2023 to 2032.

Automotive Coatings Market Report Key Highlights

- Global automotive coatings market revenue is expected to increase by USD 24.2 Billion by 2032, with a 4.9% CAGR from 2023 to 2032

- Asia-Pacific region led with more than 39% of automotive coatings market share in 2022

- China is the world's largest automotive producer, accounting for over 27% of global production in 2020

- The electric vehicle market is rapidly growing, with global EV sales increasing by 43% in 2020

- A survey conducted by Autotrader found that 53% of car shoppers are interested in personalizing their vehicles

- According to a study by J.D. Power, 69% of Gen Z and 66% of millennials are interested in vehicle customization

- Rising trend of customization and personalization of vehicles, drives the automotive coatings market size

Automotive coatings refer to specialized paints and coatings used in the production of vehicles, including cars, trucks, and other vehicles. These coatings are applied to both the exterior and interior of vehicles to protect against corrosion, UV rays, heat, and other environmental factors, as well as to enhance the vehicle's appearance.

The automotive coatings market has experienced steady growth over the past few years, primarily driven by the increasing demand for vehicles worldwide, especially in emerging economies. The market is also driven by the growing demand for environmentally friendly coatings and the development of innovative technologies that offer improved performance and durability. Additionally, the increasing use of lightweight materials in the automotive industry has also led to the development of specialized coatings that can be applied to these materials to enhance their performance and durability.

Global Automotive Coatings Market Trends

Market Drivers

- Increasing demand for vehicles worldwide

- Growing automotive production and sales

- Growing demand for eco-friendly coatings

- Increasing use of lightweight materials in automotive manufacturing

- Growing demand for premium vehicles and customization options

Market Restraints

- Fluctuating raw material prices

- Stringent regulations and environmental policies

Market Opportunities

- Growing demand for advanced coatings for autonomous vehicles

- Expansion of the automotive industry in emerging economies

Automotive Coatings Market Report Coverage

| Market | Automotive Coatings Market |

| Automotive Coatings Market Size 2022 | USD 15.3 Billion |

| Automotive Coatings Market Forecast 2032 | USD 24.2 Billion |

| Automotive Coatings Market CAGR During 2023 - 2032 | 4.9% |

| Automotive Coatings Market Analysis Period | 2020 - 2032 |

| Automotive Coatings Market Base Year | 2022 |

| Automotive Coatings Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Resin Type, By Coat Type, By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Axalta Coating Systems Ltd, Jotun Group, Berger Paints India Limited, BASF SE, Akzo Nobel NV, Eastman Chemical Company, PPG Industries Inc., Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., The Sherwin-Williams Company, RPM International Inc., and Covestro AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The coating is done on the automotive surface for the purpose of protection and decoration is known as the automotive coating. The automotive coating is done to enhance the look and robustness of a vehicle and protect it from extreme weather conditions such as acid rain, and UV radiation. The thickness of coatings on the automotive surface is at least 0.1 mm. Robotic arms are used for applying coatings on the automotive surface.

The global automotive coating market is growing at a significant pace owing to the growing automotive industry. Also, the government policies supporting the development of automotive infrastructure drive the market for automotive coatings. The increase in research & development activities by manufacturers for the development of products drives the market for automotive coatings. However, the volatile raw material prices hamper the automotive coating market growth. Also, the ill effects of the application of harmful solvent-based coatings restrain the growth of the automotive coatings market. The volatile organic compound content emitted by the use of solvent-borne coatings causes global warming through the emission of greenhouse gases into the environment. The growing automotive industry in the economies such as India, China, Malaysia, Indonesia, Brazil, UAE, Saudi Arabia, and parts of Africa offers huge growth opportunities for the manufacturers of automotive coatings. The major challenge faced by manufacturers of automotive coatings is the stringent regulations regarding the emission of harmful greenhouse gases causing global warming by the use of solvent-based coatings.

Automotive Coatings Market Segmentation

The global automotive coatings market segmentation is based on resin type, coat type, technology, application, and geography.

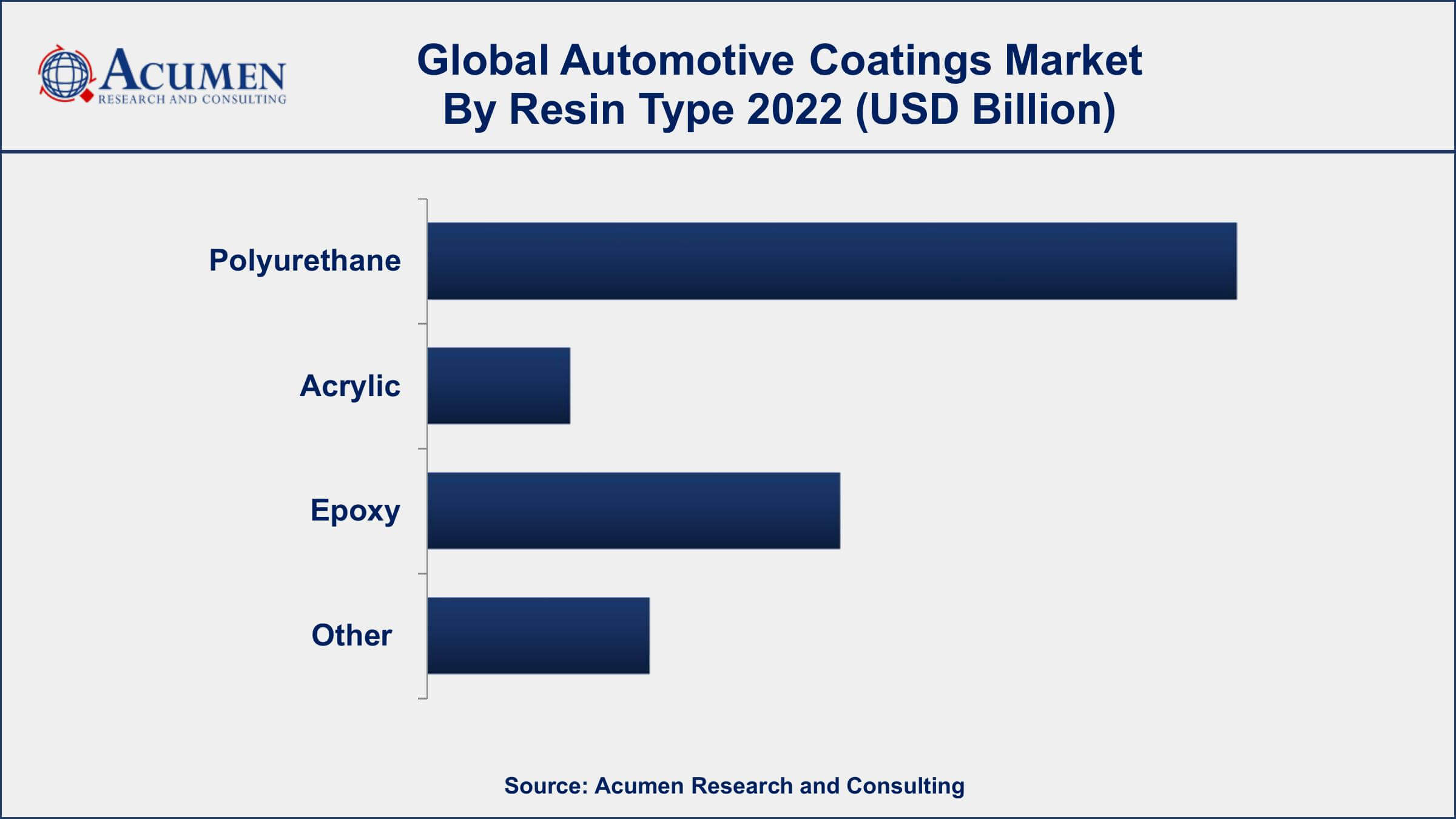

Automotive Coatings Market By Resin Type

- Polyurethane

- Acrylic

- Epoxy

- Other

According to the automotive coatings industry analysis, the polyurethane segment accounted for the largest market share in 2022. Polyurethane coatings are widely used in the automotive industry due to their superior durability, chemical resistance, and high gloss finish. These coatings are suitable for various applications such as clear coats, topcoats, basecoats, and primers, among others. The polyurethane segment of the automotive coatings market is expected to witness significant growth in the coming years, primarily driven by the increasing demand for high-performance coatings with excellent adhesion and weathering properties. Additionally, the growing trend of lightweight materials in the automotive industry, such as composites and plastics, is expected to boost the demand for polyurethane coatings as they offer excellent adhesion to these materials.

Automotive Coatings Market By Coat Type

- E-coat

- Base Coat

- Primer

- Clear Coat

In terms of coat type, the base coat segment of the automotive coatings market is expected to witness significant growth in the coming years, primarily driven by the increasing demand for high-quality finishes and customization options in the automotive industry. The growing trend of personalization and customization of vehicles has led to a surge in demand for special effect pigments, which can be incorporated into base coats to create unique colors and finishes. Moreover, the demand for eco-friendly coatings is also driving the growth of the base coat segment, as waterborne base coats are increasingly being used in automotive manufacturing due to their low VOC emissions and low toxicity.

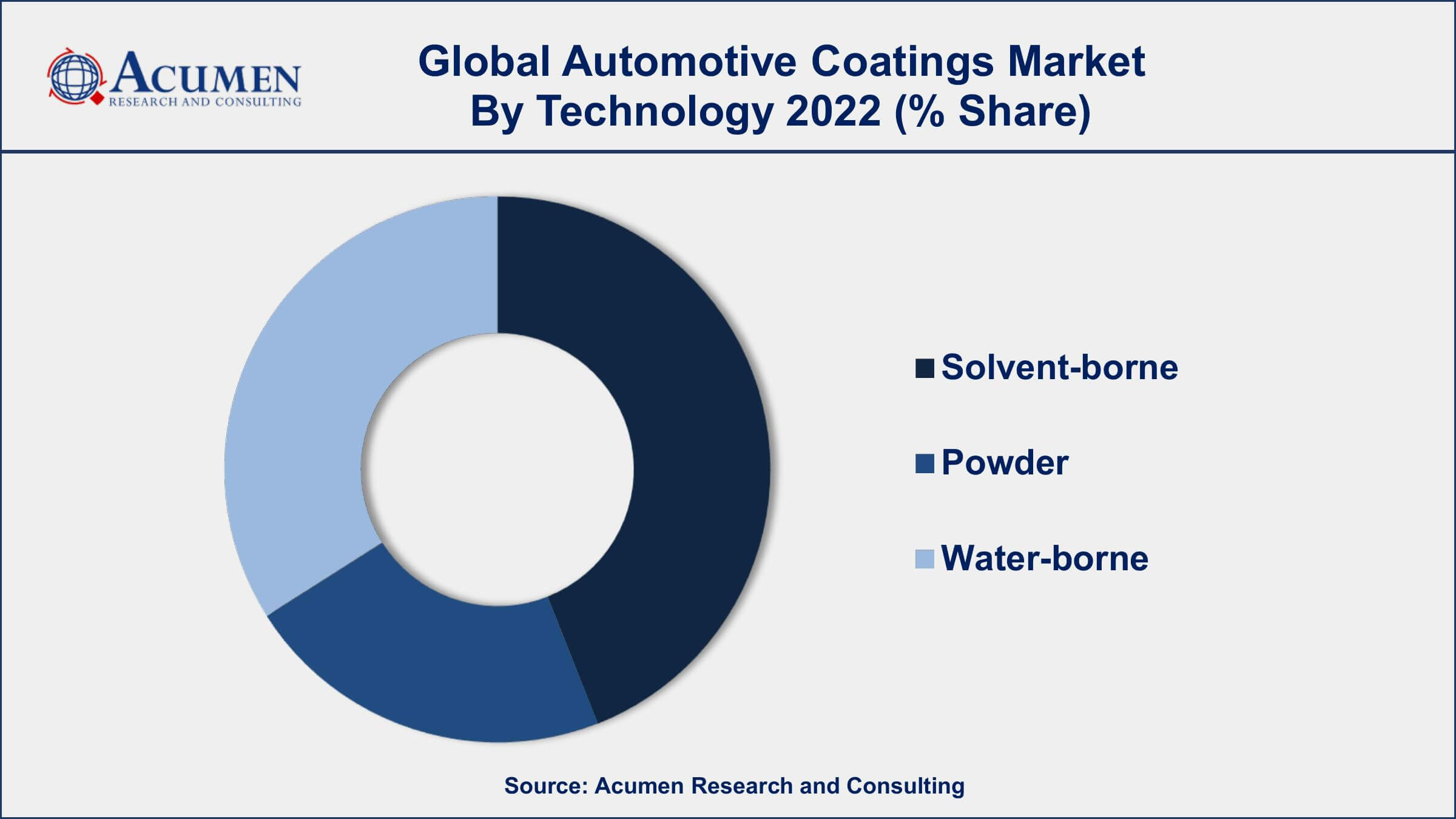

Automotive Coatings Market By Technology

- Solvent-borne

- Powder

- Water-borne

According to the automotive coatings market forecast, the powder technology segment is growing significantly in the coming years. Powder coatings are applied as a dry powder and then cured using heat, resulting in a durable and high-quality finish that is resistant to chipping, scratching, and fading. Moreover, the use of powder coatings is increasing in the automotive industry due to their excellent adhesion to various substrates, including metals, plastics, and composites, among others. Additionally, powder coatings offer a wide range of colors and finishes, making them ideal for customizing and personalizing vehicles.

Automotive Coatings Market By Application

- OEM

- Refinish

In terms of application, the OEM segment is the largest segment of the market. OEM coatings are applied to new vehicles during the manufacturing process and are designed to provide excellent adhesion, corrosion resistance, and durability. The OEM segment of the automotive coatings market is expected to witness steady growth in the coming years, primarily driven by the increasing demand for vehicles worldwide and the growing trend of lightweight materials in the automotive industry. As more manufacturers adopt lightweight materials such as composites and plastics, there is an increasing need for coatings that offer excellent adhesion and durability on these substrates. Additionally, the OEM segment is expected to benefit from the increasing demand for electric and hybrid vehicles, which require specialized coatings to protect their sensitive electronics and battery systems.

Automotive Coatings Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Coatings Market Regional Analysis

Geographically, Asia-Pacific dominates the automotive coatings market. This dominance is due to the rapid growth of the automotive industry in emerging economies, increasing demand for vehicles, and the rising disposable income of consumers. Additionally, the region has a large manufacturing base, which makes it an attractive market for automotive coatings manufacturers. One of the key drivers of the automotive coatings market in the Asia-Pacific region is the rapid growth of the automotive industry in emerging economies such as China and India. The rising demand for vehicles in these countries is driving the demand for automotive coatings, as manufacturers seek to produce high-quality and durable finishes for their vehicles.

Moreover, the rising disposable income of consumers in the Asia-Pacific region is also driving the growth of the automotive coatings market value, as consumers are increasingly demanding high-quality and aesthetically pleasing vehicles. This has led to a surge in demand for specialized coatings that offer unique colors and finishes, which can be used to customize and personalize vehicles.

Automotive Coatings Market Player

Some of the top automotive coatings market companies offered in the professional report include Axalta Coating Systems Ltd, Jotun Group, BASF SE, Akzo Nobel NV, Berger Paints India Limited, Eastman Chemical Company, PPG Industries Inc., Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., The Sherwin-Williams Company, RPM International Inc., and Covestro AG.

Frequently Asked Questions

How big is the automotive coatings market?

The automotive coatings market size was USD 15.3 Billion in 2022.

What is the CAGR of the global automotive coatings market during forecast period of 2023 to 2032?

The CAGR of automotive coatings market is 4.9% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global automotive coatings market are Axalta Coating Systems Ltd, BASF SE, Jotun Group, Berger Paints India Limited, Akzo Nobel NV, Eastman Chemical Company, PPG Industries Inc., Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., The Sherwin-Williams Company, RPM International Inc., and Covestro AG.

Which region held the dominating position in the global automotive coatings market?

Asia-Pacific held the dominating position in automotive coatings market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

North America region exhibited fastest growing CAGR for automotive coatings market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automotive coatings market?

The current trends and dynamics in the automotive coatings industry include the growing automotive production and salesand rising demand for eco-friendly coatings.

Which resin type held the maximum share in 2022?

The polyurethane resin type held the maximum share of the automotive coatings market.