Automotive Clutch Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Automotive Clutch Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

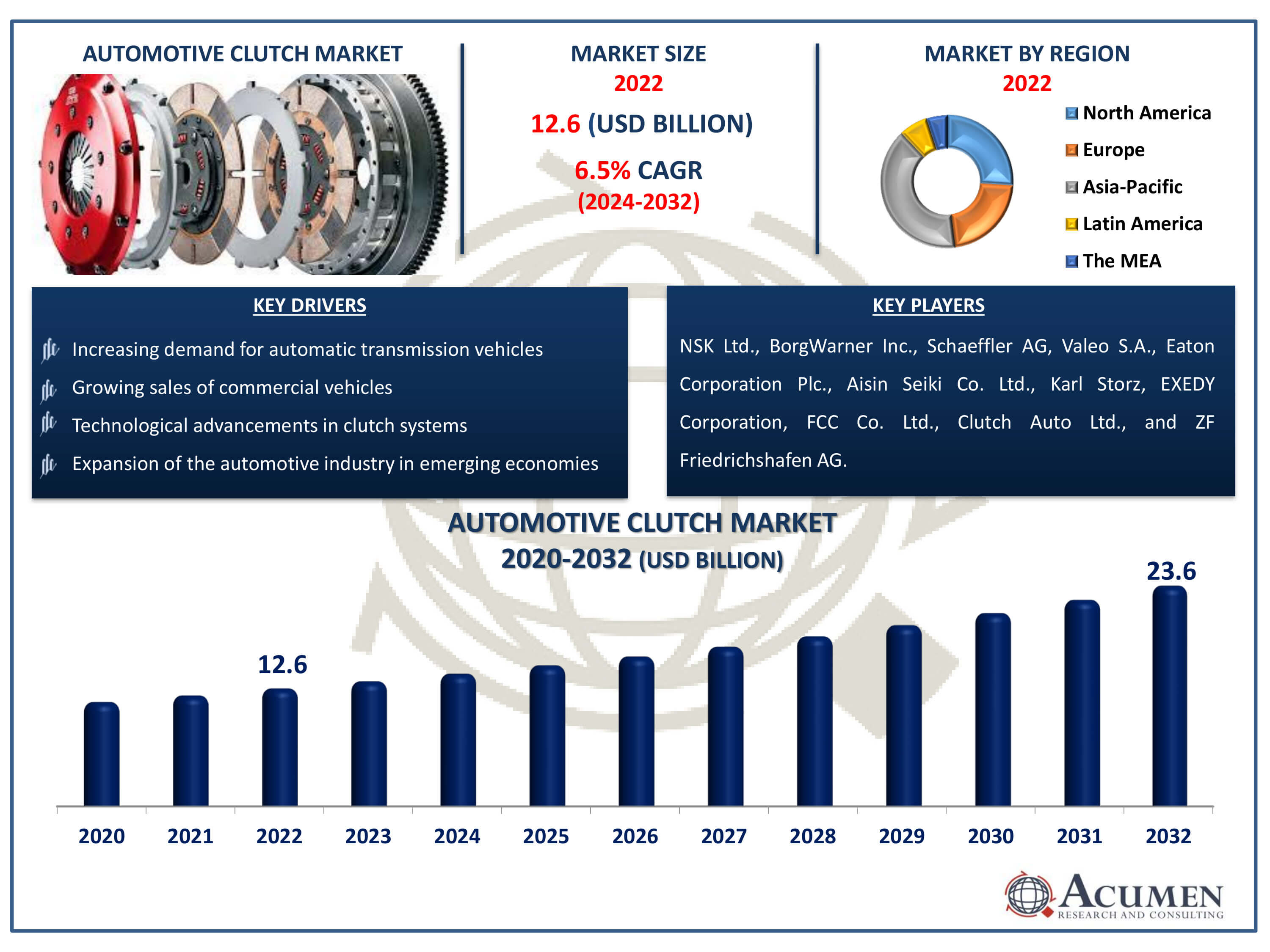

Request Sample Report

The Automotive Clutch Market Size accounted for USD 12.6 Billion in 2022 and is estimated to achieve a market size of USD 23.6 Billion by 2032 growing at a CAGR of 6.5% from 2024 to 2032.

Automotive Clutch Market Highlights

- Global automotive clutch market revenue is poised to garner USD 23.6 billion by 2032 with a CAGR of 6.5% from 2024 to 2032

- Asia-Pacific automotive clutch market value occupied around USD 5 billion in 2022

- North America automotive clutch market growth will record a CAGR of more than 7% from 2024 to 2032

- Among vehicle, the passenger vehicles sub-segment generated more than USD 7.6 billion revenue in 2022

- Based on type, the manual sub-segment generated significant market share in 2022

- Expansion of aftermarket services and customization options is a popular automotive clutch market trend that fuels the industry demand

An automotive clutch connects and disconnects the manual transmission to the engine. It is used in automobiles for the transmission of power between two shafts. As the automotive engine spins constantly, synchronization between the spinning engine and the non-spinning transmission is required. Clutches serve to disconnect the motor from the wheels to achieve this synchronization. The demand for automotive drive systems is projected to increase significantly in the near future due to rising car sales, the demand for efficient transmission modes, and the development of sophisticated cars. This, in turn, will lead to the growth of the car clutch market worldwide. For instance, drivers can easily switch gears entirely automatically or sequentially without using the clutch, thanks to automated manual transmission (AMT). Worldwide clutch producers have developed high-quality products to meet the technological requirements of various car manufacturers.

Global Automotive Clutch Market Dynamics

Market Drivers

- Increasing demand for automatic transmission vehicles

- Growing sales of commercial vehicles

- Technological advancements in clutch systems

- Expansion of the automotive industry in emerging economies

Market Restraints

- Fluctuating raw material prices

- Market saturation in mature economies

- Intense competition among clutch manufacturers

Market Opportunities

- Rising adoption of electric vehicles with clutch less transmissions

- Demand for high-performance and heavy-duty clutch systems

- Integration of advanced materials for lightweight and durable clutches

Automotive Clutch Market Report Coverage

| Market | Automotive Clutch Market |

| Automotive Clutch Market Size 2022 | USD 12.6 Billion |

| Automotive Clutch Market Forecast 2032 |

USD 23.6 Billion |

| Automotive Clutch Market CAGR During 2024 - 2032 | 6.5% |

| Automotive Clutch Market Analysis Period | 2020 - 2032 |

| Automotive Clutch Market Base Year |

2022 |

| Automotive Clutch Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Type, By Vehicle, By Clutch Disc/Clutch Plate Size, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | NSK Ltd., BorgWarner Inc., Schaeffler AG, Valeo S.A., Eaton Corporation Plc., Aisin Seiki Co. Ltd., Karl Storz, EXEDY Corporation, FCC Co. Ltd., Clutch Auto Ltd., and ZF Friedrichshafen AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Clutch Market Insights

Increasing demand for vehicles is expected to fuel sales growth in the worldwide automotive seal market in both emerging and developed nations over the automotive clutch industry forcast period. Improved purchasing power, higher living standards, and rising urbanization all contribute to the growth of the automotive sector, which in turn fosters the long-term expansion of the worldwide target market. Furthermore, rising R&D efforts and growing worries about vehicle safety are projected to expand the target market. automobiles with Automated Manual Transmission (AMT) systems are expected to promote sales growth in the global consumer market due to their more competitive cost when compared to automobiles with Automated Transmission (AT). This pricing element makes AMT-equipped automobiles more appealing to buyers across all demographics, broadening the market reach.

In addition, the need to introduce upgraded and automated systems such as dual-clutch gearbox (DCT), combined with stringent regulations and rules governing vehicle safety and emissions standards, creates lucrative opportunities for the target market's growth in the automotive clutch market forecast period. The use of sophisticated gearbox technology not only improves driving performance but also solves environmental issues, in line with worldwide initiatives to decrease carbon emissions and increase vehicle economy. In summary, the confluence of favourable economic conditions, technical breakthroughs, and regulatory frameworks highlights the positive future for the automotive seal industry. As consumer tastes and industry standards develop, the market is positioned for further growth and innovation, providing several possibilities for stakeholders throughout the automotive value chain.

Automotive Clutch Market Segmentation

The worldwide market for automotive clutch is split based on type, vehicle, clutch disc/clutch plate size, and geography.

Automotive Clutch Market By Types

- Automatic

- Manual

- AMT

- Other

According to automotive clutch industry analysis, the manual clutch sector emerges as the market leader for a number of convincing reasons. Despite the rising popularity of automatic and automated manual gearbox (AMT) systems, manual gearbox is still chosen by a large number of people globally. Manual transmissions provide better control and involvement for driving aficionados, resulting in a more immersive driving experience. Additionally, manual gearboxes are frequently less expensive to buy and maintain, making them popular in price-sensitive regions. Furthermore, manual clutches are noted for their durability and dependability, especially in severe driving circumstances such as off-road or heavy-duty use. As a result, the manual clutch category continues to occupy a strong position in the automotive industry, particularly in areas where driving habits, economic circumstances, and vehicle usage patterns favour manual gearbox cars.

Automotive Clutch Market By Vehicles

- Commercial Vehicles

- Passenger Cars

The passenger vehicles segment dominates the automotive clutch market due to a number of factors. For starters, passenger vehicles outnumber commercial vehicles internationally, resulting in increased demand for automotive clutches in this category. Passenger vehicles encompass a wide range of automobiles, from sedans and hatchbacks to SUVs and sports cars, responding to a variety of consumer tastes and demands. Furthermore, passenger car manufacturers are always innovating and introducing new models with varied transmission systems, giving customers an option between manual, automatic, and automated manual transmissions. This range of vehicle types and gearbox options leads to the strong demand for clutches in passenger cars. Moreover, the growing trend of urbanisation, rising disposable incomes, and increased consumer mobility drive up demand for passenger vehicles, ensuring this segment's dominance in the automotive clutch market.

Automotive Clutch Market By Clutch Disc/Clutch Plate Sizes

- Below 9 Inches

- 9 Inches to 10 Inches

- 10 Inches to 11 Inches

- 11 Inches and Above

For a variety of factors, the below 9 inch sector is expected to be the largest in the automotive clutch market. Firstly, vehicles with smaller clutch discs or clutch plates are typically seen in compact automobiles, subcompact cars, and light-duty vehicles, which account for a sizable share of the worldwide automotive industry. These cars are frequently chosen for their fuel economy, maneuverability, and affordability, particularly in highly populated metropolitan regions where small vehicles are sought. Furthermore, advances in engine and gearbox technology have allowed manufacturers to create smaller, more efficient clutch systems without sacrificing performance. Additionally, the below 9 inches category serves a diverse variety of applications, including everyday commuting, city driving, and light-duty trucking, contributing to its dominance in the automotive clutch market. Overall, the need for smaller clutch discs or plates reflects current customer demands for compact and economical automobiles in the automotive industry.

Automotive Clutch Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

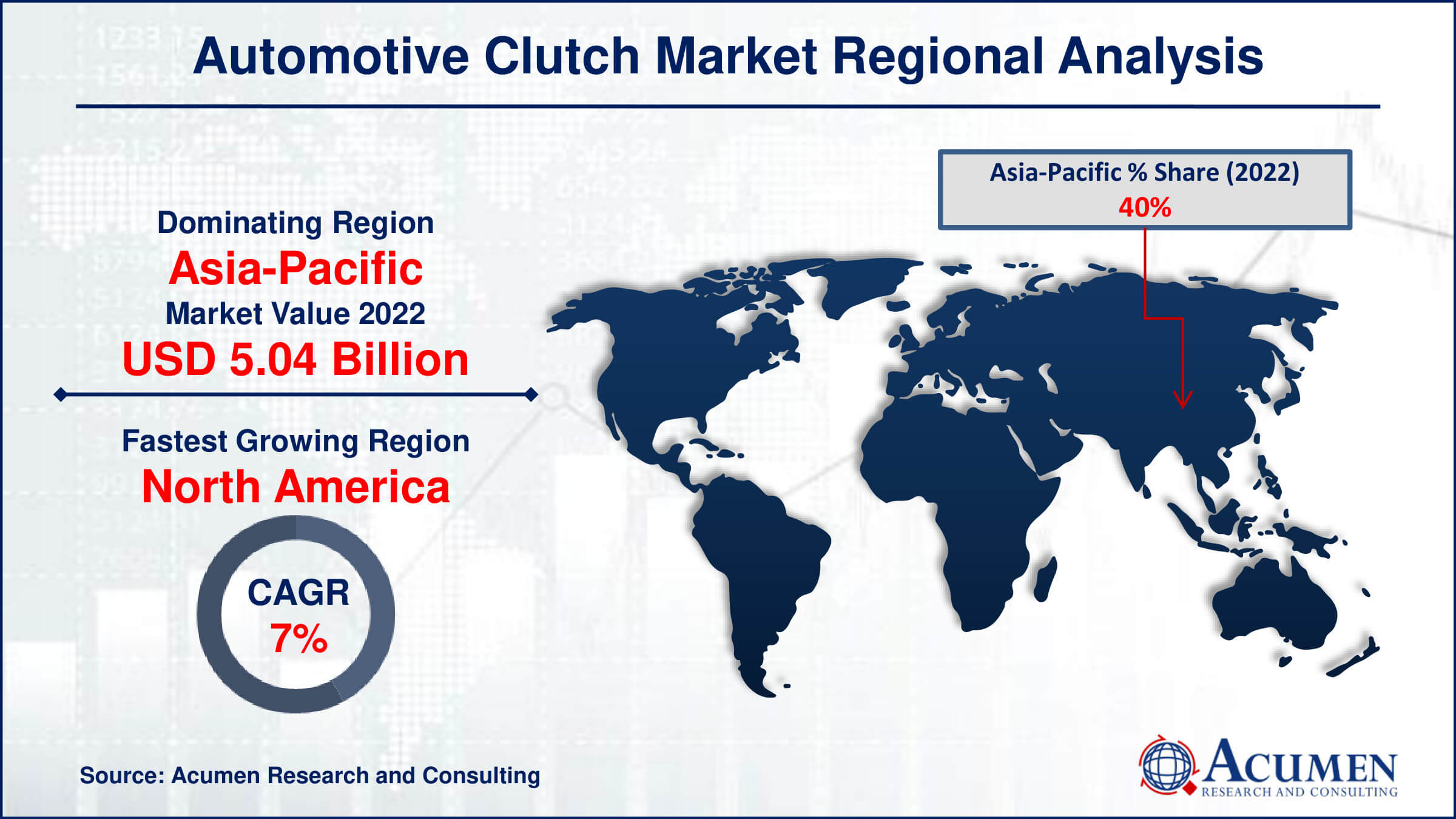

Automotive Clutch Market Regional Analysis

Asia-Pacific is expected to dominate the car frequency friction market over the automotive clutch industry forecast period, primarily due to the region's high volume of car sales and technological advancements such as dual-clutch transmission systems and automatic and manual transmission systems, driving industry growth in this area. In emerging economies such as China and India, the expansion of the automobile manufacturing industry is propelling the car frequency friction market forward. Other contributing factors include the introduction of more affordable manual transmission clutches and consumer preference for comfortable transmission modes, further fueling market growth.

In North America, increased car purchases and the transition towards electric cars are factors contributing to competition in the automotive clutch market. Additionally, while the North American region currently represents a modest share of global sales, it is predicted to steadily rise over the forecast period, largely driven by increased car purchases in the United States and Canada. Moreover, in Europe, the presence of a growing number of car manufacturers is expected to drive a more rapid growth over the automotive clutch market forecast period.

Automotive Clutch Market Players

Some of the top automotive clutch companies offered in our report includes NSK Ltd., BorgWarner Inc., Schaeffler AG, Valeo S.A., Eaton Corporation Plc., Aisin Seiki Co. Ltd., Karl Storz, EXEDY Corporation, FCC Co. Ltd., Clutch Auto Ltd., and ZF Friedrichshafen AG.

Frequently Asked Questions

How big is the automotive clutch market?

The automotive clutch market size was valued at USD 12.6 billion in 2022.

What is the CAGR of the global automotive clutch market from 2024 to 2032?

The CAGR of automotive clutch is 6.5% during the analysis period of 2024 to 2032.

Which are the key players in the automotive clutch market?

The key players operating in the global market are including NSK Ltd., BorgWarner Inc., Schaeffler AG, Valeo S.A., Eaton Corporation Plc., Aisin Seiki Co. Ltd., Karl Storz, EXEDY Corporation, FCC Co. Ltd., Clutch Auto Ltd., and ZF Friedrichshafen AG.

Which region dominated the global automotive clutch market share?

Asia-Pacific held the dominating position in automotive clutch industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of automotive clutch during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global automotive clutch industry?

The current trends and dynamics in the automotive clutch industry include increasing demand for automatic transmission vehicles, growing sales of commercial vehicles, technological advancements in clutch systems, and expansion of the automotive industry in emerging economies.

Which vehicle held the maximum share in 2022?

The passenger vehicles held the maximum share of the automotive clutch industry.