Automotive Advanced High Strength Steel Market | Acumen Research and Consulting

Automotive Advanced High Strength Steel Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

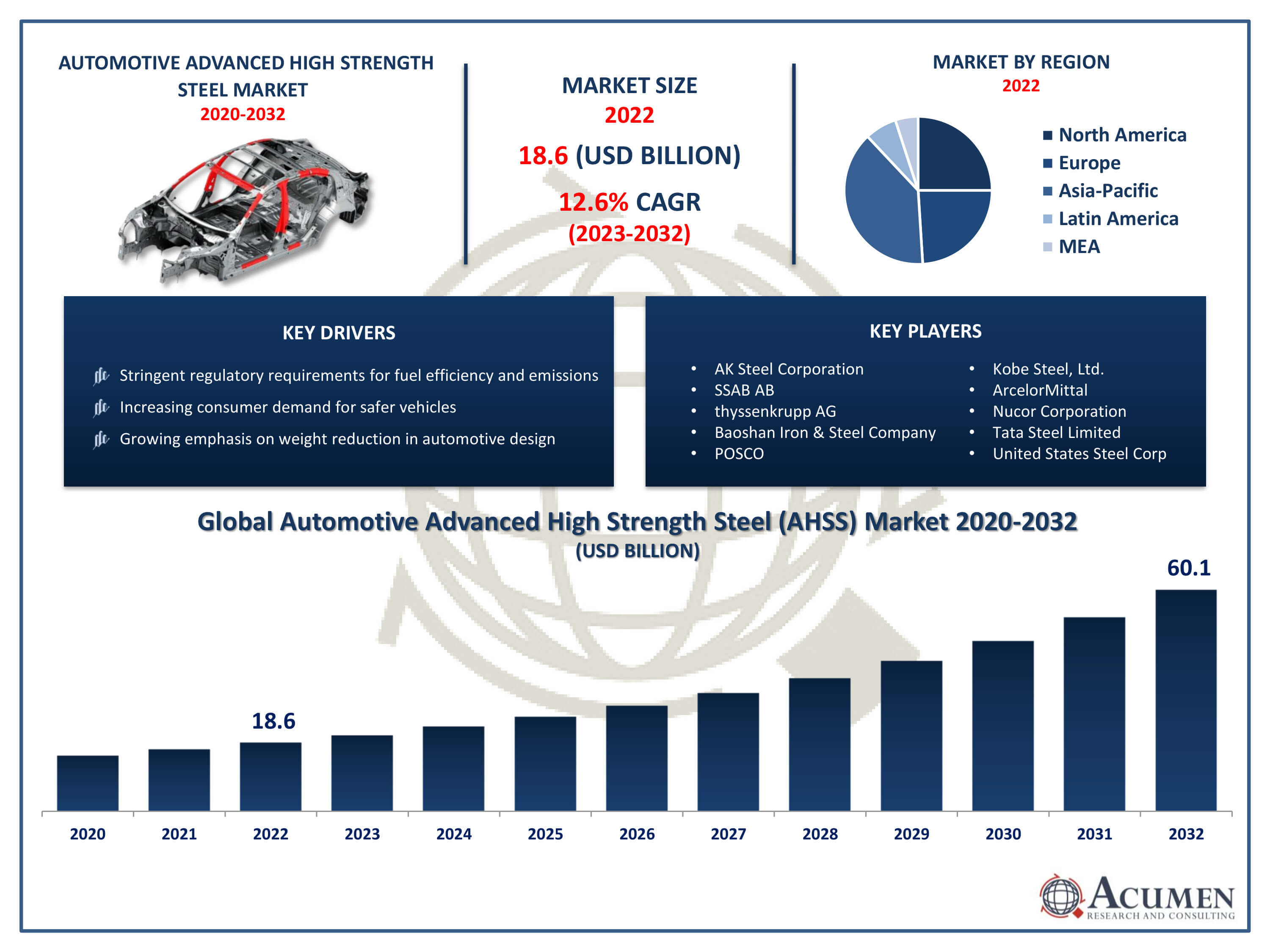

The Global Automotive Advanced High Strength Steel (AHSS) Market Size accounted for USD 18.6 Billion in 2022 and is projected to achieve a market size of USD 60.1 Billion by 2032 growing at a CAGR of 12.6% from 2023 to 2032.

Automotive Advanced High Strength Steel (AHSS) Market Highlights

- Global automotive advanced high strength steel market revenue is expected to increase by USD 60.1 Billion by 2032, with a 12.6% CAGR from 2023 to 2032

- Asia-Pacific region led with more than 54% of automotive advanced high strength steel market share in 2022

- By type, the dual phase segment captured more than 56% of revenue share in 2022

- By application, the structural assembly & closures segment has held the largest market share of 33% in 2022

- By end use, the passenger carssegment is projected to expand at the fastest CAGR over the projected period

- Growing emphasis on weight reduction in automotive design, drives the automotive advanced high strength steel market value

Advanced High Strength Steel (AHSS) is a type of steel that offers superior strength and formability compared to conventional steel grades. It is engineered to provide high tensile strength, improved crash performance, and reduced weight, making it an ideal material for automotive applications. AHSS typically contains a combination of elements such as manganese, aluminum, silicon, and boron, along with precise heat treatment processes to achieve its desired properties. Its enhanced strength allows for the design of lighter and safer vehicles while maintaining structural integrity and occupant protection.

The market for automotive AHSS has been experiencing significant growth in recent years, driven by several factors. Stringent government regulations regarding fuel efficiency and emissions have prompted automakers to seek lightweight materials to improve the performance of their vehicles. Additionally, increasing consumer demand for safer cars has led manufacturers to adopt AHSS for its exceptional crashworthiness. Moreover, advancements in steelmaking technologies have made AHSS more affordable and easier to produce at scale, further fueling its adoption in the automotive industry. As a result, the market for automotive AHSS is expected to continue expanding as automakers prioritize weight reduction, safety, and sustainability in vehicle design and manufacturing processes.

Global Automotive Advanced High Strength Steel Market Trends

Market Drivers

- Stringent regulatory requirements for fuel efficiency and emissions

- Increasing consumer demand for safer vehicles

- Advancements in steelmaking technologies making AHSS more affordable

- Growing emphasis on weight reduction in automotive design

- Expanding opportunities in electric and autonomous vehicle segments

Market Restraints

- High initial investment required for equipment and technology upgrades

- Challenges associated with forming and joining AHSS in manufacturing processes

Market Opportunities

- Rising adoption of electric vehicles (EVs) driving demand for lightweight materials

- Development of AHSS grades tailored for specific automotive applications

Automotive Advanced High Strength Steel Market Report Coverage

| Market | Automotive Advanced High Strength Steel Market |

| Automotive Advanced High Strength Steel Market Size 2022 | USD 18.6 Billion |

| Automotive Advanced High Strength Steel Market Forecast 2032 | USD 60.1 Billion |

| Automotive Advanced High Strength Steel Market CAGR During 2023 - 2032 | 12.6% |

| Automotive Advanced High Strength Steel Market Analysis Period | 2020 - 2032 |

| Automotive Advanced High Strength Steel Market Base Year |

2022 |

| Automotive Advanced High Strength Steel Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AK Steel Corporation, SSAB, thyssenkrupp AG, Baoshan Iron & Steel Company Limited, POSCO, Kobe Steel, Ltd., ArcelorMittal, Nucor Corporation, Tata Steel Limited, and United States Steel Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Advanced High Strength Steel (AHSS) is a specialized type of steel engineered to provide exceptional strength, formability, and durability for use in various automotive applications. It is composed of a precise alloy blend, including elements like manganese, aluminum, silicon, and boron, along with advanced heat treatment processes. The result is a material that offers significantly higher tensile strength compared to traditional steel grades while maintaining excellent formability, allowing for complex shapes and designs in vehicle components. AHSS finds widespread applications throughout the automotive industry, particularly in critical areas where strength and crashworthiness are paramount. These include safety-critical components such as structural reinforcements, door beams, pillars, and crash rails, where AHSS helps improve occupant protection by absorbing and dissipating impact energy more effectively during collisions.

The automotive advanced high strength steel (AHSS) market has been experiencing robust growth, driven by various factors contributing to its widespread adoption in the automotive industry. One of the primary drivers is the increasing demand for lightweight materials to improve vehicle fuel efficiency and reduce emissions. AHSS offers a compelling solution as it enables automakers to manufacture lighter vehicles without compromising on safety or structural integrity. Furthermore, stringent safety regulations worldwide have propelled the demand for AHSS due to its superior crash performance and enhanced occupant protection. Additionally, advancements in steelmaking technologies have led to the development of AHSS grades that offer exceptional strength and formability, making them highly attractive for automotive applications. These advancements have not only improved the mechanical properties of AHSS but have also made it more cost-effective to produce at scale. As a result, automakers are increasingly incorporating AHSS into their vehicle designs to meet evolving market demands for safer, more fuel-efficient, and environmentally friendly vehicles

Automotive Advanced High Strength Steel Market Segmentation

The globalautomotive advanced high strength steel (AHSS) market segmentation is based on type, application, end use, and geography.

Automotive Advanced High Strength Steel Market By Type

- Complex Phase

- Dual Phase

- Transformation induced plasticity (TRIP) steel

- Others

According to the automotive advanced high strength steel industry analysis, the dual phase segment accounted for the largest market share in 2022. Dual-phase AHSS is characterized by a microstructure consisting of a mixture of ferrite and martensite phases, which provides excellent strength while also allowing for some degree of formability during manufacturing processes. This makes it an ideal material for various automotive components, including safety-critical structural parts, such as pillars, reinforcements, and crash rails. One of the key factors fueling the growth of the dual-phase AHSS segment is the automotive industry's increasing focus on lightweighting to improve fuel efficiency and meet stringent emissions regulations. Dual-phase AHSS enables automakers to achieve weight reduction goals without compromising on vehicle safety or performance. Moreover, advancements in steel manufacturing technologies have led to the development of new grades of dual-phase AHSS with enhanced properties, further expanding its applications in the automotive sector.

Automotive Advanced High Strength Steel Market By Application

- Bumpers

- Suspension

- Structural Assembly & Closures

- Others

In terms of applications, the structural assembly & closures segment is expected to witness significant growth in the coming years. Structural assembly components, such as chassis frames, body structures, and reinforcements, are essential for providing rigidity and crashworthiness to vehicles. AHSS offers a compelling solution for these applications, as it provides exceptional strength-to-weight ratio, allowing automakers to design lighter yet stronger vehicle structures. This not only improves fuel efficiency but also enhances overall vehicle performance and occupant protection. Moreover, closures, including doors, hoods, and trunk lids, are critical components that contribute to the aerodynamics, aesthetics, and safety of vehicles. AHSS is increasingly being utilized in the manufacturing of closures due to its excellent formability and dent resistance properties. By incorporating AHSS into closures, automakers can achieve weight reduction while maintaining structural integrity and enhancing vehicle safety.

Automotive Advanced High Strength Steel Market By End Use

- Commercial Vehicle

- Passenger Cars

According to the automotive advanced high strength steel market forecast, the passenger cars segment is expected to witness significant growth in the coming years. One significant driver is the increasing demand for lighter vehicles with improved safety features. AHSS offers a compelling solution for automakers seeking to meet stringent safety standards while simultaneously reducing vehicle weight to enhance fuel efficiency and performance. The superior strength-to-weight ratio of AHSS allows for the design of lightweight vehicle structures without compromising on crashworthiness, making it particularly attractive for passenger car applications. Moreover, the growing consumer preference for safer vehicles has further fueled the adoption of AHSS in passenger cars. With AHSS's exceptional crash performance and enhanced occupant protection capabilities, automakers can enhance the safety of their vehicles, thus meeting consumer expectations and regulatory requirements. Additionally, advancements in steel manufacturing technologies have led to the development of AHSS grades specifically tailored for passenger car applications, offering improved formability, weldability, and corrosion resistance.

Automotive Advanced High Strength Steel Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Advanced High Strength Steel Market Regional Analysis

The Asia-Pacific region has emerged as a dominating force in the automotive advanced high strength steel (AHSS) market, driven by several key factors. One of the primary reasons is the rapid growth of the automotive industry in countries like China, India, Japan, and South Korea. These nations have witnessed a surge in automotive production and sales, fueled by urbanization, rising disposable incomes, and increasing demand for passenger vehicles. As automakers in the Asia-Pacific region strive to meet stringent fuel efficiency and safety regulations, they are increasingly turning to AHSS to achieve lightweighting goals without compromising on structural integrity or safety standards. Moreover, the Asia-Pacific region is home to some of the world's leading steel producers and manufacturers, giving it a competitive edge in the AHSS market. With significant investments in research and development, steel companies in this region have been at the forefront of developing innovative AHSS grades tailored to meet the specific needs of automotive applications. Additionally, the presence of a robust manufacturing infrastructure and skilled workforce further enhances the region's capabilities in AHSS production and fabrication. As a result, Asia-Pacific has become a hub for AHSS manufacturing, supplying not only domestic automotive manufacturers but also catering to the growing demand for AHSS globally.

Automotive Advanced High Strength Steel Market Player

Some of the top automotive advanced high strength steel (AHSS) market companies offered in the professional report include AK Steel Corporation, SSAB, thyssenkrupp AG, Baoshan Iron & Steel Company Limited, POSCO, Kobe Steel, Ltd., ArcelorMittal, Nucor Corporation, Tata Steel Limited, and United States Steel Corporation.

Frequently Asked Questions

How big is the automotive advanced high strength steel market?

The automotive advanced high strength steel market size was USD 18.6 Billion in 2022.

What is the CAGR of the global automotive advanced high strength steel (AHSS) market from 2023 to 2032?

The CAGR of automotive advanced high strength steel is 12.6% during the analysis period of 2023 to 2032.

Which are the key players in the automotive advanced high strength steel (AHSS) market?

The key players operating in the global market are including AK Steel Corporation, SSAB, thyssenkrupp AG, Baoshan Iron & Steel Company Limited, POSCO, Kobe Steel, Ltd., ArcelorMittal, Nucor Corporation, Tata Steel Limited, and United States Steel Corporation.

Which region dominated the global automotive advanced high strength steel (AHSS) market share?

Asia-Pacific held the dominating position in automotive advanced high strength steel industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of automotive advanced high strength steel during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automotive advanced high strength steel (AHSS) industry?

The current trends and dynamics in the automotive advanced high strength steel industry include stringent regulatory requirements for fuel efficiency and emissions, increasing consumer demand for safer vehicles, and advancements in steelmaking technologies making AHSS more affordable.

Which application held the maximum share in 2022?

The structural assembly & closures application held the maximum share of the automotive advanced high strength steel industry.