Automotive Acoustic Engineering Services Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Automotive Acoustic Engineering Services Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

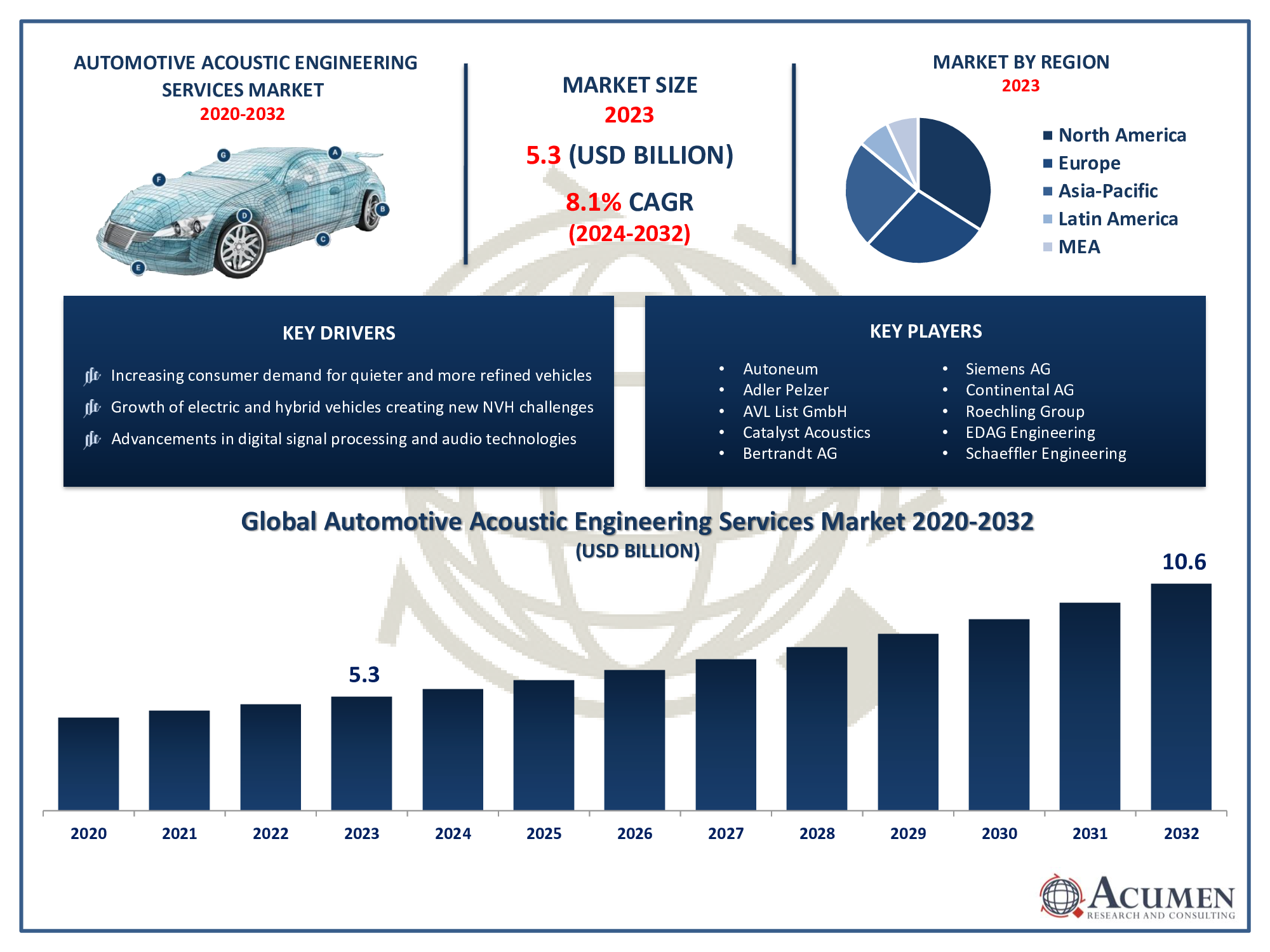

The Automotive Acoustic Engineering Services Market Size accounted for USD 5.3 Billion in 2023 and is projected to achieve a market size of USD 10.6 Billion by 2032 growing at a CAGR of 8.1% from 2024 to 2032.

Automotive Acoustic Engineering Services Market - By Process (Designing, Testing, Development), By Solution (Calibration, Simulation, Vibration, Others), By Offering (Virtual, Physical), By Vehicle (Commercial vehicle, Passenger vehicle), By Application (Interior, Powertrain, Body & structure, Drivetrain) - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032.

Automotive Acoustic Engineering Services Market Key Highlights

- Global automotive acoustic engineering services market revenue is expected to increase by USD 10.6 Billion by 2032, with a 8.1% CAGR from 2024 to 2032

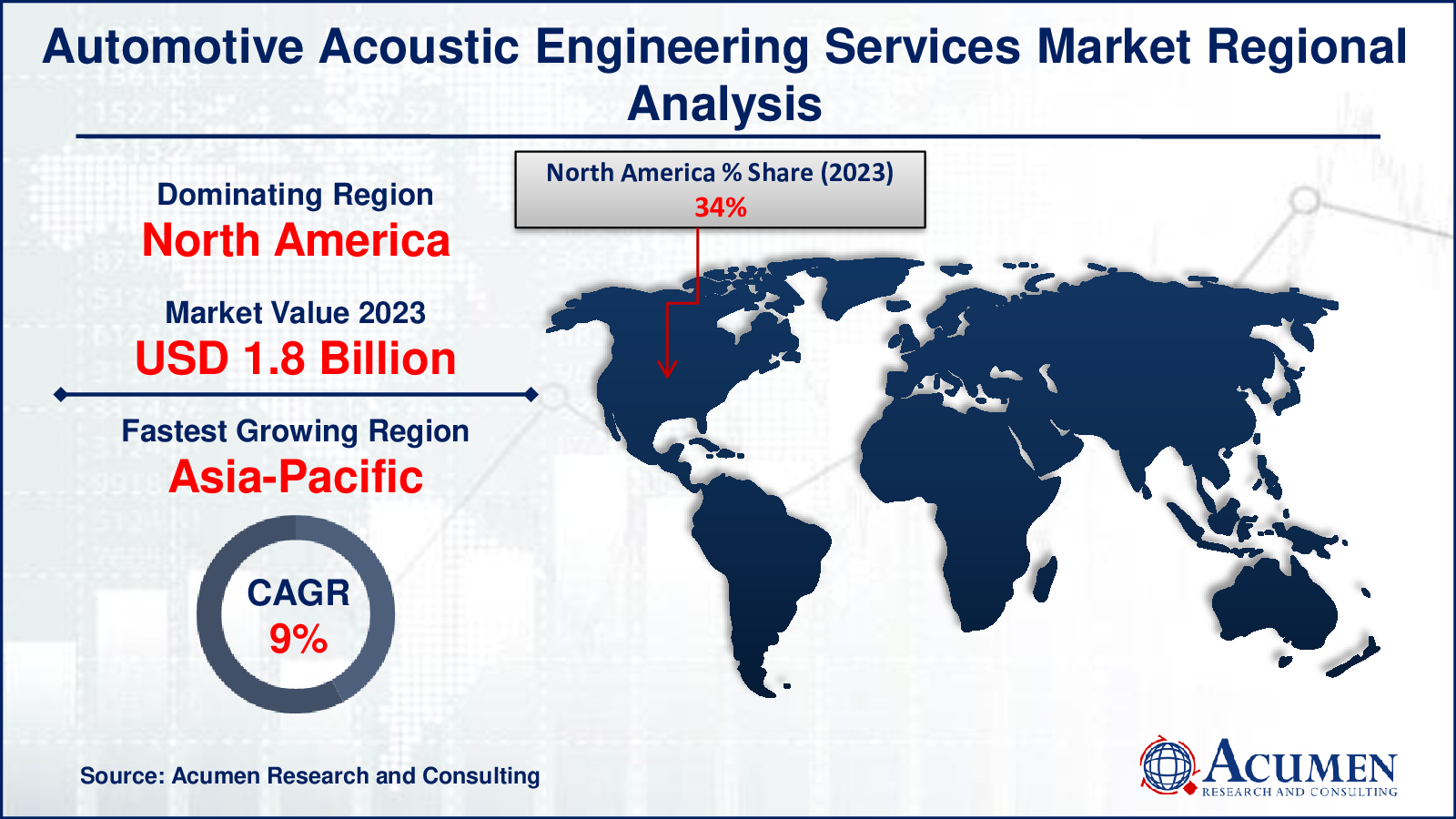

- North America region led with more than 34% of automotive acoustic engineering services market share in 2023

- Asia-Pacific automotive acoustic engineering services market growth will record a CAGR of more than 9.3% from 2024 to 2032

- By solution, the simulation segment contributed over 41% of revenue share in 2023

- By vehicle, the passenger vehicle segment captured more than 60% of revenue share in 2023

- Increasing consumer demand for quieter and more refined vehicles, drives the automotive acoustic engineering services market value

Automotive acoustic engineering services involve the design and implementation of sound-related solutions within vehicles to optimize noise levels, improve sound quality, and enhance overall driving experience. This specialized field encompasses various aspects, including noise reduction, vibration control, and audio system tuning. Acoustic engineers work on a range of components, from engines and exhaust systems to interiors and infotainment systems, striving to achieve the desired acoustic performance while meeting regulatory standards and customer preferences.

The market for automotive acoustic engineering services has been witnessing steady growth in recent years, driven by several factors such as growing emphasis on vehicle refinement and comfort, with automakers aiming to create quieter cabins and smoother driving experiences. Additionally, advancements in technology have enabled more sophisticated sound management solutions, such as active noise cancellation and sound enhancement algorithms, further fueling demand for acoustic engineering expertise. Moreover, as electric vehicles become increasingly prevalent, there's a need to address unique acoustic challenges associated with their propulsion systems, presenting new opportunities for acoustic engineers to innovate and develop specialized solutions.

Global Automotive Acoustic Engineering Services Market Trends

Market Drivers

- Increasing consumer demand for quieter and more refined vehicles

- Growth of electric and hybrid vehicles creating new NVH challenges

- Advancements in digital signal processing and audio technologies

- Emphasis on enhancing vehicle comfort and driving experience

- Emerging trend of autonomous driving requiring superior cabin tranquility

Market Restraints

- High initial investment in acoustic engineering technologies

- Complexity of integrating acoustic solutions into vehicle design

Market Opportunities

- Rising demand for premium audio systems and active noise cancellation

- Potential for innovation in lightweight and eco-friendly acoustic materials

Automotive Acoustic Engineering Services Market Report Coverage

| Market | Automotive Acoustic Engineering Services Market |

| Automotive Acoustic Engineering Services Market Size 2022 |

USD 5.3 Billion |

| Automotive Acoustic Engineering Services Market Forecast 2032 | USD 10.6 Billion |

| Automotive Acoustic Engineering Services Market CAGR During 2023 - 2032 | 8.1% |

| Automotive Acoustic Engineering Services Market Analysis Period | 2020 - 2032 |

| Automotive Acoustic Engineering Services Market Base Year |

2022 |

| Automotive Acoustic Engineering Services Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Process, By Solution, By Offering, By Vehicle, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Autoneum, Adler Pelzer, AVL List GmbH, Catalyst Acoustics, Bertrandt AG, Siemens AG, Continental AG, Roechling Group, EDAG Engineering, and Schaeffler Engineering. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive acoustic engineering services involve the application of specialized techniques and technologies to manage and optimize the sound quality within vehicles. These services encompass a broad spectrum of tasks aimed at controlling noise, vibration, and harshness (NVH) levels, as well as refining the overall auditory experience for vehicle occupants. Acoustic engineers utilize advanced simulation software, testing methodologies, and material selection to mitigate unwanted noise sources, minimize vibrations, and enhance the acoustic environment within the vehicle cabin. The applications of automotive acoustic engineering services are multifaceted and essential for ensuring a comfortable and pleasant driving experience. One primary application is NVH control, where engineers work to reduce noise from various sources such as powertrain components, road and wind noise, and suspension systems.

The automotive acoustic engineering services market has been experiencing steady growth, driven by several factors contributing to an increasing demand for quieter, more refined vehicles. With consumers placing greater emphasis on comfort and driving experience, automakers are investing heavily in acoustic engineering to mitigate noise, vibration, and harshness (NVH) levels within their vehicles. This has led to a surge in demand for specialized services and technologies aimed at optimizing sound quality and cabin tranquility. Moreover, the proliferation of electric and hybrid vehicles has introduced new challenges and opportunities for acoustic engineers. While these vehicles inherently produce less engine noise, they also introduce unique NVH issues such as electric motor whine and tire noise, necessitating innovative solutions to maintain a high level of cabin comfort. Additionally, advancements in digital signal processing and audio technologies have enabled the integration of sophisticated sound systems and active noise cancellation systems into vehicles, further driving the growth of the automotive acoustic engineering services market.

Automotive Acoustic Engineering Services Market Segmentation

The global automotive acoustic engineering services market segmentation is based on process, solution, offering, vehicle, application, and geography.

Automotive Acoustic Engineering Services Market By Process

- Designing

- Testing

- Development

According to automotive acoustic engineering services industry analysis, the designing segment held the largest market share in 2023. Designing encompasses various aspects, including the structural layout of vehicle components, selection of materials, and integration of soundproofing technologies, all aimed at achieving optimal noise, vibration, and harshness (NVH) control. As automakers strive to meet increasingly stringent noise regulations and consumer expectations for quieter and more refined vehicles, the demand for expertise in designing effective acoustic solutions has surged. One key driver of growth in the designing segment is the integration of advanced simulation tools and modeling techniques into the design process. These tools enable engineers to predict and analyze the acoustic performance of vehicle components and systems early in the development cycle, allowing for iterative refinement and optimization to meet desired NVH targets.

Automotive Acoustic Engineering Services Market By Solution

- Calibration

- Simulation

- Vibration

- Others

In terms of solutions, the simulation segment dominated the market in 2023. Simulation plays a critical role in predicting and analyzing the behavior of acoustic systems within vehicles, allowing engineers to assess the impact of design changes on noise, vibration, and harshness (NVH) levels without the need for costly physical prototypes. This capability enables automotive manufacturers to streamline the design process, reduce development time, and minimize expenses associated with traditional testing methods. One of the key drivers behind the growth of the simulation segment is the increasing complexity of vehicle architectures and the need for more sophisticated acoustic solutions. Modern vehicles incorporate a wide array of components and systems that contribute to overall noise levels, making it challenging to identify and address potential NVH issues during the design phase.

Automotive Acoustic Engineering Services Market By Offering

- Virtual

- Physical

According to the automotive acoustic engineering services market forecast, the virtual segment is expected to witness significant growth in the coming years. This growth is fueled by advancements in virtual reality (VR) and augmented reality (AR) technologies. Virtual solutions are revolutionizing the way automotive acoustics are analyzed, simulated, and optimized, offering cost-effective and efficient alternatives to traditional physical testing methods. Through virtual simulations, engineers can recreate realistic acoustic environments and assess the impact of design changes on noise, vibration, and harshness (NVH) levels without the need for expensive prototypes or dedicated testing facilities. One of the key drivers behind the growth of the virtual segment is the increasing complexity of vehicle architectures and the need for more comprehensive NVH analysis. Modern vehicles incorporate a multitude of components and systems that contribute to overall noise levels, making it challenging to identify and address potential NVH issues during the design phase.

Automotive Acoustic Engineering Services Market By Vehicle

- Commercial vehicle

- Passenger vehicle

Based on the vehicle, the passenger vehicle segment is expected to witness significant growth in the coming years. This growth is propelled by increasing consumer expectations for quieter, more comfortable, and refined driving experiences. As consumers prioritize cabin tranquility and NVH reduction, automakers are placing greater emphasis on integrating advanced acoustic technologies and solutions into passenger vehicles. This has led to a surge in demand for acoustic engineering services tailored specifically to passenger vehicles, encompassing various aspects such as interior sound quality refinement, active noise cancellation systems, and vibration isolation techniques. One of the key drivers behind the growth of the passenger vehicle segment is the rising demand for premium features and amenities among consumers.

Automotive Acoustic Engineering Services Market By Application

- Interior

- Powertrain

- Body & structure

- Drivetrain

In terms of application, the interior segment has been experiencing significant growth in recent years. Interior acoustics play a crucial role in shaping the overall driving experience, influencing factors such as speech intelligibility, audio system performance, and overall cabin tranquility. As a result, automakers are increasingly investing in acoustic engineering services tailored specifically to interior spaces, encompassing a range of techniques and technologies to minimize noise, vibration, and harshness (NVH) levels while optimizing sound quality and comfort. One of the key drivers behind the growth of the interior segment is the growing consumer demand for premium interior features and amenities. As consumers seek vehicles that offer a quiet and refined driving experience, automakers are prioritizing the integration of advanced acoustic technologies into interior spaces to meet these expectations.

Automotive Acoustic Engineering Services Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Acoustic Engineering Services Market Regional Analysis

North America dominates the automotive acoustic engineering services market due to several key factors that position the region as a leader in innovation, technological advancement, and automotive manufacturing. North America is home to some of the world's largest automotive manufacturers, including General Motors, Ford, and Fiat Chrysler Automobiles, among others. These companies invest significantly in research and development, including acoustic engineering, to enhance the quality and competitiveness of their vehicles. As a result, there is a high demand for acoustic engineering services to support the design and production of vehicles that meet stringent noise regulations and consumer expectations for comfort and refinement. Furthermore, North America boasts a robust ecosystem of automotive suppliers and technology providers specializing in acoustic solutions. From acoustic materials and soundproofing technologies to active noise cancellation systems and audio enhancement technologies, the region offers a diverse array of products and services to meet the evolving needs of automakers. This concentration of expertise and resources makes North America an attractive destination for automotive OEMs seeking to collaborate with suppliers and partners to develop innovative acoustic solutions.

Automotive Acoustic Engineering Services Market Player

Some of the top automotive acoustic engineering services market companies offered in the professional report include Autoneum, Adler Pelzer, AVL List GmbH, Catalyst Acoustics, Bertrandt AG, Siemens AG, Continental AG, Roechling Group, EDAG Engineering, and Schaeffler Engineering.

Frequently Asked Questions

What was the market size of the global automotive acoustic engineering services in 2023?

The market size of automotive acoustic engineering services was USD 5.3 Billion in 2023.

What is the CAGR of the global automotive acoustic engineering services market from 2024 to 2032?

The CAGR of automotive acoustic engineering services is 8.1% during the analysis period of 2024 to 2032.

Which are the key players in the automotive acoustic engineering services market?

The key players operating in the global market are including Autoneum, Adler Pelzer, AVL List GmbH, Catalyst Acoustics, Bertrandt AG, Siemens AG, Continental AG, Roechling Group, EDAG Engineering, and Schaeffler Engineering.

Which region dominated the global automotive acoustic engineering services market share?

North America held the dominating position in automotive acoustic engineering services industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of automotive acoustic engineering services during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global automotive acoustic engineering services industry?

The current trends and dynamics in the automotive acoustic engineering services industry include increasing consumer demand for quieter and more refined vehicles, and growth of electric and hybrid vehicles creating new NVH challenges.

Which offering held the maximum share in 2023?

The virtual offering held the maximum share of the automotive acoustic engineering services industry.