Automatic Feeding Market | Acumen Research and Consulting

Automatic Feeding Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

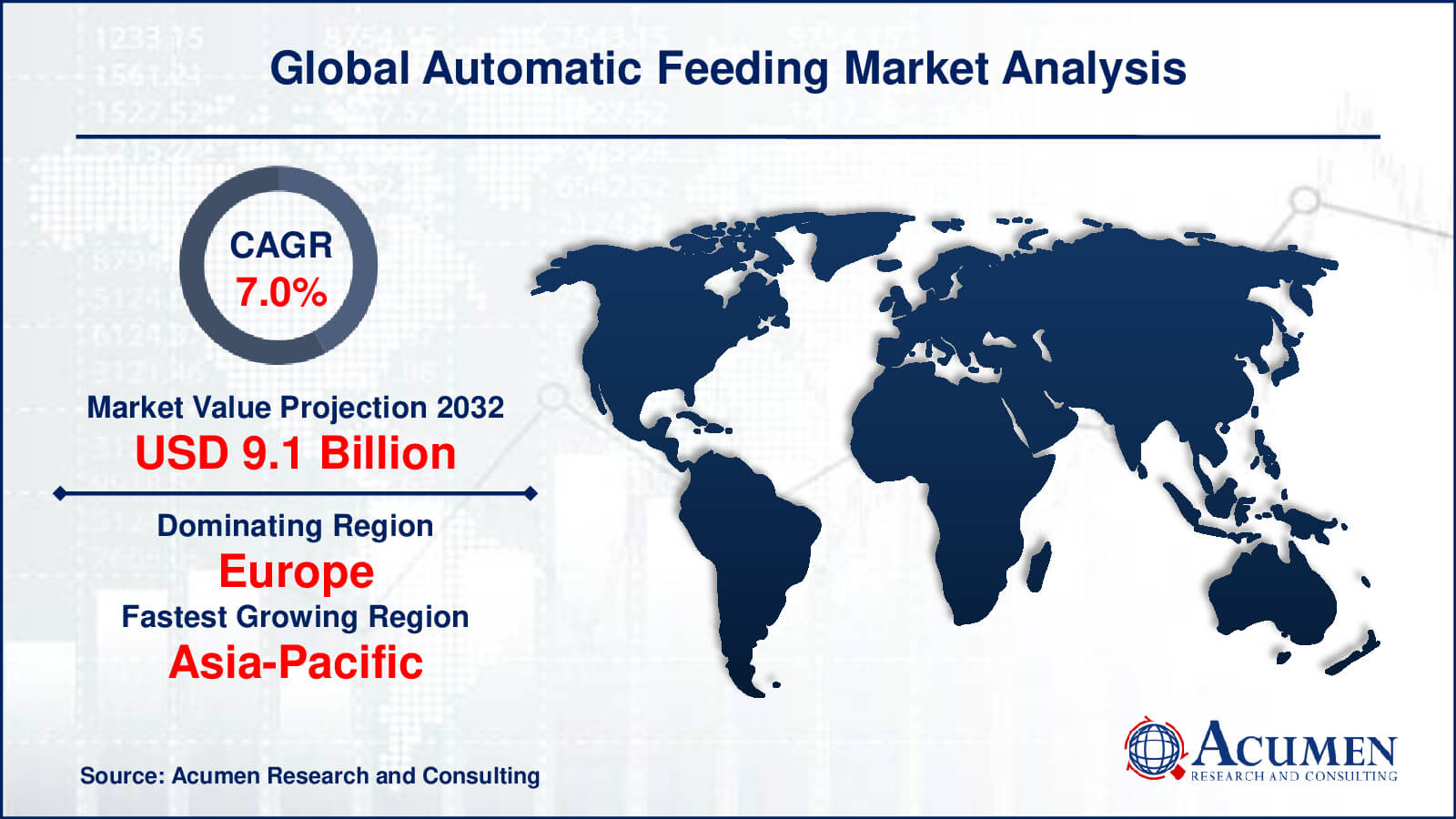

The Global Automatic Feeding Market Size accounted for USD 4.7 Billion in 2022 and is estimated to achieve a market size of USD 9.1 Billion by 2032 growing at a CAGR of 7.0% from 2023 to 2032.

Automatic Feeding Market Highlights

- Global automatic feeding market revenue is poised to garner USD 9.1 billion by 2032 with a CAGR of 7.0% from 2023 to 2032

- Europe automatic feeding market value occupied more than USD 1.9 billion in 2022

- Asia-Pacific automatic feeding market growth will record a CAGR of around 22% from 2023 to 2032

- Among feeding line, the distributors sub-segment generated around US$ 1.6 billion revenue in 2022

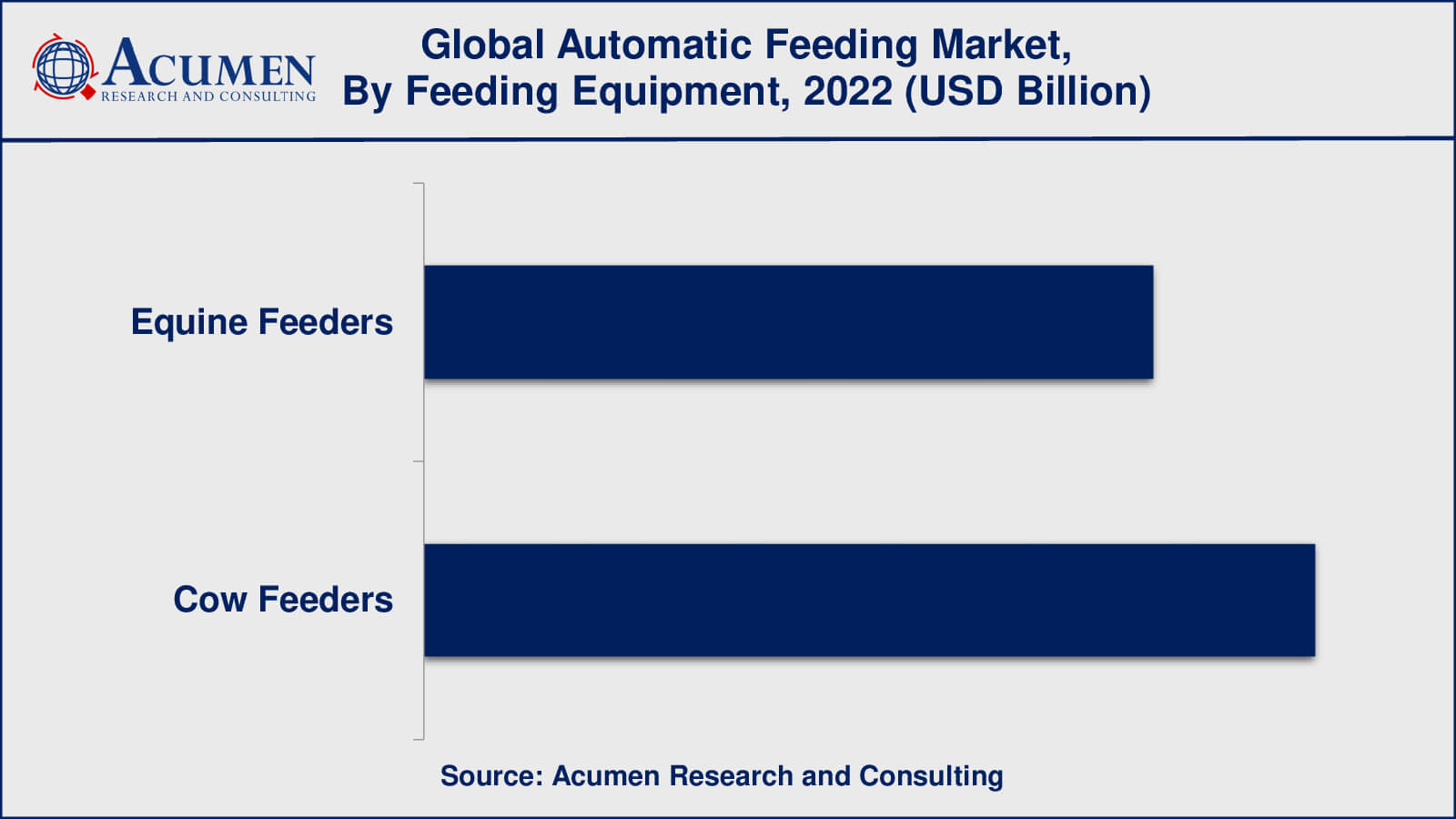

- Based on feeding equipment, the cow feeders sub-segment generated around 55% share in 2022

- Advancements in technology and automation is a popular automatic feeding market trend that fuels the industry demand

Automated feeding systems can provide livestock farmers with a variety of advantages, including increased efficiency, lower labor costs, improved animal health and welfare, and reduced feed waste. These systems can also collect data on feeding patterns, feed intake, and animal behavior, which can be used to optimize feeding strategies and improve farm management overall. The use of equipment and systems to automate the feeding process for livestock such as dairy and beef cattle, poultry, swine, fish, and equine is referred to as automatic feeding. The goal of automatic feeding is to increase efficiency, lower labor costs, and improve animal welfare. Automatic feeding assists farmers to give feed as per the need of ruminants and helps to keep a large herd. Farmers in developed countries invest in individual feeders for equine. Equine feeders are of various types, such as hay feeders, feed bins, buckets, and automatic equine waterers, which are used on a daily basis to provide feed and water.

Global Automatic Feeding Market Dynamics

Market Drivers

- Increasing demand for protein-rich food products from a growing population

- Rising awareness about animal welfare and the benefits of automated feeding systems

- Growing trend towards precision agriculture and data-driven decision making in livestock management

- Government initiatives and subsidies supporting the adoption of automatic feeding systems

Market Restraints

- High initial costs associated with purchasing and installing automatic feeding systems

- Limited availability of skilled labor and technical expertise in some regions

- Concerns over the environmental impact of large-scale livestock operations

Market Opportunities

- Increasing adoption of smart farming and precision agriculture technologies

- Growing demand for organic and sustainable livestock farming practices

- Rising popularity of aquaculture and other non-traditional livestock farming practices

- Expansion of the automatic feeding market into developing regions

Automatic Feeding Market Report Coverage

| Market | Automatic Feeding Market |

| Automatic Feeding Market Size 2022 | USD 4.7 Billion |

| Automatic Feeding Market Forecast 2032 | USD 9.1 Billion |

| Automatic Feeding Market CAGR During 2023 - 2032 | 7.0% |

| Automatic Feeding Market Analysis Period | 2020 - 2032 |

| Automatic Feeding Market Base Year | 2022 |

| Automatic Feeding Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Feeding Line, By Individual Feeding Equipment, By Livestock, By Feed, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | DeLaval Inc., GEA Group AG, Lely Holding S.A.R.L., Trioliet B.V., Fullwood Packo Ltd., AgroLogic Ltd., Cormall AS, Bauer Technics A.S., Rovibec Agrisolutions Inc., and GSI Group, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automatic Feeding Market Insights

Increasing consumption of meat and dairy products and growing demand for high-value animal protein are some factors driving the growth of this market. However, the lack of standardization and the high set up cost is a major restraint to the growth of this market. Penetration in developing regions and growing investments are some growth opportunities for the growth of automatic feeding systems market.

Automatic Feeding Market Segmentation

The worldwide market for automatic feeding is split based on feeding line, individual feeding equipment, livestock, feed, and geography.

Automatic Feeding Lines

- Controllers

- Mixers

- Conveyors

- Distributors

According to an automatic feeding industry analysis, controllers and mixers are two of the most important components of an automatic feeding system and are thus widely used and in demand. Conveyors and distributors are also important in the feeding process, but their market share is likely to be lower than that of controllers and mixers. In the feeding area, distributors are used to distribute feed to the livestock. They can be mounted on a rail system and moved along the length of the feeding area, distributing feed evenly to the livestock. Distributors can be programmed to dispense specific amounts of feed at specific times, ensuring that the livestock receive the appropriate amount of feed. Conveyors transport feed from storage areas to feeding areas. Sensors can be installed to monitor feed levels and instantaneously refill the feeding area as needed. Depending on the size and layout of the feeding system, conveyors come in a variety of lengths and configurations.

Automatic Feeding Individual Feeding Equipments

- Equine Feeders

- Cow Feeders

Cow feeders are the most common type of automatic feeding equipment, and they are found in dairy farms and livestock facilities all over the world. They come in a variety of sizes and configurations, including stationary and mobile feeders, and can handle a variety of feeds, including silage, haylage, and grains. Cow feeders are frequently outfitted with sensors and data analysis capabilities, allowing farmers to monitor feed consumption and adjust feeding as needed to optimise their cows' health and productivity.

Equine feeders, on the other hand, are a significant segment of the automatic feeding market, especially for bigger horse farms and equestrian facilities. Equine feeders are specifically designed for horses and can be used in a variety of settings such as stables, paddocks, and pastures. They come in a variety of sizes and configurations, including wall-mounted feeders, trough feeders, and automated feeders. Equine feeders can dispense various types of feed, such as hay, grains, and supplements, and they can be programmed to do so at specific times or intervals.

Automatic Feeding Livestocks

- Poultry

- Swine

- Fish

- Ruminants

- Equine

Poultry and swine account for the largest share in the automatic feeding systems market. These two livestock industries have large-scale operations that require consistent and efficient feeding solutions. Fish, ruminants, and equine are also important segments of the automatic feeding market, but they have smaller market shares compared to poultry and swine. However, as the global population continues to grow, demand for protein from all types of livestock is expected to increase, which may drive growth in all segments of the automatic feeding machine market.

Automatic Feeding Feeds

- TMR (Total Mix Ration)

- Starter Feed

- Water

TMR (Total Mix Ration) and starter feed account for the largest share of the automatic feeding market, according to the market forecast. TMR is a feed mixture that provides all of the nutrients required by livestock in a single ration, making it a popular choice for dairy and beef cattle operations.

Starter feed is primarily used for young animals in the poultry and swine industries. It contains a lot of protein and other nutrients that help young animals grow and develop. Starter feed is frequently given in small, frequent meals to encourage consumption and ensure that the young animals get the nutrition they need to grow.

Water is also an essential element of any automatic feeding system because livestock require constant access to clean, fresh water. Watering systems that monitor water consumption and refill water tanks or troughs as needed are available, ensuring that livestock always have access to water.

Automatic Feeding Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automatic Feeding Market Regional Analysis

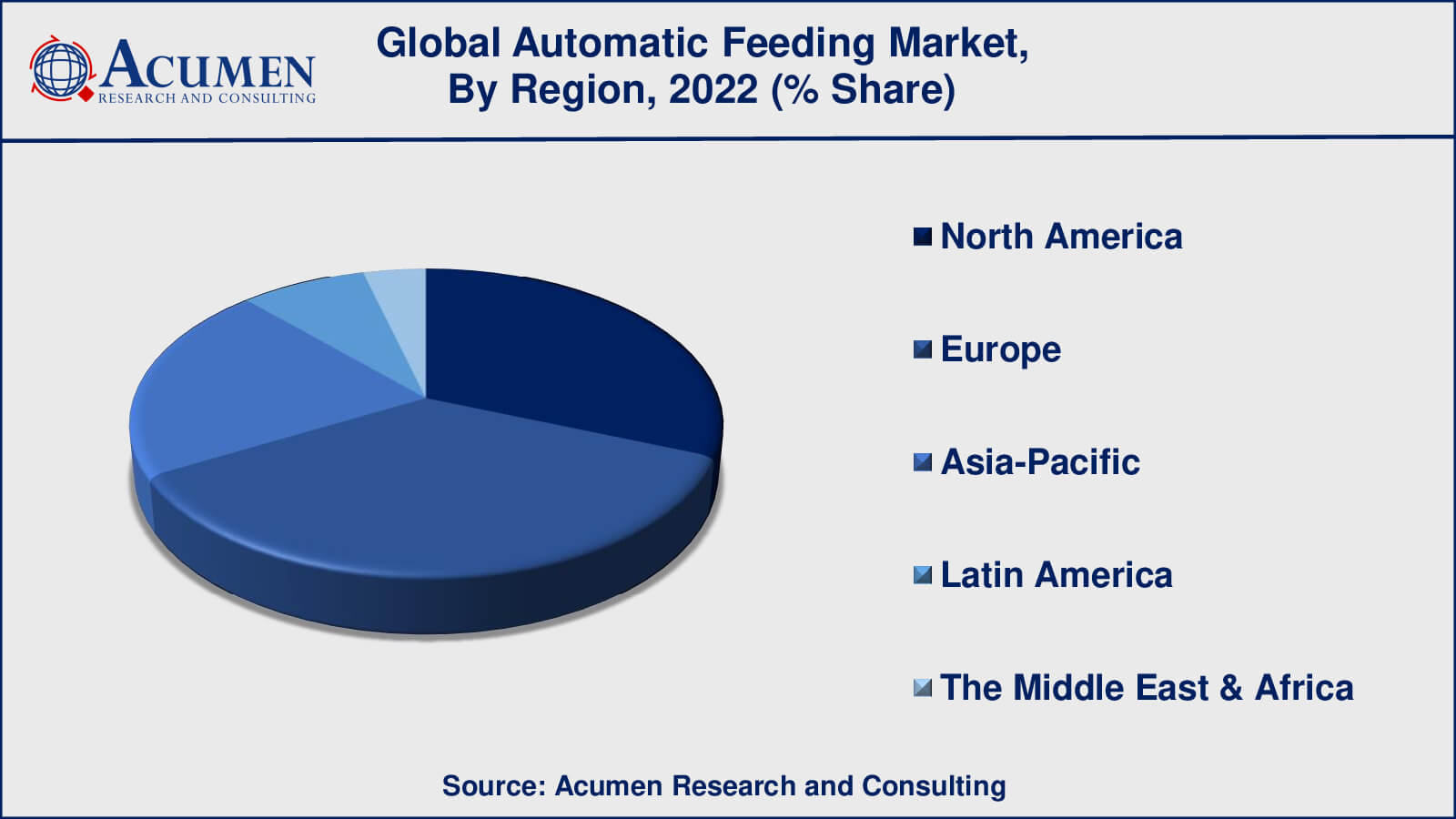

North America is a mature market for automatic feeding systems, primarily driven by the dairy and beef cattle industries. The region's largest markets are the United States and Canada, which have a large number of large-scale livestock operations that require efficient feeding solutions. Demand for automated feeding systems is also increasing in the poultry and swine industries, particularly as labor costs continue to rise.

Europe is another mature market for automatic feeding systems that places a strong emphasis on animal welfare and sustainability. The dairy and beef cattle industries are the region's largest users of automatic feeding systems, with demand growing in the poultry and swine industries as well. Europe's key markets include Germany, France, and the Netherlands.

The Asia-Pacific region is a rapidly expanding market for automatic feeding systems, primarily due to rising protein demand from a growing population. The region's largest markets are China and India, with rising demand for automatic feeding solutions in the poultry, swine, and aquaculture industries. Demand for automated feeding systems is also increasing in the dairy and beef cattle industries, particularly in Japan and South Korea.

Automatic Feeding Market Players

Some of the top automatic feeding companies offered in the professional report include DeLaval Inc., GEA Group AG, Lely Holding S.A.R.L., Trioliet B.V., Fullwood Packo Ltd., AgroLogic Ltd., Cormall AS, Bauer Technics A.S., Rovibec Agrisolutions Inc., and GSI Group, Inc.

Frequently Asked Questions

What was the market size of the global automatic feeding in 2022?

The market size of automatic feeding was USD 4.7 billion in 2022.

What is the CAGR of the global automatic feeding from 2023 to 2032?

The CAGR of automatic feeding is 7.0% during the analysis period of 2023 to 2032.

Which are the key players in the automatic feeding market?

The key players operating in the global automatic feeding market is includes DeLaval Inc., GEA Group AG, Lely Holding S.A.R.L., Trioliet B.V., Fullwood Packo Ltd., AgroLogic Ltd., Cormall AS, Bauer Technics A.S., Rovibec Agrisolutions Inc., and GSI Group, Inc.

Which region dominated the global automatic feeding market share?

North America held the dominating position in automatic feeding industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of automatic feeding during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automatic feeding industry?

The current trends and dynamics in the automatic feeding industry include increasing number of cyber-attacks and frauds, growing adoption of online and mobile payments, e-commerce, and other digital transactions, need for secure automatic feeding to protect against identity theft and fraud, and rise of passwordless authentication.

Which feeding line held the maximum share in 2022?

The distributors feeding line held the maximum share of the automatic feeding industry.