Automated Parcel Delivery Terminals Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Automated Parcel Delivery Terminals Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

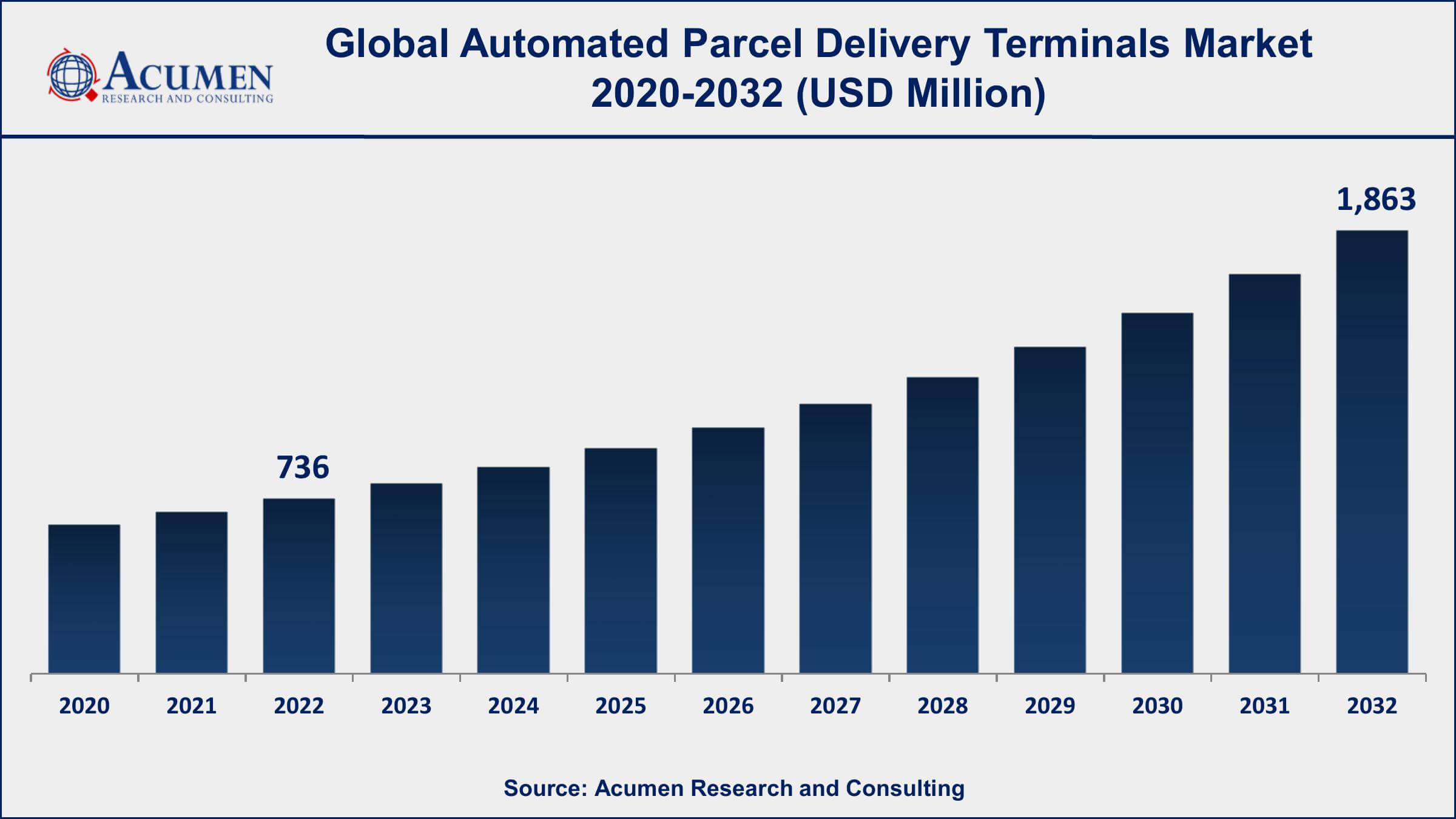

The Automated Parcel Delivery Terminals Market Size accounted for USD 736 Million in 2022 and is projected to achieve a market size of USD 1,863 Million by 2032 growing at a CAGR of 9.9% from 2023 to 2032.

Automated Parcel Delivery Terminals Market Report Key Highlights

- Global automated parcel delivery terminals market revenue is expected to increase by USD 1,863 Million by 2032, with a 9.9% CAGR from 2023 to 2032

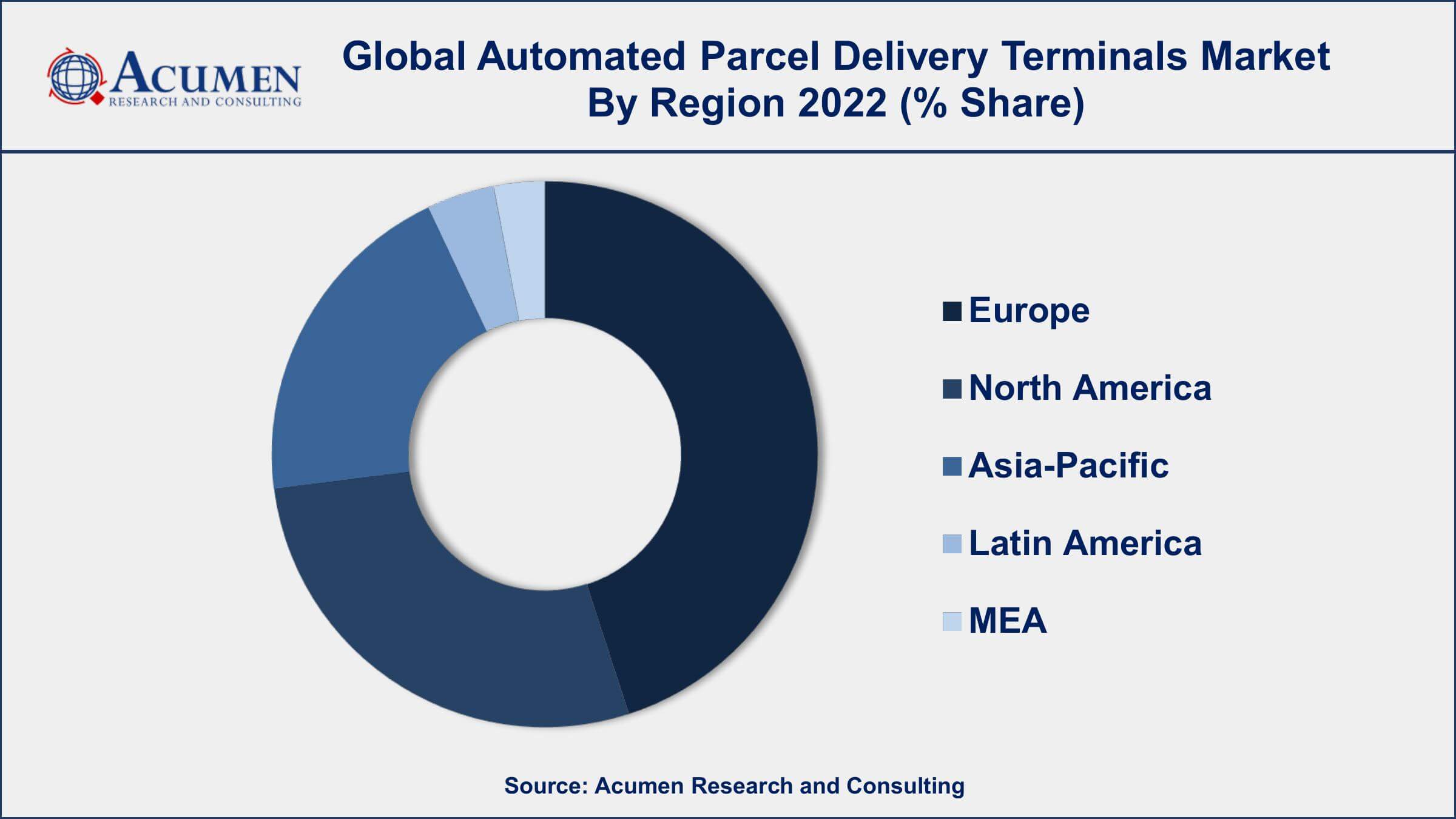

- Europe region led with more than 44% of automated parcel delivery terminals market share in 2022

- According to a survey by McKinsey, nearly 30% of all parcel deliveries in the US and Europe are expected to be made via APDTs by 2025

- According to a report, over 80% of global e-commerce deliveries are expected to be made to urban areas by 2030

- Logistics companies are the largest users of APDTs, accounting for over 50% of the market share, followed by the retail sector

- Some of the leading players in the APDTs market include Cleveron, KEBA AG, Smartbox Ecommerce Solutions Pvt. Ltd., and InPost S.A

- Need for contactless delivery options due to the COVID-19 pandemic, drives the automated parcel delivery terminals market size

Automated Parcel Delivery Terminals (APDTs), also known as automated lockers or parcel lockers, are self-service kiosks that enable the automated storage and retrieval of parcels. They provide a secure, convenient, and efficient way for customers to collect and return their parcels without the need for human interaction. APDTs are typically installed in public areas such as shopping centers, train stations, and residential areas, where customers can access them 24/7. Customers can choose to use APDTs as a delivery option when ordering online, or as a collection point when they are not available to receive deliveries at home.

The global market for APDTs has been growing rapidly in recent years, driven by the increasing demand for e-commerce and the need for efficient last-mile delivery solutions. The automated parcel delivery terminals market growth is being fueled by factors such as the increasing adoption of e-commerce, the need for faster and more efficient delivery options, and the growing demand for contactless delivery solutions due to the COVID-19 pandemic. In addition, the deployment of APDTs can help reduce delivery costs, increase customer satisfaction, and improve operational efficiency for logistics companies. Overall, the market for APDTs is expected to continue to grow in the coming years, driven by the increasing demand for e-commerce and the need for efficient last-mile delivery solutions.

Global Automated Parcel Delivery Terminals Market Trends

Market Drivers

- Increasing demand for e-commerce and online shopping

- Rising consumer expectations for faster and more convenient delivery options

- Need for efficient last-mile delivery solutions

- Advancements in technology and automation

- Need for contactless delivery options due to the COVID-19 pandemic

Market Restraints

- High initial investment costs for installation and maintenance of APDTs

- Limited availability of suitable locations for installation

Market Opportunities

- Expansion of APDT networks in new and emerging markets

- Development of new and innovative APDT technologies, such as smart lockers and temperature-controlled lockers

Automated Parcel Delivery Terminals Market Report Coverage

| Market | Automated Parcel Delivery Terminals Market |

| Automated Parcel Delivery Terminals Market Size 2022 | USD 736 Million |

| Automated Parcel Delivery Terminals Market Forecast 2032 | USD 1,863 Million |

| Automated Parcel Delivery Terminals Market CAGR During 2023 - 2032 | 9.9% |

| Automated Parcel Delivery Terminals Market Analysis Period | 2020 - 2032 |

| Automated Parcel Delivery Terminals Market Base Year | 2022 |

| Automated Parcel Delivery Terminals Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Deployment, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Keba AG, Cleveron Ltd., Neopost group, Winnsen Industry Co., Ltd., ENGY Company, InPost S.A., ByBox Holdings Ltd., Smartbox Ecommerce Solutions Pvt. Ltd., TZ Ltd., and LL OPTIC (Loginpost). |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

An automated parcel delivery terminal is an ultramodern delivery solution, developed to simplify present-day logistic operations. These are the individual units, which are deployed in populated areas such as shopping malls, walkways, grocery outlets, railway stations, etc. These terminals allow the receiver to collect and return the parcel as per their suitability 24/7. Furthermore, e-commerce and cross-border delivery are expected to boost market growth.

The large amount of human interference required in conventional parcel distribution systems can make it difficult to distribute parcels on time to consumers during festivals, holidays, and in bad weather. These failures of orthodox distribution systems, coupled with an increase in the volume of parcels and numbers, have generated the demand for substitute delivery solutions, thereby being the prime factor for the growth in automated parcel delivery terminals and other such delivery systems. Automated parcel delivery terminal offers consistent service to users irrespective of weather and other concerns. This not only facilitates an easy return process for consumers to drop off parcels at the automated parcel delivery terminals but also increases the suitability for delivery services to transport parcels. However, lessening human interference can also create concerns in terms of package security and integrity. The smooth operation and reliability of a supply service that uses automated delivery terminals are more concerned about convenience, hence consumers are more comfortable if the parcel is supplied to their doorstep.

Automated Parcel Delivery Terminals Market Segmentation

The global automated parcel delivery terminals market segmentation is based on deployment, end-user, and geography.

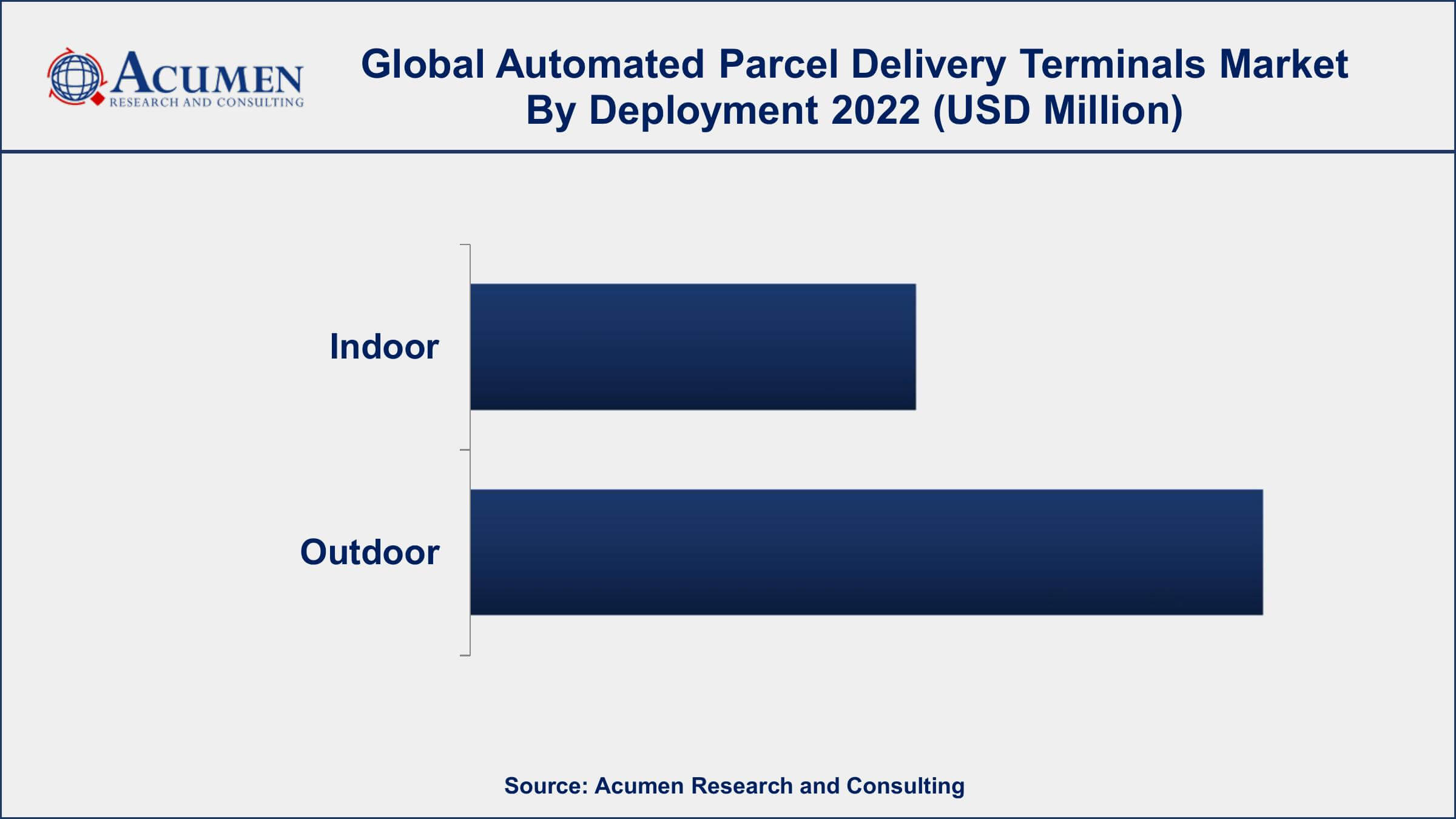

Automated Parcel Delivery Terminals Market By Deployment

- Indoor

- Outdoor

According to an automated parcel delivery terminals industry analysis, the outdoor segment accounted for the largest market share in 2022. The outdoor segment of the market includes APDTs that are installed in public outdoor locations such as shopping centers, train stations, airports, and residential areas. The deployment of APDTs in outdoor settings has gained significant traction in recent years, as it enables customers to access their parcels at their convenience, without the need for human interaction, while also providing a secure and convenient way for logistics companies to deliver parcels. One of the key drivers for the growth of the outdoor segment of the APDTs market is the increasing demand for e-commerce and online shopping. The rise of e-commerce has led to an increase in the volume of parcels being delivered, which has put pressure on traditional delivery methods, such as home delivery and pickup points. By deploying APDTs in outdoor locations, logistics companies can provide customers with a more convenient and flexible delivery option, while also reducing delivery costs.

Automated Parcel Delivery Terminals Market By End-User

- Logistics Companies

- Retail/E-Commerce

- Government

- Others

According to the automated parcel delivery terminals market forecast, the logistics companies segment is expected to grow significantly in the coming years. Logistics companies are increasingly adopting APDTs as a means of improving their delivery efficiency, reducing delivery costs, and enhancing customer satisfaction. The deployment of APDTs by logistics companies also provides a number of other benefits, such as improved operational efficiency, reduced delivery times, and enhanced customer satisfaction. By providing customers with a secure and convenient way to collect and return their parcels, logistics companies can improve their overall delivery experience and build customer loyalty. The rise of e-commerce has led to an increase in the volume of parcels being delivered, which has put pressure on logistics companies to provide more efficient and cost-effective delivery solutions.

Automated Parcel Delivery Terminals Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automated Parcel Delivery Terminals Market Regional Analysis

Europe is currently dominating the Automated Parcel Delivery Terminals (APDTs) market, accounting for a significant share of the global market. One of the key factors is the high level of e-commerce adoption in Europe. Europe has one of the highest e-commerce penetration rates in the world, with a large and growing number of consumers shopping online. This has created a significant demand for efficient and convenient delivery options, such as APDTs, which can provide customers with a secure and convenient way to collect and return their parcels.

Another factor is the supportive regulatory environment in Europe. European governments and regulatory bodies have been actively promoting the adoption of APDTs, with initiatives such as the European Commission's Action Plan for the development of parcel delivery services. This has helped to create a favorable business environment for APDT providers, enabling them to develop and deploy their solutions more effectively. Additionally, Europe has a well-developed logistics infrastructure and a high level of technological advancement, which has enabled the rapid deployment of APDTs across the region.

Automated Parcel Delivery Terminals Market Player

Some of the top automated parcel delivery terminals market companies offered in the professional report includes Keba AG, Cleveron Ltd., Neopost group, Winnsen Industry Co., Ltd., ENGY Company, InPost S.A., ByBox Holdings Ltd., Smartbox Ecommerce Solutions Pvt. Ltd., TZ Ltd., and LL OPTIC (Loginpost).

Frequently Asked Questions

How big is the automated parcel delivery terminals market?

The automated parcel delivery terminals market size was USD 736 Million in 2022.

What is the CAGR of the global automated parcel delivery terminals market during forecast period of 2023 to 2032?

The CAGR of automated parcel delivery terminals market is 9.9% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global automated parcel delivery terminals market are Keba AG, Cleveron Ltd., Neopost group, Winnsen Industry Co., Ltd., ENGY Company, InPost S.A., ByBox Holdings Ltd., Smartbox Ecommerce Solutions Pvt. Ltd., TZ Ltd., and LL OPTIC (Loginpost).

Which region held the dominating position in the global automated parcel delivery terminals market?

Europe held the dominating position in automated parcel delivery terminals market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for automated parcel delivery terminals market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automated parcel delivery terminals market?

The current trends and dynamics in the automated parcel delivery terminals industry include the increasing demand for e-commerce and online shopping.

Which deployment held the maximum share in 2022?

The outdoor deployment held the maximum share of the automated parcel delivery terminals market.