Automated Microbial Identification Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Automated Microbial Identification Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

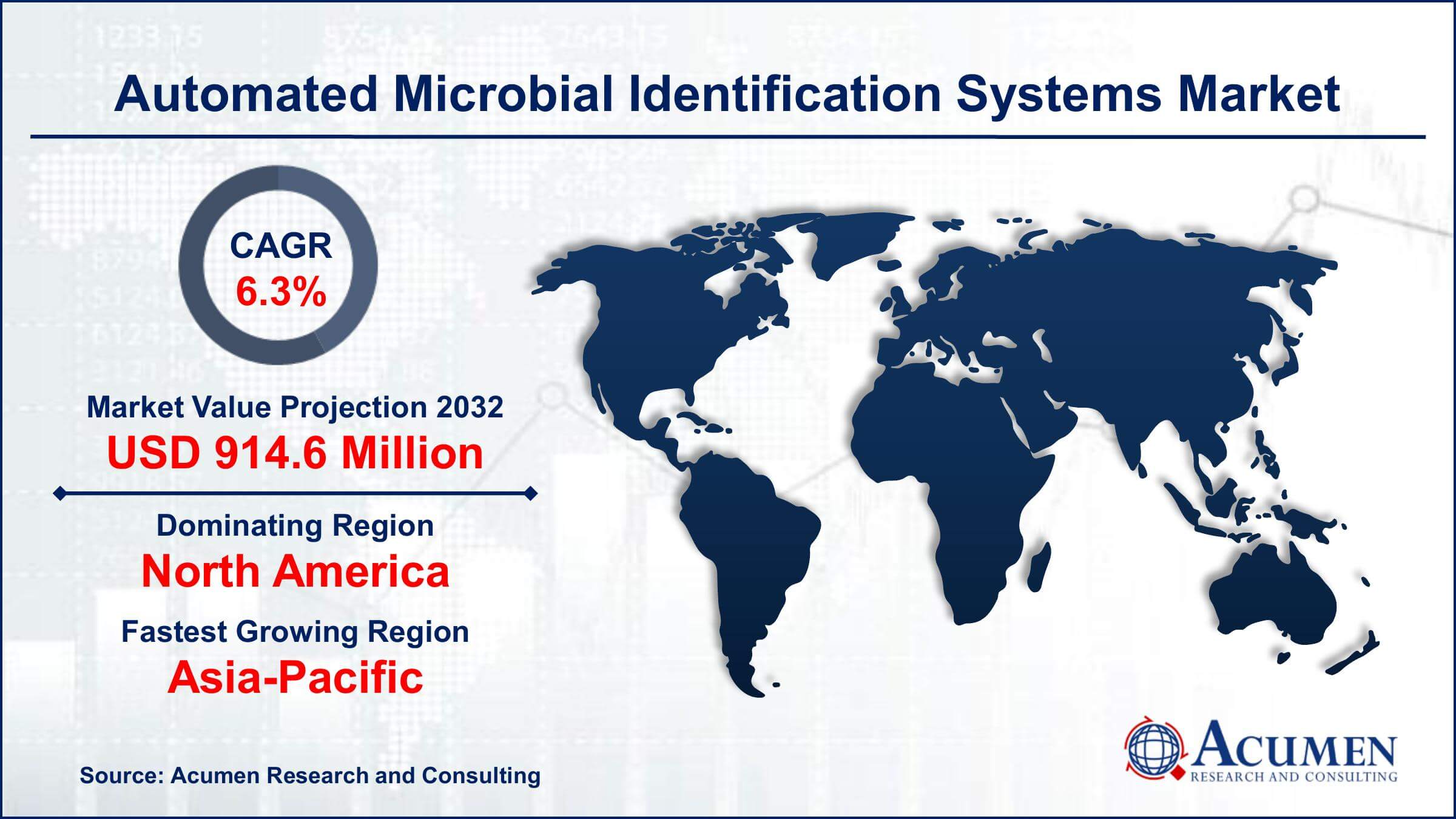

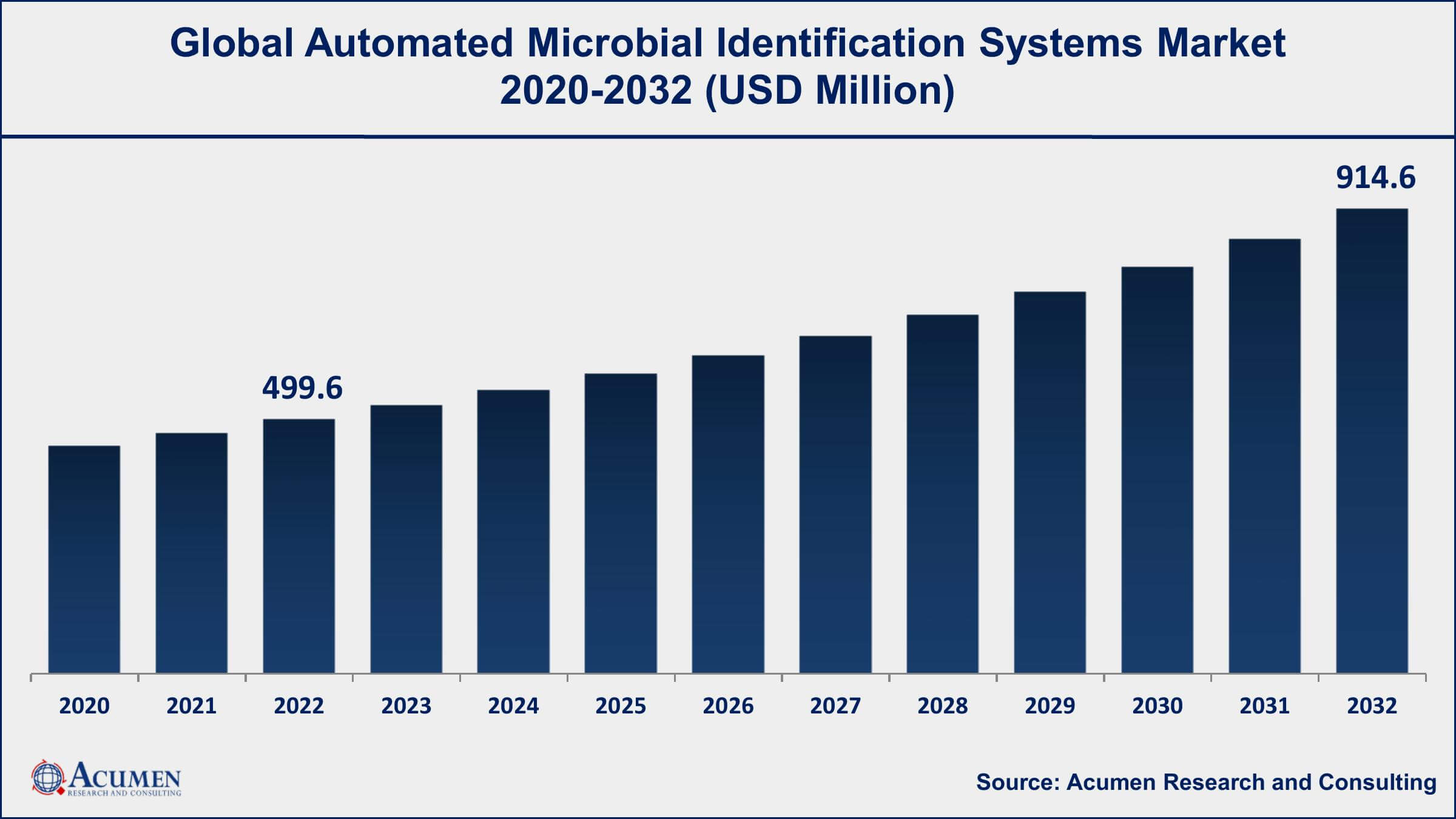

The Global Automated Microbial Identification Systems Market Size accounted for USD 499.6 Million in 2022 and is projected to achieve a market size of USD 914.6 Million by 2032 growing at a CAGR of 6.3% from 2023 to 2032.

Automated Microbial Identification Systems Market Key Highlights

- Global automated microbial identification systems market revenue is expected to increase by USD 914.6 Million by 2032, with a 6.3% CAGR from 2023 to 2032

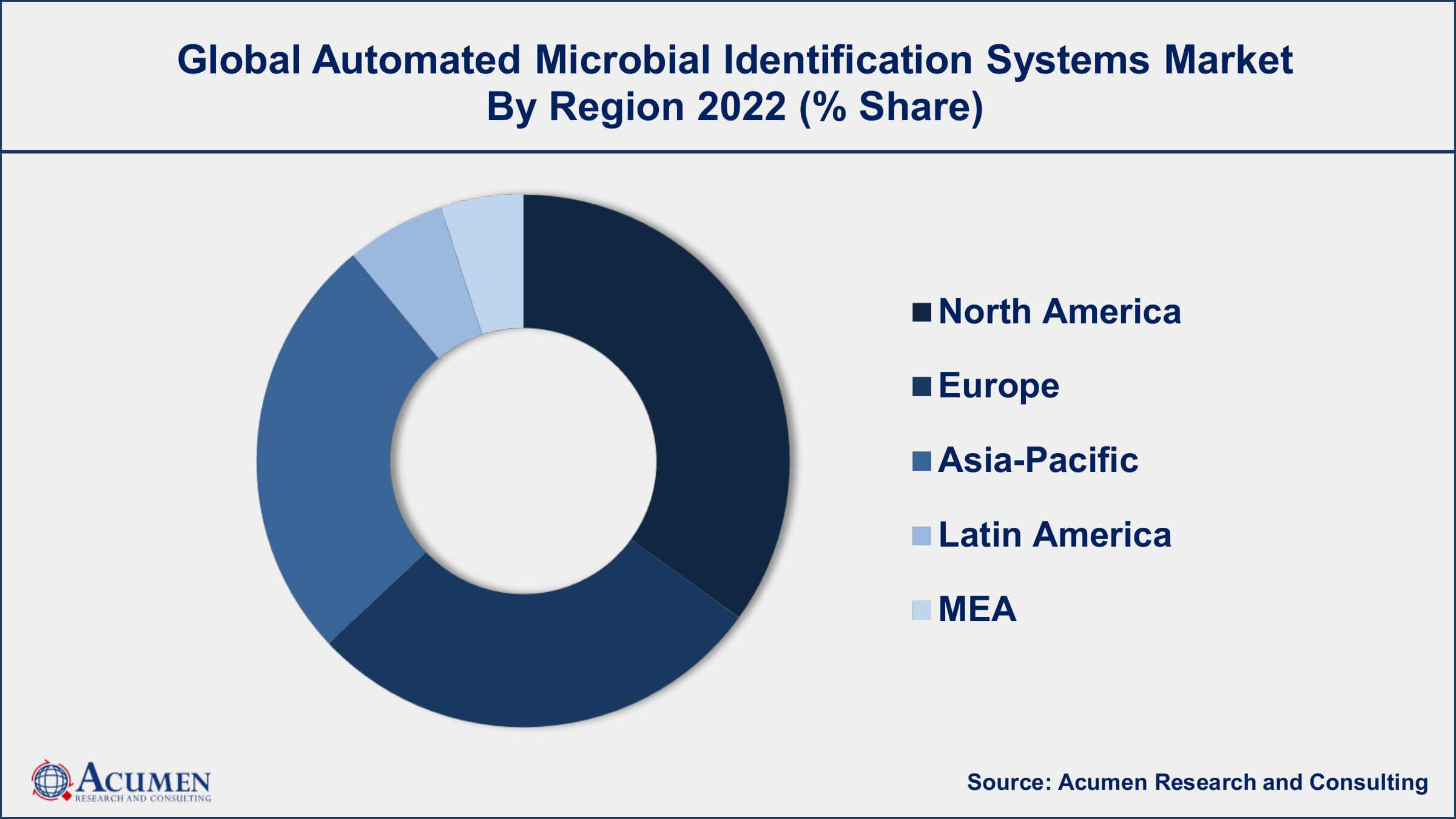

- North America region led with more than 44% of automated microbial identification systems market share in 2022

- Asia-Pacific region is expected to witness significant growth in the coming years

- One study found that the use of an automated microbial identification system resulted in a 20% decrease in hospital-acquired infections

- In a study published in the Journal of Clinical Microbiology, the MALDI-TOF system was found to have a sensitivity of 92.7% and a specificity of 96.6% for identifying gram-negative bacteria

- Some of the key players in the market include bioMérieux SA, Bruker Corporation, Thermo Fisher Scientific Inc., and Becton, Dickinson and Company

- Increasing prevalence of infectious diseases, drives the automated microbial identification systems market value

Automated microbial identification systems refer to the technological solutions that enable the rapid and accurate identification of microorganisms, such as bacteria, viruses, fungi, and parasites. These systems use various technologies such as mass spectrometry, PCR, and flow cytometry to analyze the genetic and biochemical properties of microorganisms and generate reliable identification results. Automated microbial identification systems are widely used in clinical laboratories, hospitals, research institutes, and biopharmaceutical and biotechnology companies to diagnose infectious diseases, monitor food safety, and develop new therapeutics.

The global automated microbial identification systems market has been experiencing significant growth in recent years, and this trend is expected to continue in the coming years. The market growth is driven by several factors such as the increasing prevalence of infectious diseases, rising demand for faster and more accurate diagnostic solutions, and the growing awareness of food safety regulations. Moreover, the advent of advanced technologies such as mass spectrometry and PCR has enabled the development of more efficient and accurate automated microbial identification systems, further fueling market growth.

Global Automated Microbial Identification Systems Market Trends

Market Drivers

- Increasing prevalence of infectious diseases

- Rising demand for faster and accurate diagnostic solutions

- Growing awareness of food safety regulations

- Increasing government funding for research and development activities

Market Restraints

- High cost of automated microbial identification systems

- Lack of skilled professionals to operate these systems

Market Opportunities

- Integration of artificial intelligence and machine learning technologies in microbial identification systems

- Increasing focus on personalized medicine and companion diagnostics

Automated Microbial Identification Systems Market Report Coverage

| Market | Automated Microbial Identification Systems Market |

| Automated Microbial Identification Systems Market Size 2022 | USD 499.6 Million |

| Automated Microbial Identification Systems Market Forecast 2032 | USD 914.6 Million |

| Automated Microbial Identification Systems Market CAGR During 2023 - 2032 | 6.3% |

| Automated Microbial Identification Systems Market Analysis Period | 2020 - 2032 |

| Automated Microbial Identification Systems Market Base Year | 2022 |

| Automated Microbial Identification Systems Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Technology, By End-user, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Thermo Fisher Scientific Inc., bioMérieux SA, Becton, Dickinson and Company, Danaher Corporation, Bruker Corporation, Merck KGaA, Shimadzu Corporation, QIAGEN N.V., Biolog, Inc., Genewiz, Inc., Charles River Laboratories International, Inc., and Eurofins Scientific SE. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automated microbial identification systems were introduced to identify microorganisms through automated instruments for clinical purposes. They are widely accepted and helpful in healthcare sectors; these instruments are used in clinical chemistry and hematology laboratories for decades and are evolving continuously for better advancement to accomplish clinical microbiological laboratories' purposes. Therefore, with the rising growth in the healthcare sector, the automated microbial identification systems market is anticipated to foresee rapid growth opportunities.

The increasing food safety concerns, initiatives by the government to encourage the use of microbial identification systems, and the occurrence of infectious diseases are the major factors fueling the market growth. However, automated microbial identification systems are expensive which results in restricting the growth of this market. The growing use of microbial identification for infectious disease diagnosis in humans and animals is anticipated to raise the growth of this market.

Automated Microbial Identification Systems Market Segmentation

The global automated microbial identification systems market segmentation is based on product type, technology, end-user, and geography.

Automated Microbial Identification Systems Market By Product Type

- Instruments

- Consumables

- Services

According to the automated microbial identification systems industry analysis, the instruments segment accounted for the largest market share in 2022. The segment comprises various instruments used for microbial identification, such as mass spectrometry, PCR systems, flow cytometry systems, and others. Mass spectrometry is one of the most widely used technologies for automated microbial identification, and the mass spectrometry segment is expected to witness significant growth in the coming years due to its high accuracy and speed. The increasing adoption of MALDI-TOF technology in clinical laboratories and hospitals is expected to drive the growth of the mass spectrometry segment. The PCR systems segment is also expected to witness significant growth in the coming years due to the increasing demand for real-time PCR and digital PCR technologies for microbial identification. The development of multiplex PCR assays for the simultaneous identification of multiple microorganisms is expected to further boost the growth of the PCR systems segment.

Automated Microbial Identification Systems Market By Technology

- PCR-based Systems

- Mass Spectrometry Systems

- Flow Cytometry Systems

- Others

In terms of technologies, the PCR-based systems segment is expected to witness significant growth in the coming years. PCR (polymerase chain reaction) is a widely used technology for the identification of microorganisms, and PCR-based systems offer several advantages such as high accuracy, sensitivity, and specificity. Real-time PCR technology is gaining popularity in clinical laboratories and hospitals for the rapid identification of microorganisms. The real-time PCR segment is expected to witness significant growth in the coming years due to its ability to provide accurate and reliable results within a short period of time. The digital PCR technology is also gaining traction in the market due to its ability to detect rare and low abundance microorganisms. The digital PCR segment is expected to witness significant growth in the coming years due to the increasing demand for high-throughput microbial identification solutions.

Automated Microbial Identification Systems Market By End-user

- Clinical Laboratories

- Hospitals

- Research and Academic Institutes

- Biopharmaceutical and Biotechnology Companies

- Others

According to the automated microbial identification systems market forecast, the hospital segment is expected to witness significant growth in the coming years. The increasing prevalence of infectious diseases and the growing demand for faster and more accurate diagnostic solutions are driving the demand for automated microbial identification systems in hospitals. Automated microbial identification systems offer several advantages such as high accuracy, speed, and reliability, which are crucial for the diagnosis and treatment of infectious diseases. Moreover, the integration of these systems with electronic health records (EHR) and laboratory information systems (LIS) enables the efficient management of patient data and improves the overall workflow efficiency in hospitals. The increasing adoption of MALDI-TOF technology in clinical laboratories and hospitals is expected to further boost the growth of the hospital segment.

Automated Microbial Identification Systems Market Regional Outlook

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automated Microbial Identification Systems Market Regional Analysis

North America is dominating the automated microbial identification systems market due to various factors such as the presence of established healthcare infrastructure, increased funding for research and development, and the high prevalence of infectious diseases in the region. The United States is the largest market for automated microbial identification systems in North America, driven by the increasing demand for advanced diagnostic and treatment methods. The market is also being driven by the growing adoption of automated technologies in microbiology laboratories, which is helping to reduce errors and increase efficiency. Another reason for the dominance of North America in the automated microbial identification systems market growth is the presence of key market players in the region. Many leading companies in this space, such as Thermo Fisher Scientific Inc., Becton, Dickinson and Company, and Bruker Corporation, are headquartered in North America. These companies are investing heavily in research and development to create new and innovative products that can cater to the growing demand for automated microbial identification systems in the region.

Automated Microbial Identification Systems Market Player

Some of the top automated microbial identification systems market companies offered in the professional report include Thermo Fisher Scientific Inc., bioMérieux SA, Becton, Dickinson and Company, Danaher Corporation, Bruker Corporation, Merck KGaA, Shimadzu Corporation, QIAGEN N.V., Biolog, Inc., Genewiz, Inc., Charles River Laboratories International, Inc., and Eurofins Scientific SE.

Frequently Asked Questions

What was the market size of the global automated microbial identification systems in 2022?

The market size of automated microbial identification systems was USD 499.6 Million in 2022.

What is the CAGR of the global automated microbial identification systems market from 2023 to 2032?

The CAGR of automated microbial identification systems is 6.3% during the analysis period of 2023 to 2032.

Which are the key players in the automated microbial identification systems market?

The key players operating in the global market are including Thermo Fisher Scientific Inc., bioM�rieux SA, Becton, Dickinson and Company, Danaher Corporation, Bruker Corporation, Merck KGaA, Shimadzu Corporation, QIAGEN N.V., Biolog, Inc., Genewiz, Inc., Charles River Laboratories International, Inc., and Eurofins Scientific SE.

Which region dominated the global automated microbial identification systems market share?

North America held the dominating position in automated microbial identification systems industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of automated microbial identification systems during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automated microbial identification systems industry?

The current trends and dynamics in the automated microbial identification systems industry include increasing prevalence of infectious diseases, and rising demand for faster and accurate diagnostic solutions.

Which technology held the maximum share in 2022?

The PCR-based systems technology held the maximum share of the automated microbial identification systems industry.