Automated Material Handling Machinery Market | Acumen Research and Consulting

Automated Material Handling Machinery Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

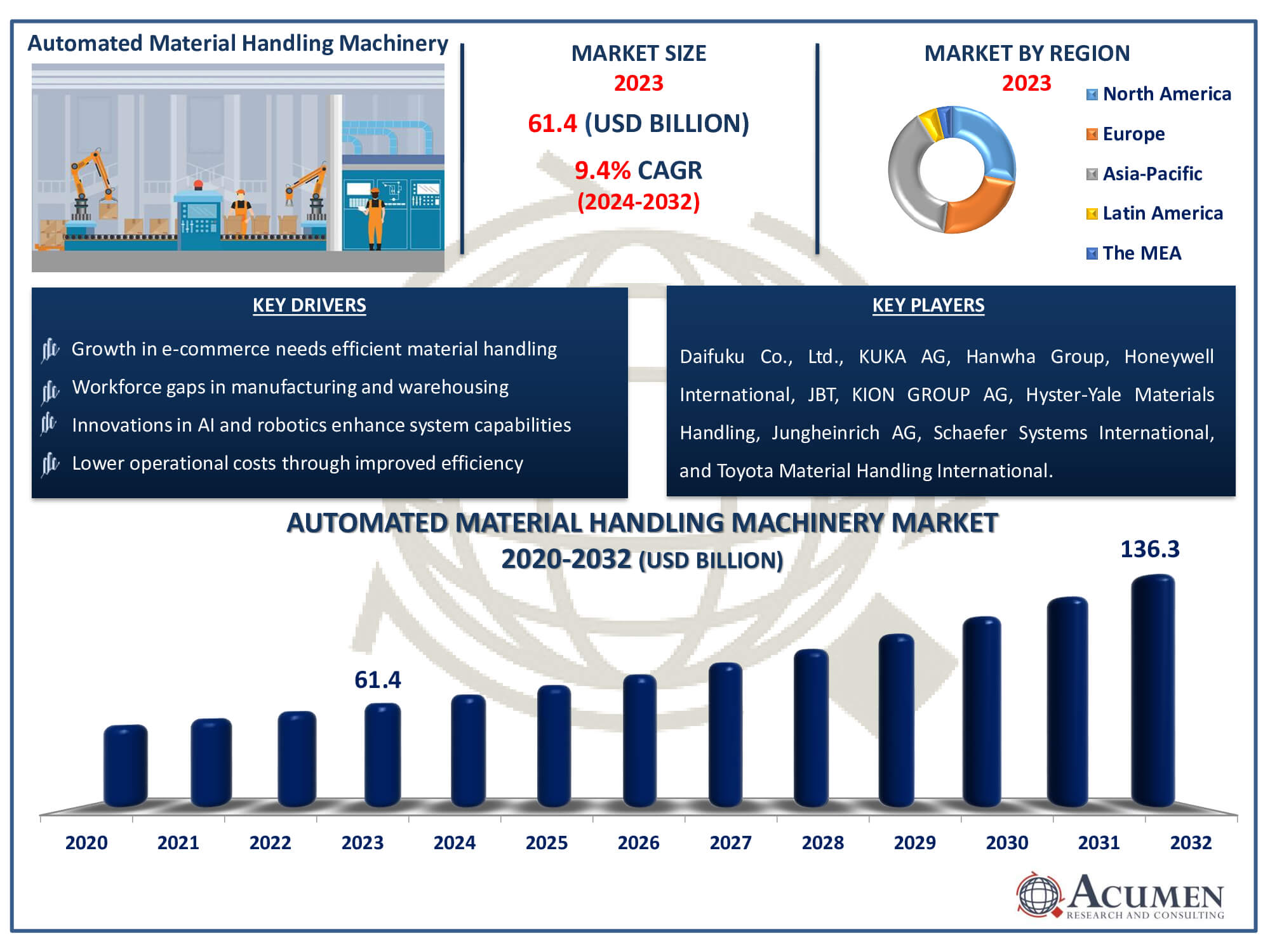

The Automated Material Handling Machinery Market Size accounted for USD 61.4 Billion in 2023 and is estimated to achieve a market size of USD 136.3 Billion by 2032 growing at a CAGR of 9.4% from 2024 to 2032.

Automated Material Handling Machinery Market Highlights

- The global automated material handling machinery market is projected to reach USD 136.3 billion by 2032, growing at a CAGR of 9.4% from 2024 to 2032

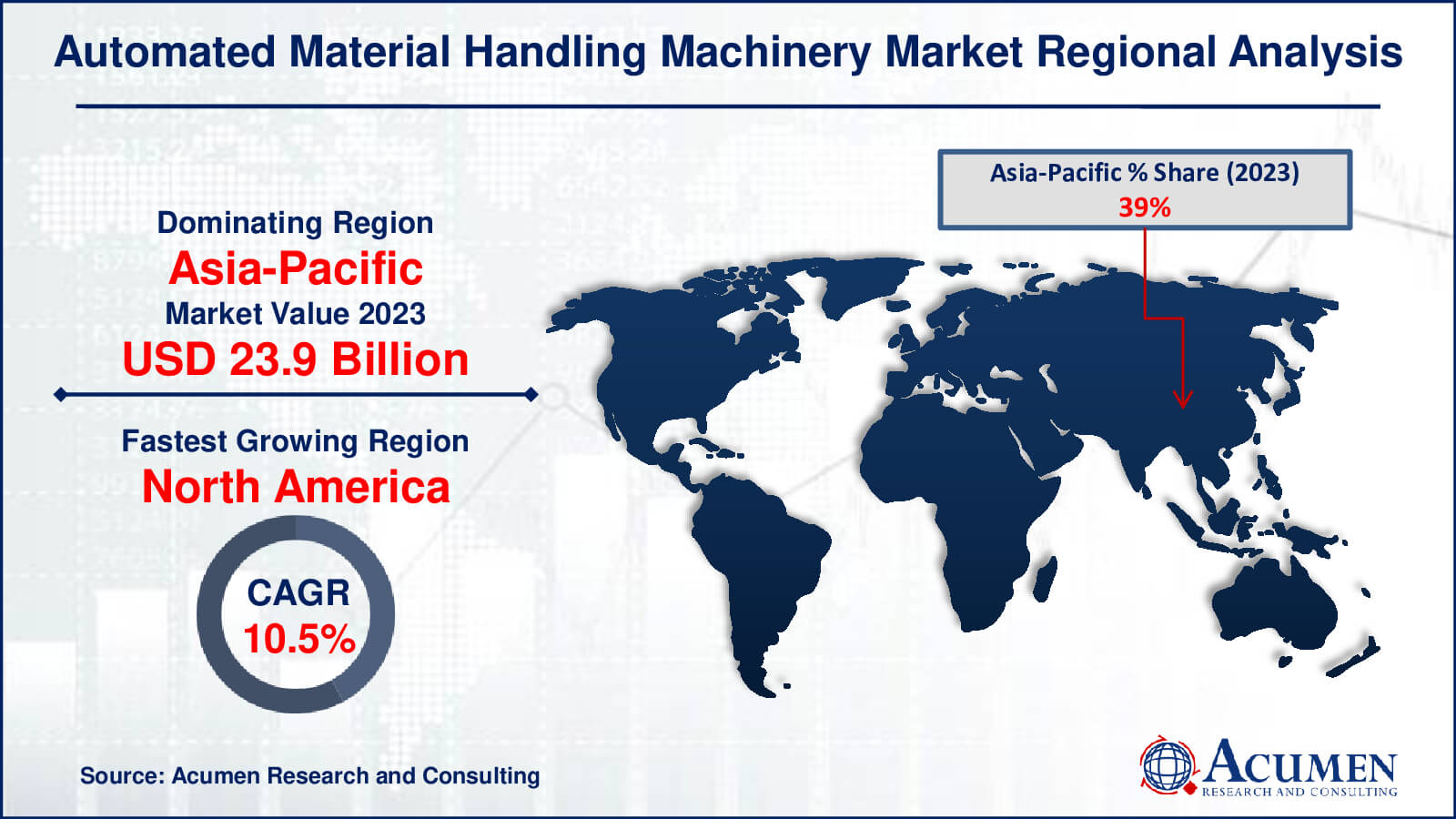

- The Asia-Pacific automated material handling machinery market was valued at USD 23.9 billion in 2023

- North America automated material handling machinery market is expected to grow at a CAGR of 10.5% from 2024 to 2032

- Based on product, the automated storage and retrieval system (AS/RS) occupied significant revenue in 2023

- The unit load material handling application held around 60% share in the automated material handling machinery market in 2023

- Integration of internet of things (IoT) technologies to enable real-time data monitoring and predictive maintenance is a key trend in the automated material handling machinery market, boosting industry growth

Automated material handling (AMH) machinery refers to equipment and systems that can handle, transfer, store, and manage items with little human interaction. These systems use a variety of technologies, including automated storage and retrieval systems (AS/RS), conveyor systems, robots, automated guided vehicles (AGVs), and automated cranes. AMH machinery is used in a variety of industries to improve efficiency, accuracy, and safety during operations. These systems automate material handling activities, reducing the need for manual labor, minimizing errors, and optimizing the flow of items throughout manufacturing plants, warehouses, and distribution centers.

The deployment of AMH machinery provides numerous benefits to enterprises. It improves operational efficiency by speeding up activities including sorting, storing, and transferring items, resulting in speedier order fulfillment and better supply chain management. Furthermore, automation improves safety by lowering the likelihood of injuries related with manual material handling operations. Automated systems' precision and consistency contribute to improved inventory control and lower operational expenses. As industries evolve and the demand for faster, more dependable material handling solutions grows, the use of AMH technology is projected to increase dramatically.

Global Automated Material Handling Machinery Market Dynamics

Market Drivers

- Growth in e-commerce increases need for efficient material handling

- Automation addresses workforce gaps in manufacturing and warehousing

- Innovations in AI and robotics enhance system capabilities

- Lower operational costs through improved efficiency and reduced errors

Market Restraints

- Significant upfront costs deter small and medium enterprises

- Challenges in integrating with existing systems and processes

- Ongoing maintenance and technical support can be costly

Market Opportunities

- Growing industrialization and infrastructure development in emerging markets

- Automation reduces waste and enhances energy efficiency

- Increasing need for tailored solutions for specific industry requirements

Automated Material Handling Machinery Market Report Coverage

| Market | Automated Material Handling Machinery Market |

| Automated Material Handling Machinery Market Size 2022 | USD 61.4 Billion |

| Automated Material Handling Machinery Market Forecast 2032 | USD 136.3 Billion |

| Automated Material Handling Machinery Market CAGR During 2023 - 2032 | 9.4% |

| Automated Material Handling Machinery Market Analysis Period | 2020 - 2032 |

| Automated Material Handling Machinery Market Base Year |

2022 |

| Automated Material Handling Machinery Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By System Type, By Application, By Industry Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Daifuku Co., Ltd., Hanwha Group, Honeywell International Inc., Hyster-Yale Materials Handling, Inc., JBT, Jungheinrich AG, KION GROUP AG, KUKA AG, Schaefer Systems International, Inc., and Toyota Material Handling International. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automated Material Handling Machinery Market Insights

The automated material handling (AMH) machinery market is primarily driven by the rapid expansion of e-commerce and the rising demand for effective material handling solutions. As the popularity of online shopping grows, businesses need faster and more dependable inventory management and order fulfillment solutions. This has resulted in a major increase in the use of automated technology such automated storage and retrieval systems (AS/RS), conveyor systems, and robots. Furthermore, labor shortages and the need to cut operational costs are driving businesses to engage in automation. Automated systems can run constantly without weariness, eliminating the need for manual labor and increasing overall output.

However, the automated material handling equipment market faces some constraints that may impede its expansion. High initial investment expenses pose a significant obstacle, particularly for small and medium-sized businesses. These businesses frequently struggle to justify the initial costs of complex automated systems, despite the long-term benefits. Furthermore, integrating new automated gear into existing infrastructure can be complex and difficult. Companies may have difficulty synchronizing new systems with their existing procedures and technology, resulting in possible operational disruptions. Furthermore, the continuous maintenance and technical assistance necessary for these advanced systems can be costly, increasing the overall cost of ownership. All of these issues are projected to limit the growth of the automated material handling equipment market.

Despite these challenges, the AMH machinery market offers numerous attractive opportunities. The rise of industrialization and infrastructural development in emerging regions is driving up demand for automated material handling technologies. Companies in these regions are increasingly using automation to improve operational efficiency and fulfill growing market demands. Furthermore, sustainability goals are accelerating the adoption of automated technologies that decrease waste and increase energy efficiency. There is also an increasing demand for customized solutions adapted to specific sector requirements, which presents opportunity for businesses to develop and offer specialized products and services. As businesses evolve, the demand for innovative, dependable, and efficient material handling machinery is predicted to rise, fueling additional AMH machinery market growth.

Automated Material Handling Machinery Market Segmentation

The worldwide market for automated material handling machinery is split based on product type, system type, application, industry vertical, and geography.

Automated Material Handling (AMH) Machinery Market By Product Type

- Automated Storage and Retrieval System (AS/RS)

- Unit Load AS/RS

- Mini Load AS/RS

- Vertical Lift Modules (VLMs)

- Horizontal Carousels

- Vertical Carousels

- Automated Conveyor & Sortation Systems

- Belt Conveyors

- Roller Conveyors

- Pallet Conveyors

- Sortation Systems

- Robots

- Articulated Robots

- Gantry Robots

- Autonomous Mobile Robots (AMRs)

- Automated Guided Vehicles (AGVs)

- Automated Cranes

- Bridge Cranes

- Gantry Cranes

- Jib Cranes

- Automated Transport Systems

- Automated Forklifts

- Pallet Trucks

According to the automated material handling machinery industry analysis, the automated storage and retrieval systems (AS/RS) product category has dominated the market. AS/RS systems are widely valued for their capacity to greatly improve storage efficiency, optimize space use, and increase throughput in warehouses and distribution centers. Unit load and mini load systems are particularly popular in the AS/RS category, as they provide flexibility and scalability for a wide range of industrial applications. AS/RS demand has increased in tandem with the rise of e-commerce and the requirement for quick, accurate order fulfillment, making it an essential component of modern automated material handling solutions.

Automated Material Handling (AMH) Machinery Market By System Type

- Unit Load Material Handling

- Bulk Load Material Handling

Unit load material handling systems have dominated the automated material handling (AMH) machinery industry. This dominance is primarily driven by the growing demand for efficient and precise handling of individual units, such as pallets and containers, across a variety of industries, including e-commerce, automotive, and food and beverage. Unit load systems are extremely effective in optimizing space use and streamlining warehouse operations, making them perfect for modern supply chain management. They enable improved inventory control, faster retrieval times, and lower labor expenses. As companies prioritize accuracy and speed while handling materials, the use of unit load systems grows, cementing their position as the leading system type in the AMH machinery industry.

Automated Material Handling (AMH) Machinery Market By Application

- Assembly

- Distribution

- Transportation

- Packaging

- Others

According to the automated material handling machinery market projection, distribution has emerged as the most important application. This sector includes the movement, storage, and retrieval of items in warehouses and distribution facilities, which is critical for addressing the growing demands of global supply chains and e-commerce fulfillment. Automated systems such as conveyor and sortation systems, automated storage and retrieval systems (AS/RS), and autonomous mobile robots (AMRs) are critical in increasing operational efficiency, accuracy, and throughput in distribution operations. The growing demand for rapid order fulfillment and inventory management has accelerated the implementation of AMH solutions in distribution, resulting in market growth. As businesses strive to improve their logistics networks and minimize lead times, the use of automated material handling technology in distribution settings grows, bolstering its position in the AMH machinery market.

Automated Material Handling (AMH) Machinery Market By Industry Vertical

- Automotive

- Food & Beverage

- Retail & E-commerce

- Healthcare & Pharmaceuticals

- Aerospace

- Logistics & Warehousing

- Chemicals

- Electronics & Semiconductors

- Others

The retail and e-commerce industry vertical has emerged as the leading sector. This increase is being driven by the rapid expansion of online retail platforms, as well as rising consumer demand for fast and precise order delivery. Retailers and e-commerce businesses need effective material handling technologies to manage enormous volumes of various products, optimize warehouse space, and improve delivery operations. Automated systems, including automated conveyor and sortation systems, robots, and AS/RS, play an important role in addressing these needs by improving speed, accuracy, and operating efficiency. As the e-commerce landscape continues to expand internationally, investments in AMH machinery within the retail & e-commerce sector are projected to stay strong, strengthening its position as the dominant industry vertical in the AMH machinery market.

Automated Material Handling Machinery Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automated Material Handling Machinery Market Regional Analysis

Asia-Pacific is the largest revenue-generating region in the worldwide steel casting market, owing to fast industrialization, infrastructural development, and the presence of significant manufacturing centers in countries such as China, India, and Japan. The region benefits from large investments in industries including automotive, construction, and industrial machinery, all of which rely significantly on steel castings in their manufacturing processes. Asia-Pacific's dominance is further strengthened by rapid urbanization and consumer demand, which drives the demand for strong and durable steel components in a wide range of applications.

Meanwhile, North America is expected to have significant expansion in the steel casting market over the forecast period. This expansion is being driven by technological breakthroughs, particularly in the automobile, aerospace, and energy sectors. The region's emphasis on innovation and sustainability in industrial processes promotes the use of modern steel casting techniques. North America also has a significant presence of key businesses and a well-established industrial base, which supports ongoing technological developments and product development in steel casting applications.

Europe, on the other hand, remains a critical region, distinguished by high quality standards, innovative industrial skills, and a focus on sustainable practices. The European steel casting market is driven by a variety of industries, including automotive, aerospace, and machinery manufacture. Manufacturers in Europe use sophisticated casting processes and strong regulatory frameworks to assure high-quality production and environmental compliance.

Automated Material Handling Machinery Market Players

Some of the top automated material handling machinery companies offered in our report includes Daifuku Co., Ltd., Hanwha Group, Honeywell International Inc., Hyster-Yale Materials Handling, Inc., JBT, Jungheinrich AG, KION GROUP AG, KUKA AG, Schaefer Systems International, Inc., and Toyota Material Handling International.

Frequently Asked Questions

How big is the automated material handling machinery market?

The automated material handling machinery market size was valued at USD 61.4 billion in 2023.

What is the CAGR of the global automated material handling machinery market from 2024 to 2032?

The CAGR of automated material handling machinery industry is 9.4% during the analysis period of 2024 to 2032.

Which are the key players in the automated material handling machinery market?

The key players operating in the global market are including Daifuku Co., Ltd., Hanwha Group, Honeywell International Inc., Hyster-Yale Materials Handling, Inc., JBT, Jungheinrich AG, KION GROUP AG, KUKA AG, Schaefer Systems International, Inc., and Toyota Material Handling International.

Which region dominated the global automated material handling machinery market share?

Asia-Pacific held the dominating position in automated material handling machinery industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of automated material handling machinery during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global automated material handling machinery industry?

The current trends and dynamics in the automated material handling machinery market include growth in e-commerce increases need for efficient material handling, automation addresses workforce gaps in manufacturing and warehousing, innovations in AI and robotics enhance system capabilities, and lower operational costs through improved efficiency and reduced errors.

Which type held the maximum share in 2023?

The automated storage and retrieval systems (AS/RS) held the maximum share of the automated material handling machinery industry.