Audiology Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 � 2030

Published :

Report ID:

Pages :

Format :

Audiology Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 � 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

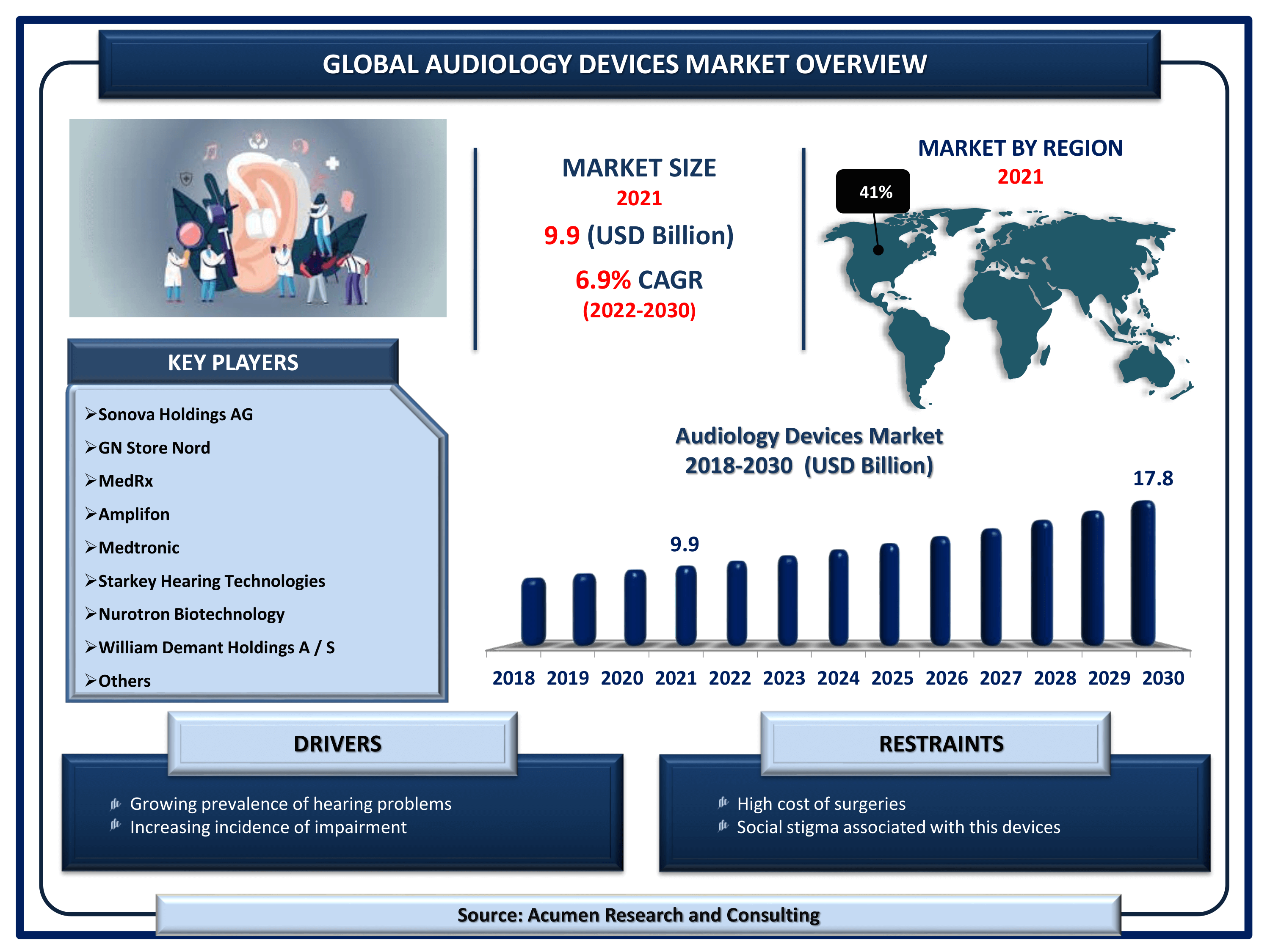

The Global Audiology Devices Market Size accounted for USD 9.9 Billion in 2021 and is estimated to garner a market size of USD 17.8 Billion by 2030 rising at a CAGR of 6.9% from 2022 to 2030. The growing incidence of hearing impairment is a primary aspect that is fueling the global audiology devices market revenue. In addition, the rapidly rising innovation in product development is a popular audiology devices market trend that is bolstering the industry growth.

Audiology Devices Market Report Key Highlights

- Global audiology devices market revenue is estimated to reach USD 17.8 Billion by 2030 with a CAGR of 6.9% from 2022 to 2030

- North America audiology devices market share accounted for over 41% shares in 2021

- According to Centers for Disease Control and Prevention (CDC) data, 1 to 3 children among every 1,000 suffer from hearing loss

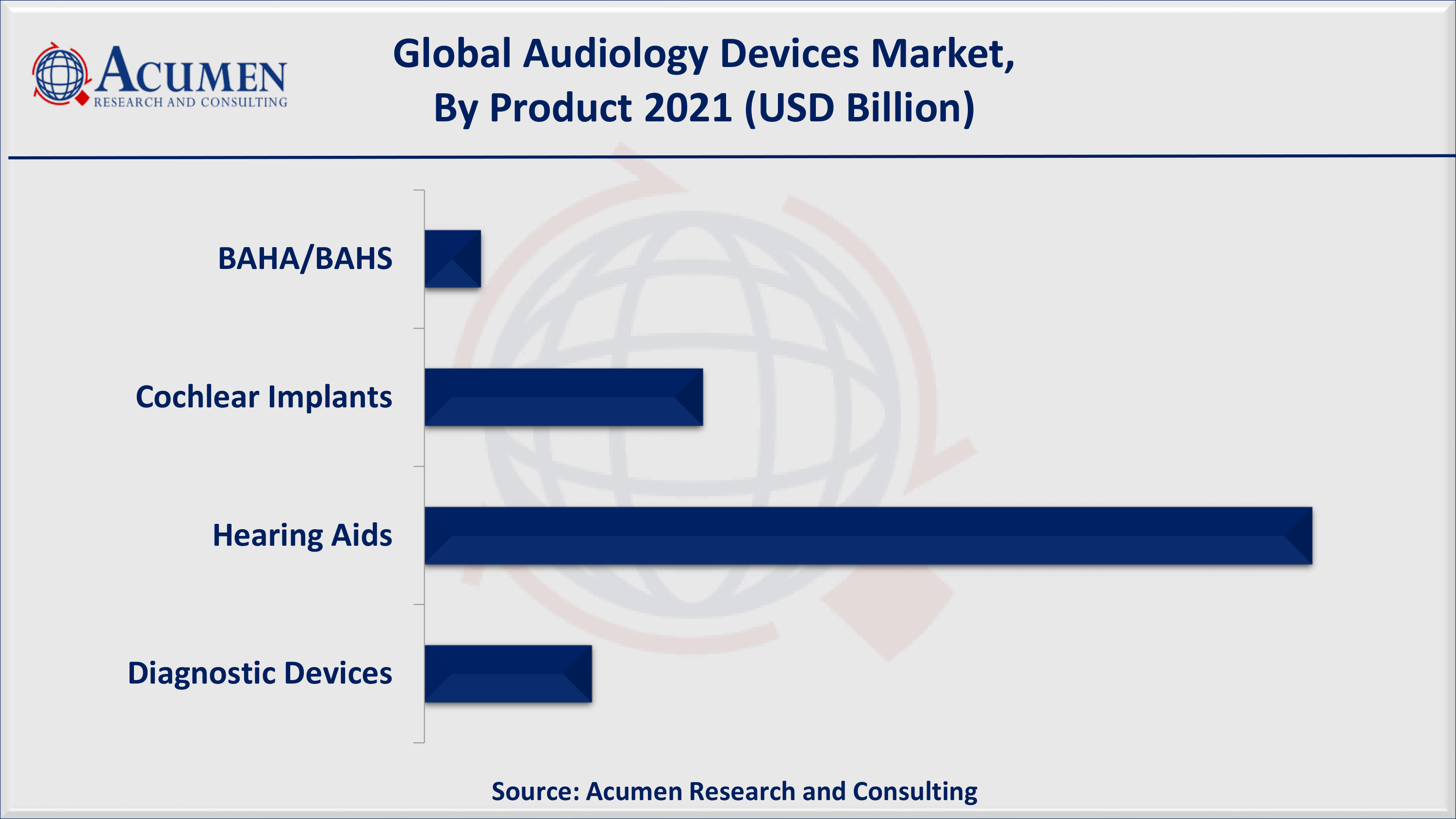

- Based on product, hearing aids accounted for over 60% of the overall market share in 2021

- Asia-Pacific audiology devices market growth will record fastest CAGR from 2022 to 2030

- Rising cases of age related hearing problems propels the global audiology devices market value

Audiology equipment is an electronic instrument for the diagnosis and treatment of impaired hearing. For instance, the congenital audition issue and nerve deafness, these instruments are very efficient. Three Products of hearing loss are sensorineural, conductive, and blended, and are organized into mild, severe, moderate, and deep according to severity. Audiological devices take on importance throughout the globe because the correspondence is the most important know-how that improves links and maintains independence. On the contrary, the elevated costs connected with the appearance of audiological instruments for alternatives used in surgeries and social stigma function as important restrictions for this industry. Nevertheless, the untapped possibilities for players in developing nations, such as Brazil, China, and India, and increasing health awareness are important opportunities for players to gain momentum in the worldwide audiology industry.

Global Audiology Devices Market Dynamics

Market Drivers

- Growing prevalence of hearing problems

- Rising base of elderly population

- Surging noise pollution

Market Restraints

- High cost of surgeries

- Social stigma associated with this devices

Market Opportunities

- Technological advancement in the products

- Favorable regulatory scenarios in developed regions

Audiology Devices Market Report Coverage

| Market | Audiology Devices Market |

| Audiology Devices Market Size 2021 | USD 9.9 Billion |

| Audiology Devices Market Forecast 2030 | USD 17.8 Billion |

| Audiology Devices Market CAGR During 2022 - 2030 | 6.9% |

| Audiology Devices Market Analysis Period | 2018 - 2030 |

| Audiology Devices Market Base Year | 2021 |

| Audiology Devices Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By Technology, By Sales Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Sonova Holdings AG, GN Store Nord, MedRx, Amplifon, Medtronic, Starkey Hearing Technologies, Nurotron Biotechnology, William Demant Holdings A / S, Widex A / S, Phonak, and Audioscan. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Audiology Devices Market Dynamics

The global audiology devices sector is driven by a growing geriatric population worldwide combined with a huge rise in hearing loss disorders. In this forecast period, the sector will further increase technological developments, product innovations, and a favorable regulatory environment. The sector should see solid development backed by raising knowledge and implementation of the industry's advanced audiology technology. One of the main drivers is the increased number of persons living with hearing loss illnesses in developed countries, such as the United States, and leading players in research and product development. But the progressive development of health infrastructure acceptance and development will support sector development in developing regions such as India and Brazil. However, high cost and social stigma are the two major restraining factors that are limiting the hearing care devices market growth.

Audiology Devices Market Insights

Factors such as the increasing geriatric population and hearing illnesses and supporting governmental projects for a simple hearing aid can attribute to market development. By 2030, the overall world population of geriatrics is estimated at 1,4 billion. In the United States, approximately 35 million Americans have hearing loss and approximately 70% to 85% of cases are untreated. However, increased market players will improve the therapy rate of hearing problems to incorporate traditional equipment with contemporary telemetry. The internet audiology platform providing audiological devices, testing, and internet support for all customers was actively introduced in January 2019.

All platform users can interact through a video conference with an audiologist and obtain listening assistance without visiting an office or retail stores. In some government areas, basic hearing aids work poorly. Hearing Aid Technology (HAT), which uses frequency modulation, infrarouge, and induction loop technologies to eliminate noise, distance, and reverberation effects. Without hearing aids or cochlear implants, HAT devices can be used. Another driving force for audiology systems is the growing demand for efficient instruments, the development of wireless systems, and the ever greater acceptance of such technology-enhanced devices.

Audiology Devices Market Segmentation

The worldwide audiology devices market is split based on product, technology, sales channel, and geography.

Audiology Devices Market By Product

- BAHA/BAHS

- Cochlear Implants

- Hearing Aids

- Diagnostic Device

According to the audiology devices industry analysis, the listening aids dominated the product sector, whereas the highest development in the forecast time is expected in cochlear implants. Otoscope, audiometer, and tympanometer are included in diagnostic systems. Implantation technology innovation decreases the risk of infection, complications, and surgical time and increases the patient's listening skills. The market growth should be increased by the demand for the invisible-in-channel hearing aid and full-in-channel hearing aid.

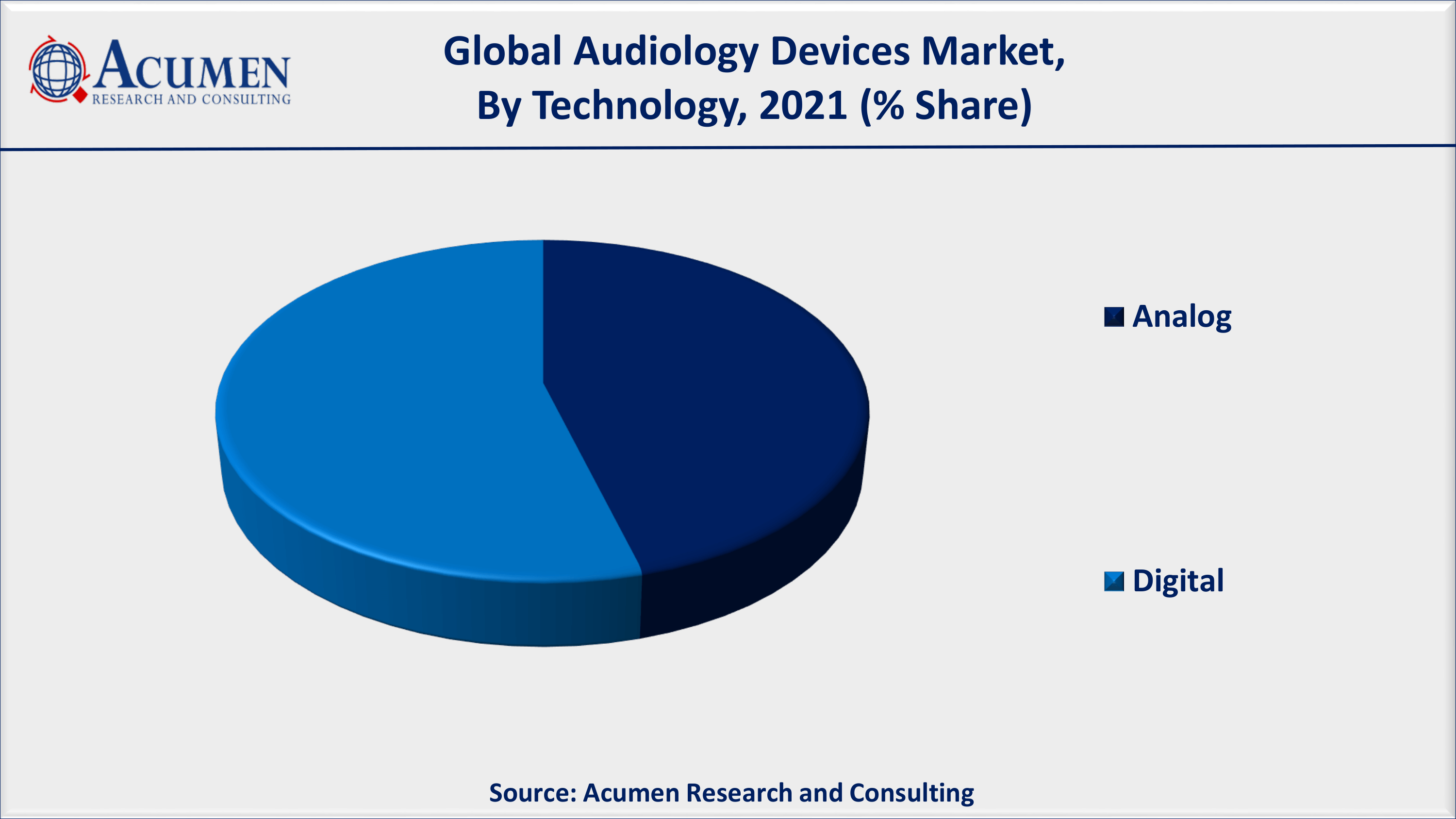

Audiology Devices Market By Technology

- Analog

- Digital

As per our audiology devices market forecast, digital listening aids have dominated the technology segment. To intensify sound, analog hearing aids use an amplifier and a microphone. A microchip enabling programmable setup for various listening environments is included in some analog audio systems. Due to the provision of unadulterated sound at an inexpensive price, analog devices are better than digital technology. The Oticon Opn range of hearing aids can also be linked to iPhone, iPad, and iPod touch systems and enables consumers to stream audio directly to their hearing aids. Many producers give digital hearing aids with Bluetooth-based connectivity, integrated within - the-ear (IS) and behind-the-ear models (BTE).

Audiology Devices Market By Sales Channel

- Government Purchases

- E-commerce

- Retail Sales

Among the sales channel, retail sales will account for a considerable market share. During 2016 around 3,28-3,65 million listening instruments were purchased on the U.S. market, comprising 78% sold in personal markets and 22% sold through Veterans Authority (VA). HERING ADMIPING Retail studios are dominated by the existence of large retail chains in nations such as the United States. Many market players use eCommerce to offer online service assistance and expert advice to sell hearing aid products.

Audiology Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Audiology Devices Market Regional Analysis

In 2021, the general income share of North America dominated the market. The development of the US industry can be ascribed to the progress of audiology, an increase in the number of audiologists, and the creation by existing suppliers of innovative digital platforms. The introduction of patient-centered audiology solutions that simplify product handling further leads to market development. The region of Asia Pacific will grow over the forecast period at the greatest CAGR. Market growth is due to growing geriatric populations and age-related hearing issues, a continuous improvement of health infrastructures, increased health care costs, and consumer sensitivity.

Audiology Devices Market Players

The global audiology devices companies profiled in the report include Sonova Holdings AG, GN ReSound Group, MedRx, and Amplifon, Starkey Hearing Technologies, William Demant Holdings A / S, Widex A / S, Phonak, Audioscan, and others.

Mergers & acquisitions, the creation of new goods, joint ventures, and partnerships form the strategies of these market actors. In March 2019, for instance, Sivantos Pte. The company was merged into WS Audiology, which formed a varied range of audio assistance products including Signia, Widex, and Rexton. Widex A. and Ltd. finished a company fusion.

Frequently Asked Questions

What is the size of global audiology devices market in 2021?

The market size of audiology devices market in 2021 was accounted to be USD 9.9 Billion.

What is the CAGR of global audiology devices market during forecast period of 2022 to 2030?

The projected CAGR of audiology devices market during the analysis period of 2022 to 2030 is 6.9%.

Which are the key players operating in the market?

The prominent players of the global audiology devices market are Sonova Holdings AG, GN ReSound Group, MedRx, and Amplifon, Starkey Hearing Technologies, William Demant Holdings A / S, Widex A / S, Phonak, Audioscan, and others.

Which region held the dominating position in the global audiology devices market?

North America held the dominating audiology devices during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for audiology devices during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global audiology devices market?

Growing prevalence of hearing problems, increasing incidence of impairment, and rising base of elderly population drives the growth of global audiology devices market.

Which product held the maximum share in 2021?

Based on form, hearing aids segment is expected to hold the maximum share audiology devices market.