Atrial Fibrillation Drugs Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Atrial Fibrillation Drugs Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

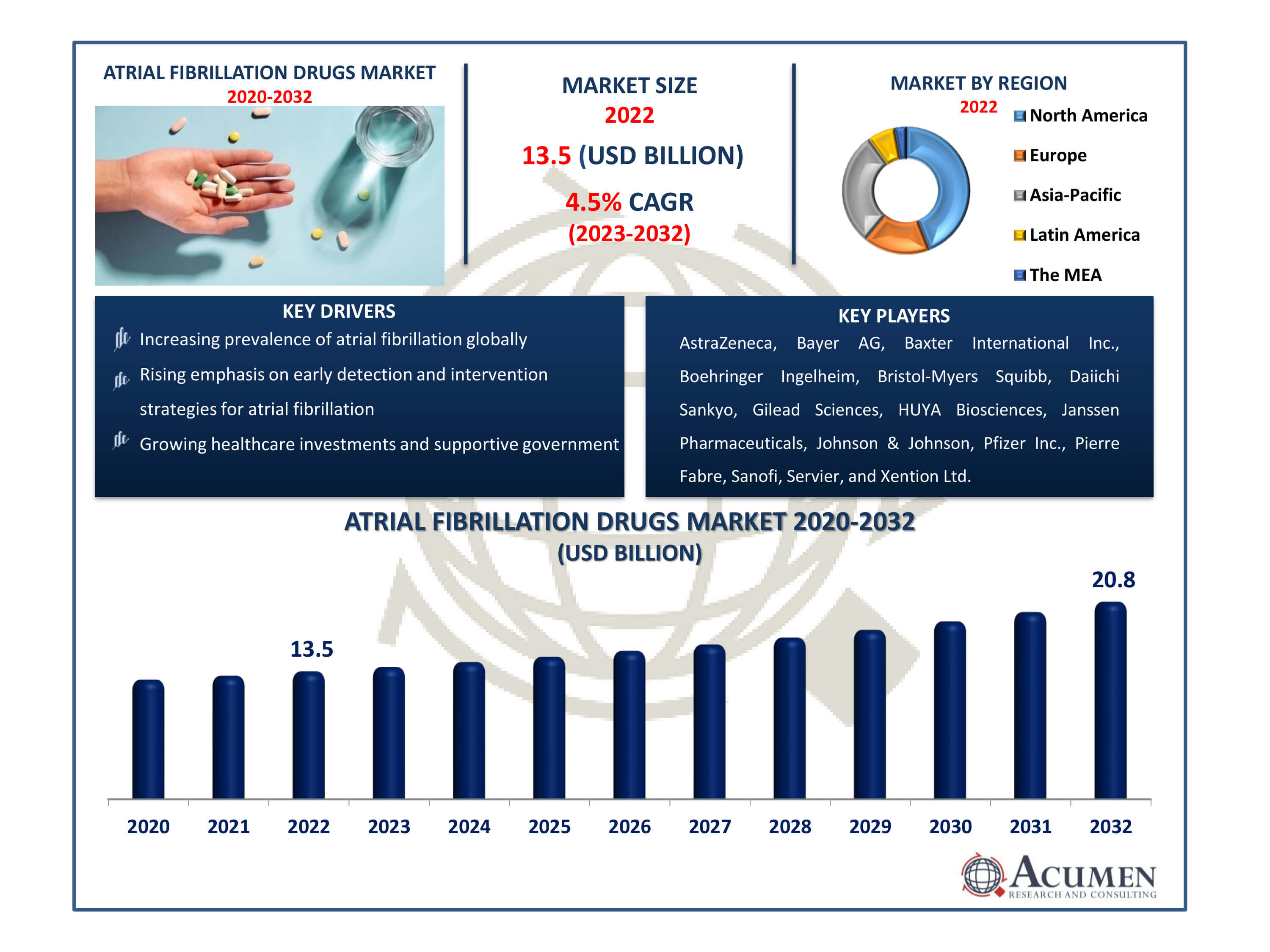

The Atrial Fibrillation Drugs Market Size accounted for USD 13.5 Billion in 2022 and is estimated to achieve a market size of USD 20.8 Billion by 2032 growing at a CAGR of 4.5% from 2023 to 2032.

Atrial Fibrillation Drugs Market Highlights

- Global atrial fibrillation drugs market revenue is poised to garner USD 20.8 billion by 2032 with a CAGR of 4.5% from 2023 to 2032

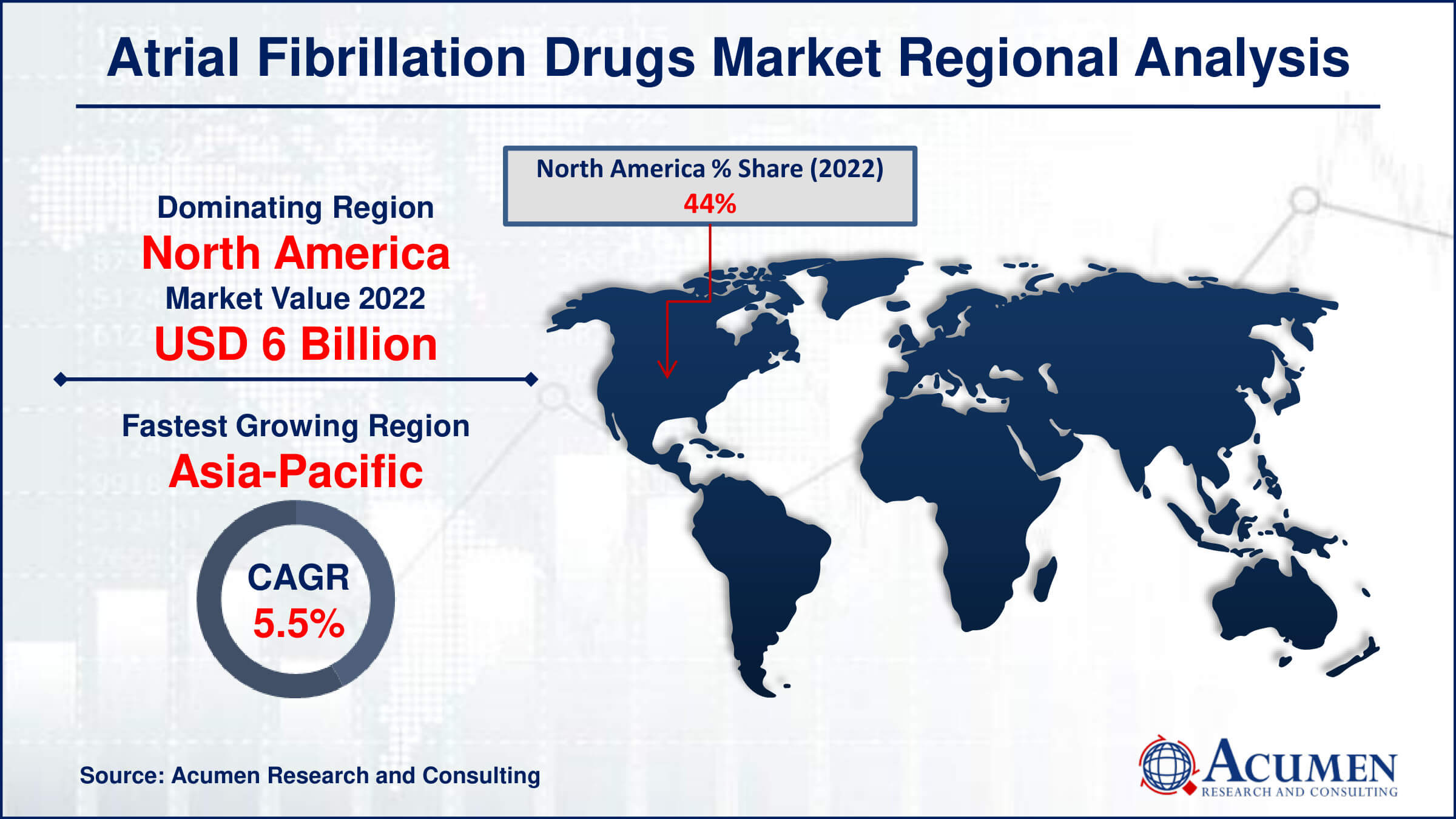

- North America atrial fibrillation drugs market value occupied around USD 6 billion in 2022

- Asia-Pacific atrial fibrillation drugs market growth will record a CAGR of more than 5.5% from 2023 to 2032

- Among product, the anticoagulant drugs sub-segment generated over US$ 11.9 billion revenue in 2022

- Based on type, the permanent sub-segment generated around 53% share in 2022

- Advancements in diagnostic technologies facilitating early diagnosis and targeted therapies is a popular atrial fibrillation drugs market trend that fuels the industry demand

Atrial fibrillation drugs are prescription medications aimed at managing and treating the symptoms of atrial fibrillation (AF), an irregular heartbeat, or arrhythmia. They primarily focus on decreasing the heart rate, regulating heart rhythm, preventing blood clots, and reducing associated complications such as stroke or heart failure. Atrial fibrillation is characterized by a fast and irregular heart rate, elevating the risk of discomfort (angina), chest pain, and congestive heart failure. Common symptoms include confusion, dizziness, fatigue, and intermittent loss of consciousness. A boom in healthcare investments, supportive government efforts, and a growing emphasis on early diagnosis and intervention in cases of atrial fibrillation all contribute to the market's expansion.

Global Atrial Fibrillation Drugs Market Dynamics

Market Drivers

- Increasing prevalence of atrial fibrillation globally

- Technological advancements in drug formulations and treatment modalities

- Growing healthcare investments and supportive government

- Rising emphasis on early detection and intervention strategies for atrial fibrillation

Market Restraints

- Potential side effects associated with atrial fibrillation drugs

- Stringent regulatory approvals and compliance standards

- High treatment costs and limited access to advanced therapies in certain regions

Market Opportunities

- Increasing focus on precision medicine and personalized treatment

- Emerging markets and untapped regions

- Collaborations and strategic partnerships among pharmaceutical companies

Atrial Fibrillation Drugs Market Report Coverage

| Market | Atrial Fibrillation Drugs Market |

| Atrial Fibrillation Drugs Market Size 2022 | USD 13.5 Billion |

| Atrial Fibrillation Drugs Market Forecast 2032 | USD 20.8 Billion |

| Atrial Fibrillation Drugs Market CAGR During 2023 - 2032 | 4.5% |

| Atrial Fibrillation Drugs Market Analysis Period | 2020 - 2032 |

| Atrial Fibrillation Drugs Market Base Year |

2022 |

| Atrial Fibrillation Drugs Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Type, By Route Of Administration, By Application, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AstraZeneca, Bayer AG, Baxter International Inc., Boehringer Ingelheim, Bristol-Myers Squibb, Daiichi Sankyo, Gilead Sciences, HUYA Biosciences, Janssen Pharmaceuticals, Johnson & Johnson, Pfizer Inc., Pierre Fabre, Sanofi, Servier, Xention Ltd., and ARCA Biopharma. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Atrial Fibrillation Drugs Market Insights

During the atrial fibrillation drugs industry forecast period, the market is expected to witness profitable growth. This surge is primarily attributed to the increasing rates of the geriatric population, coupled with a rising prevalence of valvular diseases, which are driving market expansion. Additionally, the growing diabetic population is contributing significantly to the demand for atrial fibrillation drugs. However, barriers to adoption exist, particularly in some developing and underdeveloped countries, primarily due to the side effects associated with these drugs. Adverse effects such as severe bleeding and fatigue are likely to impede market growth. Moreover, in several emerging regions, a lack of awareness regarding recent advancements in medical drug therapies could potentially hinder the uptake of treatments for atrial fibrillation.

Over the estimated period, the market for anticoagulants is expected to experience growth. The rate of stroke in individuals with atrial fibrillation has shown a consistent decline over several years. Many thromboembolic complications associated with atrial fibrillation drugs and oral anticoagulants are preventable. For more than fifty years, vitamin K antagonists have been the sole effective therapeutic option for preventing atrial fibrillation. However, manufacturers' increased focus on developing oral anticoagulants has surged demand for these products, driving market growth in anticoagulants.

Conversely, the market for antiarrhythmic drugs in atrial fibrillation is estimated to decline in the near future due to reduced efficacy in restoring and maintaining normal cardiac rhythms. While individuals over 65 years often experience heart rhythm disorders, the preferred treatment for this older population remains antiarrhythmic medications. Yet, the emergence of more effective oral anticoagulants is gradually replacing the use of antiarrhythmic drugs in atrial fibrillation. As a result, the market for antiarrhythmic drugs is anticipated to gradually diminish in the foreseeable future within the realm of atrial fibrillation drugs.

Atrial Fibrillation Drugs Market Segmentation

The worldwide market for atrial fibrillation drugs is split based on product, type, route of administration, application, end use, and geography.

Atrial Fibrillation Drugs Products

- Antiarrhythmic Drugs

- Anticoagulant Drugs

The anticoagulant drugs subcategory dominates the product segment of atrial fibrillation drugs. Anticoagulants are essential in the treatment of atrial fibrillation because they inhibit blood clot formation, lowering the risk of stroke and other consequences. Many patients with atrial fibrillation benefit from these drugs because they efficiently prevent clot formation in the atria, lowering the risk of systemic embolism. Their significance originates from their capacity to considerably reduce the likelihood of thromboembolic events, making them a cornerstone in the treatment regimen for atrial fibrillation, and therefore significantly contributing to the market's supremacy within the product segment.

Atrial Fibrillation Drugs Types

- Paroxysmal

- Permanent

- Persistent

According to atrial fibrillation drugs industry analysis, the permanent subtype of market is the most prevalent within the sector. Permanent atrial fibrillation is characterised by an abnormal heart beat that continues despite efforts to restore a normal rhythm. This subtype, distinguished by persistent irregular heartbeats, frequently necessitates continuing management rather than interventions targeted at restoring normal heart rhythm. Its prevalence highlights the importance of long-term treatment techniques, leading to a greater emphasis on drugs designed to maintain cardiac function while minimising associated risks. The preponderance of the Permanent subtype indicates a market demand for long-term medicines that address the chronic nature of this type of atrial fibrillation.

Atrial Fibrillation Drugs Route Of Administrations

- Injectable

- Oral

In the past year, the market for oral atrial fibrillation medicinal products had substantial value. The global prevalence of atrial fibrillation is notably increasing, particularly with the aging population. Patients experiencing thromboembolic events related to atrial fibrillation tend to have higher morbidity, mortality rates, and longer hospital stays compared to those with other stroke types.

Oral therapy stands out due to its effectiveness in preventing blood clotting, leading to increased market growth as the most prescribed pharmaceutical approach for preventing atrial strokes. There's an anticipated significant rise in the segment of injectable atrial fibrillation drugs during the upcoming period. This growth is attributed to the extensive use of injectables in patients with atrial fibrillation who cannot take oral medications. Hence, the increased demand for injectable atrial fibrillation drugs in such cases is notable.

Atrial Fibrillation Drugs Applications

- Heart Rate Control

- Heart Rhythm Control

In the past year, the utilization of atrial fibrillation drugs was significant. Many patients with atrial fibrillation require restoration of their sinus rhythm to enhance their quality of life. The efforts to achieve and maintain sinus rhythms in atrial fibrillation patients are known as rhythm control. Antiarrhythmic drugs are typically recommended as a first-line therapy, considering factors such as the presence of structural cardiac disorders, heart failure, renal function, and other associated conditions.

The growing geriatric population has contributed to increased demand for atrial fibrillation medicines, primarily due to their heightened susceptibility to cardiac rhythm disturbances.

Atrial Fibrillation Drugs End Use

- Cardiac Centre’s

- Hospitals

- Ambulatory Surgical Centre’s

The hospital segment remains a significant hub for the utilization of atrial fibrillation medication, commanding substantial market shares. The hospital setting generated significant revenue in recent years, showcasing a substantial demand for these medications. This trend is expected to persist, with hospitals maintaining their lead in the market due to increased availability of drug therapies within these settings, bolstered by enhanced supply agreements between pharmaceutical companies and hospitals.

Cardiac centers emerged as the preferred location for atrial fibrillation medication therapies in both developed and developing countries, holding a prominent share in the industry. The segment pertaining to cardiac centers is projected to witness healthy growth during the forecast period, likely driven by the expansion of oral drug therapy offerings within these centers, thereby fostering industry growth.

Atrial Fibrillation Drugs Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Atrial Fibrillation Drugs Market Regional Analysis

The United States held a dominant position in the North American market for atrial fibrillation drugs, with substantial revenue in 2022. This was largely due to factors such as the growing geriatric population and an increasing prevalence of valve diseases among the populace. Moreover, the U.S. market for atrial fibrillation drugs is poised for continued growth, driven by the expanding presence of major drug manufacturers like Johnson & Johnson and Bristol-Myers Squibb.

Over the atrial fibrillation drugs market forecast period, China is expected to experience rapid growth in the industry, estimated at largest share. This growth can be attributed to the development of hospitals and the rising acceptance of local private clinics. Additionally, an increased prevalence of heart disease due to rapid lifestyle changes and increased binge eating habits has contributed to the industry's growth.

Atrial Fibrillation Drugs Market Players

Some of the top atrial fibrillation drugs companies offered in our report includes AstraZeneca, Bayer AG, Baxter International Inc., Boehringer Ingelheim, Bristol-Myers Squibb, Daiichi Sankyo, Gilead Sciences, HUYA Biosciences, Janssen Pharmaceuticals, Johnson & Johnson, Pfizer Inc., Pierre Fabre, Sanofi, Servier, Xention Ltd., and ARCA Biopharma.

Frequently Asked Questions

How big is the atrial fibrillation drugs market?

The atrial fibrillation drugs market size was USD 13.5 billion in 2022.

What is the CAGR of the global atrial fibrillation drugs market from 2023 to 2032?

The CAGR of atrial fibrillation drugs is 4.5% during the analysis period of 2023 to 2032.

Which are the key players in the atrial fibrillation drugs market?

The key players operating in the global market are including AstraZeneca, Bayer AG, Baxter International Inc., Boehringer Ingelheim, Bristol-Myers Squibb, Daiichi Sankyo, Gilead Sciences, HUYA Biosciences, Janssen Pharmaceuticals, Johnson & Johnson, Pfizer Inc., Pierre Fabre, Sanofi, Servier, Xention Ltd., and ARCA Biopharma.

Which region dominated the global atrial fibrillation drugs market share?

North America held the dominating position in atrial fibrillation drugs industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of atrial fibrillation drugs during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global atrial fibrillation drugs industry?

The current trends and dynamics in the atrial fibrillation drugs industry include increasing prevalence of atrial fibrillation globally, technological advancements in drug formulations and treatment modalities, growing healthcare investments and supportive government, and rising emphasis on early detection and intervention strategies for atrial fibrillation.

Which product held the maximum share in 2022?

The anticoagulant drugs product held the maximum share of the atrial fibrillation drugs industry.?