Atrazine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Atrazine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

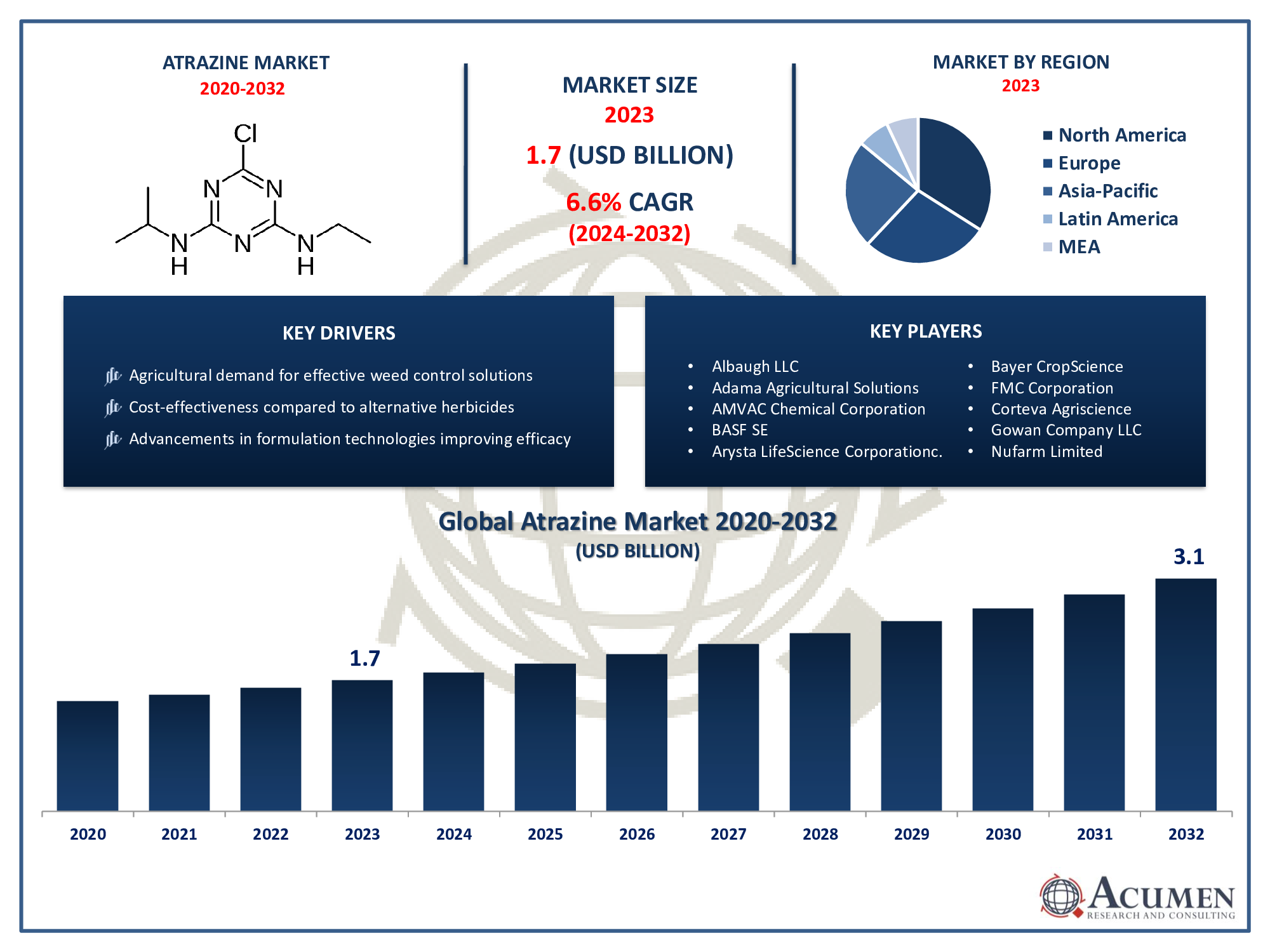

The Atrazine Market Size accounted for USD 1.7 Billion in 2023 and is projected to achieve a market size of USD 3.1 Billion by 2032 growing at a CAGR of 6.6% from 2024 to 2032.

Atrazine Market - By Type (Dry, Liquid, Others), By Crop (Cereal, Sugar crops, Corn, Wheat, Sorghum, Others), By Application (Field crop, Aquatic weed, Forestry, Other) - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032.

Atrazine Market Highlights

- Global atrazine market revenue is expected to increase by USD 3.1 Billion by 2032, with a 6.6% CAGR from 2024 to 2032

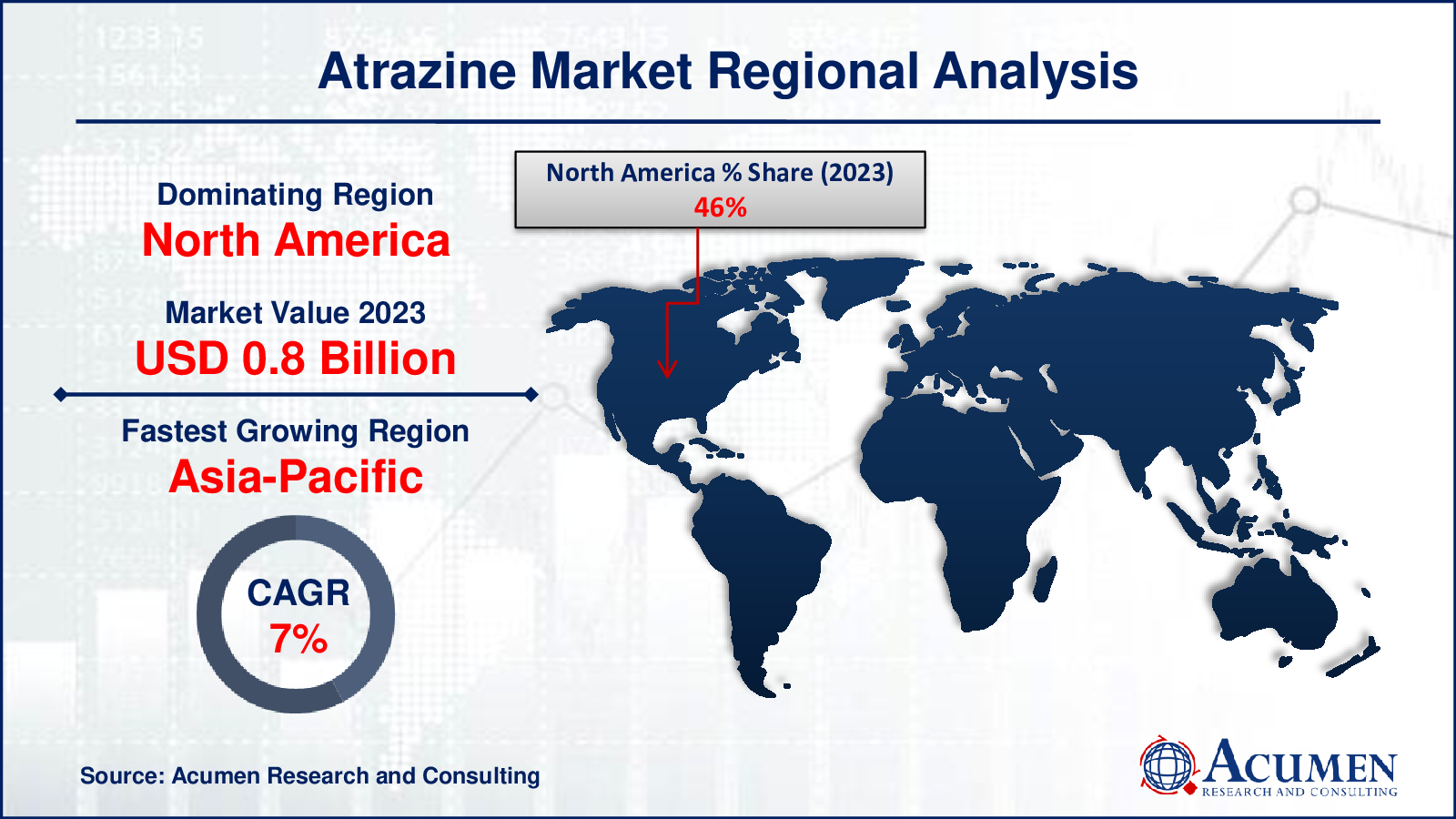

- North America region led with more than 46% of atrazine market share in 2023

- Asia-Pacific atrazine market growth will record a CAGR of more than 7.3% from 2024 to 2032

- By type, the liquid segment captured more than 58% of revenue share in 2023

- By technology, the cereal segment is projected to expand at the fastest CAGR over the projected period

- Growing awareness and adoption of integrated weed management practices, drives the atrazine market value

Atrazine is a widely used herbicide primarily employed in agriculture to control broadleaf and grassy weeds, particularly in corn crops. It belongs to the class of chemicals known as triazines and works by inhibiting photosynthesis in target plants. Due to its effectiveness and relatively low cost, atrazine has been a staple in weed management for decades. It's typically applied as a spray onto fields either before or after planting crops.

The market for atrazine has seen significant growth over the years, driven by the expansion of industrial agriculture and the need for efficient weed control methods. Despite concerns about its environmental impact and potential health risks, atrazine remains one of the most widely used herbicides globally. However, regulatory pressures and increasing awareness of its negative effects have led to efforts to reduce its use and find alternative solutions. Nonetheless, in regions where atrazine is still permitted and widely used, its market continues to be robust, supported by the ongoing demand for effective weed management solutions in agriculture. In recent years, alongside the growth of sustainable and organic farming practices, there has been a slight shift away from atrazine in some markets.

Global Atrazine Market Trends

Market Drivers

- Agricultural demand for effective weed control solutions

- Cost-effectiveness compared to alternative herbicides

- Advancements in formulation technologies improving efficacy

- Expansion of agriculture in emerging economies

- Growing focus on sustainable farming practices

Market Restraints

- Regulatory scrutiny and restrictions due to environmental concerns

- Potential health impacts and public perception issues

Market Opportunities

- Development of eco-friendly and biodegradable alternatives

- Adoption of precision agriculture technologies enhancing herbicide efficiency

Atrazine Market Report Coverage

| Market | Atrazine Market |

| Atrazine Market Size 2022 |

USD 1.7 Billion |

| Atrazine Market Forecast 2032 | USD 3.1 Billion |

| Atrazine Market CAGR During 2023 - 2032 | 6.6% |

| Atrazine Market Analysis Period | 2020 - 2032 |

| Atrazine Market Base Year |

2022 |

| Atrazine Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Crop, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Albaugh LLC, Adama Agricultural Solutions, AMVAC Chemical Corporation, BASF SE, Arysta LifeScienceCorporationc., Bayer CropScience, FMC Corporation, Corteva Agriscience, Gowan Company LLC, Nufarm Limited, Nissan Chemical Corporation, and Nippon Soda Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Atrazine is a selective herbicide belonging to the triazine class, widely used in agriculture to control broadleaf and grassy weeds in crops such as corn, sugarcane, sorghum, and various grains. It works by inhibiting photosynthesis in plants, effectively suppressing weed growth while allowing the cultivated crops to thrive. Atrazine is appreciated for its broad spectrum of weed control, affordability, and ease of application, making it a popular choice among farmers globally. The applications of atrazine in agriculture are diverse and crucial for ensuring high yields and efficient crop production. It is primarily used as a pre-emergent herbicide, applied before weed seeds germinate, to create a weed-free environment for young crops to establish themselves. Additionally, atrazine can be used as a post-emergent herbicide, targeting weeds that have already emerged, thereby preventing them from competing with crops for nutrients, water, and sunlight.

The atrazine market has exhibited steady growth over the years, driven primarily by the continued demand for effective weed control solutions in agriculture. Despite facing regulatory scrutiny and concerns regarding its environmental and health impacts, atrazine remains a popular choice among farmers due to its proven efficacy, cost-effectiveness, and broad spectrum of weed control. The market growth is further supported by advancements in formulation technologies, which have enhanced the herbicide's effectiveness and minimized its adverse effects on non-target organisms. Moreover, the expansion of agriculture in emerging economies has contributed to the increasing adoption of atrazine, as farmers seek efficient solutions to address weed infestations and improve crop yields. The versatility of atrazine in controlling a wide range of weeds across various crops, including corn, sugarcane, and sorghum, further fuels its market growth.

Atrazine Market Segmentation

The global atrazine market segmentation is based on type, crop, application, and geography.

Atrazine Market By Type

- Dry

- Liquid

- Others

According to the atrazine industry analysis, the liquid segment accounted for the largest market share in 2023. One key factor contributing to the growth of the liquid segment is the convenience and ease of application offered by liquid formulations. Liquid atrazine formulations can be easily mixed and applied using various spraying equipment, allowing for efficient and precise weed control. This convenience has led to increased adoption among farmers, particularly those with large-scale agricultural operations seeking to optimize their herbicide application processes. Additionally, liquid formulations of atrazine often offer improved efficacy and faster absorption by target weeds compared to granular or dry formulations. This enhanced effectiveness has further propelled the demand for liquid atrazine products in the market.

Atrazine Market By Crop

- Cereal

- Sugar crops

- Corn

- Wheat

- Sorghum

- Others

In terms of crops, the cereal segment is expected to witness significant growth in the coming years. Cereals such as corn, wheat, barley, and sorghum are staple crops in many regions worldwide, and atrazine plays a crucial role in weed management within these cereal crops. The effectiveness of atrazine in controlling a broad spectrum of weeds while being relatively cost-effective has made it a preferred herbicide among cereal crop farmers. As global demand for cereals continues to rise to meet the needs of growing populations and expanding livestock industries, the demand for atrazine in this segment has also increased. Moreover, advancements in agricultural practices and technology have further boosted the growth of the cereal segment in the atrazine market. Precision agriculture techniques, such as GPS-guided machinery and variable rate application systems, allow farmers to apply atrazine more efficiently and precisely, optimizing weed control while minimizing herbicide use.

Atrazine Market By Application

- Field crop

- Aquatic weed

- Forestry

- Other

According to the atrazine market forecast, the field crop segment is expected to witness significant growth in the coming years. Field crops encompass a diverse range of crops including corn, soybeans, sugarcane, cotton, and various grains, all of which benefit significantly from atrazine's weed control properties. Atrazine's broad-spectrum effectiveness against a wide array of weeds makes it particularly valuable for field crop farmers who often face challenges in managing weed infestations that can significantly impact crop yield and quality. As such, the demand for atrazine within the field crop segment has remained consistently high. Moreover, the field crop segment has experienced growth spurred by advancements in agricultural practices and technology. Precision agriculture techniques, including GPS-guided machinery and data-driven decision-making, have enabled farmers to optimize atrazine application, ensuring more efficient and targeted weed control while minimizing herbicide usage.

Atrazine Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Atrazine Market Regional Analysis

North America has emerged as a dominating region in the atrazine market due to several key factors that contribute to its strong market presence. One significant factor is the extensive cultivation of crops such as corn and soybeans in the region, where atrazine is widely utilized for weed control. These crops are staple commodities in North America, with a high demand both domestically and internationally, leading to a substantial usage of atrazine to ensure optimal crop yields. Moreover, the favorable climatic conditions in many parts of North America facilitate the growth of weeds, necessitating effective weed management solutions like atrazine. Additionally, North America benefits from a well-established agricultural infrastructure and advanced farming practices, which further contribute to its dominance in the atrazine market. The region is home to some of the world's leading agricultural research institutions and companies, driving innovation and technological advancements in crop protection products like atrazine. Farmers in North America have access to sophisticated machinery and equipment for precise herbicide application, optimizing the efficacy of atrazine while minimizing environmental impact. Furthermore, the regulatory environment in North America, although stringent, provides a clear framework for the use of atrazine, ensuring its responsible application and minimizing risks associated with its usage.

Atrazine Market Player

Some of the top atrazine market companies offered in the professional report include Albaugh LLC, Adama Agricultural Solutions, AMVAC Chemical Corporation, BASF SE, Arysta LifeScienceCorporationc., Bayer CropScience, FMC Corporation, Corteva Agriscience, Gowan Company LLC, Nufarm Limited, Nissan Chemical Corporation, and Nippon Soda Co., Ltd.

Frequently Asked Questions

What was the market size of the global atrazinein 2023?

The market size of atrazine was USD 1.7 Billion in 2023.

What is the CAGR of the global atrazine market from 2024 to 2032?

The CAGR of atrazine is 6.6% during the analysis period of 2024 to 2032.

Which are the key players in the atrazine market?

The key players operating in the global market are including Albaugh LLC, Adama Agricultural Solutions, AMVAC Chemical Corporation, BASF SE, Arysta LifeScienceCorporationc., Bayer CropScience, FMC Corporation, Corteva Agriscience, Gowan Company LLC, Nufarm Limited, Nissan Chemical Corporation, and Nippon Soda Co., Ltd.

Which region dominated the global atrazine market share?

North America held the dominating position in atrazine industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of atrazine during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global atrazine industry?

The current trends and dynamics in the atrazineindustry include agricultural demand for effective weed control solutions, cost-effectiveness compared to alternative herbicides, and advancements in formulation technologies improving efficacy.

Which crop held the maximum share in 2023?

The cereal crop held the maximum share of the atrazine industry.