Asthma Therapeutics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Asthma Therapeutics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

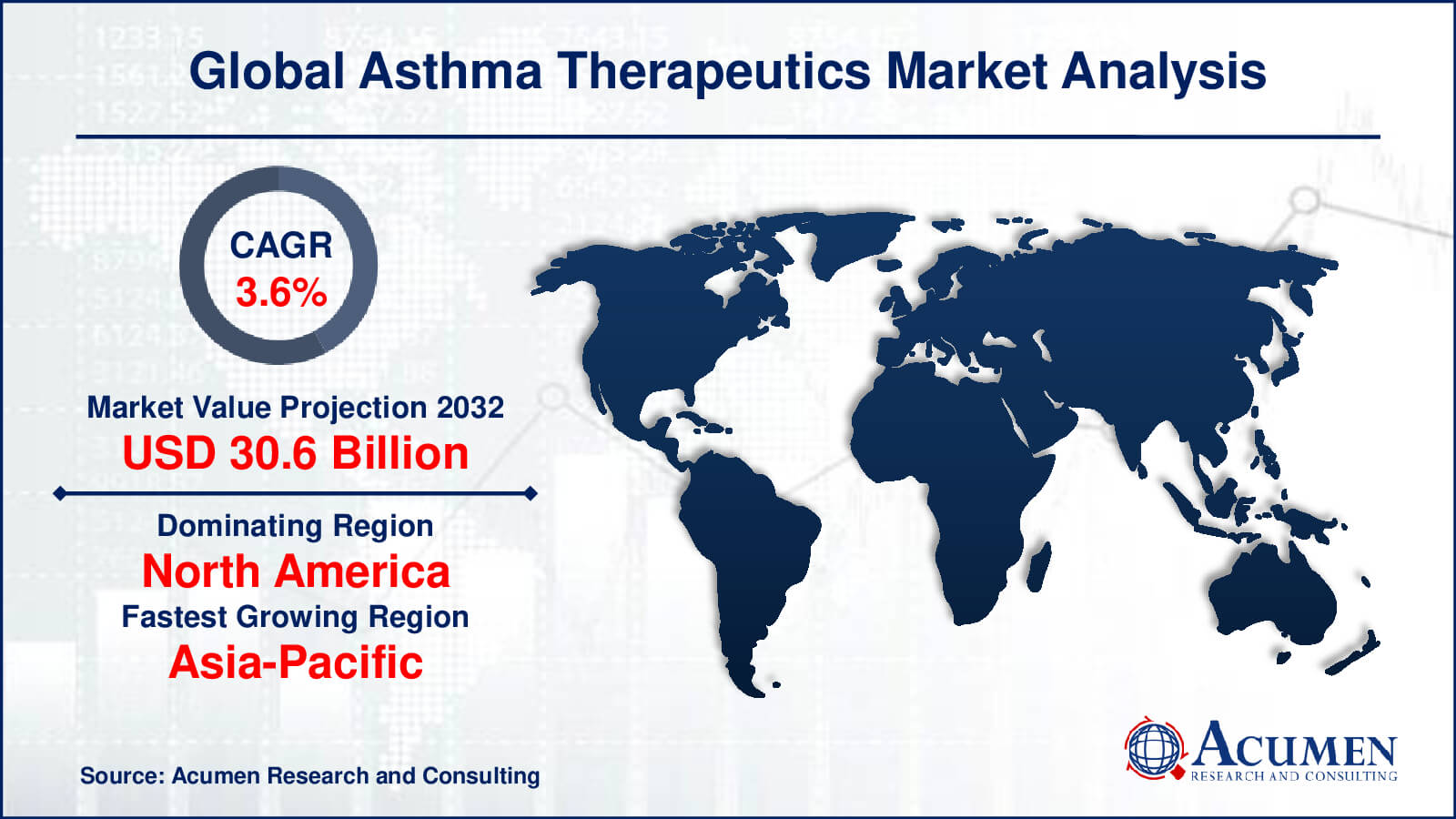

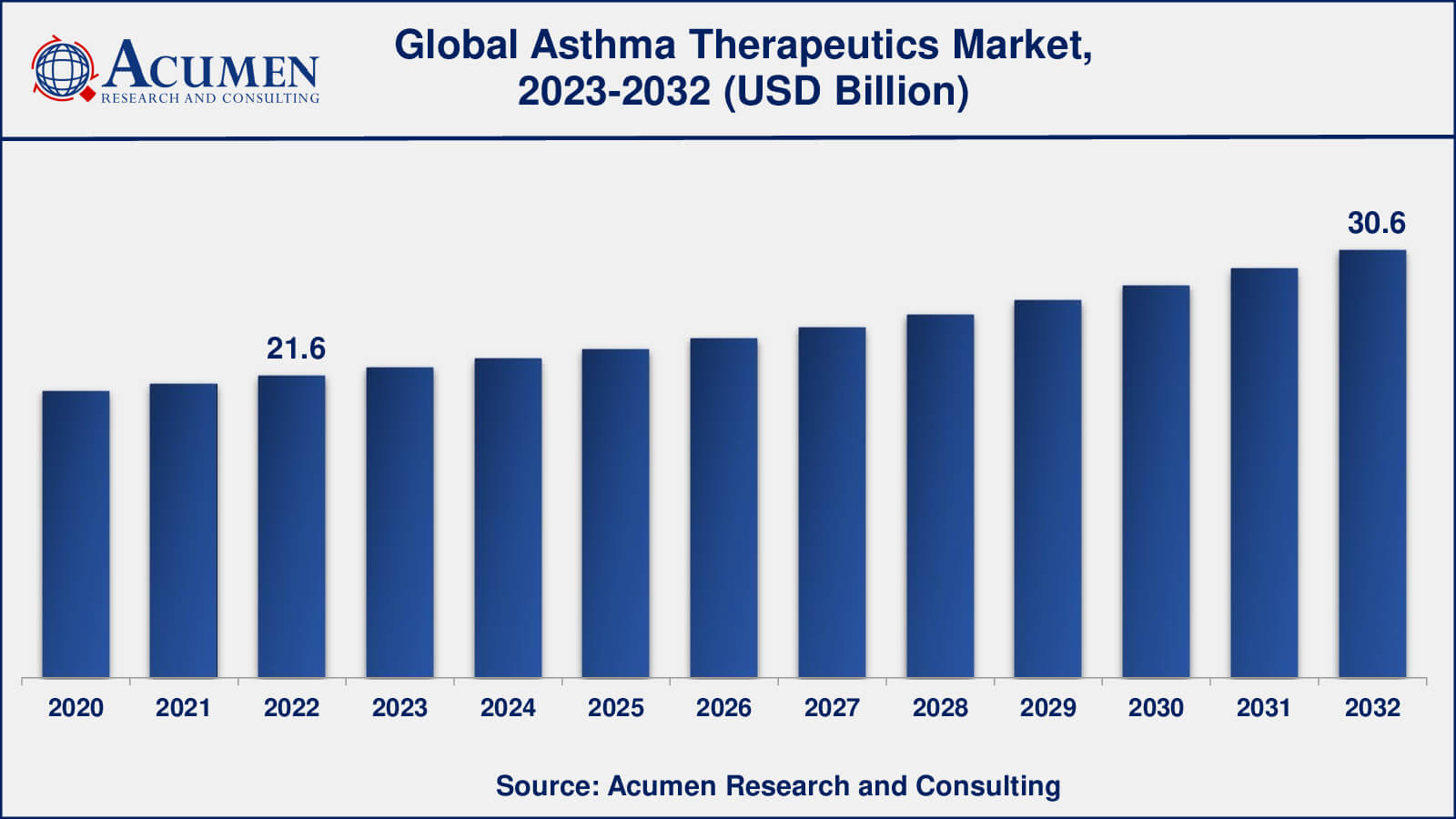

The global Asthma Therapeutics Market size was valued at USD 21.6 Billion in 2022 and is projected to attain USD 30.6 Billion by 2032 mounting at a CAGR of 3.6% from 2023 to 2032.

Asthma Therapeutics Market Highlights

- Global asthma therapeutics market revenue is poised to garner USD 30.6 billion by 2032 with a CAGR of 3.6% from 2023 to 2032

- North America asthma therapeutics market value occupied around USD 10.8 billion in 2022

- Asia-Pacific asthma therapeutics market growth will record a CAGR of more than 4% from 2023 to 2032

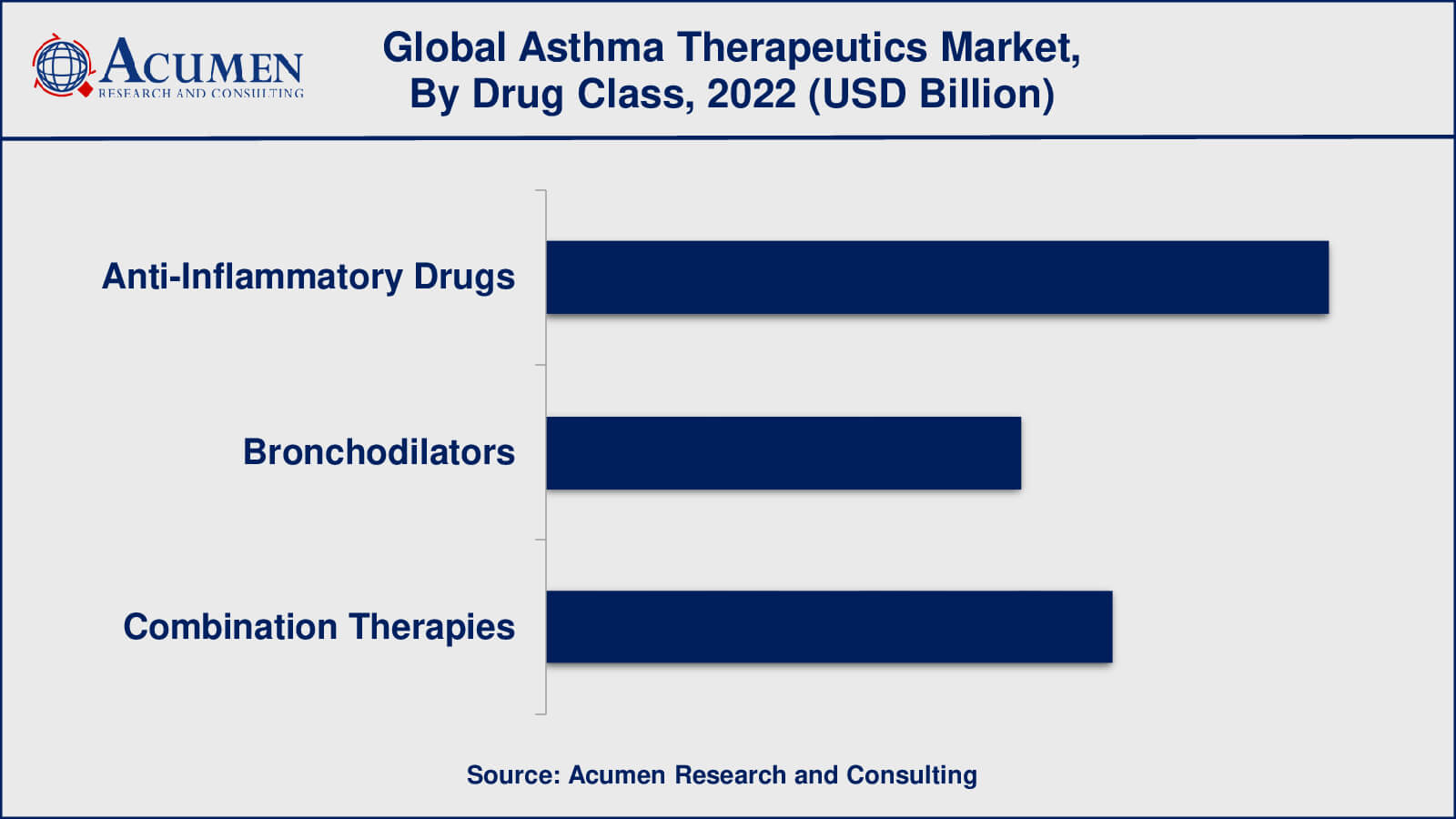

- Among drug class, the anti-inflammatory drugs sub-segment occupied over US$ 9.3 billion revenue in 2022

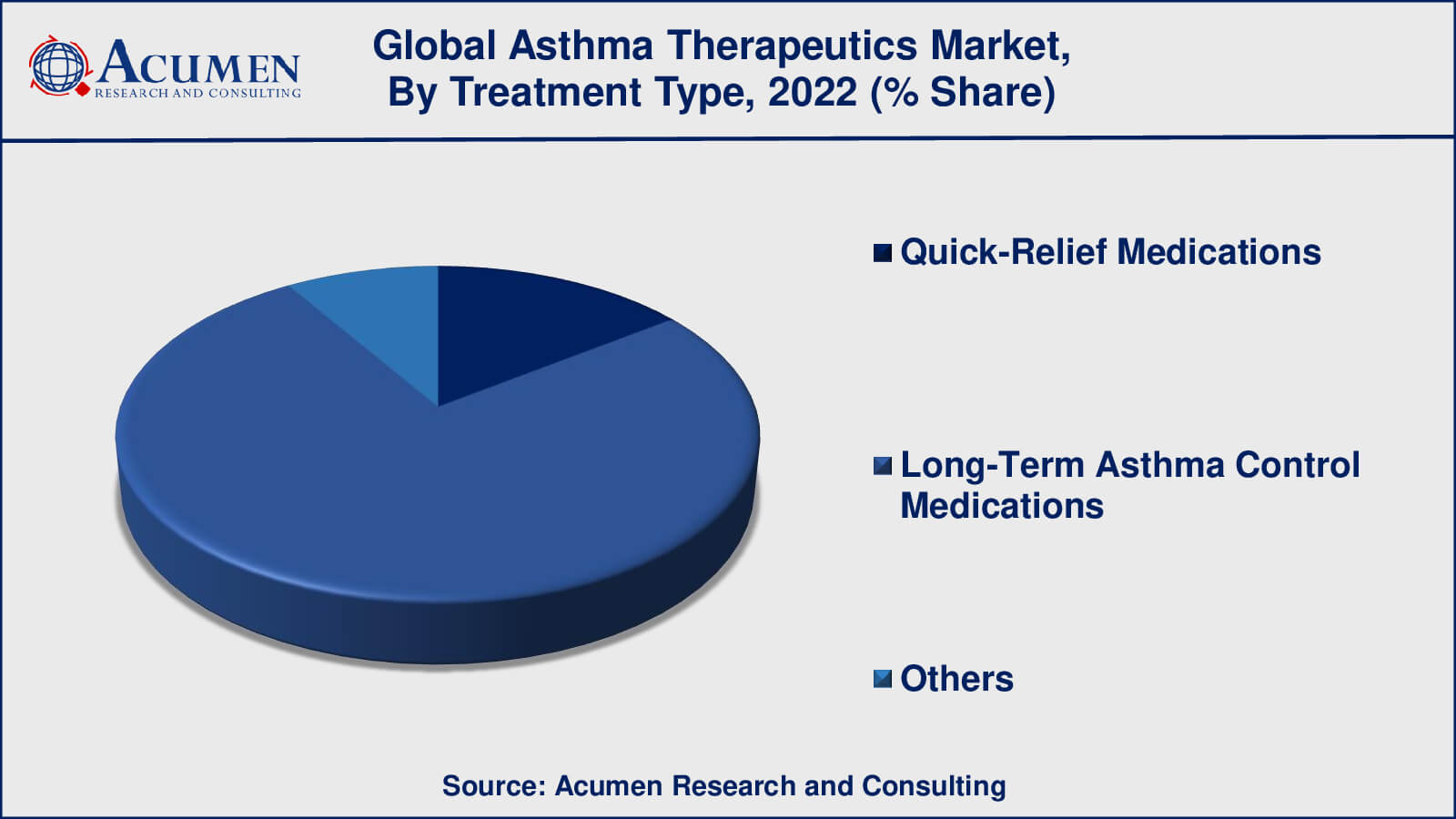

- Based on treatment type, the long-term asthma control medications sub-segment gathered around 76% share in 2022

- Biologic therapies advancements is a popular asthma therapeutics market trend that drives the industry demand

Asthma therapeutics refers to the numerous medical techniques and treatments aimed at treating and reducing the symptoms of asthma, a chronic respiratory disorder affecting the lungs' airways. Asthma is characterized by inflammation, airway constriction, and heightened sensitivity to particular triggers, resulting in recurring bouts of wheezing, coughing, shortness of breath, and chest tightness. As a complex and diverse illness, asthma therapies take a comprehensive approach to controlling and preventing asthma episodes, improving lung function, and improving the overall quality of life for those who suffer from it.

The use of long-term control drugs, such as inhaled corticosteroids, long-acting beta-agonists, leukotriene modifiers, and mast cell stabilizers, is the cornerstone of asthma treatments. These medications help to reduce airway inflammation, relax the muscles around the airways, and prevent the occurrence of asthma symptoms. Long-term controllers are typically taken daily to maintain stable asthma control, and the choice of medication depends on the severity and individual response to treatment.

In severe cases of asthma that do not respond well to standard treatments, biologic therapies may be considered. These targeted therapies aim to suppress specific immune responses that contribute to asthma symptoms, providing an alternative treatment option for individuals with severe and difficult-to-control asthma. In conclusion, asthma therapeutics encompasses a range of medical interventions, from long-term control medications and quick-relief inhalers to trigger avoidance strategies and patient education. By tailoring treatment plans to individual needs and regularly reviewing asthma management with healthcare professionals, patients can achieve better asthma control, minimize the frequency and severity of asthma attacks, and enjoy improved respiratory function and overall well-being.

Global Asthma Therapeutics Market Dynamics

Market Drivers

- Increasing prevalence of asthma

- Growing awareness and healthcare expenditure

- Advancements in treatment options

Market Restraints

- Side effects of medications

- Lack of adherence to treatment

- High cost of biologic therapies

Market Opportunities

- Rising demand for personalized medicine

- Development of novel therapies

- Expanding telemedicine services

Asthma Therapeutics Market Report Coverage

| Market | Asthma Therapeutics Market |

| Asthma Therapeutics Market Size 2022 | USD 21.6 Billion |

| Asthma Therapeutics Market Forecast 2032 | USD 30.6 Billion |

| Asthma Therapeutics Market CAGR During 2023 - 2032 | 3.6% |

| Asthma Therapeutics Market Analysis Period | 2020 - 2032 |

| Asthma Therapeutics Market Base Year | 2022 |

| Asthma Therapeutics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Drug Class, By Product Type, By Treatment Type, By Route of Administration, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Sunovion Pharmaceuticals Inc., GlaxoSmithKline Plc, Biogen Inc., Teva Pharmaceutical Industries Ltd., Amgen Inc., Novartis International AG, F. Hoffmann-La Roche Ltd., Boehringer Ingelheim International GmbH, AstraZeneca PLC, Merck Sharp & Dohme Corp., and Abbott Laboratories. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Asthma Therapeutics Market Insights

A number of dynamic elements drive the growth and development of the asthma treatments market. One of the key factors is the rising global prevalence of asthma. The growing prevalence of asthma illnesses, particularly among children and young people, has increased the demand for efficient treatment alternatives. As asthma remains a significant chronic respiratory disorder, the demand for improved therapies in treating the disease and improving patient outcomes grows.

Growing awareness and healthcare spending are two key driving forces in the asthma treatments industry. As people become more aware of asthma and its symptoms, more people seek medical attention and diagnosis, resulting in a rise in demand for asthma treatments. Furthermore, governments and commercial healthcare sectors are investing in asthma management and research, allowing sufferers to have access to improved healthcare facilities and drugs. This rising healthcare spending opens up possibilities for the research and marketing of novel and better asthma medicines.

Continuous developments in therapeutic choices can have an impact on market dynamics. Pharmaceutical firms are continually investing in R&D to produce novel treatments and delivery technologies with higher efficacy and fewer adverse effects. As a result, healthcare providers now have a wider selection of therapeutic options to tailor treatment strategies to the individual needs of each patient. The emergence of biologic medicines, especially tailored treatments that address underlying inflammatory pathways, has transformed the management of severe asthma and created a huge market growth opportunity.

However, there are certain constraints in the asthma treatments industry. One significant problem is the potential negative effects of several asthma treatments. Patients may have adverse medication responses, resulting in treatment cessation or poor compliance, impeding efficient disease management. Furthermore, some patients' noncompliance with treatment regimens is a substantial impediment to good asthma management. Noncompliance might result in poorly controlled symptoms, recurring asthma episodes, and higher healthcare expenses.

Furthermore, the expensive cost of biologic medicines limits their general use. These novel medicines, while beneficial, are often too expensive for some individuals and healthcare systems. Addressing the cost-effectiveness of these medicines and making them more accessible to all patients will be critical for long-term growth in the asthma treatment industry.

Asthma Therapeutics Market Segmentation

The worldwide market for asthma therapeutics is split based on drug class, product type, treatment type, route of administration, and geography.

Asthma Therapeutic Drug Classes

- Anti-Inflammatory Drugs

- Bronchodilators

- Combination Therapies

According to the asthma therapeutics industry analysis, anti-inflammatory medications was the most prevalent treatment class in 2022. These drugs are important in asthma therapy because they reduce inflammation in the airways, which is a key component of asthma pathogenesis. Inhaled corticosteroids, leukotriene modifiers, and oral corticosteroids are examples of anti-inflammatory medications. They are routinely administered to individuals with chronic asthma and are regarded as the cornerstone of long-term asthma treatment.

Bronchodilators, on the other hand, are a kind of drug that relaxes the smooth muscles around the airways, resulting in bronchodilation and better airflow. These treatments, known as "quick-relief" or "rescue" medications, give immediate relief during asthma attacks. In addition, combination therapy are medicines that mix anti-inflammatory agents with bronchodilators in a single inhaler. These combination medicines are intended to provide complete asthma care by concurrently targeting inflammation and bronchoconstriction. Combination therapy frequently use the same device to deliver an inhaled corticosteroid and a long-acting beta-agonist (LABA).

Asthma Therapeutic Product Types

- Inhalers

- Dry Powder Inhalers

- Metered Dose Inhalers

- Soft Mist Inhalers

- Nebulizers

- Pneumatic Nebulizers

- Ultrasonic Nebulizers

- Mesh Nebulizers

According to the asthma therapeutics market forecast, inhalers were the product type that dominated the asthma therapeutics market. Inhalers are devices that use inhalation to deliver medicine directly to the lungs. They are a common and successful means of giving asthma drugs, both for immediate relief during acute asthma episodes and for long-term asthma treatment. Inhalers provide a number of benefits, including mobility, convenience of use, and quick medication delivery to the lungs. They are convenient for self-administration, helping patients to efficiently control their asthma at home, work, or on the road.

In contrast, nebulizers are machines that turn liquid drugs into a fine mist that may be breathed through a mask or mouthpiece. Nebulizers are frequently used in more severe asthma situations or for young children who may have trouble efficiently utilising inhalers. They are primarily utilised in clinical settings or at home under the direction of a physician. While nebulizers offer advantages, such as patient convenience, inhalers have long been the favoured form of asthma therapy due to their broad availability, adaptability, and patient-friendliness.

Asthma Therapeutic Treatment Types

- Quick-Relief Medications

- Long-Term Asthma Control Medications

- Others

The treatment type that has historically dominated the asthma treatment industry is "long-term asthma control medications." These drugs are a cornerstone of asthma management recommendations and serve a critical role in controlling asthma for those with chronic symptoms. Long-term control drugs attempt to minimise asthma symptoms, avoid exacerbations, and improve overall lung function by addressing the underlying inflammation and bronchoconstriction in the airways.

Inhaled corticosteroids are among the most widely recommended long-term control drugs. These anti-inflammatory medications act by inhibiting the immune response and decreasing airway inflammation, so keeping the airways open and decreasing the probability of asthma attacks. Inhaled corticosteroids are frequently regarded as the first-line therapy for the majority of people with chronic asthma.

Asthma Therapeutic Route of Administrations

- Inhalation

- Oral

- Parenteral

In 2022, inhalation route of administration gathered utmost market share in the entire asthma treatment market. Inhalation refers to the delivery of medications directly into the lungs through inhalers or nebulizers. It is the preferred route for asthma medications due to its targeted action, rapid onset of effect, and reduced systemic side effects compared to oral or parenteral administration Inhalation therapy is highly effective in managing asthma because it delivers the medication directly to the site of action, the airways. Inhaled medications, such as bronchodilators and anti-inflammatory drugs, act directly on the inflamed airways, providing quick relief during asthma attacks and long-term control for persistent asthma.

Metered-Dose Inhalers (MDIs) and Dry Powder Inhalers (DPIs) are common types of inhalers used for asthma treatment. MDIs deliver a pre-measured dose of medication in aerosol form, while DPIs deliver medication in a powdered form that requires a forceful inhalation by the patient to disperse the drug.

Nebulizers, although part of the inhalation route, are less commonly used in everyday asthma management compared to inhalers. Nebulizers convert liquid medications into a fine mist that can be inhaled through a mask or mouthpiece, making them suitable for young children or individuals who have difficulty using inhalers effectively. While oral and parenteral routes are also utilized for certain asthma medications, such as oral corticosteroids for severe exacerbations or parenteral biologic therapies for severe and refractory asthma, they do not dominate the asthma therapeutics market as inhalation does.

Asthma Therapeutics Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Asthma Therapeutics Market Regional Analysis

The North American area, which includes the United States and Canada, has been a major participant in the market for asthma medicines. Asthma prevalence, well-established healthcare systems, and a strong emphasis on research and development all contribute to the region's market growth. Personalized medicine and biologic therapy for severe asthma sufferers have advanced in North America. Furthermore, the availability of asthma drug insurance coverage and access to diverse treatment alternatives has contributed to the market's growth.

Asthma prevalence has risen in the Asia-Pacific area as a result of causes such as urbanization, industrialization, and pollution. Countries with vast populations and various levels of access to healthcare services include China, India, and Japan. The affordability and availability of asthma drugs in this region might have an impact on the market. While inhaled corticosteroids and bronchodilators are widely utilized, biologic treatments may be difficult to get in some countries due to financial constraints.

Asthma Therapeutics Market Players

Some of the top asthma therapeutics companies offered in our report include Sunovion Pharmaceuticals Inc., GlaxoSmithKline Plc, Biogen Inc., Teva Pharmaceutical Industries Ltd., Amgen Inc., Novartis International AG, F. Hoffmann-La Roche Ltd., Boehringer Ingelheim International GmbH, AstraZeneca PLC, Merck Sharp & Dohme Corp., and Abbott Laboratories.

Frequently Asked Questions

What was the size of the global asthma therapeutics market in 2022?

The size of asthma therapeutics market was USD 21.6 billion in 2022.

What is the asthma therapeutics market CAGR from 2023 to 2032?

The asthma therapeutics market CAGR during the analysis period of 2023 to 2032 is 3.6%.

Which are the key players in the asthma therapeutics market?

The key players operating in the global asthma therapeutics market are including Sunovion Pharmaceuticals Inc., GlaxoSmithKline Plc, Biogen Inc., Teva Pharmaceutical Industries Ltd., Amgen Inc., Novartis International AG, F. Hoffmann-La Roche Ltd., Boehringer Ingelheim International GmbH, AstraZeneca PLC, Merck Sharp & Dohme Corp., and Abbott Laboratories.

Which region dominated the global asthma therapeutics market share?

North America region held the dominating position in asthma therapeutics industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of asthma therapeutics during the analysis period of 2023 to 2032.

What are the current trends in the global asthma therapeutics industry?

The current trends and dynamics in the asthma therapeutics industry include increasing prevalence of asthma, growing awareness and healthcare expenditure, and advancements in treatment options.

Which drug class held the maximum share in 2022?

The anti-inflammatory drug class held the maximum share of the asthma therapeutics industry.