Aspartic Acid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Aspartic Acid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

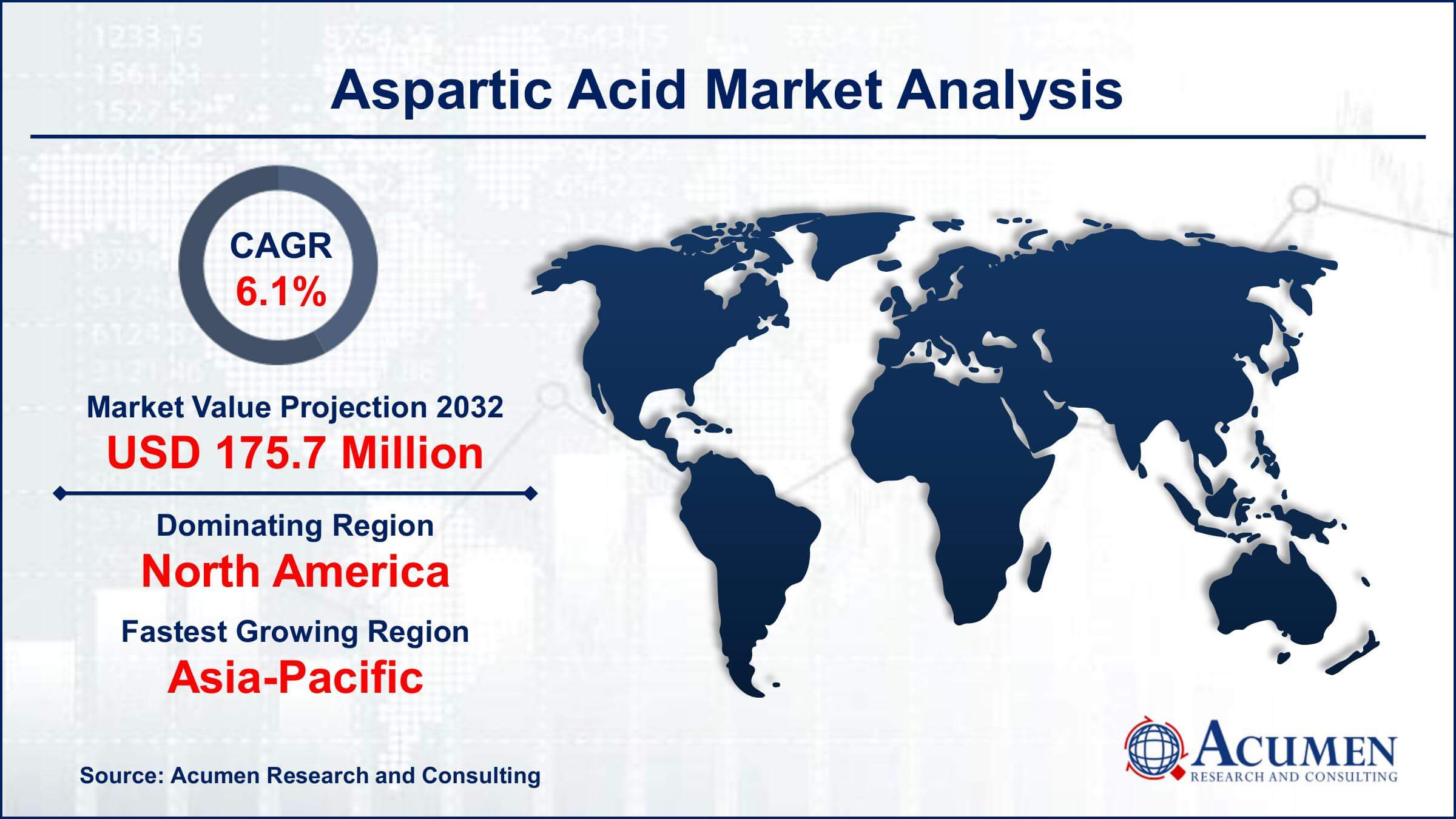

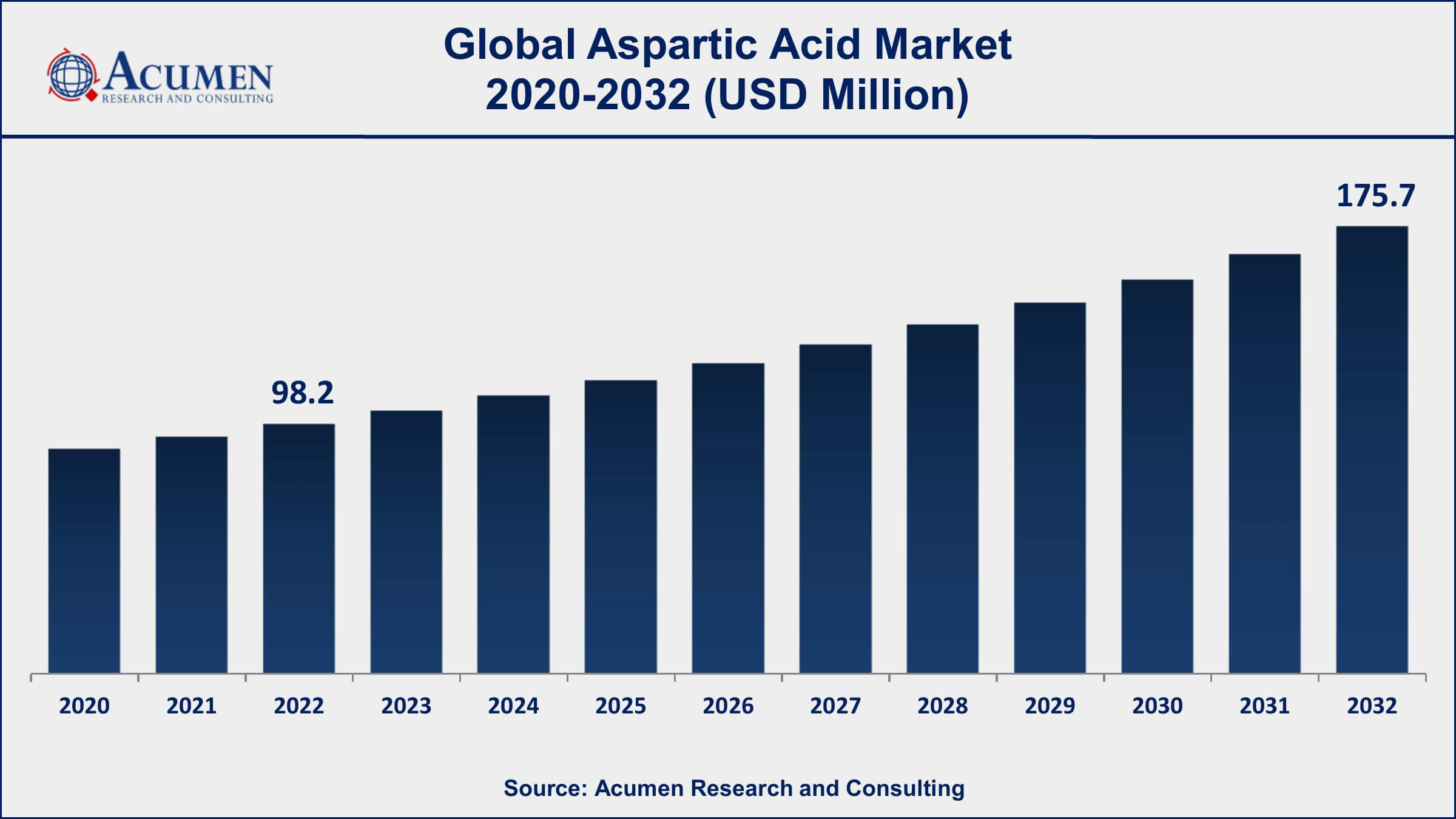

The Global Aspartic Acid Market Size accounted for USD 98.2 Million in 2022 and is projected to achieve a market size of USD 175.7 Million by 2032 growing at a CAGR of 6.1% from 2023 to 2032.

Aspartic Acid Market Key Highlights

- Global aspartic acid market revenue is expected to increase by USD 175.7 Million by 2032, with a 6.1% CAGR from 2023 to 2032

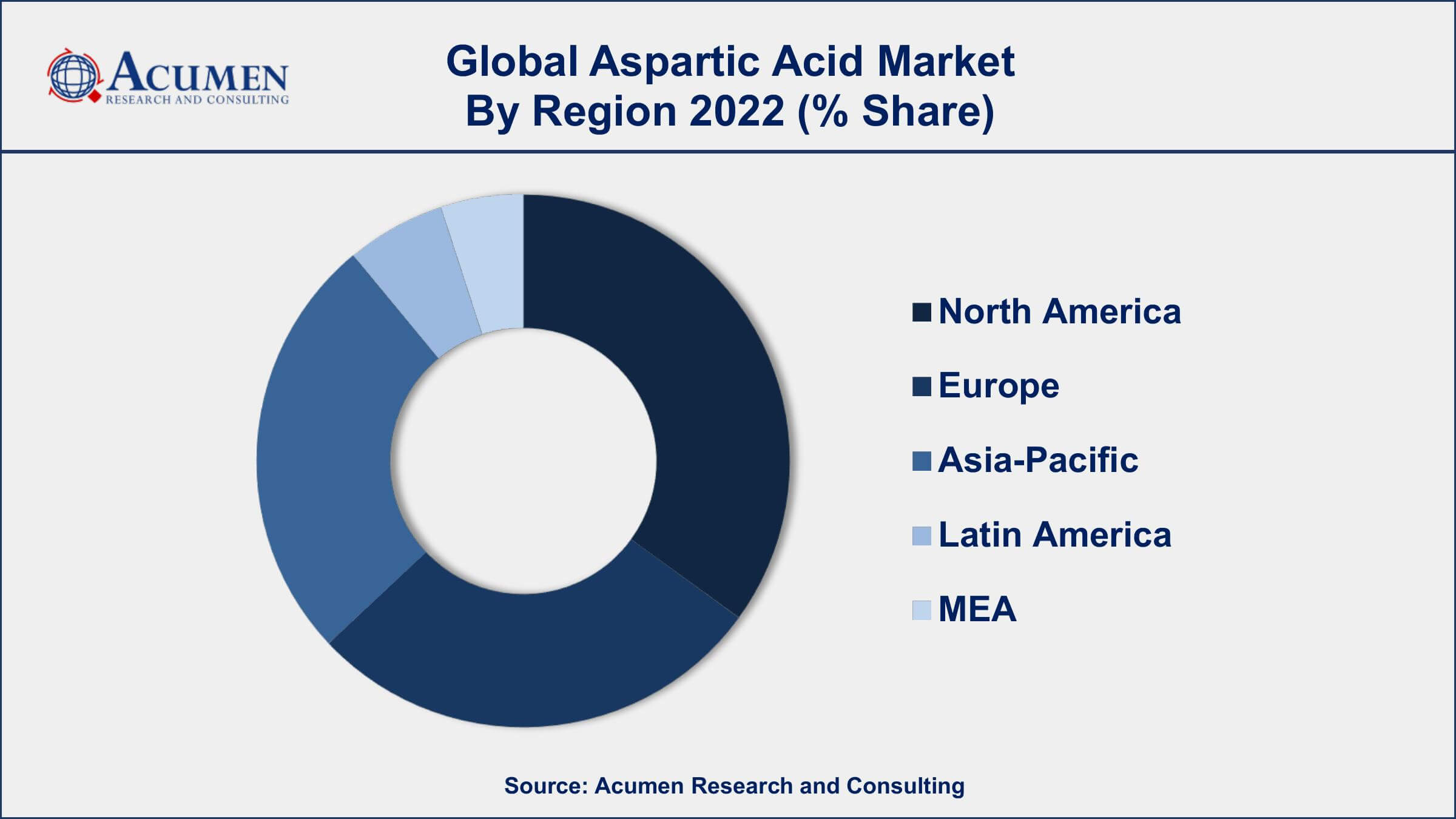

- North America region led with more than 41% of aspartic acid market share in 2022

- Asia-Pacific region is growing at a CAGR of 7% between 2023 and 2032

- By product type, the L-Aspartic acid segment generated more than 60% of the revenue share in 2022

- By application, the food and beverage segment captured for the largest market share in 2022

- Rising demand for dietary supplements and nutraceuticals, drives the aspartic acid market value

Aspartic acid is a type of amino acid, which is an essential building block for proteins in the body. It is classified as a non-essential amino acid, meaning that it can be synthesized by the body from other amino acids. Aspartic acid is found in many foods, including meat, dairy products, and vegetables, and is also used in the production of artificial sweeteners, flavor enhancers, and dietary supplements.

The market for aspartic acid has seen significant growth in recent years, driven primarily by the increasing demand for food and beverage products and dietary supplements. The food and beverage industry is the largest application segment for aspartic acid, where it is used as a flavor enhancer and in the production of artificial sweeteners. The demand for aspartic acid in the food and beverage industry is driven by the growing demand for convenience foods and the increasing use of artificial sweeteners in food and beverage products. The pharmaceutical industry is also a significant application segment for aspartic acid, which is used as a dietary supplement and testosterone booster. The growing interest in health and wellness and the increasing demand for dietary supplements are expected to drive the aspartic acid market growth in the coming years.

Global Aspartic Acid Market Trends

Market Drivers

- Increasing demand for food and beverage products

- Growing use of artificial sweeteners

- Rising demand for dietary supplements and nutraceuticals

- Growth of the pharmaceutical industry

- Increasing demand from the cosmetics industry

Market Restraints

- Potential health risks associated with excessive consumption of aspartic acid

- Stringent regulations on the use of aspartic acid in some countries

Market Opportunities

- Increasing focus on sustainable and organic products

- Rising adoption of plant-based diets

Aspartic Acid Market Report Coverage

| Market | Aspartic Acid Market |

| Aspartic Acid Market Size 2022 | USD 98.2 Million |

| Aspartic Acid Market Forecast 2032 | USD 175.7 Million |

| Aspartic Acid Market CAGR During 2023 - 2032 | 6.1% |

| Aspartic Acid Market Analysis Period | 2020 - 2032 |

| Aspartic Acid Market Base Year | 2022 |

| Aspartic Acid Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ajinomoto Co., Inc., Archer Daniels Midland Company, Evonik Industries AG, Cargill, Incorporated, Prinova Group LLC, Fufeng Group Limited, KYOWA HAKKO BIO CO., LTD., Ningxia Eppen Biotech Co., Ltd., Daesang Corporation, and Shandong Yuxin Bio-Tech Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Aspartic acid, also known as aspartate, is used in the biosynthesis of proteins. Aspartic acid, in combination with glutamic acid, is known as an acidic amino acid. L-aspartic acid and D-aspartic acid are the two forms of enantiomers of aspartic acid available in the industry. L-aspartic acid is directly combined into proteins, unlike D-aspartic acid. Aspartic acid is used in the production of a sweetener known as aspartame. The market for aspartic acid is driven by the increased demand for biodegradable products because of the depleting fossil fuel reserves.

Upsurge in the end-use industries such as pharmaceuticals, food & beverage, and chemicals is believed to be the major factor augmenting the growth of the aspartic acid industry. Increased consumption of meat and sweeteners is another important factor contributing to the market growth. Moreover, the upsurge in biodegradable polymers also boosts the market for aspartic acid. However, the fluctuating raw material price hampers the market growth. Also, the complexity of the manufacturing process and its increased cost restrains the market growth for aspartic acid.

Aspartic Acid Market Segmentation

The global aspartic acid market segmentation is based on product type, application, and geography.

Aspartic Acid Market By Product Type

- L-Aspartic Acid

- D-Aspartic Acid

- DL-Aspartic Acid

In terms of product types, the L-aspartic acid segment has seen significant growth in recent years. The demand for L-Aspartic acid is driven by the growing food and beverage industry, especially in emerging economies. The use of L-Aspartic acid as a flavor enhancer and artificial sweetener in processed foods and beverages has become increasingly popular due to its ability to enhance the taste while reducing calories. The rise in the prevalence of obesity and diabetes has also led to an increased demand for low-calorie sweeteners, which has further boosted the demand for L-Aspartic acid. In addition, L-Aspartic acid is also used in the production of amino acids, which are essential building blocks for proteins. The demand for amino acids is growing due to their increasing use in the production of dietary supplements and nutraceuticals. L-Aspartic acid is also used in the production of biodegradable plastics, which is a rapidly growing industry.

Aspartic Acid Market By Application

- Food and Beverages

- Pharmaceuticals

- Cosmetics

- Agriculture

- Others

According to the aspartic acid market forecast, the food and beverages segment is expected to witness significant growth in the coming years. The demand for aspartic acid in the food and beverage industry is driven by its use as a flavor enhancer and in the production of artificial sweeteners. Aspartic acid provides a unique taste profile that enhances the flavor of food and beverages, and it is widely used in the production of processed foods and beverages, including soft drinks, juices, and dairy products. The growing demand for convenience foods and the increasing use of artificial sweeteners in food and beverage products is expected to drive the growth of the food and beverage segment. In addition, the rise in the prevalence of obesity and diabetes has led to an increased demand for low-calorie sweeteners, which has further boosted the demand for aspartic acid in the food and beverage industry. Aspartic acid is a low-calorie sweetener that is widely used in the production of sugar-free and reduced-calorie food and beverage products.

Aspartic Acid Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Aspartic Acid Market Regional Analysis

North America is currently dominating the aspartic acid market and is expected to continue its dominance in the coming years. The region's dominance is primarily due to the high demand for aspartic acid in the food and beverage industry, which is the largest application segment for amino acids. The growing demand for low-calorie and sugar-free food and beverage products, coupled with the increasing health consciousness among consumers, has led to increased use of aspartic acid as an artificial sweetener and flavor enhancer in the region. In addition, the pharmaceutical industry in North America is also a major contributor to the market growth. Aspartic acid is used in the production of various drugs and dietary supplements, which are in high demand in the region. The growth of the pharmaceutical industry, coupled with the increasing use of aspartic acid in drug production, has led to an increased demand for amino acids in North America.

Aspartic Acid Market Player

Some of the top aspartic acid market companies offered in the professional report include Ajinomoto Co., Inc., Archer Daniels Midland Company, Evonik Industries AG, Cargill, Incorporated, Prinova Group LLC, Fufeng Group Limited, KYOWA HAKKO BIO CO., LTD., Ningxia Eppen Biotech Co., Ltd., Daesang Corporation, and Shandong Yuxin Bio-Tech Co., Ltd.

Frequently Asked Questions

What was the market size of the global aspartic acid in 2022?

The market size of aspartic acid was USD 98.2 Million in 2022.

What is the CAGR of the global aspartic acid market from 2023 to 2032?

The CAGR of aspartic acid is 6.1% during the analysis period of 2023 to 2032.

Which are the key players in the aspartic acid market?

The key players operating in the global market are including Ajinomoto Co., Inc., Archer Daniels Midland Company, Evonik Industries AG, Cargill, Incorporated, Prinova Group LLC, Fufeng Group Limited, KYOWA HAKKO BIO CO., LTD., Ningxia Eppen Biotech Co., Ltd., Daesang Corporation, and Shandong Yuxin Bio-Tech Co., Ltd.

Which region dominated the global aspartic acid market share?

North America held the dominating position in aspartic acid industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of aspartic acid during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global aspartic acid industry?

The current trends and dynamics in the aspartic acid industry include increasing demand for food and beverage products, growing use of artificial sweeteners, and rising demand for dietary supplements and nutraceuticals.

Which product type held the maximum share in 2022?

The L-aspartic acid product type held the maximum share of the aspartic acid industry.