Artificial Insemination Market | Acumen Research and Consulting

Artificial Insemination Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format : ![]()

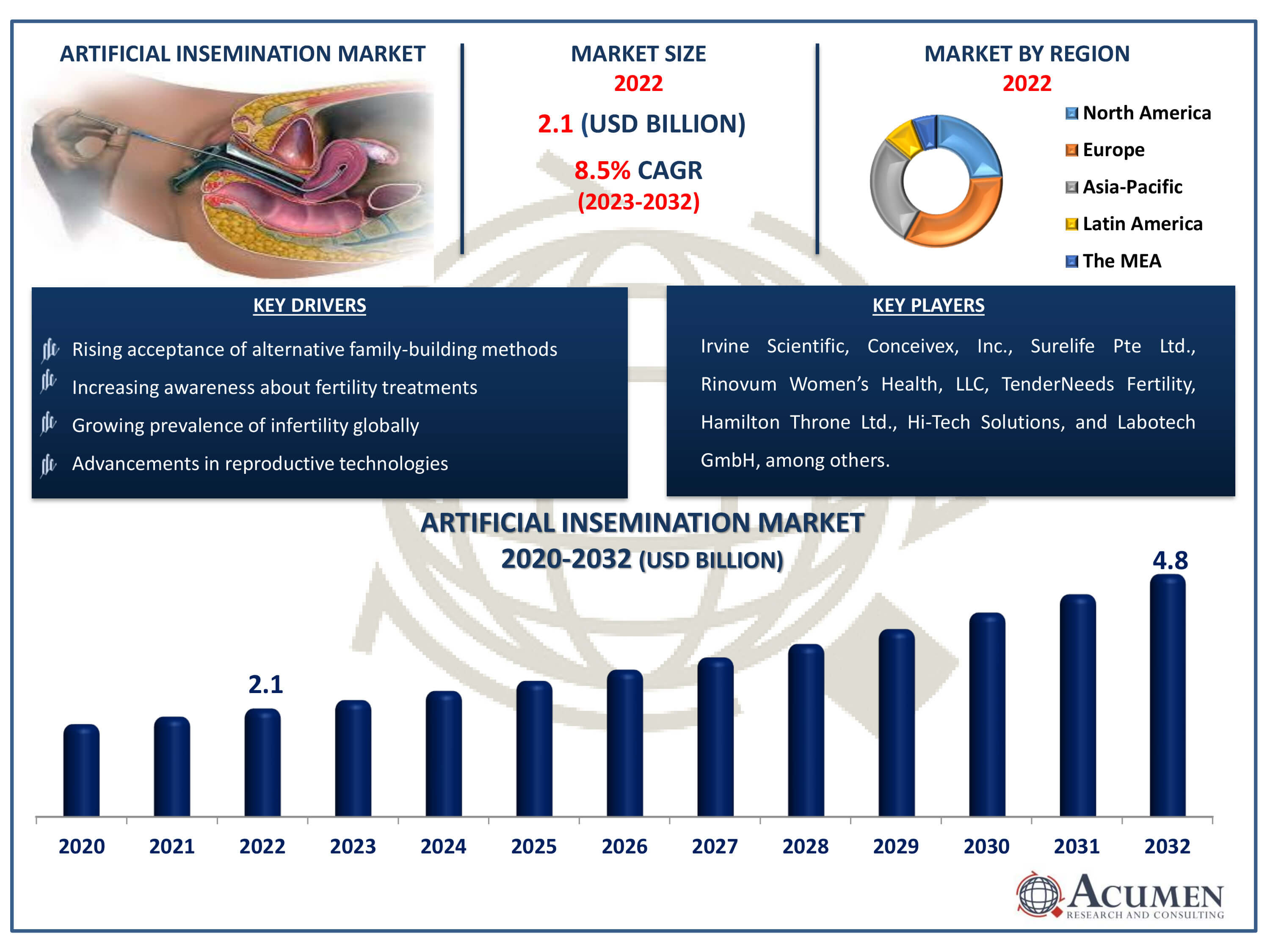

The Artificial Insemination Market Size accounted for USD 2.1 Billion in 2022 and is estimated to achieve a market size of USD 4.8 Billion by 2032 growing at a CAGR of 8.5% from 2023 to 2032.

Artificial Insemination Market Highlights

- Global artificial insemination market revenue is poised to garner USD 4.8 billion by 2032 with a CAGR of 8.5% from 2023 to 2032

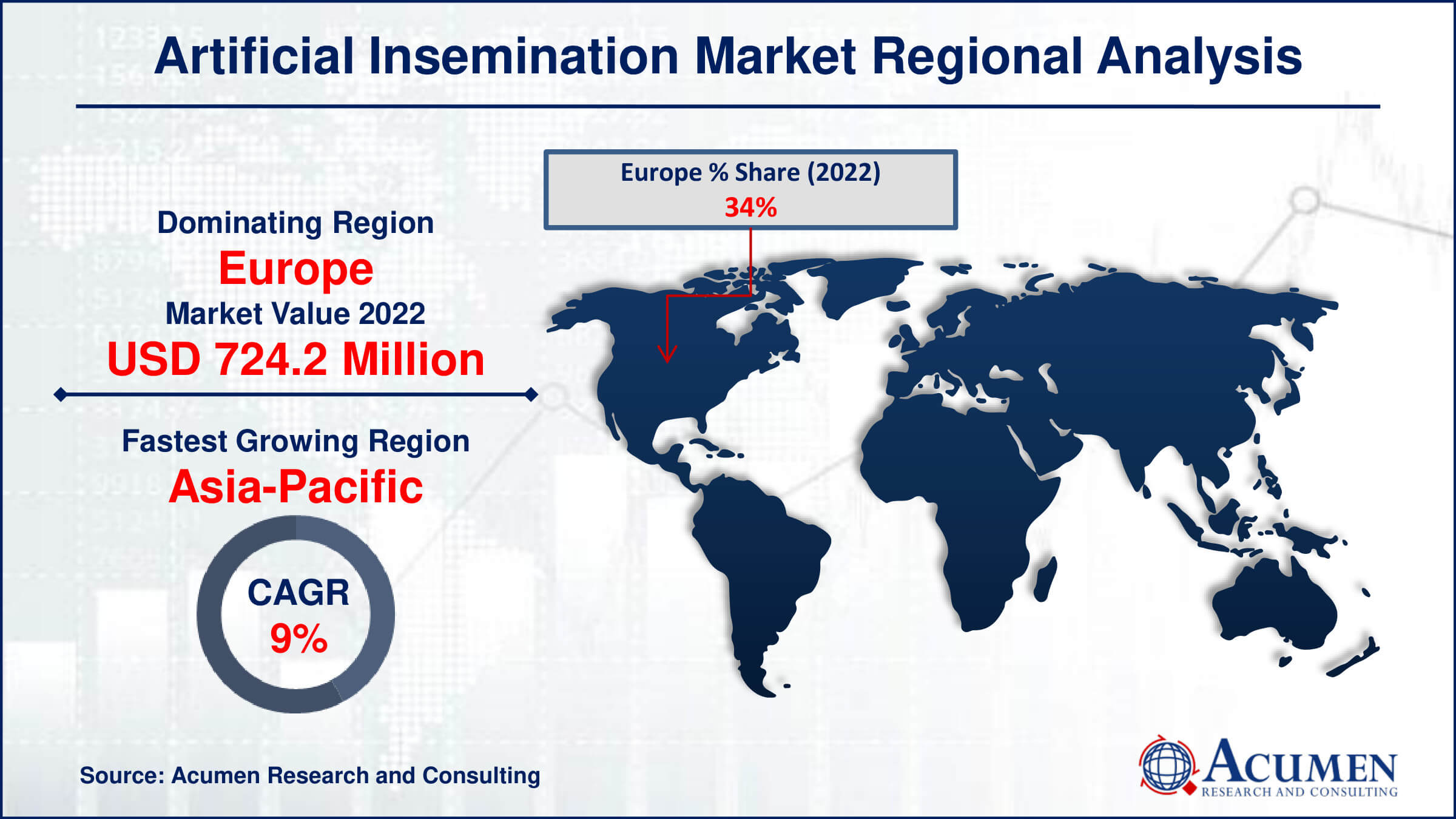

- Europe artificial insemination market value occupied around USD 724.2 million in 2022

- Asia-Pacific artificial insemination market growth will record a CAGR of more than 9% from 2023 to 2032

- Among source, the AIH-Husband sub-segment generated more than USD 1.2 billion revenue in 2022

- Based on end use, the fertility clinics & other facilities sub-segment generated around 54% market share in 2022

- Increasing investment in research and development for improved fertility solutions is a popular artificial insemination market trend that fuels the industry demand

Artificial insemination is a fertility procedure involving the insertion of sperm into a female's reproductive tract using a syringe. This method commonly employed for single women, lesbian couples, and couples facing infertility issues, can address cases of total infertility, sub fertility, and unexplained infertility. Many couples experiencing initial difficulties conceiving turn to artificial insemination before resorting to in vitro fertilization (IVF). This procedure can be conducted at home using a semen collection kit, sterile syringes, ovulation tests, and other assistance tools. Some kits even include ovulation predictor tests, as timing is crucial based on a woman's menstrual cycle. Home insemination offers various advantages over clinical insemination, including partner involvement, the use of fresh sperm, a relaxed environment, increased pregnancy success rates, and lower costs. While artificial insemination is legal in most countries, adherence to insemination guidelines and regulations is necessary.

Global Artificial Insemination Market Dynamics

Market Drivers

- Increasing awareness about fertility treatments

- Growing prevalence of infertility globally

- Advancements in reproductive technologies

- Rising acceptance of alternative family-building methods

Market Restraints

- High cost associated with artificial insemination procedures

- Ethical and legal considerations surrounding donor sperm usage

- Limited accessibility to specialized fertility clinics in certain regions

Market Opportunities

- Expansion of insurance coverage for fertility treatments

- Technological innovations enhancing success rates

- Rising adoption of at-home insemination kits

Artificial Insemination Market Report Coverage

| Market | Artificial Insemination Market |

| Artificial Insemination Market Size 2022 | USD 2.1 Billion |

| Artificial Insemination Market Forecast 2032 |

USD 4.8 Billion |

| Artificial Insemination Market CAGR During 2023 - 2032 | 8.5% |

| Artificial Insemination Market Analysis Period | 2020 - 2032 |

| Artificial Insemination Market Base Year |

2022 |

| Artificial Insemination Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Source, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Irvine Scientific, Conceivex, Inc., Surelife Pte Ltd., Rinovum Women’s Health, LLC, TenderNeeds Fertility, Hamilton Throne Ltd., Hi-Tech Solutions, Labotech GmbH, Pride Angel, Zander Scientific Inc., Biogenics Inc., and Nikon Instruments Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Artificial Insemination Market Insights

Modern women's lifestyle changes, their focus on planned parental care, and their tendency to postpone childbearing due to their career commitments are significant factors driving the development of the global artificial insemination market. Other factors contributing to market growth in the artificial insemination industry forecast period 2023-2032 include considerations such as cost efficiency compared to other fertility treatments and the increasing prevalence of male infertility. However, the global artificial insemination market faces certain challenges, including ethical concerns, safety issues, and the elevated risk of sexually transmitted diseases. These factors may limit the adoption of artificial insemination kits, potentially hindering the market's growth.

Furthermore, the National Institutes of Health have revealed that approximately 12% of individuals of reproductive age are affected by infertility.

According to the World Health Organization's Reproductive Health Indicators guidelines, which provide standards for generating, interpreting, and analyzing global surveillance data, the WHO monitors infertility incidence worldwide. The United Nations projects that by 2030, the global fertility rate will decrease to 2.4%, and by 2050, to 2.2%. Insurance coverage for artificial insemination procedures is available in certain countries, including the United States and the United Kingdom.

According to the National Institute of Health and Clinical Excellence (NICE) guidelines, homosexual couples should be eligible for reproductive treatments. The NHS expects such couples to be eligible for NHS-funded fertility treatments, which include up to six self-funded artificial insemination cycles. Artificial insemination is the preferred first-line treatment for infertility since it is less intrusive and less expensive than IVF. In recent years, intrauterine insemination has been the most popular and non-invasive sector, and it is projected to expand even faster in the future. Fertility clinics have maintained a significant market share in recent years, owing to the growing number of medical centres providing infertility treatments.

Artificial Insemination Market Segmentation

The worldwide market for artificial insemination is split based on type, source, end use, and geography.

Artificial Insemination Types

- Intravaginal

- Intracervical

- Intrauterine

- Intratubal

According to artificial insemination industry analysis, the intrauterine insemination retained the bulk of the market share in 2022 and is anticipated to be the rapidly growing segment over the forecast period. This mode of insemination is considered the most important way to treat infertility, as it boasts the highest pregnancy rate and is non-invasive. Additionally, the second-largest section, intravaginal insemination (IVI), is expected. IVI can be conducted in fertility clinics or at home, and it is preferred in instances of surgery and donor insemination, in particular.

Artificial Insemination Sources

- AID-Donor

- AIH-Husband

The market was driven by the artificial intrauterine insemination (AIH) segment, which is also anticipated to have the most rapid compound annual growth rate (CAGR) over the forecast period. Donor insemination (AID) is chosen as a last option for couples with non-viable sperm. AID may also be chosen by single females or homosexual couples. Donor insemination has been proven to be secure, as sperm banks require donors to provide their private medical and extended family history.

Artificial Insemination End Uses

- Home

- Fertility Clinics & Other Facilities

The most significant market share in 2022 was in fertility clinics and is likely to be the fastest-growing end-use segment during the artificial insemination market forecast period. Due to increasing infertility rates around the globe, the number of medical facilities providing fertility treatment has risen in recent years. In fertility clinics, all kinds of artificial insemination can be carried out, with most processes being done intrauterine (IUI) and intratubal (ITI). Clinic insemination processes require consulting, which involves determining the ovulation cycle before proceeding. Additionally, physicians may prescribe fertility medicines to boost the likelihood of conception.

Artificial Insemination Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Artificial Insemination Market Regional Analysis

As the fertility rate in the area decreased over the years, Europe emerged as the largest national market in 2022. Pregnancy delays and changes in lifestyle are among the factors contributing to this decline. North America followed as the second-largest market. According to the National Center for Health Statistics, only 62.5 births per 1000 women were reported.

Asia-Pacific, driven by the increasing infertility rate and growing awareness of available treatments, is anticipated to be the fastest-growing market in the forecasted years. Countries such as India, China, and Brazil, due to increasing government and private sector investments in the health sector, are expected to develop at a high pace. However, some factors that might hinder the development of artificial insemination kits include unfavorable reimbursement scenarios and increased costs of surgical processes before and after pregnancies.

Artificial Insemination Market Players

Some of the top artificial insemination companies offered in our report include Irvine Scientific, Conceivex, Inc., Surelife Pte Ltd., Rinovum Women’s Health, LLC, TenderNeeds Fertility, Hamilton Throne Ltd., Hi-Tech Solutions, Labotech GmbH, Pride Angel, Zander Scientific Inc., Biogenics Inc., and Nikon Instruments Inc.

Frequently Asked Questions

How big is the artificial insemination market?

The Artificial Insemination market size was valued at USD 2.1 billion in 2022.

What is the CAGR of the global artificial insemination market from 2023 to 2032?

The CAGR of artificial insemination is 8.5% during the analysis period of 2023 to 2032.

Which are the key players in the artificial insemination market?

The key players operating in the global market are including Irvine Scientific, Conceivex, Inc., Surelife Pte Ltd., Rinovum Women’s Health, LLC, TenderNeeds Fertility, Hamilton Throne Ltd., Hi-Tech Solutions, Labotech GmbH, Pride Angel, Zander Scientific Inc., Biogenics Inc., and Nikon Instruments Inc.

Which region dominated the global artificial insemination market share?

Europe held the dominating position in artificial insemination industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of artificial insemination during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global artificial insemination industry?

The current trends and dynamics in the artificial insemination industry include increasing awareness about fertility treatments, growing prevalence of infertility globally, advancements in reproductive technologies, and rising acceptance of alternative family-building methods.

Which source held the maximum share in 2022?

The AIH-Husband source held the maximum share of the artificial insemination industry.