Arrowroot Starch Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Arrowroot Starch Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

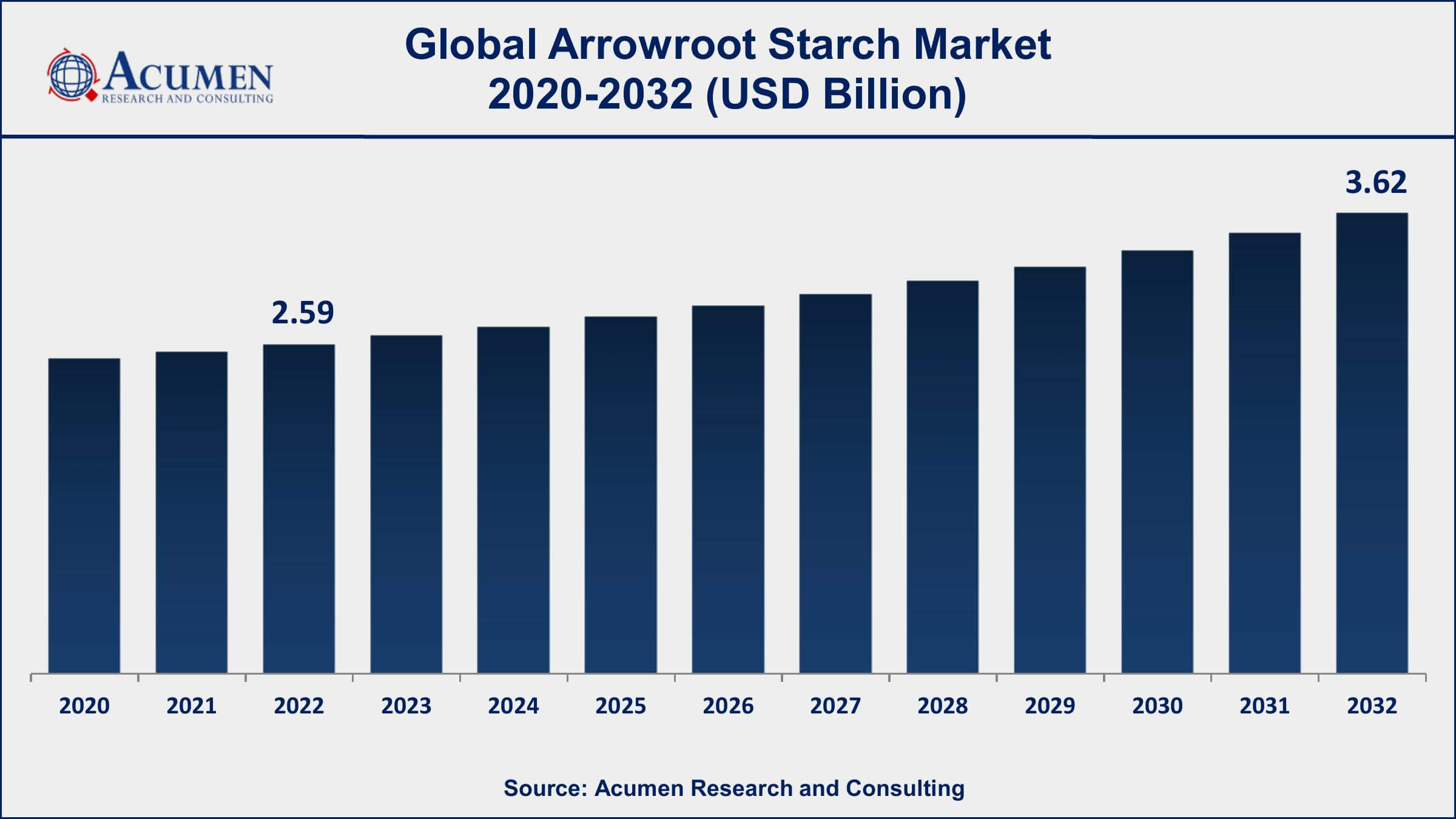

The Global Arrowroot Starch Market Size accounted for USD 2.59 Billion in 2022 and is projected to achieve a market size of USD 3.62 Billion by 2032 growing at a CAGR of 3.5% from 2023 to 2032.

Arrowroot Starch Market Highlights

- Global Arrowroot Starch Market revenue is expected to increase by USD 3.62 Billion by 2032, with a 3.5% CAGR from 2023 to 2032

- North America region led with more than 33% of Arrowroot Starch Market share in 2022

- Asia-Pacific Arrowroot Starch Market growth will record a CAGR of around 3.9% from 2023 to 2032

- By type, the organic segment captured more than 61% of revenue share in 2022

- By application, the food and beverages segment contributed more than 36% of revenue share in 2022

- Increasing demand for gluten-free and clean-label ingredients in food products, drives the Arrowroot Starch Market value

Arrowroot starch, also known as arrowroot powder or arrowroot flour, is a type of plant-based starch extracted from the rhizomes (underground stems) of various tropical plants, primarily the arrowroot plant (Maranta arundinacea). It has been used for centuries in culinary applications, often as a thickening agent for soups, sauces, and desserts due to its neutral flavor and high starch content. Arrowroot starch is a popular choice in gluten-free and grain-free cooking and baking, making it suitable for individuals with dietary restrictions.

The arrowroot starch market has experienced steady growth in recent years, driven by increasing consumer demand for natural and gluten-free food ingredients. As consumers become more health-conscious and seek clean-label products, arrowroot starch is being used as a healthier alternative to traditional thickening agents like cornstarch. Its natural origin and neutral taste make it a versatile ingredient in a wide range of food products, including baked goods, sauces, gravies, and baby foods. Additionally, the growing popularity of paleo and gluten-free diets has further boosted the demand for arrowroot starch. As dietary preferences continue to evolve, the arrowroot starch market is expected to witness sustained growth, with opportunities for innovation and product development in various food and beverage sectors.

Global Arrowroot Starch Market Trends

Market Drivers

- Increasing demand for gluten-free and clean-label ingredients in food products

- Growth in the health-conscious consumer base seeking natural thickeners

- Expanding applications in gluten-free baked goods and baby foods

- The rising popularity of paleo and grain-free diets

- Opportunities for innovation and product development in the food industry

Market Restraints

- Limited geographic cultivation of arrowroot plants

- Price volatility due to weather-related crop fluctuations

Market Opportunities

- Development of value-added arrowroot-based products

- Diversification into non-food applications like cosmetics and pharmaceuticals

Arrowroot Starch Market Report Coverage

| Market | Arrowroot Starch Market |

| Arrowroot Starch Market Size 2022 | USD 2.59 Billion |

| Arrowroot Starch Market Forecast 2032 | USD 3.62 Billion |

| Arrowroot Starch Market CAGR During 2023 - 2032 | 3.5% |

| Arrowroot Starch Market Analysis Period | 2020 - 2032 |

| Arrowroot Starch Market Base Year |

2022 |

| Arrowroot Starch Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Bob's Red Mill, NOW Foods, Authentic Foods, Nature's Way, Tropical Traditions, Pure Organic Ingredients, Frontier Co-op, Anthony's Goods, Health Garden USA, Arrowhead Mills, Barry Farm Foods, and Let's Do...Organic. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Arrowroot starch is known for its neutral flavor, high clarity, and excellent thickening properties, making it a popular choice in the food industry. In culinary applications, arrowroot starch serves as an effective thickening agent for a wide range of dishes. It has several advantages over other thickeners like cornstarch and wheat flour. Arrowroot starch thickens at a lower temperature, so it is less likely to form lumps when added to hot liquids. It also produces a clear, glossy texture in sauces and gravies, making it ideal for dishes where visual appeal is important. Moreover, arrowroot starch is a preferred option for individuals with dietary restrictions, as it is gluten-free and grain-free, suitable for those following gluten-free, paleo, or grain-free diets. It is commonly used in soups, sauces, puddings, and baked goods to achieve the desired consistency and texture.

The arrowroot starch market has experienced significant growth in recent years, driven by several key factors. One of the primary drivers is the increasing consumer demand for clean-label and gluten-free ingredients in food products. Arrowroot starch, being a natural and gluten-free thickening agent, has gained popularity among health-conscious consumers and those with dietary restrictions. This trend has spurred its adoption in a wide range of food applications, including baked goods, sauces, and baby foods.

Moreover, the rise in awareness of alternative diets, such as paleo and grain-free, has further fueled the demand for arrowroot starch. These dietary preferences have prompted food manufacturers to reformulate their products, replacing traditional thickeners with arrowroot starch to meet the evolving consumer demands. Additionally, the versatility of arrowroot starch and its neutral flavor make it an attractive choice for food manufacturers seeking to improve the texture and consistency of their products while maintaining a clean and natural ingredient label. With the growing emphasis on healthy and natural eating, the arrowroot starch market is poised to continue its growth trajectory, offering opportunities for innovation and expansion in various food and beverage sectors.

Arrowroot Starch Market Segmentation

The global Arrowroot Starch Market segmentation is based on type, application, distribution channel, and geography.

Arrowroot Starch Market By Type

- Conventional

- Organic

According to the arrowroot starch industry analysis, the organic segment accounted for the largest market share in 2022. Consumers are increasingly prioritizing health and sustainability, driving demand for organic ingredients and products perceived as more environmentally friendly. Arrowroot starch, being a naturally derived starch extracted from the rhizomes of tropical plants, is well-positioned to cater to this growing demand for organic options. One of the primary factors fueling the growth of the organic arrowroot starch segment is the heightened awareness of the benefits of organic farming practices. Organic arrowroot starch is cultivated without synthetic pesticides or chemical fertilizers, ensuring a cleaner and more sustainable production process. This aligns with consumers' concerns for food safety, environmental conservation, and minimizing exposure to harmful chemicals. As a result, consumers are willing to pay a premium for organic arrowroot starch, which has boosted its market share.

Arrowroot Starch Market By Application

- Food and beverages

- Nutraceuticals

- Pharmaceuticals

- Industrial

- Textile

- Others

In terms of applications, the food and beverages segment is expected to witness significant growth in the coming years. This growth is primarily due to the increasing use of arrowroot starch as a versatile ingredient in a wide range of culinary applications. Arrowroot starch's neutral taste, gluten-free nature, and clean-label appeal have made it a popular choice among food manufacturers seeking to meet consumer demand for healthier and more natural ingredients. One significant driver of growth in this segment is the expanding market for gluten-free products. As more consumers adopt gluten-free diets due to health concerns or dietary preferences, arrowroot starch has become a favored substitute for traditional thickeners like wheat-based flour or cornstarch in various gluten-free food items. This includes gluten-free baked goods, sauces, gravies, and snacks, where arrowroot starch is used to achieve the desired texture and consistency.

Arrowroot Starch Market By Distribution Channel

- Online retail

- Retail stores

According to the arrowroot starch market forecast, the online retail segment is expected to witness significant growth in the coming years. This growth is driven by several key factors that have transformed the way consumers purchase food ingredients and products. As consumers increasingly turn to e-commerce for their grocery shopping needs, the online retail segment for arrowroot starch has expanded rapidly. One of the primary drivers of growth in the online retail segment is convenience. Online shopping offers consumers the ease of browsing and purchasing arrowroot starch and related products from the comfort of their homes, saving time and effort compared to traditional brick-and-mortar stores. Additionally, the wider availability of arrowroot starch products from various brands and suppliers on online marketplaces allows consumers to access a diverse range of options, including different packaging sizes and organic varieties.

Arrowroot Starch Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Arrowroot Starch Market Regional Analysis

Geographically, North America dominates the arrowroot starch market for several key reasons. First and foremost is the region's well-established food industry, which includes a strong demand for natural and clean-label ingredients like arrowroot starch. North American consumers have become increasingly health-conscious and conscious of dietary restrictions, such as gluten-free and grain-free diets, which has driven the demand for arrowroot starch as a versatile and gluten-free thickening agent. As a result, food manufacturers in North America have integrated arrowroot starch into a wide range of products, including baked goods, sauces, and baby foods, contributing to the market's dominance. Moreover, the extensive agricultural infrastructure in North America has played a pivotal role in the dominance of the arrowroot starch market. The region has suitable climate conditions for the cultivation of arrowroot plants, which are primarily tropical. As a result, North American countries such as the United States have been able to establish their own arrowroot starch production facilities, ensuring a steady supply of domestically sourced products. This not only reduces dependence on imports but also supports local farmers and processors, further strengthening North America's position in the market.

Arrowroot Starch Market Player

Some of the top arrowroot starch market companies offered in the professional report include Bob's Red Mill, NOW Foods, Authentic Foods, Nature's Way, Tropical Traditions, Pure Organic Ingredients, Frontier Co-op, Anthony's Goods, Health Garden USA, Arrowhead Mills, Barry Farm Foods, and Let's Do...Organic.

Frequently Asked Questions

What was the market size of the global arrowroot starch in 2022?

The market size of arrowroot starch was USD 2.59 Billion in 2022.

What is the CAGR of the global arrowroot starch market from 2023 to 2032?

The CAGR of arrowroot starch is 3.5% during the analysis period of 2023 to 2032.

Which are the key players in the arrowroot starch market?

The key players operating in the global market are including Bob's Red Mill, NOW Foods, Authentic Foods, Nature's Way, Tropical Traditions, Pure Organic Ingredients, Frontier Co-op, Anthony's Goods, Health Garden USA, Arrowhead Mills, Barry Farm Foods, and Let's Do...Organic.

Which region dominated the global arrowroot starch market share?

North America held the dominating position in arrowroot starch industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of arrowroot starch during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global arrowroot starch industry?

The current trends and dynamics in the arrowroot starch industry include increasing demand for gluten-free and clean-label ingredients in food products, growth in the health-conscious consumer base seeking natural thickeners, and expanding applications in gluten-free baked goods and baby foods.

Which application held the maximum share in 2022?

The food and beverages application held the maximum share of the arrowroot starch industry.