Aramid Fiber Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Aramid Fiber Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

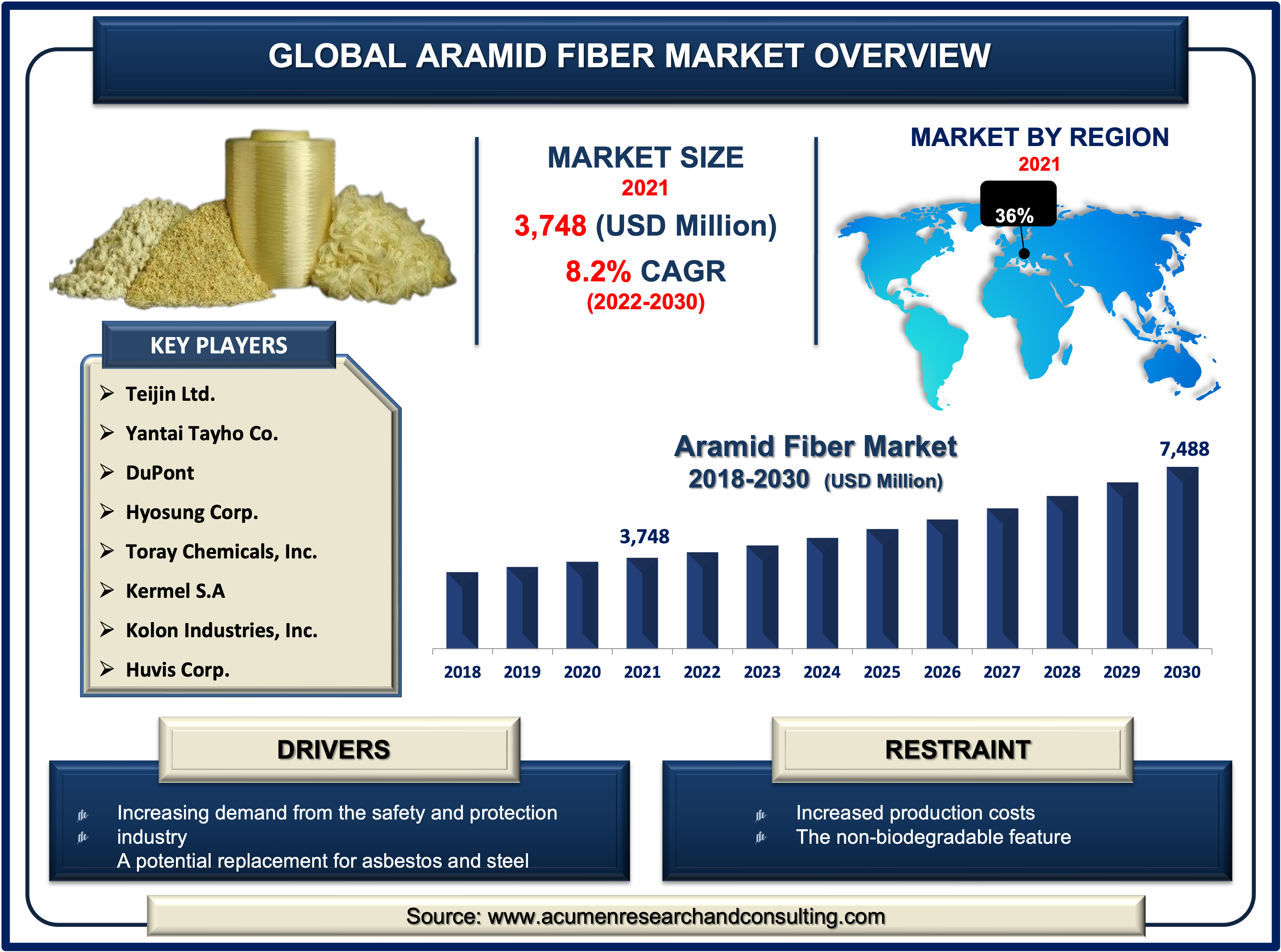

The Global Aramid Fiber Market size accounted for USD 3,748 Million in 2021 and is expected to reach USD 7,488 Million by 2030 growing at a CAGR of 8.2% during the forecast period from 2022 to 2030.

Constantly rising demand for safety products is expected to drive the aramid fiber market's growth throughout the forecast period. Furthermore, the increased demand for flexible and lightweight materials from the military & defense, and automotive industries for a wide range of applications is leading to the growth of the aramid fiber market size.

Aramid fiber is a synthetic fiber with high thermal stability and exceptionally tough properties. Some of the benefits of this type of fiber include its lightweight, high-temperature resistance, high modulus, high strength, and high corrosion resistance. It also has one of the high-temperature resistance and high-performance modern fibers that could be useful in the defense, civil, automobile, and technical fabric fields. Due to their exceptional heat resistance and increased strength-to-weight ratio, aramids are extremely popular for use in safety clothing and body armor, including ballistic protection accessorized by law enforcement officers. Furthermore, these fibers are categorized into para-aramid and meta-aramid, which are widely used in safety equipment. Aerospace and defense, security body armor, and other fields are among the major applications of these fibers.

Aramid Fiber Market Dynamics

Drivers

- Protective measures requirements led by the upsurge in asymmetric warfare

- Increasing demand from the safety and protection industry

- A potential replacement for asbestos and steel

- Increasing interest in aerospace and automobile industries

Restraints

- Increased production costs

- The non-biodegradable feature

Opportunity

- Rising demand for lightweight materials that offer significant emission reduction in vehicles

- Strict government regulations associated with workplace safety

Report Coverage

| Market | Aramid Fiber Market |

| Market Size 2021 | USD 3,748 Million |

| Market Forecast 2030 | USD 7,488 Million |

| CAGR During 2022 - 2030 | 8.2% |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Teijin Ltd., Kolon Industries, Inc., DuPont De Numerous, Inc., Huvis Corp., SRO Aramid (Jiangzu) Co., Ltd., Kermel S.A, Yantai Tayho Advanced Materials Co., Hyosung Corp., Toray Chemicals South Korea, Inc., and China National Bluestar (Group) Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

The growing demand for personal protection and safety gear in the military, defense, and manufacturing sectors is propelling the global aramid fiber market value. Along with its flame-resistant and heat-protective properties, aramid fiber is in high demand in the defense sector for national security and international terrorism strategies. Aramid fiber use in projectile applications such as ballistic protection and protective gear is expected to drive market growth in the coming years. Aramid fiber is also used in the car manufacturing industry to manufacture belts, clutches, gaskets, brake pads, tires, hoses, and other components. They also help to improve vehicle performance, safety, and durability.

Furthermore, rising demand for a wide range of applications such as optical fiber, electrical insulation, and others is propelling the aramid fiber industry. Since the product is a fine replacement for metal and asbestos, it is widely used in various automotive and construction industries. These fibers are widely used in the manufacture of consumer goods such as air conditioning systems, refrigerators, washing machines, and other items in order to make them strong and easy to handle. Despite this, the Occupational Health and Safety Administration's strict occupational safety regulations are expected to drive market growth. However, the high production costs and non-biodegradability of these fibers are expected to stifle aramid fiber market growth.

Aramid Fiber Market Segmentation

The global aramid fiber market segmentation based on the product, application and region.

Market by Product

- Para-Aramid

- Meta-Aramid

Based on the product, the para-aramid segment is expected to grow significantly in the market over the next few years. Para-aramid is a synthetic fiber used in the production of personal protection equipment and other protective equipment. As a result, they are primarily used for tire reinforcement and friction materials in vehicle brake pads, as well as reinforcing fiber optic cables, deep-sea oil exploration, bulletproof vests, and barrier protection materials. Although para-aramid fabrics are resistant to abrasion, their main application is for gloves due to their high thermal properties. Furthermore, these para-aramid fiber gloves are commonly used in processing plants, factories, kitchens, and other industries where workers are exposed to open flames, extreme temperatures, and other tasks that necessitate flame-resistant personal protection equipment.

In addition, the meta-aramid fiber segment held a significant aramid fiber market share and is expected to grow at a consistent rate over the forecast period. The product's increasing use in safety equipment, and excellent electrical, and safety equipment are expected to benefit segment growth.

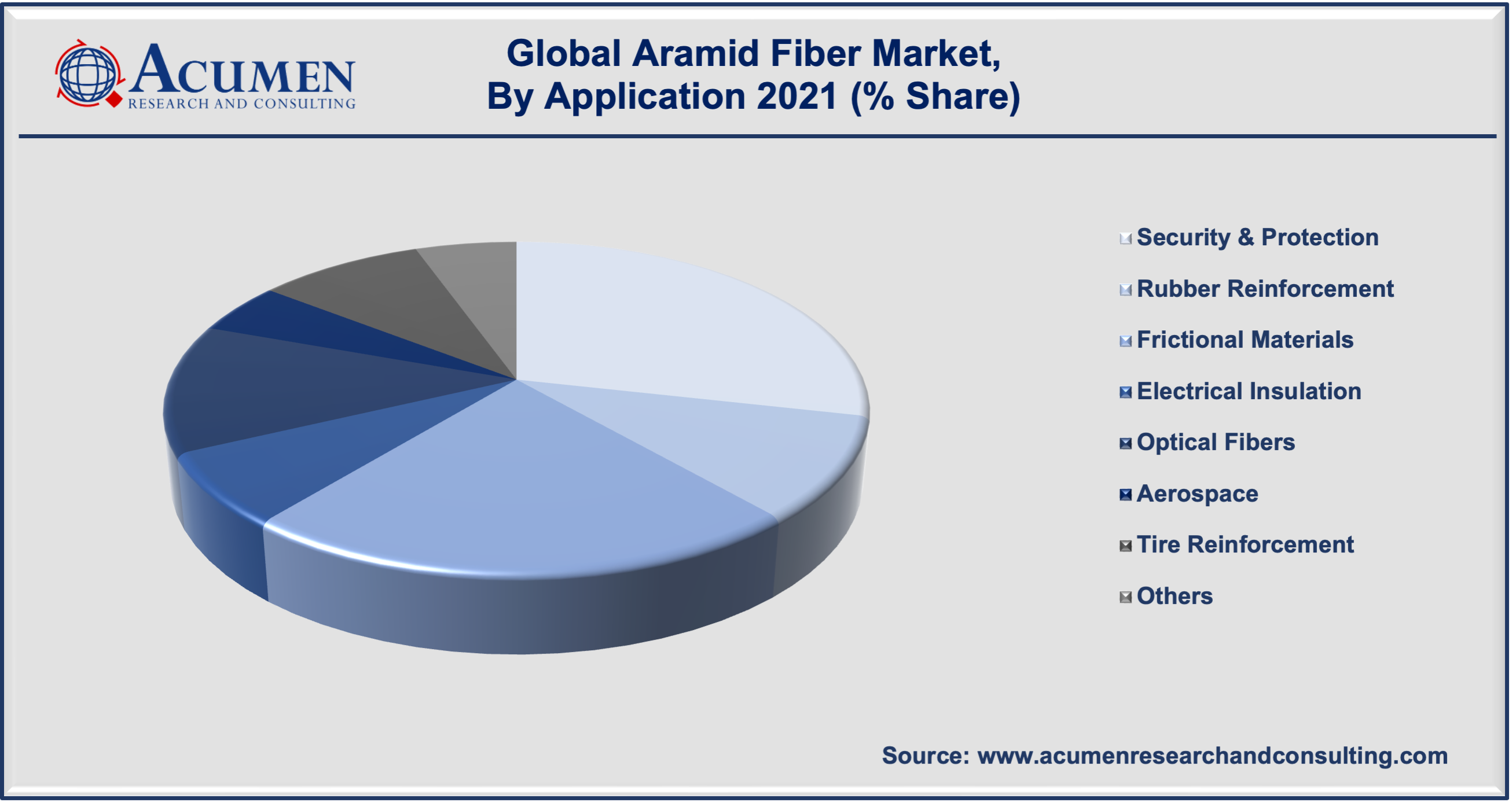

Market by Application

- Security & Protection

- Rubber Reinforcement

- Frictional Materials

- Electrical Insulation

- Optical Fibers

- Aerospace

- Tire Reinforcement

- Others

Based on the application, the security and protection segment is expected to account for the majority of the market share in 2021. Protective clothing and accessories made from aramid fibers protect against gunfire, heat, cuts, stabbing, bomb fragments, and metal fragments, among other things. Moreover, Industrial gloves, vehicle armors, ballistic apparel, hard armors, and other items fall into this category. The increase in unconventional warfare occurrences and unforeseen circumstances around the globe has led to significant defense investments by various countries in recent years, which is driving the segment growth. Border tensions have boosted sales of ballistic shielding products such as armored vehicles, eyewear, headgear, and bulletproof vests. Besides that, due to their exceptional set of features that cause these fibers to thicken when exposed to high temperatures, such as thermal runaway, they are widely used in safety and protection applications. As a result, the segment controls the majority of the market.

Aramid Fiber Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Europe is expected to lead the global market during the forecast period due to rising market growth in countries such as Germany, France, and the United Kingdom. The growing demands for efficient fuel, as well as other advancements in the electronics, telecommunications, and automotive industries, are driving the region's market. Furthermore, Europe leads the aramid fiber market due to strict safety requirements in industries such as manufacturing, oil and gas, construction, and defense, which fuels the demand for safety gear and thus aramid fiber in this region. Germany dominates the European automotive market, accounting for one-third of total European automobile manufacturing through the largest assembly and engine manufacturing plants. As a result, demand for aramid fibers is growing in these countries, as is regional growth.

Key Players

Some of the prominent global aramid fiber market companies are Teijin Ltd., Kolon Industries, Inc., DuPont De Numerous, Inc., Huvis Corp., SRO Aramid (Jiangzu) Co., Ltd., Kermel S.A, Yantai Tayho Advanced Materials Co., Hyosung Corp., Toray Chemicals South Korea, Inc., and China National Bluestar (Group) Co., Ltd.

Frequently Asked Questions

How much was the estimated market size of global aramid fiber market in 2021?

The estimated market size of global aramid fiber market in 2021 was accounted to be USD 3,748 Million.

What will be the projected CAGR for global aramid fiber market during forecast period of 2022 to 2030?

The projected CAGR of aramid fiber during the analysis period of 2022 to 2030 is 8.2%.

Which are the prominent competitors operating in the market?

The prominent players of the global aramid fiber market involve Teijin Ltd., Kolon Industries, Inc., DuPont De Numerous, Inc., Huvis Corp., SRO Aramid (Jiangzu) Co., Ltd., Kermel S.A, Yantai Tayho Advanced Materials Co., Hyosung Corp., Toray Chemicals South Korea, Inc., and China National Bluestar (Group) Co., Ltd.

Which region held the dominating position in the global aramid fiber market?

Europe held the dominating share for aramid fiber during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for aramid fiber during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global aramid fiber market?

Increasing demand from the safety and protection industry, as well as growing interest in aerospace and automobile industries, are the prominent factors that fuel the growth of global aramid fiber market.

By segment product, which sub-segment held the maximum share?

Based on product, para-aramid segment held the maximum share for aramid fiber market in 2021.