Application Server Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Application Server Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

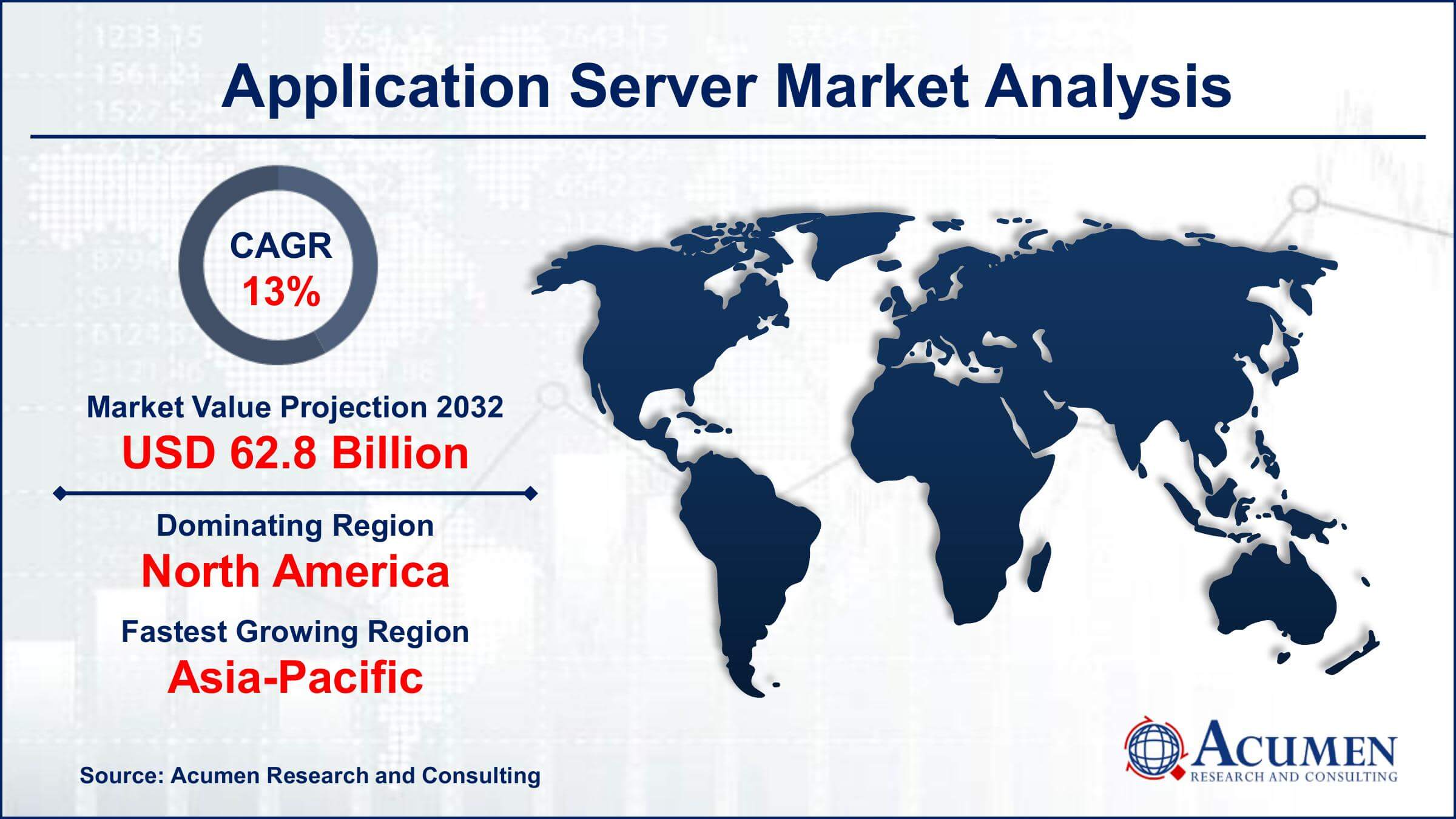

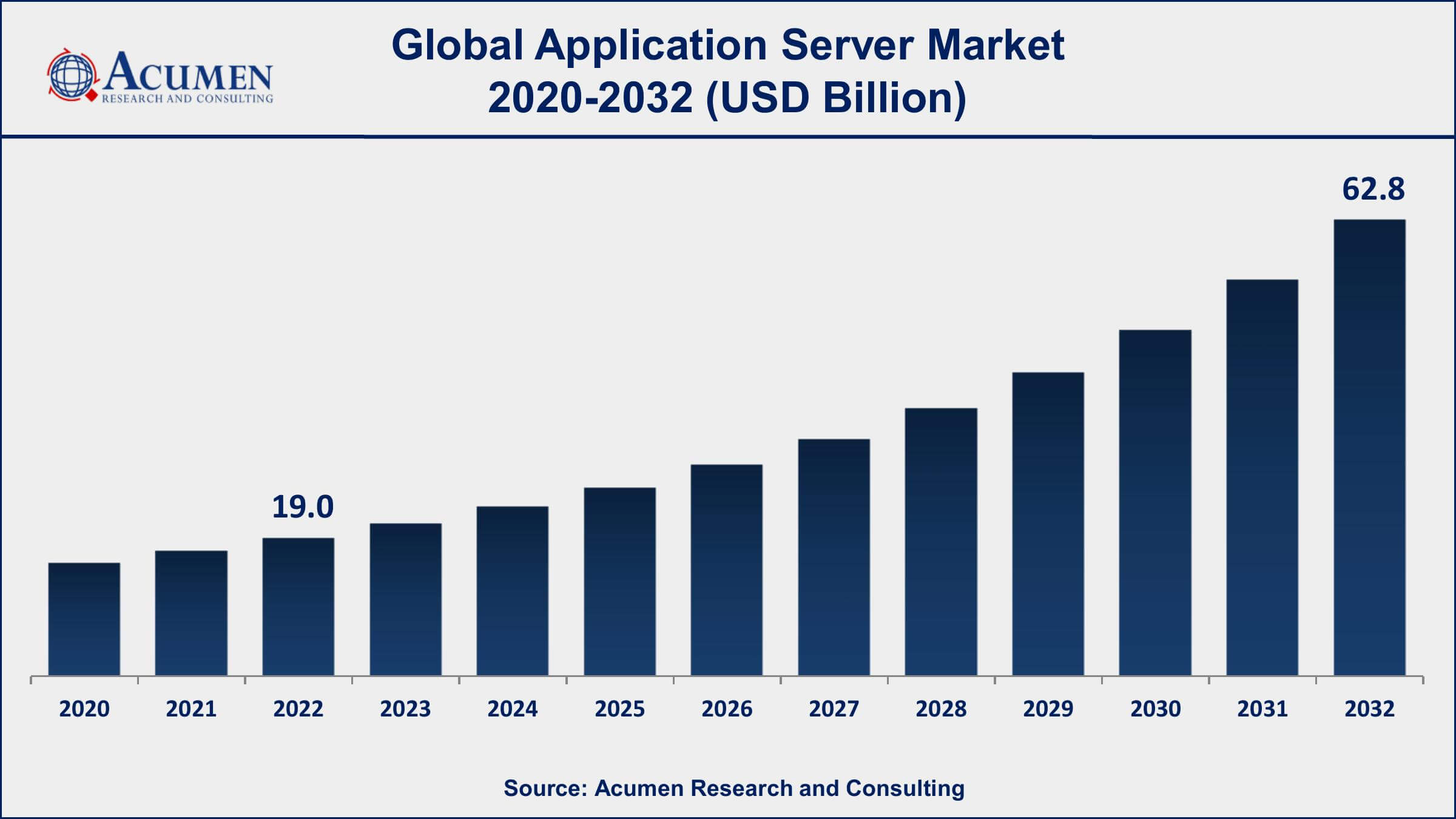

The Application Server Market Size accounted for USD 19.0 Billion in 2022 and is projected to achieve a market size of USD 62.8 Billion by 2032 growing at a CAGR of 13% from 2023 to 2032.

Application Server Market Report Key Highlights

- Global application server market revenue is expected to increase by USD 62.8 Billion by 2032, with a 13% CAGR from 2023 to 2032

- North America region led with more than 39% of application server market share in 2022

- According to a survey by Stack Overflow in 2021, Java is the third most popular programming language after JavaScript and Python.

- In a survey by Oracle in 2020, Java EE (Enterprise Edition) was the second most popular application development framework after Spring.

- Some of the popular application servers include Apache Tomcat, JBoss, IBM WebSphere, Oracle WebLogic, and Microsoft IIS.

- Increasing demand for web and mobile applications, drives the application server market size

An application server is a software platform that provides a framework for building, deploying, and running web-based applications. It typically sits between the front-end user interface and the back-end database and handles tasks such as session management, transaction processing, security, and data access. Application servers are commonly used in enterprise environments to support business-critical applications and provide a centralized platform for managing and scaling applications.

The market for application servers has been steadily growing over the past few years, driven by the increasing adoption of cloud computing and the demand for scalable, reliable, and secure application infrastructure. Moreover, the growth is attributed to the increasing demand for scalable and secure application infrastructure by businesses of all sizes, the adoption of cloud-based application delivery models, and the emergence of new technologies such as containerization and serverless computing. Overall, the application server market value is expected to continue its growth trajectory as organizations increasingly rely on web-based applications to drive their business operations and digital transformation initiatives. The market is also likely to witness new innovations and product offerings as vendors compete to meet the evolving needs of their customers.

Global Application Server Market Trends

Market Drivers

- Increasing demand for web and mobile applications

- Growing adoption of microservices architecture

- Rising popularity of cloud computing

- Advancements in technology such as artificial intelligence, machine learning, and IoT

- Growing trend of digital transformation and automation

Market Restraints

- High cost of implementation and maintenance

- Complexity of application server architecture

- Security concerns related to cloud-based infrastructure

Market Opportunities

- Growing market for edge computing and IoT applications

- Adoption of hybrid cloud models

Application Server Market Report Coverage

| Market | Application Server Market |

| Application Server Market Size 2022 | USD 19.0 Billion |

| Application Server Market Forecast 2032 | USD 62.8 Billion |

| Application Server Market CAGR During 2023 - 2032 | 13% |

| Application Server Market Analysis Period | 2020 - 2032 |

| Application Server Market Base Year | 2022 |

| Application Server Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Deployment Model, By End-Use Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | IBM Corporation, Microsoft Corporation, Oracle Corporation, Red Hat, Inc., VMware, Inc., Adobe Systems Incorporated, Apache Software Foundation, Fujitsu Limited, NEC Corporation, SAP SE, TIBCO Software Inc., and PegaSystems Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

An application server is dignified to deal with the intricacy, which is nowadays instantiated at each level of an environment touched by a human. Analytics, communication, and collaboration are all fragments of a relevant application server. Application server basically refers to the program that manages all the processes and operations between the backend application or database and the user. Primarily, the application servers are used for mobile devices, tablets, and cloud applications. They are known to escalate the evolving software delivery models, emerging mobile applications, new development strategies, and open-source software. The chief usage of these servers is in the development of mobile applications that are technically advanced and cope with the upcoming trends, such as IoT (Internet of Things). As the infrastructure for smart mobile devices and the internet is getting advanced, the demand for more sophisticated web applications and web developments increases, which has made application servers one of the key aspects of evolution in the Internet market.

Extensive utilization of mobile and computer internet applications, which is expected to grow more in the nearing future, is the major factor driving the application servers market. Also, the rising trend of IoT is anticipated to be a key growth factor owing to the rising demand for highly potent application servers to develop more innovative applications for smartphones, mobile devices, and tablets. However, the high cost of maintenance and issues with system integration of application servers can debar the growth of the application servers market, globally. Whereas rising dependency of enterprises on application servers in order to make the optimistic usage of the internet and changing communication infrastructure is anticipated to generate opportunities for the application server market growth in coming years.

Application Server Market Segmentation

The global application server market segmentation is based on type, deployment model, end-use vertical, and geography.

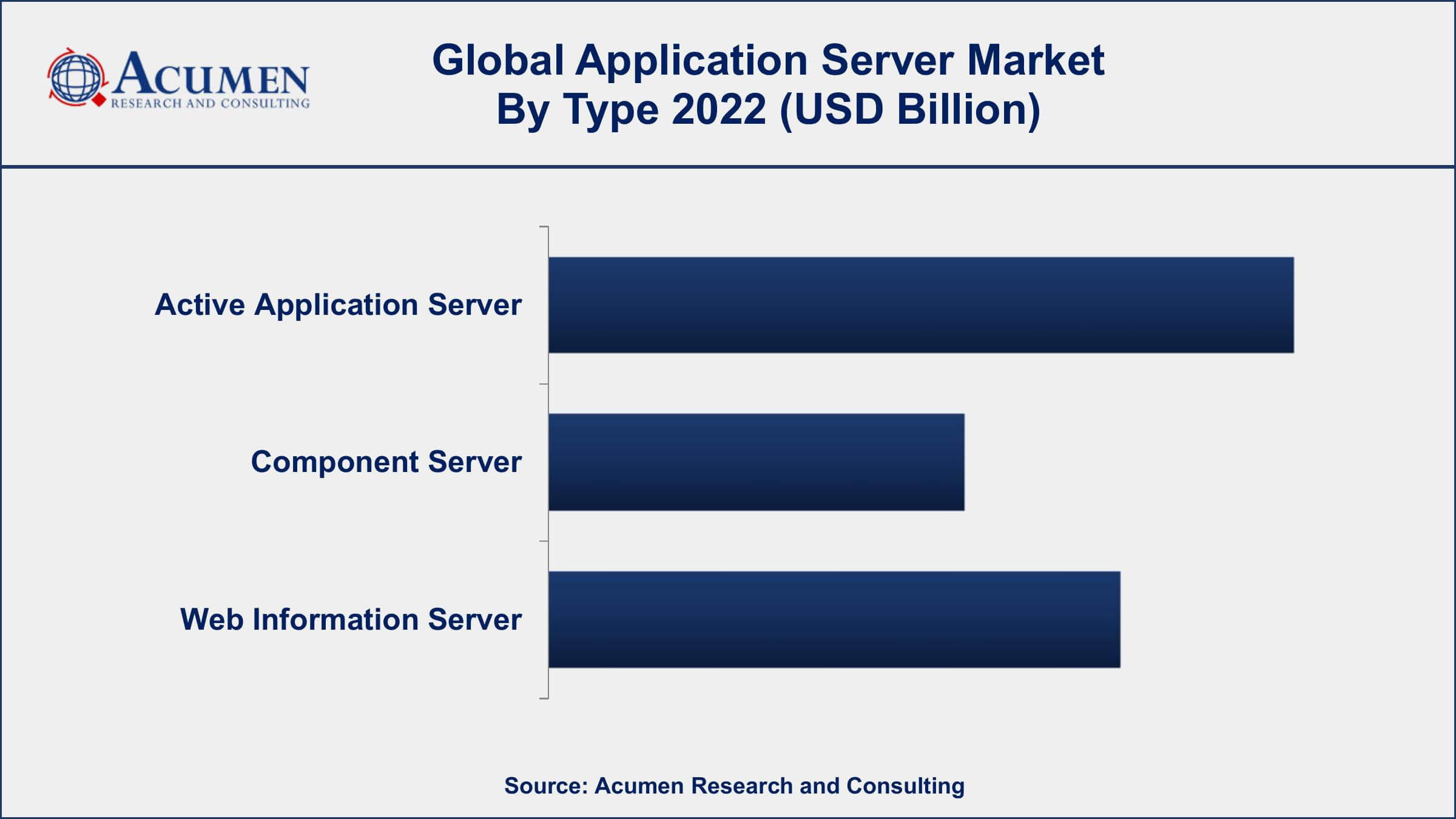

Application Server Market By Type

- Active Application Server

- Component Server

- Web Information Server

According to the application server industry analysis, the active application server segment accounted for the largest market share in 2022. Active application servers are designed to handle a large volume of transactions and provide high availability and fault tolerance. These servers are typically used in mission-critical applications such as e-commerce, financial services, and healthcare. The growth of the active application server segment is being driven by several factors, including the increasing demand for web and mobile applications, the adoption of microservices architecture, the need for efficient data management, and the rise of cloud computing. Another factor that is driving growth in the active application server segment is the trend toward a microservices architecture. Microservices architecture allows for the development of highly modular, loosely-coupled applications that can be easily scaled and updated. Active application servers play a key role in microservices architecture by providing a platform for managing and orchestrating microservices.

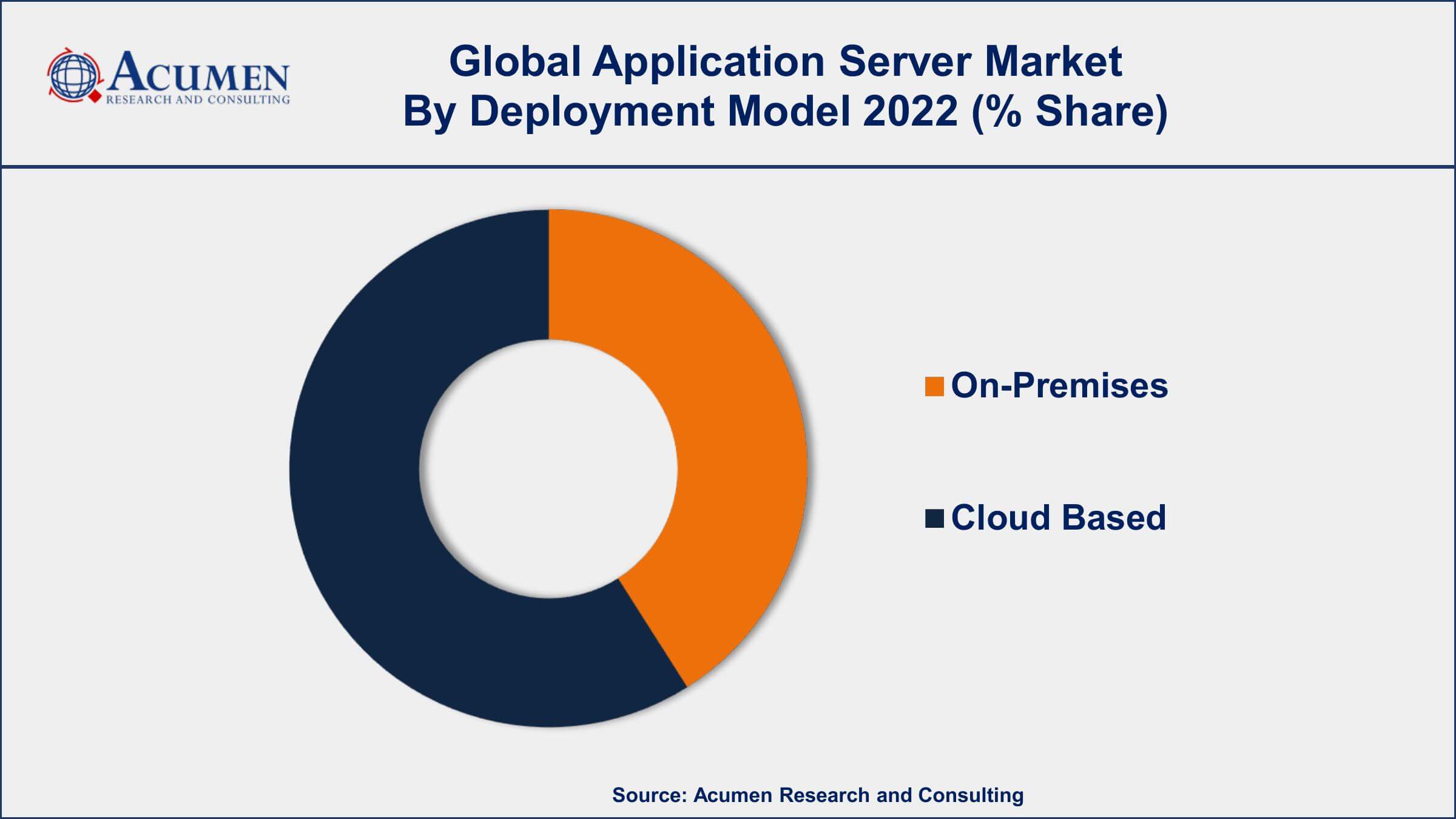

Application Server Market By Deployment Model

- On-Premises

- Cloud Based

In terms of the deployment model, the cloud-based application server market is expected to grow at a significant pace in the coming years, driven by the increasing adoption of cloud computing and the growing need for scalable and flexible application infrastructure. Cloud-based application servers eliminate the need for upfront hardware and infrastructure investments, reducing the capital expenditure required for deploying an application server. Additionally, cloud-based models typically offer a pay-as-you-go pricing model, allowing organizations to only pay for the resources they use.

Application Server Market By End-Use Vertical

- BSFI

- IT and Telecom

- Retail and Consumer Goods

- Government and Public Sector

- Healthcare and Life Sciences

- Others

According to the application server market forecast, the BSFI segment is projected to grow significantly in the coming years. The BSFI segment is undergoing a major digital transformation, as organizations seek to modernize their technology infrastructure to better serve customers and compete in the marketplace. Application servers play a critical role in this transformation, providing a platform for managing and processing the applications that underpin digital business operations. Moreover, the BSFI segment generates large volumes of data related to customer transactions, financial performance, and risk management. Application servers with built-in data management and analytics capabilities can help organizations process and analyze this data in real time, enabling them to make informed decisions.

Application Server Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Application Server Market Regional Analysis

North America has been dominating the application server market due to its advanced technological infrastructure and high adoption rate of new technologies. The region is home to some of the world's largest technology companies, such as Microsoft, IBM, Oracle, and HP, who have been driving innovation and investing heavily in research and development to improve their products and services. Furthermore, the region has a large number of small and medium-sized enterprises (SMEs) that are adopting application server solutions to streamline their business operations and improve their efficiency.

Another factor contributing to the dominance of North America in the application server market is the region's strong focus on cloud-based solutions. With the increasing demand for cloud-based services, many businesses in North America are moving their operations to the cloud, which requires application server solutions to manage their data and applications. The region has a well-established cloud infrastructure, which makes it easier for businesses to migrate to the cloud and adopt application server solutions.

Application Server Market Player

Some of the top application server market companies offered in the professional report include IBM Corporation, Microsoft Corporation, Oracle Corporation, Red Hat, Inc., VMware, Inc., Adobe Systems Incorporated, Apache Software Foundation, Fujitsu Limited, NEC Corporation, SAP SE, TIBCO Software Inc., and PegaSystems Inc.

Frequently Asked Questions

What was the market size of the global application server in 2022?

The market size of application server was USD 19.0 Billion in 2022.

What is the CAGR of the global application server market during forecast period of 2023 to 2032?

The CAGR of application server market is 13% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global application server market are IBM Corporation, Microsoft Corporation, Oracle Corporation, Red Hat, Inc., VMware, Inc., Adobe Systems Incorporated, Apache Software Foundation, Fujitsu Limited, NEC Corporation, SAP SE, TIBCO Software Inc., and PegaSystems Inc.

Which region held the dominating position in the global application server market?

North America held the dominating position in application server market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for application server market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global application server market?

The current trends and dynamics in the application server industry include the growing adoption of microservices architecture, and rising popularity of cloud computing.

Which deployment model held the maximum share in 2022?

The cloud based deployment model held the maximum share of the application server market.