API Contract Manufacturing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

API Contract Manufacturing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

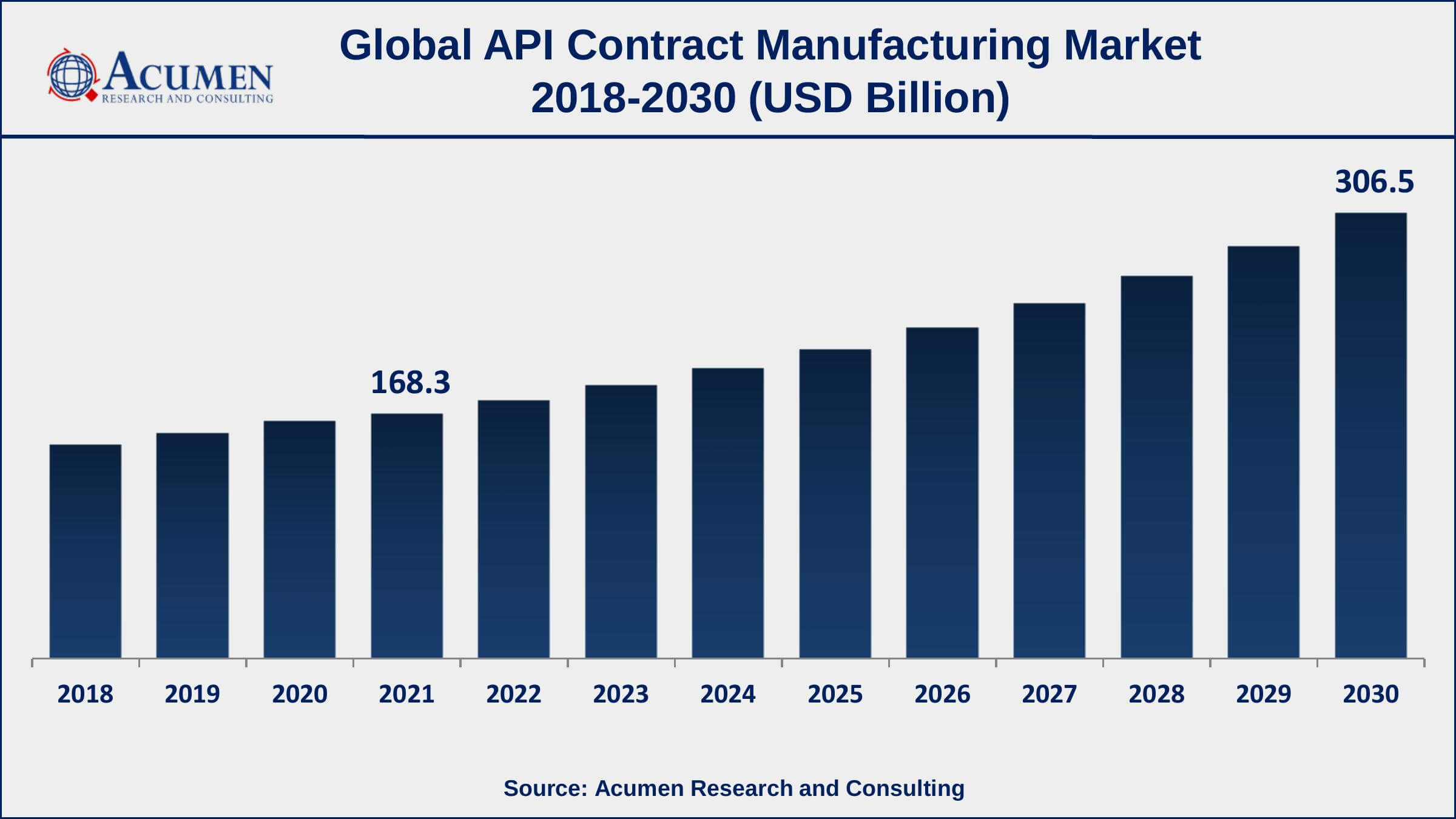

The Global API Contract Manufacturing Market Size accounted for USD 168.3 Billion in 2021 and is estimated to achieve a market size of USD 306.5 Billion by 2030 growing at a CAGR of 7.1% from 2022 to 2030. Growing generics demand, increasing pharmaceutical R&D expenditures, and contract manufacturing & research projects capital in sophisticated manufacturing systems are propelling the worldwide API contract manufacturing market value. Furthermore, the patent expiration of certain pharmaceuticals is a crucial driver driving the API contract manufacturing market growth.

API Contract Manufacturing Market Report Key Highlights

- Global API contract manufacturing market revenue intended to gain USD 306.5 billion by 2030 with a CAGR of 7.1% from 2022 to 2030

- Asia-Pacific region led with more than 39% API contract manufacturing market share in 2021

- Latin America API contract manufacturing market growth will observe strongest CAGR from 2022 to 2030

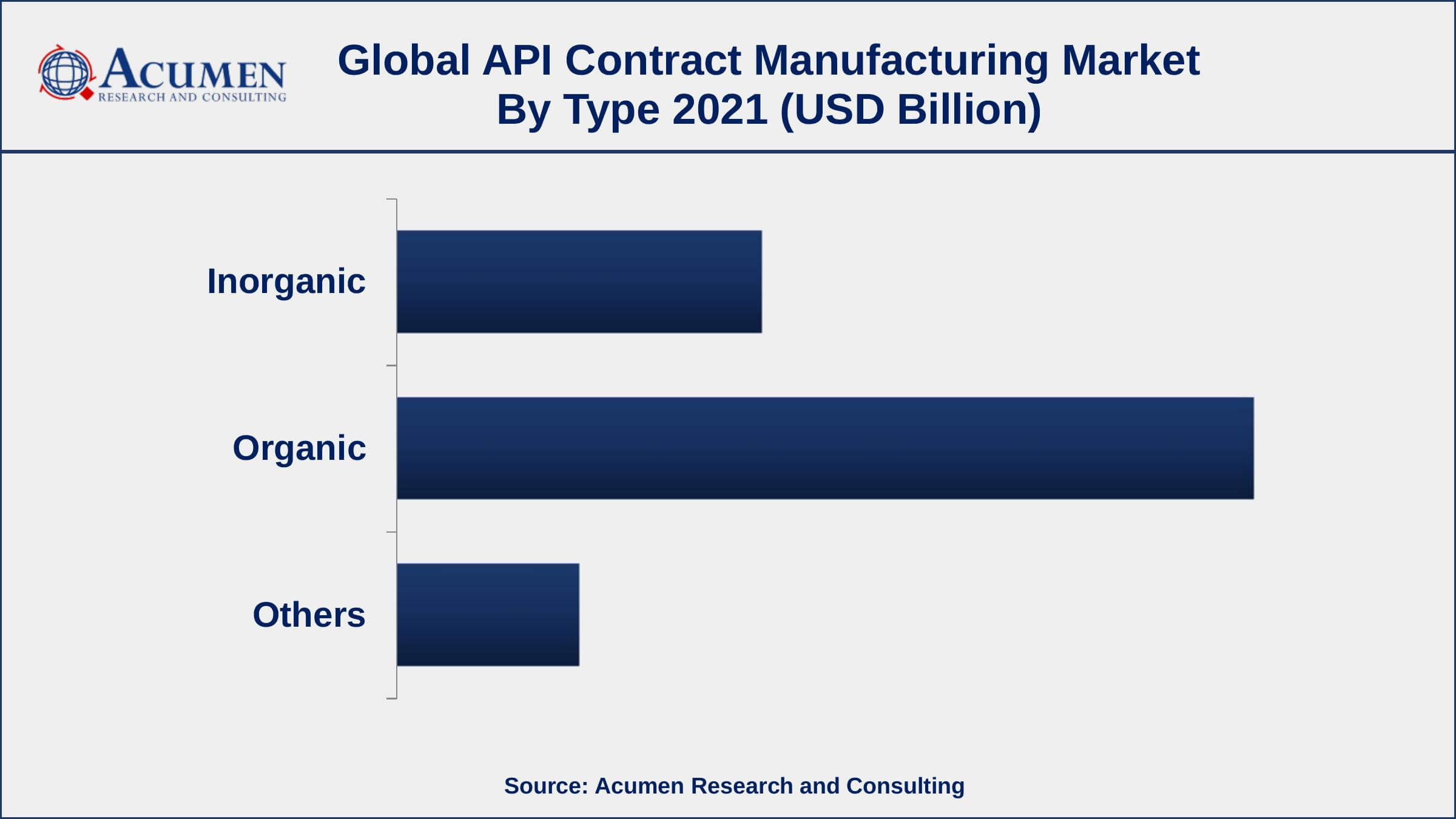

- By type, organic segment generated about 61% market share in 2021

- By end-users, the pharmaceutical industry engaged more than 66% of the total market share in 2021

- Increasing CDMO investments in cutting-edge manufacturing technologies, drives the API contract manufacturing market size

Contract manufacturing is the method by which a manufacturer enters into an arrangement with a company to manufacture a component or a product. The production of pharmaceutical medications through contract manufacturing through outsourcing to other companies is referred to as active pharmaceutical ingredient (API) contract manufacturing. The market for API contract manufacturing is predicted to grow in the next years due to the availability of trained personnel at low cost, favorable government policies, and tax breaks.

Global API Contract Manufacturing Market Trends

Market Drivers

- Growing acceptance of quality standards in API manufacturing, including GMP.

- Growing demand for generic medicines due to patent expirations

- Increasing spending in pharmaceutical research and development

- Increasing CDMO investments in cutting-edge manufacturing technologies

Market Restraints

- Emerging demand in biological therapies

- Increasing adoption for gene and cell therapies

Market Opportunities

- Increasing pharmaceutical manufacturing study and development

- Growing the number of collaborations, agreements, and expansions

API Contract Manufacturing Market Report Coverage

| Market | API Contract Manufacturing Market |

| API Contract Manufacturing Market Size 2021 | USD 168.3 Billion |

| API Contract Manufacturing Market Forecast 2030 | USD 306.5 Billion |

| API Contract Manufacturing Market CAGR During 2022 - 2030 | 7.1% |

| API Contract Manufacturing Market Analysis Period | 2018 - 2030 |

| API Contract Manufacturing Market Base Year | 2021 |

| API Contract Manufacturing Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By Form, By End-Users, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ranbaxy Laboratories Ltd., Piramal Pharma Solutions, Teva Pharmaceuticals Industries Ltd, Novartis AG, BoehringerIngelhein GmbH, Dr. Reddy's Laboratories Ltd, Sun Pharmaceutical Industries Ltd., Merck & Co., Inc., Sandoz-Lek-Biochemie, AstraZeneca Plc, and GlaxoSmithKline Pharmaceuticals Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Technological improvement in the manufacture of API, which is very efficient in fulfilling regulatory criteria, as well as a strong demand for innovative bio-generic pharmaceuticals, drives the market growth. Furthermore, rising demands for low-cost therapies in emerging nations, as well as a growth in the authorization of novel pharmaceuticals for chronic disease treatment provide opportunities for market expansion. However, the lengthy production process and tight laws and regulations regarding equipment and facilities needed for sterile small-molecule pharmaceuticals may stymie the worldwide API contract manufacturing industry.

Numerous variables are anticipated to fuel the total growth of the global API Contract Manufacturing Market. The availability of inexpensive labor in emerging nations has emerged as one of the main drivers fueling industry expansion. Reduced economic costs owing to the availability of inexpensive labor in developing Asia countries, better access to innovative technologies available on the market, and increased efficiency in such regions are primary driver’s factors for the expansion of the API contract manufacturing market.

API Contract Manufacturing Market Segmentation

The worldwide API contract manufacturing market segmentation is based on the type, form, end-users, distribution channel, and geography.

API Contract Manufacturing Market By Type

- Inorganic

- Organic

- Others

According to an API contract manufacturing industry analysis, the organics segment held the majority of shares in the global market in 2021. By limiting exposure to hazardous and persistent chemicals, organic products minimize public health hazards for laborers, their families, as well as consumers.

API Contract Manufacturing Market By Form

- Solid

- Semi-Solids

- Liquid

- Others

According to the API contract manufacturing market forecast, the solid segment is projected to expand at a rapid pace in the market over the forecasting years. Depending on the technique or route of administration, there are many different dosage form types in the pharmaceutical industry. Solid dosage forms, semi-solid dosage forms, liquid dosage forms, and gaseous dosage forms are utilized for the evaluation or treatment of the illness by multiple pathways. Solid dosage forms are among the most critical delivery systems in pharmaceuticals; that have 1 or even more unit dosage of a drug. In comparison to other dosage forms, the solid dosage form is the one most frequently utilized and prescribed by physicians.

API Contract Manufacturing Market By End-Users

- Pharmaceutical Industries

- Research Organization

- Others

In terms of end-users, the pharmaceutical companies sector dominated the API contract manufacturing market in 2021. Large pharmaceutical organizations' significant want of end-to-end services, increased competitive pressures and distribution challenges in corporate operations, as well as the increasing need to improve operational costs as popular drug patents expiration can all contribute to the market growth in the coming years.

API Contract Manufacturing Market By Distribution Channel

- Retailers

- Direct Tender

- Others

In terms of distribution channels, the direct tender segment will gain major market attention in the coming years. Tendering is a formal technique for acquiring pharmaceuticals through public tender for a specific contract. Tendering, while effective for cost conservation, can result in less competitiveness in a particular market.

API Contract Manufacturing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Asia-Pacific Holds Dominating Share of API Contract Manufacturing Market

On the basis of geography, the Asia-Pacific market is evolving and is ranked among the most attractive API contract manufacturing markets. Owing to the high costs of APIs production in Western Countries, India and China have become the most preferred regions for the outsourcing of contract manufacturing. These countries are ranked among the most stable democracies and are gifted with advanced technologies. Also, it has become an experienced market region for outsourcing API contract manufacturing as a large number of international companies are outsourcing API manufacturing to this region. Also, this region possesses large technical manpower and is further developing owing to technological developments, which will further boost the market growth.

API Contract Manufacturing Market Players

Some of the top API contract manufacturing market companies offered in the professional report includes Ranbaxy Laboratories Ltd., Piramal Pharma Solutions, Teva Pharmaceuticals Industries Ltd, Novartis AG, BoehringerIngelhein GmbH, Dr. Reddy's Laboratories Ltd, Sun Pharmaceutical Industries Ltd., Merck & Co., Inc., Sandoz-Lek-Biochemie, AstraZeneca Plc, and GlaxoSmithKline Pharmaceuticals Ltd.

Frequently Asked Questions

What is the size of global API contract manufacturing market in 2021?

The estimated value of global API contract manufacturing market in 2021 was accounted to be USD 168.3 Billion.

What is the CAGR of global API contract manufacturing market during forecast period of 2022 to 2030?

The projected CAGR API contract manufacturing market during the analysis period of 2022 to 2030 is 7.1%.

Which are the key players operating in the market?

The prominent players of the global API contract manufacturing market are Ranbaxy Laboratories Ltd., Piramal Pharma Solutions, Teva Pharmaceuticals Industries Ltd, Novartis AG, BoehringerIngelhein GmbH, Dr. Reddy's Laboratories Ltd, Sun Pharmaceutical Industries Ltd., Merck & Co., Inc., Sandoz-Lek-Biochemie, AstraZeneca Plc, and GlaxoSmithKline Pharmaceuticals Ltd.

Which region held the dominating position in the global API contract manufacturing market?

Asia-Pacific held the dominating API contract manufacturing during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Latin America region exhibited fastest growing CAGR for API contract manufacturing during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global API contract manufacturing market?

Growing demand for generic medicines and rising acceptance of quality standards in API manufacturing, including GMP drives the growth of global API contract manufacturing market.

By type segment, which sub-segment held the maximum share?

Based on type, organic segment is expected to hold the maximum share API contract manufacturing market.