Antimicrobial Plastics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Antimicrobial Plastics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

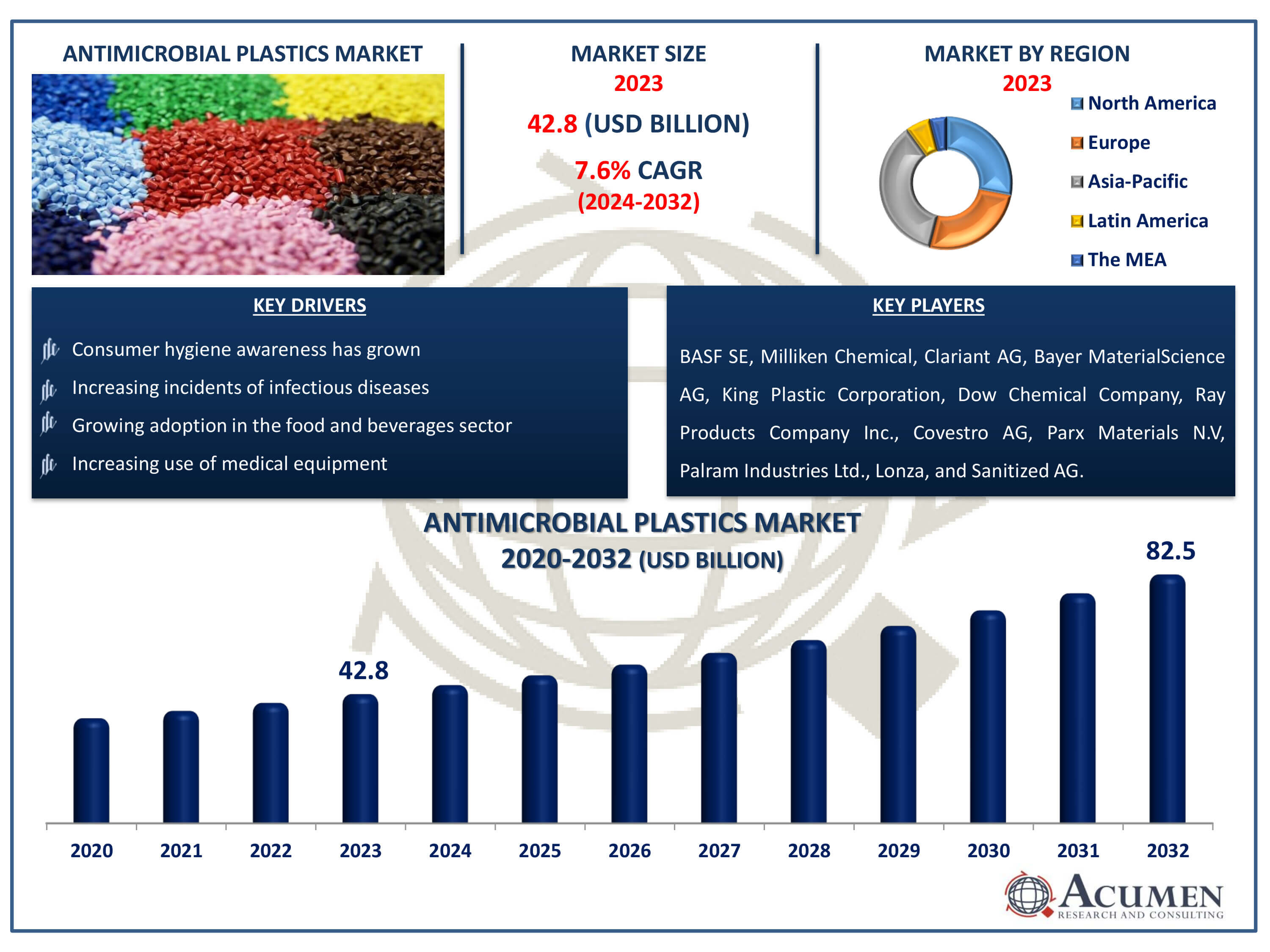

The Antimicrobial Plastics Market Size accounted for USD 42.8 Billion in 2023 and is estimated to achieve a market size of USD 82.5 Billion by 2032 growing at a CAGR of 7.6% from 2024 to 2032.

Antimicrobial Plastics Market Highlights

- Global antimicrobial plastics market revenue is poised to garner USD 82.5 billion by 2032 with a CAGR of 7.6% from 2024 to 2032

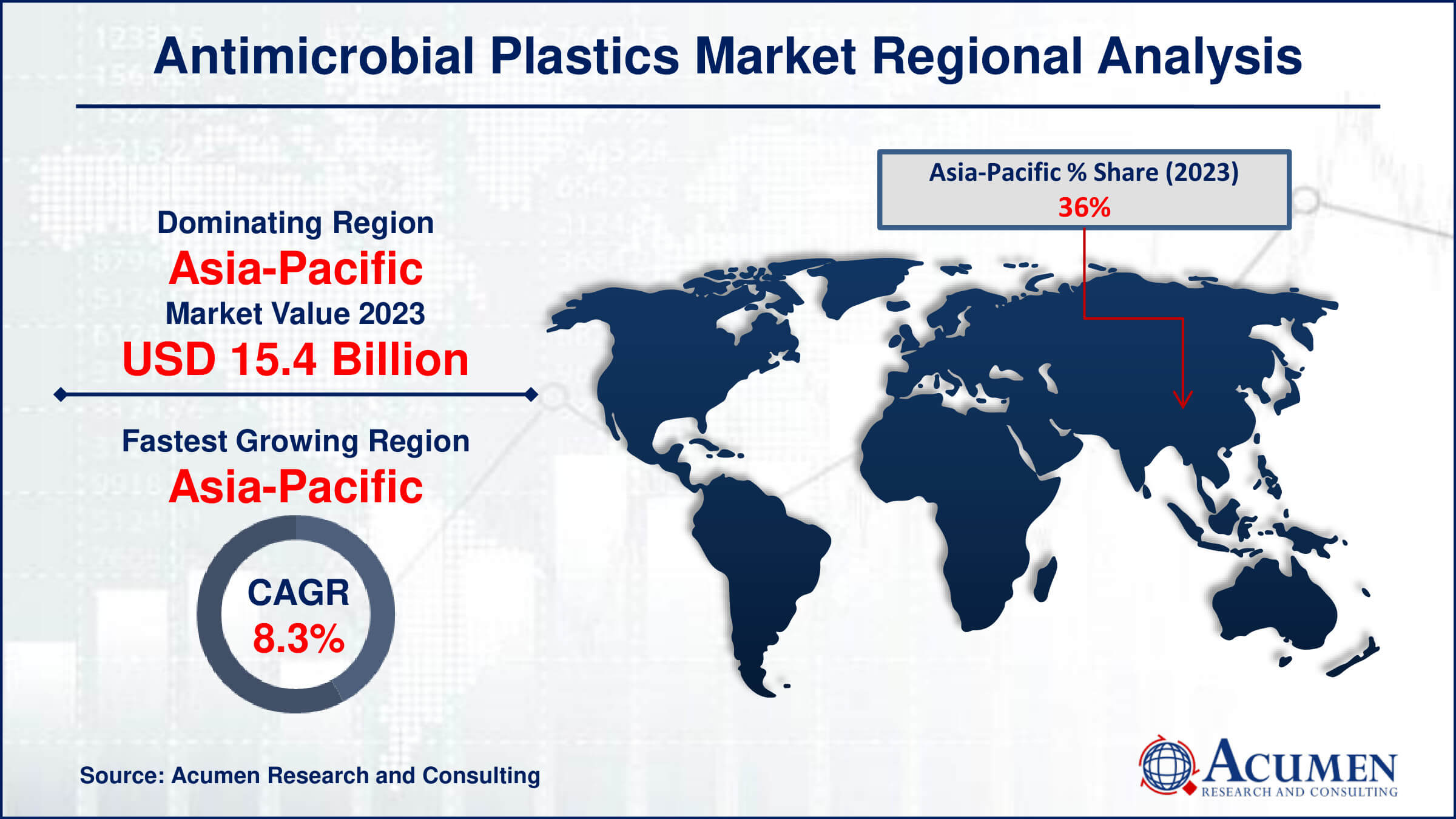

- Asia-Pacific antimicrobial plastics market value occupied around USD 15.4 billion in 2023

- Asia-Pacific antimicrobial plastics market growth will record a CAGR of more than 8.3% from 2024 to 2032

- Among product, the commodity plastics sub-segment generated more than USD 27.4 billion revenue in 2023

- Based on end-use, the healthcare sub-segment generated around 31% market share in 2023

- Innovation in biodegradable antimicrobial plastics to address environmental concerns is a popular antimicrobial plastics market trend that fuels the industry demand

Antimicrobial plastics are synthetic substances infused with active agents that inhibit germ growth, primarily on protective surfaces, thus promoting a hygienic environment. These compounds are known to extend the operational lifespan of plastics by reducing microbial contamination that can lead to premature degradation. Consequently, products made with antimicrobial plastics tend to be more durable and easier to recycle after use. As their use expands in manufacturing and consumer goods, the demand for antimicrobial plastics is expected to surge in the coming years. Moreover, they are gaining traction as substitutes for traditional materials in critical medical devices like ventilators and anesthetic equipment. This underscores their increasing importance in maintaining health and hygiene standards across various applications.

Global Antimicrobial Plastics Market Dynamics

Market Drivers

- Consumer hygiene awareness has grown

- Increasing incidents of infectious diseases

- Growing adoption in the food and beverages sector

- Increasing use of medical equipment

Market Restraints

- Strict environmental regulations

- Price volatility in raw materials

- Limited recyclability of antimicrobial plastics

Market Opportunities

- Increasing adoption in the textile industry

- Growing awareness about plastic pollution

- Expansion into the packaging industry due to heightened concern for food safety

Antimicrobial Plastics Market Report Coverage

| Market | Antimicrobial Plastics Market |

| Antimicrobial Plastics Market Size 2022 | USD 42.8 Billion |

| Antimicrobial Plastics Market Forecast 2032 | USD 82.5 Billion |

| Antimicrobial Plastics Market CAGR During 2023 - 2032 | 7.6% |

| Antimicrobial Plastics Market Analysis Period | 2020 - 2032 |

| Antimicrobial Plastics Market Base Year |

2022 |

| Antimicrobial Plastics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Additive, By Product, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Milliken Chemical, Clariant AG, Bayer MaterialScience AG, King Plastic Corporation, Dow Chemical Company, Ray Products Company Inc., Covestro AG, Parx Materials N.V, Palram Industries Ltd., Lonza, and Sanitized AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Antimicrobial Plastics Market Insights

The adoption of antimicrobial polymers across various industries, driven by their superior properties and increasing demand, is expanding the antimicrobial plastic market significantly. Key drivers include their substitution of traditional materials in numerous applications and rising demand from sectors like medical and food and beverage industries. The COVID-19 pandemic heightened consumer awareness of hygiene, boosting the need for market in the antimicrobial plastics industry forecast period. In the food and beverage sector, the prevalence of chronic illnesses is prompting the uptake of antimicrobial polymers for packaging solutions. These plastics inhibit the growth of viruses and bacteria, enhancing food safety and shelf life.

Moreover, in healthcare, antimicrobial plastics are increasingly replacing conventional materials in the production of critical equipment such as anesthetic machines and ventilators. This shift is crucial in maintaining hygienic conditions and preventing healthcare-associated infections. Antimicrobial plastics offer strong moisture resistance and effectively inhibit the growth of germs, algae, and bacteria, making them pivotal in food safety protocols and various industrial applications. However, stringent environmental regulations and increasing concerns about pollution pose challenges to market growth. Manufacturers are therefore focusing on developing sustainable practices and materials to mitigate these impacts while meeting the growing demand for antimicrobial plastics across diverse sectors.

Antimicrobial Plastics Market Segmentation

The worldwide market for antimicrobial plastics is split based on additive, product, end-use, and geography.

Antimicrobial Plastic Market By Additives

- Organic

- Inorganic

According to antimicrobial plastics industry analysis, additives play a crucial role in imparting pathogen-inhibiting properties to antimicrobial plastics. These additives can be broadly categorized into organic and inorganic types. In the market, the inorganic category is anticipated to dominate due to its versatility and effectiveness against a broad spectrum of infections. Inorganic additives, such as silver and copper nanoparticles, possess natural antibacterial properties that are highly efficient against bacteria, viruses, and fungi. Their robustness and durability make them particularly suitable for applications requiring prolonged antimicrobial protection, such as medical equipment, food packaging, and hygiene products. As industries increasingly prioritize cleanliness and infection control, the demand for inorganic antimicrobial additives is expected to escalate. This solidifies their role as the cornerstone of the antimicrobial plastics market, driving innovation and adoption across various sectors.

Antimicrobial Plastic Market By Products

- Commodity Plastics

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Acrylonitrile Butadiene Systems (ABS)

- Engineering Plastics

- Polycarbonate (PC)

- Polyamide (PA)

- Thermoplastic polyurethane (TPU)

- Others

- High Performance Plastics

The commodity plastic segment emerged as the dominant force in the antimicrobial plastics market in 2023, commanding a significant market share. These versatile plastics find extensive application across various sectors, including textiles, packaging, hygiene products, and more, owing to their exceptional properties such as high impact strength, chemical resistance, and moisture tolerance. Notably, polyethylene and polypropylene antimicrobial polymers play a pivotal role in driving the demand for commodity plastics due to their wide-ranging applications and biocompatibility. The burgeoning demand from industries like processing, electronics, and medical products further propels the growth of this segment. However, concerns regarding plastic waste and increasing governmental regulations pertaining to plastic packaging usage pose challenges to the future growth trajectory of commodity plastics.

Antimicrobial Plastic Market By End-Uses

- Building & Construction

- Healthcare

- Automotive & transportation

- Packaging

- Textile

- Food & Beverage

- Consumer Goods

- Others

The healthcare segment is poised to play a pivotal role in the antimicrobial plastics market forecast period, solidifying its position as a significant consumer of antimicrobial plastics. A myriad of industries are swiftly integrating antimicrobial plastics into their operations, spurred by a complex and dynamic evolution marked by stringent standards, heightened consumer demand, regulatory constraints, innovative additives, and a broadening array of everyday applications. Across diverse industrial sectors, the quest for effective materials that cater to specific needs such as reliability, aesthetics, and odor reduction is driving the adoption of antimicrobial plastics.

Primary drivers of global demand for medical equipment include the escalating incidence of chronic and infectious diseases, a burgeoning population, and a surge in hospital admissions. Moreover, the growing preference for home-based treatment is fueling the consumption of various intensive care medical equipment, thereby reshaping the landscape of antimicrobial plastics in the healthcare sector. This shift towards home-based care is anticipated to drive demand for antimicrobial plastics, particularly in the healthcare sector, where they offer cost-effective solutions compared to traditional hospital settings.

Antimicrobial Plastics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Antimicrobial Plastics Market Regional Analysis

In terms of antimicrobial plastics market analysis, in 2023, the Asia-Pacific region has emerged as the leader in the antimicrobial plastics market, commanding the largest market share. This dominance is expected to strengthen further, driven by significant growth in key industries such as consumer hygiene, healthcare, and automotive sectors. Countries like India, Japan, Korea, and Thailand are making substantial investments to enhance healthcare infrastructure, responding to the challenges posed by an aging population and rising medical expenses.

The region's demand for antimicrobial polymers has been further propelled by outbreaks of communicable diseases such as Bird Flu and COVID-19, particularly in healthcare and food and beverage sectors. This has led to increased use of antimicrobial polymers in food packaging, meeting the growing demand for packaged food due to population growth and evolving consumption patterns in the region. Overall, the Asia-Pacific region is poised for robust growth in the antimicrobial plastics industry, driven by these diverse factors and trends during the forecast period.

Antimicrobial Plastics Market Players

Some of the top antimicrobial plastics companies offered in our report includes BASF SE, Milliken Chemical, Clariant AG, Bayer MaterialScience AG, King Plastic Corporation, Dow Chemical Company, Ray Products Company Inc., Covestro AG, Parx Materials N.V, Palram Industries Ltd., Lonza, and Sanitized AG.

Frequently Asked Questions

How big is the antimicrobial plastics market?

The antimicrobial plastics market size was valued at USD 42.8 billion in 2023.

What is the CAGR of the global antimicrobial plastics market from 2024 to 2032?

The CAGR of antimicrobial plastics is 7.6% during the analysis period of 2024 to 2032.

Which are the key players in the antimicrobial plastics market?

The key players operating in the global market are including BASF SE, Milliken Chemical, Clariant AG, Bayer MaterialScience AG, King Plastic Corporation, Dow Chemical Company, Ray Products Company Inc., Covestro AG, Parx Materials N.V, Palram Industries Ltd., Lonza, and Sanitized AG.

Which region dominated the global antimicrobial plastics market share?

Asia-Pacific held the dominating position in antimicrobial plastics industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of antimicrobial plastics during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global antimicrobial plastics industry?

The current trends and dynamics in the antimicrobial plastics industry include consumer hygiene awareness has grown, increasing incidents of infectious diseases, growing adoption in the food and beverages sector, and increasing use of medical equipment.

Which end-use held the maximum share in 2023?

The healthcare end-use held the maximum share of the antimicrobial plastics industry.