Antifungal Drugs Market | Acumen Research and Consulting

Antifungal Drugs Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

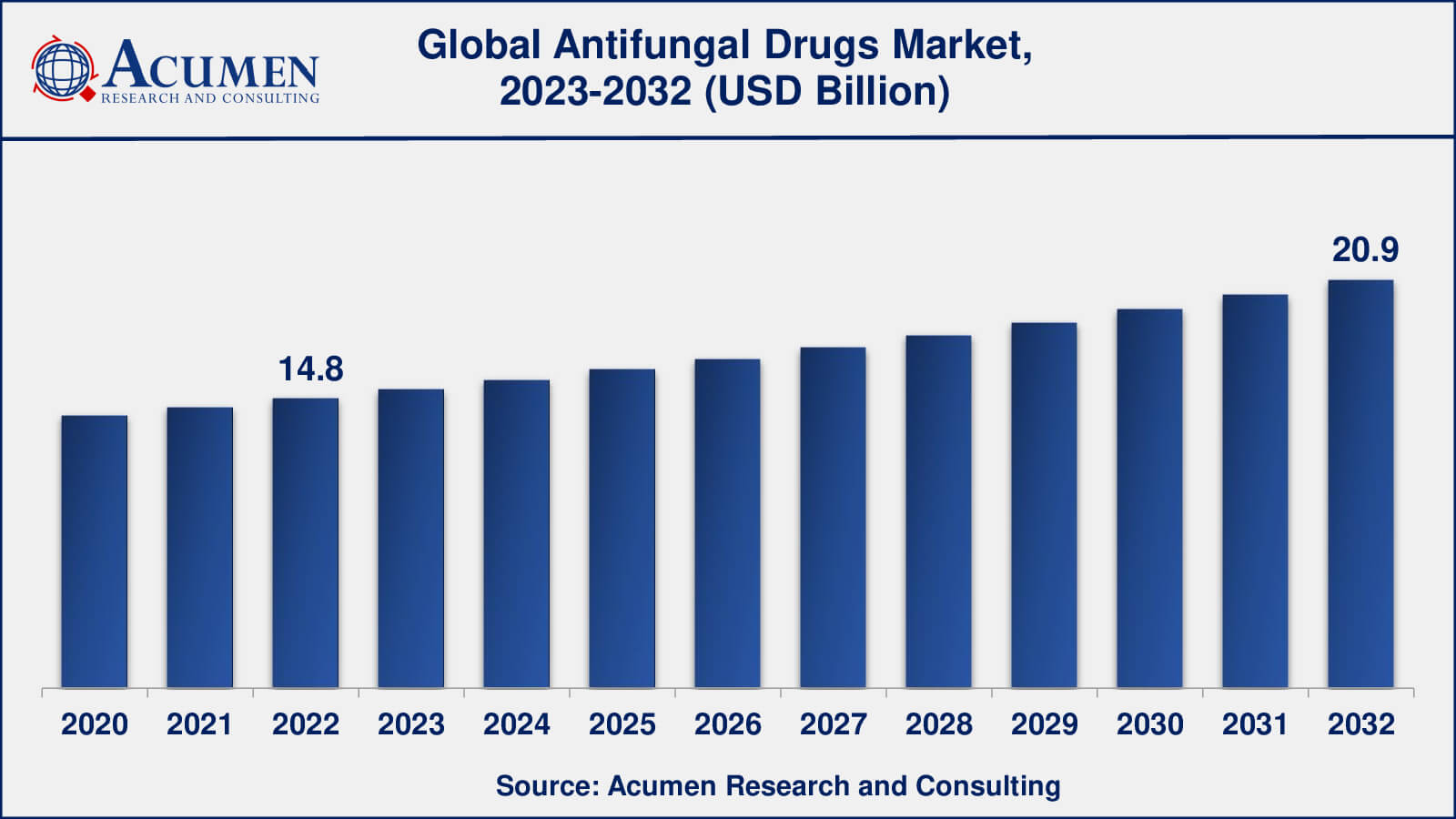

The Global Antifungal Drugs Market Size accounted for USD 14.8 Billion in 2022 and is estimated to achieve a market size of USD 20.9 Billion by 2032 growing at a CAGR of 3.5% from 2023 to 2032.

Antifungal Drugs Market Highlights

- Global antifungal drugs market revenue is poised to garner USD 20.9 billion by 2032 with a CAGR of 3.5% from 2023 to 2032

- North America antifungal drugs market value occupied more than USD 6.2 billion in 2022

- Asia-Pacific antifungal drugs market growth will record a CAGR of more than 4% from 2023 to 2032

- According to the UK Government-commissioned Review on Antimicrobial Resistance, AMR could kill 10 million people each year by 2050

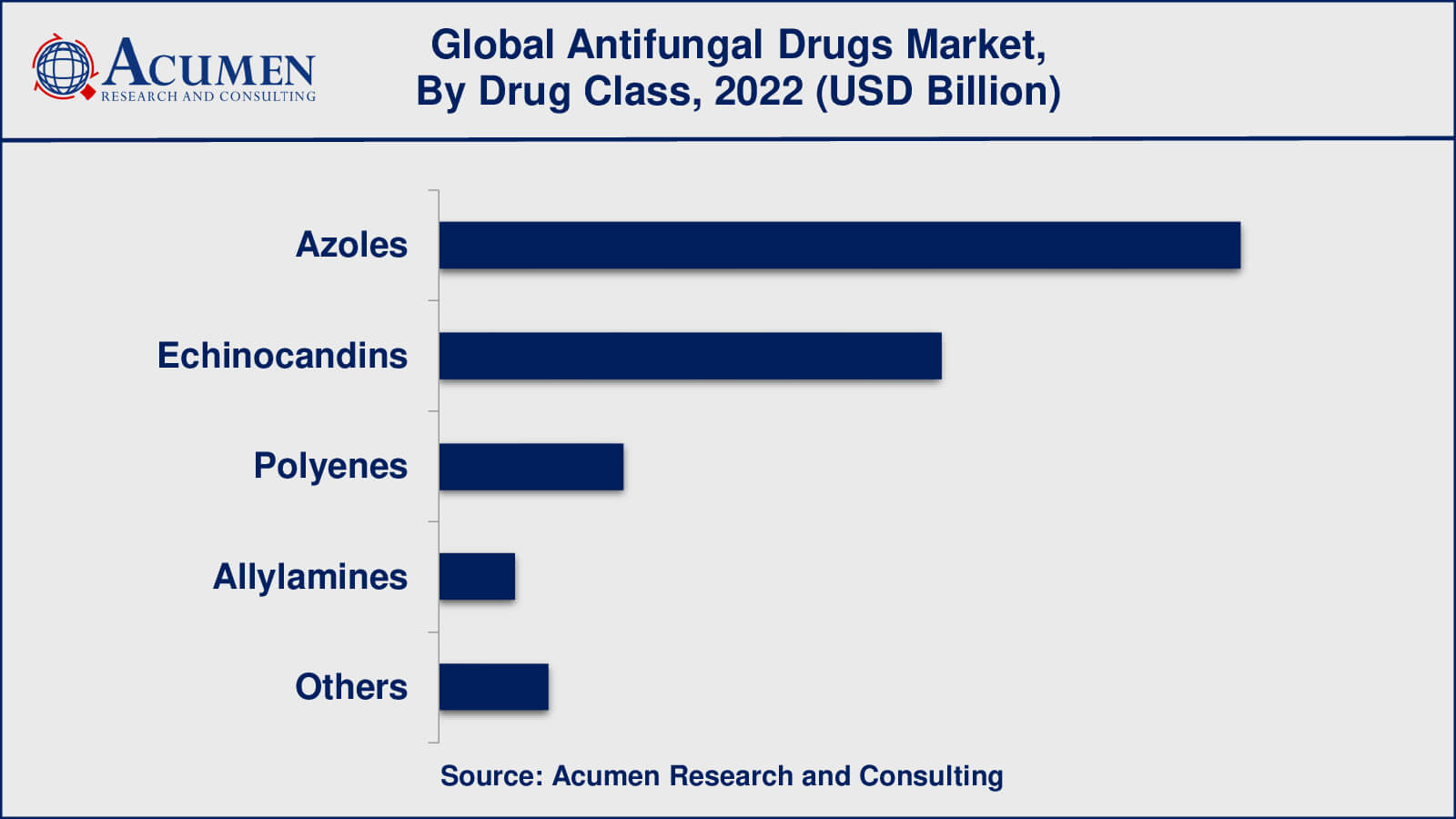

- Among drug class, the azoles sub-segment generated over US$ 7.1 billion revenue in 2022

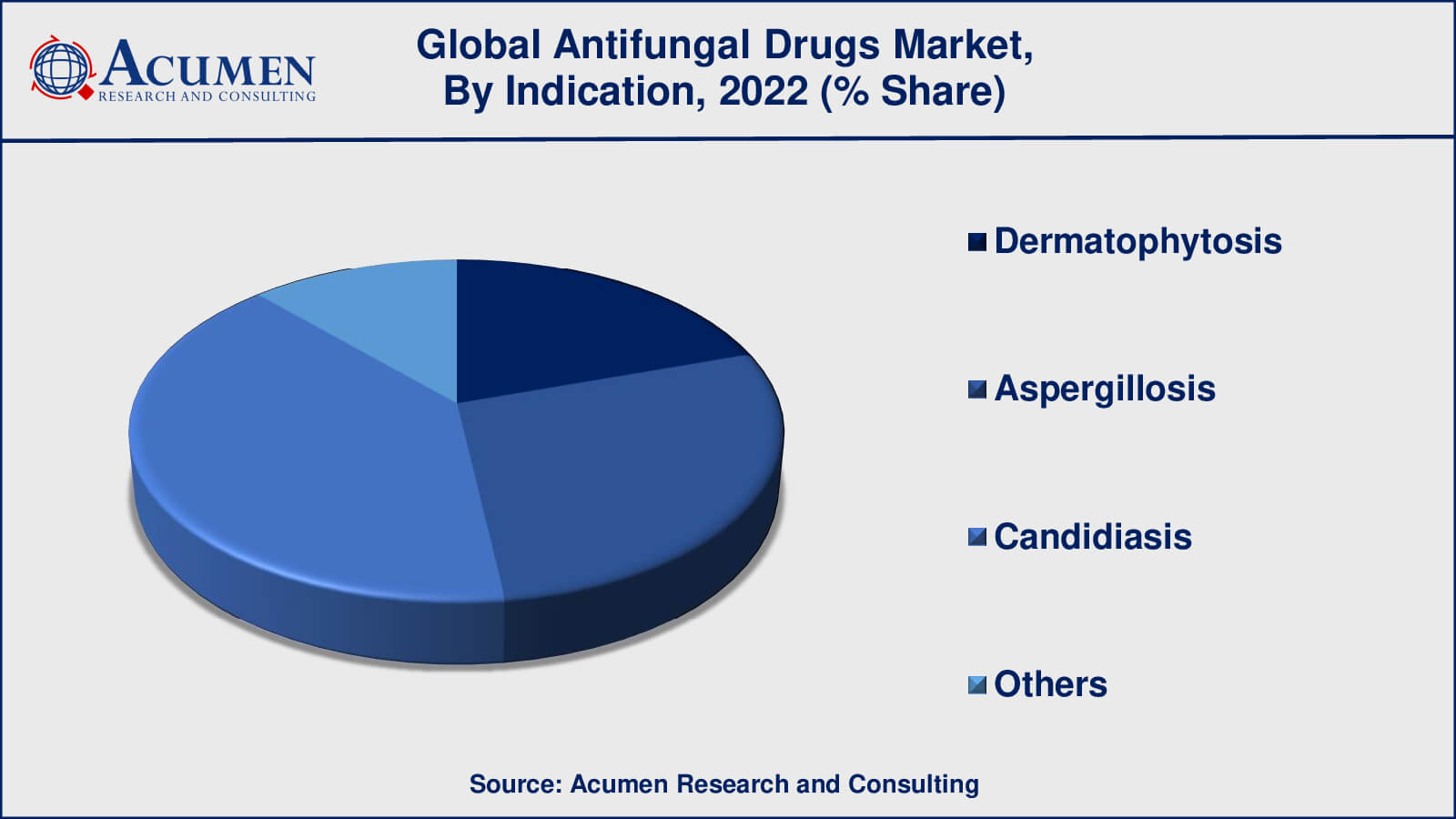

- Based on indications, the candidiasis sub-segment generated around 40% share in 2022

- Increasing focus on combination therapy is a popular antifungal drugs market trend that fuels the industry demand

Antifungal drugs are used to treat fungal infections in humans and animals. These drugs work by specifically targeting fungal cells and either inhibiting or killing them. Antifungal drugs are classified into several classes, including azoles, echinocandins, polyenes, allylamines, and others. Antifungal drugs are currently popular due to a variety of factors. To begin, the global prevalence of fungal infections is rising, particularly among immunocompromised patients such as those with HIV/AIDS or undergoing chemotherapy. As a result, there is an increasing demand for effective antifungal drugs.

Second, there has been an increase in antifungal drug research and development, which has resulted in the development of novel and more effective medications. This has helped to broaden the treatment options for fungal infections and improve patient outcomes. Furthermore, healthcare providers and patients are becoming more aware of the importance of early identification and therapy of fungal infections. As a result, there has been an increase in the demand for antifungal drugs as a first-line treatment option.

Global Antifungal Drugs Market Dynamics

Market Drivers

- Increasing incidence of fungal infections

- Technological advancements in drug development

- Growing awareness and diagnosis of fungal infections

- Rising demand for broad-spectrum antifungal drugs

Market Restraints

- High cost of antifungal drugs

- Antifungal drug resistance

- Stringent regulatory requirements

Market Opportunities

- Increasing demand for combination therapy

- Focus on developing antifungal drugs for rare diseases

- Growing interest in topical antifungal drugs

- Emergence of new drug delivery technologies

Antifungal Drugs Market Report Coverage

| Market | Antifungal Drugs Market |

| Antifungal Drugs Market Size 2022 | USD 14.8 Billion |

| Antifungal Drugs Market Forecast 2032 | USD 20.9 Billion |

| Antifungal Drugs Market CAGR During 2023 - 2032 | 3.5% |

| Antifungal Drugs Market Analysis Period | 2020 - 2032 |

| Antifungal Drugs Market Base Year | 2022 |

| Antifungal Drugs Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Drug Class, By Indication, By Dosage Form, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott, Astellas Pharma, Inc., Bayer AG, Enzon Pharmaceuticals, Inc., Gilead Sciences Inc., GlaxoSmithKline plc, Glenmark, Johnson & Johnson, Merck & Co., Inc., MerzPharma, Novartis AG, Pfizer, Inc., and Sanofi. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Antifungal Drugs Market Insights

The increasing incidence of fungal infections, which is being driven by an ageing population, the increased use of immunosuppressive therapies, and the growing number of people with HIV/AIDS, is one of the primary drivers of market growth. Furthermore, the development of new antifungal drugs with improved efficacy and fewer side effects, as well as increased awareness and diagnosis of fungal infections among patients and healthcare professionals, are expected to drive anti-fungal drugs market growth.

However, several factors, such as the high cost of many antifungal drugs, the rise of new of drug-resistant fungal strains, and the complex as well as rigorous regulatory requirements for drug approval, may act as restraints on market growth. Nonetheless, rising demand for combination therapy, a focus on developing antifungal drugs for rare diseases, and emerging markets in Asia-Pacific, Latin America, the Middle East, and Africa are expected to fuel significant growth in the antifungal drugs market.

In the coming years, the antifungal drugs market will present several opportunities for growth. Companies can invest in R&D to create novel antifungal drugs that overcome the limitations of existing treatments and provide patients with better treatment options. Diagnostic advances can improve the accuracy and speed of diagnosing fungal infections, reducing the burden on healthcare systems and enhancing patient results. The growing demand for over-the-counter antifungal products, as well as the adoption of combination therapy, provides opportunities for companies to develop and market new, effective, and simple-to-use products.

Emerging markets in Asia-Pacific, Latin America, the Middle East, and Africa provide opportunities for companies to expand their presence and provide patients with better access to antifungal drugs. Overall, the antifungal drugs market is expected to grow in the coming years, driven by the rising incidence of fungal infections, the invention of novel antifungal drugs, and increased patient and healthcare professional awareness and diagnosis of fungal infections.

Antifungal Drugs Market Segmentation

The worldwide market for antifungal drugs is split based on drug class, indication, dosage form, distribution channel, and geography.

Antifungal Drug Class

- Azoles

- Echinocandins

- Polyenes

- Allylamines

- Others

According to the antifungal drugs industry analysis, the azoles drug class has historically and continues to dominate the antifungal drugs market. Azoles are antifungal drugs with a broad spectrum of activity against a variety of fungal infections, including both superficial as well as systemic infections. They are versatile and widely used in clinical practise because they are available in both topical and systemic formulations. Fluconazole, itraconazole, and voriconazole are some of the most commonly used azoles.

Echinocandins are another essential drug class in the market for antifungal drugs. These drugs primarily treat systemic fungal infections by inhibiting the synthesis of fungal cell walls. Echinocandins that are commonly used include caspofungin, micafungin, and anidulafungin.

Polyenes, such as amphotericin B, are broad-spectrum antifungal drugs that work by binding to and disrupting the integrity of fungal cell membranes. They are frequently used to treat systemic fungal infections, especially in patients with weakened immune systems. Terbinafine and other allylamines are typically used to treat superficial fungal infections like nail fungus and ringworm. They work by preventing the formation of fungal cell walls.

Antifungal Drug Indications

- Dermatophytosis

- Aspergillosis

- Candidiasis

- Others

Dermatophytosis is a common fungal infection that affects the skin, nails, and hair. It is also known as ringworm or tinea. The high prevalence of dermatophytosis, particularly in developing countries, drives the market for antifungal drugs. The most widely used antifungal drugs for dermatophytosis are azoles and allylamines. In addition, candidiasis is another common fungal infection caused by fungi of the Candida species. It can affect the skin, mouth, and genital areas, among other places. The increased prevalence of candidemia, a serious systemic disease caused by Candida, particularly in immunocompromised patients, is driving the market for antifungal drugs for candidiasis. The most commonly used antifungal drugs for candidiasis are azoles, echinocandins, and polyenes.

The growing prevalence of aspergillosis in patients with compromised immune systems, such as those undergoing chemotherapy or organ transplantation, is driving the market for antifungal drugs. The most commonly used antifungal drugs for aspergillosis are azoles and echinocandins. Antifungal drugs are also used to treat cryptococcosis, histoplasmosis, and pneumocystis pneumonia. These symptoms, however, are less common than dermatophytosis, candidiasis, and aspergillosis.

Antifungal Drug Dosage Forms

- Oral Drugs

- Ointments

- Powders

- Others

According to market forecasts for antifungal drugs, oral drugs are the most commonly used dosage form for systemic fungal infections. They come in a variety of forms, including tablets, capsules, and liquids, and are preferred due to their ease of administration and systemic distribution. Fluconazole, itraconazole, and voriconazole, which are popularly used to treat systemic fungal infections, dominate the oral antifungal drug market.

To treat superficial fungal infections such as ringworm and athlete's foot, topical formulations such as ointments and powders are commonly used. These formulations, which are applied directly to the affected area, are preferred due to their localised action and lower risk of systemic side effects. The market for topical antifungal drugs is dominated by allylamines like terbinafine and azoles like clotrimazole, miconazole, and ketoconazole.

Antifungal Drug Distribution Channels

- Hospital Pharmacies

- Retails Pharmacies

- Others

Historically, hospital pharmacies dominated the distribution channel for antifungal drugs, particularly those used to treat systemic fungal infections. Because these infections are frequently severe and necessitate hospitalisation, the drugs are administered via intravenous routes in a hospital setting. Hospitals also buy a lot of antifungal medications for their formularies.

However, with the rising prevalence of superficial fungal infections and the affordability of over-the-counter (OTC) antifungal drugs for these conditions, retail pharmacies have emerged as a significant antifungal drug distribution channel. Topical antifungal medications, such as creams, ointments, and powders, are widely available in retail pharmacies, and patients frequently prefer to buy these products over-the-counter due to their convenience and cost-effectiveness.

Antifungal Drugs Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Antifungal Drugs Market Regional Analysis

North America and Europe have traditionally been the largest markets for antifungal drugs, owing to the high prevalence of fungal infections, robust healthcare infrastructure, and widespread awareness of the availability and benefits of antifungal drugs. In North America, the major contributors are the United States and Canada, while in Europe; the major contributors are Germany, France, and the United Kingdom.

The Asia-Pacific region is expected to experience significant growth in the antifungal drugs market over the next few years, owing to rising prevalence of fungal infections, expanding healthcare infrastructure, and increased awareness of the benefits of antifungal drugs. Countries such as China as well as India are expected to drive the growth of the Asia-Pacific antifungal drugs market.

Antifungal Drugs Market Players

Some of the top antifungal drugs companies offered in the professional report includes Abbott, Astellas Pharma, Inc., Bayer AG, Enzon Pharmaceuticals, Inc., Gilead Sciences Inc., GlaxoSmithKline plc, Glenmark, Johnson & Johnson, Merck & Co., Inc., MerzPharma, Novartis AG, Pfizer, Inc., and Sanofi.

Frequently Asked Questions

What was the market size of the global antifungal drugs in 2022?

The market size of antifungal drugs was USD 14.8 billion in 2022.

What is the CAGR of the global antifungal drugs market from 2023 to 2032?

The CAGR of antifungal drugs is 3.5% during the analysis period of 2023 to 2032.

Which are the key players in the antifungal drugs market?

The key players operating in the global market are including Abbott, Astellas Pharma, Inc., Bayer AG, Enzon Pharmaceuticals, Inc., Gilead Sciences Inc., GlaxoSmithKline plc, Glenmark, Johnson & Johnson, Merck & Co., Inc., MerzPharma, Novartis AG, Pfizer, Inc., and Sanofi.

Which region dominated the global antifungal drugs market share?

North America held the dominating position in antifungal drugs industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of antifungal drugs during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global antifungal drugs industry?

The current trends and dynamics in the antifungal drugs industry include increasing incidence of fungal infections, technological advancements in drug development, growing awareness and diagnosis of fungal infections, and rising demand for broad-spectrum antifungal drugs.

Which drug class held the maximum share in 2022?

The azoles drug class held the maximum share of the antifungal drugs industry.