Antibody Therapy Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Antibody Therapy Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

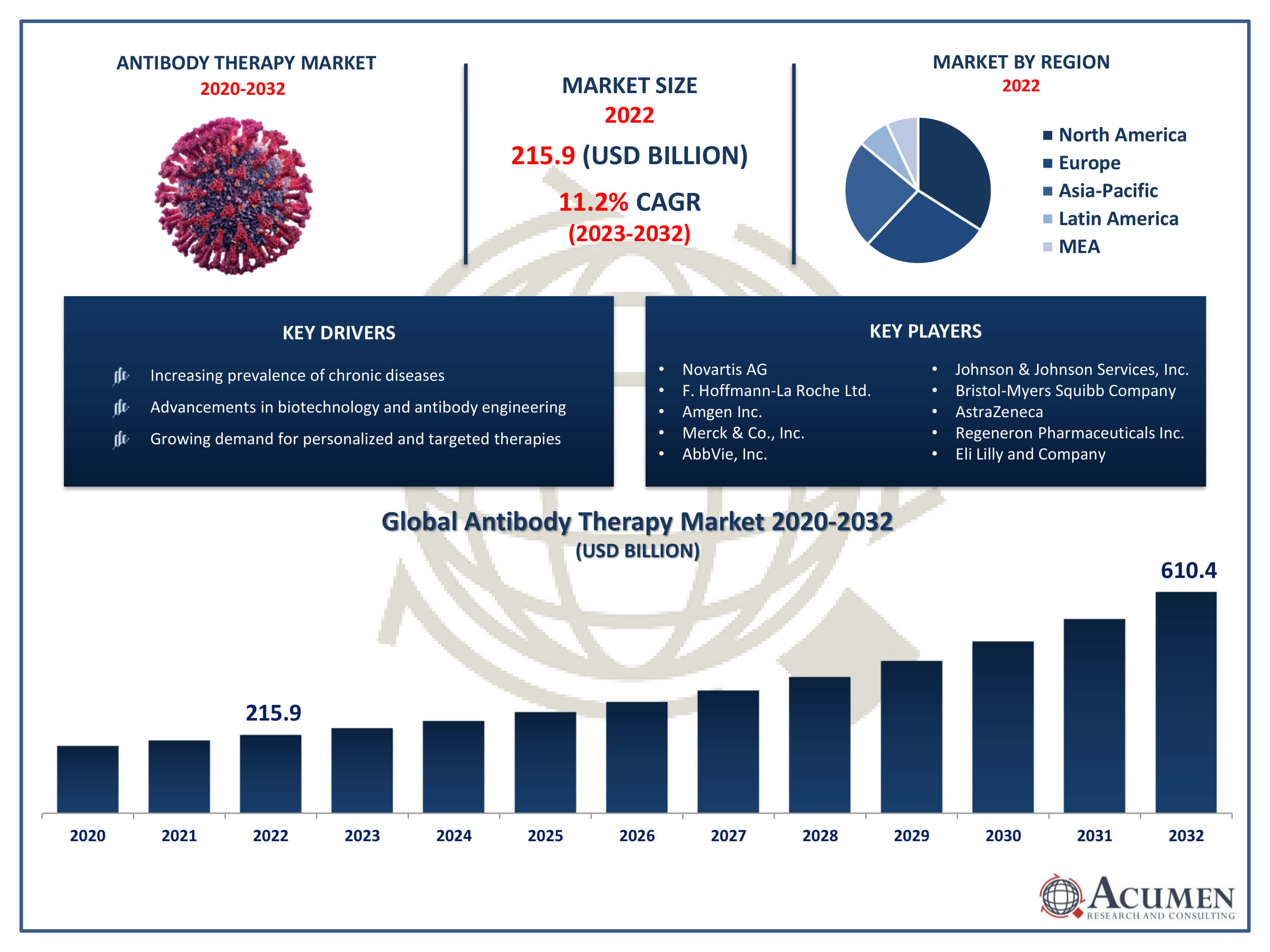

The Antibody Therapy Market Size accounted for USD 215.9 Billion in 2022 and is projected to achieve a market size of USD 610.4 Billion by 2032 growing at a CAGR of 11.2% from 2023 to 2032.

Antibody Therapy Market Highlights

- Global antibody therapy market revenue is expected to increase by USD 610.4Billionby 2032, with a11.2%CAGR from 2023 to 2032

- North America region led with more than 42% of Antibody Therapy Market share in 2022

- Asia-Pacific antibody therapy market growth will record a CAGR of more than 12.3% from 2023 to 2032

- By type, the monoclonal antibodies are the largest segment of the market, accounting for over 91% of the global market share

- By end-use, the hospital is one of the largest and fastest-growing segments of the antibody therapy industry

- Increasing incidence of chronic diseases, especially cancer, drives the antibody therapy market value

Antibody therapy, also known as immunotherapy, leverages the immune system to combat diseases, particularly cancers and autoimmune disorders. This treatment uses monoclonal antibodies, which are laboratory-created molecules designed to imitate the immune system's ability to fight pathogens. These antibodies can be engineered to target specific proteins on the surfaces of cancer cells or modulate immune responses in autoimmune conditions. By harnessing the body's natural defenses, antibody therapy offers a more targeted and precise treatment option, potentially reducing side effects compared to traditional therapies.

The antibody therapy market has seen significant growth recently, propelled by advancements in biotechnology, a deeper understanding of the immune system, and successful clinical outcomes. For instance, the global biotechnology market, which reached USD 372.8 billion in 2021, is projected to reach USD 1,345.0 billion by 2030, experiencing a compound annual growth rate (CAGR) of 15.5% from 2022 to 2030. The demand for more effective and personalized treatments for cancer and autoimmune diseases has spurred extensive research and development in antibody production. Several monoclonal antibody drugs have been approved, with many more in various stages of clinical trials. As scientists continue to identify new targets for antibody-based treatments and enhance existing therapies, the antibody therapy industry is poised to expand further growth. For instance, the U.S. FDA has approved more than 100 monoclonal antibody (mAb) products, and the range of therapeutic applications for mAbs is anticipated to expand. This expansion is attributed to advancements such as antibody fragments, derivatives, and bispecific antibodies, which provide enhanced treatment possibilities.

Global Antibody Therapy Market Trends

Market Drivers

- Increasing incidence of chronic diseases, especially cancer

- Advancements in biotechnology and antibody engineering

- Growing emphasis on personalized medicine and targeted therapies

- Expanding applications in autoimmune disorders and infectious diseases

- Favorable regulatory environment and expedited approval processes

Market Restraints

- High cost of antibody therapies and limited affordability

- Complex manufacturing processes and high development costs

Market Opportunities

- Development of biosimilar antibody therapies

- Rising focus on next-generation antibody technologies

Antibody Therapy Market Report Coverage

| Market | Antibody Therapy Market |

| Antibody Therapy Market Size 2022 | USD 215.9 Billion |

| Antibody Therapy Market Forecast 2032 | USD 610.4 Billion |

| Antibody Therapy Market CAGR During 2023 - 2032 | 11.2% |

| Antibody Therapy Market Analysis Period | 2020 - 2032 |

| Antibody Therapy Market Base Year |

2022 |

| Antibody Therapy Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Novartis AG, F. Hoffmann-La Roche Ltd., Amgen Inc., Merck & Co., Inc., AbbVie, Inc., Johnson & Johnson Services, Inc., Bristol-Myers Squibb Company, AstraZeneca, Regeneron Pharmaceuticals Inc., Eli Lilly and Company, Takeda Pharmaceutical Company Ltd., and GlaxoSmithKline plc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Antibody Therapy Market Dynamics

Antibody therapy represents a groundbreaking approach to treating various diseases by harnessing the body's immune system. This therapy uses monoclonal antibodies, which are lab-engineered molecules designed to mimic the immune system's ability to identify and combat specific pathogens, such as cancer cells or harmful proteins linked to autoimmune disorders. These antibodies can be tailored to bind to precise targets on cell surfaces, either tagging them for immune system destruction or directly disrupting their function. Antibody therapy has diverse medical applications. In cancer treatment, monoclonal antibodies can neutralize cancer cells, inhibit tumor growth, or boost the immune system's capacity to detect and destroy malignant cells. For autoimmune disorders, where the immune system erroneously attacks the body's own tissues, antibody therapy can modulate immune responses to decrease inflammation and alleviate symptoms.

The antibody therapy industry has seen remarkable growth in recent years, spurred by a surge in research and development, groundbreaking advancements in biotechnology, and a rising demand for more effective and targeted treatments. Monoclonal antibodies, known for their ability to precisely target and bind to specific proteins, have transformed therapeutic interventions, especially in oncology, autoimmune diseases, and infectious diseases. The approval and commercial success of several monoclonal antibody drugs have increased confidence in this treatment method, leading to greater investment and innovation in the sector. However, cost of antibody therapies and limited affordability hamper the market growth. For instance, COVID-19 treatments like Regeneron’s REGEN-COV (casirivimab and imdevimab) and GlaxoSmithKline & Vir Biotechnology’s sotrovimab are priced around $1,250 and $2,100 per infusion, respectively. These steep costs can restrict access to monoclonal antibody therapies for many patients. Besides, the growing global prevalence of chronic diseases, including cancer and autoimmune disorders, and strategic initiatives taken by key players has created significant market opportunities for antibody therapies. For instance, in January 2022, Ono Pharmaceutical Co., Ltd. and Neurimmune AG formed a partnership to develop monoclonal antibody drugs targeting new therapeutic areas for neurodegenerative diseases. The trend towards personalized medicine and a deeper understanding of the immune system's role in diseases have also driven the development of novel antibody-based treatments.

Antibody Therapy Market Segmentation

The global antibody therapy market segmentation is based on type, end-use, and geography.

Antibody Therapy Market By Type

- Monoclonal antibodies (mAbs)

- Infectious diseases

- Autoimmune diseases

- Oncology

- Other

- Antibody-drug conjugates (ADCs)

In terms of types, the monoclonal antibodies (mAbs) segment accounted for the largest market share in 2022. Monoclonal antibodies, engineered in laboratories to emulate the immune system's targeting capabilities, have become essential in treating diseases like cancer, autoimmune disorders, and infections. Their precise binding to specific cell surface proteins has made them popular for therapeutic use, offering high specificity and fewer side effects compared to traditional treatments. This specificity also supports the advancement of personalized medicine. The market for monoclonal antibodies is growing rapidly, driven by the success and approval of numerous drugs in this category, a broader range of applications, and an increasing number of mAbs entering clinical trials. As researchers deepen their understanding of disease mechanisms and discover new therapeutic targets, innovation in the monoclonal antibodies sector is surging.

Antibody Therapy Market By End-use

- Specialty centers

- Hospitals

- Other

According to the antibody therapy industry forecast, the hospital segment is poised for significant growth in the coming years due to the rising prevalence of chronic diseases such as cancer and autoimmune disorders. For instance, according to estimates, 129 million people in the US have at least one major chronic disease, such as heart disease, cancer, diabetes, obesity, or hypertension, as defined by the US Department of Health and Human Services. Hospitals serve as primary centers for the diagnosis, treatment, and management of these conditions. Antibody therapies, including monoclonal antibodies, are frequently administered in hospital settings, where healthcare professionals can monitor patients closely and manage potential side effects, driving the growth of this segment. Additionally, the expanding adoption of these therapies across various medical specialties fuels this growth. Oncology departments, in particular, have seen an increased use of monoclonal antibodies for cancer treatment, highlighting the growing acceptance of targeted and personalized approaches. Furthermore, as hospitals invest in advanced infrastructure and collaborate with pharmaceutical companies to provide cutting-edge treatments, the antibody therapy market is expected to continue its growth within the hospital-based healthcare delivery model.

Antibody Therapy Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

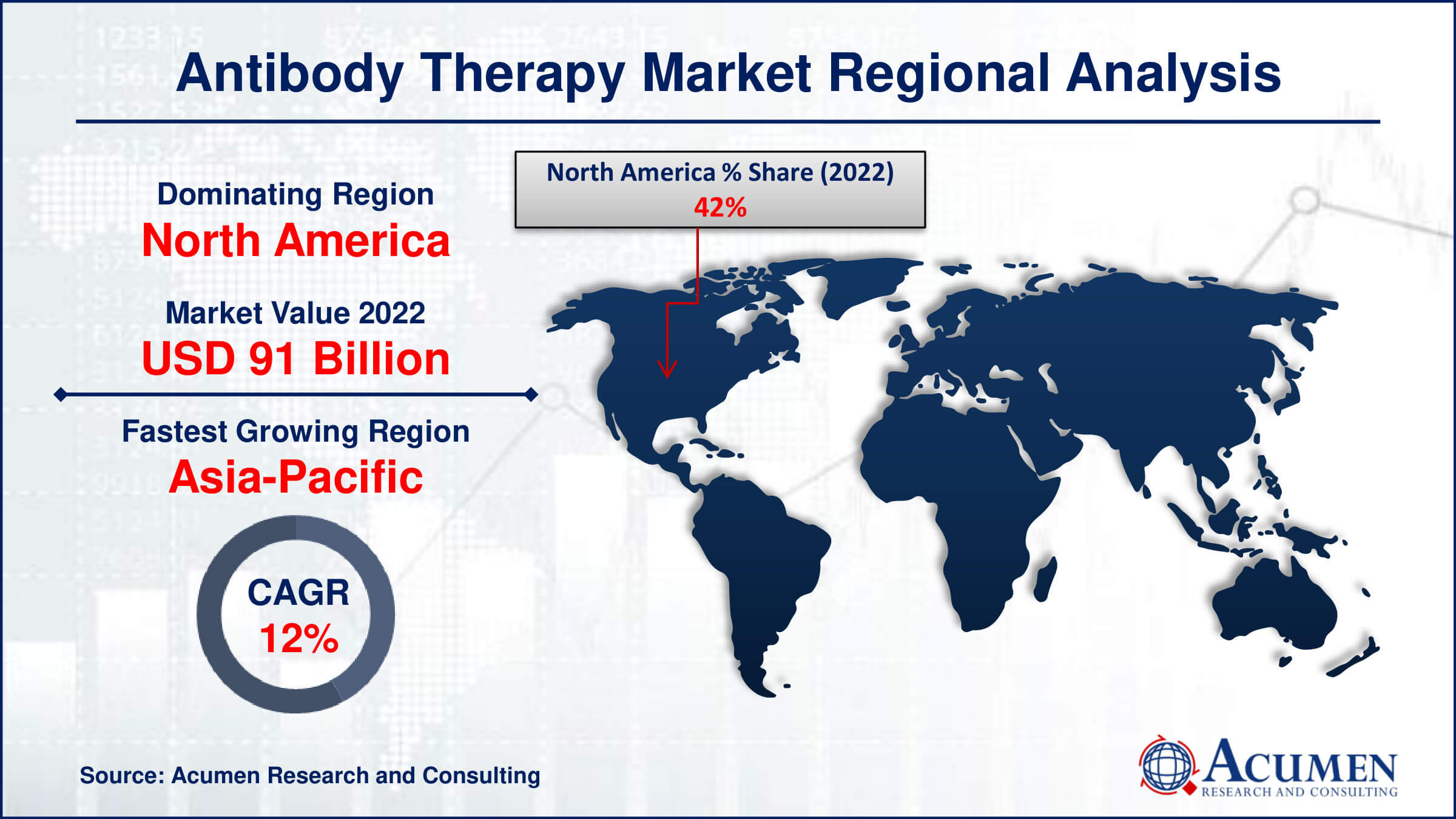

Antibody Therapy Market Regional Analysis

North America dominates the antibody therapy market due to several key factors that position it at the forefront of this evolving industry. The region benefits from a robust healthcare infrastructure, high levels of research and development, and a well-established pharmaceutical and biotechnology sector. For instance, the 2023 Budget allocates $110.9 billion for basic and applied research, marking a significant increase of $24.8 billion (29%) compared to the 2021 enacted amount. The United States, in particular, plays a central role, with numerous pharmaceutical companies and research institutions driving advancements in therapeutic antibodies. For instance, in October 2023, AbCellera expanded its existing multi-target partnership with Regeneron, aiming to discover therapeutic antibodies for up to eight targets designated by Regeneron, doubling the initial four. This extended collaboration foresees an increase in the generation of innovative therapeutic antibodies. Additionally, North America enjoys a strong regulatory framework that supports the timely approval and commercialization of antibody-based drugs. Regulatory agencies like the U.S. Food and Drug Administration (FDA) proactively support innovative therapies, creating a favorable environment for market growth. For instance, in February 2022, the U.S. FDA granted an Emergency Use Authorization (EUA) for Eli Lilly's bebtelovimab to treat COVID-19 patients at risk of severe illness or requiring hospitalization. The region's healthcare system, focused on cutting-edge technologies and patient-centric approaches, further promotes the adoption of antibody therapies. Consequently, North America leads in market share, with increasing numbers of patients and healthcare professionals embracing these advanced treatments across various medical specialties, reinforcing the region's dominance in the global antibody therapy industry.

The Asia Pacific region is experiencing rapid growth in the antibody therapy market due to increasing prevalence of chronic diseases and a growing aging population. For instance, according to National Institute of Health, China's population of 1.44 billion is undergoing rapid aging. Those aged 65 years and older make up 12.0% (173 million) of the population, and this percentage is projected to increase to approximately 26.1% (366 million) by 2050. Additionally, advancements in biotechnology and healthcare infrastructure are driving the adoption of antibody therapies across the region. Moreover, collaborations between pharmaceutical companies and research institutions are fostering innovation and expanding access to these treatments in Asia Pacific.

Antibody Therapy Market Player

Some of the top antibody therapy market companies offered in the professional report include Novartis AG, F. Hoffmann-La Roche Ltd., Amgen Inc., Merck & Co., Inc., AbbVie, Inc., Johnson & Johnson Services, Inc., Bristol-Myers Squibb Company, AstraZeneca, Regeneron Pharmaceuticals Inc., Eli Lilly and Company, Takeda Pharmaceutical Company Ltd., and GlaxoSmithKline plc.

Frequently Asked Questions

How big is the antibody therapy market?

The antibody therapy market size was USD 215.9 Billion in 2022.

What is the CAGR of the global antibody therapy market from 2023 to 2032?

The CAGR of antibody therapy is 11.2% during the analysis period of 2023 to 2032.

Which are the key players in the antibody therapy market?

The key players operating in the global market are including Novartis AG, F. Hoffmann-La Roche Ltd., Amgen Inc., Merck & Co., Inc., AbbVie, Inc., Johnson & Johnson Services, Inc., Bristol-Myers Squibb Company, AstraZeneca, Regeneron Pharmaceuticals Inc., Eli Lilly and Company, Takeda Pharmaceutical Company Ltd., and GlaxoSmithKline plc.

Which region dominated the global antibody therapy market share?

North America held the dominating position in antibody therapy industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of antibody therapy during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global antibody therapy industry?

The current trends and dynamics in the antibody therapy market growth include increasing incidence of chronic diseases, especially cancer, advancements in biotechnology and antibody engineering, and growing emphasis on personalized medicine and targeted therapies.

Which type held the maximum share in 2022?

The Monoclonal antibodies (mAbs) type held the maximum share of the antibody therapy industry.