Antibody Production Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Antibody Production Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

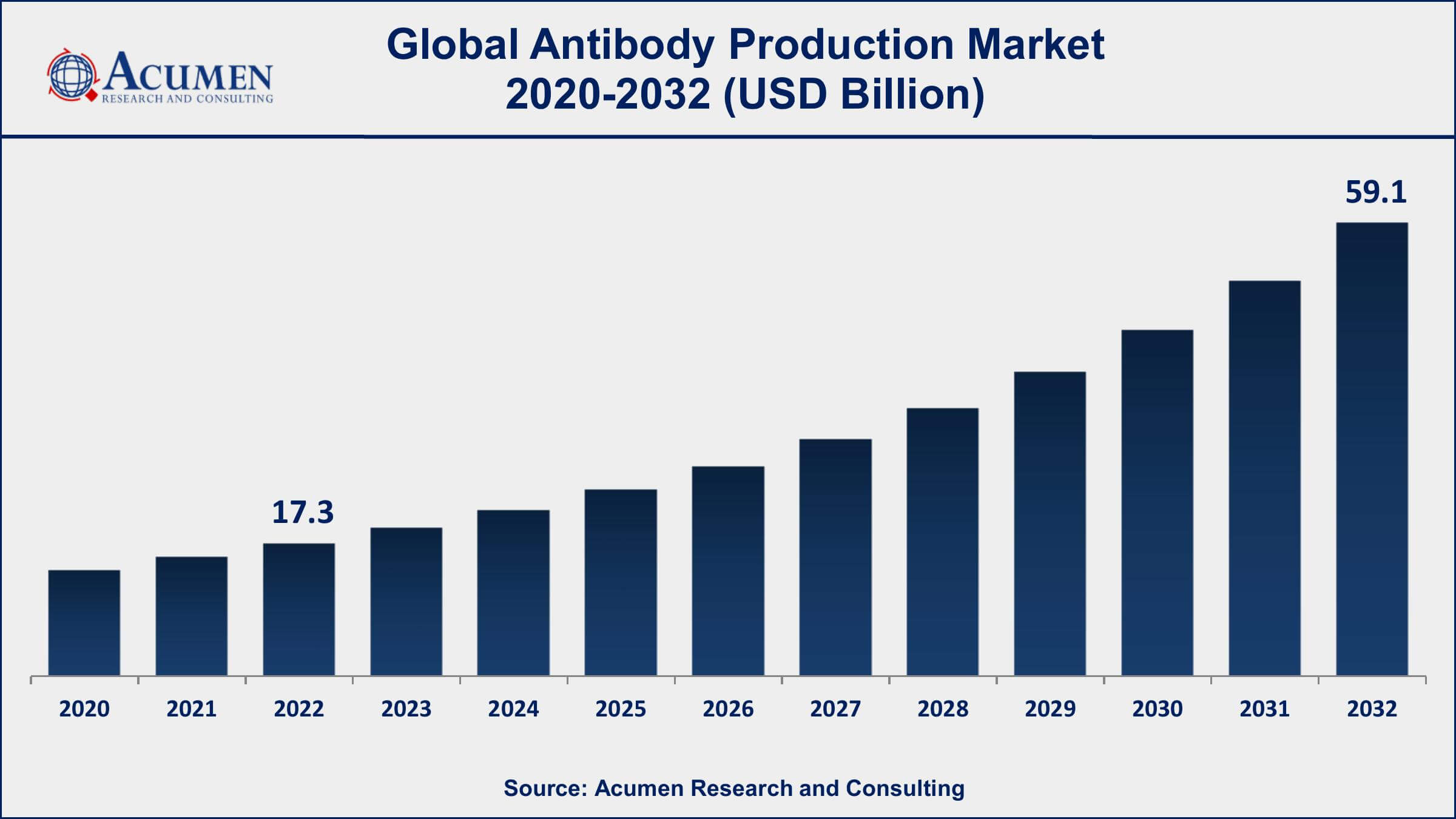

The Global Antibody Production Market Size accounted for USD 17.3 Billion in 2022 and is projected to achieve a market size of USD 59.1 Billion by 2032 growing at a CAGR of 13.2% from 2023 to 2032.

Antibody Production Market Highlights

- Global Antibody Production Market revenue is expected to increase by USD 59.1Billion by 2032, with a 13.2% CAGR from 2023 to 2032

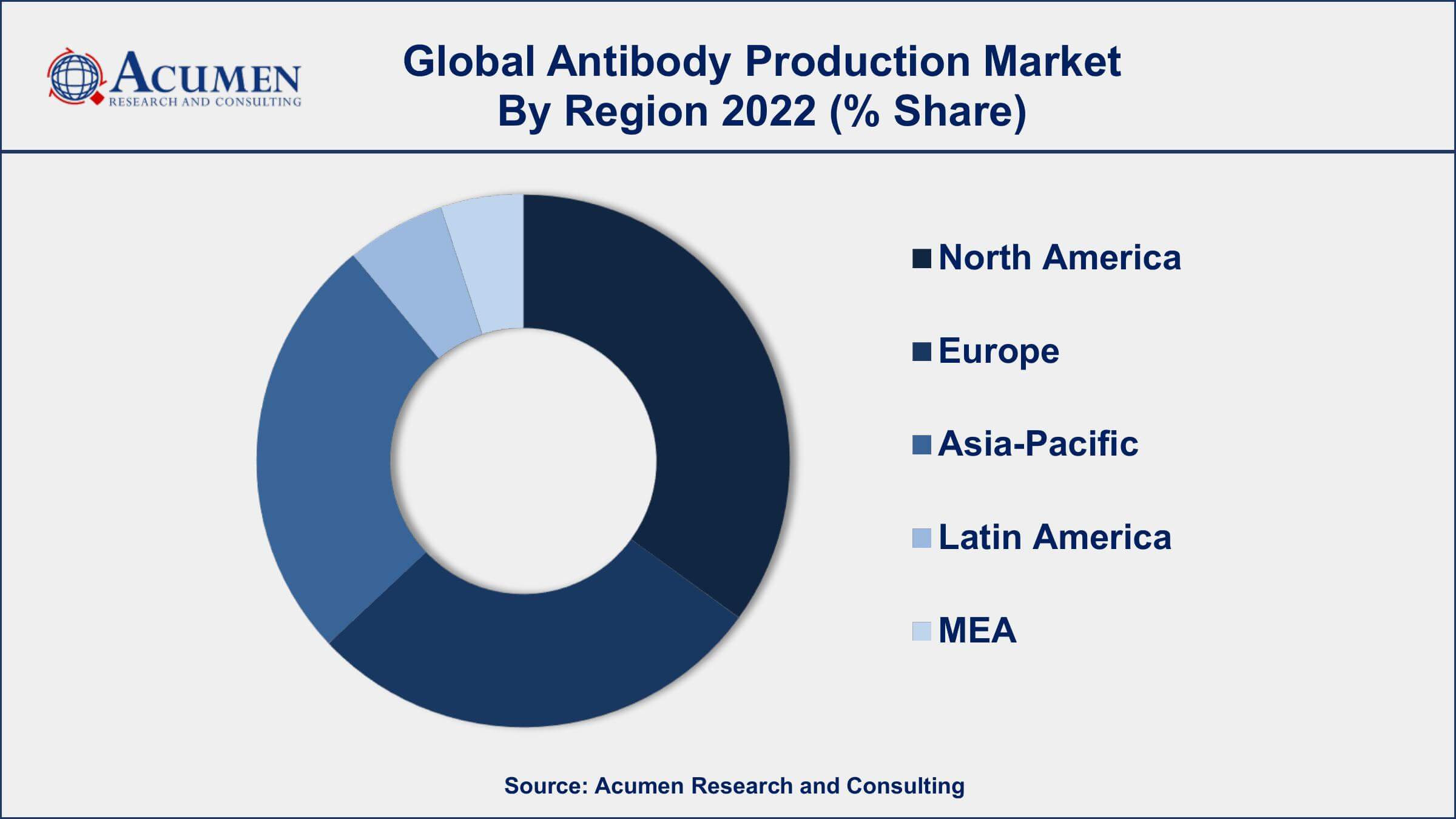

- North America region led with more than 39% of Antibody Production Market share in 2022

- Asia-Pacific Antibody Production Market growth will record a CAGR of around 15% from 2023 to 2032

- By product, the consumables segment has accounted more than 56% of the revenue share in 2022

- By process, the downstream processing segment has recorded more than 67% of the revenue share in 2022

- Rise in demand for targeted therapies and precision medicine, drives the Antibody Production Market Value

Antibody production is the process of generating antibodies, which are specialized proteins produced by the immune system to identify and neutralize foreign substances such as pathogens (e.g., bacteria, viruses) and other antigens. Antibodies play a crucial role in immune responses by binding to specific antigens and marking them for destruction by other immune cells. In a laboratory setting, antibody production often involves the use of hybridoma technology or recombinant DNA technology to create monoclonal antibodies, which are highly specific antibodies derived from a single type of immune cell. These monoclonal antibodies have a wide range of applications, including diagnostic tests, therapeutic treatments, and research tools.

The antibody production market has experienced significant growth over the past few years due to the increasing demand for antibodies in various fields, such as diagnostics, therapeutics, and research. The rise in chronic and infectious diseases, coupled with advancements in personalized medicine, has fueled the demand for precise and reliable diagnostic tools and targeted therapies. Monoclonal antibodies are used in cancer therapies, autoimmune disease treatments, and infectious disease management. Additionally, the expansion of biotechnology and pharmaceutical industries has further driven the market, as these sectors heavily rely on antibodies for drug discovery and development. As a result, the antibody production market has seen a surge in investments, research collaborations, and product launches, contributing to its robust growth trajectory.

Global Antibody Production Market Trends

Market Drivers

- Rise in demand for targeted therapies and precision medicine

- Increased investment in biopharmaceutical research and development

- Growing prevalence of chronic diseases and infectious agents

- Advancements in antibody engineering and production techniques

- Rising focus on personalized medicine and companion diagnostics

Market Restraints

- High production costs of monoclonal antibodies

- Stringent regulatory approval processes for antibody-based products

Market Opportunities

- Development of point-of-care antibody-based diagnostic tests

- Exploration of bispecific antibodies and antibody-drug conjugates

Antibody Production Market Report Coverage

| Market | Antibody Production Market |

| Antibody Production Market Size 2022 | USD 17.3 Billion |

| Antibody Production Market Forecast 2032 | USD 59.1 Billion |

| Antibody Production Market CAGR During 2023 - 2032 | 13.2% |

| Antibody Production Market Analysis Period | 2020 - 2032 |

| Antibody Production Market Base Year | 2022 |

| Antibody Production Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Process, By Type, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Thermo Fisher Scientific, Merck KGaA, Abcam, Bio-Rad Laboratories, GenScript, Lonza Group, Cell Signaling Technology, BioLegend, Agilent Technologies, Novus Biologicals, Proteintech Group, and Rockland Immunochemicals |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Antibody production is the process of generating specific proteins called antibodies that play a pivotal role in the immune system's defense against harmful substances such as pathogens and antigens. These proteins are produced by specialized immune cells known as B cells in response to the detection of foreign molecules. Antibodies, also called immunoglobulins, are highly specific and capable of recognizing a wide array of antigens. Their primary function is to mark these antigens for destruction by other immune cells or to directly neutralize them, thereby protecting the body from infections and diseases.

The applications of antibody production are vast and diverse, spanning across multiple fields including diagnostics, therapeutics, and research. In diagnostics, antibodies are harnessed to create sensitive and specific tests that can detect the presence of pathogens, biomarkers, or other molecules in clinical samples. These tests play a crucial role in diagnosing various diseases, monitoring patient health, and assessing treatment effectiveness. In therapeutics, antibodies have become a cornerstone of modern medicine. Monoclonal antibodies, produced through advanced biotechnological processes, are designed to target specific molecules involved in diseases. They are used as treatments for various conditions, including cancer, autoimmune disorders, and infectious diseases.

The antibody production market has witnessed remarkable growth in recent years, driven by a convergence of factors that have propelled its expansion across various sectors. One of the key drivers is the escalating demand for targeted therapies and precision medicine. As the understanding of diseases at the molecular level grows, the need for highly specific antibodies for accurate diagnosis and tailored treatments has surged. This demand has led to intensified research and development activities, boosting the market's growth trajectory. The biopharmaceutical industry's burgeoning focus on innovation has also significantly contributed to the market's expansion. Antibodies play a pivotal role in drug discovery and development, particularly in the design of biologic therapies. The development of novel antibody formats, such as bispecific antibodies and antibody-drug conjugates, has extended the potential applications of antibodies beyond traditional treatments.

Antibody Production Market Segmentation

The global Antibody Production Market segmentation is based on product, process, type, end-use, and geography.

Antibody Production Market By Product

- Instruments

- Bioreactors

- Filtration systems

- Chromatography Systems

- Consumables

- Media

- Filtration Consumables and Accessories

- Chromatography Resins and Columns

- Buffers and Reagents

- Others

- Software

According to the antibody production industry analysis, the consumables segment accounted for the largest market share in 2022. This segment encompasses a range of products necessary for antibody production, including culture media, growth factors, purification kits, and assay reagents. As the biopharmaceutical and biotechnology industries expand, the demand for these consumables has surged, particularly with the increasing focus on monoclonal antibodies and other biologics. One of the primary drivers of consumables segment growth is the surge in research and development activities related to therapeutic antibodies and diagnostic applications. As companies and research institutions delve deeper into antibody-based treatments, the need for specialized culture media, growth factors, and purification kits has intensified.

Antibody Production Market By Process

- Downstream Processing

- Upstream Processing

In terms of processes, the downstream processing segment is expected to witness significant growth in the coming years. Downstream processing involves a series of steps to isolate and purify antibodies from the complex mixture produced during the upstream fermentation phase. This segment's growth has been driven by the expanding demand for high-quality, pure antibodies in therapeutic, diagnostic, and research applications. The surge in monoclonal antibody-based therapies and biopharmaceuticals has led to an increased need for efficient downstream processing methods. As more therapeutic antibodies enter clinical trials and commercial production, the industry places greater emphasis on ensuring product purity and meeting regulatory standards. This demand has prompted the development of advanced chromatography resins, filtration technologies, and separation techniques that optimize yield and minimize the risk of contamination.

Antibody Production Market By Type

- Polyclonal Antibody

- Monoclonal Antibody

According to the antibody production market forecast, the monoclonal antibody segment is expected to witness significant growth in the coming years. Monoclonal antibodies are highly specific antibodies derived from a single type of immune cell and have become pivotal tools in precision medicine, targeted therapies, and disease understanding. This segment's growth can be attributed to the increasing demand for effective and personalized treatments, as well as the ongoing advancements in biotechnology and antibody engineering. In the therapeutic arena, monoclonal antibodies have become a cornerstone of modern medicine. Their ability to precisely target disease-causing molecules while sparing healthy cells has led to the development of numerous successful therapies for cancer, autoimmune diseases, and other medical conditions.

Antibody Production Market By End-use

- Pharmaceutical and Biotechnology Companies

- CROs and CDMOs

- Research Laboratories

Based on the End-use, the CROs and CDMOs segment is expected to continue its growth trajectory in the coming years. This segment's growth has been driven by the increasing demand for outsourcing in the biopharmaceutical industry and the need for efficient and cost-effective antibody production solutions. CROs and CDMOs play a crucial role in accelerating drug development timelines, reducing production costs, and mitigating risks associated with manufacturing and regulatory challenges. As the complexity of biologics, including monoclonal antibodies, continues to grow, companies seek specialized expertise to navigate intricate development processes and ensure compliance with regulatory standards. CROs and CDMOs offer state-of-the-art facilities, established process protocols, and experienced teams that streamline antibody production and enhance the chances of successful product development.

Antibody Production Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Antibody Production Market Regional Analysis

North America's dominance in the antibody production market can be attributed to a combination of factors that have established the region as a thriving hub for biopharmaceuticals, research, and technological innovation. One key factor is the presence of a robust ecosystem comprising world-renowned research institutions, pharmaceutical companies, and biotechnology firms. This concentrated expertise fosters a dynamic environment for collaboration and knowledge exchange, driving advancements in antibody discovery, development, and production. Moreover, North America benefits from a well-developed regulatory framework that facilitates efficient approval processes for antibody-based products. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) have established clear guidelines for biologics, including monoclonal antibodies, ensuring safety and efficacy while expediting the development timeline. This regulatory clarity provides a competitive advantage for companies seeking to bring antibody-based therapies and diagnostics to market.

Antibody Production Market Player

Some of the top antibody production market companies offered in the professional report include Thermo Fisher Scientific, Merck KGaA, Abcam, Bio-Rad Laboratories, GenScript, Lonza Group, Cell Signaling Technology, BioLegend, Agilent Technologies, Novus Biologicals, Proteintech Group, and Rockland Immunochemicals.

Frequently Asked Questions

What was the market size of the global antibody production in 2022?

The market size of antibody production was USD 17.3 Billion in 2022.

What is the CAGR of the global antibody production market from 2023 to 2032?

The CAGR of antibody production is 13.2% during the analysis period of 2023 to 2032.

Which are the key players in the antibody production market?

The key players operating in the global market are including Thermo Fisher Scientific, Merck KGaA, Abcam, Bio-Rad Laboratories, GenScript, Lonza Group, Cell Signaling Technology, BioLegend, Agilent Technologies, Novus Biologicals, Proteintech Group, and Rockland Immunochemicals.

Which region dominated the global antibody production market share?

North America held the dominating position in antibody production industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of antibody production during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global antibody production industry?

The current trends and dynamics in the antibody production industry include rise in demand for targeted therapies and precision medicine, increased investment in biopharmaceutical research and development, and growing prevalence of chronic diseases and infectious agents.

Which product held the maximum share in 2022?

The consumables product held the maximum share of the antibody production industry.