Anti-Corrosion Paints Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Anti-Corrosion Paints Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

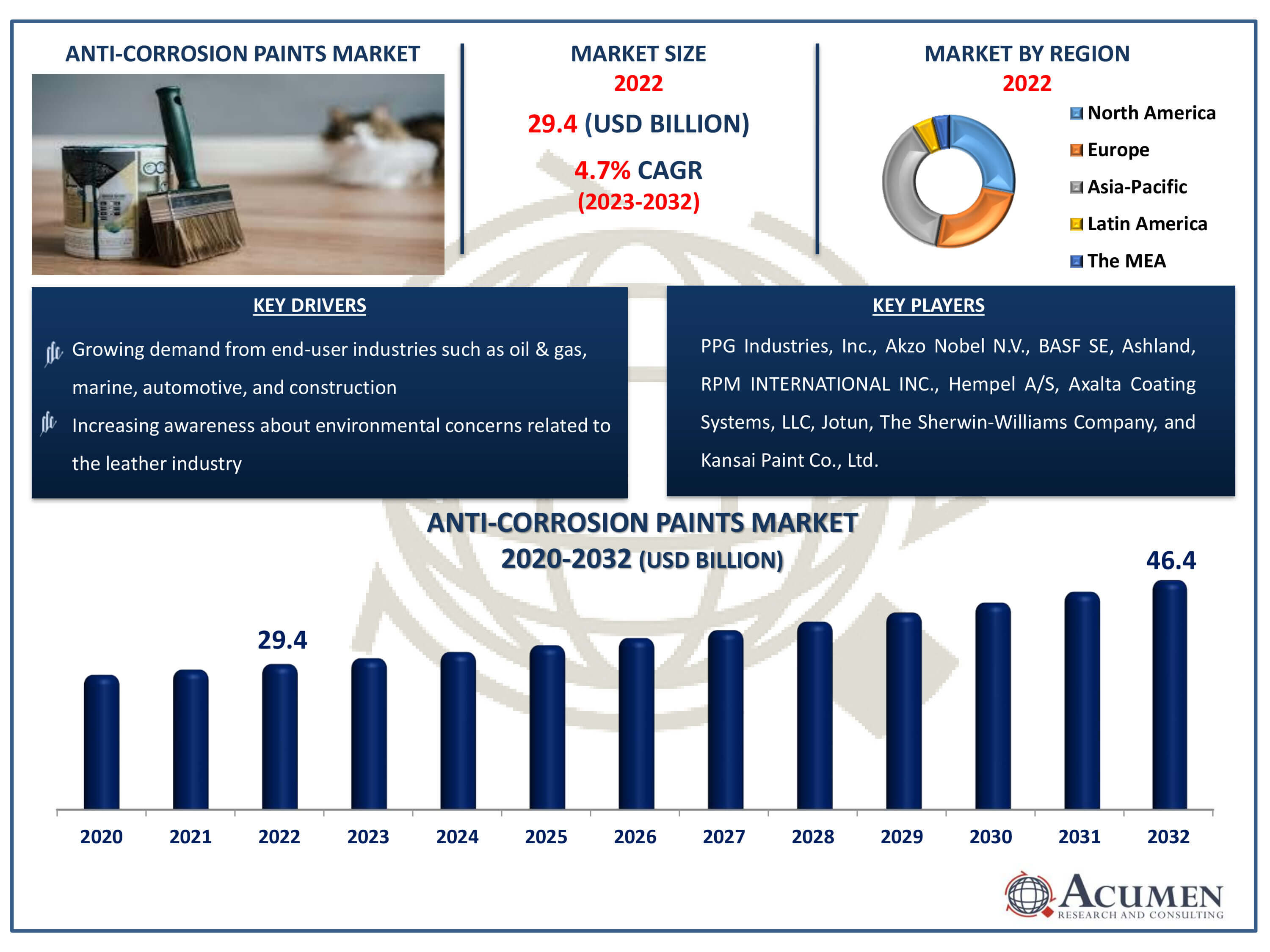

The Anti-Corrosion Paints Market Size accounted for USD 29.4 Billion in 2022 and is estimated to achieve a market size of USD 46.4 Billion by 2032 growing at a CAGR of 4.7% from 2023 to 2032.

Anti-Corrosion Paints Market Highlights

- Global anti-corrosion paints market revenue is poised to garner USD 46.4 billion by 2032 with a CAGR of 4.7% from 2023 to 2032

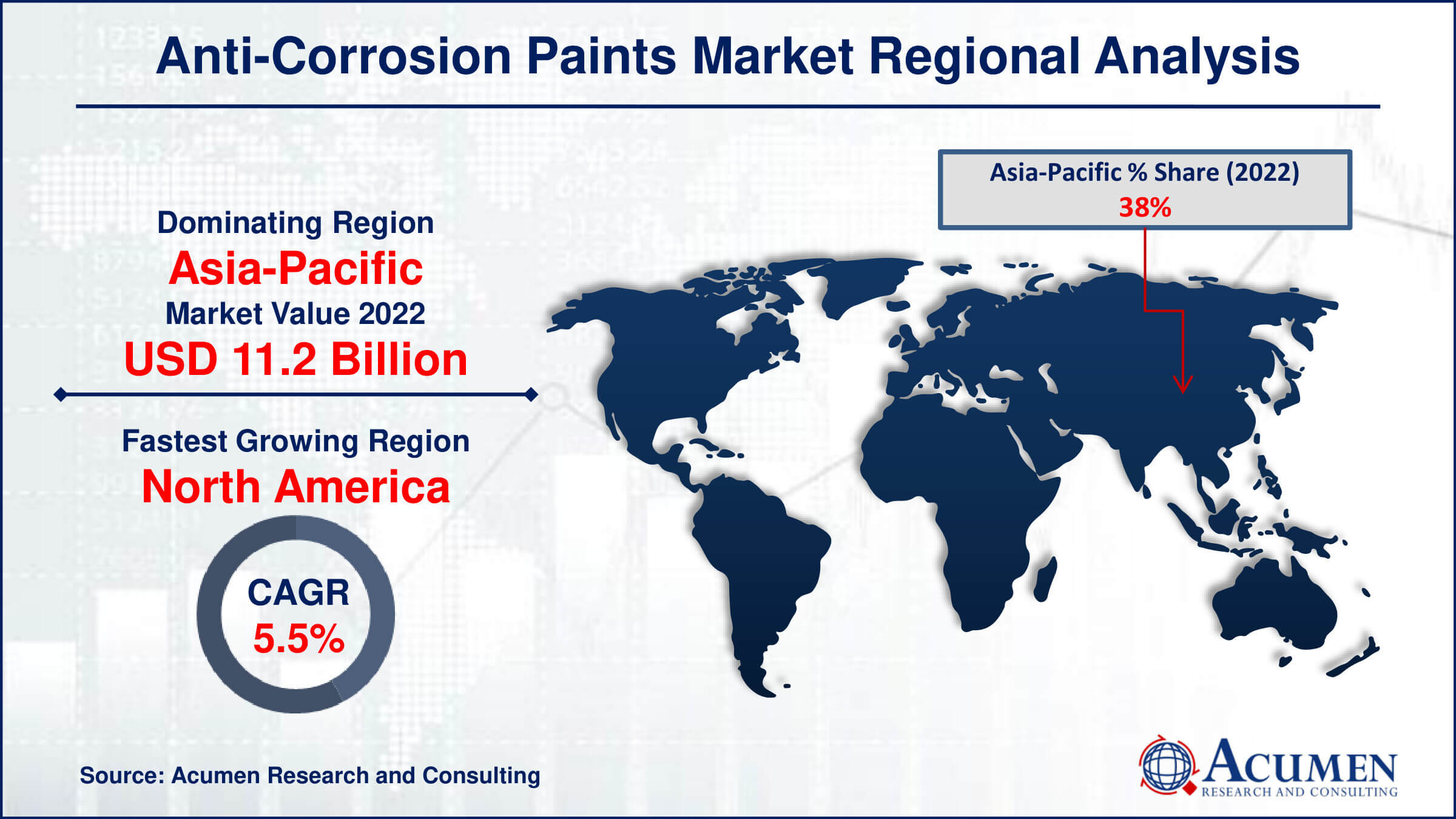

- Asia-Pacific anti-corrosion paints market value occupied around USD 11.2 billion in 2022

- North America anti-corrosion paints market growth will record a CAGR of more than 5.5% from 2023 to 2032

- Among material, the acrylic sub-segment generated more than USD 13.8 billion revenue in 2022

- Based on application, the oil & gas sub-segment generated around 37% market share in 2022

- Growth of the renewable energy sector, creating opportunities for anti-corrosion coatings in wind turbines and solar panels is a popular anti-corrosion paints market trend that fuels the industry demand

Anti-corrosion paints mainly contain corrosion-resistant pigments such as zinc chromate, lead chromate, or red lead, along with linseed oil used as a binder. These paints protect against corrosion by creating a barrier that reduces the direct contact of air and water with the metal surface. The principle of anti-corrosion paint is to shield metal surfaces and act as a barrier to prevent contact with chemical compounds or corrosive materials. Anti-corrosion paints prevent industrial equipment from degradation caused by exposure to oxidation, salt spray, moisture, and industrial chemicals. They are widely used in industries such as marine, oil & gas, industrial manufacturing, infrastructure, and power generation. Desired characteristics of anti-corrosion paint include rust prevention, abrasion resistance, impact resistance, and water resistance. Anti-corrosion paints are cost-effective and provide long-lasting protection against corrosion.

Global Anti-Corrosion Paints Market Dynamics

Market Drivers

- Growing demand from end-user industries such as oil & gas, marine, automotive, and construction

- Increasing awareness about the importance of corrosion prevention for prolonging the lifespan of assets

- Stringent regulatory standards mandating the use of anti-corrosion coatings in various industrial applications

- Technological advancements leading to the development of high-performance and eco-friendly anti-corrosion paints

Market Restraints

- Rising costs of raw materials used in anti-corrosion paints production

- Environmental concerns related to the use of hazardous chemicals in certain types of anti-corrosion paints

- Limited availability of skilled labor for the application of specialized anti-corrosion coatings

Market Opportunities

- Expansion of infrastructure projects in emerging economies

- Increasing adoption of anti-corrosion coatings in the aerospace and defense sectors

- Development of novel formulations and coatings tailored for specific industrial applications

Anti-Corrosion Paints Market Report Coverage

| Market | Anti-Corrosion Paints Market |

| Anti-Corrosion Paints Market Size 2022 | USD 29.4 Billion |

| Anti-Corrosion Paints Market Forecast 2032 |

USD 46.4 Billion |

| Anti-Corrosion Paints Market CAGR During 2023 - 2032 | 4.7% |

| Anti-Corrosion Paints Market Analysis Period | 2020 - 2032 |

| Anti-Corrosion Paints Market Base Year |

2022 |

| Anti-Corrosion Paints Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Material, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | PPG Industries, Inc., Akzo Nobel N.V., BASF SE, Ashland, RPM INTERNATIONAL INC., Hempel A/S, Axalta Coating Systems, LLC, Jotun, The Sherwin-Williams Company, and Kansai Paint Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Anti-Corrosion Paints Market Insights

Infrastructure improvements, rising corrosion losses, and the expansion of end-user sectors such as infrastructure, oil and gas, and power generation are key factors moving the anti-corrosion paints market forward. The need for infrastructure renovation and growth, particularly in rising nations, promotes high demand for anti-corrosion paints to protect structures and equipment from corrosion-related damage. Furthermore, as industries expand and develop across the world, the requirement for dependable corrosion protection grows in importance to maintain asset longevity and integrity. In addition to these forces, the automobile industry makes a considerable contribution to the need for anti-corrosion paint. Anti-corrosion paints play an important role in the automobile industry, protecting vehicle exteriors and underbodies against rust and corrosion caused by exposure to external factors and driving conditions. The proper application of anti-corrosion coatings is critical to maintaining the structural integrity of cars, preserving their longevity and resell value.

Despite the obvious benefits of anti-corrosion paints, environmental laws represent a barrier to industry expansion. The raw ingredients used in the manufacture of anti-corrosion paints frequently contain toxic compounds that can affect the environment and human health. Regulatory agencies put severe standards and restrictions on the use of such materials, mandating the development of environmentally friendly alternatives and sustainable production methods within the business. Nonetheless, there are several prospects for market growth, particularly in developing countries where infrastructure development is growing and demand for high-efficiency anti-corrosion paints is increasing. Furthermore, advances in nanotechnology provide a potential route for innovation in the anti-corrosion paints sector. Nanotechnology provides unique methods for improving the performance and durability of anti-corrosion coatings, satisfying industries' changing need for strong and long-lasting corrosion protection solutions. As industries prioritise asset lifespan, safety, and sustainability, the use of innovative anti-corrosion paints is likely to increase, driving market expansion and technical innovation in the anti-corrosion coatings market forecast period.

Anti-Corrosion Paints Market Segmentation

The worldwide market for anti-corrosion paints is split based on type, material application, and geography.

Anti-Corrosion Paints Market by Types

- Water-Based

- Solvent-Based

- Powder-Based

- Others

According to anti-corrosion paints industry analysis, many construction companies are adopting powder coating to provide long-term exterior finishes for outdoor venues and public works projects. However, solvent-based anti-corrosion paints have captured the maximum share by revenue of the overall market and are expected to grow at a moderate rate during the anti-corrosion paints market forecast period. The rise in demand for solvent-based paints is attributed to their superior block resistance features, shorter drying time, and wide range of applications.

Anti-Corrosion Paints Market by Materials

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Zinc

- Others

As the most common substance in anti-corrosion paints, acrylic dominates the market. Acrylic-based anti-corrosion paints are a flexible solution with high adhesion and weather resistance, making them appropriate for a wide range of applications. Acrylic paints provide a long-lasting protective covering on metal surfaces, preventing corrosion and increasing the life of covered buildings and equipment. Furthermore, acrylic anti-corrosion paints are noted for their quick drying time and simplicity of application, which improves productivity in industrial and commercial environments. Their adaptability enables for additive customisation to suit unique performance needs, which contributes to their appeal in industries such as automotive, construction, maritime, and infrastructure. Overall, the acrylic market is growing rapidly because to its numerous advantages and adaptability for a variety of anti-corrosion applications.

Anti-Corrosion Paints Market by Applications

- Marine

- Oil & Gas

- Building & Construction

- Automotive & Rail

- Aerospace and Defense

- Others

The oil and gas sector largest in the anti-corrosion paints market because to its critical role in protecting equipment and infrastructure in this industry. Anti-corrosion coatings are essential for shielding pipelines, storage tanks, drilling rigs, and other assets against corrosion caused by harsh weather, chemical exposure, and high-pressure operations. With the oil and gas sector operating in extreme environments such as offshore platforms and remote sites, reliable corrosion prevention is crucial to guaranteeing safety, operational efficiency, and asset integrity. Anti-corrosion paints designed for oil and gas applications have high durability, chemical resistance, and adhesion qualities, ensuring long-term protection against corrosion failures and costly downtime. As the oil and gas sector expands internationally, demand for effective anti-corrosion solutions is projected to stay strong, driving anti-corrosion coatings market expansion.

Anti-Corrosion Paints Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Anti-Corrosion Paints Market Regional Analysis

Asia-Pacific is expected to dominate the global high-performance anti-corrosion paint market, driven by an increase in end users such as oil & gas, marine, construction, and power generation. In Europe, demand for high-performance anti-corrosion paint is estimated to remain steady due to stringent governmental regulations and a saturated end-user market in the North America region. However, during the forecasted period, the stable growth of high-performance anti-corrosion paint is likely to be supported by the power generation industry. Latin America is expected to witness slow growth, while the Middle East & Africa is anticipated to be the fastest-growing market for high-performance anti-corrosion paints during the anti-corrosion coatings market forecast period.

Anti-Corrosion Paints Market Players

Some of the top anti-corrosion paints companies offered in our report includes PPG Industries, Inc., Akzo Nobel N.V., BASF SE, Ashland, RPM INTERNATIONAL INC., Hempel A/S, Axalta Coating Systems, LLC, Jotun, The Sherwin-Williams Company, and Kansai Paint Co., Ltd.

Frequently Asked Questions

How big is the anti-corrosion paints market?

The anti-corrosion paints market size was valued at USD 29.4 billion in 2022.

What is the CAGR of the global anti-corrosion paints market from 2023 to 2032?

The CAGR of anti-corrosion paints is 4.7% during the analysis period of 2023 to 2032.

Which are the key players in the anti-corrosion paints market?

The key players operating in the global market are including PPG Industries, Inc., Akzo Nobel N.V., BASF SE, Ashland, RPM INTERNATIONAL INC., Hempel A/S, Axalta Coating Systems, LLC, Jotun, The Sherwin-Williams Company, and Kansai Paint Co., Ltd.

Which region dominated the global anti-corrosion paints market share?

Asia-Pacific held the dominating position in anti-corrosion paints industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of anti-corrosion paints during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global anti-corrosion paints industry?

The current trends and dynamics in the anti-corrosion paints industry include growing demand from end-user industries such as oil & gas, marine, automotive, and construction, increasing awareness about the importance of corrosion prevention for prolonging the lifespan of assets, stringent regulatory standards mandating the use of anti-corrosion coatings in various industrial applications, and technological advancements leading to the development of high-performance and eco-friendly anti-corrosion paints.

Which material held the maximum share in 2022?

The acrylic material held the maximum share of the anti-corrosion paints industry.