Anti-Allergic Drugs Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Anti-Allergic Drugs Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

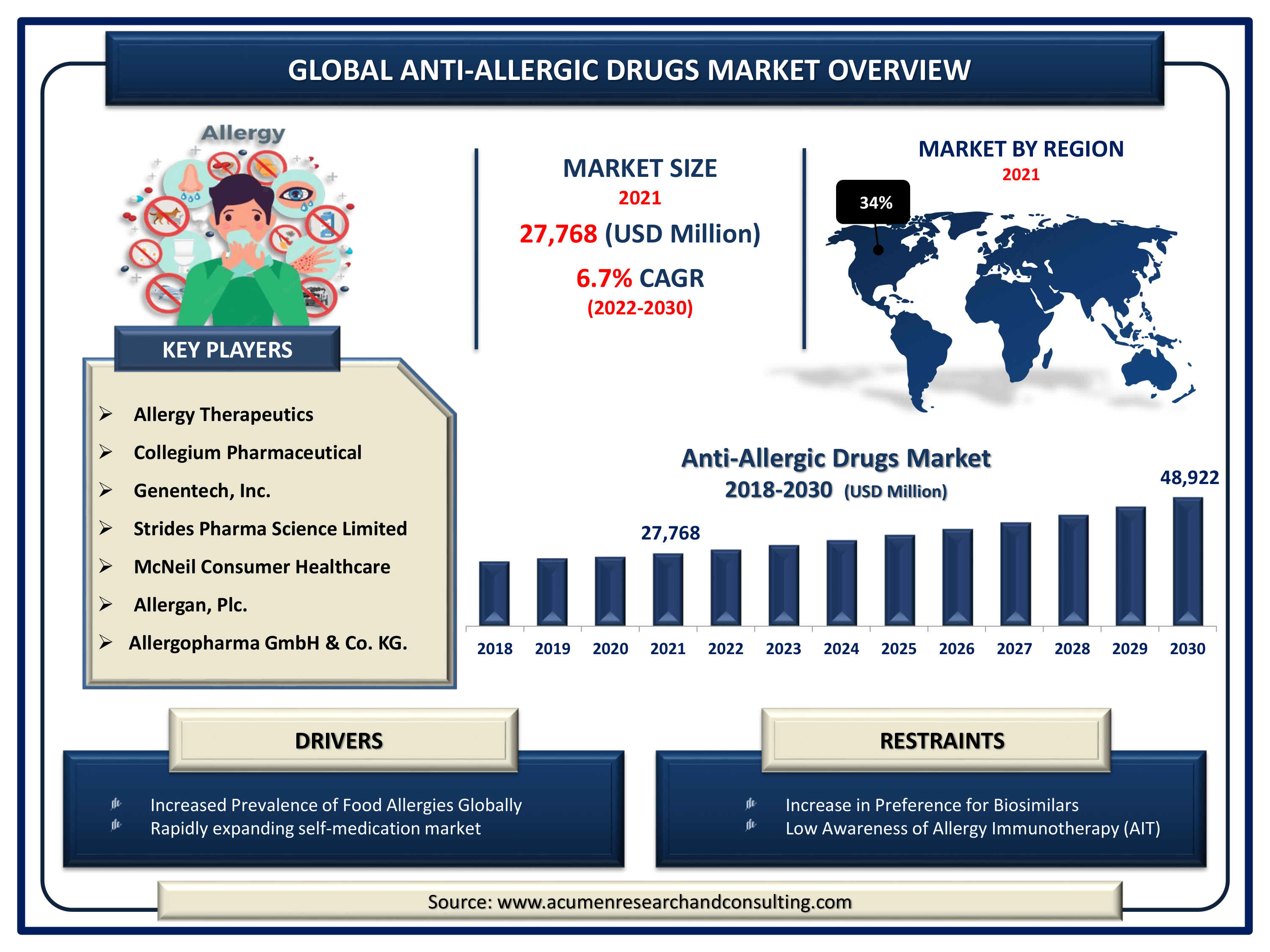

Request Sample Report

The Global Anti-Allergic Drugs Market Size accounted for USD 27,768 Million in 2021 and is estimated to achieve a market size of USD 48,922 Million by 2030 growing at a CAGR of 6.7% from 2022 to 2030. The rising prevalence of various types of allergies, increased investment by industry players in the development of novel allergic therapies and the increasing importance of self-treatment are the primary factors driving the anti-allergic drugs market growth. Moreover, the growing focus on R&D to grow relatively new products to meet high unmet medical needs is having a significant impact on the growth of the anti-allergic drugs market value.

Anti-Allergic Drugs Market Report Key Highlights

- Global anti-allergic drugs market revenue is expected to increase by USD 48,922 million by 2030, with a 6.7% CAGR from 2022 to 2030.

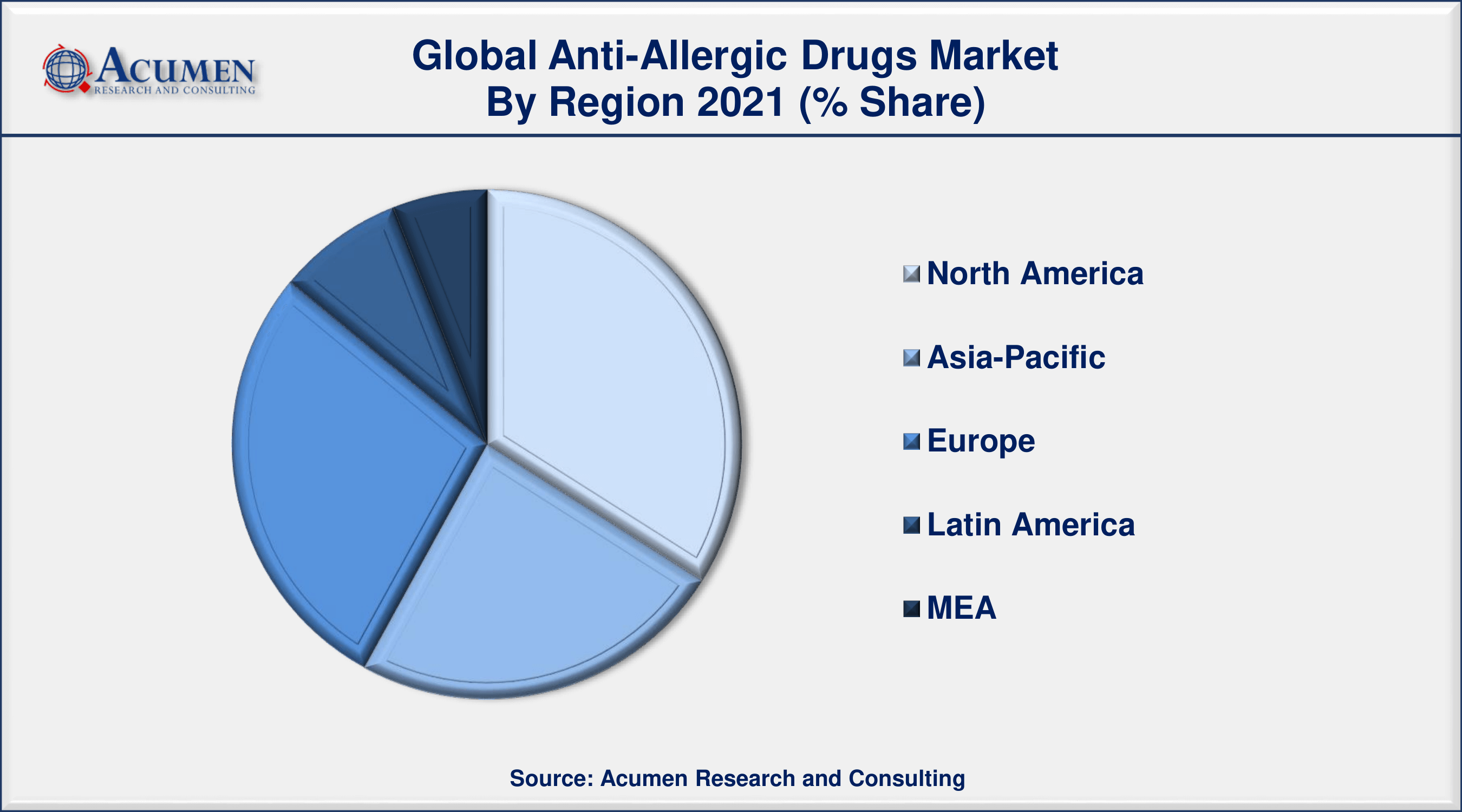

- North America region led with more than 34% anti-allergic drugs market share in 2021

- According to study, Allergies are the 6th leading cause of chronic illness in the U.S.

- Asia-Pacific regional market is expected to grow at a CAGR of more than 7% during the forecast period

- Among end-user, hospital sector engaged more than 38% of the total market share

- By type of allergy, food allergy segment is growing at a strongest CAGR over the forecast period

The term “anti-allergy drug” refers to drugs that regulate the release and action of chemical mediators involved in allergic reactions, whether mediated by IgE (immediate or type I allergic reaction) or inflammatory mediators. Many anti-allergy drugs on the market today are classified into five types based on their mechanism of action: mediator-release inhibitors, histamine H1 antagonists, thromboxane A2 inhibitors, leukotriene antagonists, and Th2 cytokine inhibitors.

Global Anti-Allergic Drugs Market Dynamics

Market Drivers

- Increased prevalence of food allergies globally

- The rapidly expanding self-medication market

- Growing manufacturer investments in the development of innovative allergy treatments

- An increasing geriatric population

Market Restraints

- Increase in preference for biosimilars

- Low awareness of allergy immunotherapy (AIT) among patients

Market Opportunities

- Increasing rates of allergic rhinitis and conjunctivitis

- Rise in the number of R&D activities

Anti-Allergic Drugs Market Report Coverage

| Market | Anti-Allergic Drugs Market |

| Anti-Allergic Drugs Market Size 2021 | USD 27,768 Million |

| Anti-Allergic Drugs Market Forecast 2030 | USD 48,922 Million |

| Anti-Allergic Drugs Market CAGR During 2022 - 2030 | 6.7% |

| Anti-Allergic Drugs Market Analysis Period | 2018 - 2030 |

| Anti-Allergic Drugs Market Base Year | 2021 |

| Anti-Allergic Drugs Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Type of Allergy, By Medication, By End-Users, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Allergy Therapeutics, Collegium Pharmaceutical, Genentech, Inc., Strides Pharma Science Limited, McNeil Consumer Healthcare, Allergan, Plc., and Allergopharma GmbH & Co. KG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Big Calls For "Allergy Shots" Resulting In Growth Of Global Anti-Allergic Drugs Market

Allergy shots are the most common and effective type of allergy immunotherapy. They are used to treat allergic conditions of the nose and eyes (allergic rhinoconjunctivitis), the ears (allergic otitis media), the lungs (bronchial asthma), and severe insect sting allergy. Many allergens, including trees, grass, weeds, mold, house dust, animal dander, and insect stings, are effectively treated with shots. According to the American College of Allergy, Asthma, and Immunology, there is little risk associated with allergy shots. There is also a slight risk of anaphylactic shock (severe allergic reactions) shortly after injection. As a result, allergic shots are administered in an allergist's office. Allergy shots are effective in treating allergic asthma. Allergy shots can help relieve the allergic reactions that cause asthma attacks, improving breathing and reducing the need for asthma medications.

Anti-Allergic Drugs Market Dynamics

Rising Prevalence Of Allergic Reactions Upsurge The Demand For Anti-Allergic Drugs Contributing Overall Growth Of The Market

When a patient's immune system reacts to a foreign substance known as an allergen, this is referred to as an allergy. Coughing, sneezing, hives, rashes, itchy eyes, a runny nose, and a scratchy throat may result from this reaction. It can cause low blood pressure, breathing difficulties, asthma attacks, and even death in severe cases. According to the Asthma and Allergy Foundation of America, more than 50 million Americans suffer from various types of allergies each year. Furthermore, allergies are the sixth leading cause of chronic illness in the United States. Allergic conditions are among the most common health problems affecting children in the United States. Hay fever was diagnosed in 7.7 percent of adults and 7.2 percent of children in 2018. Anaphylaxis to food is estimated to cause 30,000 emergency room visits in the United States each year. Such factors increase the global demand for anti-allergy medications.

Introduction Of Immunotherapy Specifically Sublingual Immunotherapy Boosts The Anti-Allergic Drugs Market Trend

Immunotherapy may be used to treat some allergy patients. Immunotherapy is classified into two types. Allergy shots and sublingual immunotherapy are the two options (SLIT). SLIT is another method for treating certain allergies without the use of injections. Allergists administer small doses of an allergen under the tongue to patients. This exposure increases tolerance to the substance and alleviates symptoms. SLIT is a relatively safe and effective treatment for nasal allergies and asthma. SLIT tablets for dust mites, grass, and ragweed are currently available. While allergy shots are relatively safe, there is a risk of a severe, life-threatening allergic reaction, so they must always be administered in an allergist's office under the supervision of a medical professional. Researchers are looking into potential treatments for certain food allergies. Oral immunotherapy (OIT), SLIT, and other methods are among them. These studies are still in the early stages. They are not tried-and-true treatments. The studies are evaluating the treatments' safety and efficacy.

Combination Therapy In Anti-Allergic Drugs Fuels Overall Growth Of The Market

Corticosteroids, which were first introduced in the 1970s, have different mechanisms of action but do not suppress histamine release; thus, they are commonly used in combination with antihistamines. The patent expiration of leading prescription antihistamines and corticosteroids is resulting in the introduction of more generic and over-the-counter (OTC) products into the anti-allergic therapeutic market. According to the American Academy of Family Physicians, one study that looked at the combination of corticosteroids and antihistamines, such as fluticasone and azelastine, found that this treatment combination was superior to either treatment alone in patients with moderate to severe allergic rhinitis. As a result, while patients should not begin therapy with more than one agent, combination therapy is an option for patients who have severe or persistent symptoms.

Covid-19 Impact On The Global Anti-Allergic Drugs Market

The worldwide spread of the coronavirus has disrupted the supply chain across the globe, as well as industrial activities, have also slowed down due to the nationwide lockdowns and halt on construction activities. The need for social distancing has badly affected the working of almost every industry vertical as in turn the demand for Anti-Allergic Drugs has also been affected negatively.

Anti-Allergic Drugs Market Segmentation

The global anti-allergic drugs market segmentation is based on type of allergy, medication, end-users, and geography.

Anti-Allergic Drugs Market By Type of Allergy

- Food Allergy

- Drug Allergies

- Skin Allergy

- Insect Allergy

- Indoor and Outdoor Allergies

- Latex Allergy

- Others

According to the anti-allergic drugs industry analysis, the food allergy segment is expected to hold a significant market share in 2021. A food allergy is an immune reaction that occurs shortly after consuming a specific food. The increasing incidence of food allergies among children is expected to boost segment growth. Furthermore, the growing geriatric population is expected to boost market growth during the forecast period. As stated by the World Health Organization (WHO), the global geriatric population, which was predicted to be over 524 million in 2010, will grow to nearly 2 billion by 2050. Geriatrics are more susceptible to food allergies due to their weakened immune systems, which is expected to boost the market's growth rate.

Anti-Allergic Drugs Market By Medication

- Corticosteroids

- Decongestants

- Epinephrine

- Allergen Immunotherapy

- Antihistamines

- Others

In terms of medication, the corticosteroids segment is predicted to rise in the market over the next few years. The increased incidence and quantity of patient pools, together with the potent effects of corticosteroids for the aforementioned purposes, are the key drivers driving the expansion of this segment. The rising frequency of asthma, autoimmune disorders, and COPD is most likely to increase the number of corticosteroid-based medicines, supporting the market's long-term growth. Moreover, favorable reimbursement policies implemented by several developed countries are expected to fuel the expansion of the corticosteroid segment in the approaching years.

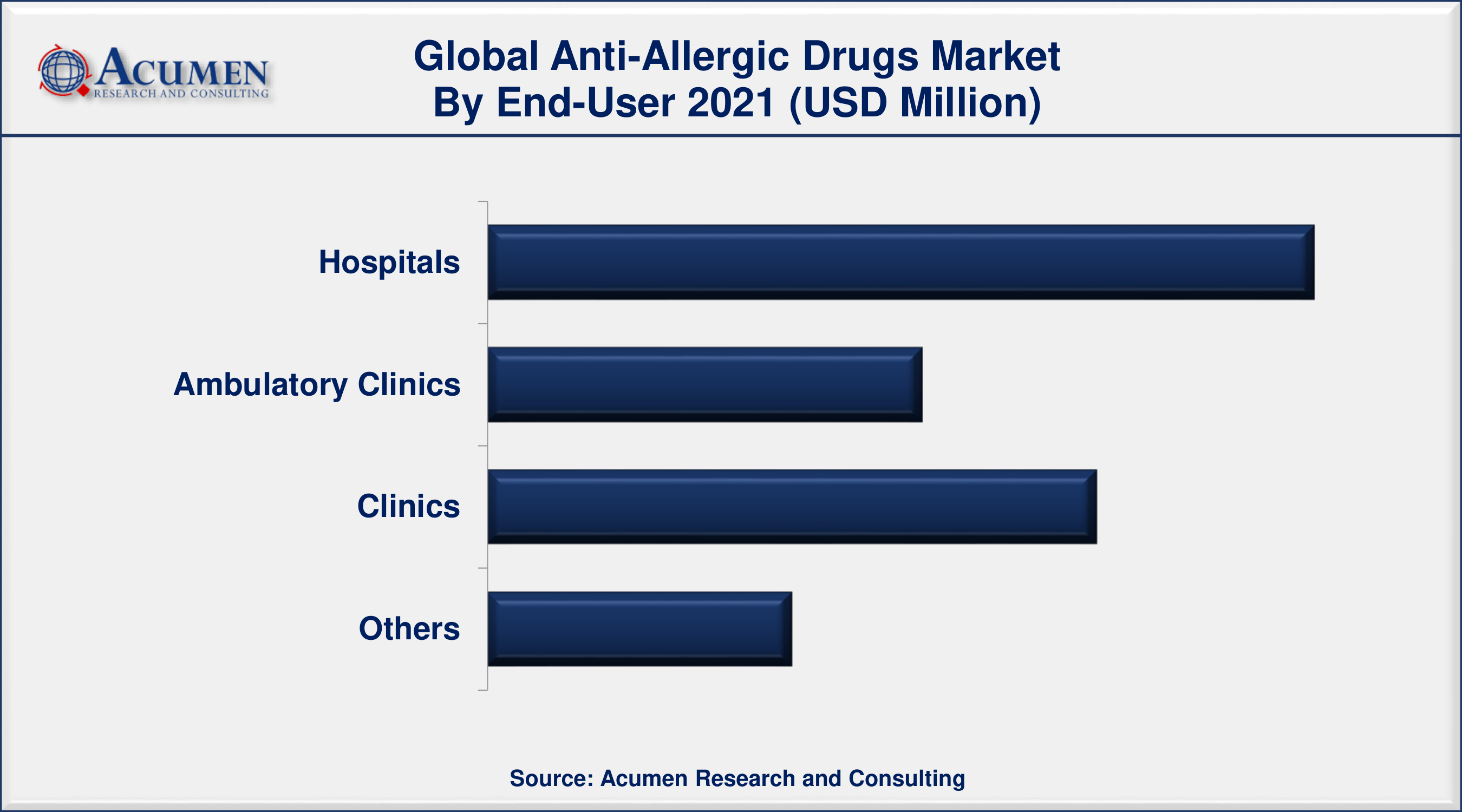

Anti-Allergic Drugs Market By End-Users

- Hospitals

- Ambulatory Clinics

- Clinics

- Others

According to the anti-allergic drugs market forecast, the ambulatory clinics sector is predicted to develop at the fastest rate in the market over the predicted years. The growing demand for outpatient treatment, which is less expensive and doesn't require a stay in the hospital, is projected to be the primary driver of the market. Government projects and investments for ambulatory medical facilities are also expected to drive segment expansion in the future years.

Anti-Allergic Drugs Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

North America Has The Highest Revenue Share In The Global Anti-Allergic Drugs Market

Geographically, North America is expected to hold a significant market share in the global anti-allergic drugs market during the forecast period. One of the major factors contributing to the global growth of anti-allergic drugs is the growing number of people who suffer from allergies. , Asia Pacific, on the other hand, is expected to have the fastest growing CAGR in the coming years. The rapid development of healthcare infrastructure is a major factor driving the growth of the global anti-allergic drugs market. Europe will have the world's second-largest market share for anti-allergic drugs. The growing demand for immunotherapy treatment is exacerbating the growth of the anti-allergic drugs market.

Anti-Allergic Drugs Market Players

Some of the top anti-allergic drugs market companies offered in the professional report include Allergy Therapeutics, Collegium Pharmaceutical, Genentech, Inc., Strides Pharma Science Limited, McNeil Consumer Healthcare, Allergan, Plc., and Allergopharma GmbH & Co. KG.

Frequently Asked Questions

What is the size of global anti-allergic drugs market in 2021?

The estimated value of global anti-allergic drugs market in 2021 was accounted to be USD 27,768 Million.

What is the CAGR of global anti-allergic drugs market during forecast period of 2022 to 2030?

The projected CAGR anti-allergic drugs market during the analysis period of 2022 to 2030 is 6.7%.

Which are the key players operating in the market?

The prominent players of the global anti-allergic drugs market are Allergy Therapeutics, Collegium Pharmaceutical, Genentech, Inc., Strides Pharma Science Limited, McNeil Consumer Healthcare, Allergan, Plc., and Allergopharma GmbH & Co. KG.

Which region held the dominating position in the global anti-allergic drugs market?

North America held the dominating anti-allergic drugs during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for anti-allergic drugs during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global anti-allergic drugs market?

Increased prevalence of food allergies globally, and rapidly expanding self-medication sector, drives the growth of global anti-allergic drugs market.

By end-users segment, which sub-segment held the maximum share?

Based on end-users, hospital segment is expected to hold the maximum share anti-allergic drugs market.