Anti-Aging Products Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Anti-Aging Products Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

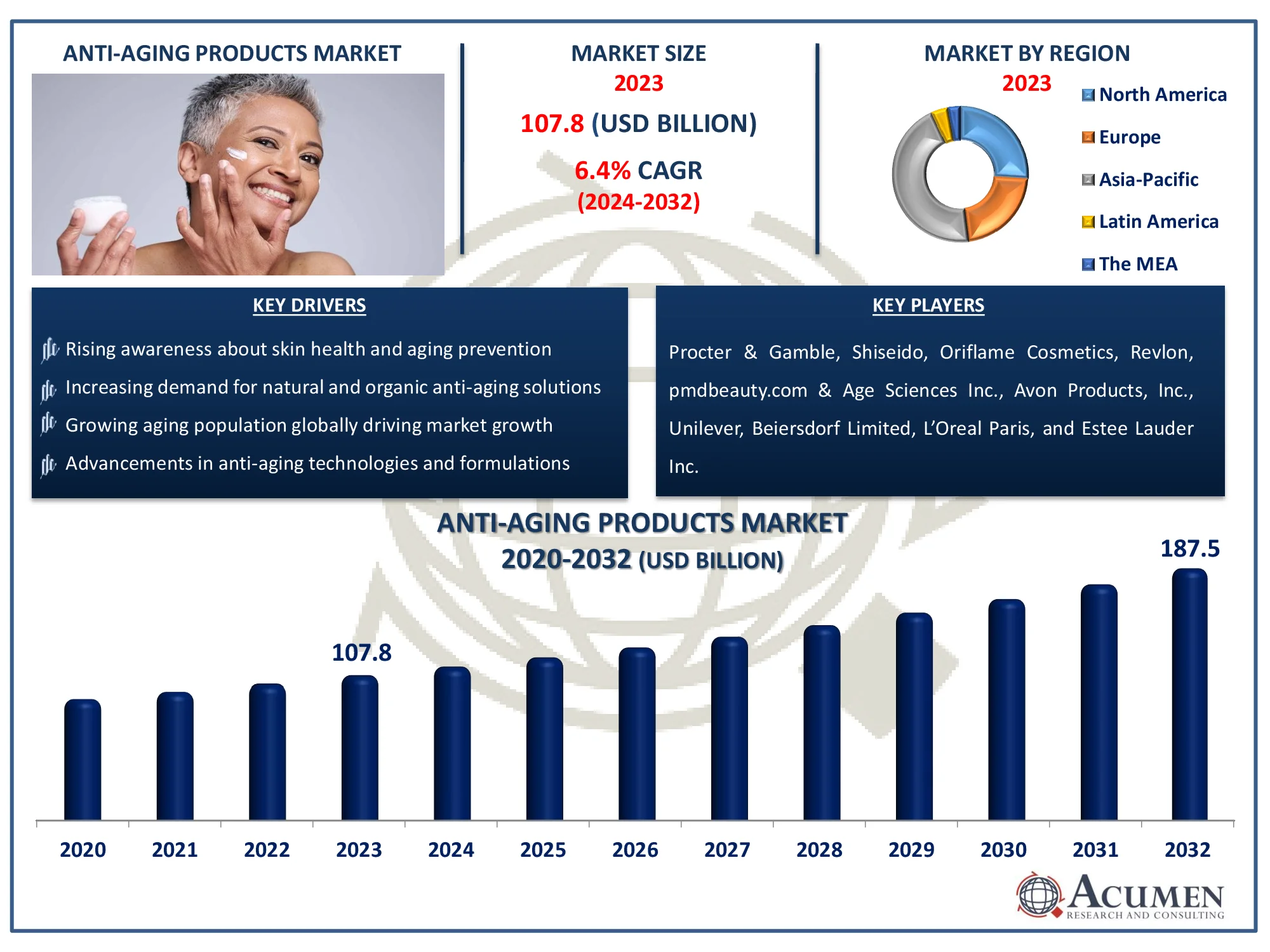

The Global Anti-Aging Products Market Size accounted for USD 107.8 Billion in 2023 and is estimated to achieve a market size of USD 187.4 Billion by 2032 growing at a CAGR of 6.4% from 2024 to 2032.

Anti-Aging Products Market Highlights

- Global anti-aging products market revenue is poised to garner USD 187.4 billion by 2032 with a CAGR of 6.4% from 2024 to 2032

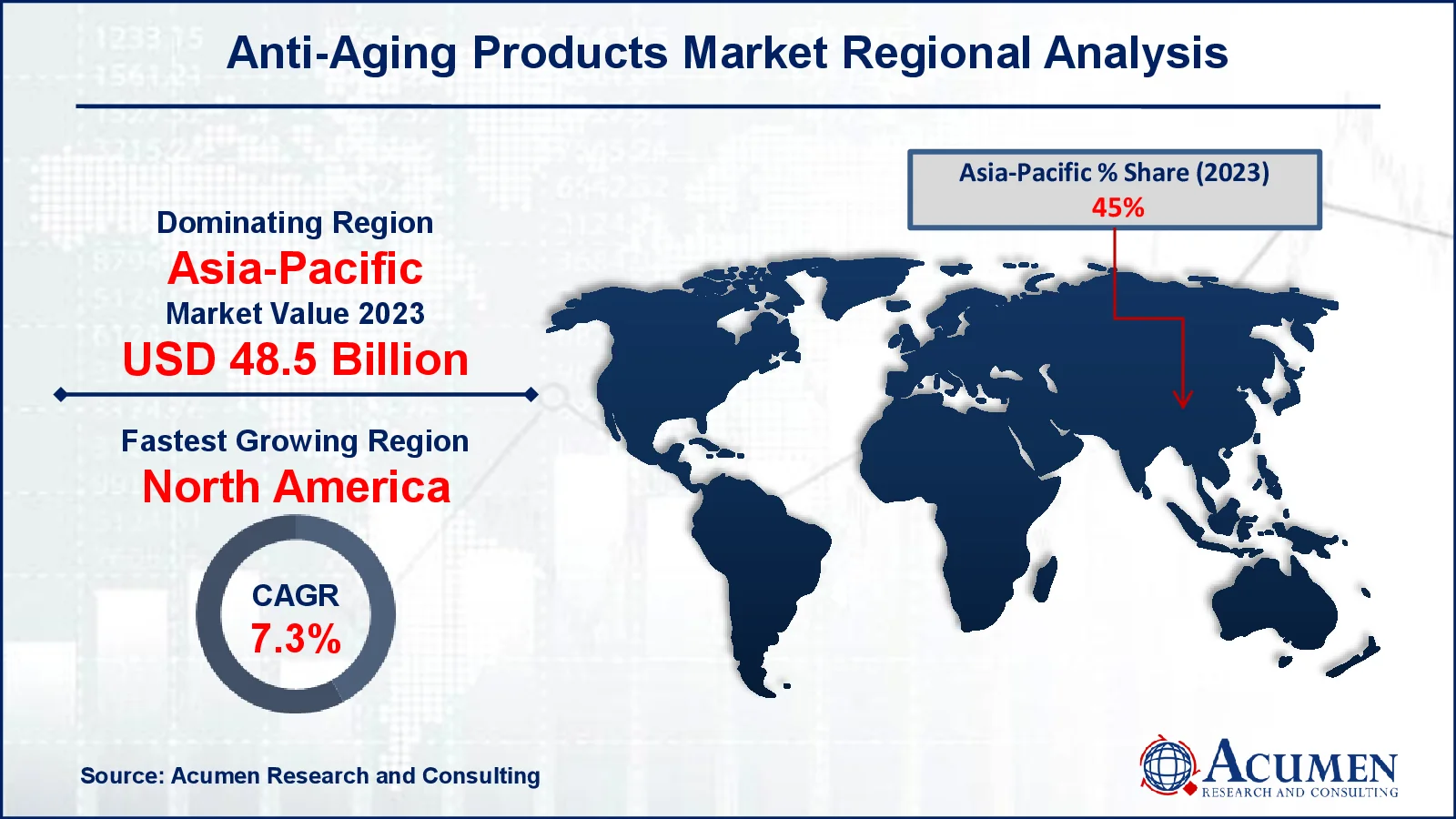

- Asia-Pacific anti-aging products market value occupied around USD 48.5 billion in 2023

- North America anti-aging products market growth will record a CAGR of more than 7.3% from 2024 to 2032

- Among product type, the skincare products sub-segment generated USD 56.03 billion revenue in 2023

- Based on end-user, the women sub-segment generated significant anti-aging products market share in 2023

- Innovations in personalized anti-aging skincare is a popular anti-aging products market trend that fuels the industry demand

Wrinkling, loss of elasticity, laxity, and a rough-textured look are all symptoms of skin aging. The aging process causes phenotypic changes in cutaneous cells, as well as structural and functional changes in extracellular matrix components including collagen and elastin. Because skin health and beauty are considered to be one of the most important indicators of general well-being in humans, various anti-aging techniques have been developed in recent years. Furthermore, rising consumer awareness of skin problems due to aging such as wrinkles, dullness, and fine lines as well as their increasing willingness to spend on treatments to proclaim their skin's youthfulness, is likely to fuel market demand throughout the anti-aging products market forecast period.

Global Anti-Aging Products Market Dynamics

Market Drivers

- Rising awareness about skin health and aging prevention

- Increasing demand for natural and organic anti-aging solutions

- Growing aging population globally driving market growth

- Advancements in anti-aging technologies and formulations

Market Restraints

- High cost of premium anti-aging products

- Concerns regarding the safety of certain chemical ingredients

- Availability of counterfeit products affecting consumer trust

Market Opportunities

- Expansion of anti-aging product lines into emerging markets

- Growing influence of social media on beauty and wellness trends

- Collaboration with dermatologists and skincare professionals for credibility

Anti-Aging Products Market Report Coverage

| Market | Anti-Aging Products Market |

| Anti-Aging Products Market Size 2022 |

USD 107.8 Billion |

| Anti-Aging Products Market Forecast 2032 | USD 187.4 Billion |

| Anti-Aging Products Market CAGR During 2023 - 2032 | 6.4% |

| Anti-Aging Products Market Analysis Period | 2020 - 2032 |

| Anti-Aging Products Market Base Year |

2023 |

| Anti-Aging Products Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Product Type, By Skin Type, By Ingredient Type, By End-User, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Procter & Gamble, Oriflame Cosmetics, Shiseido, Revlon, pmdbeauty.com & Age Sciences Inc., Avon Products, Inc., Unilever, Beiersdorf Limited, L’Oreal Paris, Sera Labs Inc., POND'S, and Estee Lauder Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Anti-Aging Products Market Insights

The growing elder population is increasing the demand for anti-aging skincare market, especially skincare products such as anti-wrinkle creams and skin lotions, which, in turn, drive the growth of the global anti-aging products market. For instance according to the Department of Economic and Social Affairs by 2030, one out of every six persons globally will be 60 or older. The number of people in this age group will increase from 1 billion in 2020 to 1.4 billion. By 2050, the number of people aged 60 and up is predicted to double, reaching 2.1 billion. Furthermore, the number of people aged 80 and older is expected to treble from 2020 to 2050, reaching around 426 million.

Anti-aging product advancements and improved efficiency are expected to drive the market in the coming years. Technological advancements have resulted in the introduction of more advanced and radical anti-aging products to the market.

However, global manufacturers are expanding on a large scale to develop new products and combat the various aging effects. Increasing concerns related to health and beauty is driving the market. One of the market's main drivers is Asia-Pacific's growing aging population. For instance, according to the United Nations ESCAP In 2023, a projected 697 million older people (60 and older) would live in Asia-Pacific, accounting for over 60% of the world's elderly population.

Impact of COVID-19

The global pandemic of COVID-19 has had a significant impact on all aspects of the healthcare and cosmetics industries. Even though the economic impact of the COVID-19 pandemic on brands and retailers will be far greater than that of any recession, there are signs that the beauty industry may once again be relatively resilient. In China, the beauty industry's February 2020 sales dropped by up to 80% compared to 2019. Furthermore, according to a survey carried by Skin Research and Technology, the use of quarantine masks produces short-term changes in skin temperature, redness, and transepidermal water loss (TEWL), as well as long-term changes in skin elasticity, pores, and acne. This study showed that wearing a mask for an extended time can harm the skin. As a result, the anti-aging product industry is predicted to rise in the coming years as a result of the post-pandemic.

Anti-Aging Products Market Segmentation

The worldwide market for anti-aging products is split based on product type, skin type, ingredient type, end-user, distribution channels, and geography.

Anti Aging Products Market By Product Type

- Skincare Products

- Haircare products

- Cosmetics

- Others

According to anti-aging products industry analysis, the product type section is separated into four categories: skincare, haircare, cosmetics, and others. Skincare items include serums, creams, and lotions, while haircare products are subdivided into anti-aging shampoos and conditioners. The cosmetic section includes anti-aging foundations and concealers. The skincare products category is likely to lead the anti-aging products market. This is due to the growing demand for creams, serums, and lotions that address wrinkles, fine lines, and other symptoms of aging. The increasing knowledge of skincare routines, as well as the availability of improved formulas, contribute to its rise. Furthermore, customer demands for natural and organic skincare solutions are leading this sector to claim the greatest market share.

Anti Aging Products Market By Skin Type

- Oily Skin

- Dry Skin

- Sensitive Skin

- Combination Skin

The oily skin segment now holds the largest portion of the anti-aging skincare market. Oily skin necessitates specific treatment to counteract aging symptoms such as wrinkles and fine lines while also controlling excess sebum production. Anti-aging creams for oily skin are designed to balance oil production, reduce clogged pores, and give hydration without leaving the skin greasy. The increased awareness of skincare routines suited to certain skin types, as well as the growing preference for specialized treatments, are driving demand for these products. Furthermore, the increasing popularity of oil-free anti-aging formulations, as well as the incorporation of anti-aging advantages into acne treatments, are boosting the segment's growth.

Anti Aging Products Market By Type

- Retinoids

- Peptides

- Antioxidants (e.g., Vitamin C, E)

- Hyaluronic acid

- Others

The antioxidants (e.g., Vitamin C, E) segment now holds the largest proportion of the anti-aging products market. Antioxidants are popular because they can neutralize free radicals, which cause skin aging. Vitamin C and E, in particular, are known for their skin-rejuvenating effects, which aid in brightening the complexion, reducing wrinkles, and protecting against environmental damage. These chemicals are valued for their ability to stimulate collagen formation and improve skin suppleness. The increased demand for goods with anti-aging and skin protection features has contributed to this segment's domination. Furthermore, antioxidants are frequently mixed with other active substances, which increase their appeal in cosmetics compositions.

Anti Aging Products Market By End-User

- Men

- Women

The women segment dominates the anti-aging products market, owing to the increased demand for skincare and beauty products that address aging problems. Women have a significant predilection for products that address wrinkles, fine lines, and age spots, driving the segment's growth. Women's increased use of anti-aging creams, serums, and therapies is driven by a greater understanding of skincare routines and a desire to seem younger. Furthermore, the growing influence of social media and beauty influencers has increased product visibility and adoption rates. Key industry players are always innovating and launching items geared toward women, assuring long-term demand. As a result, the women category has a sizable share, solidifying its position as the leading contributor to market sales.

Anti Aging Products Market By Distribution Channel

- Online sales

- Retail (Pharmacies, Specialty Stores)

The retail category, which includes pharmacies and specialty stores, emerges as the most important distribution channel in the anti-aging products market. These stores offer a trustworthy platform for customers to discover and purchase skincare items, frequently with expert guidance from qualified experts. Pharmacies meet the demand for dermatologist-recommended formulations, but specialized stores attract customers with unique and premium product offers. The tactile experience of evaluating products in-store, along with personalized consultations, boosts consumer confidence and sales. Furthermore, the extensive presence of retail stores provides accessibility in both urban and suburban locations. Despite the rise of online sales, the retail sector remains dominating due to its dependability, in-person customer care, and capacity to meet instant purchasing needs.

Anti-Aging Products Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Anti-Aging Products Market Regional Analysis

Asia-Pacific is the largest anti-aging cosmetics market, driven by fast urbanization, an expanding middle-class population, and rising knowledge of skincare and anti-aging solutions. China, India, South Korea, and Japan are major contributors to this expansion, with increased consumer demand for effective and economical products. For instance according to an NBS research, in the 75 years after the founding of the People's Republic of China, the country has seen the world's quickest and most thorough urbanization. Social media, beauty trends, and celebrity and influencer endorsements have all had a big impact on the region's desire for anti-aging cosmetics and skincare products.

Furthermore, the growing preference for tailored beauty solutions, as well as the proliferation of e-commerce platforms, has made anti-aging products more accessible, resulting in rapid anti-aging cosmetics market expansion in Asia-Pacific. This region is expected to provide profitable prospects in the next years.

North America is the fastest-growing region, because to increased consumer spending on high-end skincare, haircare, and cosmetic items. The region benefits from a well-established beauty and personal care business, as well as a sizable elderly population seeking cutting-edge treatments to keep their youthful appearance. The prevalence of high discretionary expenditures, along with a strong emphasis on aesthetic wellness, has increased demand for anti-aging products. Furthermore, the availability of novel products created from natural ingredients and advanced technologies contributes to North America's anti-aging cosmetics market dominance.

Anti-Aging Products Market Players

Some of the top anti-aging products companies offered in our report includes Procter & Gamble, Oriflame Cosmetics, Shiseido, Revlon, pmdbeauty.com & Age Sciences Inc., Avon Products, Inc., Unilever, Beiersdorf Limited, L’Oreal Paris, Sera Labs Inc., POND'S, and Estee Lauder Inc.

Competitive Landscape

- In January 2021, Shiseido Company developed g-edge technology for 3D image of internal and external skin elasticity. Using this technology, it analyzed the mechano-physical properties of skin for consumers in various age groups, from adolescent to elderly, and found that the balance of elasticity between the stratum corneum and the dermis deteriorates with age, concluding that such phenomenon is the root cause of wrinkle formation.

- In August 2020, Merck KgaA partnered with Chinese cosmetic company Pechoin Group for the develop herbal technology and launch the new product with Pechoin Zhenyan anti-wrinkle repair series.

Frequently Asked Questions

How big is the anti-aging products market?

The anti-aging products market size was valued at USD 107.8 Billion in 2023.

What is the CAGR of the global anti-aging products market from 2024 to 2032?

The CAGR of anti-aging products is 6.4% during the analysis period of 2024 to 2032.

Which are the key players in the anti-aging products market?

The key players operating in the global market are including Procter & Gamble, Oriflame Cosmetics, Shiseido, Revlon, pmdbeauty.com & Age Sciences Inc., Avon Products, Inc., Unilever, Beiersdorf Limited, L�Oreal Paris, Sera Labs Inc., POND'S, and Estee Lauder Inc.

Which region dominated the global anti-aging products market share?

Asia-Pacific held the dominating position in anti-aging products industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of anti-aging products during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global anti-aging products industry?

The current trends and dynamics in the anti-aging products industry include rising awareness about skin health and aging prevention, increasing demand for natural and organic anti-aging solutions, and growing aging population globally driving market growth.

Which product type held the maximum share in 2023?

The skincare products held the maximum share of the anti-aging products industry.