Animal Model Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Animal Model Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

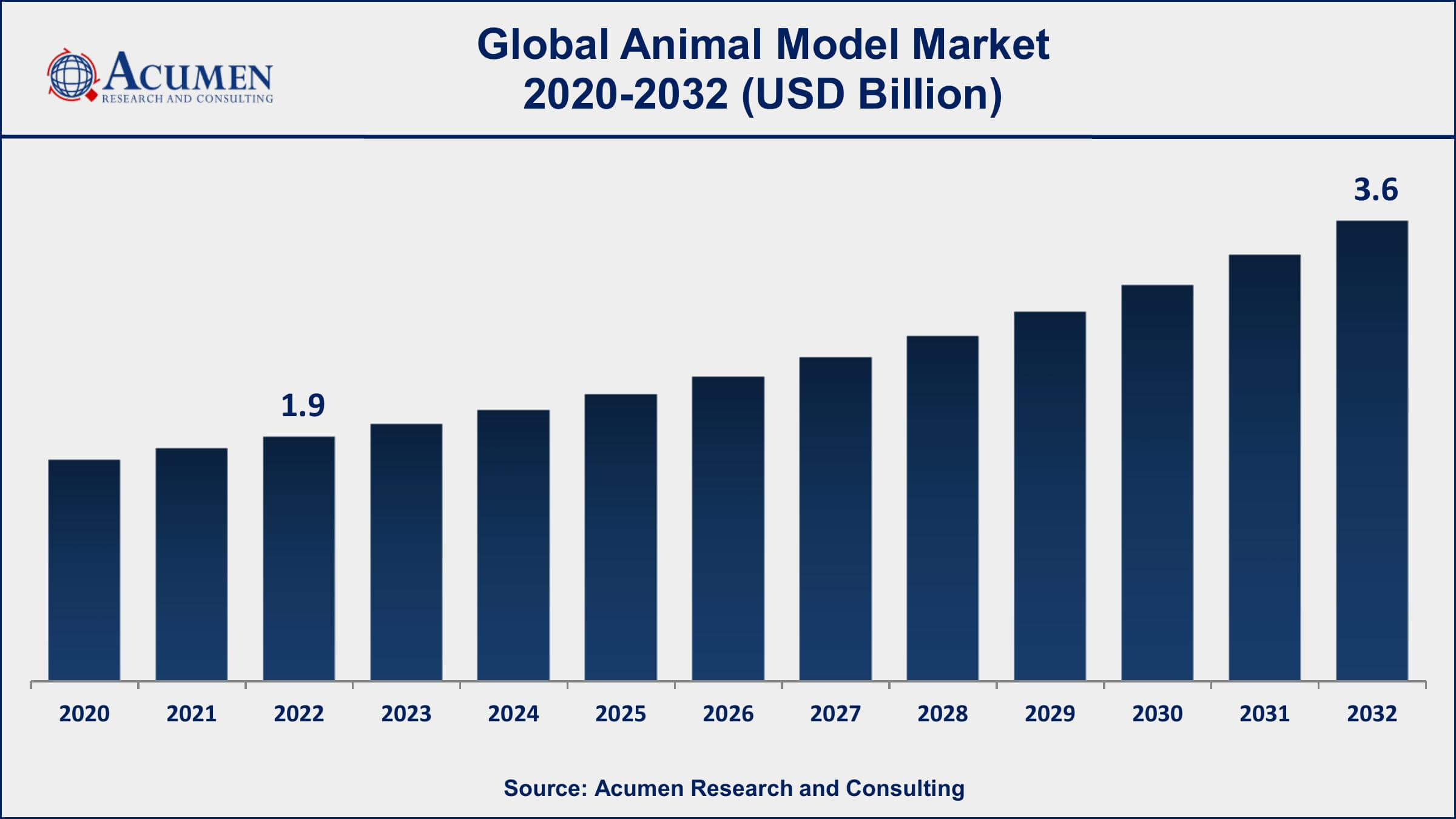

The Global Animal Model Market Size accounted for USD 1.9 Billion in 2022 and is projected to achieve a market size of USD 3.6 Billion by 2032 growing at a CAGR of 6.7% from 2023 to 2032.

Animal Model Market Highlights

- Global Animal Model Market revenue is expected to increase by USD 3.6 Billion by 2032, with a 6.7% CAGR from 2023 to 2032

- North America region led with more than 44% of Animal Model Market share in 2022

- Asia-Pacific Animal Model Market growth will record a CAGR of around 7.5% from 2023 to 2032

- By animal type, the mice segment is the largest segment in the market, accounting for over 49% of the market share in 2022

- By application, the drug discovery and development segment has recorded more than 38% of the revenue share in 2022

- Rise in usage of animal models in virology and infectious diseases, drives the Animal Model Market value

Animal models are living organisms, typically non-human species, that are used in scientific research to study and simulate various aspects of human biology, physiology, and disease. These models play a crucial role in advancing our understanding of human health and diseases, as they allow researchers to investigate the effects of treatments, test new drugs, and gain insights into biological processes in a controlled environment. Common animal models include mice, rats, zebrafish, fruit flies, and nematode worms, among others. The choice of model depends on the specific research question and the biological similarity between the model organism and humans.

The animal model market has experienced steady growth in recent years and is expected to continue expanding. This growth is driven by several factors, including the increasing prevalence of chronic diseases and the need for effective treatments, the demand for personalized medicine, and the development of advanced biotechnological tools for genetic manipulation and precision medicine. Additionally, regulatory agencies often require extensive preclinical testing in animal models before new drugs or therapies can progress to human clinical trials, further fueling the demand for these models. As the field of biotechnology and drug discovery continues to advance, the animal model market is likely to see continued growth and innovation, with a focus on refining models to better mimic human biology and disease states while also addressing ethical and animal welfare considerations.

Global Animal Model Market Trends

Market Drivers

- Increasing prevalence of chronic diseases

- Growing demand for personalized medicine

- Advancements in biotechnological tools for genetic manipulation

- Regulatory requirements for preclinical testing

- Expansion of pharmaceutical and biotechnology industries

- Growing demand for CRISPR/Cas9-based models and gene editing services

Market Restraints

- Ethical concerns and animal welfare considerations

- High costs associated with animal model maintenance and experiments

Market Opportunities

- Development of more human-relevant and predictive animal models

- Increasing focus on 3D organoid and organ-on-a-chip technologies

Animal Model Market Report Coverage

| Market | Animal Model Market |

| Animal Model Market Size 2022 | USD 1.9 Billion |

| Animal Model Market Forecast 2032 | USD 3.6 Billion |

| Animal Model Market CAGR During 2023 - 2032 | 6.7% |

| Animal Model Market Analysis Period | 2020 - 2032 |

| Animal Model Market Base Year |

2022 |

| Animal Model Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Animal Type, By Technology, By Application, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Charles River Laboratories International, Inc., Taconic Biosciences, Inc., The Jackson Laboratory, Envigo, genOway S.A., Horizon Discovery Group plc, JANVIER LABS, Trans Genic Inc., Ozgene Pty Ltd., Crown Bioscience, Inc., Ingenious Targeting Laboratory, and Pharmaron. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Animal models are living organisms, often non-human species, used in scientific research to mimic and study various biological processes, diseases, and drug responses that are relevant to humans. These models provide researchers with a controlled environment to conduct experiments and investigations that would be unethical or impractical in humans. Common animal models include mice, rats, zebrafish, fruit flies, and nematode worms. Researchers choose these models based on factors such as genetic similarity to humans, ease of manipulation, and relevance to the specific research question.

Animal models find applications in a wide range of scientific disciplines, including medicine, pharmacology, toxicology, genetics, and neuroscience. They are instrumental in drug discovery and development, allowing researchers to test the safety and efficacy of potential drugs before they advance to human clinical trials. Animal models are also essential for understanding the underlying mechanisms of diseases such as cancer, diabetes, Alzheimer's, and cardiovascular diseases, which can lead to the development of new therapies and treatment strategies.

The animal model market has been experiencing significant growth in recent years, and this trend is expected to continue in the coming years. One of the primary drivers of this growth is the increasing prevalence of chronic diseases worldwide. As the global population ages and lifestyles change, diseases such as cancer, cardiovascular disorders, and neurodegenerative conditions are on the rise. Animal models play a crucial role in preclinical research and drug development, providing a means to study disease mechanisms and test potential therapies before they reach human clinical trials. This heightened demand for effective treatments and therapies is fueling the need for more sophisticated and diverse animal models. Another key factor contributing to the growth of the animal model market is the rapid advancement of biotechnological tools and genetic manipulation techniques. Innovations like CRISPR/Cas9 have revolutionized the field by enabling precise gene editing in animal models, allowing researchers to create models that closely mimic human diseases.

Animal Model Market Segmentation

The global Animal Model Market segmentation is based on animal type, technology, application, end user, and geography.

Animal Model Market By Animal Type

- Rat

- Guinea Pigs

- Rabbits

- Mice

- Others

According to the animal model industry analysis, the mice segment accounted for the largest market share in 2022. Mice, particularly genetically modified mice, have become indispensable tools for studying human diseases and developing potential therapies. One of the key drivers of growth in the mice segment is their genetic similarity to humans, making them valuable models for investigating the genetic basis of diseases. Researchers can create transgenic and knockout mice with specific genetic mutations, enabling the study of various diseases, including cancer, cardiovascular conditions, and neurological disorders. Furthermore, advancements in gene-editing technologies, such as CRISPR/Cas9, have significantly expanded the capabilities of the mice segment.

Animal Model Market By Technology

- CRISPR

- Nuclear Transfer

- Embryonic Stem Cell Injection

- Others

In terms of technology, the CRISPR segment is expected to witness significant growth in the coming years. CRISPR (Clustered Regularly Interspaced Short Palindromic Repeats) technology has revolutionized the field of genetic manipulation, making it faster, more precise, and cost-effective to create genetically modified animal models. This segment's growth is driven by the increasing demand for genetically tailored animal models, which are crucial for studying specific diseases, drug development, and understanding the functions of individual genes. One of the key factors contributing to the growth of the CRISPR segment is its versatility and accessibility. Researchers across the globe are adopting CRISPR technology to create custom-designed animal models, such as mice with targeted genetic mutations or modifications.

Animal Model Market By Application

- Basic Research

- Drug Discovery and Development

- Others

According to the animal model market forecast, the drug discovery and development segment is expected to witness significant growth in the coming years. Animal models are fundamental to the drug development process, serving as critical tools for assessing the safety and efficacy of potential therapeutic compounds before they enter human clinical trials. This segment's growth is driven by the ever-increasing demand for new drugs to address a wide range of diseases, including cancer, cardiovascular disorders, neurological conditions, and infectious diseases. One of the primary factors fueling the growth of the drug discovery and development segment is the complexity of modern drug development.

Animal Model Market By End User

- Academic Research Institutes

- Pharma and Biotech Companies

- Others

Based on the end user, the pharma and biotech companies segment is expected to continue its growth trajectory in the coming years. These companies heavily rely on animal models for various stages of drug development, from early preclinical research to toxicity testing and safety assessment. The segment's growth is primarily driven by the increasing demand for innovative drugs and therapies to address a wide spectrum of diseases, including rare and complex conditions. As a result, pharmaceutical and biotechnology firms are continuously seeking more sophisticated and predictive animal models to accelerate their drug discovery and development pipelines. One key factor contributing to the growth of this segment is the need for personalized medicine. As the healthcare industry shifts towards more targeted and individualized treatment approaches, pharmaceutical and biotechnology companies require animal models that closely mimic specific patient populations or genetic backgrounds.

Animal Model Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Animal Model Market Regional Analysis

Geographically, North America dominates the animal model market in 2022. The United States, in particular, is home to numerous pharmaceutical giants, cutting-edge biotechnology firms, and leading research institutions. These companies and organizations require animal models for a wide range of research and drug development activities, and they have the financial resources to invest significantly in this field. The presence of such a robust industry ecosystem fuels the demand for animal models, making North America a key market. Moreover, North America benefits from a strong regulatory framework that supports the ethical use of animal models in research. Regulatory bodies like the U.S. Food and Drug Administration (FDA) have stringent requirements for preclinical testing and the evaluation of potential therapies. This regulatory environment ensures that animal models are not only widely used but also subject to high-quality standards, which further encourages their utilization. Additionally, North America has a rich history of biomedical research and innovation, including advances in genetics, genomics, and biotechnology.

Animal Model Market Player

Some of the top animal model market companies offered in the professional report include Charles River Laboratories International, Inc., Taconic Biosciences, Inc., The Jackson Laboratory, Envigo, genOway S.A., Horizon Discovery Group plc, JANVIER LABS, Trans Genic Inc., Ozgene Pty Ltd., Crown Bioscience, Inc., Ingenious Targeting Laboratory, and Pharmaron.

Frequently Asked Questions

What was the market size of the global animal model in 2022?

The market size of animal model was USD 1.9 Billion in 2022.

What is the CAGR of the global animal model market from 2023 to 2032?

The CAGR of animal model is 6.7% during the analysis period of 2023 to 2032.

Which are the key players in the animal model market?

The key players operating in the global market are including Charles River Laboratories International, Inc., Taconic Biosciences, Inc., The Jackson Laboratory, Envigo, genOway S.A., Horizon Discovery Group plc, JANVIER LABS, Trans Genic Inc., Ozgene Pty Ltd., Crown Bioscience, Inc., Ingenious Targeting Laboratory, and Pharmaron.

Which region dominated the global animal model market share?

North America held the dominating position in animal model industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of animal model during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global animal model industry?

The current trends and dynamics in the animal model industry include increasing prevalence of chronic diseases, growing demand for personalized medicine, and advancements in biotechnological tools for genetic manipulation.

Which animal type held the maximum share in 2022?

The mice animal type held the maximum share of the animal model industry.