Animal Feed Preservatives Market | Acumen Research and Consulting

Animal Feed Preservatives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format : ![]()

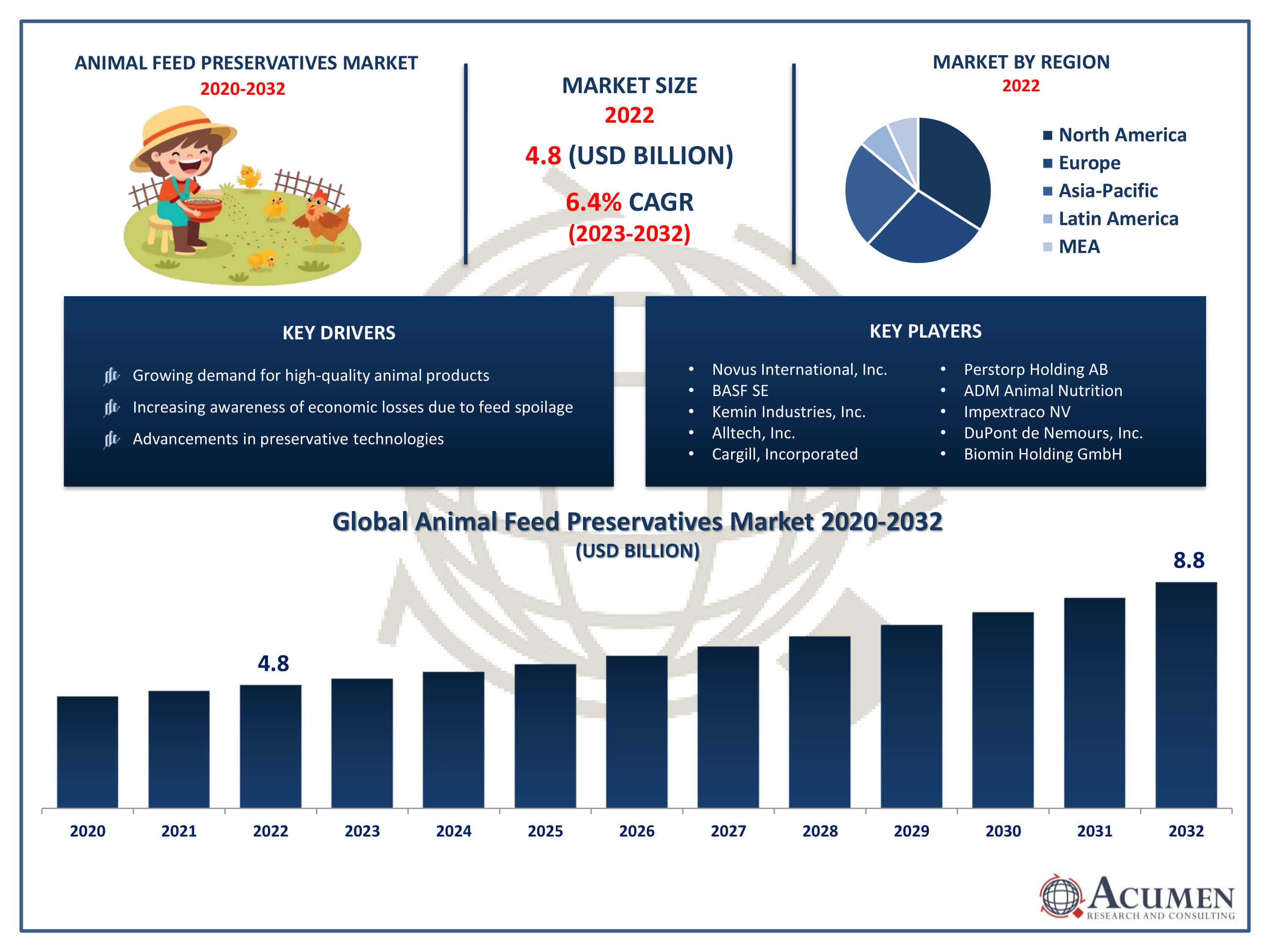

The Animal Feed Preservatives Market Size accounted for USD 4.8 Billion in 2022 and is projected to achieve a market size of USD 8.8 Billion by 2032 growing at a CAGR of 6.4% from 2023 to 2032.

Animal Feed Preservatives Market Highlights

- Global animal feed preservatives market revenue is expected to increase by USD 8.8 billion by 2032, with a 6.4% CAGR from 2023 to 2032

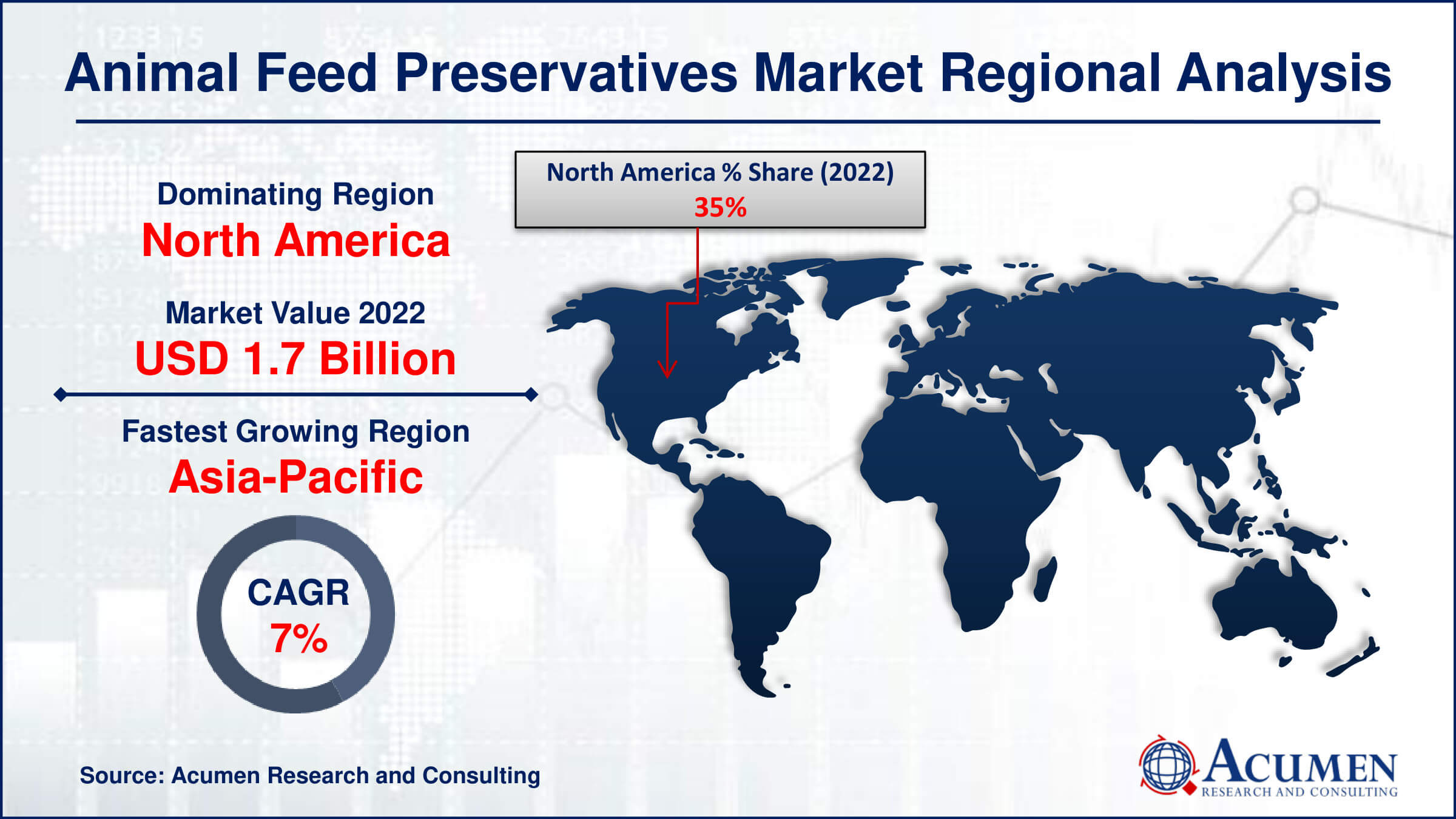

- North America region led with more than 35% of animal feed preservatives market share in 2022

- Asia-Pacific animal feed preservatives market growth will record a CAGR of around 7.1% from 2023 to 2032

- By preservatives type, the natural preservatives segment is the largest segment in the market, accounting for over 59% of the market share in 2022

- By animal type, the poultry segment has recorded more than 25% of the revenue share in 2022

- Growing demand for high-quality animal products, drives the animal feed preservatives market value

Animal feed preservatives are substances added to animal feeds to extend their shelf life and maintain their nutritional quality. These preservatives help prevent the growth of microorganisms, such as bacteria and fungi, in feed ingredients and finished feeds. Common types of animal feed preservatives include organic acids, antioxidants, mold inhibitors, and antimicrobial agents. By inhibiting the growth of harmful microorganisms, these preservatives contribute to the overall safety and stability of animal feeds, ensuring that animals receive nutritionally sound and uncontaminated feed.

Animal feed preservatives are substances added to animal feeds to extend their shelf life and maintain their nutritional quality. These preservatives help prevent the growth of microorganisms, such as bacteria and fungi, in feed ingredients and finished feeds. Common types of animal feed preservatives include organic acids, antioxidants, mold inhibitors, and antimicrobial agents. By inhibiting the growth of harmful microorganisms, these preservatives contribute to the overall safety and stability of animal feeds, ensuring that animals receive nutritionally sound and uncontaminated feed.

The market for animal feed preservatives has experienced significant growth in recent years, driven by several factors. One key factor is the increasing demand for high-quality and safe animal feed to support the growing livestock and poultry industries globally. For instance, BASF has launched a new enzyme called Natupulse® TS for animal feed. Natupulse® TS is an NSP (non-starch polysaccharide) enzyme. As the demand for animal products such as meat, milk, and eggs rises, there is a parallel need for reliable and efficient preservation methods to ensure the integrity of the feed throughout the supply chain. Additionally, the awareness of the economic losses associated with feed spoilage and contamination has led to an increased adoption of feed preservatives by farmers and feed manufacturers.

Global Animal Feed Preservatives Market Trends

Market Drivers

- Growing demand for high-quality animal food products

- Increasing awareness of economic losses due to feed spoilage

- Advancements in preservative technologies

- Regulatory emphasis on feed safety

- Expansion of the livestock industry in emerging economies

Market Restraints

- Stringent regulations limiting certain preservative usage

- Concerns about the potential impact of preservatives on animal health

Market Opportunities

- Expansion of aquaculture and pet food industries

- Growing market for organic and natural feed preservatives

Animal Feed Preservatives Market Report Coverage

| Market | Animal Feed Preservatives Market |

| Animal Feed Preservatives Market Size 2022 | USD 4.8 Billion |

| Animal Feed Preservatives Market Forecast 2032 | USD 8.8 Billion |

| Animal Feed Preservatives Market CAGR During 2023 - 2032 | 6.4% |

| Animal Feed Preservatives Market Analysis Period | 2020 - 2032 |

| Animal Feed Preservatives Market Base Year |

2022 |

| Animal Feed Preservatives Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Preservatives Type, By Animal Type, By Form, By Function, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Novus International, Inc., BASF SE, Kemin Industries, Inc., Alltech, Inc., Cargill, Incorporated, Perstorp Holding AB, ADM Animal Nutrition, Impextraco NV, DuPont de Nemours, Inc., Biomin Holding GmbH, Nutreco N.V., and Chr. Hansen Holding A/S. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Animal feed preservatives are vital substances utilized to extend the shelf life and safety of animal feeds by inhibiting the proliferation of harmful microorganisms and maintaining the nutritional value of the feed. They play a crucial role in agriculture and livestock industries, ensuring that the feed remains untainted and nutritionally beneficial throughout its production and consumption cycle. Organic acids, antioxidants, mold inhibitors, and antimicrobial agents are among the commonly employed animal feed preservatives, each fulfilling specific functions in safeguarding the quality of feed ingredients and final products. The applications of these preservatives are manifold and indispensable for the health and productivity of livestock and poultry. By impeding the growth of molds, bacteria, and fungi in feed, they mitigate the risk of mycotoxin contamination and microbial spoilage.

The animal feed preservatives market has witnessed robust growth in recent years, driven by several key factors. The increasing global demand for high-quality animal products, such as meat, milk, and eggs, has prompted a parallel need for reliable and efficient feed preservation methods. Feed preservatives play a vital role in maintaining the nutritional integrity of animal feeds, ensuring that livestock and poultry receive safe and nutritionally balanced diets. This demand is further amplified by the growth of the livestock industry, especially in emerging economies, where changing dietary preferences are contributing to an increased consumption of animal products. Advancements in preservative technologies have also been a significant growth driver for the market. The industry has seen the development of innovative and sustainable preservative solutions that address both the need for effective preservation and the growing preference for environmentally friendly practices. For instance, the U.S. government has introduced a novel approach for obtaining approvals for additives utilized in feed formulation. The American Feed Industry Association (AFIA) has expressed its backing for this proposed procedure. Additionally, regulatory emphasis on feed safety and quality standards has led to increased adoption of preservatives by feed manufacturers and farmers alike.

Animal Feed Preservatives Market Segmentation

The global Animal Feed Preservatives Market segmentation is based on preservatives type, animal type, form, function, and geography.

Animal Feed Preservatives Market By Preservatives Type

- Synthetic Preservatives

- Natural Preservatives

According to the animal feed preservatives industry analysis, the natural preservatives segment accounted for the largest market share in 2022. With increasing concerns about synthetic additives and their potential impact on both animal and human health, there has been a rising demand for natural alternatives in animal feed preservation. Natural preservatives, derived from sources such as herbs, spices, and plant extracts, offer a safer and more environmentally friendly option for maintaining the quality and safety of animal feeds. Additionally, key players are also focusing on introducing natural food preservatives. For instance, in April 2019, Ingredient Trading Company (ITC) introduced natural food preservatives. These innovations further maintain the segment's dominance in the market.

Animal Feed Preservatives Market By Animal Type

- Poultry

- Cattle

- Swine

- Aquaculture

- Equine

- Pet food

- Others

In terms of animal types, the poultry segment is expected to witness significant growth in the coming years. With the global demand for poultry products, such as chicken meat and eggs, continuing to rise, there is a corresponding need for high-quality and safe poultry feed. For instance, in 2022, per capita consumption of broiler meat in the U.S. reached 98.9 pounds, with a projected slight increase to 100.1 pounds by 2023. Animal feed preservatives, including antioxidants, mold inhibitors, and antimicrobial agents, play a crucial role in maintaining the freshness and nutritional integrity of poultry feed throughout the production and supply chain. The poultry industry's emphasis on efficiency and productivity has led to an increased adoption of preservative technologies to prevent feed spoilage and contamination, ensuring that poultry flocks receive optimal nutrition for healthy growth and improved production outcomes. Furthermore, the intensification of poultry farming practices, particularly in emerging economies, has contributed to the demand for advanced feed preservation methods.

Animal Feed Preservatives Market By Form

- Dry

- Liquid

According to the animal feed preservatives market forecast, the dry segment is expected to witness significant growth in the coming years. This growth is driven by the increasing demand for convenience, shelf stability, and efficient preservation methods in the production of dry or pelleted animal feeds. Dry feeds, including pellets and granules, are widely used in the livestock and poultry industries due to their ease of handling, storage, and transport. However, the dry nature of these feeds makes them susceptible to microbial contamination and oxidation, necessitating the use of effective preservatives to maintain their nutritional value over time. The growth of the dry segment can be attributed to the expanding global livestock and poultry industries, where processed and dry feeds are extensively utilized.

Animal Feed Preservatives Market By Function

- Antimicrobials

- Antioxidants

- Mycotoxin Binders

Based on the function, the antimicrobials segment is expected to continue its growth trajectory in the coming years. Antimicrobial preservatives play a crucial role in inhibiting the growth of bacteria and other harmful microorganisms in animal feeds, thereby preventing the spoilage of feed ingredients and ensuring the delivery of uncontaminated and nutritionally sound diets to animals. With the intensification of animal farming and the increasing focus on disease prevention, the demand for effective antimicrobial preservatives has surged in the livestock and poultry industries. The growth of the antimicrobials segment is propelled by the need to enhance feed hygiene and mitigate the risk of diseases in animal populations. Antibiotics and other antimicrobial agents are incorporated into animal feeds to control the proliferation of pathogens, improve feed efficiency, and promote overall animal health.

Animal Feed Preservatives Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Animal Feed Preservatives Market Regional Analysis

North America has emerged as a dominant region in the animal feed preservatives market, driven by a combination of factors that underscore the region's robust livestock industry, technological advancements, and stringent regulatory standards. The United States and Canada, in particular, play pivotal roles in shaping the market landscape. The North American livestock sector, including poultry, swine, and cattle production, is extensive and highly industrialized, resulting in substantial demand for high-quality and preserved animal feeds. For instance, in 2023, poultry production in the U.S. reached 52.58 billion pounds, marking a rise of 439.663 million pounds compared to the previous year. One of the key factors contributing to North America's dominance in the animal feed preservatives market is the region's commitment to feed safety and quality standards. Stringent regulations, enforced by agencies such as the Food and Drug Administration (FDA) and the Canadian Food Inspection Agency (CFIA), mandate the use of preservatives to ensure the integrity of animal feeds. Compliance with these regulations has driven the adoption of advanced preservative technologies, positioning North America as a leading market for innovative and effective solutions.

The Asia-Pacific is the fastest-growing region in the animal feed preservative market. Firstly, the increasing demand for high-quality animal products, coupled with a rising population, drives the need for efficient feed preservation methods to maintain feed quality and safety. Secondly, the region's expanding livestock industry, particularly in countries like China and India, necessitates effective preservation techniques to prevent feed spoilage and ensure animal health. Additionally, advancements in feed technology and rising awareness among farmers about feed production further fuel market growth. For instance, in 2022, Russia's feed production surged to 34.2 million tons, showing growth from the previous year's output of 31.95 million tons. Moreover, government initiatives promoting animal welfare and food safety standards contribute to the adoption of preservative solutions in animal feed across the region. For instance, in April 2023, President Xi introduced the term "blue granary" to refer to marine fisheries and mariculture, particularly emphasizing deep-sea fishing and ranching. Furthermore, advancements by key players further boost market demand in this region. For instance, in June 2023, Alltech introduced Triad, an innovative solution designed to enhance pig livability and promote successful farrowing. Overall, these factors converge to propel the Asia Pacific as the fastest-growing region in the animal feed preservative market.

Animal Feed Preservatives Market Player

Some of the top animal feed preservatives market companies offered in the professional report include Novus International, Inc., BASF SE, Kemin Industries, Inc., Alltech, Inc., Cargill, Incorporated, Perstorp Holding AB, ADM Animal Nutrition, Impextraco NV, DuPont de Nemours, Inc., Biomin Holding GmbH, Nutreco N.V., and Chr. Hansen Holding A/S.

Frequently Asked Questions

How big is the animal feed preservatives market?

The animal feed preservatives market size was USD 4.8 Billion in 2022.

What is the CAGR of the global animal feed preservatives market from 2023 to 2032?

The CAGR of animal feed preservatives is 6.4% during the analysis period of 2023 to 2032.

Which are the key players in the animal feed preservatives market?

The key players operating in the global market are including Novus International, Inc., BASF SE, Kemin Industries, Inc., Alltech, Inc., Cargill, Incorporated, Perstorp Holding AB, ADM Animal Nutrition, Impextraco NV, DuPont de Nemours, Inc., Biomin Holding GmbH, Nutreco N.V., and Chr. Hansen Holding A/S.

Which region dominated the global animal feed preservatives market share?

North America held the dominating position in animal feed preservatives industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of animal feed preservatives during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global animal feed preservatives industry?

The current trends and dynamics in the animal feed preservatives industry include growing demand for high-quality animal products, increasing awareness of economic losses due to feed spoilage, and advancements in preservative technologies.

Which animal type held the maximum share in 2022?

The poultry animal type held the maximum share of the animal feed preservatives industry.