Anesthesia & Respiratory Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 � 2030

Published :

Report ID:

Pages :

Format :

Anesthesia & Respiratory Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 � 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Anesthesia & Respiratory Devices Market Size accounted for USD 28.3 Billion in 2021 and is estimated to garner a market size of USD 49.9 Billion by 2030 rising at a CAGR of 6.5% from 2022 to 2030. The increasing prevalence of respiratory devices is one of the primary factors boosting the global anesthesia & respiratory devices market size. In addition, technological advancements in anesthesia monitoring are the popular anesthesia & respiratory devices market trend that is fueling the industry growth.

Anesthesia & Respiratory Devices PRP Market Report Key Highlights

- Global anesthesia & respiratory devices market revenue is estimated to reach USD 49.9 Billion by 2030 with a CAGR of 6.5% from 2022 to 2030

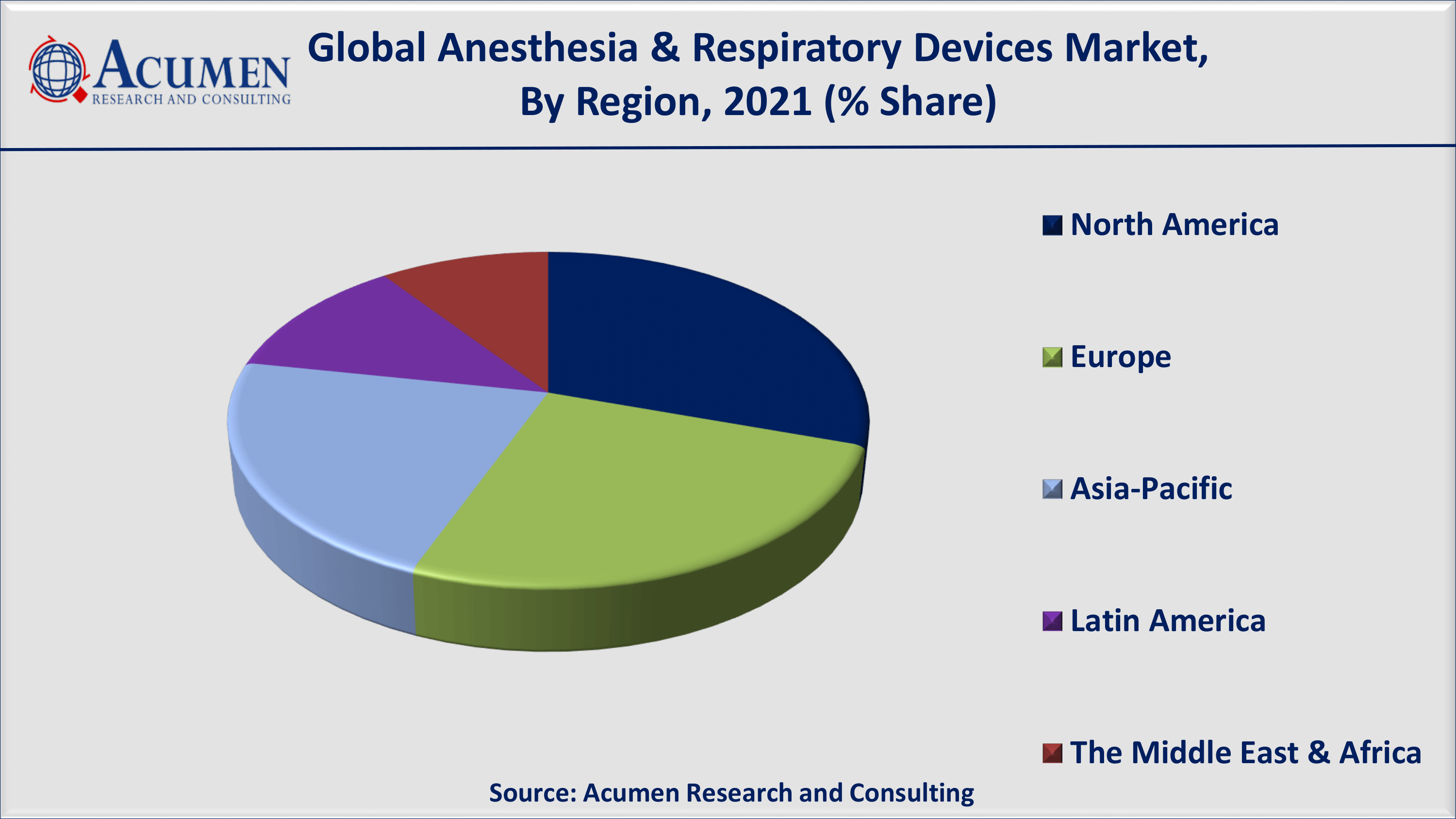

- North America anesthesia & respiratory devices market share accounted for over 30% regional shares in 2021

- According to the PAHO, 534,242 deaths were recorded in America region in 2019

- Asia-Pacific anesthesia & respiratory devices market growth will record fastest CAGR from 2022 to 2030

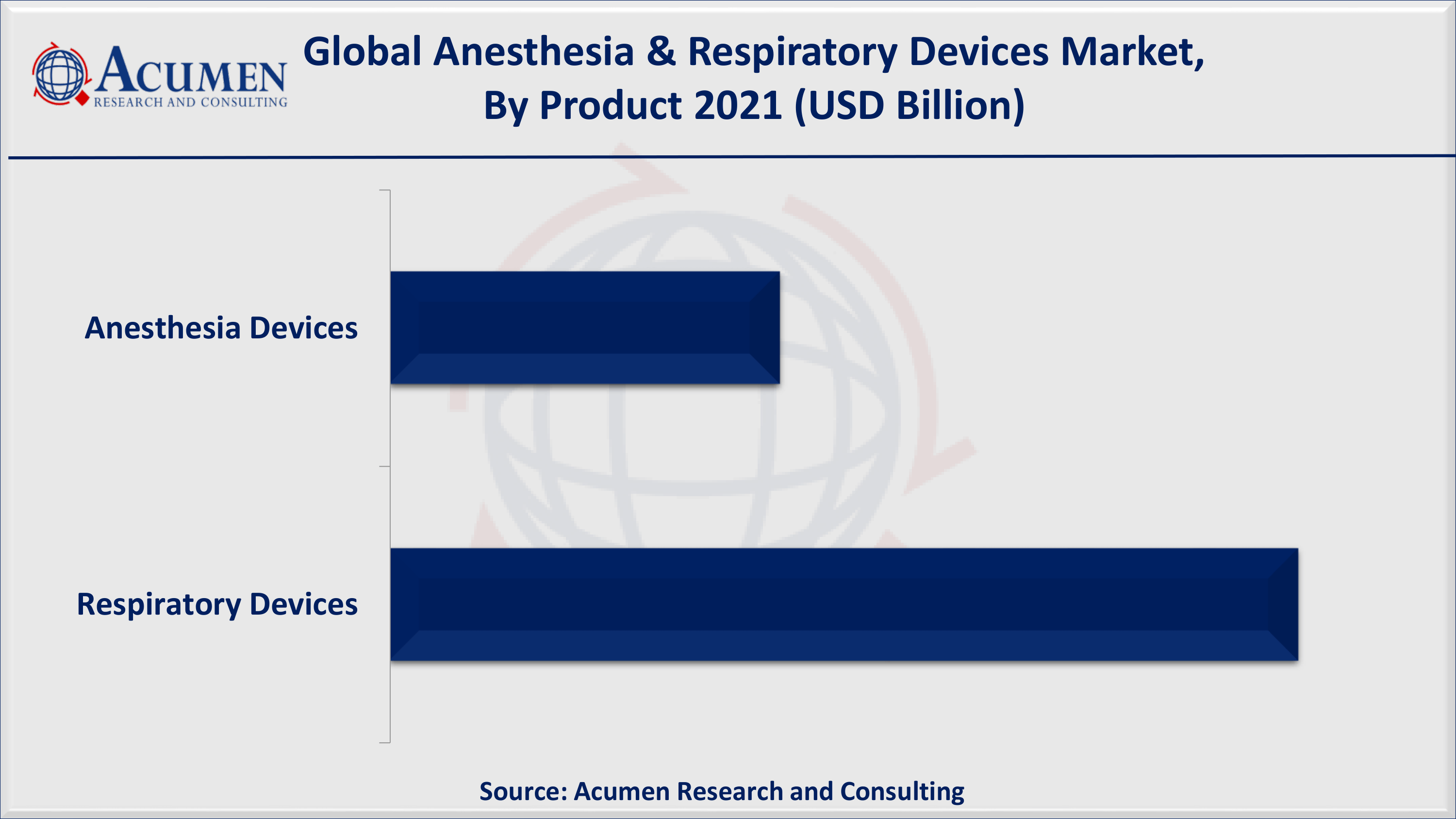

- Based on product segment, respiratory devices accounted for approx 65% of the overall market share in 2021

- Growing cases of preterm birth propels the anesthesia & respiratory devices market value in coming years

Anesthesia and respiratory devices are equipped with ventilators that provide patients of respiratory failure with life-sustaining mechanical ventilation. Instruments and techniques for administering or delivering anesthesia to patients are known as anesthesia equipment and accessories. Respiratory treatment devices are also commonly used to diagnose and treat respiratory problems such as COPD, asthma, tuberculosis, and pneumonia.

Global Anesthesia & Respiratory Devices (PRP) Market Dynamics

Market Drivers

- Rising incidence of respiratory disorders

- Increasing base of preterm births

- Growing number of surgical procedures

- Rise in geriatric population

Market Restraints

- High cost of these devices

- Regulatory compliance associated with these devices

Market Opportunities

- Growing demand for home-care respiratory devices

- Rising technological advancements in anesthesia monitoring

Anesthesia & Respiratory Devices Market Report Coverage

| Market | Anesthesia & Respiratory Devices Market |

| Anesthesia & Respiratory Devices Market Size 2021 | USD 28.3 Billion |

| Anesthesia & Respiratory Devices Market Forecast 2030 | USD 49.9 Billion |

| Anesthesia & Respiratory Devices Market CAGR During 2022 - 2030 | 6.5% |

| Anesthesia & Respiratory Devices Market Analysis Period | 2018 - 2030 |

| Anesthesia & Respiratory Devices Market Base Year | 2021 |

| Anesthesia & Respiratory Devices Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | CAIRE Inc., B. Braun Medical Inc., Becton, Dickinson and Company, Medtronic plc, Drägerwerk AG, Getinge AB., GE Healthcare, Koninklijke Philips N.V., and Teleflex Incorporated. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Impact of COVID-19 on anesthesia & respiratory care devices market

During the start COVID-19 pandemic, the hospitals had challenges in supplying emergency ventilation to individual patients due to unprecedented demand for hospital and ICU services. The US Department of Health and Human Services (HHS) and the Federal Emergency Management Agency (FEMA) collaborated with multiple organizations to sustain the balance between demand and supply of anesthesia and respiratory equipment, involving healthcare systems, research institutions, professional medical societies, and the National Academies of Science, Engineering, and Medicine. In addition, in response to inadequate supply and availability of anesthesia & respiratory devices, the FDA-cleared ventilators for use in healthcare settings to treat patients during the COVID-19 pandemic. To overcome such a challenging situation, the Food and Drug Administration (FDA) released an umbrella Emergency Use Authorization (EUA). Apart from that, the FDA collaborated closely with the Strategic National Stockpile (SNS) to develop strategies for the use of respirators and respiratory accessories in the SNS. High-flow nasal cannulae (HFNC) is a type of oxygen therapy that is less invasive than mechanical ventilation and has proven clinical effectiveness in the treatment of serious and critical COVID-19 patients, according to reports released by the US Department of Health and Human Services. The Office of the Assistant Secretary for Preparedness and Response (ASPR) is currently providing 30,000 HFNC kits for the Strategic National Stockpile (SNS) to allow GM/Ventec V+Pro ventilators to provide this type of therapy. This is the only probable respiratory model in the SNS. As part of the acquisition of the COVID-19 ventilator, the SNS presently holds 30,000 Ventec V+Pro ventilators that will be paired 1:1 with these new HFNC kits.

Anesthesia & Respiratory Devices Market Dynamics

Rising Prevalence of Respiratory Diseases Is Projected To Drive the Global Anesthesia & Respiratory Devices Market Globally

According to the World Health Organization (WHO), respiratory diseases are the leading cause of death and disability worldwide. About 65 million people suffer from the chronic obstructive pulmonary disorder (COPD) and 3 million die every year, making it the world's third leading cause of death. In addition, according to the Australian Disease Expenditure Study in 2015-2016, an estimated 3.5% of the total expenditure on disease in the Australian health system accounting for US$ 4 billion has been attributed to respiratory conditions. In addition, respiratory disease accounted for 7.5% of all deaths in the European Union (EU) in 2016.

High Government Involvement and Fast Product Approvals Propels the Growth of Respiratory & Anesthesia Devices Market Globally

According to reports published by The Therapeutic Goods Administration (TGA), the exemption has been announced, which began in April 2020 and remained in force until January 2021. The exemption encouraged ventilators manufactured in Australia to comply with minimum technical requirements to be supplied in Australia that meet the criteria of minimum technical requirements. In addition, ventilators to be supplied to hospitals have been exempted from TGA approval. This exemption was made to support the Australian Government's rapid response to the emergency COVID-19 by facilitating access to medical devices for the treatment of patients requiring invasive ventilation. In addition, the U.S. Department of Health & Human Services reports that, to shorten the time allowed for product licensing and reduce the spread of COVID-19, federal agencies aimed at identifying products and technologies that have progressed beyond non-clinical studies. Moreover, the formation of domestic large-scale manufacturing capacities combined with commercial Good Manufacturing Practices (cGMP) and the use of a platform to manufacture a product is already approved by the FDA.

Anesthesia & Respiratory Devices Market Segmentation

The worldwide anesthesia & respiratory devices market is split based on product, end-user, and geography.

Anesthesia & Respiratory Devices Market By Product

- Anesthesia Devices

- Machines

- Monitors

- Ventilators

- Workstations

- Disposables

- Disposables Masks

- Disposables Accessories

- Machines

- Respiratory Devices

- Equipment

- Ventilators

- Nebulizers

- Humidifiers

- Inhalers

- Oxygen Concentrators

- Reusable Resuscitators

- Disposables

- Disposable Oxygen Masks

- Resuscitators

- Tracheostomy Tubes

- Oxygen Cannula

- Measurement Devices

- Pulse Oximeters

- Capnography

- Spirometers

- Peak Flow Meters

- Equipment

According to our anesthesia and respiratory devices industry analysis, respiratory devices are anticipated to witness fastest growth in the forecast period. Rising prevalence of respiratory devices, rising number of surgical procedures, and surging healthcare expenditure are the prominent factors that contribute for the growth of anesthesia & respiratory devices market globally.

Anesthesia & Respiratory Devices Market By End-User

- Hospitals

- Clinics

- Homecare Settings

- Ambulatory Service Centers

As per our anesthesia and respiratory devices market forecast, the hospital end-user generated significant market share in 2021. In addition, the sub-segment is expected to continue its dominance throughout the forecasted years from 2022 to 2030. However, homecare settings sub-segment is currently booming across the world. In addition to that, growing consumer awareness about health and increasing disposable income the homecare settings is likely to attain a substantial growth rate in the coming years.

Anesthesia & Respiratory Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

According to the U.S. Census Bureau, over 54 million adults aged 65 years and beyond were reported in the U.S. in 2021

North America is expected to have a dominant share in the forecast period. Rising adoption of technologically advanced devices in this region, an increase in investment by pharmaceutical companies, and an increase in healthcare expenditure are promising factors responsible for the growth of the global market for anesthesia and respiratory devices.

On the other hand, Asia-Pacific is expected to witness lucrative growth in recording all-time high CAGR in the coming years. Among the Asia-Pacific regional market, Japan seems to have the largest market share for anesthesia & respiratory devices worldwide. In addition, India and China are expected to see significant growth that will ultimately contribute to the growth of the market for anesthesia and respiratory devices in the coming years. As both countries are experiencing a high prevalence of pulmonary diseases, there is a growing demand for respiratory and anesthesia devices in emerging economies such as China, India, and Japan. According to estimates published in the International Journal of Pulmonary and Respiratory Sciences, COPD was the second largest cause of death in India in 2016. The growing pool of patients suffering from respiratory devices has resulted in a high demand for advanced medical devices consisting of anesthesia and respiratory devices that is driving the regional market.

Anesthesia & Respiratory Devices Market Players

The global anesthesia & respiratory devices companies profiled in the report include CAIRE Inc., B. Braun Medical Inc., Becton, Dickinson and Company, Medtronic plc, Drägerwerk AG, Getinge AB., GE Healthcare, Koninklijke Philips N.V., and Teleflex Incorporated.

Frequently Asked Questions

What is the size of global anesthesia & respiratory devices market in 2021?

The market size of anesthesia & respiratory devices market in 2021 was accounted to be USD 28.3 Billion.

What is the CAGR of global anesthesia & respiratory devices market during forecast period of 2022 to 2030?

The projected CAGR of anesthesia & respiratory devices market during the analysis period of 2022 to 2030 is 6.5%.

Which are the key players operating in the market?

The prominent players of the global anesthesia & respiratory devices market are CAIRE Inc., B. Braun Medical Inc., Becton, Dickinson and Company, Medtronic plc, Dr�gerwerk AG, Getinge AB., GE Healthcare, Koninklijke Philips N.V., and Teleflex Incorporated.

Which region held the dominating position in the global anesthesia & respiratory devices market?

North America held the dominating anesthesia & respiratory devices during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for anesthesia & respiratory devices during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global anesthesia & respiratory devices market?

Rise incidence of respiratory disorders, rise in geriatric population, and growing number of surgical procedures drives the growth of global anesthesia & respiratory devices market.

Which product held the maximum share in 2021?

Based on product, respiratory devices segment is expected to hold the maximum share anesthesia & respiratory devices market.