Anatomic Pathology Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

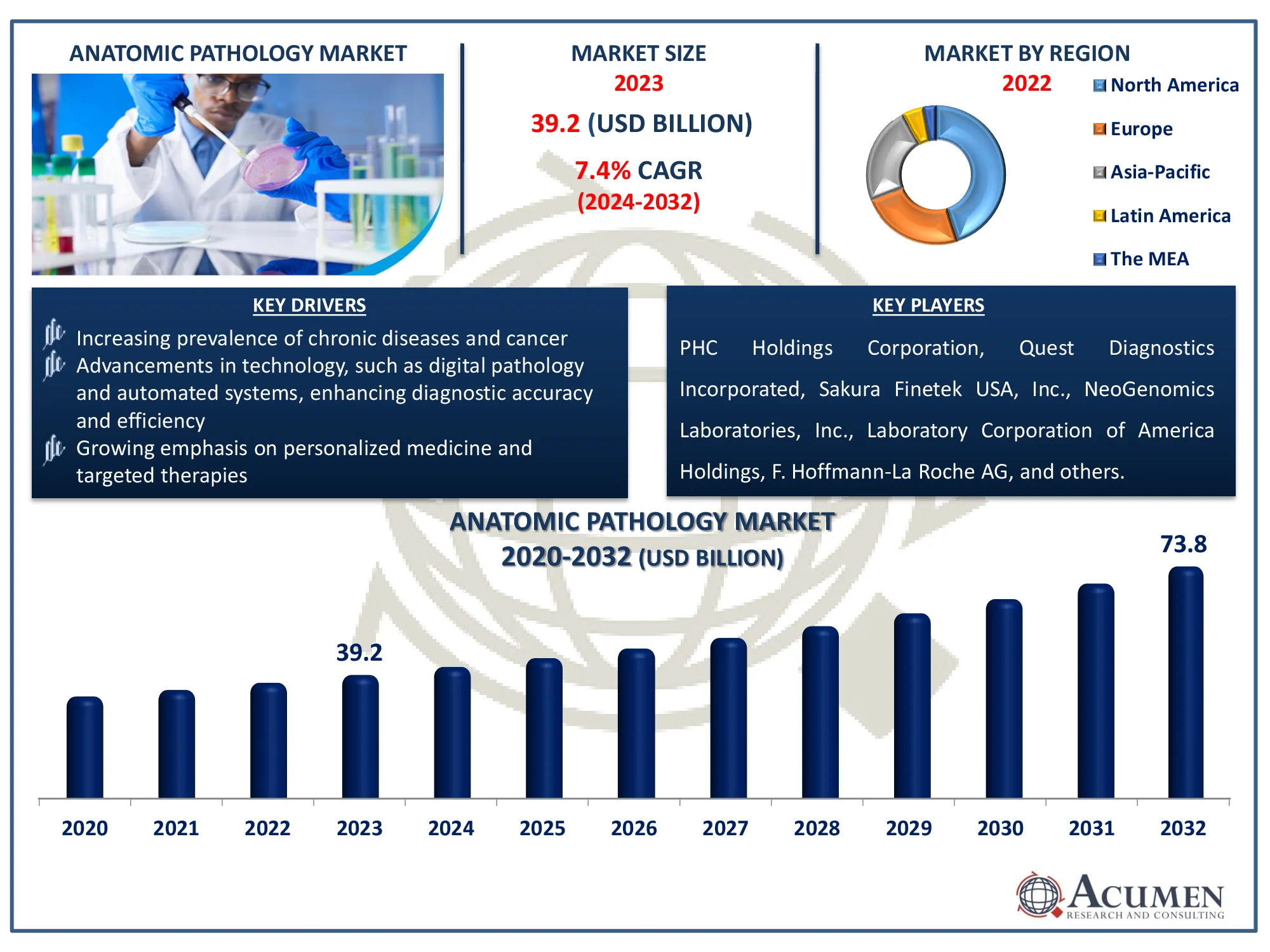

The Global Anatomic Pathology Market Size accounted for USD 39.2 Billion in 2023 and is estimated to achieve a market size of USD 73.8 Billion by 2032 growing at a CAGR of 7.4% from 2024 to 2032.

Anatomic Pathology Market Highlights

- The global anatomic pathology market is expected to reach USD 73.8 billion by 2032, growing at a CAGR of 7.4% from 2024 to 2032

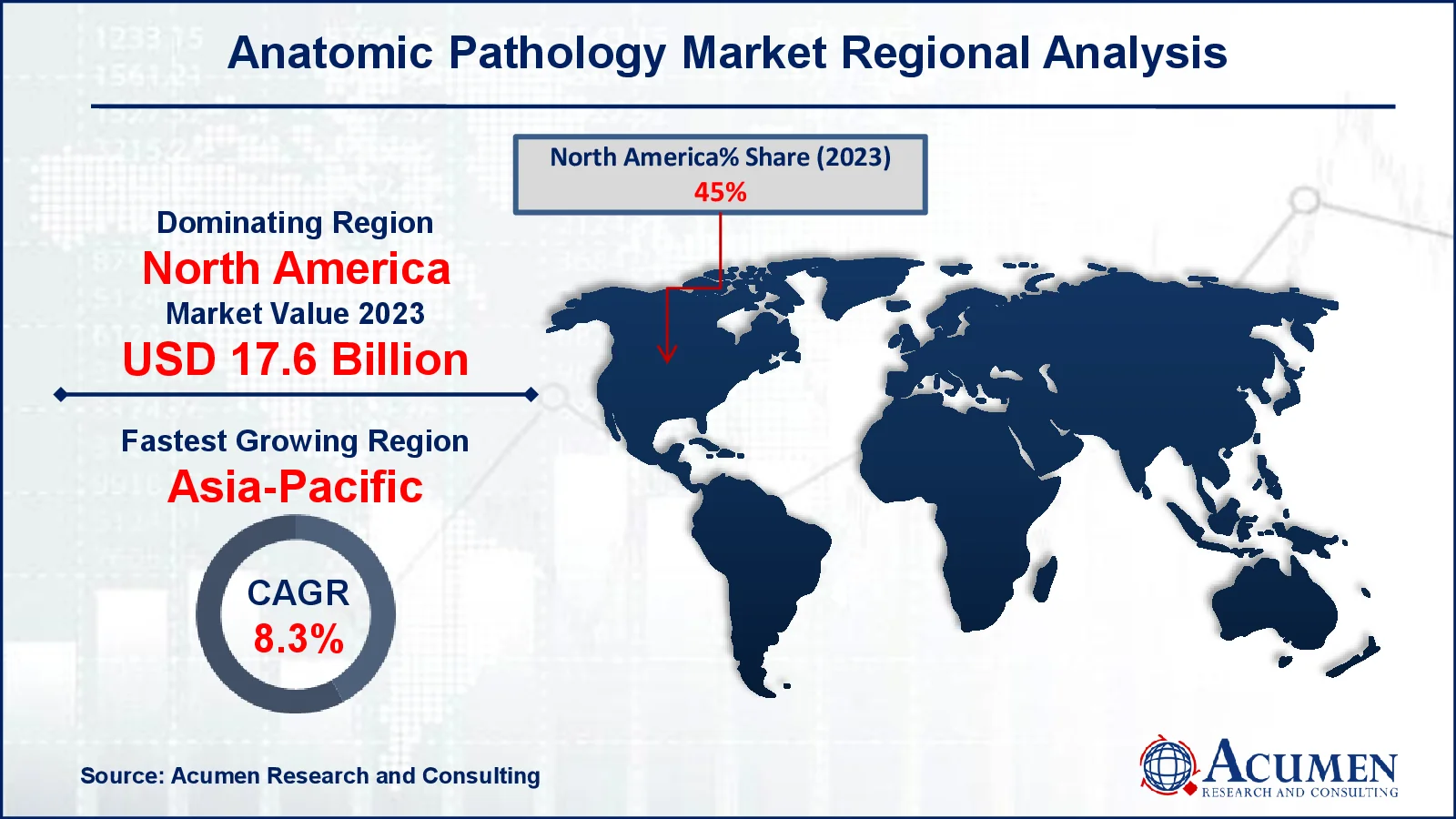

- In 2023, the North American anatomic pathology market was valued at approximately USD 17.6 billion

- The Asia-Pacific region is projected to grow at a CAGR of over 8.3% from 2024 to 2032

- Consumables accounted for 68% of the market share in 2023

- The disease diagnosis application sub-segment held 59% of the market share in 2023

- Hospitals, as end-users, represented 48% of the market share in 2023

- Mergers and acquisitions among pathology labs are creating larger, more integrated service providers to improve resource utilization and service delivery is the anatomic pathology market trend that fuels the industry demand

Anatomic pathology is a medical science specialty concerned with the diagnosis of various tissues and organs using microscopic, macroscopic, immunological, biochemical, or molecular examinations. Over the years, operational pathology has made incredible development from the crude autopsy procedure to a sophisticated approach. It also focuses on diagnostic cancer and oncological projections to assist and guide decision-making. The global anatomical pathological market is driving the increasing expansion of cancers such as breast, lung, and colorectal cancer.

Global Anatomic Pathology Market Dynamics

Market Drivers

- Increasing prevalence of chronic diseases and cancer fueling the demand for diagnostic testing

- Advancements in technology, such as digital pathology and automated systems, enhancing diagnostic accuracy and efficiency

- Growing emphasis on personalized medicine and targeted therapies driving the need for detailed pathology assessments

Market Restraints

- High costs associated with advanced diagnostic technologies limiting accessibility for some healthcare facilities

- Shortage of skilled pathologists and technicians affecting service delivery and turnaround times

- Regulatory challenges and lengthy approval processes for new diagnostic tests hindering market growth

Market Opportunities

- Expansion of emerging markets with rising healthcare expenditures and infrastructure development

- Increasing integration of artificial intelligence and machine learning in pathology for improved diagnostics

- Growing demand for telepathology solutions to enhance access to pathology services in remote areas

Anatomic Pathology Market Report Coverage

| Market | Anatomic Pathology Market |

| Anatomic Pathology Market Size 2022 |

USD 39.2 Billion |

| Anatomic Pathology Market Forecast 2032 | USD 73.8 Billion |

| Anatomic Pathology Market CAGR During 2023 - 2032 | 7.4% |

| Anatomic Pathology Market Analysis Period | 2020 - 2032 |

| Anatomic Pathology Market Base Year |

2022 |

| Anatomic Pathology Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product & Service, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | PHC Holdings Corporation, Quest Diagnostics Incorporated, Sakura Finetek USA, Inc., NeoGenomics Laboratories, Inc., Laboratory Corporation of America Holdings, F. Hoffmann-La Roche AG, Agilent Technologies, Inc., Danaher Corporation, Cardinal Health, and Bio SB. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Anatomic Pathology Market Insights

The increased clinical use of biomarkers enables pathologists to establish the molecular pathogenesis of diseases, resulting in better patient outcomes. The market is being driven by an increased reliance on biomarker pathology tests and methods for the investigation of common malignancies and tumorigenesis. For instance, according to the Critical Values Organization, in the era of precision medicine, detecting the existence of cancer biomarkers is an important step in determining whether patients will benefit from targeted medicines and immune checkpoint inhibitors. Advanced pathology instruments, like as staining machines, gross imaging, and digital microscopes, and are poised for considerable advances in anatomical pathology. Digital imaging solutions outperform traditional technologies in terms of specificity and precision, which increases service adoption in the worldwide marketplace.

Companies are constantly enhancing the design and usability of advanced pathological equipment. For instance, on June 2022, Roche introduces the VENTANA DP 600 slide scanner for digital pathology, which improves patient care through precision diagnostics. This is used in anatomical pathology. To minimize problems with illness management, numerous collaboration and agreement efforts have been done among major corporations to introduce an efficient portfolio. The integration of automation in laboratories optimizes procedures for anatomical diseases by lowering errors and turnaround time while increasing efficiency.

There are numerous public pathology training programs available to increase knowledge of the technological and legal issues affecting anatomy. Furthermore, these training modules focus on developing students' theoretical understanding, addressing the market challenge for professionals.

The increasing demand for telepathology solutions creates a substantial potential in the anatomic pathology industry by enhancing diagnostic access in remote and disadvantaged locations. Telepathology enables pathologists to remotely analyze and diagnose specimens via digital imaging and advanced communication technology, thereby to avoid geographical limitations. This increased accessibility not only improves patient outcomes by allowing for more rapid diagnosis and treatment, but it also enhances pathology service provider’s market opportunities.

Anatomic Pathology Market Segmentation

The worldwide market for anatomic pathology is split based on product and service, application, end-use, and geography.

Anatomic Pathology Market By Product and Service

- Consumables

- Reagents & Antibodies

- Probes & Kits

- Others

- Instruments

- Tissue processors

- Automatic Stainers

- Microtomes & Cryostat

- Others

- Services

According to the anatomic pathology industry analysis, a large number of reagents, kits, anticorps, and probes are available on the market. The availability of a diverse range of items, combined with high consumables consumption, accounts for the majority of the revenue-generating segment, according to the study findings. On the other hand, market participants anticipate continued technological advancements and concerted efforts to supply improved-designed anatomical gadgets for income growth in their instrument industry.

Anatomic Pathology Market By Application

- Drug Discovery & Development

- Disease Diagnosis

- Others

According to the anatomic pathology industry analysis, market saw the highest revenue share due to widespread disease diagnosis implementation.This method aids in the detection of tumors at the site of inflammatory and proliferating stromal cells, hence reducing tumor eradication costs. Furthermore, manufacturers' increased emphasis on offering inventive and novel diagnostic procedures is drives segment development. The research and development of pharmaceuticals is likely to be profitable over the projection period. During pre-clinical research, pathologists examine tissue samples, providing pharmaceutical producers with a wealth of data. In toxicological evaluation, the unfavorable effects of proposed medications play an important part in anatomical pathology.

Anatomic Pathology Market By End-use

- Hospitals

- Diagnostic Laboratories

- Research Laboratories

- Others

According to the anatomic pathology market forecast, hospitals dominated the business in terms of revenue due to increased hospitalization rates among cancer patients, as well as a considerable number of frequent hospital readmissions in 2023. Furthermore, the presence of well-developed infrastructure and well-trained personnel in hospital laboratories promotes the expansion of the hospital sector. Furthermore, the area is expected to gain from an increasing number of government and private-sector projects supporting advanced care technology. In the diagnostic laboratory market, sophisticated test procedures and equipment evolved, creating significant expansion opportunities. Similarly, the growth of study laboratories has been accelerated by a large number of clinical studies and other ongoing efforts. Research laboratories give quick and detailed data on the operation of ill tissues, with the overall goal of achieving a high degree of patient satisfaction.

Anatomic Pathology Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Anatomic Pathology Market Regional Analysis

For several reasons, North America had the biggest market share in 2023 due to significant players and public projects supporting pathological training programs. The rising use of tissue-diagnostic related processes in malignancy screening in the United States, facilitated by favorable reimbursement rules, promotes regional market growth. Furthermore, increasing investment in healthcare strengthens the anatomic pathology market in the United States. For instance, according to Congressional Budget Office, in 2023, government health insurance subsidies are expected to total $1.8 trillion, or 7.0 percent of GDP. According to CBO and JCT predictions, net subsidies will total $3.3 trillion, or 8.3 percent of GDP, by 2033. This increase in government health insurance subsidies drives market growth in North American region.

The increased need for sophisticated imaging, the expansion of enhanced patient care centers, and the franchising of a number of pathology labs in Asia-Pacific all contribute to this growth. For instance, the Union Cabinet approved a significant extension of the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY) on September 11, 2024. This ruling ensures health coverage for all senior persons aged 70 and above, regardless of income. In addition, government organizations, such as the Chinese Medical Association's pathology branch in China, fund pathology activities.

Anatomic Pathology Market Players

Some of the top anatomic pathology companies offered in our report include PHC Holdings Corporation, Quest Diagnostics Incorporated, Sakura Finetek USA, Inc., NeoGenomics Laboratories, Inc., Laboratory Corporation of America Holdings, F. Hoffmann-La Roche AG, Agilent Technologies, Inc., Danaher Corporation, Cardinal Health, and Bio SB.

Frequently Asked Questions

How big is the anatomic pathology market?

The anatomic pathology market size was valued at USD 39.2 billion in 2023.

What is the CAGR of the global anatomic pathology market from 2024 to 2032?

The CAGR of anatomic pathology is 7.4% during the analysis period of 2024 to 2032.

Which are the key players in the anatomic pathology market?

The key players operating in the global market are including PHC Holdings Corporation, Quest Diagnostics Incorporated, Sakura Finetek USA, Inc., NeoGenomics Laboratories, Inc., Laboratory Corporation of America Holdings, F. Hoffmann-La Roche AG, Agilent Technologies, Inc., Danaher Corporation, Cardinal Health, and Bio SB.

Which region dominated the global anatomic pathology market share?

North America held the dominating position in anatomic pathology industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of anatomic pathology during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Anatomic Pathology industry?

The current trends and dynamics in the anatomic pathology industry include increasing prevalence of chronic diseases and cancer fueling the demand for diagnostic testing, expansion of emerging markets with rising healthcare expenditures and infrastructure development, and increasing integration of artificial intelligence and machine learning in pathology for improved diagnostics.

Which product and service held the maximum share in 2023?

The consumables product and service held the maximum share of the anatomic pathology industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date