Analytics As A Service Market | Acumen Research and Consulting

Analytics as a Service Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

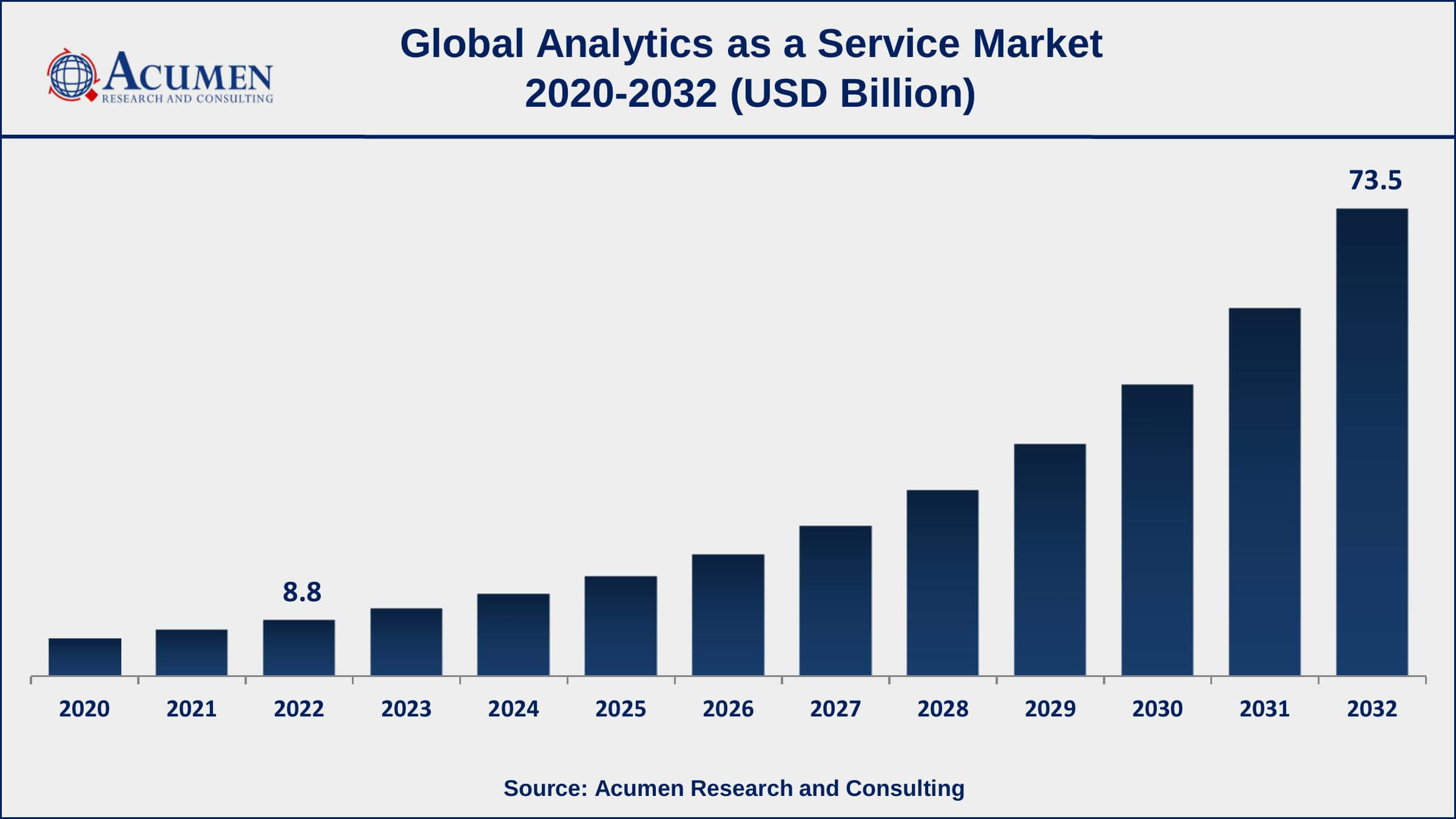

The Global Analytics as a Service Market Size accounted for USD 8.8 Billion in 2022 and is projected to achieve a market size of USD 73.5 Billion by 2032 growing at a CAGR of 24.1% from 2023 to 2032. The Analytics as a Service (AaaS) market is experiencing significant growth, driven by the increasing demand for cloud-based analytics solutions and the need for real-time data insights to inform business decisions. The rise of big data and the Internet of Things (IoT) is also contributing to the AaaS market growth, as organizations require more advanced analytics tools to manage and analyze the vast amounts of data generated by these technologies. Furthermore, the trend toward digital transformation and the growing need for data-driven decision-making is also boosting the expansion of the AaaS market value.

Analytics as a Service Market Report Key Highlights

- Global analytics as a service market revenue is expected to increase by USD 73.5 Billion by 2032, with a 24.1% CAGR from 2023 to 2032

- North America region led with more than 38% of analytics as a service market share in 2022

- The demand for predictive analytics services is increasing, with a CAGR of 19% expected over the next five years

- By enterprise size, the large enterprise captured the majority of the market

- The use of big data analytics is increasing, with a CAGR of 20% expected over the next five years

- Major players in the analytics as a service market include IBM, Microsoft, Oracle, Amazon Web Services, and Google Cloud

- Increasing use of artificial intelligence and machine learning, drives the analytics as a service market size

Analytics as a service, also abbreviated as AaaS, refers to the provision of software-based operations and analytics via web-delivered technologies. Such type of solutions offers enterprises and businesses an alternative to developing a setup for internal hardware to perform business analytics. Analytics as a service is becoming an increasingly popular and valuable option for businesses since setting up an overall analytics process might be a tedious and work-intensive process. Businesses that require performing more analytics might need relatively more servers and other types of hardware. They might also require more staff for information and technology in order to maintain and implement such programs. If a business can deploy analytics as a service instead, it might be able to bypass such new added costs.

Global Analytics as a Service Market Trends

Market Drivers

- Increasing popularity of cloud technology

- Rise of big data and the Internet of Things (IoT)

- A trend toward digital transformation and the growing need for data-driven decision making

- Cost savings compared to traditional, on-premise analytics solutions

Market Restraints

- Data security and privacy concerns

- Lack of skilled professionals

Market Opportunities

- Continuous advancements in technology, such as artificial intelligence and machine learning

- Increasing demand for customized AaaS solutions

Analytics as a Service Market Report Coverage

| Market | Analytics as a Service Market |

| Analytics as a Service Market Size 2022 | USD 8.8 Billion |

| Analytics as a Service Market Forecast 2032 | USD 73.5 Billion |

| Analytics as a Service Market CAGR During 2023 - 2032 | 24.1% |

| Analytics as a Service Market Analysis Period | 2020 - 2032 |

| Analytics as a Service Market Base Year | 2022 |

| Analytics as a Service Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By End-Use, By Enterprise Size, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, SAP, Oracle, Alteryx, TIBCO Software, SAS Institute, and Tableau |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Analytics as a Service Market Dynamics

Some of the major growth drivers in the global analytics as a service market growth include business intelligence maturation, increased ability of technologies to process huge workloads using the cloud as well as lower initial and maintenance costs of ownership. Some factors such as rapid and continuous growth of unstructured and structured data from diverse social media platforms are some key reasons anticipated to impel the prospects for growth in the global analytics as a service market value over the forecast period.

Also, one of the major drivers in the global analytics as a service market is the rising adoption of data analytics across diverse business segments. Most benefits linked with data analytics come up from its ability to recognize major patterns and to make related predictions based on past experiences. Based on the aforementioned criteria, various organizations are opting for data analytics in order to understand the patterns for customer acquisition, and consumption as well as other factors to increase overall revenues, save costs, and maintain customer loyalty.

Analytics as a Service Market Segmentation

The global analytics as a service market segmentation is based on type, end-use, enterprise size, and geography.

Analytics as a Service Market By Type

- Predictive

- Diagnostic

- Prescriptive

- Descriptive

According to analytics as a service industry analysis, the predictive segment held the largest market share in 2022. Predictive analytics uses advanced techniques, such as machine learning and statistical algorithms, to analyze historical data and make predictions about future outcomes. The predictive analytics as a service (PAaaS) market is growing rapidly as more and more companies seek to leverage the power of predictive analytics to gain a competitive edge. By using PAaaS solutions, companies can quickly and easily access predictive analytics capabilities without the need for large upfront investments in hardware and software. PAaaS solutions are being used in a variety of industries, including healthcare, finance, retail, and telecommunications, to drive business outcomes such as improved customer experience, increased operational efficiency, and reduced costs.

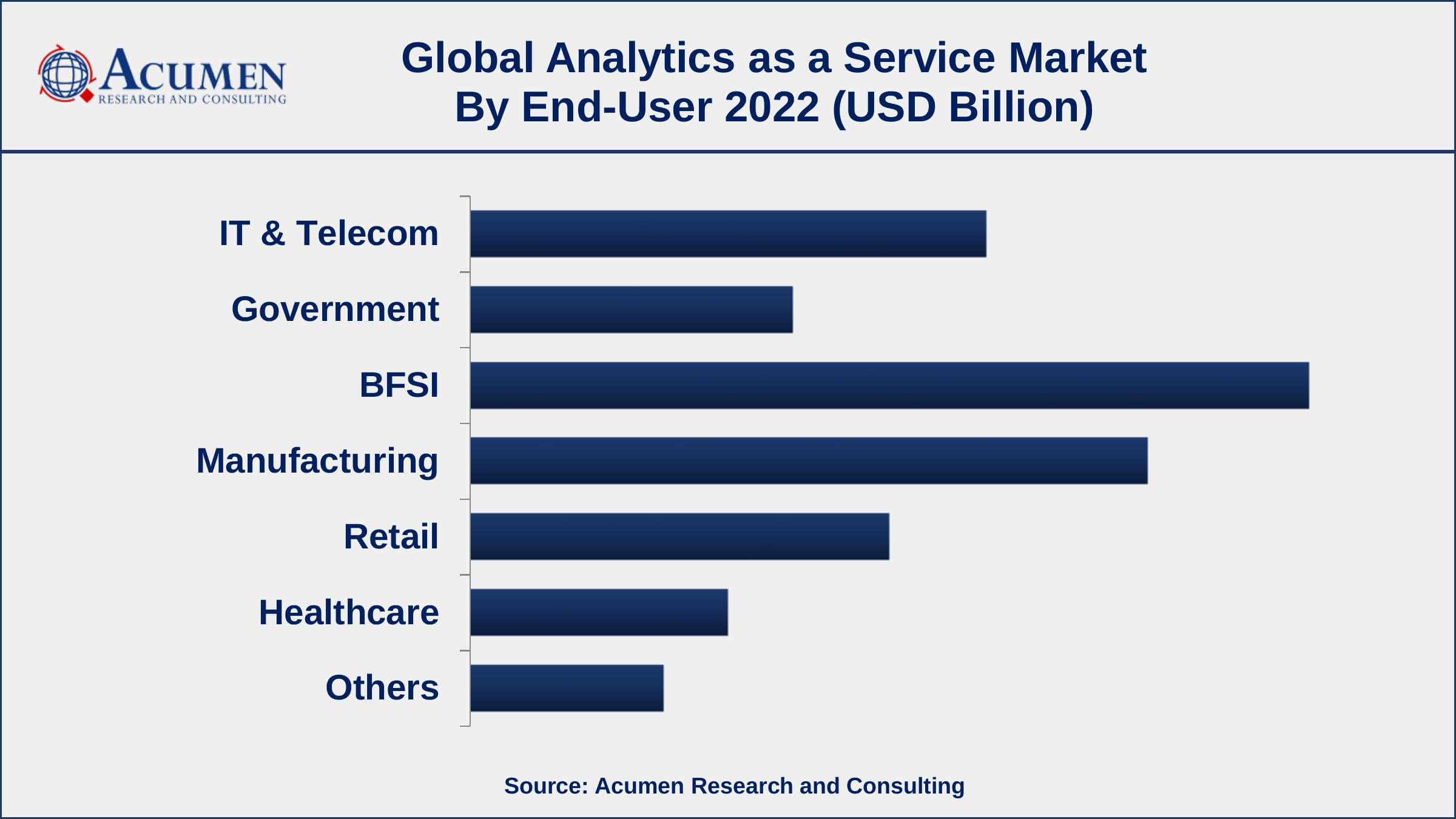

Analytics as a Service Market By End-Use

- IT & Telecom

- Government

- BFSI

- Manufacturing

- Retail

- Healthcare

- Others

In terms of end-user, the Banking, Financial Services, and Insurance (BFSI) sector is one of the key industries that is leveraging Analytics as a Service (AaaS) solutions. The BFSI sector generates large amounts of data, and AaaS solutions enable these organizations to effectively manage, analyze, and make data-driven decisions. AaaS solutions in the BFSI sector are being used for a variety of applications, including risk management, customer behavior analysis, fraud detection, and financial forecasting. By using AaaS solutions, BFSI organizations can quickly and easily access advanced analytics capabilities, allowing them to make better-informed decisions and improve their overall operations.

Analytics as a Service Market By Enterprise Size

- Large Enterprise

- Small & Medium Enterprise (SME)

According to the analytics as a service market forecast, the small and medium-sized enterprise sector is predicted to develop significantly in the market over the predicted period. AaaS solutions offer SMEs access to advanced analytics capabilities without the need for large upfront investments in hardware and software, making them a cost-effective solution for organizations with limited resources. AaaS solutions in SMEs are being used for a variety of applications, including sales and marketing analysis, customer behavior analysis, and financial forecasting. By using AaaS solutions, SMEs can quickly and easily gain insights into their data, allowing them to make better-informed decisions and improve their overall operations. The SME market for AaaS is expected to continue to grow as more SMEs embrace cloud-based solutions and the demand for advanced analytics capabilities continues to rise.

Analytics as a Service Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

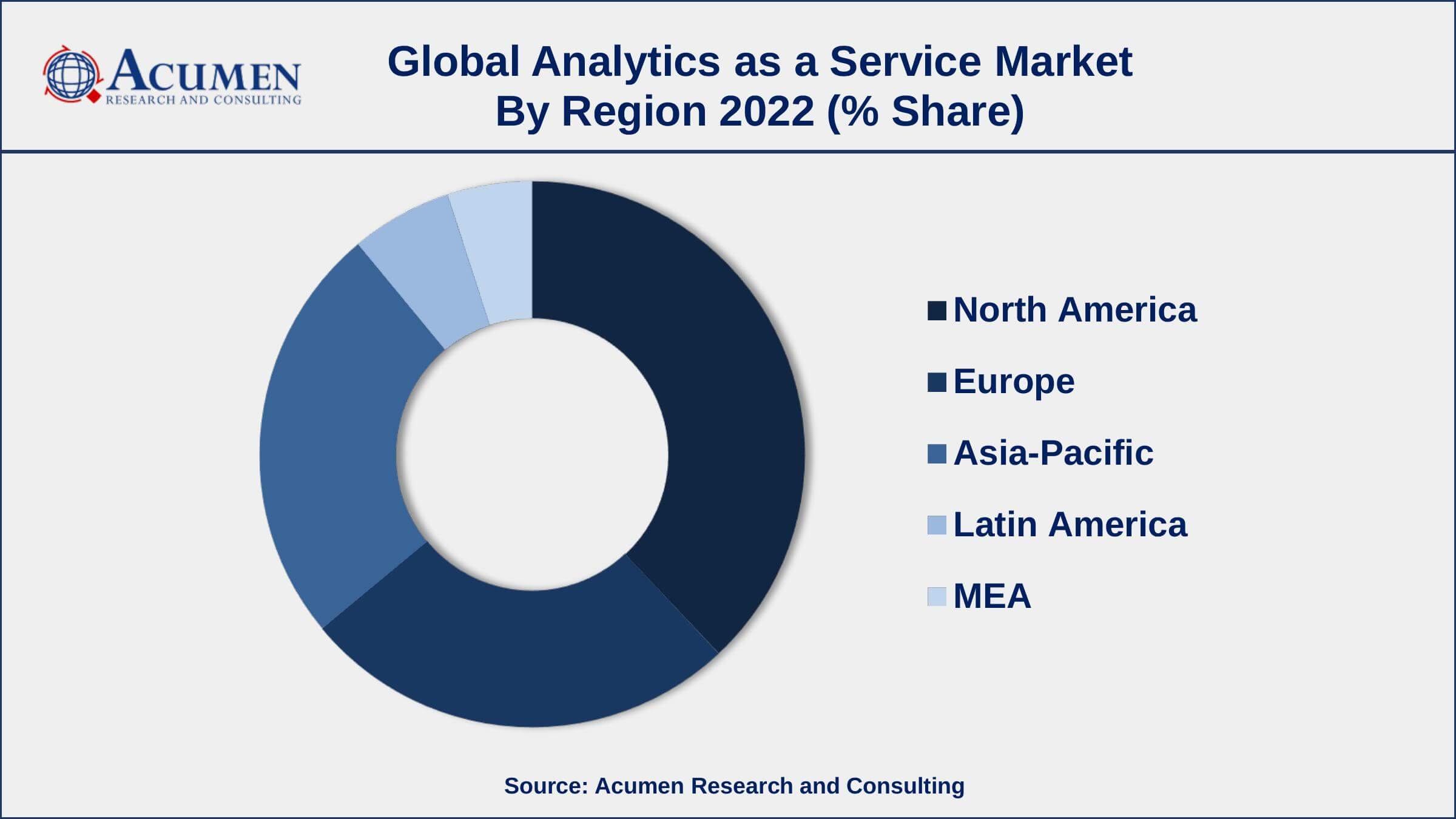

Geographically, North America is one of the largest markets for Analytics as a Service (AaaS), driven by the presence of a large number of technology companies and the widespread adoption of cloud computing solutions in the region. The US is the largest market for AaaS in North America, followed by Canada. North American companies across various industries, including healthcare, finance, retail, and telecommunications, are leveraging AaaS solutions to gain a competitive edge and improve their overall operations. AaaS solutions are being used for a variety of applications, including customer behavior analysis, sales and marketing analysis, and financial forecasting.

The North American AaaS market is expected to continue to grow as more companies adopt cloud-based solutions and the demand for advanced analytics capabilities continues to rise. The growth of the AaaS market in North America is also being driven by the increasing amount of data generated by organizations, the increasing need for data-driven decision-making, and the rising need for cost-effective analytics solutions.

Analytics as a Service Market Player

Some of the top analytics as a service market companies offered in the professional report include Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, SAP, Oracle, Alteryx, TIBCO Software, SAS Institute, and Tableau.

Frequently Asked Questions

What was the market size of the global analytics as a service in 2022?

The market size of analytics as a service was USD 8.8 Billion in 2022.

What is the CAGR of the global analytics as a service market during forecast period of 2023 to 2032?

The CAGR of analytics as a service market is 24.1% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global analytics as a service market are Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, SAP, Oracle, Alteryx, TIBCO Software, SAS Institute, and Tableau.

Which region held the dominating position in the global analytics as a service market?

North America held the dominating position in analytics as a service market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for analytics as a service market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global analytics as a service market?

The current trends and dynamics in the analytics as a service industry include the increasing popularity of cloud technology and rise of big data and the Internet of Things (IoT).

Which type held the maximum share in 2022?

The predictive type held the maximum share of the analytics as a service market.