AMOLED Display Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

AMOLED Display Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

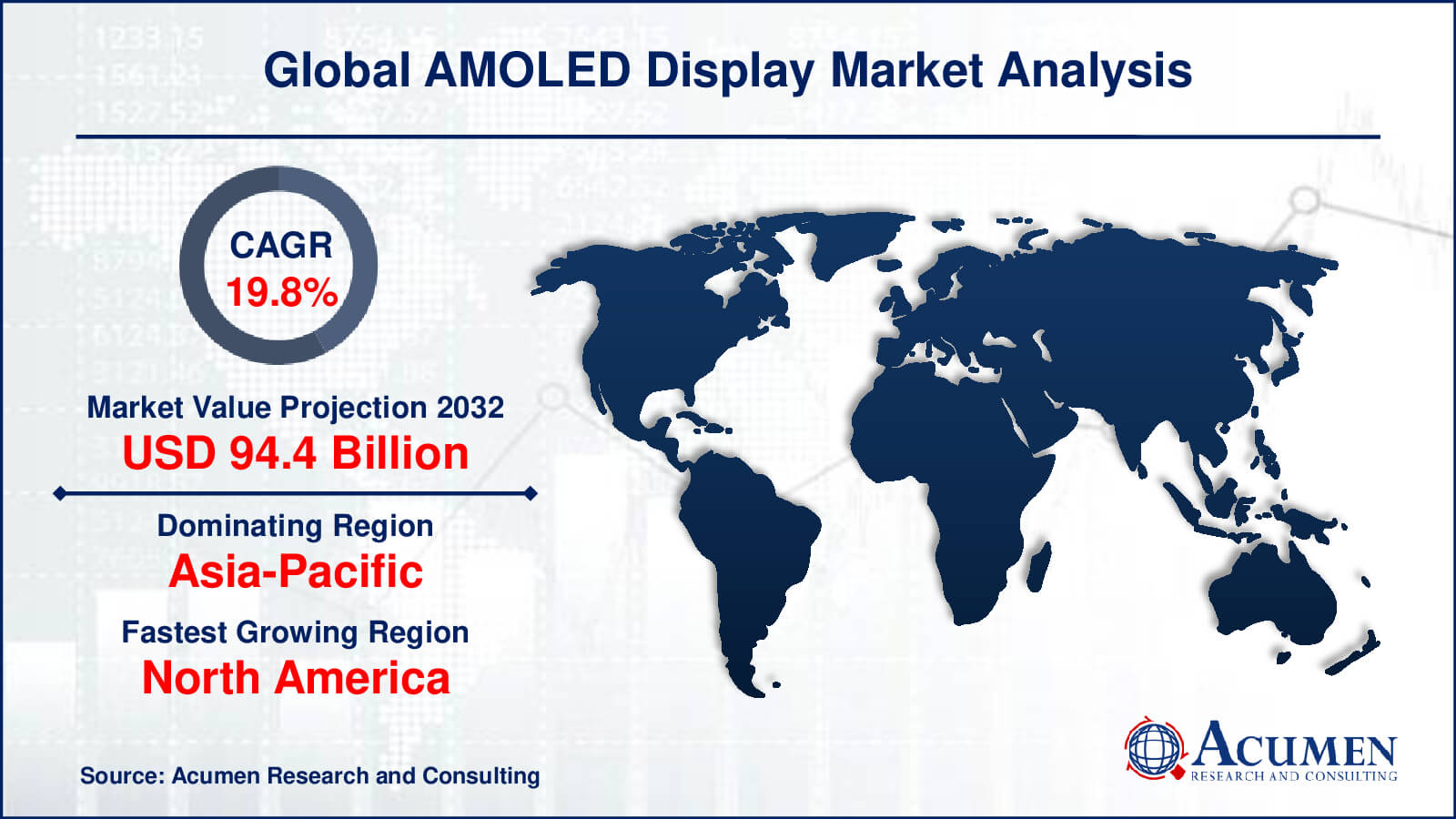

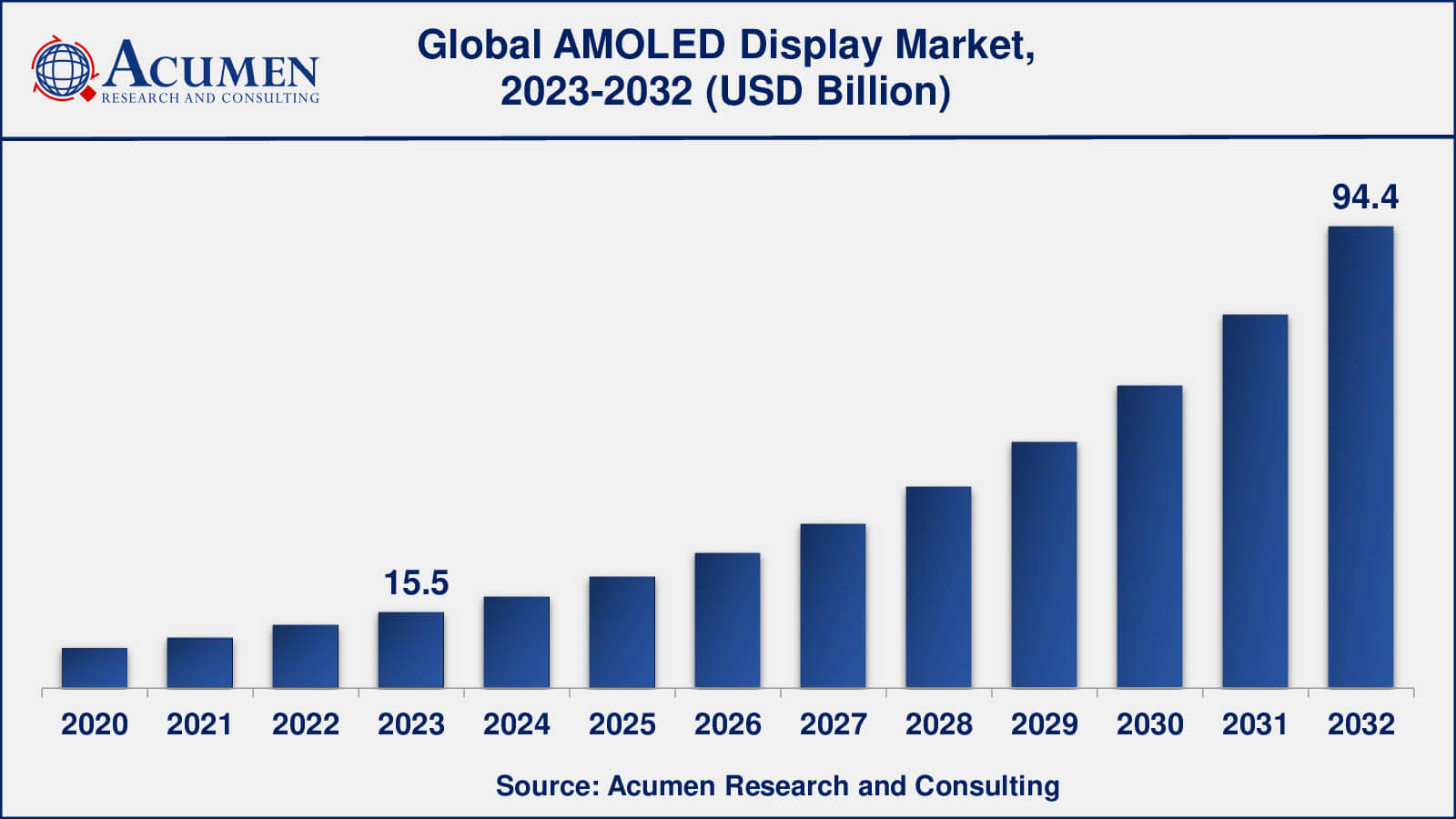

The Global AMOLED Display Market Size collected USD 12.9 Billion in 2022 and is set to achieve a market size of USD 94.4 Billion in 2032 growing at a CAGR of 19.8% from 2023 to 2032.

AMOLED or active-matrix organic light-emitting diode is an advanced category of then film display technology that is utilized in mobile devices, laptops and smart television, and smart watches among others. In an AMOLED display, various organic compounds are used to develop the electroluminescent material. The AMOLED display is an advanced category of OLED technology. An AMOLED utilizes a thin-film transistor (TFT) an active-matrix array that contains a storage capacitor that is used to maintain the line pixel states and thus enable large resolution and larger size displays. AMOLED displays offer more thinner and compact displays and run on optimal power. Thus, the AMOLED display provides better energy management.

In order to provide an exhaustive analysis of the market, the global AMOLED display market has been segmented on the basis of Application, Display Type, material Application, application, and geography. Various categories of AMOLED displays available in the market include flexible display, 3D display, transparent display, and conventional display. AMOLED displays are also utilized by various Application segments such as smartphones, television, tablets, and personal computers among others.

AMOLED Display Market Report Statistics

- Global AMOLED display market revenue is estimated to reach USD 94.4 billion by 2032 with a CAGR of 19.8% from 2023 to 2032

- Asia-Pacific AMOLED display market value occupied more than USD 4.9 billion in 2022

- North America AMOLED display market growth will register a CAGR of around 20% from 2023 to 2032

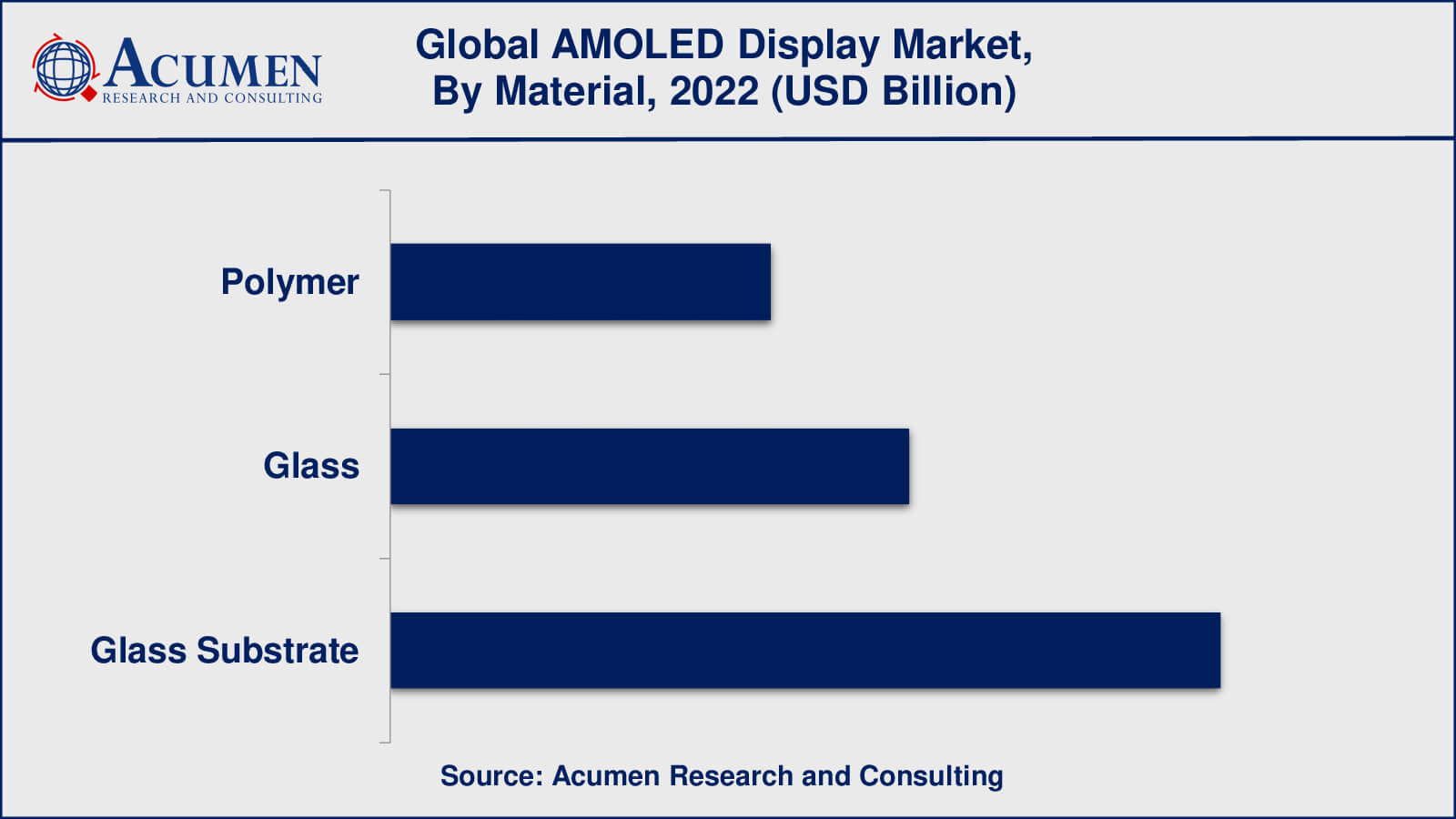

- Among display type, the glass substrate sub-segment generated around 48% share in 2022

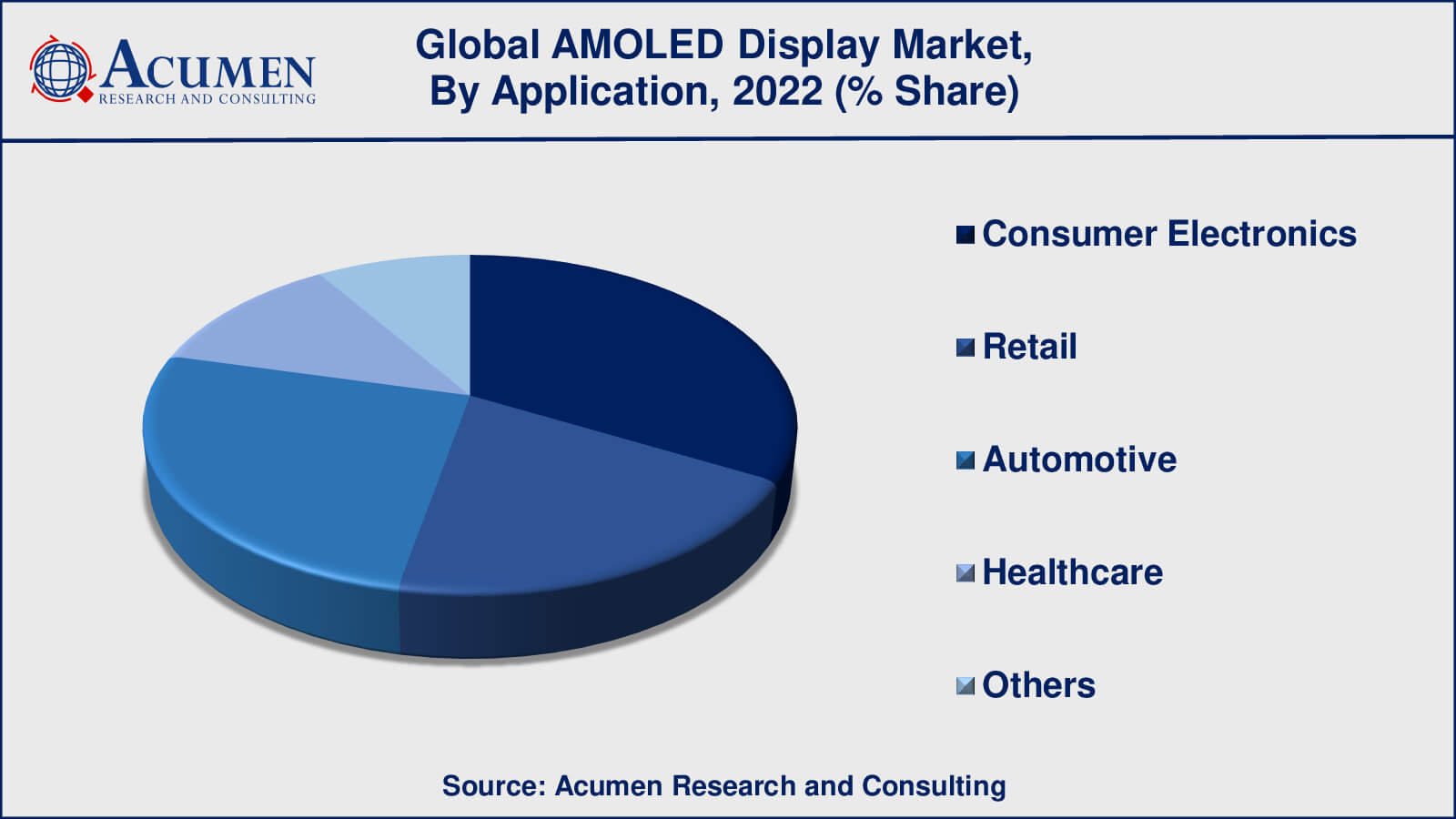

- Based on application, the consumer electronics sub-segment generated US $ 4.3 billion revenue in 2022

- Growing demand for flexible displays is a popular AMOLED display market trend that fuels the industry demand

Global AMOLED Display Market Dynamics

Market Drivers

- Increasing demand for smartphones and other consumer electronics

- Growing adoption of AMOLED displays in televisions, monitors, and other large-screen devices

- Rising demand for flexible and foldable displays in smartphones, wearables, and other devices

Market Restraints

- High manufacturing costs and complex production processes

- Limited production capacity and supply chain issues

- Durability and reliability concerns

Market Opportunities

- Increased investment in research and development by display manufacturers

- Advancements in manufacturing technology

AMOLED Display Market Report Coverage

| Market | AMOLED Display Market |

| AMOLED Display Market Size 2022 | USD 18.5 Billion |

| AMOLED Display Market Forecast 2032 | USD 94.4 Billion |

| AMOLED Display Market CAGR During 2023 - 2032 | 19.8% |

| AMOLED Display Market Analysis Period | 2020 - 2032 |

| AMOLED Display Market Base Year | 2022 |

| AMOLED Display Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Display Type, By Material, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AU Optronics Corp, BOE Technology Group Co. Ltd., Innolux Corporation, Japan Display Inc., LG Display Co. Ltd. (LG Corporation), Novaled GmbH (Samsung SDI Co., Ltd.), Panasonic Corporation, Sharp Corporation, Sony Corporation and Universal Display Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

AMOLED Display Market Growth Factors

AMOLED display technology has several advantages over other display technologies in terms of low power consumption, enhanced image quality, and high-resolution display. Moreover, owing to the thinner, flexible, and lighter nature of AMOLED displays in comparison to LCDs and LEDs, AMOLEDs are preferred across various end-user segments such as smart mobile phones, notebooks, tablets, and computers among others. The rapidly growing demand for high-resolution and brighter display smartphones, television sets, and other consumer electronics across the globe is predicted to boost the market for AMOLED displays at an exponential rate during the forecast period. In addition, the material used in AMOLED displays is easily degradable and comply with the regulation and policies of the Environmental Protection Agency (EPA). Owing to this factor, the market of AMOLED displays is predicted to experience a clean sweep from different environmental protection and control agencies across different parts of the world.

However, the high manufacturing cost of AMOLED displays is one of the primary factors predicted to limit many industries to enter the AMOLED display market, thereby affecting the market negatively. Moreover, the high replacement and repair cost of AMOLED is also predicted to deter the demand to some extent. Among different Display Types, the flexible display held the largest market share in 2015 and is predicted to maintain its dominance during the forecast period. Flexible AMOLEDs are manufactured using flexible organic materials. Thus, flexible ALOMED displays are lighter and more durable than other flat AMOLEDs and are being rapidly adopted across various end-user segments.

AMOLED Display Systems Market Segmentation

The worldwide AMOLED display market is categorized based on display type, material, application, and geography.

AMOLED Display Market By Display Type

- Conventional

- Flexible

- Transparent

- 3D

- Others

According to our AMOLED Display industry analysis, the major display types that have gained significant market share in the AMOLED display market are transparent, conventional, flexible, and 3D. Transparent AMOLED displays are used in a wide range of applications, including automotive displays, augmented reality, and head-up displays. Because of their high resolution, vivid colors, and low power consumption, conventional AMOLED displays are widely used in tablets, smartphones, and other consumer electronic devices. Because of their ability to be bent, curved, or rolled, flexible AMOLED displays are becoming increasingly popular for wearable devices, foldable phones, and other innovative form factors. 3D AMOLED displays provide depth perception and are used in virtual reality, gaming, and medical imaging.

AMOLED Display Market By Material

- Polymer

- Glass

- Glass Substrate

Glass substrate accounts for the majority of the market share in the AMOLED display market. The glass substrate serves as the foundation for AMOLED displays' thin-film transistors (TFTs) and organic layers, providing structural support and protection for the delicate organic layers.

Glass substrates provide AMOLED display manufacturers with several advantages, including high transparency, good thermal stability, and excellent chemical resistance. Glass substrates are also available in various sizes and can be produced with extreme accuracy and uniformity, making them suitable for AMOLED display mass production. While polymer substrates have some advantages over glass substrates in terms of flexibility and weight, they are currently less broadly used in AMOLED displays due to their lower reliability and durability when compared to glass.

AMOLED Display Market By Application

- Consumer Electronics

- Retail

- Automotive

- Healthcare

- Others

According to the AMOLED display market forecast, the consumer electronics is the application that dominates the largest market share in the AMOLED display market. This includes smartphones, tablets, laptops, televisions, and other electronic devices that use AMOLED displays for their high resolution, color accuracy, and low power consumption. The consumer electronics segment has been the primary driver of growth in the AMOLED display market, due to the increasing demand for high-quality displays in mobile devices and the growing popularity of larger-screen devices such as televisions.

AMOLED Display Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

AMOLED Display Market Regional Analysis

Geographically, the Asia-Pacific region is anticipated to experience promising growth in the AMOLED display market during the forecast period. The large industry cluster of AMOLED display manufacturers in this region coupled with increasing demand from various consumers electronic OEMs (Original Equipment Manufacturers) in countries like China, Japan, Korea, and India is anticipated to boost the demand for AMOLED displays in order to satisfy the changing requirements of consumers. The global AMOLED display market was majorly dominated by Samsung in 2015. Other major players operating in the AMOLED display market include LG Display, AU Optronics, Panasonic, and Sony among others.

AMOLED Display Market Players

Some of the leading AMOLED display companies include AU Optronics Corp, Innolux Corporation, BOE Technology Group Co. Ltd., Japan Display Inc., Novaled GmbH (Samsung SDI Co., Ltd.), LG Display Co. Ltd. (LG Corporation), Sharp Corporation, Panasonic Corporation, Sony Corporation and Universal Display Corporation.

Frequently Asked Questions

What was the market size of the global AMOLED display in 2022?

The market size of AMOLED display was USD 12.9 Billion in 2022.

What is the CAGR of the global AMOLED display market during forecast period of 2023 to 2032?

The CAGR of AMOLED display market is 19.8% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global market are AU Optronics Corp, BOE Technology Group Co. Ltd., Innolux Corporation, Japan Display Inc., LG Display Co. Ltd. (LG Corporation), Novaled GmbH (Samsung SDI Co., Ltd.), Panasonic Corporation, Sharp Corporation, Sony Corporation and Universal Display Corporation.

Which region held the dominating position in the global AMOLED display market?

North America held the dominating position in AMOLED display market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for AMOLED display market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global AMOLED display market?

The current trends and dynamics in the AMOLED display industry include Increasing demand for smartphones and other consumer electronics, increased investment in research and development by display manufacturers, and advancements in manufacturing technology.

Which display type held the maximum share in 2022?

The glass substrate held the maximum share of the AMOLED display market.