Ammonium Acetate Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Ammonium Acetate Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

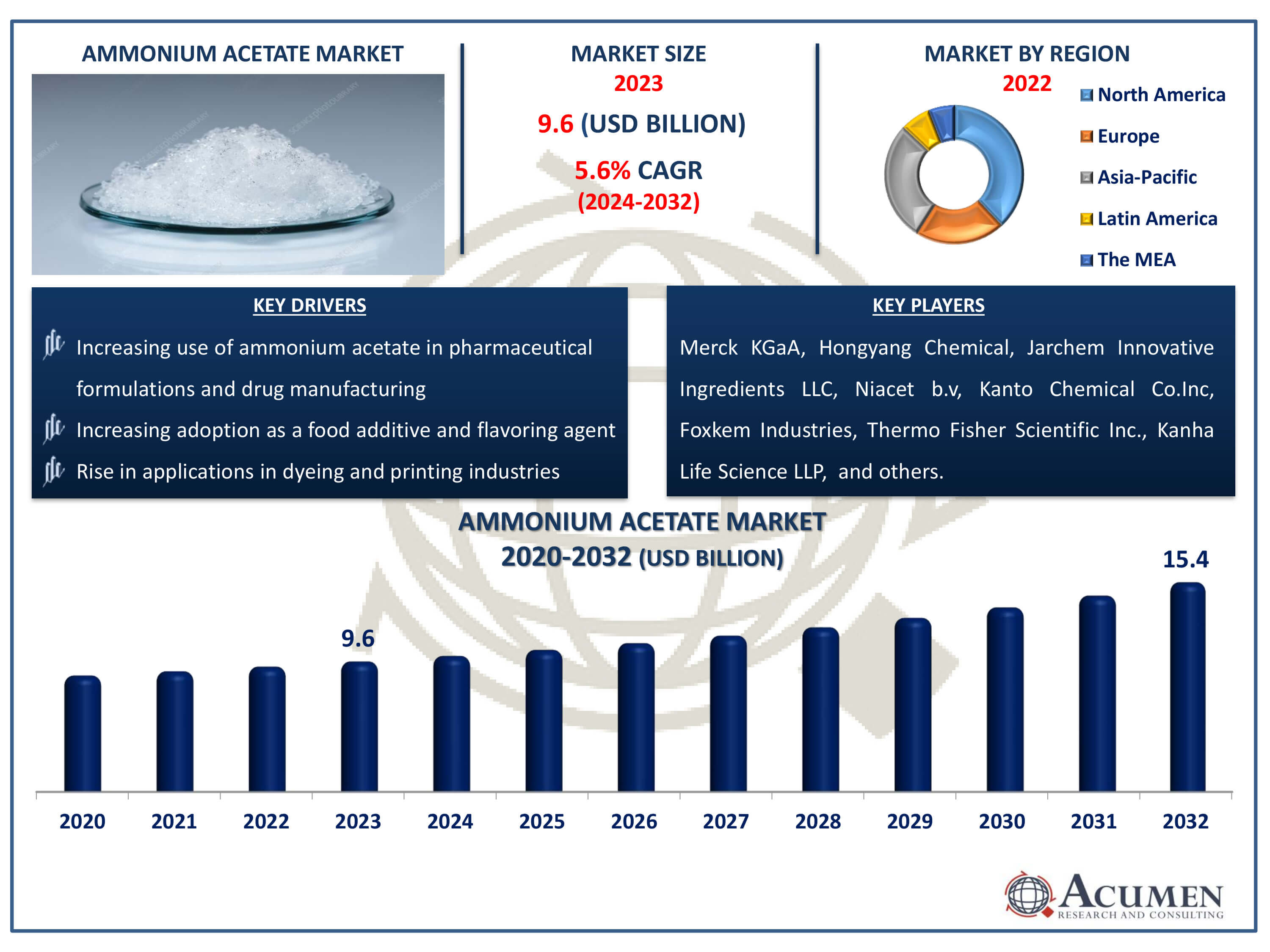

The Ammonium Acetate Market Size accounted for USD 9.6 Billion in 2023 and is estimated to achieve a market size of USD 15.4 Billion by 2032 growing at a CAGR of 5.6% from 2024 to 2032.

Ammonium Acetate Market Highlights

- Global ammonium acetate market revenue is poised to garner USD 15.4 billion by 2032 with a CAGR of 5.6% from 2024 to 2032

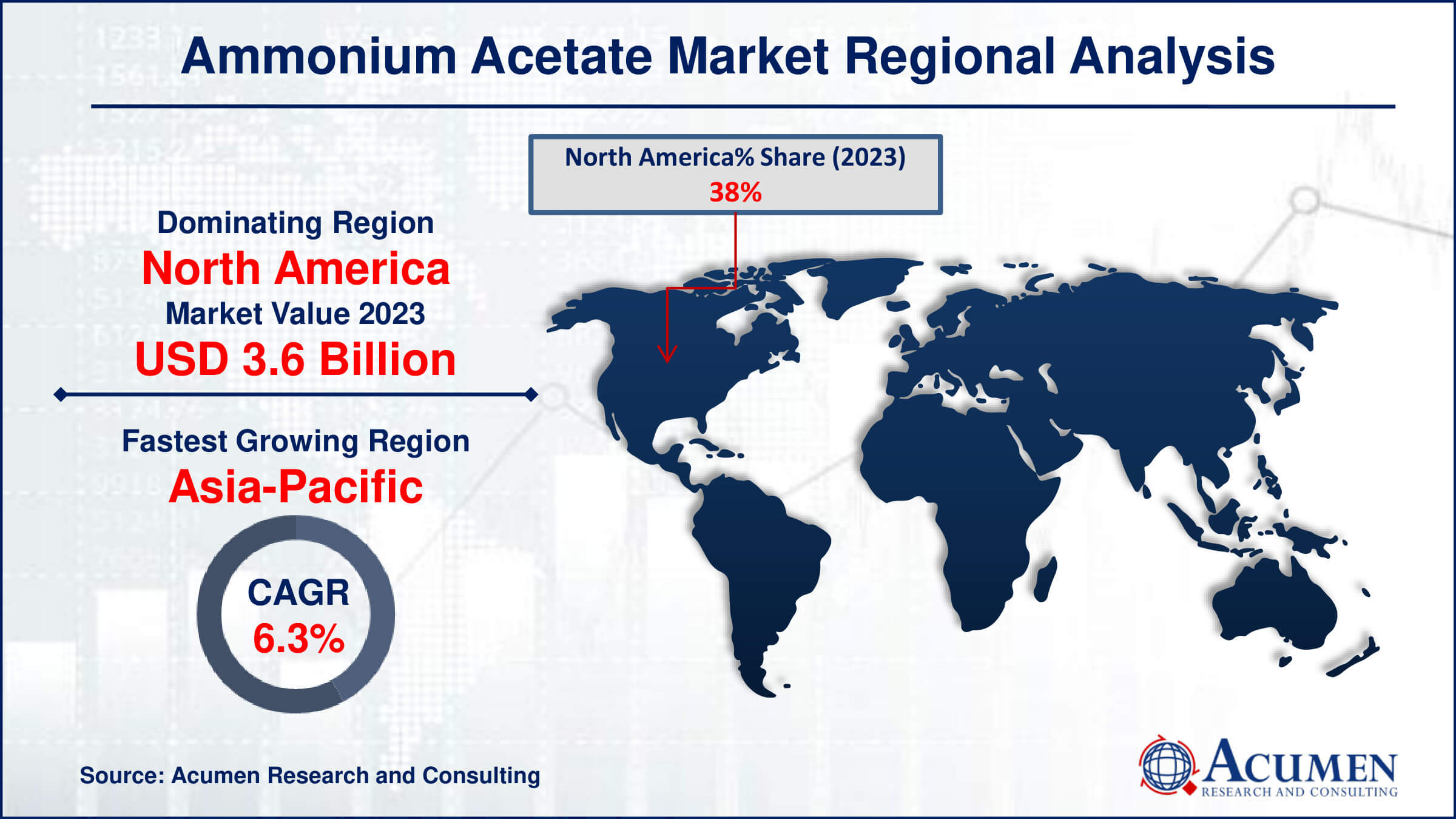

- North America ammonium acetate market value occupied around USD 3.6 billion in 2023

- Asia-Pacific ammonium acetate market growth will record a CAGR of more than 6.3% from 2024 to 2032

- Among grade, the agriculture grade sub-segment expected to generated significant market share in 2023

- Based on application, the pharmaceutical sub-segment anticipated to generated notable share in 2023

- Increased use of ammonium acetate in food preservation and flavor enhancement is the ammonium acetate market trend that fuels the industry demand

Ammonium acetate, a crystalline compound composed of ammonium ions (NH4+) and acetate ions (CH3COO−), is valued for its versatility across various applications. Primarily, it serves as a crucial reagent in organic synthesis, facilitating reactions like esterifications and amidations. Its buffering properties make it indispensable in biochemical and molecular biology laboratories, where it stabilizes pH levels around neutrality. In mass spectrometry, ammonium acetate is employed for its ability to generate ions via electrospray ionization, aiding in the analysis of biomolecules and other compounds. Additionally, its hygroscopic nature enables use as a desiccant in certain drying processes. In regulated quantities, it also functions as a food additive, serving as an acidity regulator in specific food products.

Global Ammonium Acetate Market Dynamics

Market Drivers

- Increasing use of ammonium acetate in pharmaceutical formulations and drug manufacturing

- Increasing adoption as a food additive and flavoring agent

- Rise in applications in dyeing and printing industries

Market Restraints

- Stringent regulations regarding environmental impact

- Volatility in raw material prices

- Limited availability of skilled labor in manufacturing

Market Opportunities

- Expansion in the pharmaceutical and biotechnology sectors

- Innovations in production processes for cost efficiency

- Growing demand in the food industry as a preservative and acidity regulator

Ammonium Acetate Market Report Coverage

| Market | Ammonium Acetate Market |

| Ammonium Acetate Market Size 2022 | USD 9.6 Billion |

| Ammonium Acetate Market Forecast 2032 | USD 15.4 Billion |

| Ammonium Acetate Market CAGR During 2023 - 2032 | 5.6% |

| Ammonium Acetate Market Analysis Period | 2020 - 2032 |

| Ammonium Acetate Market Base Year |

2022 |

| Ammonium Acetate Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Application, By Grade, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Merck KGaA, Hongyang Chemical, Jarchem Innovative Ingredients LLC , Niacet b.v, Kanto Chemical Co.Inc, Foxkem Industries, Thermo Fisher Scientific Inc., Kanha Life Science LLP, Hefei TNJ Chemical Industry Co., Ltd, and Anhui Hongyang Chemical Co., Ltd., among others. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Ammonium Acetate Market Insights

Ammonium acetate's growing adoption as a food additive and flavoring agent is bolstering demand in the market. It serves as a versatile substance, enhancing food flavor profiles without imparting harsh tastes. As a stabilizer and acidity regulator, it finds use in various food products, including baked goods, sauces, and snacks. Its ability to modify pH levels effectively contributes to its popularity in the food industry. Moreover, growing food industry further propels market growth in forecast year. For instance, according to the India Brand Equity Foundation (IBEF), the Indian food processing sector is projected to reach US$535 billion by 2025-26. Overall, its status as a safe and approved substance by regulatory bodies further supports its increasing integration into food processing applications.

Stringent environmental regulations pose significant challenges for the ammonium acetate market. These regulations typically aim to reduce pollution and promote sustainable practices, impacting production processes and waste management within the industry. Compliance requires investments in technology and processes to minimize environmental impact, which can increase operational costs. Additionally, regulatory uncertainties may affect market dynamics, influencing investment decisions and market growth. Companies in the ammonium acetate market must navigate these challenges to remain competitive while meeting environmental standards.

The expansion in the pharmaceutical and biotechnology sectors presents a significant opportunity for the ammonium acetate market. For instance, according to Invest India, there have been 22 mergers and acquisitions (M&A) transactions in the life sciences sector in India, totaling $4.6 billion in combined value. Ammonium acetate is widely used as a reagent in various pharmaceutical processes, including drug formulation and analysis. Its role in biotechnology spans applications in protein purification, where it aids in maintaining pH levels critical for enzymatic activities. As these sectors continue to grow, the demand for high-purity reagents like ammonium acetate is expected to rise, driven by its versatility and reliability in research and production processes. This growth underscores its pivotal role in supporting advancements and innovations in pharmaceutical and biotechnological applications.

Ammonium Acetate Market Segmentation

The worldwide market for ammonium acetate is split based on grade, application, end-use industry, and geography.

Ammonium Acetate Grades

- Industrial Grade

- Food Grade

- Agriculture Grade

- Medicine Grade

- Others

According to the ammonium acetate industry analysis, agriculture grade expected to dominate due to its role as a source of nitrogen and in pH regulation. In agriculture, it serves as a nitrogen source in fertilizers, promoting plant growth and enhancing crop yield. Its ability to adjust soil pH also makes it valuable for optimizing nutrient availability to plants. As global agricultural practices intensify to meet food demand, the demand for ammonium acetate is projected to rise, driven by its efficacy and versatility in agricultural applications. For instance, ChemChina, a global company in the agrochemical sector, acquired Syngenta, a company that also operates in agrochemicals and seeds. This growth trend underscores its pivotal role in modern farming practices worldwide.

Ammonium Acetate Applications

- Food Additive

- Pharmaceuticals

- Electrolyte Solution

- Others

The pharmaceuticals segment is the largest application category in the ammonium acetate market and it is expected to increase over the industry, stems from its versatile applications in drug formulation and manufacturing. Ammonium acetate is widely used as a buffering agent in pharmaceutical preparations, aiding in pH adjustment and stabilization of formulations. Its compatibility with various active pharmaceutical ingredients (APIs) and its role in chromatographic techniques further enhance its importance in drug development and analysis. Additionally, its cost-effectiveness and regulatory acceptance contribute to its widespread adoption in the pharmaceutical industry. As pharmaceutical research expands, the demand for ammonium acetate is expected to grow, solidifying its position as a pivotal component in drug development processes.

Ammonium Acetate End-use Industries

- Food & Beverages (Bakery, Dairy, Meat and Others)

- Medical & Pharmaceutical (Patent Drug, Chemical Medication and Others)

- Cosmetics & Personal Care (Hair Care, Skin Care, Body Care and Others)

- Agriculture

- Chemical

- Textile

- Others

Medical & pharmaceutical (patent drug, chemical medication and others) segment shows significant share in ammonium acetate market. In these fields, it serves primarily as a key component in formulations for medications and drug synthesis due to its ability to act as a source of acetate ions under mild conditions. Pharmaceutical applications include its use as a buffer in chromatography and as a reactant in the production of active pharmaceutical ingredients (APIs). Its role in drug development and formulation underscores its significance in ensuring chemical stability and efficacy of pharmaceutical products, making it indispensable in the medical and pharmaceutical sectors.

Ammonium Acetate Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Ammonium Acetate Market Regional Analysis

For several reasons, North America dominates ammonium acetate market, due to increasing demand across various industries such as pharmaceuticals, food and beverages, and chemicals. Robust key players and their advancements further contribute its market growth. For instance, in November 2023, Thermo Fisher Scientific and Flagship Pioneering unveiled a strategic partnership focused on expediting the advancement and market introduction of multiproduct platforms. This collaboration marks a major achievement for Thermo Fisher, solidifying its prominent role in delivering cutting-edge scientific solutions globally. This growth is driven by expanding applications of ammonium acetate in these sectors, including its use as a chemical intermediate and a buffering agent. Additionally, favorable regulatory environments and technological advancements are further bolstering market expansion in the region.

Asia-Pacific is fastest-growing region in ammonium acetate market, due to its significant production capabilities and expanding chemical industry. Countries like China and India are major contributors, driven by their robust agricultural sectors and increasing industrial applications of ammonium acetate in pharmaceuticals, food additives, and chemical synthesis. For instance, according to Invest India, the Indian agriculture sector is expected to expand by 3.5% in the fiscal year 2022-23. The region's strategic geographical advantage, coupled with growing investments in research and development, further strengthens its position as a fastest-growing in global ammonium acetate market.

Ammonium Acetate Market Players

Some of the top ammonium acetate companies offered in our report include Anhui Hongyang Chemical Co., Ltd., Merck KGaA, Hongyang Chemical, Jarchem Innovative Ingredients LLC, Niacet b.v, Foxkem Industries, Kanto Chemical Co. Inc, Thermo Fisher Scientific Inc., Hefei TNJ Chemical Industry Co., Ltd, and Kanha Life Science LLP among others.

Frequently Asked Questions

How big is the ammonium acetate market?

The ammonium acetate market size was valued at USD 9.6 billion in 2023.

What is the CAGR of the global ammonium acetate market from 2024 to 2032?

The CAGR of ammonium acetate is 5.6% during the analysis period of 2024 to 2032.

Which are the key players in the ammonium acetate market?

The key players operating in the global market are including Merck KGaA, Hongyang Chemical, Jarchem Innovative Ingredients LLC, Niacet b.v, Kanto Chemical Co.Inc, Foxkem Industries, Thermo Fisher Scientific Inc., Kanha Life Science LLP, Hefei TNJ Chemical Industry Co., Ltd, and Anhui Hongyang Chemical Co., Ltd., among others.

Which region dominated the global ammonium acetate market share?

North America held the dominating position in Ammonium Acetate industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of ammonium acetate during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global ammonium acetate industry?

The current trends and dynamics in the ammonium acetate industry include increasing prevalence of food additive syndrome globally, advancements in lacrimal device technology, enhancing efficacy and patient comfort, and growing aging population prone to lacrimal disorders.

Which grade held the maximum share in 2023?

The agriculture grade expected to hold the maximum share of the ammonium acetate industry.