Amines Market | Acumen Research and Consulting

Amines Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

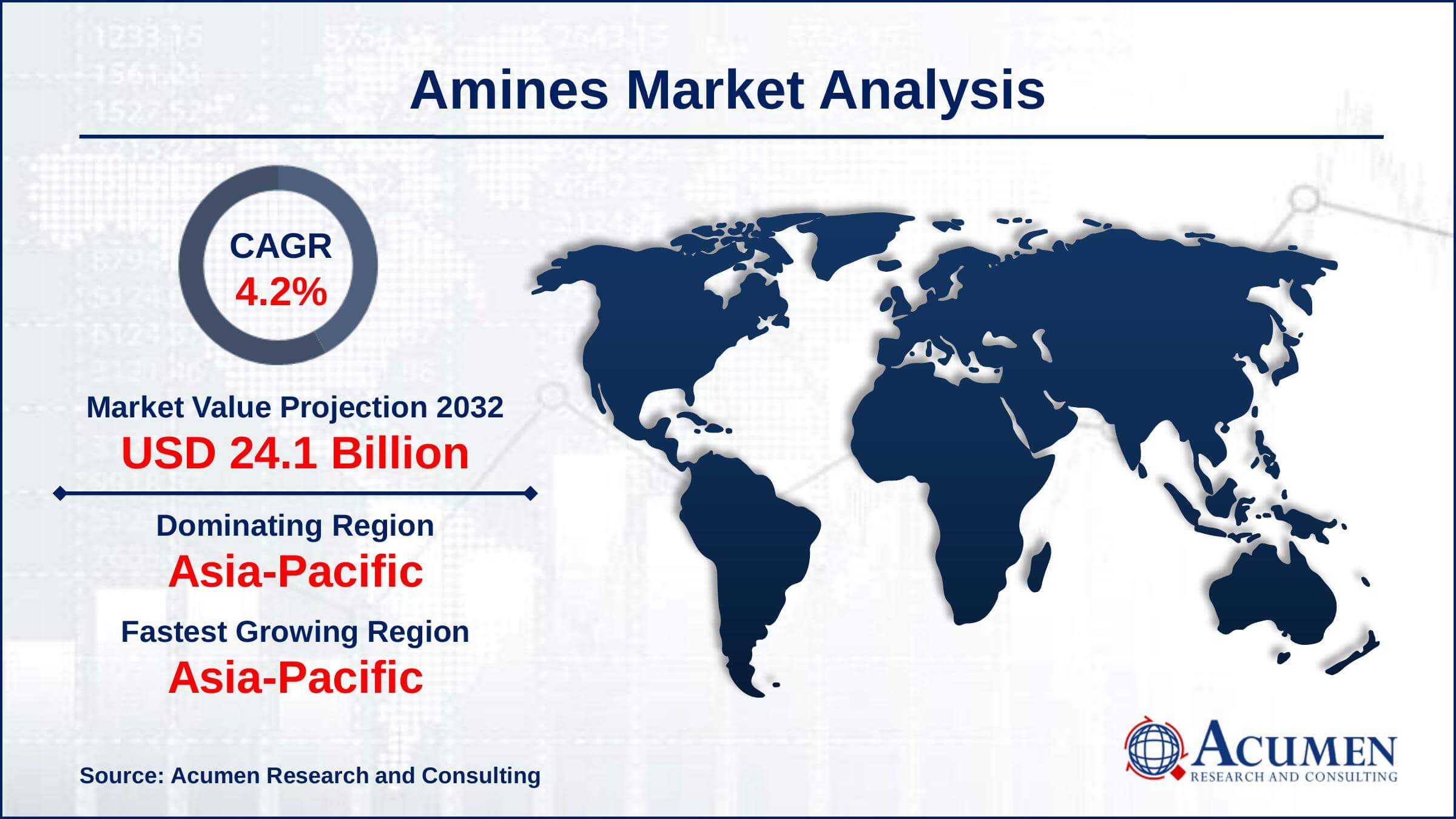

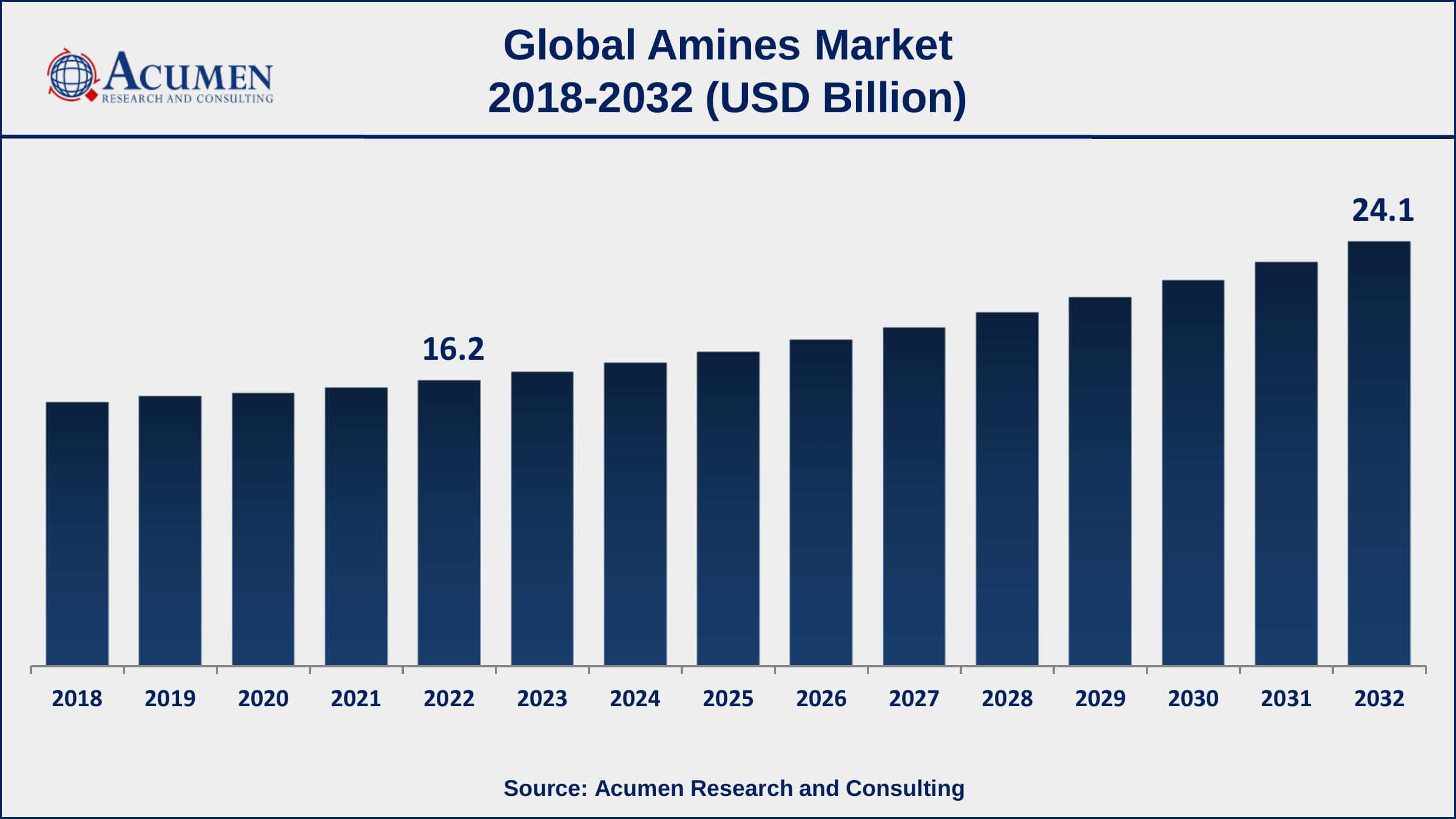

The Amines Market Size accounted for USD 16.2 Billion in 2022 and is estimated to achieve a market size of USD 24.1 Billion by 2032 growing at a CAGR of 4.2% from 2023 to 2032. The demand for amines in various end-use sectors such as agrochemicals, personal care, and water treatment is driving amines market growth. Furthermore, the increased use of amines in personal care products such as shampoos and conditioners is predicted to boost the amines market value in the coming years.

Amines Market Report Key Highlights

- Global amines market revenue is expected to increase by USD 24.1 Billion by 2032, with a 4.2% CAGR from 2023 to 2032

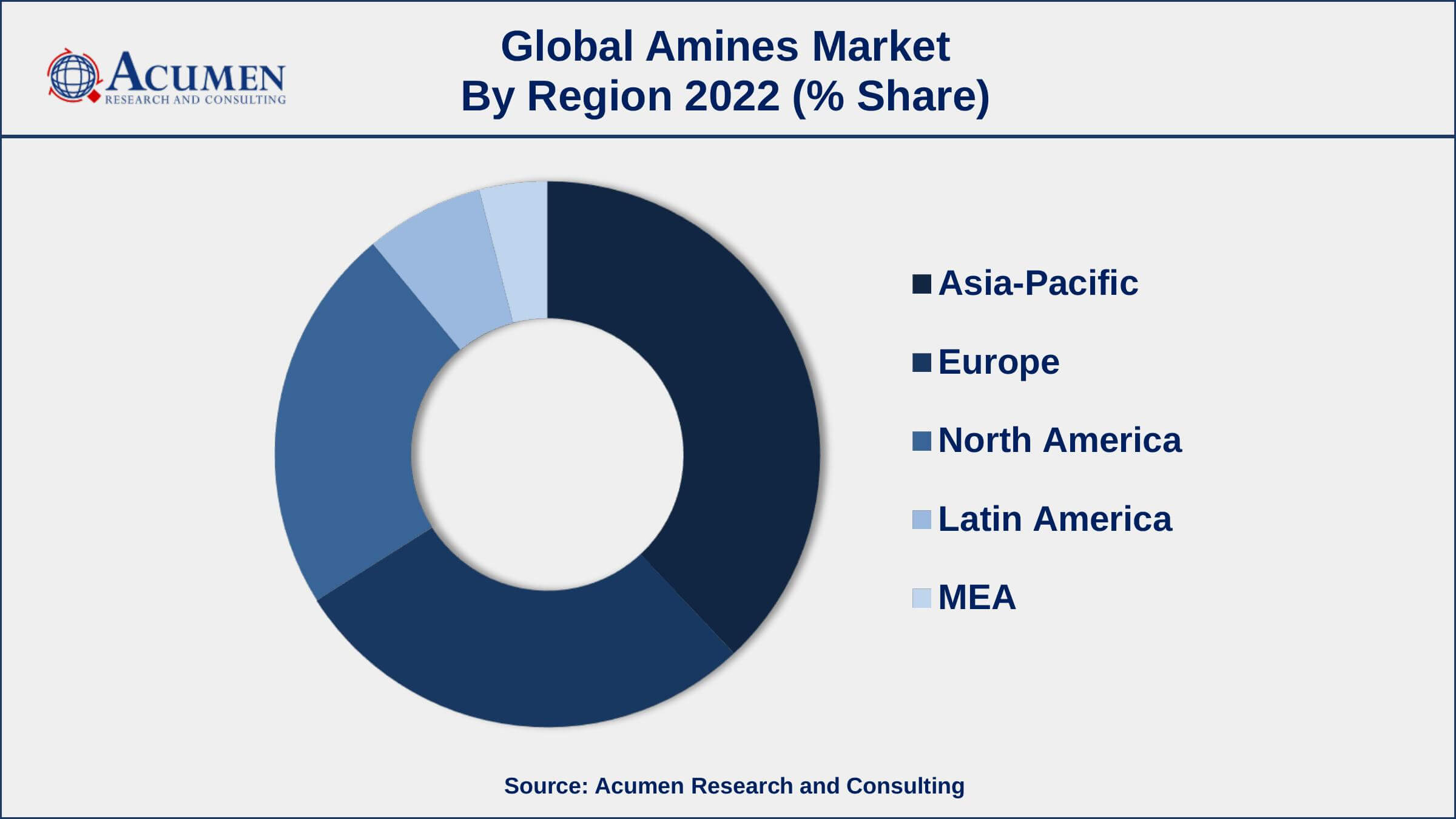

- Asia-Pacific region led with more than 39% of amines market share in 2022

- According to the IQVIA Institute for Human Data Science, the worldwide pharmaceutical business was worth USD 1.2 trillion in 2018

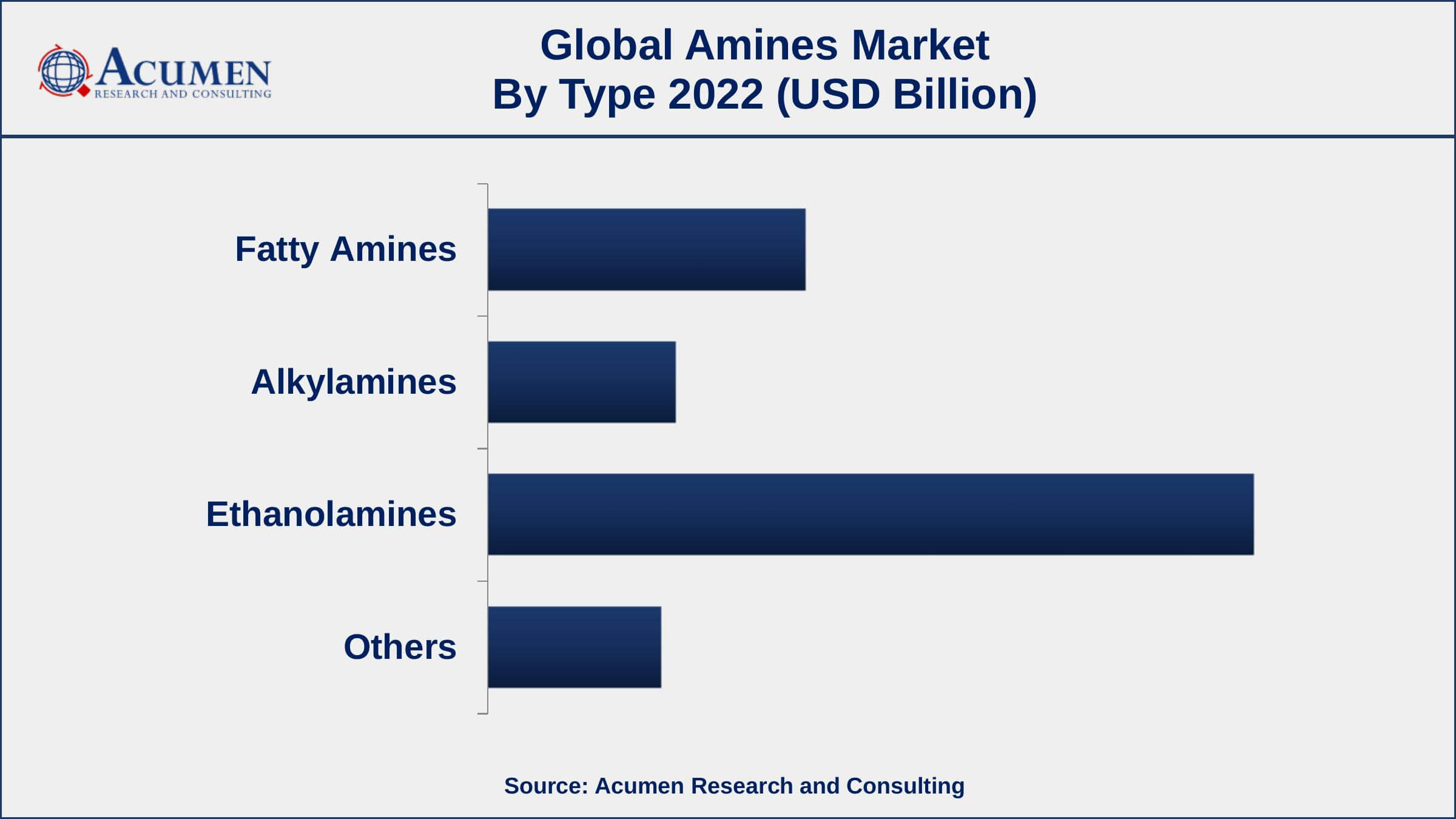

- By type, the ethanolamines segment has accounted market share of over 53% in 2022

- By application, the agriculture segment captured the majority of the market

- Increasing use in the production of agrochemicals and pharmaceuticals, drives the amines market size

Amines are basically those organic compounds that are traditional derivatives of ammonia as well as one or more hydrogen atoms. Such compounds are substituted either by alkyl or aryl group. The aim of this market research study is to analyze the current and future trends in the global amines market. It is anticipated various industrial applications are expected to increase the consumption of amines and related organic compounds.

Global Amines Market Trends

Market Drivers

- Increasing use in the production of agrochemicals and pharmaceuticals

- Growing demand in the oil and gas industry for use as corrosion inhibitors and demulsifiers

- Increasing use in the production of personal care and home care products

Market Restraints

- High cost of raw materials and production processes

- Availability of alternative products

Market Opportunities

- Growing demand for bio-based amines

- Increasing the use of amines in the production of biofuels

Amines Market Report Coverage

| Market | Amines Market |

| Amines Market Size 2022 | USD 16.2 Billion |

| Amines Market Forecast 2032 | USD 24.1 Billion |

| Amines Market CAGR During 2023 - 2032 | 4.2% |

| Amines Market Analysis Period | 2018 - 2032 |

| Amines Market Base Year | 2022 |

| Amines Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | The Dow Chemical Company, Arkema S.A., Lyondell Basell Industries Holdings B.V., Akzo Nobel N.V., INEOS Group, SABIC, BASF SE, Huntsman Corporation, Celanese Corporation, Taminco Corporation, Solvay S.A., Mitsubishi Gas Chemical Company, and Lanxess Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Growing applications of amines in personal care products, paints & coatings, surfactants, crop protection, and water treatment are anticipated to play a crucial role in fueling the growth of the global amines market over foreseeable years. Governments of several economies such as India, China, and the Middle East have relatively increased their overall expenditure on the improvement of infrastructure, which is another key factor projected to pose a positive impact on the global amines demand in surfactant application. The increasing number of technical innovations in the production of amines has led to an effective and more improved use of amines in consumer and industrial applications which is a key factor driving the growth of the global market.

However, the use of amines results in human health concerns such as skin disorders, which is a major aspect anticipated to hamper the growth of the amines market, globally. In addition, stringent government regulations on the use of amines limit their use in beauty and personal care products, which is likely to restrict market growth. Also, increasing consumption of amines, especially in new applications is expected to tender good growth opportunities for the global market. Furthermore, increasing crop protection, personal care, coatings & paints, surfactants, and water treatment applications are expected to fuel the growth of the market over the forecast period.

Amines Market Segmentation

The global amines market segmentation is based on type, application, and geography.

Amines Market By Type

- Fatty Amines

- Alkylamines

- Ethanolamines

- Others

According to the amines industry analysis, the ethanolamines segment is the largest and fastest-growing segment of the amines market. Ethanolamines are a type of amine that is derived from ethanol and are commonly used as surfactants, corrosion inhibitors, and emulsifiers. One of the main reasons for this is the high demand for ethanolamines in various end-use industries. These industries include detergents, personal care, oil and gas, and construction. The increasing usage of these industries is driving the growth of the ethanolamines segment. Another reason for the dominance of the ethanolamines segment is the technological advancements that have been made in the production of ethanolamines. These advancements have made it possible to produce ethanolamines more efficiently and cost-effectively, which has further increased their demand.

Amines Market By Application

- Water Treatment

- Personal Care

- Cleaning

- Agriculture

- Pharmaceutical

- Paint & Coating

- Gas Treatment

- Petroleum

- Other

According to the amines market forecast, the pharmaceutical is one of the fastest growing segments in the global market. One of the main reasons for this is the increasing demand for drugs and other pharmaceutical products. This is driven by factors such as an aging population, rising incidences of chronic diseases, and an increasing focus on healthcare. Additionally, the growing demand for biopharmaceuticals is also driving the growth of the pharmaceutical segment. Biopharmaceuticals are produced using biotechnology techniques and are used to treat a wide range of diseases, such as cancer, diabetes, and autoimmune disorders. They are generally considered to be safer and more effective than traditional drugs and are becoming increasingly popular among consumers. Therefore, the increasing demand for biopharmaceuticals is expected to drive the growth of the pharmaceutical segment of the amines market in the forecast period.

Amines Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Geographically, the Asia-Pacific region leads the amines market due to several factors. One of the main reasons is the growing industrial base in countries such as China and India. These countries are rapidly industrializing and are experiencing significant growth in various end-use industries such as construction, oil and gas, and chemicals. This has led to an increase in demand for amines in these countries, driving the growth of the Asia-Pacific market.

Another reason is the presence of a large number of amines manufacturers in the Asia-Pacific region. Many of these manufacturers are based in China and India and are able to produce amines at a lower cost than manufacturers in other regions, making them more competitive in the global market. Additionally, the Asia-Pacific region has a large population, which leads to a high demand for consumer goods such as detergents and personal care products, which also contributes to the market growth in the region.

Amines Market Players

Some of the top amines market companies offered in the professional report include The Dow Chemical Company, Arkema S.A., Lyondell Basell Industries Holdings B.V., Akzo Nobel N.V., INEOS Group, SABIC, BASF SE, Huntsman Corporation, Celanese Corporation, Taminco Corporation, Solvay S.A., Mitsubishi Gas Chemical Company, and Lanxess Corporation.

Frequently Asked Questions

What was the market size of the global amines in 2022?

The market size of amines was USD 16.2 Billion in 2022.

What is the CAGR of the global amines market during forecast period of 2023 to 2032?

The CAGR of amines market is 4.2% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global amines market are The Dow Chemical Company, Arkema S.A., Lyondell Basell Industries Holdings B.V., Akzo Nobel N.V., INEOS Group, SABIC, BASF SE, Huntsman Corporation, Celanese Corporation, Taminco Corporation, Solvay S.A., Mitsubishi Gas Chemical Company, and Lanxess Corporation.

Which region held the dominating position in the global amines market?

Asia-Pacific held the dominating position in amines market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for amines market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global amines market?

The current trends and dynamics in the amines industry include the increasing demand for surfactants from various applications such as agricultural formulations, fabric softeners, biocides, detergents, and emulsifiers.

Which application held the maximum share in 2022?

The pharmaceutical application held the maximum share of the amines market.