Aluminum Chemicals Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Aluminum Chemicals Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

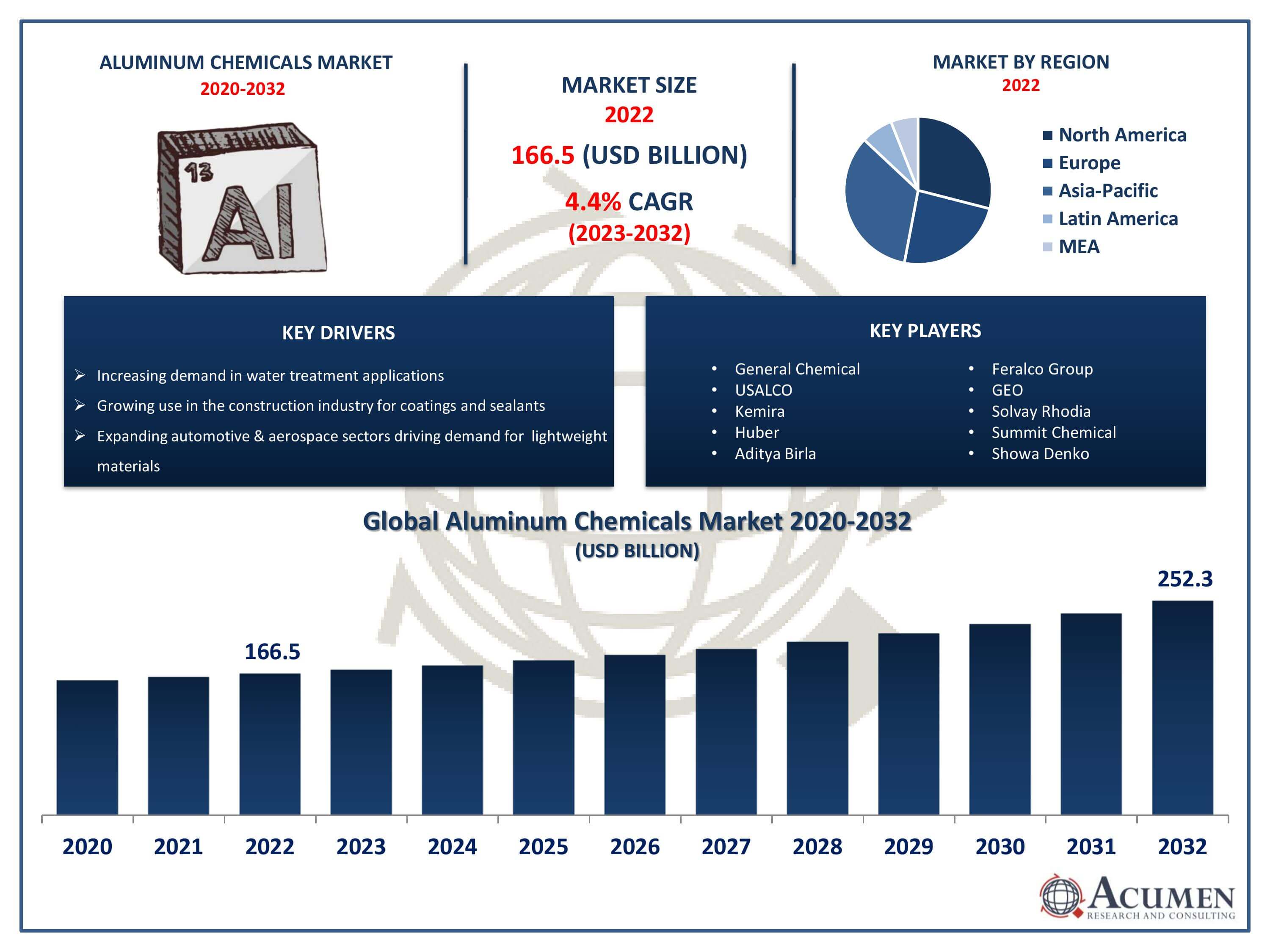

The Aluminum Chemicals Market Size accounted for USD 166.5 Billion in 2022 and is projected to achieve a market size of USD 252.3 Billion by 2032 growing at a CAGR of 4.4% from 2023 to 2032.

Aluminum Chemicals Market Highlights

- Global Aluminum Chemicals Market revenue is expected to increase by USD 252.3 Billion by 2032, with a 4.4% CAGR from 2023 to 2032

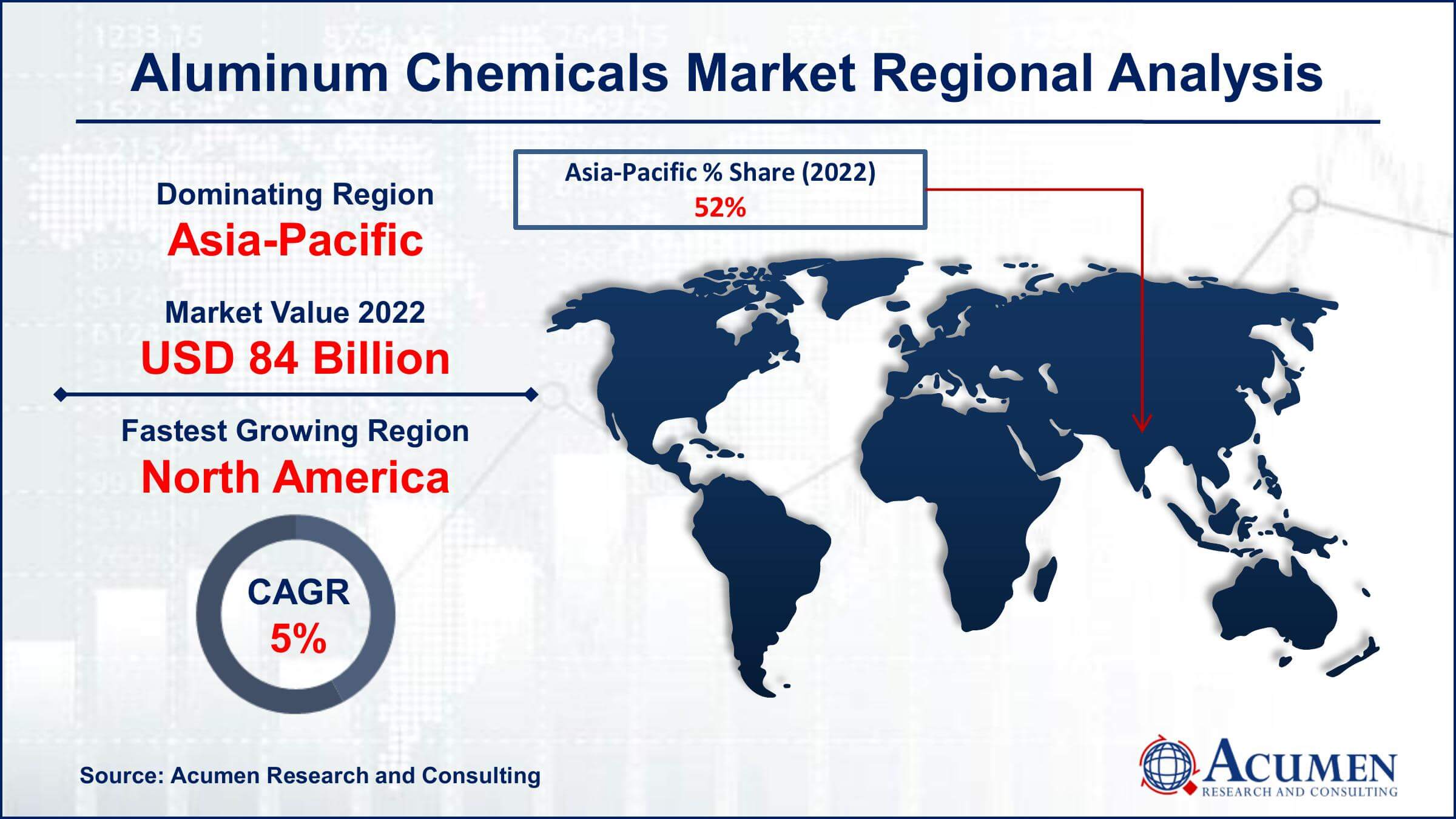

- Asia-Pacific region led with more than 52% of Aluminum Chemicals Market share in 2022

- North America Aluminum Chemicals Market growth will record a CAGR of more than 4.6% from 2023 to 2032

- By type, the aluminum oxides segment accounted for a dominating share of the market in 2022

- By end use, the construction segment is expected to grow at a significant rate during the forecast period

- Increasing demand for aluminum chemicals in water treatment applications, drives the Aluminum Chemicals Market value

Aluminum chemicals refer to a variety of compounds derived from aluminum, a versatile metal with widespread industrial applications. These chemicals find usage in various sectors, including manufacturing, construction, automotive, and aerospace industries. Some common aluminum chemicals include aluminum sulfate, used in water treatment and paper manufacturing; aluminum oxide, a key component in abrasives and refractories; and aluminum chloride, employed in the production of pharmaceuticals and as a catalyst in chemical processes. The diverse range of aluminum chemicals underscores the metal's significance in modern industrial processes.

The market for aluminum chemicals has experienced steady growth in recent years, driven by the expanding demand across end-user industries. The construction sector, in particular, has been a major contributor to the increased consumption of aluminum chemicals due to their use in products like sealants, coatings, and adhesives. Additionally, the automotive and aerospace industries, which rely heavily on lightweight and durable materials, have also contributed to the market growth. As economies continue to develop and industrialize, the demand for aluminum chemicals is expected to persist and potentially increase, making it a crucial segment within the broader aluminum industry. Factors such as technological advancements, regulatory changes, and a growing emphasis on sustainable practices may further influence the trajectory of the aluminum chemicals market in the coming years.

Global Aluminum Chemicals Market Trends

Market Drivers

- Increasing demand for aluminum chemicals in water treatment applications

- Growing use of aluminum chemicals in the construction industry for coatings and sealants

- Expanding automotive and aerospace sectors driving demand for lightweight materials

- Technological advancements enhancing the efficiency and application scope of aluminum chemicals

- Rising emphasis on sustainable practices boosting demand for eco-friendly aluminum chemical solutions

Market Restraints

- Fluctuating prices of raw materials impacting profit margins

- Stringent environmental regulations affecting the production and use of certain aluminum chemicals

Market Opportunities

- Growing infrastructure development in emerging economies creating new avenues for aluminum chemical applications

- Increasing focus on recycling aluminum chemicals for environmental sustainability

Aluminum Chemicals Market Report Coverage

| Market | Aluminum Chemicals Market |

| Aluminum Chemicals Market Size 2022 | USD 166.5 Billion |

| Aluminum Chemicals Market Forecast 2032 | USD 252.3 Billion |

| Aluminum Chemicals Market CAGR During 2023 - 2032 | 4.4% |

| Aluminum Chemicals Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | General Chemical, USALCO, Kemira, Huber, Aditya Birla, Feralco Group, GEO, Solvay Rhodia, Summit Chemical, Showa Denko, KC Corp, Kurita, Tenor Chemical, and Zhongke Tianze. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Aluminum chemicals encompass a diverse group of compounds derived from aluminum, a lightweight and corrosion-resistant metal. These chemicals are integral to various industrial processes and find applications across multiple sectors. One commonly used aluminum chemical is aluminum sulfate, employed in water treatment to clarify drinking water and wastewater. Its ability to form flocs with impurities aids in their removal during the water treatment process. Additionally, aluminum oxide, known for its hardness and resistance to abrasion, is widely used in the production of abrasives, refractories, and ceramics. Another significant aluminum chemical is aluminum chloride, a versatile compound utilized as a catalyst in numerous chemical reactions, including the production of pharmaceuticals and petrochemicals. In the construction industry, aluminum chemicals are used in sealants, coatings, and adhesives, benefitting from aluminum's corrosion resistance and durability.

The aluminum chemicals market has witnessed robust growth in recent years, propelled by increasing demand across diverse industries. Factors such as rapid urbanization, infrastructure development, and the expanding automotive and aerospace sectors have significantly contributed to the market's upward trajectory. Aluminum chemicals, including compounds like aluminum sulfate and aluminum chloride, find extensive applications in water treatment, paper manufacturing, construction, and various industrial processes. The rise in construction activities worldwide, coupled with the need for lightweight materials in automotive and aerospace manufacturing, has stimulated the demand for aluminum chemicals. Moreover, technological advancements in production processes have played a crucial role in enhancing the efficiency and cost-effectiveness of aluminum chemical manufacturing. The industry's growth is further fueled by a global emphasis on sustainability, leading to increased adoption of eco-friendly aluminum chemical products.

Aluminum Chemicals Market Segmentation

The global Aluminum Chemicals Market segmentation is based on type, end use, and geography.

Aluminum Chemicals Market By Type

- Aluminum oxides

- Aluminum Polymer

- Aluminates

- Aluminum Salt

- Others

In terms of types, the aluminum oxides segment accounted for the largest market share in 2022. This growth is fueled by its versatile applications across various industries. Aluminum oxide, also known as alumina, is a critical component in the production of abrasives, refractories, ceramics, and catalysts. Its high strength, hardness, and resistance to corrosion make it an essential material, particularly in the manufacturing of abrasive products used in grinding, polishing, and sanding applications. The increasing demand for durable and high-performance materials in industrial processes has driven the expansion of the aluminum oxides segment. Moreover, the growth of the aerospace and automotive industries has further propelled the demand for aluminum oxides. In these sectors, aluminum oxide is utilized for its lightweight properties and excellent thermal and electrical insulation capabilities. As these industries continue to evolve and demand materials that meet stringent performance standards, the aluminum oxides segment is poised for sustained growth.

Aluminum Chemicals Market By End Use

- Water Treatment

- Agrochemical

- Medical and Pharmaceutical

- Construction

- Automobile

- Oil and Gas

- Plastic

- Food Packaging

- Others

According to the aluminum chemicals market forecast, the construction segment is expected to witness significant growth in the coming years. This growth is driven by the expanding global construction industry and the versatile applications of aluminum chemicals in various construction-related products. Aluminum chemicals, such as aluminum sulfate and aluminum chloride, play a crucial role in the formulation of sealants, adhesives, coatings, and concrete additives. These materials enhance the durability, strength, and performance of construction materials, addressing the increasing demand for high-quality and sustainable building solutions. As urbanization and infrastructure development continue on a global scale, the construction segment's reliance on aluminum chemicals is expected to persist and grow. The lightweight nature of aluminum chemicals makes them particularly attractive in construction applications, offering advantages such as reduced weight and increased ease of handling. Additionally, aluminum-based products contribute to sustainable construction practices, aligning with the industry's increasing focus on environmental responsibility. The demand for aluminum chemicals in the construction sector is further bolstered by their use in water treatment applications, ensuring the quality and durability of construction materials.

Aluminum Chemicals Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Aluminum Chemicals Market Regional Analysis

The Asia-Pacific region has emerged as a dominant force in the aluminum chemicals market, experiencing robust growth and playing a pivotal role in shaping the industry landscape. The region's dominance is attributed to a confluence of factors, including rapid industrialization, urbanization, and substantial investments in infrastructure development. As countries like China, India, and Southeast Asian nations undergo significant economic expansion, the demand for aluminum chemicals has soared, particularly in construction, manufacturing, and automotive sectors. China, in particular, stands out as a major contributor to the Asia-Pacific dominance in the aluminum market. The country's vast manufacturing capabilities, coupled with its status as the world's largest consumer of aluminum, drive substantial demand for aluminum chemicals across various applications. Moreover, the region benefits from the abundant availability of raw materials, such as bauxite, which is a key component in aluminum chemical production. The Asia-Pacific dominance is further fueled by the region's increasing focus on sustainable practices, with a growing emphasis on eco-friendly and energy-efficient manufacturing processes, aligning with global trends and bolstering the appeal of Asia-Pacific in the aluminum chemicals market.

Aluminum Chemicals Market Player

Some of the top aluminum chemicals market companies offered in the professional report include General Chemical, USALCO, Kemira, Huber, Aditya Birla, Feralco Group, GEO, Solvay Rhodia, Summit Chemical, Showa Denko, KC Corp, Kurita, Tenor Chemical, and Zhongke Tianze.

Frequently Asked Questions

How big is the aluminum chemicals market?

The market size of aluminum chemicals was USD 166.5 Billion in 2022.

What is the CAGR of the global aluminum chemicals market from 2023 to 2032?

The CAGR of aluminum chemicals is 4.4% during the analysis period of 2023 to 2032.

Which are the key players in the aluminum chemicals market?

The key players operating in the global market are including General Chemical, USALCO, Kemira, Huber, Aditya Birla, Feralco Group, GEO, Solvay Rhodia, Summit Chemical, Showa Denko, KC Corp, Kurita, Tenor Chemical, and Zhongke Tianze.

Which region dominated the global aluminum chemicals market share?

Asia-Pacific held the dominating position in aluminum chemicals industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of aluminum chemicals during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global aluminum chemicals industry?

The current trends and dynamics in the aluminum chemicals market growth include increasing demand in water treatment applications, growing use in the construction industry for coatings and sealants, and expanding automotive and aerospace sectors driving demand for lightweight materials.

Which type held the maximum share in 2022?

The aluminum oxides type held the maximum share of the aluminum chemicals industry.