Algorithmic Trading Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Algorithmic Trading Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Algorithmic Trading Market Size gathered USD 14.1 Billion in 2021 and is set to garner a market size of USD 41.9 Billion by 2030 growing at a CAGR of 12.9% from 2022 to 2030.

Algorithmic trading, also known as algo trading or black box trading, is the execution of trades in financial markets using computer programmes and complex mathematical algorithms. Based on a set of predefined rules and market conditions, these algorithms are designed to make decisions and carry out trades at high speeds and with high accuracy. Large financial institutions and hedge funds typically use algorithmic trading, which can be applied to a variety of markets such as stocks, bonds, currencies, and commodities.

Algorithmic Trading Market Report Statistics

- Global algorithmic trading market revenue is estimated to reach USD 41.9 Billion by 2030 with a CAGR of 12.9% from 2022 to 2030

- North America algorithmic trading market value gathered more than USD 5.1 billion in 2021

- Asia-Pacific algorithmic trading market growth will record a CAGR of more than 13% from 2022 to 2030

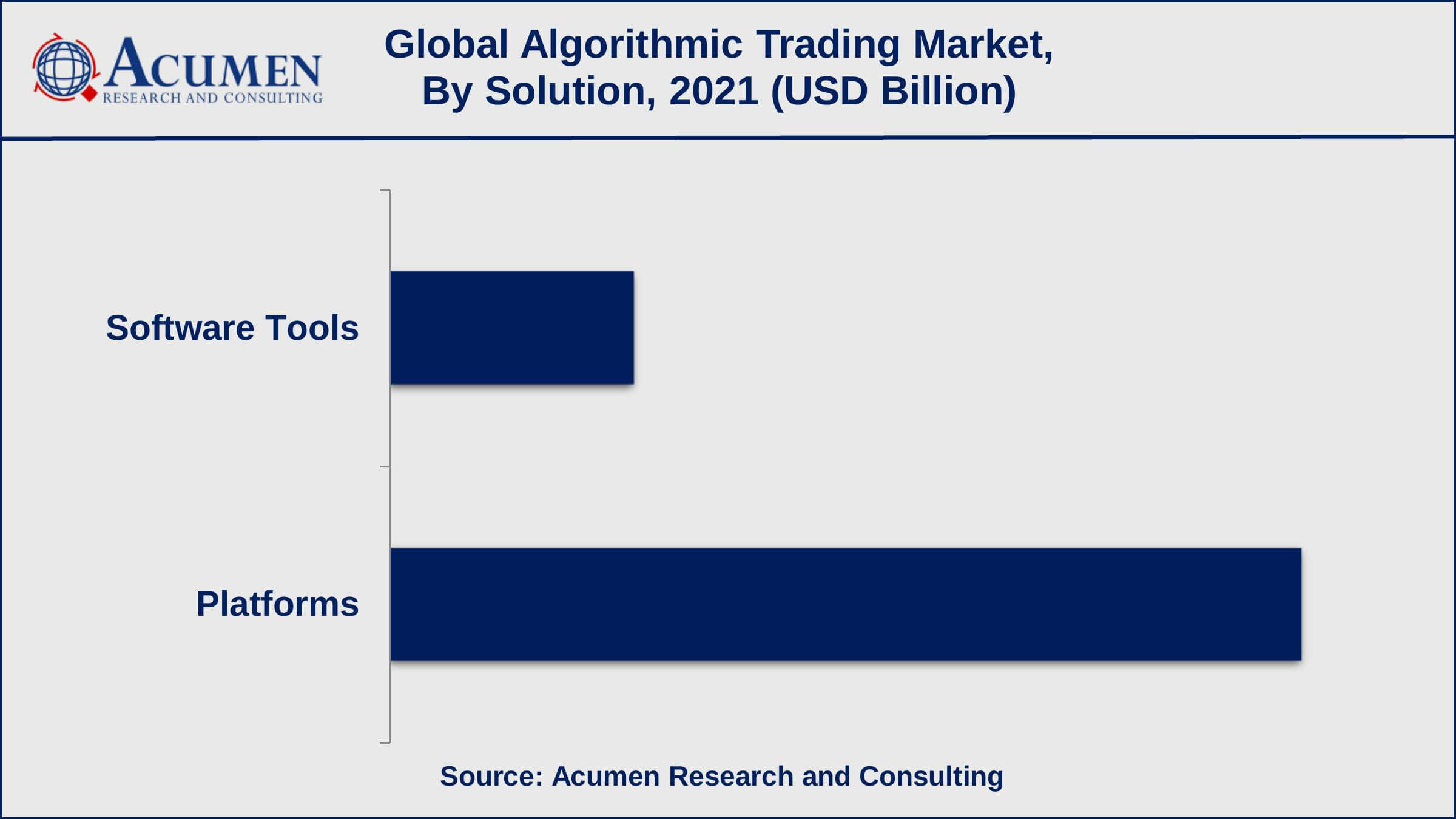

- Among solution, the platform sub-segment collected 69% share in 2021

- Based on deployments, the cloud sub-segment achieved US$ 8.5 billion in revenue in 2021

- The increased adoption of machine learning and artificial intelligence is a popular algorithmic trading market trend that drives the industry demand

Global Algorithmic Trading Market Dynamics

Market Drivers

- Increased demand for automation

- Increased market liquidity

- Improved speed and efficiency

Market Restraints

- Lack of transparency and accountability

- Increased market volatility

- Complexity issues

Market Opportunities

- Surging adoption of trading bots

- Rising trend of quantum computing

Algorithmic Trading Market Report Coverage

| Market | Algorithmic Trading Market |

| Algorithmic Trading Market Size 2021 | USD 14.1 Billion |

| Algorithmic Trading Market Forecast 2030 | USD 41.9 Billion |

| Algorithmic Trading Market CAGR During 2022 - 2030 | 12.9% |

| Algorithmic Trading Market Analysis Period | 2018 - 2030 |

| Algorithmic Trading Market Base Year | 2021 |

| Algorithmic Trading Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Solution, By Service, By Deployment, By Trading Types, By Type of Traders, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | 63 moons technologies limited, AlgoTrader, Argo Software Tools Engineering, InfoReach, Inc., Kuberre Systems, Inc., MetaQuotes Ltd., Refinitiv, Symphony, Tata Consultancy Services Limited, VIRTU Finance Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Algorithmic Trading Market Growth Factors

Increased demand for automation is a major factor driving the value of the global algorithmic trading market. Algorithmic trading has grown in popularity as the demand for automation and the decrease in human error has increased. Increased market liquidity is another factor driving the growth of the algorithmic trading market. Algorithmic trading has also contributed to increased market liquidity by allowing traders to enter and exit positions in financial markets more quickly. Furthermore, algorithmic trading can assist traders in better risk management by recognizing potential dangers and taking appropriate actions.

However, increased market volatility can limit the market's ability to grow. Algorithmic trading may increase market volatility because algorithms may respond to market changes in unexpected ways, potentially resulting in rapid and significant price fluctuations. However, because algorithmic trading is opaque, regulators may struggle to monitor and detect potential market manipulation or other illegal activities. This can lead to a lack of market transparency and accountability.

Furthermore, increased speed and efficiency are expected to provide the market with lucrative growth opportunities in the coming years. Algorithmic trading can execute trades faster than humans can and reduces the potential for human error, resulting in increased trading speed and efficiency. Increased accessibility is also likely to gain significant traction over the next few years. Trading has become more accessible to a broader range of traders, such as individual traders and smaller financial institutions, thanks to algorithmic trading.

Algorithmic Trading Market Segmentation

The worldwide algorithmic trading market is categorized based on solution, service, deployment, trading types, type of traders, and geography.

Algorithmic Trading Market By Solution

- Platforms

- Software Tools

An algorithmic trading industry analysis found that the platform segment generated the most revenue in 2021 and will continue to do so in the future. Algorithmic trading platforms can execute trades automatically based on pre-programmed rules and algorithms, eliminating the need for human intervention. They can also be used to backtest trading strategies, which allow traders to see how a strategy would have performed in the past under different market conditions. Furthermore, algorithmic trading platforms can be used to analyze large amounts of market data to inform trading decisions, such as news, financial reports, and social media sentiment.

Algorithmic Trading Market By Service

- Professional Services

- Managed Services

Based on service, professional services dominated the market in terms of market share in 2021. Professional services firms can assist companies in developing and implementing algorithmic trading strategies tailored to their specific needs and goals. In addition, professional services firms can assist businesses in developing and implementing algorithmic trading technology, such as trading platforms, risk management tools, and order management systems. Furthermore, professional services firms can provide consulting services to assist firms in identifying and implementing the best algorithmic trading strategies and technologies for their needs.

Algorithmic Trading Market By Deployment

- Cloud

- On-premise

One of the most important segments of the algorithmic trading market is cloud-based deployment. Cloud-based solutions enable algorithmic trading systems to be scaled up or down as needed, making it simple to deal with increased trading volume or unexpected spikes in demand. This adaptability is especially advantageous for small and medium-sized businesses that may lack the resources to maintain their own IT infrastructure. Cloud-based solutions can be less expensive than traditional on-premises solutions because they do not require expensive hardware or IT infrastructure. This makes advanced algorithmic trading technology available to businesses of all sizes.

Algorithmic Trading Market By Trading Types

- Foreign Exchange (FOREX)

- Stock Markets

- Exchange-Traded Fund (ETF)

- Bonds

- Cryptocurrencies

- Others

According to the algorithmic trading market forecast, the large enterprise sub-segment will have the highest market share from 2022 to 2030. Algorithmic trading in the stock market can be advantageous in terms of increasing trading speed, lowering transaction costs, and improving overall trading efficiency. It does, however, introduce some new challenges, such as regulatory oversight, data security, and potential market manipulation. Algorithmic trading in the cryptocurrency market can be advantageous in terms of increasing trading speed, lowering transaction costs, and improving overall trading efficiency. It does, however, introduce some new challenges, such as data security, regulatory oversight, and potential market manipulation. Additionally, the crypto market is more turbulent than traditional assets, and the complexity of some crypto assets may preclude the use of algorithmic trading.

Algorithmic Trading Market By Type of Traders

- Institutional Investors

- Long-term Traders

- Short-term Traders

- Retail Investors

On the basis of type of traders, institutional investors generate the largest market share in the coming years. Institutional investors, such as pension funds, hedge funds, and mutual funds, have increasingly adopted algorithmic trading to execute trades in an efficient and timely manner. Algorithmic trading allows institutional investors to access liquidity and execute trades quickly, which can be particularly useful in fast-moving markets such as stocks and cryptocurrencies. However, algorithmic trading allows short-term investors to access liquidity and execute trades quickly, which can be particularly useful in fast-moving markets. However, short-term traders also face challenges such as regulatory oversight, data security, and potential market manipulation. Additionally, short-term trading comes with a high degree of risk, which is why it is not suitable for all investors.

Algorithmic Trading Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Algorithmic Trading Market Regional Analysis

North America is the dominant region in the algorithmic trading market, owing to the region's large number of financial institutions and trading firms. The United States is the most important market for algorithmic trading, followed by Canada. Europe ranks as the second-largest market for algorithmic trading, owing to the presence of numerous financial institutions and trading firms in nations such as the United Kingdom, Germany, and France. The Asia-Pacific region is a rapidly growing market for algorithmic trading, owing to the expansion of the financial sector in countries like China, Japan, and Australia.

Algorithmic Trading Market Players

Some of the leading algorithmic trading companies include AlgoTrader, 63 moons technologies limited, Argo Software Tools Engineering, InfoReach, Inc., MetaQuotes Ltd., Symphony, Refinitiv, Tata Consultancy Services Limited, Kuberre Systems, Inc., and VIRTU Finance Inc.

Frequently Asked Questions

What was the market size of the global algorithmic trading in 2021?

The market size of algorithmic trading was USD 14.1 Billion in 2021.

What is the CAGR of the global algorithmic trading market during forecast period of 2022 to 2030?

The CAGR of algorithmic trading market is 12.9% during the analysis period of 2022 to 2030.

Which are the key players operating in the market?

The key players operating in the global market are 63 moons technologies limited, AlgoTrader, Argo Software Tools Engineering, InfoReach, Inc., Kuberre Systems, Inc., MetaQuotes Ltd., Refinitiv, Symphony, Tata Consultancy Services Limited, VIRTU Finance Inc.

Which region held the dominating position in the global algorithmic trading market?

North America held the dominating position in algorithmic trading market during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for algorithmic trading market during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global algorithmic trading market?

The current trends and dynamics in the algorithmic trading industry include increased demand for automation, increased market liquidity, and improved speed and efficiency.

Which solution held the maximum share in 2021?

The platform held the maximum share of the algorithmic trading market.