Alcohol Packaging Market

Published :

Report ID:

Pages :

Format :

Alcohol Packaging Market

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

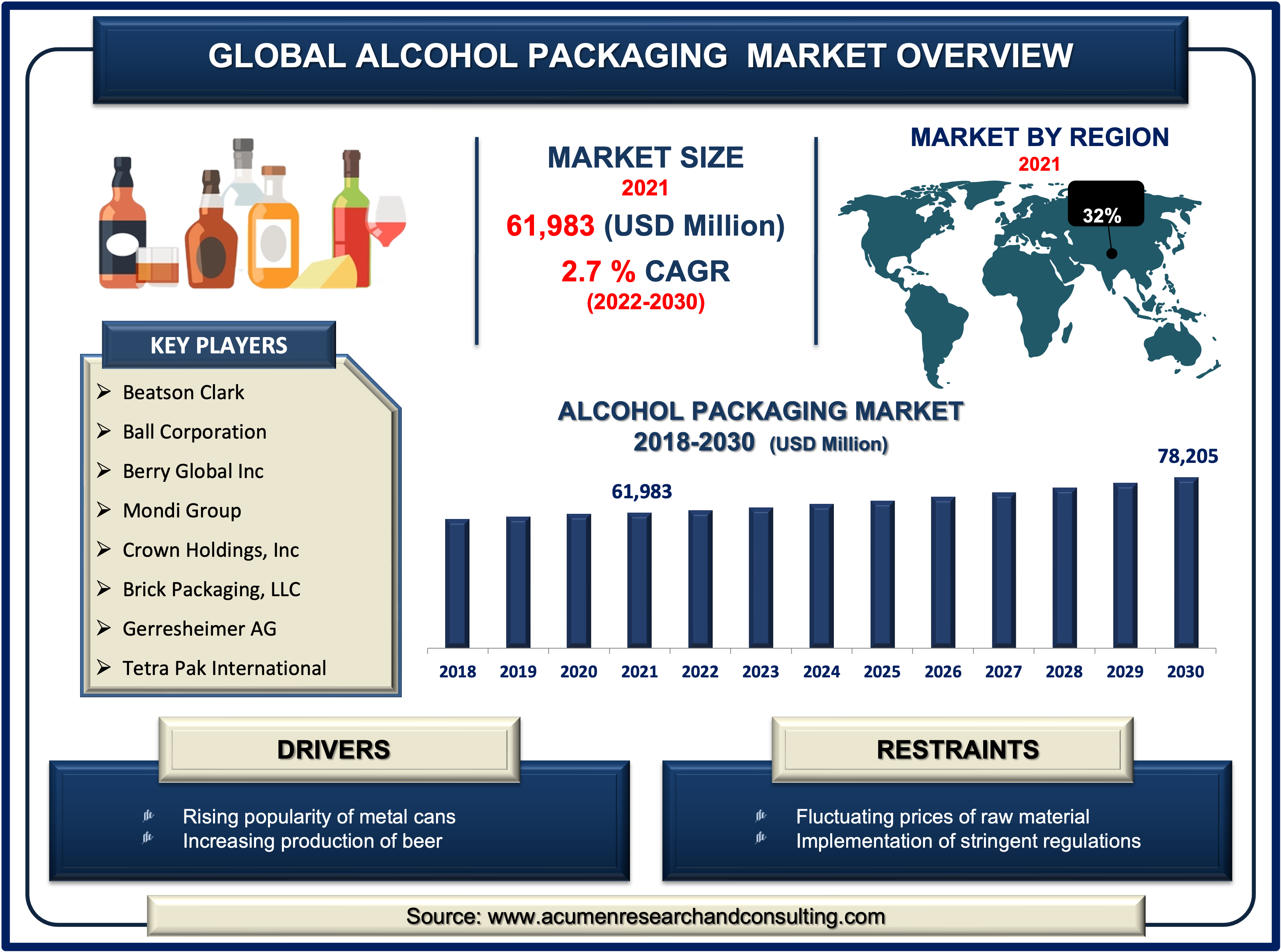

Request Sample Report

The Global Alcohol Packaging Market size accounted for US$ 61,983 Mn in 2021 and is expected to reach US$ 78,205 Mn by 2030 with a considerable CAGR of 2.7% during the forecast timeframe of 2022 to 2030.

Alcohol packaging refers to a way of safeguarding, increasing brand exposure, and improving brand promotion, all of which have an impact on consumer decision-making. Customers choose brands that offer simpler packaging options. The packaging of alcoholic beverages is changing dramatically in terms of design, durability, and to-go options. Alcohol companies are looking for new ways to capture and exhibit their brand while also reducing carbon emissions and providing acceptable to-go packaging. The packaging of alcoholic drinks will play an essential role in brand promotion and will result in enhanced brand awareness. Manufacturers provide innovative packaging specifications for alcoholic drinks in order to persuade consumers to buy their brand. The alcohol packaging market, on the other hand, will experience favorable growth throughout the projected period due to an increase in alcohol consumption and an increase in demand for alcohol packaging.

Drivers

· Increasing consumption of beer globally

· Raising public awareness of sustainable packaging

· The rising popularity of metal cans

Restraints

· Raw material price fluctuations

· Implementation of rigorous packaging material regulations

Opportunity

· Packaging innovation in wine and spirits, particularly for premium products

Report Coverage

| Market | Alcohol Packaging Market |

| Market Size 2021 | US$ 61,983 Mn |

| Market Forecast 2030 | US$ 78,205 Mn |

| CAGR | 2.7% During 2022 - 2030 |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Material, By Alcohol, By Packaging, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amcol Plc, Beatson Clark, Ball Corporatio, Berry Global Inc, Mondi Group, Crown Holdings, Inc, Brick Packaging, LLC, Gerresheimer AG, Tetra Pak International SA, Smurfit Kappa, Owens Illinois Inc., and VetreriaEtrusca SPA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Alcohol Packaging Market Dynamics

The rising standard of living, combined with an increase in the consumption of luxury wine and beer, has resulted in an increase in the demand for alcohol packaging. Beer contains vitamins, natural antioxidants, and proteins that aid in the prevention of cardiovascular disease and the rebuilding of muscle. Increased understanding of the health benefits of beer would increase demand for alcohol, boosting the alcohol packaging industry. Vendors in the global Alcohol Packaging Market have tapped into the demands and wishes of the most affluent customers. These companies also put money into packaging technologies, which have become a dependable aspect of global market dynamics. For the leading market vendors, this is a critical growth and advancement dynamic.

However, price volatility in raw materials required in plastic manufacture, as well as strict alcohol-related restrictions, are expected to limit the global alcohol packaging market's growth. Besides this, a boom in the use of PET as a packaging material, as well as untapped new markets, are likely to create appealing opportunities for global market growth.

Alcohol Packaging Market Segmentation

The global alcohol packaging market segmented into material, alcohol, packaging, and region.

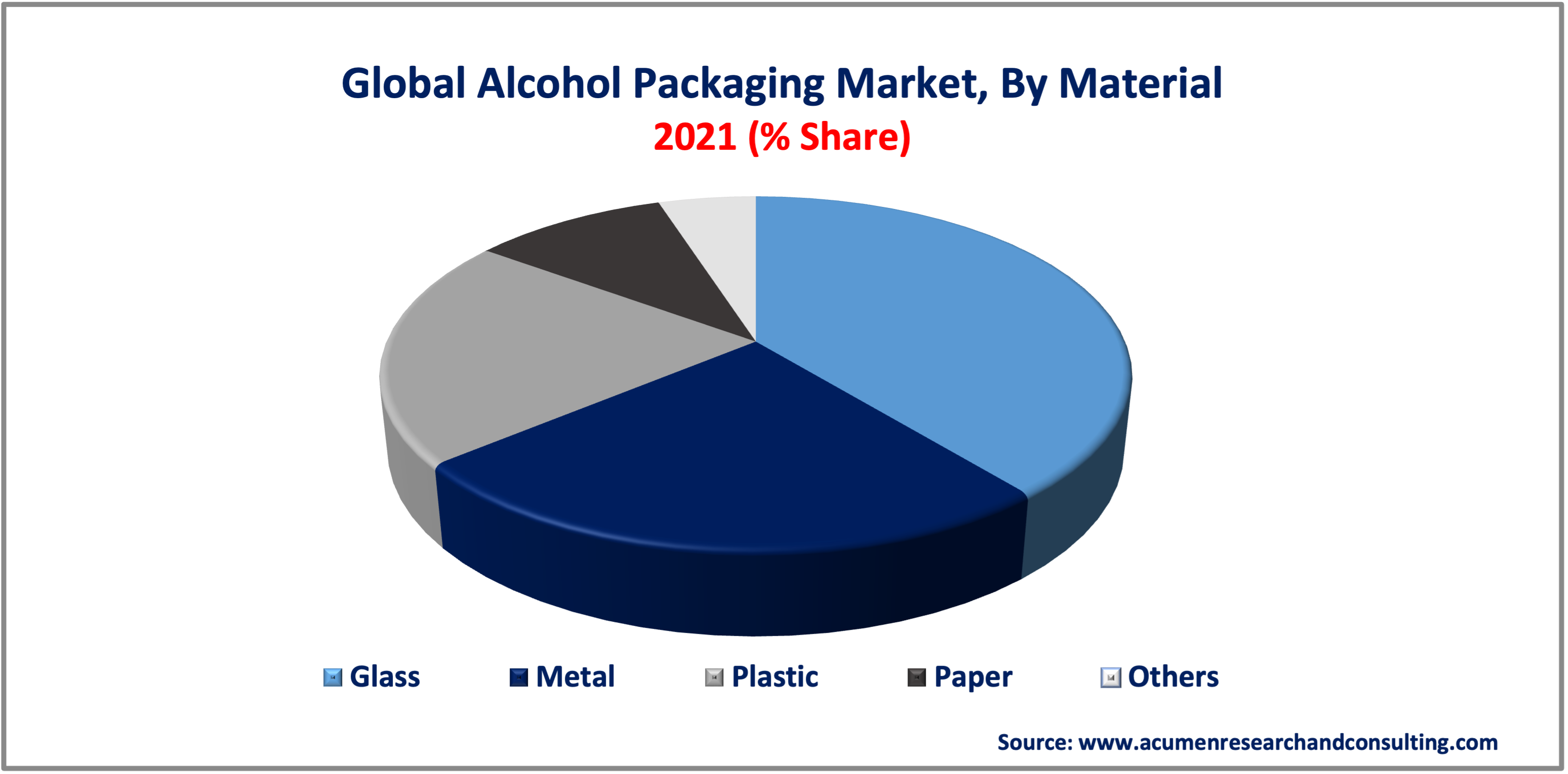

Market by Material

· Glass

· Metal

· Plastic

· Paper

· Others

In terms of material, the glass segment held the largest share of the alcohol packaging market in 2021. Plastic does not withstand water as well as glass does. The alcohol is more likely to deteriorate in a plastic bottle. Because glass is impermeable to O2 and CO2, alcohol can be stored for a longer amount of time in glass containers. Glass is also often used in alcohol packaging since it is totally recyclable and may be reused endlessly without losing quality or purity. The water-resistant ability of glass helps in avoiding the contamination of the flavor of alcohol in glass packaging. It does not influence the strength, smell, or flavor of the alcohol because it has a 0% rate of chemical interaction. As a result, the glass category is predicted to increase its global alcohol packaging market share.

Market by Alcohol

· Beer

· Wine

· Spirits

· Others

In terms of alcohol, the beer segment will account for the majority of the global market in 2021. Beer is an alcoholic beverage created from yeast-fermented malt that has been flavored with hops. Beer is a popular alcoholic drink that is consumed all over the world. It is mainly made by fermenting cereal grains, yeast, and water for a predetermined amount of time. Herbs and fruits are frequently used to enhance the flavor and smell of the drink. Beer's alcohol level varies from less than 3% to 40% by volume, depending on the brand and formula of the formulation. The increasing numbers of breweries around the world, as well as the expanding demand for beer globally, are some of the primary drivers driving the global beer industry. With the increased interest from health-conscious customers, the industry has been witnessing a rise in sale of low-alcohol beers.

Market by Packaging

· Primary

· Secondary

Based on the packaging, primary packaging will be the fastest-growing sector in the worldwide market over the next few years. The primary function of alcohol packaging is to safeguard, preserve, and inform the consumer. The primary packaging, also known as a consumer unit, is the package that has direct contact with the product. This type of packaging is typically geared toward the end-user or consumer. It not only makes items easier for customers to handle, but it also makes them more appealing and can be used for communication purposes to provide written information about the products to consumers.

Alcohol Packaging Market Regional Overview

North America

· U.S.

· Canada

Europe

· U.K.

· France

· Germany

· Spain

· Rest of Europe

Latin America

· Mexico

· Brazil

· Rest of Latin America

Asia-Pacific

· India

· China

· Japan

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· South Africa

· GCC

· Rest of Middle East & Africa

With the Rising Consumption of Beer and Wine in the Region, Asia-Pacific now Dominates the Global Industry

The evolving manufacturing trends for sustainable packaging would boost the Asia-Pacific alcohol packaging market. The existence of densely populated nations like China and India, as well as rising spending power and rising awareness of alcohol consumption, will all help to drive market expansion. Furthermore, the entry of new competing companies into this industry, as well as new brands that increase product appeal, are expected to increase the global alcohol packaging market revenue. Furthermore, expanding population and discretionary income levels, as well as rapid urbanization in countries such as China, Japan, and Thailand, are expected to drive market expansion.

Market Players

Some of the prominent players in global alcohol packaging market are Amcol Plc, Beatson Clark, Ball Corporatio, Berry Global Inc, Mondi Group, Crown Holdings, Inc, Brick Packaging, LLC, Gerresheimer AG, Tetra Pak International SA, Smurfit Kappa, Owens Illinois Inc., and VetreriaEtrusca SPA.

Frequently Asked Questions

How much was the estimated value of the global alcohol packaging market in 2021?

The estimated value of global alcohol packaging market in 2021 was accounted to be US$ 61,983 Mn.

What will be the projected CAGR for global alcohol packaging market during forecast period of 2022 to 2030?

The projected CAGR of alcohol packaging during the analysis period of 2022 to 2030 is 2.7%.

Which are the prominent competitors operating in the market?

The prominent players of the global alcohol packaging market involve Amcol Plc, Beatson Clark, Ball Corporatio, Berry Global Inc, Mondi Group, Crown Holdings, Inc, Brick Packaging, LLC, Gerresheimer AG, Tetra Pak International SA, Smurfit Kappa, Owens Illinois Inc., and VetreriaEtrusca SPA.

Which region held the dominating position in the global alcohol packaging market?

Asia-Pacific held the dominating share for alcohol packaging during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for alcohol packaging during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global alcohol packaging market?

The rising popularity of metal cans, increasing production of beer and growing awareness of sustainable packaging are the prominent factors that fuel the growth of global alcohol packaging market.

By segment material, which sub-segment held the maximum share?

Based on material, glass segment held the maximum share for alcohol packaging market in 2021.